Valid Affidavit of Gift Form

In many legal systems, the transfer of personal property, assets, or other valuable items as a gift is a common practice. However, this transaction is not as simple as just handing over an item to another person; it often requires the completion of specific documentation to ensure that the transfer is recognized and lawful. One essential document involved in this process is the Affidavit of Gift form. This form serves as a sworn statement, typically notarized, that confirms the transfer of an item from one person (the donor) to another (the recipient) without any expectation of payment or return. The Affidavit of Gift is not only a pivotal document for tax purposes, helping to differentiate a gift from a taxable sale or transaction, but it also plays a critical role in avoiding potential disputes by providing formal proof of the donor's intention and the gift's delivery. Moreover, it includes crucial details such as the identification of the donor and recipient, a description of the gift, and any conditions attached to the gift. The legal implications and requirements surrounding the Affidavit of Gift form can vary significantly depending on the jurisdiction, making it vital for individuals participating in the gift-giving process to familiarize themselves with local laws and regulations.

State-specific Tips for Affidavit of Gift Forms

Form Example

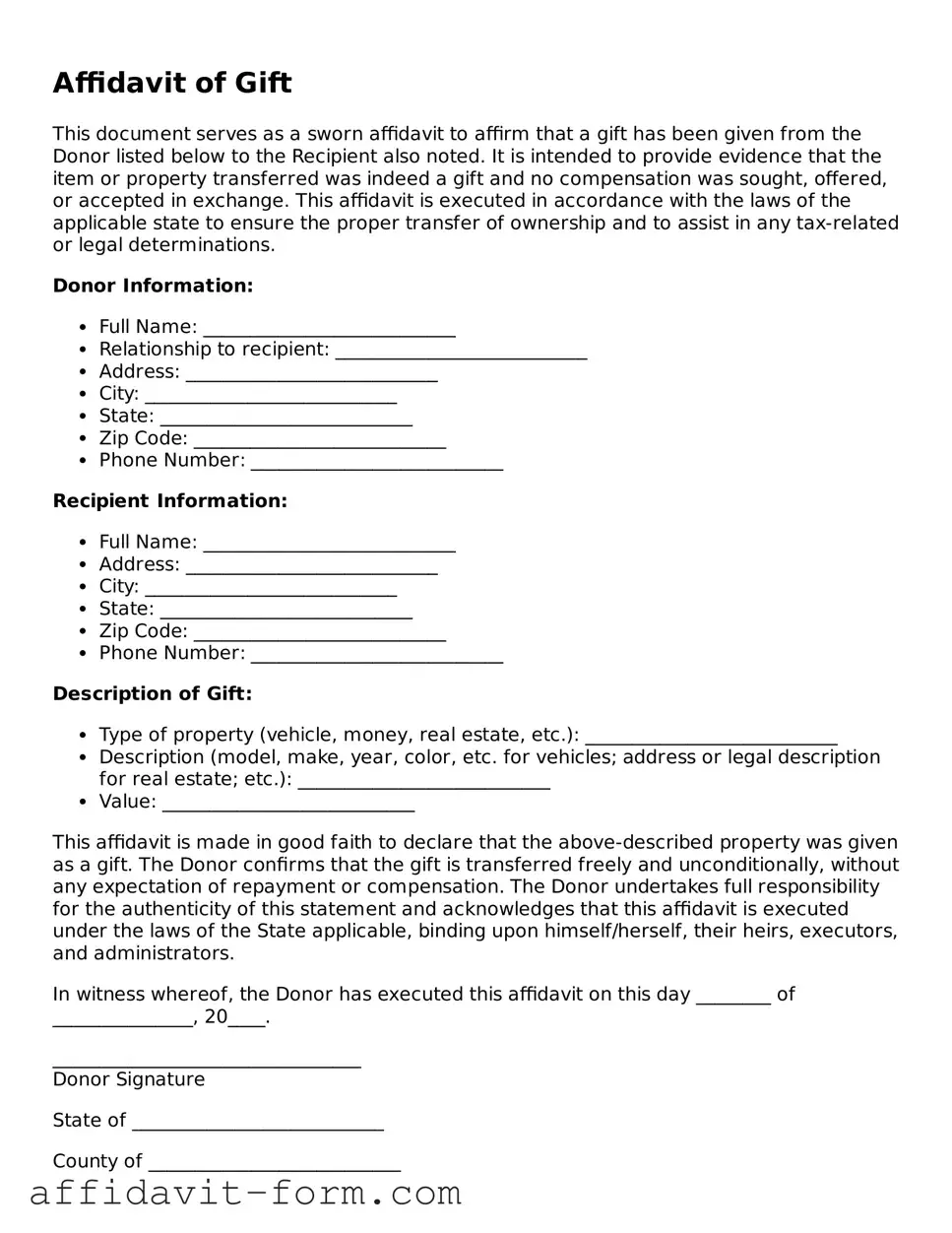

Affidavit of Gift

This document serves as a sworn affidavit to affirm that a gift has been given from the Donor listed below to the Recipient also noted. It is intended to provide evidence that the item or property transferred was indeed a gift and no compensation was sought, offered, or accepted in exchange. This affidavit is executed in accordance with the laws of the applicable state to ensure the proper transfer of ownership and to assist in any tax-related or legal determinations.

Donor Information:

- Full Name: ___________________________

- Relationship to recipient: ___________________________

- Address: ___________________________

- City: ___________________________

- State: ___________________________

- Zip Code: ___________________________

- Phone Number: ___________________________

Recipient Information:

- Full Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: ___________________________

- Zip Code: ___________________________

- Phone Number: ___________________________

Description of Gift:

- Type of property (vehicle, money, real estate, etc.): ___________________________

- Description (model, make, year, color, etc. for vehicles; address or legal description for real estate; etc.): ___________________________

- Value: ___________________________

This affidavit is made in good faith to declare that the above-described property was given as a gift. The Donor confirms that the gift is transferred freely and unconditionally, without any expectation of repayment or compensation. The Donor undertakes full responsibility for the authenticity of this statement and acknowledges that this affidavit is executed under the laws of the State applicable, binding upon himself/herself, their heirs, executors, and administrators.

