Valid Affidavit of Domicile Form

When managing the assets of a deceased loved one, the importance of accurately conveying legal documents cannot be overstated. Among these, the Affidavit of Domicile plays a pivotal role, serving as a testament to the decedent's primary place of residence at the time of their passing. This document, required by financial institutions and other relevant entities, is utilized to facilitate the transfer of securities and other assets, ensuring they’re distributed according to the deceased's last testament or estate plan. Understanding its composition, the nuances involved in its completion, and recognizing its legal implications are crucial steps in ensuring a smooth transition of assets. Bridging legal formalities with the deceased’s last wishes, the Affidavit of Domicile stands as a cornerstone document, designed to affirm residency in a legally binding manner, thereby paving the way for executors and beneficiaries to fulfill their duties and rights with confidence and clarity.

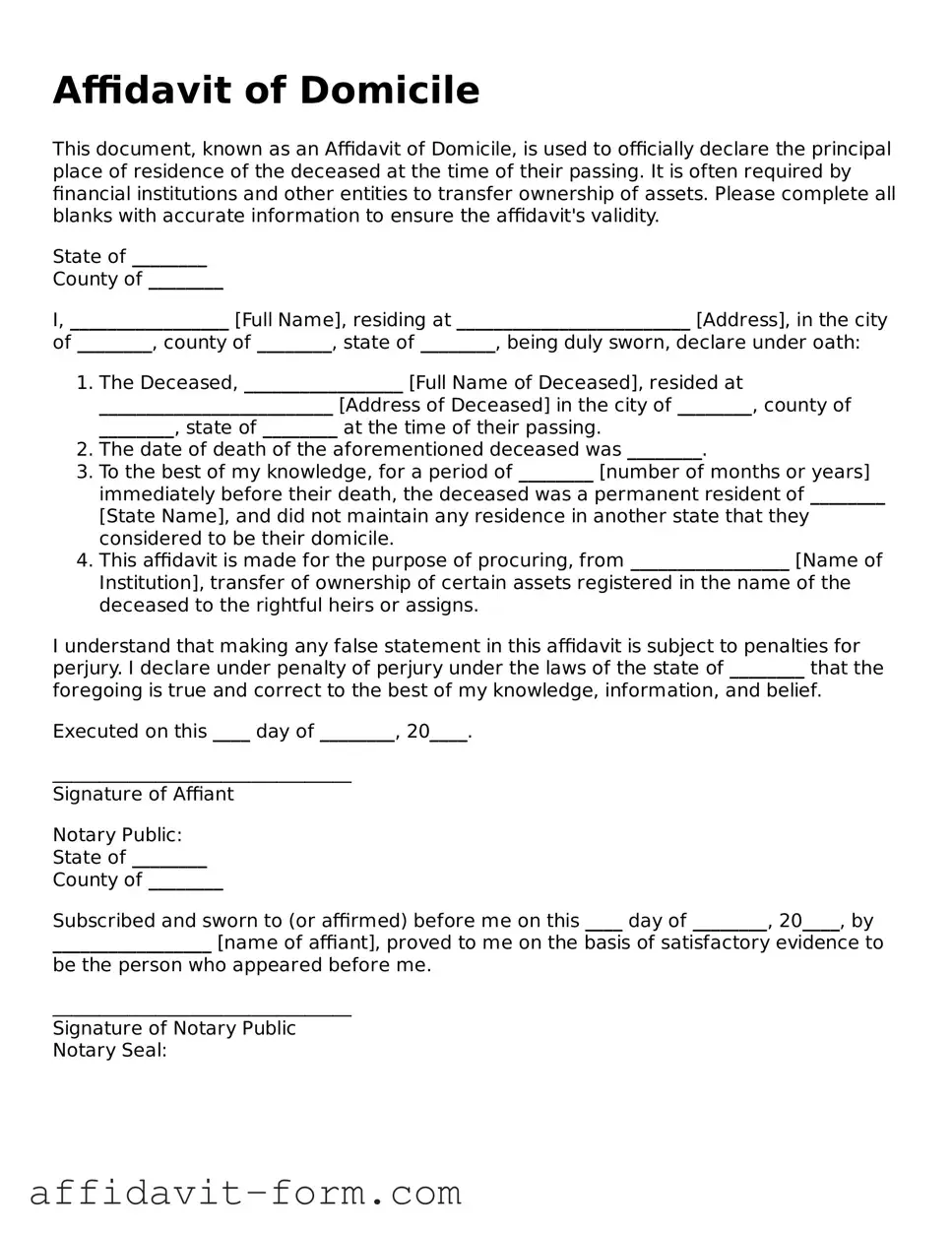

Form Example

Affidavit of Domicile

This document, known as an Affidavit of Domicile, is used to officially declare the principal place of residence of the deceased at the time of their passing. It is often required by financial institutions and other entities to transfer ownership of assets. Please complete all blanks with accurate information to ensure the affidavit's validity.

State of ________

County of ________

I, _________________ [Full Name], residing at _________________________ [Address], in the city of ________, county of ________, state of ________, being duly sworn, declare under oath:

- The Deceased, _________________ [Full Name of Deceased], resided at _________________________ [Address of Deceased] in the city of ________, county of ________, state of ________ at the time of their passing.

- The date of death of the aforementioned deceased was ________.

- To the best of my knowledge, for a period of ________ [number of months or years] immediately before their death, the deceased was a permanent resident of ________ [State Name], and did not maintain any residence in another state that they considered to be their domicile.

- This affidavit is made for the purpose of procuring, from _________________ [Name of Institution], transfer of ownership of certain assets registered in the name of the deceased to the rightful heirs or assigns.

I understand that making any false statement in this affidavit is subject to penalties for perjury. I declare under penalty of perjury under the laws of the state of ________ that the foregoing is true and correct to the best of my knowledge, information, and belief.

Executed on this ____ day of ________, 20____.

________________________________

Signature of Affiant

Notary Public:

State of ________

County of ________

