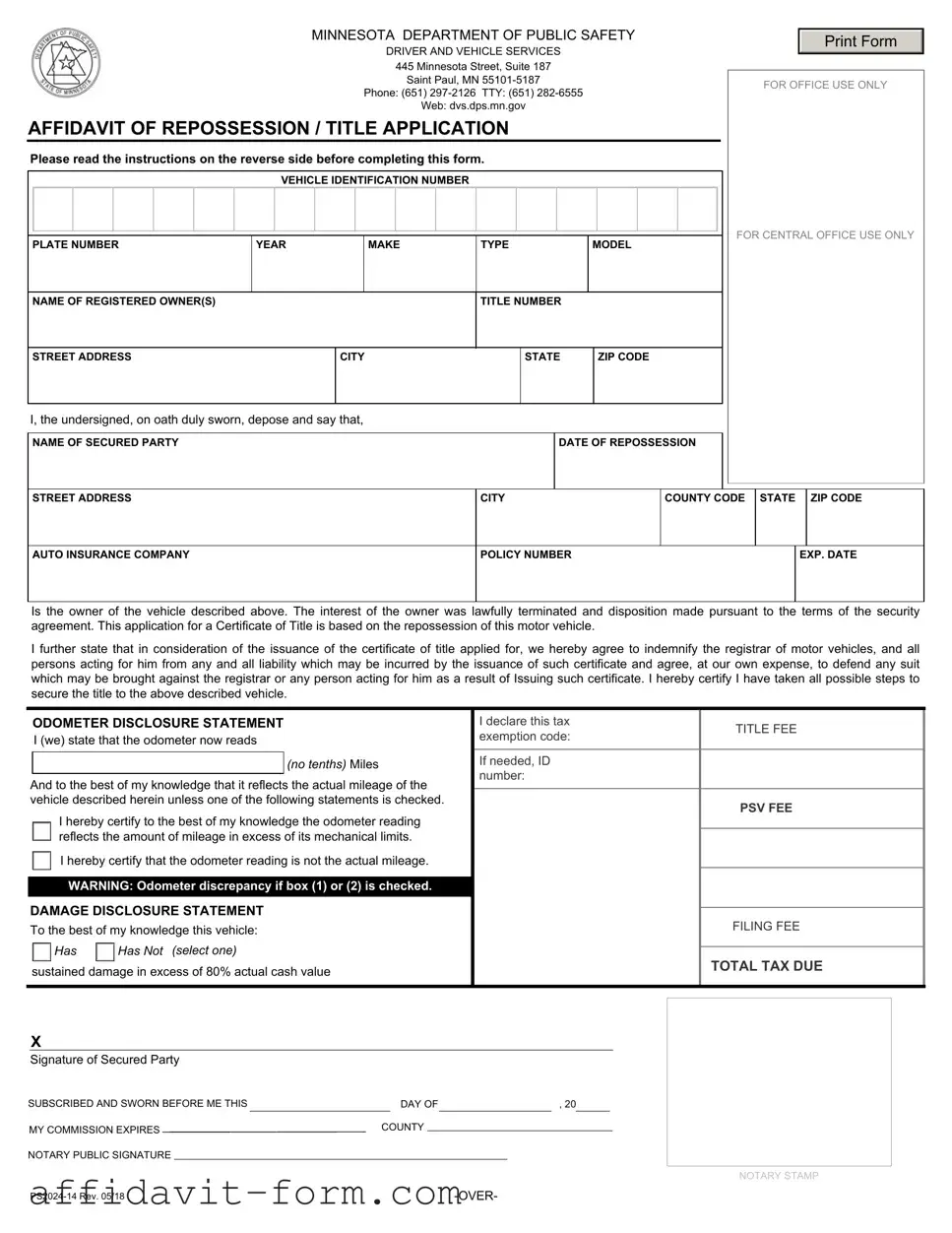

Blank Affidavit Of Repossession Minnesota PDF Template

In Minnesota, when a vehicle is repossessed, the involved parties must navigate specific legal procedures to ensure that the transfer of ownership is recognized officially. Central to this process is the Affidavit of Repossession / Title Application, a critical document overseen by the Minnesota Department of Public Safety's Driver and Vehicle Services. This document, which serves dual purposes, not only formalizes the repossession by the secured party but also acts as the application for a new title under the repossessor's name. It meticulously records details about the vehicle such as its identification number, make, model, and year, alongside information about the registered owner and the entity taking possession. Furthermore, the form contains sections including an odometer disclosure statement, which helps in verifying the vehicle's actual mileage at the time of repossession, and a damage disclosure statement which assesses whether the vehicle has sustained damage exceeding 80% of its actual cash value. Entities completing this form must also agree to indemnify the registrar of motor vehicles against any liabilities that may arise from the issuance of the new certificate of title, acknowledging the potential complexities surrounding repossessions. For those navigating this process, understanding and accurately completing this form is imperative to ensure that the repossession and subsequent title transfer are conducted lawfully and without dispute.

Form Example

MINNESOTA DEPARTMENT OF PUBLIC SAFETY |

|

|

Print Form |

||

DRIVER AND VEHICLE SERVICES |

||

|

445 Minnesota Street, Suite 187

Saint Paul, MN

Web: dvs.dps.mn.gov

AFFIDAVIT OF REPOSSESSION / TITLE APPLICATION

Please read the instructions on the reverse side before completing this form.

|

|

|

|

|

|

|

|

VEHICLE IDENTIFICATION NUMBER |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR CENTRAL OFFICE USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLATE NUMBER |

YEAR |

|

|

MAKE |

TYPE |

MODEL |

|||||||||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF REGISTERED OWNER(S) |

|

|

|

|

|

|

|

|

TITLE NUMBER |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

|

|

CITY |

|

|

STATE |

|

|

ZIP CODE |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I, the undersigned, on oath duly sworn, depose and say that, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NAME OF SECURED PARTY |

|

