Printable Small Estate Affidavit Form for Alaska

When an individual passes away with a relatively small estate, the Alaska Small Estate Affidavit form emerges as a streamlined alternative for transferring property to beneficiaries without the need for a protracted probate process. This legal document, specifically designed for estates valued below a certain threshold, provides a direct route for heirs to claim ownership of assets, ensuring a more efficient and less burdensome transfer. The form requires detailed information about the decedent, the assets in question, and the rightful heirs, thereby simplifying the legal landscape for those dealing with bereavement. By meeting specific criteria outlined by Alaska state law, individuals can bypass the complexities typically associated with estate settlement, making it an invaluable resource for eligible estates. It not only accelerates the distribution of assets but also significantly reduces the legal hurdles and expenses involved, offering a palpable sense of relief and clarity during challenging times.

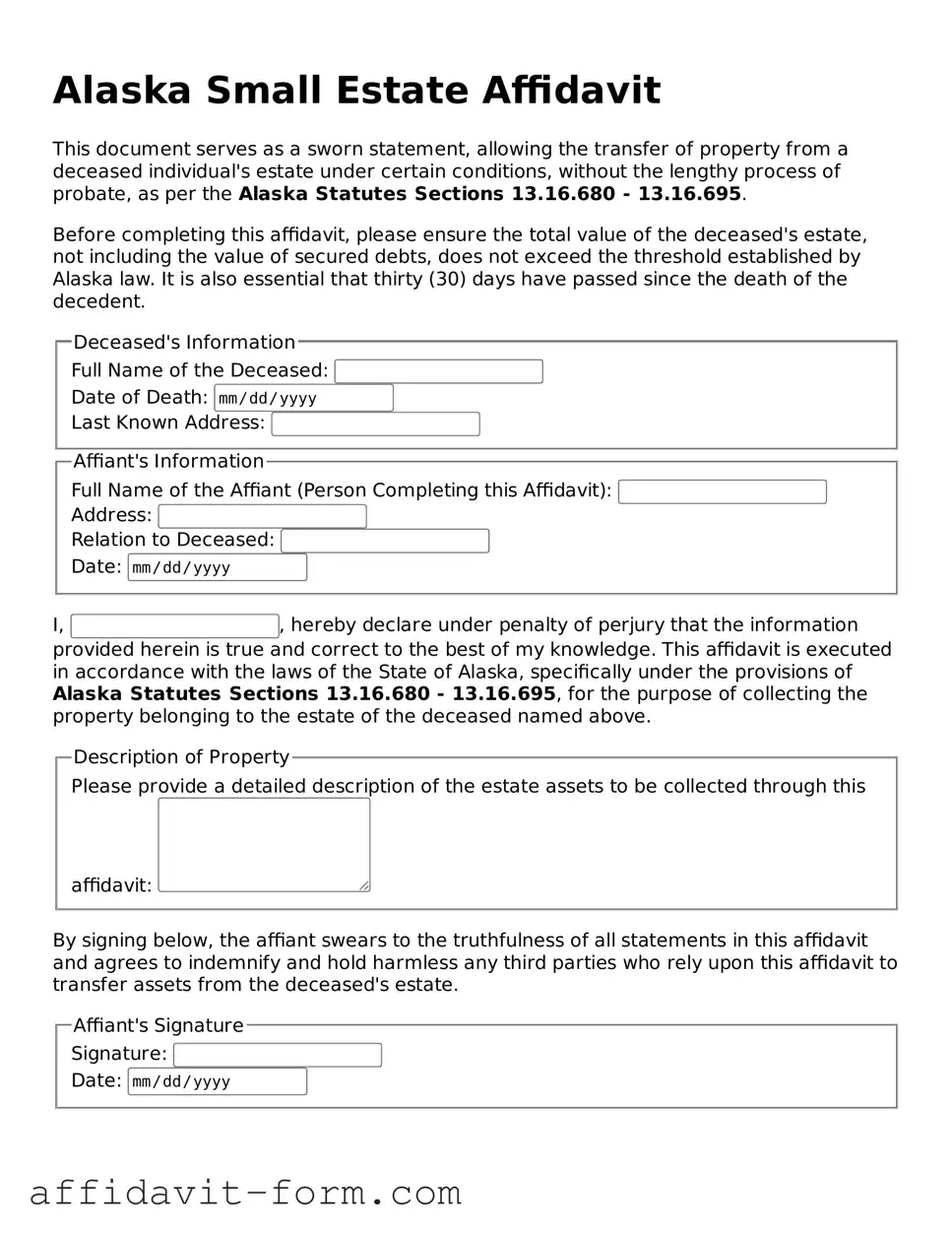

Form Example

Alaska Small Estate Affidavit

This document serves as a sworn statement, allowing the transfer of property from a deceased individual's estate under certain conditions, without the lengthy process of probate, as per the Alaska Statutes Sections 13.16.680 - 13.16.695.

Before completing this affidavit, please ensure the total value of the deceased's estate, not including the value of secured debts, does not exceed the threshold established by Alaska law. It is also essential that thirty (30) days have passed since the death of the decedent.

Document Details

| Fact | Description |

|---|---|

| Eligibility Criteria | The deceased's estate must not exceed $100,000 in personal property value for the Alaska Small Estate Affidavit to be used. |

| Waiting Period | There is a 30-day waiting period after the decedent's death before the affidavit can be filed. |

| Real Estate Exclusion | Real estate cannot be transferred using the Alaska Small Estate Affidavit; it only applies to personal property. |

| Governing Law | The Alaska Statutes Title 13, Chapter 16, specifically AS 13.16.680, govern the use of the Alaska Small Estate Affidavit. |

| Signing Requirements | The affidavit must be signed by the successor in the presence of a notary public to be legally binding. |

How to Use Alaska Small Estate Affidavit

When an individual passes away, handling their estate in a manner that respects their wishes and is in line with state laws is crucial. The Alaska Small Estate Affidavit form emerges as a pivotal document for individuals seeking a straightforward method to manage and distribute a deceased's estate without going through a lengthy probate process. This form is typically used when the total estate value does not exceed a specific threshold amount defined by Alaska law. It allows the rightful heirs or designated representatives to collect the decedent’s property in a simpler, more expedient manner. Following these step-by-step instructions can ease the process, ensuring accuracy and compliance with Alaska statutes.

