Printable Small Estate Affidavit Form for Alabama

When a loved one passes away, the process of settling their estate can seem daunting, especially during a time of grief. In Alabama, the Small Estate Affidavit form offers a simpler path for the legal transfer of property for estates that do not meet a certain financial threshold. This streamlined procedure is designed to bypass the often lengthy and complicated probate process, allowing for a quicker resolution and distribution of the deceased's assets to the rightful heirs. The form itself is a legal document that requires careful completion, attesting to the fact that the estate qualifies for this expedited method according to state laws. It's important for individuals to understand the criteria that determine eligibility, the step-by-step process for filing the affidavit, and the implications it holds for the estate's assets and liabilities. Through this approach, Alabama aims to alleviate the administrative and emotional burden on families during a difficult period, ensuring that the transition of assets is conducted with fairness and respect for the deceased's wishes.

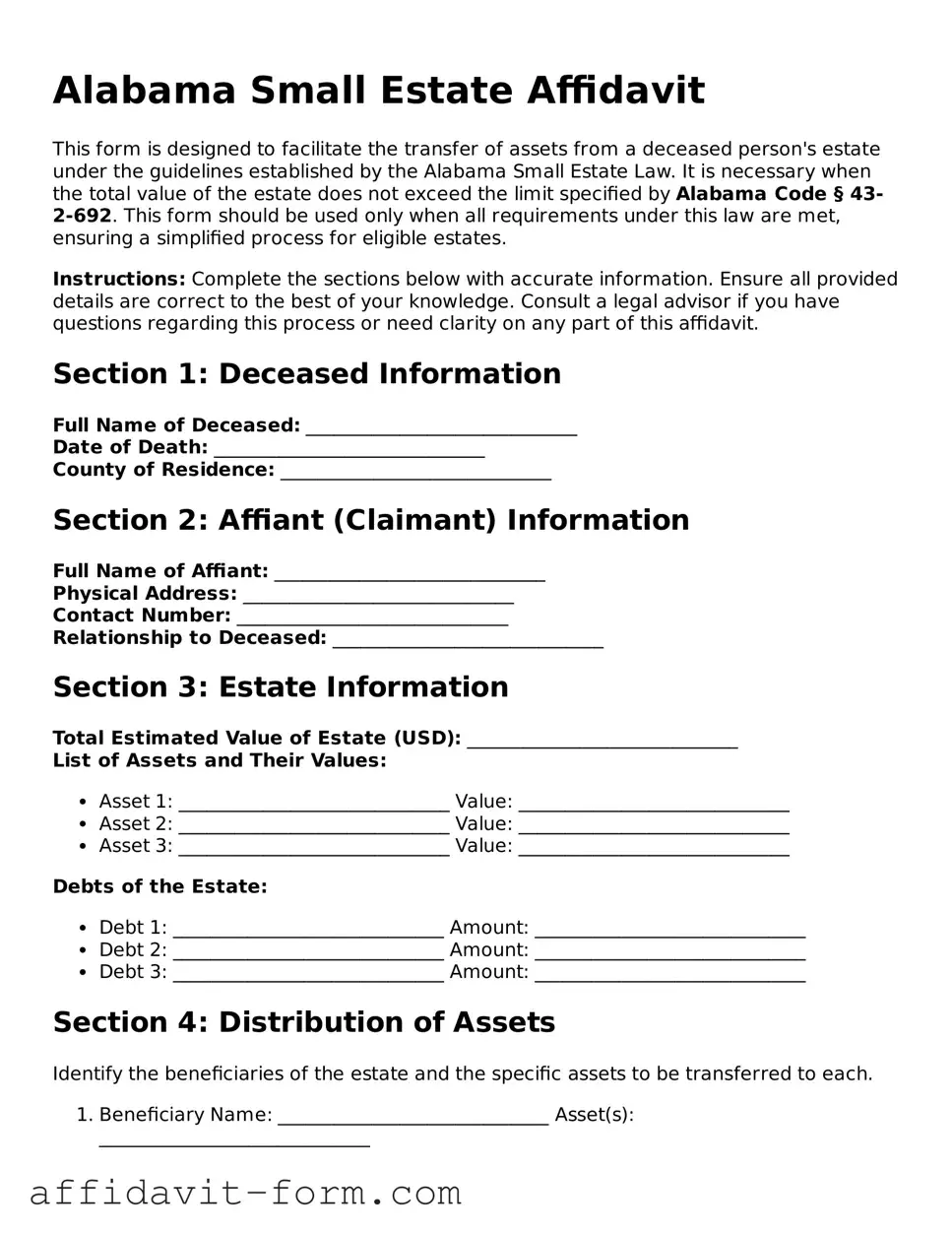

Form Example

Alabama Small Estate Affidavit

This form is designed to facilitate the transfer of assets from a deceased person's estate under the guidelines established by the Alabama Small Estate Law. It is necessary when the total value of the estate does not exceed the limit specified by Alabama Code § 43-2-692. This form should be used only when all requirements under this law are met, ensuring a simplified process for eligible estates.

Instructions: Complete the sections below with accurate information. Ensure all provided details are correct to the best of your knowledge. Consult a legal advisor if you have questions regarding this process or need clarity on any part of this affidavit.

Section 1: Deceased Information

Full Name of Deceased: _____________________________

Date of Death: _____________________________

County of Residence: _____________________________

Section 2: Affiant (Claimant) Information

Full Name of Affiant: _____________________________

Physical Address: _____________________________

Contact Number: _____________________________

Relationship to Deceased: _____________________________

Section 3: Estate Information

Total Estimated Value of Estate (USD): _____________________________

List of Assets and Their Values:

- Asset 1: _____________________________ Value: _____________________________

- Asset 2: _____________________________ Value: _____________________________

- Asset 3: _____________________________ Value: _____________________________

- Debt 1: _____________________________ Amount: _____________________________

