Printable Small Estate Affidavit Form for Arizona

In Arizona, navigating the process of handling a deceased person's estate can often be complicated and time-consuming. However, a solution exists for smaller estates that simplifies this experience significantly – the Arizona Small Estate Affidavit form. Crafted to bypass the lengthy probate process, this legal document provides a straightforward path for rightful heirs or designated representatives to claim assets. It applies to personal property and real estate under certain value thresholds, ensuring that if the estate's total value falls below these limits, the transfer of assets can occur more seamlessly. Essential for those looking to settle affairs without undue delay, understanding the Arizona Small Estate Affidavit form's requirements, eligibility criteria, and the specific steps involved in its execution is crucial. This expedited method not only alleviates the administrative burden but also significantly reduces the waiting period for asset redistribution among beneficiaries, marking a key facilitation in the often challenging journey of estate resolution.

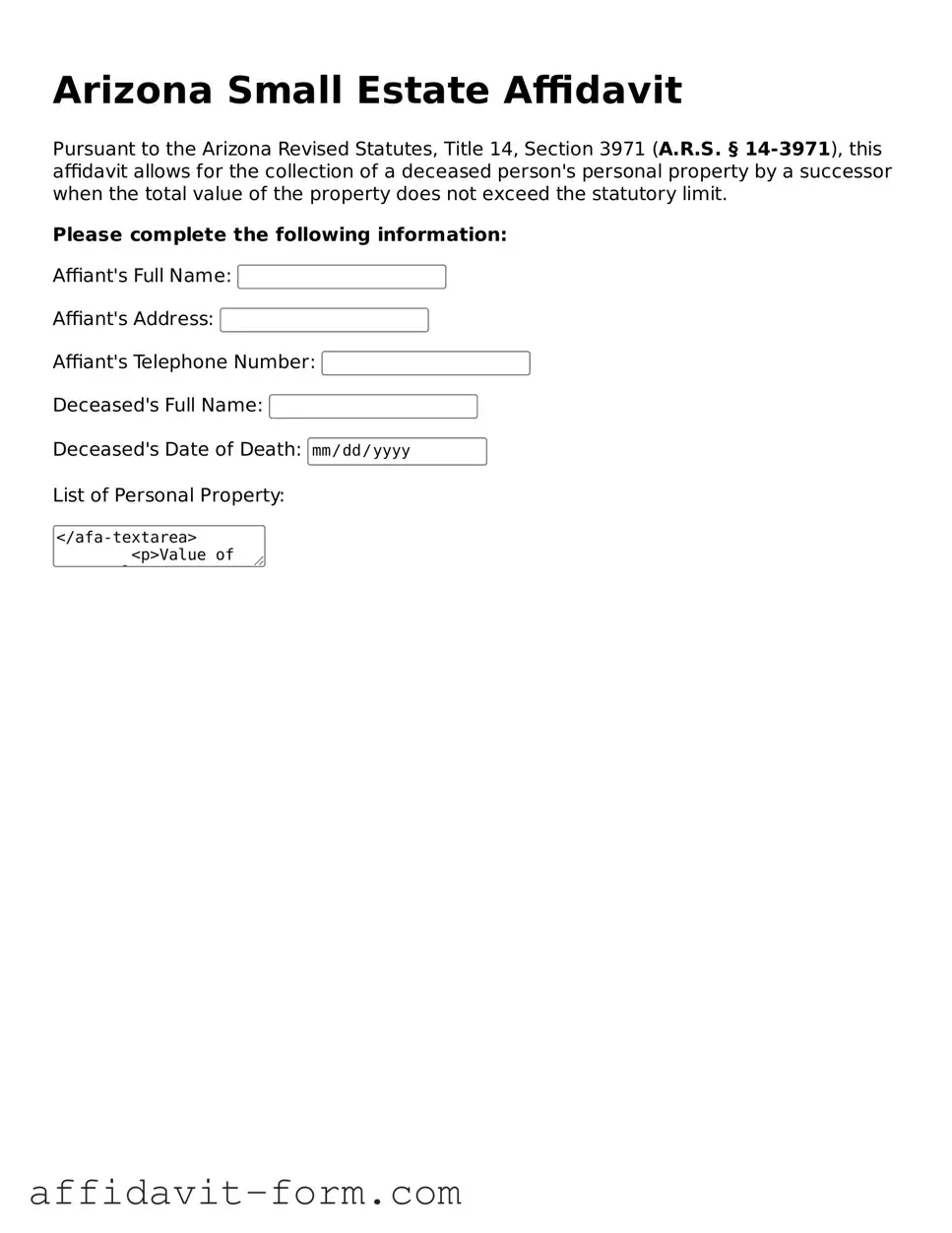

Form Example

Arizona Small Estate Affidavit

Pursuant to the Arizona Revised Statutes, Title 14, Section 3971 (A.R.S. § 14-3971), this affidavit allows for the collection of a deceased person's personal property by a successor when the total value of the property does not exceed the statutory limit.