- Gather all necessary information about the deceased's estate, including the total estimated value, types of property, and any debts owed.

- Confirm eligibility for using the Small Estate Affidavit procedure in Alaska. This involves ensuring that the estate value falls below the applicable threshold.

- Obtain the Small Estate Affidavit form specific to Alaska. This may be available online through legal resources or state government websites.

- Fill out the form thoroughly. Begin by entering the full legal name of the deceased, also known as the decedent, along with the date of death and county of residence.

- List all known heirs, their relationship to the decedent, and their contact information.

- Provide a detailed inventory of the decedent’s assets within the estate. This includes bank accounts, vehicles, real estate, and personal property among others. Be sure to also mention the estimated value of each asset.

- Include information about any debts the decedent owed at the time of death, including creditor names, amounts, and the nature of each debt.

- Read the statements at the end of the form carefully, ensuring understanding and agreement. These statements typically involve declarations about the truthfulness of the information provided and the legal rights to the property.

- Sign the form in the presence of a notary public. The notary will need to validate the identity of the person filling out the form and witness the signing.

- Finally, file the completed and notarized affidavit with the appropriate local court, or as directed by state law. There might be a filing fee, so it’s advisable to check this in advance.

After submitting the form, the individuals handling the estate should follow up with any institutions or companies holding the decedent's assets, providing them a copy of the affidavit to claim the property. It is also recommended to seek guidance from a legal professional if there are questions about distributing the estate, especially when dealing with more complex scenarios or a potential dispute among heirs.

Listed Questions and Answers

What is the Alaska Small Estate Affidavail form?

The Alaska Small Estate Affidavit form is a legal document used to handle small estates without a formal probate process. It allows successors to claim the decedent's assets if the total value does not exceed a certain threshold. This form simplifies the transfer of assets to rightful heirs or beneficiaries.