- Debt 2: _____________________________ Amount: _____________________________

- Debt 3: _____________________________ Amount: _____________________________

Section 4: Distribution of Assets

Identify the beneficiaries of the estate and the specific assets to be transferred to each.

- Beneficiary Name: _____________________________ Asset(s): _____________________________

- Beneficiary Name: _____________________________ Asset(s): _____________________________

- Beneficiary Name: _____________________________ Asset(s): _____________________________

Section 5: Declaration and Signature

I, the undersigned, declare under penalty of perjury that the information provided herein is accurate and complete to the best of my knowledge. I understand that providing false information on this affidavit can result in penalties under the law. I agree to indemnify and hold harmless any party that relies on this document for the transfer of any of the described assets from any and all claims or liabilities arising from this affidavit.

Signature of Affiant: _____________________________

Date: _____________________________

This document must be notarized in the presence of a Notary Public.

Notary Public: ______________________________________

Commission Expiration: _____________________________

Document Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Alabama Small Estate Affidavit form is utilized when managing the assets of an individual who has passed away with a small estate, to streamline the process without probate court intervention. |

| 2 | Governing laws for the Alabama Small Estate Affidavit form are found in §§ 43-2-690 et seq. of the Alabama Code. |

| 3 | To qualify for using this form, the total value of the deceased's estate must not exceed $25,000, excluding certain assets under Alabama law. |

| 4 | The affidavit can be filed 30 days or more after the decedent has passed away, providing time to accurately assess the estate's value. |

| 5 | It allows the transfer of personal property, such as bank accounts, vehicles, and other non-real estate assets, to rightful heirs without probate court involvement. |

| 6 | The affidavit requires a comprehensive list of the deceased’s personal property, including descriptions and values, to ensure all assets are accounted for. |

| 7 | The form must be signed by all heirs or the legally designated representative of the estate, in the presence of a notary public for formal acknowledgment. |

| 8 | Submitting this affidavit may require additional documentation, such as death certificates and proof of ties to the deceased, to validate the claims of the filer. |

| 9 | Once the affidavit is properly filed and accepted, assets can be distributed to the heirs without the lengthy delays and expenses commonly associated with probate proceedings. |