Please complete the following information:

Instructions for Filing:

- Ensure all the information provided is accurate and complete.

- Sign the affidavit in front of a notary public.

- Submit the affidavit to the institution holding the decedent's property (e.g., bank, brokerage firm).

- Property can be collected 30 days after the date of death, as per A.R.S. § 14-3971.

Notes:

- The total value of personal property should not exceed the statutory limit set forth by Arizona law.

- This affidavit does not apply to real estate.

- It is advisable to consult with a legal professional for guidance.

Document Details

| Fact Name | Detail |

|---|---|

| 1. Purpose | The Arizona Small Estate Affidavit form is used to manage and distribute the assets of a deceased person's estate without formal probate when the total value falls below a certain threshold. |

| 2. Threshold Amounts | As of the latest update, the threshold is $75,000 for personal property and $100,000 for real estate. |

| 3. Waiting Period | A waiting period of 30 days is required after the decedent's death before the affidavit can be filed. |

| 4. Governing Law | The form and process are governed by the Arizona Revised Statutes, Sections 14-3971(E) for personal property and 14-3971(F) for real estate. |

| 5. Required Information | The affidavit requires detailed information about the decedent, the assets, potential heirs, and the claimant. |

| 6. Notarization | The completed form must be notarized before submission to ensure its validity. |

| 7. Filing Location | For real estate, the affidavit is typically filed with the county recorder in the county where the property is located. For personal property, it may need to be presented to the entity holding the asset (e.g., a bank). |

How to Use Arizona Small Estate Affidavit

When a loved one passes away without leaving a will, families in Arizona might find the Small Estate Affidavit a helpful tool to transition the ownership of personal property in a more expedited and less formal process than traditional probate. Successfully filling out this form requires careful attention to detail and an understanding of the assets involved. Follow these steps to ensure that the document is completed accurately and fully, laying the groundwork for a smoother resolution during a difficult time.

- Gather all necessary documents related to the decedent's (the person who passed away) estate, such as death certificates, property deeds, and financial statements to have a clear understanding of what needs to be transferred.

- Confirm that the total value of the decedent's personal property subject to probate does not exceed the threshold set by Arizona law, currently at $75,000 for personal property and $100,000 for real estate.

- Read through the entire Small Estate Affidavit form to familiarize yourself with the information required and the attestations you will be making.

- Fill in the decedent’s full legal name and the county of their domicile (permanent residence) at the time of their death in the designated sections of the form.

- List all known assets of the decedent, including but not limited to bank accounts, vehicles, and stocks, along with their fair market values. Ensure this list aligns with the qualifications for using a Small Estate Affidavit in Arizona.

- Provide the names, addresses, and relationship to the decedent of all individuals entitled to inherit the assets. This step requires careful consideration to ensure all potential heirs are accounted for accurately.

- If there is real estate involved, ensure you attach a legal description of the property and verify that the affidavit meets the specific requirements for transfer of real property in Arizona.

- Review and sign the affidavit in front of a notary public. Most financial institutions and many public offices have notaries available, but it’s wise to call ahead and confirm.

- Once notarized, submit the affidavit according to the instructions provided. This may involve filing it with the appropriate county recorder’s office, presenting it to the holder of the estate asset (such as a bank), or both, depending on the type of asset and the institution's policies.

- Maintain copies of the filed affidavit and any correspondence with asset holders for your records and to resolve any potential disputes or questions about the transfer of the estate's assets.

Successfully navigating the process of completing a Small Estate Affidavit in Arizona can significantly streamline the often complex and emotionally taxing process of managing a loved one's estate. By carefully following the outlined steps and ensuring the accuracy and completeness of the information provided, families can more easily facilitate the transfer of assets and move forward during a challenging period.

Listed Questions and Answers

What is a Small Estate Affidavit in Arizona?

A Small Estate Affidavit is a legal document used in Arizona to manage the assets of a deceased person (the decedent) without formal probate when the total value of the estate does not exceed certain thresholds. This form facilitates the transfer of the decedent's assets to their rightful heirs or beneficiaries.

Who can use the Small Estate Affidavit?

