Printable Small Estate Affidavit Form for Arkansas

When an individual in Arkansas passes away with a small amount of assets, the process for settling their estate can be simplified through the use of the Arkansas Small Estate Affidaidavit form. This legal document serves as a tool for the heirs or legal representatives to collect the deceased's assets without the need for a formal probate process, which can be both time-consuming and costly. The form is applicable under specific conditions, such as when the total value of the estate does not exceed a certain threshold, currently set by Arkansas law. It requires the affiant to swear to the truthfulness of the information provided, including the rights of the heirs to the assets and the absence of disputes over the deceased's estate. The form facilitates the transfer of the deceased's assets to the rightful heirs, including but not limited to bank accounts, vehicles, and personal property, making it a critical document for those looking to expedite the estate settlement process in Arkansas.

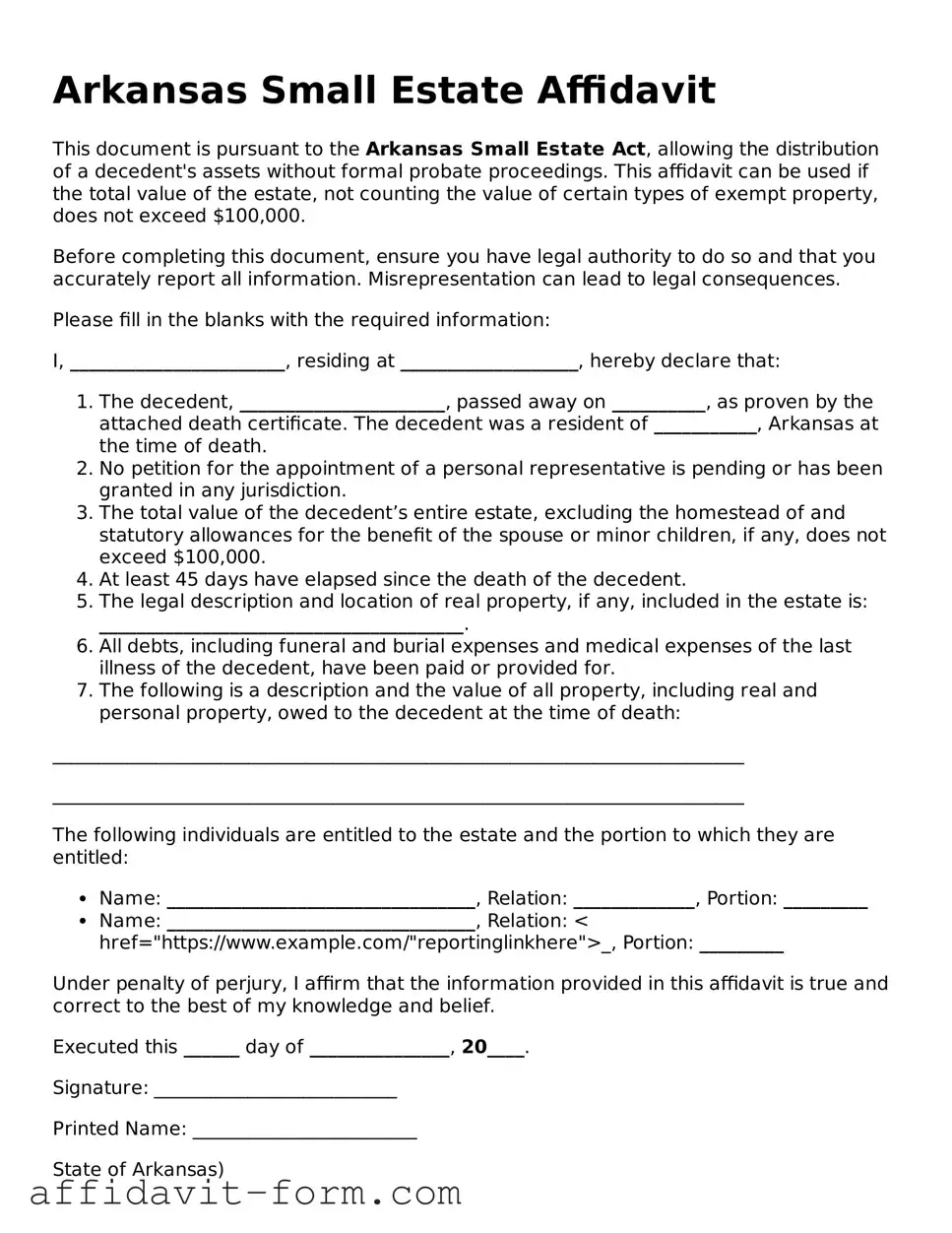

Form Example

Arkansas Small Estate Affidavit

This document is pursuant to the Arkansas Small Estate Act, allowing the distribution of a decedent's assets without formal probate proceedings. This affidavit can be used if the total value of the estate, not counting the value of certain types of exempt property, does not exceed $100,000.

Before completing this document, ensure you have legal authority to do so and that you accurately report all information. Misrepresentation can lead to legal consequences.

Please fill in the blanks with the required information:

I, _______________________, residing at ___________________, hereby declare that:

- The decedent, ______________________, passed away on __________, as proven by the attached death certificate. The decedent was a resident of ___________, Arkansas at the time of death.

- No petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The total value of the decedent’s entire estate, excluding the homestead of and statutory allowances for the benefit of the spouse or minor children, if any, does not exceed $100,000.

- At least 45 days have elapsed since the death of the decedent.

- The legal description and location of real property, if any, included in the estate is: _______________________________________.

- All debts, including funeral and burial expenses and medical expenses of the last illness of the decedent, have been paid or provided for.

- The following is a description and the value of all property, including real and personal property, owed to the decedent at the time of death:

__________________________________________________________________________

__________________________________________________________________________

The following individuals are entitled to the estate and the portion to which they are entitled:

- Name: _________________________________, Relation: _____________, Portion: _________