Who can file a Small Estate Affidavit in Alaska?

In Alaska, the following parties may file a Small Estate Affidavit:

- Successors, which could be heirs or beneficiaries named in the will

- Certain creditors, under specific circumstances

What are the requirements for using the Small Estate Affidavit?

To use the Small Estate Affidavit in Alaska, the estate must meet these requirements:

- The total value of the personal property of the decedent must not exceed the statutorily defined amount.

- At least 30 days have passed since the death of the decedent.

- No application for the appointment of a personal representative is pending or has been approved in any jurisdiction.

What assets can be transferred using the Small Estate Affidavit?

Assets that typically can be transferred using the Small Estate Affidavit include:

- Personal property, such as bank accounts, stocks, and vehicles

- Real property, under certain conditions

How do you file a Small Estate Affidavit in Alaska?

Filing a Small Estate Affidavit involves several steps:

- Complete the Small Estate Affidavit form with accurate information about the decedent, the assets, and the claimant.

- Ensure all eligibility criteria are met, including the waiting period since the decedent's death.

- Submit the affidavit to the appropriate entity, which could be a bank or other institution holding the assets.

Is there a filing fee for the Small Estate Affidavit in Alaska?

Typically, there is no filing fee for submitting a Small Estate Affidavit to claim personal property. However, if the affidavit is used to claim real estate, or if it's filed with a court, there may be associated costs. It's advisable to check the latest information on fees with local agencies or a legal expert.

Where can you get a Small Estate Affidavit form for Alaska?

The Alaska Small Estate Affidavit form can be obtained from several sources, including:

- Alaska's court system website

- Legal document preparation services

- Law libraries or local library systems

Common mistakes

Filling out a Small Estate Affidavit in Alaska is a way for individuals to settle estates that are considered "small" by legal standards. This process allows for the transfer of a deceased person's property without a full probate proceeding. However, there are several common mistakes to watch out for when completing this form. Recognizing and avoiding these errors can make the affidavit process smoother and prevent unnecessary delays or complications.

Not verifying eligibility criteria: One common mistake is not ensuring the estate actually qualifies as a "small estate" under Alaska laws. The estate must meet specific criteria regarding the total value and types of assets. Filling out the affidavit without this verification can lead to rejection.

Incorrect or incomplete information: Providing inaccurate details about the deceased, the assets, or the heirs can cause significant problems. Every piece of information should be double-checked for accuracy and completeness.

Failure to properly describe assets: A detailed description of each asset, including account numbers and precise locations, is necessary. Vague descriptions can lead to confusion and might not be accepted by financial institutions or other entities.

Overlooking the witness or notarization requirements: The Alaska Small Estate Affidavit must be signed in the presence of a notary public or other authorized official. Skipping this step can invalidate the entire document.

Not attaching necessary documents: Along with the affidavit, certain documents such as a certified copy of the death certificate and proof of ownership for the assets must be attached. Failing to include these can lead to processing delays or outright denial.

Misunderstanding the affidavit's limitations: The affidavit does not serve as a blanket transfer of all assets. Some assets might not be eligible for transfer via this process, and there may also be tax implications to consider. It’s important to understand the scope and limitations of the affidavit.

In summary, carefully reviewing and accurately completing the Alaska Small Estate Affidavit form is critical for a smooth transfer of assets. Taking the time to understand the process and pay attention to detail can significantly reduce the risk of errors and ensure that the desires of the deceased are honored in accordance with the law.

Documents used along the form

When managing the affairs of a deceased individual in Alaska, particularly under circumstances that apply to the utilization of the Small Estate Affidavit, several other documents may be necessary to efficiently process the deceased’s estate. These documents complement the Small Estate Affidavit by providing additional information required by various institutions or for fulfilling legal requirements. Understanding each of these documents and their purpose is crucial for a smooth and efficient estate administration process.

- Certified Copy of the Death Certificate: This document is essential for all matters related to the estate of the deceased. It serves as the official proof of death and is required by financial institutions, government agencies, and in court proceedings to validate the death of the individual.