In witness whereof, the Donor has executed this affidavit on this day ________ of _______________, 20____.

_________________________________

Donor Signature

State of ___________________________

County of ___________________________

Subscribed and sworn to (or affirmed) before me on this _____ day of _______________, 20____, by ___________________________ (Donor’s name), proving to me through government-issued photo identification to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

_________________________________

Notary Public

My commission expires: _______________.

Document Details

| Fact Name | Description |

|---|---|

| Purpose of the Affidavit of Gift Form | This form is used to legally document a gift's transfer from one person to another without any expectation of payment or compensation. It is commonly employed in the transfer of ownership of vehicles or personal property. |

| Governing Law | Varying by state, the Affidavit of Gift is governed by the state's laws in which the gift transfer takes place. Some states have specific forms and requirements for the affidavit to be considered valid. |

| Importance of Accuracy | Accuracy in completing the form is imperative to avoid legal complications. Incorrect or incomplete information can result in the gift being considered void or subject to taxes and penalties. |

| Tax Implications | Gifting might have tax implications for both the giver and the recipient. The form helps in documenting the transfer for tax purposes. However, the tax laws regarding gifts vary and sometimes depend on the gift's value. |

How to Use Affidavit of Gift

Completing an Affidavit of Gift is a critical step in the process of legally transferring ownership of property, such as a vehicle, from one person to another without any exchange of money. This document serves as a formal declaration to authorities, such as the Department of Motor Vehicles (DMV), that a gift has been made. The affidavit helps in documenting the transfer and ensuring that it complies with state and federal laws. The following instructions will guide you through the process of filling out the form accurately.

- Start by entering the full name of the person giving the gift (the donor) at the top of the form.

- Fill in the donor's complete address, including the city, state, and zip code.

- Provide the full name of the recipient (the giftee) of the gift.

- Enter the giftee's complete address, following the same format as the donor’s address.

- Describe the item being gifted. Include specific details, such as make, model, year, and serial number if applicable, to ensure clear identification of the property.

- State the relationship between the donor and the giftee. This helps in confirming the reason for the exemption from sales tax, if applicable.

- Include the date of the gift transfer. This is important for legal and record-keeping purposes.