- Name: _________________________________, Relation: < href="https://www.example.com/"reportinglinkhere">_, Portion: _________

Under penalty of perjury, I affirm that the information provided in this affidavit is true and correct to the best of my knowledge and belief.

Executed this ______ day of _______________, 20____.

Signature: __________________________

Printed Name: ________________________

State of Arkansas)

County of ___________)

Subscribed and sworn to (or affirmed) before me on this ___ day of ___________, 20__, by _______________________.

Notary Public: _______________________

My Commission Expires: _______________

Document Details

| Fact | Description |

|---|---|

| Eligibility Requirement | Estates valued at $100,000 or less may use the Arkansas Small Estate Affidavit form. |

| Waiting Period | There is a 45-day waiting period after the decedent's death before the form can be filed. |

| Governing Law | The process is governed by the Arkansas Code § 28-41-101 and following sections. |

| Not Required for Real Estate | The affidavit cannot be used to transfer real estate but is applicable for personal property only. |

How to Use Arkansas Small Estate Affidavit

Preparing to handle a loved one's estate can seem daunting, especially amidst the emotional weight of their passing. In Arkansas, the Small Estate Affidavit form offers a simplified process for dealing with estates valued at $100,000 or less, not including specific assets. This form allows for a quicker, court-free method to transfer the deceased's property to their rightful heirs. It's crucial to approach this process with care, ensuring all details are accurately completed to honor the decedent's wishes and adhere to legal requirements. Follow these steps to fill out the Arkansas Small Estate Affidavit form correctly.

- Identify the required information, including the full legal name and date of death of the deceased, the legal names and addresses of any heirs, and a detailed list of the property and debts.

- Gather necessary documents, such as the death certificate and any proof of ownership for the assets in question.

- Fill in the decedent's full legal name and date of death at the top of the form.

- List all known heirs, their relationships to the deceased, and their addresses. Make sure to include any minors or legally incapacitated individuals.

- Provide a complete inventory of the estate, detailing all real and personal property, including bank accounts, vehicles, and real estate. Include estimated values for each item.

- Outline all known debts and obligations of the estate, such as funeral expenses, outstanding loans, and credit card debts.

- If applicable, designate an agent authorized to act on behalf of the estate. This could be one of the heirs or an external party.

- Ensure that all heirs sign the affidavit. Their signatures must be notarized, confirming the truthfulness of the information provided.

- Check the entire form for accuracy. Any mistakes could delay the process or affect the legal transfer of assets.