- Copy of the Will: If the deceased left a will, a copy of it may be necessary along with the Small Estate Affidavit. The will provides detailed instructions on how the deceased wanted their estate to be distributed among heirs and may designate an executor for the estate.

- Letter of Testamentary: Although more commonly associated with larger estates that are going through probate, a Letter of Testamentary can be required in cases where the Small Estate Affidavit needs to be supplemented. This document authorizes an individual to act as the executor of the estate, as per the will's instructions.

- List of Heirs: A document listing all legal heirs of the deceased is crucial, especially if there is no will. This list helps ensure that all potential beneficiaries are considered and that the distribution of the estate is done according to state laws.

- Inventory of Assets: This is a detailed list of all the assets belonging to the deceased. It typically includes bank accounts, securities, real estate, and personal belongings. An accurate inventory ensures that the estate is distributed correctly among the heirs.

Collectively, these documents play a pivotal role in the administration of a small estate in Alaska. Besides the Small Estate Affidavit, each document fulfills a unique requirement that facilitates the legal and rightful distribution of the deceased’s assets. It’s advisable for individuals navigating through the process to understand the significance and requirements for each document to ensure a smooth and legally compliant transition of the estate.

Similar forms

The Alaska Small Estate Affidavit form is similar to other legal documents used across the United States for the purpose of simplifying the transfer of property from a deceased individual to their heirs. Two prominent examples include the Transfer on Death Deed and the Simplified Probate Process. Each of these instruments serves to ease the burden on grieving families by avoiding a lengthy or costly probate process under certain conditions.

The Transfer on Death Deed (TODD) is a document that allows property owners to name a beneficiary or beneficiaries who will inherit their property directly upon the owner's death, bypassing the probate process entirely. Like the Alaska Small Estate Affidavit, the TODD is designed to make the transfer of property swift and straightforward. Where they differ primarily is in the proactive step the property owner must take with a TODD, which involves preparing and recording the deed ahead of time, specifying the beneficiary. The Small Estate Affidavit, conversely, is utilized after an individual has passed away, facilitating a transfer without prior designation.

The Simplified Probate Process is available in many states for small estates, though the criteria for what constitutes a "small estate" can vary significantly. This process reduces the complexity and duration of probate for eligible estates, making it faster and less costly for heirs to receive their inheritance. Similar to the Alaska Small Estate Affidavit, the Simplified Probate Process is designed to streamline the legal transfer of assets. However, it involves a court, albeit in a more limited capacity than full probate, and may require the filing of documents and a hearing, unlike the affidavit which is a more direct transaction between parties.

Dos and Don'ts

When dealing with the intricate details of filling out the Alaska Small Estate Affidavit form, it's crucial to approach the task with accuracy and attentiveness. Navigating through it efficiently can simplify the process of managing a small estate under Alaska law. To help ensure the procedure is handled correctly, here's a list of dos and don'ts to guide you:

- Do verify if the estate qualifies as a "small estate" under Alaska law. The value limits and qualifications can change, so it's important to ensure the estate meets the current criteria.

- Do gather all necessary documents before starting to fill out the form. This includes death certificates, property titles, and any debt information related to the deceased's estate.

- Do read each question carefully. Understanding each question fully before answering can prevent mistakes that might delay the process.

- Do use accurate and complete information for every section of the form. Providing incomplete or inaccurate information can lead to legal complications or the rejection of the affidavit.

- Do review the filled-out form for any errors or omissions. A thorough review before submission can save time and effort in making corrections later.

- Don't skip any sections or questions. If a section doesn't apply, it's better to write "N/A" than to leave it blank.

- Don't guess on values or details. If you’re unsure about specific information, it's better to verify it than to risk providing incorrect data.

- Don't sign the affidavit without a notary public. The affidavit must be notarized to ensure its validity under Alaska law.

- Don't underestimate the importance of seeking legal advice. If you find the form or process confusing, consulting with a legal professional experienced in Alaska estate laws can provide clarity and guidance.

Approaching the completion of the Alaska Small Estate Affitvaid form with diligence and attention to detail will not only streamline the process but also facilitate a smoother transition during a challenging time. By adhering to these guidelines, you can confidently navigate the requirements and responsibilities entailed in managing a small estate in Alaska.