- Both the donor and the giftee must sign the affidavit in the designated areas. Ensure that these signatures are witnessed and dated.

- If required by your state, have the affidavit notarized. This involves signing the document in front of a notary public, who will also sign and stamp it.

- Review the completed form for accuracy, ensuring that all necessary information has been provided and is correct.

- Submit the affidavit to the appropriate authority, such as the DMV, along with any other required documents for the property transfer.

Once the form is duly filled and submitted, the authority will process the information and, upon satisfactory verification, will officially record the ownership transfer. It is crucial for both parties to keep copies of the submitted affidavit for their records. This documentation may be required for future reference, especially in situations where proof of the gift transfer is needed.

Listed Questions and Answers

What is an Affidavit of Gift Form?

An Affidavit of Gift Form is a legal document that proves a gift has been transferred from one person to another without any expectation of payment. It officially records the details of the transfer, helping to clarify the exchange for legal or tax purposes.

When is an Affidavit of Gift Form needed?

This form is particularly useful in situations where the transfer of a high-value item, such as a vehicle, real estate, or large sums of money, is being made. It helps in proving that the transaction was indeed a gift and not a sale, which can have tax implications and may also be required by state agencies for the transfer of titles without sales tax.

Who can witness an Affidavit of Gift?

Witnesses to an Affidavit of Gift must be neutral third parties – individuals who do not stand to benefit from the gift. Often, a notary public is required to witness the signing of the form to lend it further credibility and legal weight.

What information needs to be included in an Affidavit of Gift?

The document should clearly include:

- The full name and address of the donor (the person giving the gift).

- The full name and address of the recipient (the person receiving the gift).

- A detailed description of the gift.

- The date the gift was transferred.

- A statement declaring that the transfer is a gift, not a sale or loan.

- The signatures of the donor, recipient, and any witnesses or notary public, as required.

Is an Affidavit of Gift legally binding?

Yes, once properly completed and signed by the relevant parties and witnesses, an Affidavit of Gift is considered a legally binding document. It establishes a clear record of the gift and can be used in legal disputes.

Can an Affidat of Gift be disputed?

While an Affidavit of Gift is legally binding, it can still be disputed, especially if there is evidence suggesting the transfer was not a genuine gift. Disputes may arise in cases of alleged fraud, misrepresentation, or if the donor was under duress when the gift was made.

Are there any tax implications associated with an Affidavit of Gift?

Depending on the value of the gift and the laws in your jurisdiction, there may be tax implications for either the donor or the recipient. In the United States, for instance, gifts above a certain value must be reported to the IRS, and may be subject to the federal gift tax. It is advisable to consult a tax professional to understand any potential tax liabilities.

Where can I get an Affidavit of Gift Form?

Affidavit of Gift Forms are available through legal document services, attorneys, or local government offices. In some instances, specific forms tailored to certain types of gifts, such as vehicles, may also be obtained through the relevant department of motor vehicles or similar agencies.Common mistakes

Filling out an Affidavit of Gift form is a critical step in legally transferring ownership of property from one person to another without exchanging payment. However, this process can be fraught with mistakes if not approached with care and attention to detail. Let’s explore four common missteps that can occur during the completion of this important document.

-

Not Providing Complete Information

One of the most frequent errors is leaving fields blank or providing incomplete information. Every section of the Affidavit of Gift form plays a vital role in the legal transfer process. Omitting details such as the full names of both the giver and receiver, their addresses, or a thorough description of the gifted item can lead to delays or even invalidate the affidavit entirely.

-

Failing to Properly Describe the Gift

A clear and precise description of the gifted property is essential. This includes details like make, model, serial number, or any other identifying characteristics for items such as vehicles or electronics. A vague description can cause confusion and challenges in recognizing the ownership transfer, potentially leading to legal complications.

-

Forgetting to Date and Sign in the Presence of a Notary Public

For an Affidavit of Gift to be legally binding, it must be signed by the giver in the presence of a notary public. Neglecting to sign the document, or doing so without a notary present, essentially renders the affidavit void. The role of the notary is to verify the identity of the signer and ensure the affidavit is executed willingly and under no duress.