The Small Estate Affidavit can be used by successors or legally recognized heirs of the deceased, including spouses, children, or other relatives, as well as individuals who are named as beneficiaries in the will, if applicable. The person using the affidavit asserts their legal right to collect the property of the decedent.

What are the value thresholds for using a Small Estate Affidavit in Arizona?

As of the last update, in Arizona, the value thresholds for utilizing a Small Estate Affidavit are as follows:

- For personal property (e.g., bank accounts, stocks, and vehicles), the total value must not exceed $75,000.

- For real estate, the gross value of the deceased's real property in Arizona must not exceed $100,000.

What documents are needed to fill out a Small Estate Affidavit in Arizona?

To complete a Small Estate Affidavit in Arizona, several pieces of information and documents are necessary, including:

- A certified copy of the death certificate of the decedent.

- Documentation asserting the value of personal and real property.

- Evidence of the relationship to the decedent or a copy of the will, if applicable.

- Identification documents to prove your identity.

How is real estate handled with a Small Estate Affidavit in Arizona?

In Arizona, to transfer real estate using a Small Estate Affidavit, the affidavit must be recorded in the county where the property is located. This process involves drafting a separate affidavit that specifically addresses the real property, adhering to the state's value threshold. The informed affidavit aids in legally transferring the property title to the rightful heirs or beneficiaries.

Is there a waiting period for filing a Small Estate Affidavit in Arizona?

Yes, in Arizona, there is a mandatory waiting period of 30 days after the death of the decedent before a Small Estate Affidavit can be filed. This waiting period allows time for all claims against the estate to be presented.

Can debts of the decedent be paid using a Small Estate Affidavit?

While the Small Estate Affidavit in Arizona is primarily used to collect the decedent's assets, it is also permissible for the affidavit to address outstanding debts. The person filing the affidavit may use the assets collected to pay the decedent’s debts, in accordance with state law, ensuring debts are addressed before distribution to heirs or beneficiaries.

What happens after the Small Estate Affidavit is filed in Arizona?

After the Small Estate Affidavit is filed, the affidavit serves as legal authority for the person filing to collect the assets listed in the document. Financial institutions, such as banks, and other entities holding the decedent's property, will release the assets upon presentation of the affidavit, allowing for the distribution of the assets to the rightful heirs or beneficiaries.

Can a Small Estate Affidavit be contested?

Yes, like most legal procedures involving the distribution of a decedent's assets, a Small Estate Affidavit can be contested. If an individual believes the affidavit was filed erroneously or fraudulently, they have the right to challenge it in court. Legal advice may be necessary to navigate these challenges.

Where can I find the Small Estate Affidavit form for Arizona?

The Small Estate Affidavit form for Arizona can typically be found through the Arizona Judicial Branch's website or obtained from a county court's office. Ensure that the most current form is used and that all state-specific guidelines are followed for filing.

Common mistakes

Filling out the Arizona Small Estate Affidavit form requires attention to detail. Unfortunately, mistakes can occur during this process which may delay the transfer of assets. Here are ten common mistakes people make:

-

Not checking if the estate qualifies for the small estate process based on its gross value, leading to the mistaken submission of the affidavit for estates that exceed the allowable limit.

-

Failing to obtain an official death certificate or attaching an incomplete or incorrect death certificate to the affidavit.

-

Incorrectly listing the assets of the deceased, either by omitting essential items or including assets that do not qualify under the small estate criteria.

-

Overlooking the requirement to list all known debts and liabilities of the estate, which can affect the distribution of assets.

-

Misidentifying the legal heirs or beneficiaries by not fully understanding the legal relationships or not being up-to-date with the current beneficiary designations.

-

Omitting or incorrectly preparing the signature section, either by the affiant not signing in the presence of a notary or by the notary public not properly completing their part.

-

Not waiting the required time after the decedent's death before filing the affidavit, as Arizona law mandates a specific waiting period which must be observed.

-

Completing the affidavit with incomplete or inaccurate information regarding the decedent's last place of residence, which is crucial for the document's acceptance.

-

Forgetting to attach the necessary legal documents or supplemental forms that are required in addition to the affidavit for certain assets or situations.

-

Attempting to use the affidavit for the transfer of real estate property when it is designed primarily for personal property, bank accounts, and other types of assets.

Making these mistakes can significantly complicate the process. Individuals are encouraged to be diligent, double-check all entries, and consult with a professional if needed to ensure the form is completed accurately and in compliance with Arizona law.