Misconceptions

When handling the Alaska Small Estate Affidavit form, several misconceptions can lead to confusion and mistakes. Understanding these misunderstandings is crucial for individuals seeking to manage or settle small estates efficiently and in accordance with state laws.

Everyone can use the form regardless of their relationship to the deceased. In reality, only successors as defined by law, such as close family members or legally recognized heirs, are eligible to use the Alaska Small Estate Affidavit.

The form grants immediate access to the deceased's assets. Though it is designed to simplify the process, it may still require time for institutions to release assets, and there could be additional verifications needed.

There's no limit on the value of the estate. Alaska law specifies a maximum value for the estate to be considered small, often updated and subject to current statutes. Exceeding this limit means the estate must go through regular probate.

All types of assets can be transferred using the form. Certain assets, such as real estate in some circumstances, may not be transferable using a Small Estate Affidavit in Alaska and might require alternative legal processes.

The form is universally accepted across different institutions. Financial institutions and other entities have their own policies and may require additional documentation or forms in conjunction with the affidavit.

Filing the form with the court is always necessary. Depending on the estate's circumstances, it might not be mandatory to file the affidavit with the court, though it's often recommended for record-keeping and to initiate asset transfer.

Using a lawyer is unnecessary when handling a small estate. While the process is streamlined, legal advice can ensure the process is handled correctly, especially in more complex situations or when disputes arise.

Debts of the deceased don't affect the process. Creditors have rights, and their claims may influence the distribution of assets. An affidavit might need to address outstanding debts.

Once the form is submitted, the process is complete. Additional steps, such as notifying beneficiaries and managing specific asset transfers, are typically required to fully settle the estate.

The same form applies in all Alaska jurisdictions. While the Small Estate Affidavit is a state-wide document, local courts might have additional requirements or forms to accompany the affidavit.

Clearing up these misconceptions is vital for anyone involved in managing a small estate in Alaska. Understanding the specific requirements and limitations of the Alaska Small Estate Affidavit helps ensure the process is completed effectively and in compliance with state laws.

Key takeaways

When dealing with the Alaska Small Estate Affidavit form, it's important to understand several key aspects to ensure the process is completed accurately and efficiently. Here are eight key takeaways:

- Eligibility Criteria: Make sure the estate in question meets Alaska's definition of a small estate. This typically involves the total value of the estate not exceeding a specific threshold set by state law.

- Accuracy is Essential: Filling out the form requires attention to detail. Double-check all the information provided, including the legal descriptions of property, to avoid any delays or legal complications.

- Gathering Documentation: Before filling out the form, collect all necessary documents related to the estate, such as death certificates, proof of ownership, and any debt information. This will help ensure the affidavit is complete and accurate.

- Legal Description of Property: When listing assets, use the legal descriptions for real estate. This includes any identifying numbers, addresses, and legal terminology that accurately describe the property.

- Outstanding Debts: Disclose all known debts and liabilities of the estate. The affidavit should provide a clear picture of the estate's financial obligations.

- Witness Requirement: Understand the requirement for witnesses or notarization. The form may need to be signed in the presence of a notary or witnesses, depending on state requirements.

- File with Proper Authority: Determine where the affidavit needs to be filed. In some cases, it might be with a local court, the registrar of deeds, or another government agency.

- Legal and Tax Implications: Be aware of any legal or tax implications of transferring property using a small estate affidavit. It may be beneficial to consult with a legal or tax professional to avoid unexpected issues.

Completing the Alaska Small Estate Afficavid requires careful consideration of each step. By following these key takeaways, individuals can navigate the process with greater confidence and ensure a smoother transfer of assets.

Fill out Popular Small Estate Affidavit Forms for Different States

Wisconsin Small Estate Affidavit Form Pr-1831 - It offers a pragmatic approach for handling estates that do not justify the full probate process due to their minimal value.

Aoc-e-203b - Streamlines the settlement of certain estate matters, making it a preferred choice for many families.

Texas Small Estate Affidavit Pdf - Not all estates qualify for this simplified procedure; consulting with a legal professional can help determine eligibility based on state laws.