- File the completed affidavit with the appropriate local court, if required, or present it to the entity holding the assets (like a bank) to transfer ownership.

Successfully submitting the Arkansas Small Estate Affidavit is a positive step towards finalizing your loved one's affairs. Although this is a streamlined process, it's still important to handle every detail with precision and care. If questions arise, don't hesitate to seek legal advice to ensure everything is in order. Remember, this form not only facilitates the legal transfer of property but also helps in honoring the final wishes of those who've passed.

Listed Questions and Answers

What is an Arkansas Small Estate Affidariat?

An Arkansas Small Estate Affidavit is a legal document used to handle smaller estates without formal probate. It allows the transfer of a deceased person’s assets to heirs or legatees when the total value of the estate does not exceed a certain threshold.

Who is eligible to file an Arkansas Small Estate Affidavit?

Eligibility to file an Arkansas Small Estate Affidavit is limited to successors of the deceased. This includes relatives, legally recognized partners, or other designated individuals as per the deceased’s will, provided the estate's total value does not surpass the statutory limit.

What is the maximum value of an estate that qualifies for the Arkansas Small Estate Affidavit?

The estate in question must not exceed $100,000 in total value to qualify for processing via an Arkansas Small Estate Affidavit. This total excludes certain assets, such as property jointly owned with the right of survivorship.

What information is required to complete the Arkansas Small Estate Affidavit?

Completing an Arkansas Small Estate Affidavit requires several key pieces of information, including:

- Full legal name and address of the deceased

- Date and location of death

- A comprehensive list of the deceased’s assets

- Estimated value of each asset

- Names and addresses of the heirs or legatees

- Debts and obligations of the estate

How do I file an Arkansas Small Estate Affidavit?

Filing an Arkansas Small Estate Affidavit involves preparing the form with all required details, then submitting it to the appropriate local court in the county where the deceased person lived. The process may also require publishing a notice in a local newspaper and notifying potential creditors.

Is there a waiting period for the Arkansas Small Estate Affidavit to take effect?

Yes, there is a 45-day waiting period after the date of death before the Arkansas Small Estate Affidavit can be filed. This allows sufficient time for any potential creditors to come forward and make claims against the estate.

Can real estate be transferred using the Arkansas Small Estate Affidavit?

Yes, real estate can be transferred using an Arkansas Small Estate Affidavit, provided the total value of the estate, including real estate, does not exceed the $100,000 limit.

Are there any fees associated with filing an Arkansas Small Estate Affidavit?

Yes, there are filing fees associated with submitting an Arkansas Small Estate Affidavit. These fees vary by county and should be confirmed with the local court where the affidavit will be filed.

What happens if the estate exceeds the value limit after filing the Arkansas Small Estate Affidavit?

If it is discovered that the estate’s total value exceeds the $100,000 limit after filing the affidavit, the proceedings may be invalidated. In such cases, it may become necessary to initiate formal probate to properly manage and distribute the estate’s assets.

Common mistakes

Filling out the Arkansas Small Estate Affidavit form is a critical step in managing a small estate in Arkansas. However, mistakes in this process can lead to delays, legal complications, or even the refusal of the affidavit. Being thorough and cautious is key. Below are five common mistakes people often make when filling out this form:

-

Not waiting the required 45 days after the decedent's death to file the affidavit. Arkansas law stipulates a waiting period before the small estate process can officially begin. Filing too soon can invalidate the effort.

-

Incorrectly listing the assets of the estate. It's crucial to accurately detail all of the assets belonging to the deceased. This includes checking accounts, real estate, vehicles, and personal belongings. Errors or omissions can cause substantial issues in the estate settlement.

-

Failing to properly identify and notify all heirs. The law requires that all potential heirs are identified and notified about the affidavit. Neglecting this step can lead to disputes or claims against the estate later on.

-

Forgetting to obtain and attach the required death certificate. The submission of a death certificate is essential for the small estate affidavit to be processed. This oversight can halt the entire process.

-

Miscalculating the total value of the estate. The small estate process in Arkansas is only available for estates under a certain value. Overestimating or underestimating this value can lead to rejection or complications in the affidavit's acceptance.