Subscribed and sworn to (or affirmed) before me on this ____ day of ________, 20____, by _________________ [name of affiant], proved to me on the basis of satisfactory evidence to be the person who appeared before me.

________________________________

Signature of Notary Public

Notary Seal:

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Affidavit of Domicile form is used to legally certify an individual's primary place of residence at the time of their death. This document is often required by financial institutions when transferring ownership of securities or accounts of the deceased. |

| Signatory Requirement | This form must be signed by the executor or administrator of the deceased's estate, often in the presence of a notary public, to attest to the accuracy of the information provided. |

| State-Specific Variations | Although the purpose of the Affidavit of Domicile is consistent across states, the format and specific requirements can vary. It's important to use the version of the form that complies with the laws of the state where the deceased was domiciled. |

| Governing Laws | The form is governed by the state laws where the deceased resided. These laws outline the requirements for the affidavit's content, signing, and how it must be used with financial institutions and courts. |

| Utilization | Financial institutions require this document to ensure that the transfer of assets complies with state and federal laws, minimizing the risk of fraudulent transfers. It helps in the accurate and lawful distribution of the deceased's assets. |

How to Use Affidavit of Domicile

Once you've determined the need for an Affidavit of Domicile, the process of filling it out begins. Usually, this document is necessary during the settlement of an estate after someone passes away. It officially states the primary place of residence at the time of death. Completing this form can seem daunting, but with the right guidance, it can be straightforward. Follow these steps, and you'll have your form ready in no time.

- Gather necessary information, including the deceased's full legal name, date of birth, and date of death.

- Find the form which is typically provided by the financial institution or a government authority overseeing estate matters.

- Write the full legal name of the deceased in the designated spot on the form.

- Fill in the deceased's address, including city, state, and zip code, exactly as it was at the time of death.

- Enter the date of death in the specified format, usually month/day/year.

- Provide the social security number of the deceased, if required.

- If the form asks for the duration of time the deceased lived at the stated address, include this information accurately.

- The executor or administrator of the estate must sign the form in the presence of a notary public. Ensure not to sign until in the presence of a notary.

- Have the notary public complete their section, which includes witnessing the signature, stamping, and dating the document.