How to Use Alabama Small Estate Affidavit

When a loved one passes away in Alabama, settling their affairs doesn’t always mean going through a lengthy probate process. For smaller estates, the Small Estate Affidavit can be a simpler, faster way to transfer property to the rightful heirs. This form is used when the total value of the estate doesn't exceed a certain threshold, allowing for an expedited process. Filling out the Alabama Small Estate Affidavit requires attention to detail and an understanding of the deceased person’s assets. Here’s a step-by-step guide to help you complete the form accurately.

- Gather all necessary documents, including the death certificate of the deceased and an inventory of their assets. This preparatory step is crucial for accurately completing the affidavit.

- Locate the latest version of the Alabama Small Estate Affidavit form. This can often be found online on the website of the Alabama state court or by visiting the local courthouse.

- At the top of the form, fill in the county where the affidavit will be filed. This is typically the county where the deceased person lived at the time of their death.

- Input the full legal name of the deceased, also known as the decedent, in the designated section.

- Enter the date of death of the decedent in the space provided. Make sure this date matches the one on the death certificate.

- List the names and addresses of the heirs in the specified fields. These are the individuals entitled to the decedent’s property under the law.

- Provide a detailed description of the property that is part of the estate. This includes bank accounts, vehicles, personal belongings, and any real estate that was solely owned by the decedent.

- Indicate the estimated value of the estate’s total assets. Remember, the value should not exceed the threshold amount set by Alabama law for small estates.

- If the affidavit requires it, explain how debts of the estate, if any, will be paid. This might include funeral expenses, medical bills, or other outstanding obligations.

- Review the affidavit carefully to ensure all the information provided is accurate and truthful. Mistakes or inaccuracies can result in delays or legal issues.

- Sign and date the form in front of a notary public. Many banks offer notary services, often at no charge for customers. The notary will then seal the affidavit, officially notarizing the document.

- Submit the completed affidavit to the appropriate county office. This might be the probate court or another designated authority in the Alabama county where the form is being filed.

- Pay any required filing fees associated with the small estate process. These fees vary by county, so check in advance what the cost will be.

Once submitted and approved, the Small Estate Affaffidavit serves as authorization for the assets to be distributed to the heirs named in the document. While it’s a process that demands diligence, using the Small Estate Affidavit can significantly streamline handling your loved one’s estate in Alabama. For those unfamiliar with legal forms, or if any aspect of the process feels overwhelming, seeking guidance from a legal professional is highly recommended.

Listed Questions and Answers

What is a Small Estate Affidavit in Alabama?

A Small Estate Affidavit in Alabama is a legal document used when someone has passed away with a relatively small amount of assets. It allows the property of the deceased to be distributed without a formal probate court case. This can simplify the process, making it quicker and less expensive for the family.

Who can file a Small Estate Affidavit in Alabama?

The right to file this affidavit is typically given to the surviving spouse or next of kin of the deceased. If there is no spouse or next of kin, an interested party or creditor with evidence of the deceased's debt may also file the affidavit.

What are the requirements for using a Small Estate Affidavit in Alabama?

To use a Small Estate Affidavit in Alabama, the total value of the estate must not exceed a certain limit ($25,000, adjusting for inflation). Additionally, at least 30 days must have passed since the death of the estate owner. All debts and taxes of the estate must be satisfied or otherwise accounted for.

What information is needed to complete the Small Estate Affidified?

Completing a Small Estate Affidavit requires detailed information, including:

- The full name and address of the deceased (also known as the decedent).

- The date of death.

- A thorough list of the estate's assets.

- The value of each asset listed.

- Names and addresses of the heirs or legatees supposed to receive the assets.

- Information on any outstanding debts or taxes.

How is the Small Estate Affidavit filed in Alabama?