-

Ignoring State-Specific Requirements

Laws and regulations regarding the transfer of property as a gift can vary significantly from one state to another. It’s a common oversight not to research and comply with state-specific requirements, which may include additional forms, statements, or procedures. This oversight can lead to the affidavit being rejected or the transfer being questioned at a later date.

By steering clear of these pitfalls, individuals can ensure a smoother and legally sound process when transferring property as a gift. Paying close attention to the requirements and details of the Affidavit of Gift form can save a lot of time and prevent potential legal issues in the future.

Documents used along the form

When transferring ownership of a valuable item as a gift, an Affidavit of Gift form is essential. However, this document often works in tandem with other forms and documentation to ensure the process is completed legally and efficiently. The following are some key documents that are frequently used alongside an Affidavit of Gift form.

- Bill of Sale: This document records the transaction between the giver and the recipient, particularly if the gift is of significant value. It provides proof that the item has been transferred legally from one party to another.

- Title Transfer Documents: When the gift involves an asset requiring legal documentation of ownership, such as a vehicle or property, title transfer documents are necessary. They officially record the change of ownership with the relevant authorities.

- Gift Letter: This document is often used in conjunction with an Affidavit of Gift, especially for monetary gifts or when transferring property. It provides additional proof of the giver's intention to gift the item and that the recipient is not obligated to repay.

- Tax Forms: Depending on the value of the gift, there may be tax implications. Relevant tax forms must be completed to ensure compliance with state and federal laws concerning gifts. These forms can vary, so it's important to consult with a tax professional.

- Notarization Documents: Some states require the Affidavit of Gift and associated documents to be notarized. This process provides a legal witnessing of the signatures on the documents, adding an extra layer of authenticity and protection against fraud.

When utilized together, these documents ensure a smooth and legally sound transfer of gifts. Whether you're giving a piece of jewelry, a car, or a financial donation, having the correct paperwork in order protects both the giver and the recipient, creating a seamless transaction. It's always wise to consult with a legal professional to understand the specific requirements based on the nature of the gift and the laws in your jurisdiction.

Similar forms

The Affidavit of Gift form is similar to various other legal documents that are used to transfer ownership or declare the intention behind the transfer of an asset. These documents, while distinct in their legal application, share common purposes and structure with the Affidlifehack of Gift, including delineating the parties involved, specifying the item or asset being transferred, and often requiring notarization to legally validate the document.

One such similar document is the Bill of Sale. Like the Affidavit of Gift, a Bill of Sale serves as a legal record that an item was transferred from one party to another. However, the key distinction lies in the fact that a Bill of Sale typically involves a purchase, meaning there's a transactional exchange of money for the item, whereas an Affidavit of Gift confirms the transfer of an item as a gift, with no payment involved. Both documents provide proof of change in ownership and may require notarization depending on the jurisdiction.

Another document with similarities is the Deed of Gift. This instrument is particularly used in real estate transactions to gift property from one person to another. Similar to the Affidavit of Gift, it signifies that something of significant value is being transferred willingly from one party to another without expectation of payment. Both require clear identification of the giver and receiver, a detailed description of the property, and legal formalities to be fulfilled, such as notarization, to be considered valid and binding.

Lastly, the Gift Letter shares similarities with the Affidavit of Gift, especially in scenarios involving financial transactions like mortgage applications. A Gift Letter is used to prove that funds received by a borrower from a family member or friend are indeed a gift and not a loan. This is critical to ensure lenders that the borrower is not under additional financial obligations. Like the Affidavit of Gift, a Gift Letter specifies the parties involved, the gift's value, and the declaration that no repayment is expected, securing the transaction's integrity and intention.

Dos and Don'ts

Filling out an Affidavit of Gift form is a key step in legally documenting the transfer of a gift from one person to another without any payment or consideration in return. This document is often used for the transfer of vehicle ownership but can apply to other property types as well. To ensure the process is completed correctly and legally, here are several dos and don'ts to consider.

Do:Ensure all parties involved have a clear understanding of the gift's nature, stipulating that it’s given freely and without coercion.

Fill in all required information accurately, including the full names, addresses, and identification details of both the giver and the recipient.

Clearly describe the gifted item, including serial numbers, vehicle identification numbers (VIN), or other unique identifiers to prevent any confusion.