- Keep a copy of the completed Affidavit of Domicile for your records and submit the original to the intended recipient, which may be a financial institution or a court.

Following these steps ensures the Affidavit of Domicile is filled out correctly. Making sure all the information is accurate and complete before submission is critical. This document is a key piece in settling an estate, as it provides essential information needed by financial institutions and courts. Taking the time to fill it out carefully avoids any potential delays in processing the estate. With the completed form, the executor or administrator can move forward with settling the deceased's affairs smoothly and efficiently.

Listed Questions and Answers

What is an Affidavit of Domicile?

An Affidavit of Domicile is a legal document used by the executor or administrator of a deceased person's estate. Its primary purpose is to declare the decedent's legal residence at the time of their death. This affidavit is often required by financial institutions and transfer agents when transferring ownership of securities or assets to the beneficiaries or heirs of an estate.

Why is the Affidavit of Domicile necessary?

This document is crucial for several reasons:

- It helps in the proper administration of the decedent's estate by confirming their state of domicile. The state of domicile determines which state's laws will govern the probate process and the distribution of the decedent's assets.

- Financial institutions and transfer agents require it to transfer securities and other assets, ensuring that the transactions comply with the relevant laws and taxation rules of the decedent's state of domicile.

- It might be needed to fulfill certain tax obligations and to clarify tax responsibilities arising from the transfer of assets.

Who has the authority to complete and sign an Affididavit of Domicile?

The executor or administrator of the decedent's estate, who is legally recognized and appointed by a probate court, has the authority to complete and sign an Affidavit of Domicile. This person is responsible for managing the decedent's final affairs, including the distribution of assets in accordance with the will or state law if there is no will.

What information is required on an Affidavit of Domicile?

The document typically requires the following information:

- The name and address of the decedent.

- The date and place of the decedent's death.

- The last address and the length of time the decedent lived at their final residence.

- A declaration of the state considered to be the decedent's legal domicile at the time of death.

- The signature of the executor or administrator, sworn before a notary public.

Where can one obtain an Affidavit of Domicile form?

This form can typically be obtained from:

- Legal document websites offering standardized forms.

- An attorney specializing in estate planning or probate law.

- Some financial institutions and transfer agents may also provide a standardized form for their specific requirements.

Is a lawyer required to complete an Affidavit of Domicile?

While a lawyer is not strictly required to complete an Affidavit of Domicile, consulting with one can be beneficial. A lawyer specializing in estate or probate law can provide guidance on the correct way to fill out the form and ensure that it meets all legal requirements of the specific state. Additionally, they can offer advice on any complexities involved in the probate process or in determining the state of domicile.

How should the completed Affidavit of Domicile be used?

Once completed and notarized, the Affidavit of Domicile should be submitted to the relevant financial institutions, transfer agents, or other entities requiring proof of the decedent's domicile for the transfer of assets. It is advisable to keep copies of the affidavit for records and future use, as other entities involved in the estate proceedings may request it.

Are there any particular concerns with regard to the Affidavit of Domicile?

Several concerns should be taken into account:

- Accuracy is crucial, as any incorrect information could complicate or delay the transfer of assets and the probate process.

- The state laws governing domiciles can vary, making it essential to understand the specific requirements of the decedent's state of domicile.

- Given its legal importance, the affidavit must be completed carefully, ensuring all legal formalities are correctly observed.

Common mistakes

When completing the Affidavit of Domicile form, individuals often overlook or mishandle several critical aspects. This legal document, vital for the transfer of securities upon a person's death, requires precise and accurate information. Common errors can delay the process, leading to unnecessary complications. Below are nine mistakes frequently made:

Not verifying the deceased's legal domicile status: It is crucial to confirm and accurately report the state in which the deceased legally resided at the time of death, as this affects how the estate is processed and taxed.

Misunderstanding the form's purpose: Some individuals confuse the Affidavit of Domicile with other legal documents, such as a Will or an Affidavit of Heirship, leading to incorrect or incomplete information being provided.

Failing to provide necessary documentation: The form typically needs to be accompanied by certain documents (e.g., death certificate, executorship documentation) which are often overlooked.