DATE OF REPOSSESSION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

STREET ADDRESS |

CITY |

COUNTY CODE |

STATE |

ZIP CODE |

||||

|

|

|

|

|

|

|

|

|

AUTO INSURANCE COMPANY |

POLICY NUMBER |

|

|

|

|

EXP. DATE |

||

|

|

|

|

|

|

|

|

|

Is the owner of the vehicle described above. The interest of the owner was lawfully terminated and disposition made pursuant to the terms of the security agreement. This application for a Certificate of Title is based on the repossession of this motor vehicle.

I further state that in consideration of the issuance of the certificate of title applied for, we hereby agree to indemnify the registrar of motor vehicles, and all persons acting for him from any and all liability which may be incurred by the issuance of such certificate and agree, at our own expense, to defend any suit which may be brought against the registrar or any person acting for him as a result of Issuing such certificate. I hereby certify I have taken all possible steps to secure the title to the above described vehicle.

ODOMETER DISCLOSURE STATEMENT

I (we) state that the odometer now reads

(no tenths) Miles

And to the best of my knowledge that it reflects the actual mileage of the vehicle described herein unless one of the following statements is checked.

I hereby certify to the best of my knowledge the odometer reading reflects the amount of mileage in excess of its mechanical limits.

I hereby certify that the odometer reading is not the actual mileage.

WARNING: Odometer discrepancy if box (1) or (2) is checked.

DAMAGE DISCLOSURE STATEMENT

To the best of my knowledge this vehicle:

Has

Has  Has Not (select one)

Has Not (select one)

sustained damage in excess of 80% actual cash value

I declare this tax |

TITLE FEE |

|

exemption code: |

||

|

||

|

|

|

If needed, ID |

|

|

number: |

|

|

|

|

|

|

PSV FEE |

FILING FEE

TOTAL TAX DUE

|

X |

|

|

|

|

|

|

|

|

|

|

|

Signature of Secured Party |

|

|

|

|

|

|

|

|

|

|

||

SUBSCRIBED AND SWORN BEFORE ME THIS |

|

DAY OF |

|

, 20 |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

MY COMMISSION EXPIRES |

COUNTY |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

NOTARY PUBLIC SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTARY STAMP |

|

|

|

||||||||||

Affidavit of Repossession/Title Application

INSTRUCTIONS

Repossession/Title Application

1.When the repossessing party chooses to title the vehicle in their name, this form also serves as their application for title.