Have the form notarized, if necessary, according to the state’s laws where the transfer occurs, to add an extra layer of legal validity.

Include any additional documents that may be required by state or federal law, such as a bill of sale or a title transfer document, alongside the affidavit.

Leave any sections of the form blank. If a section does not apply, mark it with “N/A” (not applicable) to demonstrate that it was not overlooked.

Rely solely on verbal agreements. Even if trust exists between the giver and recipient, having a documented affidavit can prevent potential legal disputes and clarify the intentions of both parties.

By following these simple guidelines, individuals can ensure the process of gifting property is both legal and hassle-free. It strengthens the legal standing of the transfer and protects the interests of both the giver and the recipient.

Misconceptions

When it comes to transferring ownership of property or items through gifting, an Affidavit of Gift form is often used. However, several misconceptions surround this document. Understanding these misconceptions can help ensure that the process goes smoothly. Here are five common misunderstandings:

- It can only be used for transferring vehicles. While commonly associated with vehicle transactions, an Affidiff ArgumentNullException(); davit of Gift can be used for a variety of gifts, including money and personal items. Its flexibility makes it a valuable tool for many types of transfers.

- Notarization is always optional. The need for notarization depends on the state’s requirements and the nature of the gift. In many cases, notarizing the document is necessary to give it legal validity and prevent disputes.

- A witness is not necessary if the document is notarized. Even if a notary public authenticates the document, having a witness can add an extra layer of verification to the transfer. Some states may require a witness regardless of notarization.

- It immediately transfers ownership. Signing an Affidavit of Gift is part of the process, but the transfer of ownership is typically not complete until the document is filed with the appropriate government agency, if required. For vehicles, this could mean the Department of Motor Vehicles (DMV) or an equivalent body.

- Any template will suffice. While many templates are available, using one tailored to your state’s laws and the specific type of gift will ensure that all legal requirements are met. This attention to detail can prevent issues from arising later.

Clearing up these misconceptions helps both the giver and the recipient manage their expectations and obligations better. An Affidavit of Gift is a powerful document when used correctly, ensuring that the generosity between parties is formally recognized and legally valid.

Key takeaways

An Affidavit of Gift form serves as a legal document to certify that an individual has given a gift to another person, usually without expecting anything in return. When dealing with property or significant assets, understanding the correct way to fill out and use this form is crucial. Here's what you need to know:

- Ensure all parties are correctly identified: The form should clearly state the names, addresses, and relationships of both the giver (donor) and the receiver (donee).

- Describe the gift accurately: Be specific about the gift being transferred. If it's a vehicle, include the make, model, year, and Vehicle Identification Number (VIN). If it's property, include an accurate description and address.

- No monetary exchange should be involved: The essence of the Affidavit of Gift is that the item is given freely, without expecting anything in return. Documenting any form of payment contradicts the purpose of this affidavit.

- Witness signatures are essential: To validate the affidavit, it typically must be signed in the presence of a witness or notary public. This adds a layer of legality and authenticity to the document.

- Understand the tax implications: Gifts of significant value may have tax consequences for both the giver and the receiver. It's important to consult with a tax professional to understand any potential liabilities.

- File with the appropriate agency: Depending on what the gift is, you might need to register the transfer with a specific agency. For example, transferring a vehicle as a gift requires notifying the Department of Motor Vehicles (DMV).

- Prevent future disputes: By clearly documenting the gift and its transfer, this affidavit can serve as evidence in any future disputes over ownership or claims against the item.

- Review laws in your state: Legal requirements for an Affidavit of Gift can vary by state. It's crucial to be aware of your state's specific requirements to ensure the document is legally binding.

Filling out an Affidavit of Gift form with accuracy and attention to detail helps in the smooth transfer of ownership of assets or property. It is a straightforward process, but its significance in proving the intention behind and legitimacy of the gift cannot be overstated. When in doubt, consider seeking legal guidance to navigate any complexities involved.

More Affidavit of Gift Types:

Self Proving Affidavit for Will - It acts as a legal shortcut during probate, eliminating the need for witness corroboration in court regarding the will's authenticity.

Indiana Reassignment Form - Filing an affidavit promptly after noticing a mistake can prevent complications in transactions or legal proceedings.