Documents used along the form

When dealing with small estates in Arizona, the Small Estate Affidavit is a valuable form that streamlines the process of transferring a deceased person's assets to their rightful heirs without a formal probate. It's often used when the total value of the estate doesn't exceed certain thresholds. In addition to this affidavit, there are other forms and documents frequently required or used alongside to ensure that the transfer and processing of the estate are carried out correctly and lawfully. Here is a list of some of those important documents.

- Certified Death Certificate: This official document serves as proof of death and is necessary to verify the decedent's passing to financial institutions, government agencies, and courts.

- Last Will and Testament: If the deceased person left a will, it outlines their final wishes regarding the distribution of their possessions and the care of any minor children.

- Vehicle Title Transfer Forms: When the estate includes a vehicle, these forms are required to legally transfer ownership of the vehicle from the deceased to the beneficiary.

- Real Estate Deed Forms: If there is real property (e.g., a house or land) that needs to be transferred to heirs, appropriate deed forms are necessary to convey the property title in accordance with state law.

- Bank Account Closure Forms: These forms are used to close bank accounts that were in the deceased’s name and transfer the funds to the rightful heirs.

- Stock Transfer Forms: When the estate includes stocks or other securities, transfer forms are required to move ownership from the deceased to their beneficiaries.

Each of these documents plays a crucial role in managing the affairs of a small estate in Arizona. Together with the Small Estate Affidavit, they help ensure that the process is carried out smoothly and in compliance with state regulations. It's essential for those handling an estate to be aware of these forms and to utilize them as needed to honor the decedent's wishes and distribute their assets properly.

Similar forms

The Arizona Small Estate Affidavit form is similar to other documents used in the process of estate planning and asset transfer, providing a streamlined approach for small estates. This document, specifically used within Arizona, allows for the transfer of personal property or real estate of a deceased person to their heirs without the need for a formal probate process. Its similarity to other legal documents lies in its function and the circumstances in which it is used. Below are documents to which the Arizona Small Estate Affidavit form bears similarity and an explanation of how they are alike.

Transfer on Death Deed (TODD)

The Arizona Small Estate Affidavit form shares similarities with the Transfer on Death Deed (TODD). Both documents are designed to facilitate the transfer of property upon the owner's death, bypassing the probate process. While the Small Estate Affidavit is used for transferring assets of a deceased person under certain value thresholds, the TODD is specifically for the direct transfer of real estate. The TODD allows a property owner to name beneficiaries who will receive the property upon their death, similarly to how the Small Estate Affidavit allows for the distribution of assets to heirs or designated beneficiaries without the complexities of probate.

Joint Tenancy with Right of Survivorship

Another document similar to the Arizona Small Estate Affidat is the joint tenancy agreement with the right of survivorship. This agreement allows two or more people to share ownership of property, with the distinctive feature that upon the death of one owner, their share automatically transfers to the surviving owner(s), thus avoiding probate. The similarity to the Small Estate Affidavit lies in its purpose to simplify the transfer of assets upon death. However, the key difference is that the joint tenancy with right of survivorship is established while all owners are alive and pertains specifically to co-owned property, whereas the Small Estate Affidavit is used to settle a deceased person’s estate that falls within specific monetary limits.

Beneficiary Designations on Retirement and Bank Accounts

The Arizona Small Estate Affidavit form is also similar to beneficiary designations on retirement and bank accounts. Both methods allow for the direct transfer of assets to named beneficiaries upon death, avoiding the probate process. Retirement accounts like IRAs or 401(k)s, as well as life insurance policies and payable-on-death bank accounts, enable owners to designate who will receive the assets in these accounts when they pass away. Like the Small Estate Affidavit, these designations streamline the transfer process, making it quicker and less complicated for beneficiaries to receive their inheritances.

Dos and Don'ts

Filling out the Arizona Small Estate Affidavit form requires attention to detail and a clear understanding of the process. By following specific dos and don'ts, individuals can navigate this process more smoothly, ensuring accurate and effective handling of a small estate. Below are important guidelines to keep in mind:

- Do ensure that the total value of the personal property in the estate does not exceed the threshold set by Arizona law. This is critical for qualifying to use the Small Estate Affidavit procedure.

- Do carefully read and understand every section of the form before you start filling it out. Being well-informed can prevent mistakes and confusion later on.

- Do provide accurate and complete information about the deceased, their assets, and the heirs or beneficiaries. Precision is key to a hassle-free process.

- Do obtain and attach a certified copy of the death certificate as required. This document is essential for verifying the death and moving forward with the small estate process.

- Don't attempt to use the form if the estate includes real estate or property that does not meet the specific criteria for "small estate" under Arizona law. This process is not designed for all types of assets.