The affidavit must be filed with the Probate Court in the county where the deceased lived. If the deceased did not reside in Alabama, it should be filed in the county where their property is located. This process may involve submitting the affidavit along with death certificates and possibly other documentation.

How long does the process take in Alabama?

Once filed, the timeframe to complete the process can vary greatly. However, because it's designed to be a simplified process, it is generally quicker than going through regular probate. It may take several weeks to a few months, depending on the specifics of the estate and the local court's schedule.

Are there any fees associated with filing a Small Estate Affidavit in Alabama?

Yes, there are filing fees associated with the Small Estate Affidavit. The amount varies by county, so it's advisable to contact the local Probate Court for the exact fees. Additional costs may include the price for certified copies of the death certificate and any legal advice sought during the process.

What happens after the Small Estate Affidavit is filed and approved?

After approval, the person who filed the affidavit is authorized to collect and distribute the estate's assets according to the affidavit's terms. They might be required to provide evidence of the distributed assets to the court or parties involved.

Can a Small Estate Affidavit be contested in Alabama?

Yes, like with most legal documents and processes, the Small Estate Affidavit can be contested. If, for instance, an heir believes the assets were not distributed fairly or according to the decedent's wishes, they may contest the affidavit in court. Legal guidance is highly recommended in such situations.

Common mistakes

In navigating the legal landscape associated with the passing of a loved one, individuals often turn to tools like the Alabama Small Estate Affidavit form to simplify the estate settlement process. This document is designed to facilitate the transfer of the deceased's assets to their rightful heirs without the need for a prolonged probate procedure. However, filling out this form can be fraught with pitfalls if careful attention is not paid. Here are four common mistakes to avoid:

- Failing to ensure eligibility. One of the preliminary errors involves not properly verifying whether the estate qualifies as a 'small estate' under Alabama law. The state mandates specific criteria related to the value of the estate which must be met. Overlooking or misinterpreting these criteria can lead to invalid submission.

- Incorrectly listing assets. Another frequent mistake is the improper listing of assets within the form. It's crucial to understand which assets should be included and how they are to be valued. Tangible and intangible assets may have different requirements, and inaccuracies here could result in the rejection of the affidavit or future legal challenges.

- Omitting necessary documentation. Often, individuals submit the affidavit without the required supplemental documents. These might include death certificates, titles, and account statements, among others. The absence of these materials can delay the process significantly, as the court or financial institutions will request them before proceeding.

- Overlooking potential debts and taxes. Lastly, a common oversight is neglecting to account for the deceased person's debts and taxes. It's essential to disclose these obligations accurately within the affidavit. Failure to do so not only jeopardizes the acceptance of the affidavit but also potentially subjects the estate's administrator to personal financial liability.

By attending carefully to each of these aspects, one can better navigate the completion of the Alabama Small Estate Affidavit form, thereby streamlining the settlement of the deceased's estate. Vigilance and thoroughness are key to avoiding these pitfalls.

Documents used along the form

When handling the estate of a deceased individual in Alabama, especially small estates, several documents might be required in addition to the Small Estate Affidavit. These documents are vital for a smooth probate process, ensuring that assets are distributed correctly and legally. Here, we will briefly describe up to seven other forms and documents often used alongside the Small Estate Affidariat form, highlighting their significance in the administration of the estate.

- Death Certificate: A certified copy is often required to prove the death of the individual. This document serves as a critical prerequisite for the lawful processing of the Small Estate Affidavit.

- Last Will and Testament: When available, the deceased’s will provides instructions on how the estate should be distributed among heirs and beneficiaries. It's an essential document that guides the distribution process.

- Letters of Administration: If the deceased did not leave a will, or in some cases even with a will, letters of administration appoint an administrator to manage and distribute the estate's assets.

- Inventory of Assets: This document lists all the deceased's assets at the time of death, including real estate, vehicles, bank accounts, and personal belongings. It helps in determining if the estate qualifies as a "small estate" under Alabama law.