Incorrectly identifying the executor or administrator: Accurately naming the executor or administrator of the estate is essential, as they are the only ones authorized to execute the Affidavit on behalf of the deceased.

Omitting relevant information: Each section of the form requires attention to detail. Missing information, such as the date of death or the account numbers of securities, can render the Affidavit incomplete.

Using informal or incorrect language: The legal document should be filled out using formal language and ensuring all names, places, and dates are spelled correctly and match official documents.

Forgetting to sign and date the form: An unsigned or undated Affidavit of Domicile may be deemed invalid, as these elements are crucial for its execution.

Not seeking legal advice: The complexities of estate planning and the handling of securities often warrant professional guidance, which many individuals bypass, leading to errors on the form.

Assuming immediate processing: Submitting the form does not guarantee immediate action; understanding the process and potential delays can help manage expectations.

Correctly filling out the Affidavit of Domicile form is a key step in managing the deceased's securities and ensuring they are transferred according to legal standards. Avoiding these common mistakes facilitates a smoother process for all parties involved.

Documents used along the form

When dealing with the resolution of an estate, particularly in the transfer of assets or securities, the Affidavit of Domicile form is an essential document. However, this affidavit often accompanies several other forms and documents which are crucial for a smooth process. Knowing what these documents are can help ensure all necessary paperwork is prepared and submitted correctly.

- Certificate of Death: This is the official document issued by a government authority that declares the date, location, and cause of a person's death. It is necessary for legal and financial proceedings following an individual's demise.

- Last Will and Testament: A legal document that expresses a person's wishes as to how their property is to be distributed after their death, and which person is to manage the property until its final distribution.

- Letters of Administration: These are issued by a court to appoint someone to manage the deceased's estate when there's no will. It gives the appointed individual the authority to collect and distribute the estate's assets according to the law.

- Transfer on Death (TOD) Registration Forms: Used for assets that have a designated beneficiary upon the death of the asset's owner. It allows for the direct transfer of the asset to the beneficiary, bypassing the probate process.

- Stock Certificates: For estates that include stocks, original stock certificates may be required to transfer ownership. This document proves the ownership of the stocks and the number of shares owned.

Each of these documents plays a role in the larger process of settling an estate and ensuring that assets are transferred according to the deceased's wishes or the law. Familiarity with these documents can help in preparing for both expected and unforeseen requirements during the process.

Similar forms

The Affidavit of Domicile form is similar to several other legal documents in terms of its purpose and the information it requires. It is primarily used to certify an individual's place of residence at the time of their death, which is crucial for the execution of their will or the transfer of securities. Understanding the similarities between this form and others can provide insight into its importance and application.

One similar document is the Death Certificate. Both the Affidavit of Domicile and the Death Certificate serve as official records related to the death of an individual. While the Death Certificate officially documents the fact, location, and cause of death, the Affidavit of Domicile focuses on the deceased's legal residence at the time of death. Nevertheless, both are pivotal in legal and estate planning contexts, often required by financial institutions and courts to proceed with asset distribution and other posthumous affairs.

Another document akin to the Affidavit of Domicile is the Last Will and Testament. This document outlines the deceased's final wishes regarding the distribution of their assets and the guardianship of their dependents. While the Last Will and Testament specifies what should be done with an individual’s assets, the Affidavit of Domicile is needed to prove the deceased's domicile, which can influence how the will is executed due to differing state laws. Thus, these documents work in tandem during the probate process.

The Declaration of Residency also shares similarities with the Affididavit of Domicile. Both documents are used to declare a person's place of residence. However, the Declaration of Residency is generally used by living individuals to affirm their current residence for various legal, tax, or regulatory purposes. In contrast, the Affidavit of Domicile is specifically used to establish the legal residence of a deceased individual, often affecting the execution of their estate plans and the taxation of their assets. Despite these differences, the underlying principle of affirming one's residency links these documents closely together.

Dos and Don'ts

When you are filling out the Affidavit of Domicile form, it's important to do some things and avoid others to make sure the form is accurate and acceptable. Here are the essential dos and don'ts:

Do:- Read the instructions carefully before you start. This ensures you understand what information is needed and how to provide it.