- Don't sign the affidavit without ensuring all information is true and correct. Your signature may be required to be notarized, and falsifying information can have serious legal consequences.

- Don't overlook other potential claimants or heirs. Make sure that all individuals with a valid claim or legal interest in the estate are identified and accounted for in the affidavit.

- Don't forget to check with the institutions or agencies holding the assets. Some may have additional requirements or forms to fill out in addition to the Small Estate Affidavit.

By adhering to these dos and don'ts, individuals can effectively manage the small estate process, ensuring that the deceased's assets are distributed according to the law and their wishes. Always consider consulting with a legal professional if you encounter complex issues or specific legal questions during this process.

Misconceptions

In Arizona, the Small Estate Affidavit form is a legal document used to manage and distribute a deceased person’s assets without going through a lengthy probate process. However, several misconceptions surround its use and requirements. It's important to clarify these misunderstandings to ensure individuals can navigate their circumstances most effectively.

Misconception 1: Anyone can file the Small Estate Affidavit form for an estate in Arizona. The truth is, only successors of the deceased (like family members or heirs) or someone legally recognized by the state (such as a person designated in a will) can file this document. This limitation ensures that the person filing has a legitimate claim to the estate.

Misconception 2: You can transfer any amount of assets using the Small Estate Affidavit. In reality, Arizona law limits the total value of personal property that can be collected by this method to $75,000 or less, and for real estate, the limit is $100,000 in equity, after accounting for certain debts and obligations. These thresholds help streamline the process for smaller estates and avoid misuse.

Misconception 3: The Small Estate Affidavit immediately transfers property. While it may expedite the process, there’s still a mandatory waiting period of 30 days after the decedent's death before the affidavit can be filed. This waiting period allows for any creditors or disputes to surface before the property is distributed.

Misconception 4: The form is all you need to transfer vehicle ownership. While the Small Estate Affidavit can be part of the process, transferring vehicle ownership in Arizona typically requires additional documentation, such as a title transfer form, to be submitted to the Motor Vehicle Division. The affidavit alone does not suffice for vehicles.

Misconception 5: Filing a Small Estate Affidavit is complex and always requires a lawyer. The process has been designed to be straightforward, allowing individuals to complete and file the form without mandatory legal representation. However, seeking advice from a legal professional is advisable to navigate any complexities and ensure compliance with all requirements.

It's crucial for individuals dealing with the estate of a deceased loved one to understand the specifics of the Small Estate Affidavit form in Arizona properly. Clarifying these misconceptions can help in avoiding unnecessary complications and ensuring the efficient handling of the deceased’s assets.

Key takeaways

When taking steps to manage the estate of a person who has passed away in Arizona, the Small Estate Affidavit is an important document that simplifies the process under certain conditions. Here are key takeaways about filling out and using this form effectively:

- Eligibility Criteria Must be Met: Before using the Small Estate Affidavit form, ensure the estate meets the specific eligibility criteria set by Arizona law. This means the total value of the personal property left by the deceased must not exceed a certain threshold, and a certain amount of time must have passed since the death.

- Accurate Valuation is Crucial: It's important to accurately assess the value of the deceased's assets. The value of assets should reflect their current market value and fall below the maximum limit Arizona law allows for small estate processing. Overestimating or underestimating can lead to legal issues or processing delays.

- Complete the Form with Detailed Information: When filling out the Small Estate Affidavit, ensure all sections are completed with the required details. This includes personal information about the deceased, a comprehensive list of assets, and the names and addresses of rightful heirs or beneficiaries. Providing incomplete or incorrect information can result in the affidavit being rejected.

- Signature and Notarization: After completing the form, it must be signed in the presence of a notary public. The act of notarization confirms the identity of the signer and the authenticity of their signature, which is a legal requirement for the affidavit to be considered valid and enforceable in Arizona.

Understanding and adhering to these key points can greatly facilitate the process of utilizing the Small Estate Affidiff for efficiently handling the assets of a deceased person's estate within the state of Arizona.

Fill out Popular Small Estate Affidavit Forms for Different States

Affidavit for Probate - Facilitates the seamless transition of assets from small estates to rightful heirs or beneficiaries.

Small Estate Affidavit Washington - It serves as a sworn statement that an estate meets specific criteria to bypass probate court.

Small Estate Affidavit Georgia - Completion of the form often involves attesting to the absence of outstanding debts against the estate that would require probate to settle.

Create a Family Trust - A well-prepared Small Estate Affidavit protects the interests of heirs, ensuring they gain access to their inheritance without undue delay.