If the repossessing party has the Minnesota title in their possession, they do not need to apply for a title in their name. If the repossessing party is a private individual, please include their driver’s license number and date of birth.

2.The following fees are due when the repossessing party titles the vehicle in their name: Title, Public Safety Vehicle (PSV), and Filing. If a private party is repossessing this vehicle, MN sales tax is due if the private party was not the previous owner. To determine the amount due, visit dvs.dps.mn.gov and select Fees from the top menu or call (651)

3.A secured party that has the certificate of title but elects not to title the vehicle in their name must complete and submit a dealer purchase receipt (PS2009).

4.All forms and fees may be submitted to your local deputy registrar office or by mail to:

MINNESOTA DEPARTMENT OF PUBLIC SAFETY DRIVER AND VEHICLE SERVICES

445 MINNESOTA STREET, SUITE 187

ST. PAUL, MINNESOTA

For a list of office locations, visit dvs.dps.mn.gov or call (651)

Document Features

| Fact Name | Description |

|---|---|

| Form Identification | Affidavit of Repossession/Title Application |

| Issuing Body | Minnesota Department of Public Safety, Driver and Vehicle Services |

| Primary Use | Application for a Certificate of Title based on repossession |

| Location | 445 Minnesota Street, Suite 187, Saint Paul, MN 55101-5187 |

| Contact Information | Phone: (651) 297-2126, TTY: (651) 282-6555, Web: dvs.dps.mn.gov |

| Repossession Conditions | The interest of the owner was lawfully terminated based on the terms of the security agreement. |

| Indemnity Clause | The applicant agrees to indemnify the registrar of motor vehicles and all acting persons from liability resulting from the certificate's issuance. |

| Odometer Disclosure Statement | Applicants must disclose the vehicle's mileage, indicating if it exceeds mechanical limits or is not accurate. |

| Damage Disclosure Statement | Applicants must state whether the vehicle has sustained damage in excess of 80% of its actual cash value. |

| Notarization Requirement | The affidavit must be notarized, including the notary public's signature and stamp. |

| Required Fees | Title fee, Public Safety Vehicle (PSV) fee, and filing fee, with sales tax applicable if repossessed by a private party not previously owning the vehicle. |

How to Use Affidavit Of Repossession Minnesota

Filling out the Affidavit of Repossession for the state of Minnesota is a necessary step following the repossession of a vehicle. This form serves both as a legal declaration of repossession and, if required, an application for a new title under the repossessor's name. The accuracy and completeness of this form are critical, not only for legal compliance but also to ensure the smooth transition of the vehicle's title, free from potential liabilities or disputes. Below are the necessary steps to accurately complete the form.

- Start by entering the Vehicle Identification Number (VIN) in the designated space at the top of the form.

- Fill in the plate number, year, make, type, and model of the repossessed vehicle.

- Write the name(s) of the registered owner(s) as it appears on the title, followed by the title number.

- Enter the street address, city, state, and zip code of the registered owner(s).

- Provide the name of the secured party (individual or entity that repossessed the vehicle), the date of repossession, and the complete address including city, county code, state, and zip code.

- If applicable, fill in the auto insurance company name, policy number, and expiration date.

- Under the Odometer Disclosure Statement, input the current odometer reading (without tenths). If necessary, check the appropriate box to indicate if the reading reflects more than the mechanical limits of the odometer or if it's not the actual mileage.

- In the Damage Disclosure Statement section, indicate whether the vehicle has sustained damage in excess of 80% of its actual cash value by selecting the appropriate option.

- Declare any tax exemption code if applicable. If necessary, provide the ID number.

- Calculate and enter the title fee, PSV fee (if applicable), filing fee, and the total tax due.

- Sign and date the form in the presence of a notary public. The secured party must provide their signature.

- The notary public will complete the remainder of the form, including the county, notary public signature, date, and they will affix their notary stamp.

After the form is fully completed and signed, it, along with any necessary fees, should be submitted either in person or by mail to the Minnesota Department of Public Safety, Driver and Vehicle Services. It is essential to keep a copy for your records and follow up with the department to ensure the title transfer or new title issuance is processed without delay.

Listed Questions and Answers

What is the purpose of the Affidavit of Repossession form in Minnesota?