- Gather all necessary documents that prove domicile before filling out the form. These may include utility bills, a driver's license, or property tax receipts.

- Use black ink if you are filling out the form by hand. This makes your information clear and legible for anyone who needs to review it.

- Double-check all the information you've provided before submitting. Ensure dates, addresses, and other details are correct and current.

- Rush through the form without understanding each section. Misunderstanding questions can lead to incorrect answers.

- Leave sections blank if they are applicable to you. If a section does not apply, write "N/A" to indicate it's not applicable rather than leaving it empty.

- Use pencil to fill out the form. Pencil marks can easily smudge or be erased, making your information unreliable.

- Forget to sign and date the form. An unsigned or undated form is often considered invalid and can delay processing.

Misconceptions

When dealing with the Affidavit of Domicile form, several misconceptions often arise. Understanding these misconceptions can help individuals navigate the process more effectively.

It’s only for probate proceedings. While often used in the context of settling an estate, this document can also be required by financial institutions or in real estate transactions to verify the domicile of an individual at the time of death.

Any family member can sign it. Typically, the executor of the estate or the legal representative authorized to act on behalf of the deceased’s estate is the only person who can sign an Affidavit of Domicile.

Legal assistance is not necessary. While not always required, consulting a legal professional can help ensure that the form is completed accurately, and all legal requirements are met, potentially avoiding delays or issues with asset transfers.

It serves as a proof of residence for living individuals. This form is specifically designed to certify the domicile of a deceased individual at the time of their death, not to prove residency for living people.

There's a standard form for all states. Although the purpose of the Affidavit of Domicile is similar no matter where you are, the specific form and requirements can vary significantly by state or even by institution requesting it.

It must be filed with the court. Not all Affidavits of Domicile need to be filed with a court. Often, they are simply provided to the relevant financial institution or entity requesting proof of the deceased's domicile.

You need to attach a death certificate. While most cases require a copy of the death certificate to accompany the affidavit, it’s essential to verify the requirements with the requesting party as they can vary.

It’s only relevant for tax purposes. While tax considerations are a common reason for needing an Affidavit of Domicile, it also plays a crucial role in the transfer of securities and other assets, helping to determine applicable state laws.

Once signed, it cannot be contested. The information within an Affidavit of Domicile can be contested if there’s evidence to believe it's inaccurate or fraudulent. It’s a legal document, but like any other, it can be challenged in court.

Key takeaways

An Affidavit of Domicile is a legal document often required by financial institutions and transfer agents to confirm the residency of a deceased individual at the time of their death. This document is crucial for the handling of the estate, particularly for the transfer of securities and other assets. Here are eight key takeaways about filling out and using the Affidavit of Domicile form:

- The form must be completed by the executor or administrator of the estate. It's their responsibility to provide accurate information about the decedent's primary place of residence at the time of death.

- Accuracy is crucial when filling out the form. Any errors or inaccuracies could lead to delays or legal complications in the transfer of assets.

- The Affidavit of Domicile requires a notarization. This means the person completing the form must sign it in the presence of a notary public to verify their identity and the authenticity of the signing.

- Supporting documents may be necessary to prove the decedent’s domicile. These can include voter registration, tax returns, or a driver’s license. It’s important to check with the requesting institution about what they require.

- The document should clearly state the decedent’s full legal name, the address of their domicile at the time of death, and how long they resided at that address.

- Legal terminology such as "domicile" might be confusing. Domicile refers to the place the individual considered their permanent home, or where they intended to return to. It's not always the same as their residence.

- Once completed and notarized, the Affidavit of Domicile should be submitted to the requesting financial institution or transfer agent. It's advisable to keep a copy for your records.

- Delays in submitting the Affididavit of Domicile can complicate or postpone the process of transferring assets. Therefore, it’s important to act promptly and efficiently after obtaining all necessary information.

More Affidavit of Domicile Types:

Self Proving Affidavit for Will - It can be particularly advantageous when witnesses may be difficult to locate or unable to testify at the time the will is probated.