- Notice to Creditors: Published in a local newspaper, this notice alerts creditors to the death, allowing them to make claims against the estate. It's a step towards ensuring all debts are settled before distributing the assets.

- Waiver of Bond by Heirs: Heirs can sign this form to waive the requirement for the estate’s administrator to post a bond. This can simplify the process and reduce costs.

- Tax Forms: Depending on the estate's size and assets, various tax forms might be necessary, including final income tax returns for the deceased and estate taxes, if applicable.

In summary, when preparing a Small Estate Affidavit in Alabama, it is important to gather and prepare several other forms and documents. These documents support the affidavit, ensure compliance with Alabama law, and facilitate the smooth distribution of the deceased's assets. Remember, the requirements can vary depending on the specific circumstances of the estate, so consultation with legal professionals is highly recommended to navigate the process effectively.

Similar forms

The Alabama Small Estate Affidavit form is similar to several other documents used in the handling of estates, each with its own particular use and legal implications but sharing commonalities in their purposes and structures. This similarity mainly stems from their role in simplifying the estate settlement process under certain conditions.

Joint Tenancy Agreement: The form resembles a Joint Tenancy Agreement in the way it enables the direct transfer of property upon death, bypassing the probate process. Much like how a Small Estate Affidavit allows for the transfer of assets without court intervention, a Joint Tenancy Agreement provides that, upon one owner's death, ownership of property automatically transfers to the surviving owner(s). Both documents help in avoiding the lengthy and potentially costly probate process but are utilized in distinctly different scenarios and types of property ownership.

Transfer on Death Deed (TOD): Similarities can also be drawn with a Transfer on Death Deed, which allows for the direct transfer of real estate to a beneficiary upon the death of the owner. Like the Small Estate Affidavit, TOD deeds serve to expedite the transfer of assets without the need for probate court proceedings. Both tools are effective in their ability to simplify and speed up the transfer of assets, yet the specifics of the property type and the legal requirements surrounding their use differ significantly. The Small Estate Affidavit applies to personal property and, in some states, real estate under certain value thresholds, while TOD deeds are strictly used for real estate transactions.

Payable on Death (POD) Account Agreement: Another document that shares a function with the Alabama Small Estate Affidavit is the Payable on Death Account Agreement often used with bank accounts. This agreement allows account holders to designate beneficiaries who will receive the funds in the account without going through probate, directly mirroring the affidavit’s role in asset distribution without court involvement. While the mechanics and applicable assets vary—with POD agreements being strictly financial accounts and the affidavit covering a broader array of personal property—both serve to streamline the process of transferring assets to beneficiaries upon death.

Dos and Don'ts

When filling out the Alabama Small Estate Affidavit form, careful attention to detail ensures that the process is handled correctly and efficiently. Adhering to specific dos and don'ts can significantly streamline the administrative steps involved in managing a small estate in Alabama. Below are key recommendations to guide individuals through this process:

Do:- Verify eligibility: Ensure that the estate qualifies as a "small estate" under Alabama law, which often involves meeting specific requirements such as the total value of the estate.

- Provide accurate information: Double-check all entries for full accuracy, including the full legal names of the decedent and beneficiaries, as well as exact asset values.

- Include a certified copy of the death certificate: This is a mandatory document that must accompany the affidavit.

- Describe the assets clearly: List and describe the estate’s assets in clear detail, making sure to include any relevant account numbers or identifiers.

- Sign in the presence of a notary: Ensure the affidavit is signed before a notary public to validate its authenticity.

- Estimate asset values: Avoid guessing or estimating the value of assets. Use exact figures to prevent potential legal issues.

- Omit any known assets: Intentionally leaving out assets can result in legal penalties and delays in the distribution process.

- Sign the affidavit without reviewing: Do not rush the signing process without carefully reviewing all the information provided in the affidavit for correctness and completeness.

- Ignore filing deadlines: Make sure to submit the completed affidavit within the timeframe required by Alabama law to avoid any unnecessary complications.