The Affidavit of Repossession form serves a dual purpose in Minnesota. First, it acts as a formal declaration by the secured party (lender) affirming that they have lawfully repossessed a vehicle due to the previous owner's failure to comply with the terms of the security agreement. This declaration includes details such as the vehicle identification number (VIN), the name and address of the registered owner, and the date of repossession. Second, this document is used by the repossessing party to apply for a new Certificate of Title in their name if they choose to claim ownership of the vehicle post-repossession. This step is crucial for the legal transfer of ownership and must be completed if the secured party intends to sell the vehicle or retain it for their use.

What are the necessary fees associated with titling a repossessed vehicle in Minnesota?

Several fees are associated with titling a repossessed vehicle in Minnesota, which must be paid when the repossessing party chooses to title the vehicle in their name. These fees include:

- Title Fee

- Public Safety Vehicle (PSV) Fee

- Filing Fee

What steps should be taken if the repossessing party does not wish to title the vehicle in their name?

If the secured party recovers possession of the vehicle but chooses not to title the vehicle in their own name, they are required to complete and submit a Dealer Purchase Receipt (PS2009). This step is necessary for documenting the change in possession and ensuring that the repossessing party is released from future liability associated with the vehicle. The completion of this process aids in maintaining an accurate and current vehicle registration record within the state of Minnesota.

How can the Affidavit of Repossession/Title Application form be submitted?

The completed Affidavit of Repossession/Title Application form, along with any necessary fees and additional documentation, can be submitted in two ways:

- In-person at a local deputy registrar office. A list of office locations can be found on the Minnesota Department of Public Safety's Driver and Vehicle Services website or by calling their office.

- By mail to the MINNESOTA DEPARTMENT OF PUBLIC SAFETY DRIVER AND VEHICLE SERVICES at the address specified for such submissions. This allows for convenience if an in-person visit is not feasible.

Common mistakes

Filling out the Affidavit of Repossession Minnesota form requires careful attention to detail. Several common mistakes can occur during this process, complicating or even delaying the repossession and title application. Being aware of these pitfalls can streamline the process and help ensure that it moves forward without unnecessary issues.

Incorrect Vehicle Identification Number (VIN): Providing an inaccurate VIN can void the entire affidavit, as this number is essential for identifying the vehicle in question.

Omitting the Plate Number: While it may seem inconsequential, failing to include the vehicle's plate number can lead to processing delays, as it is another layer of identification.

Not specifying the correct Date of Repossession: This date is crucial for documenting when the secured party took possession of the vehicle, impacting legal and processing timelines.

Incomplete or incorrect owner information: All fields related to the registered owner(s) must be accurately filled out, including name, address, and title number, to ensure the affidavit is legally binding.

Failing to detail the state of the odometer accurately: Misreporting or overlooking to check the appropriate box regarding the odometer reading can raise questions about the vehicle's condition and history.

Incorrect Damage Disclosure: Not accurately disclosing the vehicle’s damage or failing to indicate whether it has sustained damage in excess of 80% of its actual cash value can affect the title and registration process.

Neglecting to declare the tax TITLE FEE exemption code correctly: If applicable, overlooking or misrepresenting this code can lead to incorrect fee assessments.

Inadequate signature and notarization: The affidavit must be signed by the secured party and notarized to be valid. Skipping these steps invalidates the document.

To avoid these common errors, individuals should proceed with meticulous care, reviewing each section of the Affidavit of Repossession Minnesota form multiple times before submission. Proper attention ensures that the affidavit is completed correctly the first time, minimizing delays and potential legal complications in the repossession process.

Documents used along the form

When handling the process of vehicle repossession in Minnesota, specifically with the Affidavit of Repossession Minnesota form, various other documents often play critical roles throughout the procedure. These complementary documents ensure completeness and compliance with the law, providing a seamless transition of ownership and status updates of the vehicle in question.

- Notice of Repossession: A document served to the borrower, informing them of the repossession. It details the reason for reposession, the date of repossession, and the rights of the borrower, including the right to redeem the property.

- Application for Title: Used when the repossessor decides to apply for a new title in their name, asserting ownership of the vehicle post-repossession.

- Power of Attorney: Grants the repossessor the authority to act on behalf of the lender in matters related to the repossession and title application for the vehicle.

- Odometer Disclosure Statement: This mandatory form records the vehicle's mileage at the time of repossession and transfer of ownership. It ensures transparency and accuracy in reporting mileage.

- Damage Disclosure Statement: Accompanies the title application to disclose any significant damage to the vehicle, affecting its value and condition.

- Dealer Purchase Receipt (PS2009): Required when the vehicle will not be titled in the name of the repossessing party but sold or transferred further. It documents the transaction from the secured party to the dealer or next owner.

- Lien Release: If applicable, this document releases the vehicle from any previous liens, other than the one involved in the repossession, asserting that the vehicle is free from other financial encumbrances.

- Personal Property Inventory: Documents personal items found within the repossessed vehicle, ensuring that items can be returned to the rightful owner and avoiding potential disputes.

Together, these documents form a comprehensive framework to manage the complex process of vehicle repossession, each serving a distinct but integral function. The proper use and submission of these documents not only fulfill legal requirements but also protect the rights and interests of all parties involved, reinforcing the importance of meticulous attention to detail in legal proceedings.

Similar forms

The Affidavit of Repossession Minnesota form is similar to other legal documents that also deal with the transfer or assertion of rights over property under specific circumstances. These documents often share similar purposes, such as clarifying ownership claims, providing proof of consent from the previous owner, or confirming the transfer of ownership under the law. Two such documents include the Notice of Default and the Mechanic's Lien.

The Notice of Default is a document frequently used by banks and lending institutions when an individual fails to meet the repayment terms of a loan. Similar to the Affididavit of Repossession, it serves as a formal declaration that the borrower has not complied with the financial agreement. Both documents initiate a legal process that could lead to the loss of property for the borrower or owner. They also both require detailed information about the property in question, the parties involved, and the specifics of the default or repossession. However, while the Notice of Default specifically pertains to payments default on loans or mortgages, the Affidavit of Repossession is more closely tied to tangible property like vehicles.

Similarly, a Mechanic's Lien is another document that shares similarities with the Affidavit of Repossession. This form is used by contractors, subcontractors, or suppliers to claim a security interest in a property against which they have provided labor or materials and have not received payment. Both documents are legal tools used to secure an interest in property due to unpaid debts. They both must be filed under specific legal guidelines and timelines to be considered valid. The Mechanic's Lien and the Affidavit of Repossession each serve as a public declaration of a party's intent to seek redress for the value they have contributed, whether it be through improvement of property or through financial lending for a vehicle.

Dos and Don'ts

Filling out the Affidavit of Repossession form for Minnesota requires careful attention to detail and an understanding of the legal and procedural guidelines. Here's a helpful list of things you should and shouldn't do to ensure the process is completed accurately and efficiently.

Do:

- Read the instructions on the reverse side of the form carefully before you begin filling it out. These instructions are designed to guide you through the process and help you avoid common mistakes.

- Ensure all information about the vehicle, such as the vehicle identification number (VIN), plate number, year, make, type, and model, is accurate and matches the records.

- Provide complete and accurate information about the registered owner(s), including their name, title number, and address.

- Clearly state the date of repossession, and make sure it is accurate, as this date has legal implications.

- Fill in the odometer disclosure statement truthfully. If the odometer reading does not reflect the actual mileage, or if it exceeds its mechanical limits, select the appropriate checkbox.

- If applicable, correctly indicate whether the vehicle has sustained damage in excess of 80% of its actual cash value.

- Sign and date the form in the presence of a Notary Public, ensuring that the notarization process is completed properly.

Don't:

- Skip any fields. If a section does not apply, mark it as "N/A" instead of leaving it blank, unless instructions specify otherwise.

- Forget to check the appropriate boxes under the odometer and damage disclosure sections based on the condition and history of the vehicle.

- Misstate the relationship or details of the secured party. Ensure that the name and address are correctly spelled and match the details of the secured party entitled to possession of the vehicle.

- Neglect to review all entered information for accuracy and completeness before notarizing the document. Mistakes can cause delays or legal complications.