Misconceptions

In understanding the Alabama Small Estate Affidavit form, several misconceptions commonly arise. Clearing up these misunderstandings can help individuals navigate the process more efficiently:

It allows immediate transfer of property: Many believe that completing the Small Estate Affidavit form leads to the instant transfer of the deceased's property. In reality, there is a mandatory waiting period intended to ensure all claims against the estate are addressed properly.

It's a one-size-fits-all document: While the form is standardized, the specifics of each case dictate how it is filled out and used. Different assets and family situations require individual considerations.

It avoids probate entirely: A common misconception is that this form eliminates the need for probate. The truth is, it simplifies the process for small estates but does not bypass probate court entirely.

Lawyer intervention is not needed: Though it seems straightforward, seeking advice from a lawyer can prevent costly mistakes. Legal advice is beneficial in navigating the complexities of estate laws.

It's only for real estate: People often think the Small Estate Affidavit is solely for transferring real estate. In actuality, it encompasses various types of property, including personal property and bank accounts.

There's no limit to the estate's value: There’s a threshold for the total value of the estate that can be processed using this form. This limit ensures the form is used appropriately for smaller estates.

Any family member can file it: Alabama law specifies who can file the affidavit, prioritizing spouses and then other heirs according to their legal standing and relation to the deceased.

Debts of the estate are irrelevant: The form requires a thorough accounting of the deceased's debts, which are considered before distribution. Ignoring existing debts can lead to legal complications.

Key takeaways

When someone passes away in Alabama without a will, handling their small estate can be simplified through the use of a Small Estate Affidavit. This document allows the transfer of the deceased's assets to their heirs without the need for a prolonged probate process. Here are seven key points to keep in mind when considering the completion and use of an Alabama Small Estate Affidavit form:

- Eligibility Requirements: The total value of the deceased's estate must not exceed $25,000, excluding certain assets, to qualify as a small estate under Alabama law. This threshold helps determine whether an affidavit can be utilized.

- Waiting Period: There is a 30-day waiting period from the date of death before the affidavit can be filed. This ensures enough time has passed to accurately assess the estate's value and for all potential claimants to come forward.

- Documentation: Accurate completion of the affidavit requires detailed information about the deceased's assets, debts, and heirs. Gathering all necessary documents beforehand can streamline the process.

- Responsibility: The person who fills out and files the affidavit, known as the affiant, is responsible for distributing the assets among the heirs according to Alabama law. They must act in good faith and with fairness to all parties involved.

- No Real Estate: The Small Estate Affidavit cannot be used to transfer ownership of real estate. Its use is limited to personal property such as bank accounts, vehicles, and personal belongings.

- Legal Obligations: The affiant may be required to settle the deceased's debts with the estate's assets before distributing the remaining assets among the heirs. This could include paying outstanding bills, funeral expenses, and taxes.

- Seek Professional Advice: Although the Small Estate Affidavit process is designed to be straightforward, consulting with a legal professional can help navigate any uncertainties or complex situations that may arise. This ensures that all legal requirements are met and the estate is handled correctly.

Using a Small Estate Affidariat is an efficient way to manage the estate of a loved one who has passed away, provided their assets are within the specified limit and no real estate is involved. Being well-informed and prepared can make this difficult time a bit easier for everyone involved.

Fill out Popular Small Estate Affidavit Forms for Different States

Wisconsin Small Estate Affidavit Form Pr-1831 - The use of a Small Estate Affidavit is contingent upon meeting state-specific requirements and adequately proving the heirs’ entitlement.

What Is Probate in Oregon - A Small Estate Affidavit form is used to settle small estates without a formal probate process, simplifying the asset distribution among heirs.

Probate Process in Maine - The Small Estate Affidavit bridges the gap between informal agreements among heirs and the formal probate process, providing a legal foundation for asset distribution.

Survivorship Affidavit Utah - Though valuable, this form is just one part of managing a deceased's affairs, and other steps may be necessary.