- Fail to provide any supporting documents that may be required, such as proof of insurance or the original certificate of title, if available.

- Attempt to use the form for any purpose other than its intended use as specified by the Minnesota Department of Public Safety.

- Forget to include the necessary fees when submitting the form. Check the current fees on the Minnesota Driver and Vehicle Services website or by contacting them directly.

By following these guidelines, you can help ensure that the affidavit of repossession is completed correctly, which is crucial for the repossession process to proceed smoothly and within the bounds of Minnesota law.

Misconceptions

There are several common misconceptions about the Affidavit of Repossession form in Minnesota that can lead to confusion for both the secured parties seeking to repossess a vehicle and the registered owners of the vehicles. Clarifying these misunderstandings is crucial to ensure the rightful process is followed.

It's only for use by commercial repossession companies: This form is not exclusively for commercial repossession companies. It is also available for use by private individuals who are secured parties needing to repossess a vehicle as long as they comply with the legal requirements for repossession in Minnesota.

Completion of the form transfers ownership immediately: Merely completing and submitting the Affidavit of Repossession form does not immediately transfer ownership. The secured party must also apply for a new title in their name, and this process includes submitting the form along with the required fees to the Minnesota Department of Public Safety, Driver and Vehicle Services.

You need the original title to fill out the form: While having the original title can simplify the process, it is not strictly necessary to fill out the Affidavit of Repossession form. If the repossessing party does not have the Minnesota title in their possession, they can still complete the form as part of the application for a new title in their name, provided other legal requisites for repossession have been met.

No sales tax is due if the form is submitted by a private party: Contrary to this belief, if a private party repossessing the vehicle was not the previous owner, Minnesota sales tax is due upon filing the form if they choose to title the vehicle in their name. The amount of sales tax due can be determined by visiting the Minnesota Driver and Vehicle Services website or contacting them directly.

Filing the form is the final step in the repossession process: Filing the Affidavit of Repossession form with the Minnesota Department of Public Safety, Driver and Vehicle Services, is a critical step in the repossession process, but it is not necessarily the final step. The secured party may need to take additional actions, such as securing a new title and registration for the vehicle in their name, and possibly defending their right to the vehicle in case of disputes or legal challenges.

Understanding these nuances can help facilitate a smoother repossession process and ensure that all parties are aware of their rights and responsibilities under Minnesota law.

Key takeaways

Completing the Affidavit of Repossession in Minnesota serves two primary purposes: it acts as an official declaration of the repossession by the secured party, and if the repossessor chooses, it can also serve as an application for a new certificate of title in their name.

Before filling out the form, one must thoroughly read the instructions provided on the reverse side to ensure accurate and compliant completion.

Accurate vehicle identification is crucial; therefore, details such as the Vehicle Identification Number (VIN), plate number, year, make, model, and the name of the registered owner(s) must be clearly and correctly filled in.

The affidavit requires the secured party to attest that the owner's interest in the vehicle was lawfully terminated according to the terms of the security agreement, and that all necessary steps have been taken to secure the title of the repossessed vehicle.

In addition to repossession details, the secured party must provide an odometer disclosure statement and, if applicable, a damage disclosure statement indicating whether the vehicle sustained damage exceeding 80% of its actual cash value.

Fees are associated with retitling the vehicle in the name of the person or entity that has repossessed the vehicle. These fees include a title fee, a public safety vehicle (PSV) fee, and a filing fee. Sales tax may also be due if the vehicle is repossessed by a private party who was not the previous owner.

To complete the title transfer process, the secured party agrees to indemnify the registrar of motor vehicles and all persons acting on behalf of the registrar from any liability incurred through the issuance of the new certificate of title.

After the form is filled out, it needs to be signed by the secured party in front of a notary public, who then also signs and applies their notary stamp to validate the document.

The completed form, along with any required fees and additional documentation, should be submitted either to a local deputy registrar office or mailed to the Minnesota Department of Public Safety, Driver and Vehicle Services as specified in the instructions.

Common PDF Documents

Michigan Deed Forms - Important for maintaining the integrity of Michigan's property records and tax administration.

Ccsd Residential Affidavit - Through this document, the Clark County School District enforces its residency requirements, ensuring equity and adherence to district regulations.