In conclusion, while the Arkansas Small Estate Affidavit process aims to simplify the settlement of small estates, attention to detail is paramount. Ensuring accuracy, meeting legal requirements, and thoroughly completing every section of the form are key steps in avoiding these common pitfalls.

Documents used along the form

When handling the transfer of assets from a deceased individual's estate under Arkansas law, the Small Estate Affidavit form provides a simplified process for estates valued under a certain threshold. However, this affidavit is often just one part of a dossier needed to comprehensively manage or close an estate. A suite of additional documents typically accompanies this form to ensure that all legal, financial, and personal facets of the estate are addressed comprehensively and lawfully.

- Certified Death Certificate: This official document confirms the death of the individual, serving as a fundamental requirement for many subsequent legal processes. It is issued by government authorities and is crucial for validating the commencement of estate proceedings.

- Proof of Relationship Documents: To establish the legal standing of the individual filing the affidavit, documents such as birth certificates, marriage certificates, or adoption papers are often required. These documents confirm the relationship between the deceased and the affiant, delineating their right to act on behalf of the estate.

- Real Property Deeds: If the estate includes real estate, deeds providing evidence of ownership are necessary. These documents are pivotal for transferring real property titles under the small estate process, ensuring legal recognition of the new ownership.

- Vehicle Titles and Registrations: For estates that encompass vehicles, including cars, boats, or motorcycles, titles and registrations must be updated. These documents facilitate the legal transfer of ownership to heirs or designated beneficiaries.

- Financial Account Statements: To accurately report the assets within the estate, recent statements from bank accounts, retirement accounts, and investment portfolios are often required. These statements provide a snapshot of the estate's financial assets, aiding in the valuation process.

- Debt and Bill Statements: Understanding the estate's liabilities is just as important as assessing its assets. Statements and bills for any outstanding debts, including mortgages, credit cards, and utility bills, are collected to ensure all debts are acknowledged and appropriately addressed.

- Inventory and Appraisal Reports: An inventory of personal property, along with appraisals for valuable items, may be necessary to satisfy court requirements or for equitable distribution among heirs. These reports help to establish the fair market value of tangible assets within the estate.

Together, these documents form a comprehensive toolkit for those navigating the process of estate settlement under Arkansas's Small Estate Affidavit procedure. By ensuring all relevant documents are gathered and appropriately filed, individuals can streamline the administrative process, mitigate potential legal challenges, and uphold their duties in managing or closing the estate of a loved one.

Similar forms

The Arkansas Small Estate Affidavit form is similar to other legal documents used when settling a deceased person’s estate without formal probate. This document allows for a more expedited process when the estate’s total value falls beneath a certain threshold. Its functions and requirements share commonalities with documents such as the Transfer on Death Deed (TODD) and the Simplified Probate Procedures.

The Transfer on Death Deed (TODD) is one of these documents, which, like the Arkansas Small Estate Affidavit, allows for the direct transfer of property upon the death of the owner without the need for probate court proceedings. Both documents facilitate easier transfer of assets, but whereas the Small Estate Affidavit can encompass various types of personal property and real estate (as long as the estate's total value is under a specific limit), the TODD is specifically designed for real estate property transfer. Additionally, the TODD must be executed and notarized during the owner’s lifetime and recorded in county records to be effective, a requirement not necessary for the Small Estate Affidavit.

Another comparable procedure is the Simplified Probate Procedures. Several states offer this streamlined approach for small estates, reducing the need for extensive court involvement. Similar to the Arkansas Small Estate Affidavit, these procedures are designed to expedite the legal process of distributing a deceased person's estate with less complexity and cost. Simplified Probate Procedures often require an affidavit or a sworn statement too but might have different criteria for what constitutes a "small estate" and vary on the types of assets that can bypass traditional probate. However, like the Small Estate Affidavit, this option greatly simplifies the process for eligible estates by potentially removing the need for a lengthy probate process.

Dos and Don'ts

Navigating the process of dealing with an estate can be daunting, especially in a time of grief. If you're in Arkansas and the estate in question qualifies as “small” by legal standards, using the Small Estate Affidavit form can simplify the process significantly. Yet, it's crucial to approach this document with care. Here’s a comprehensive list to help guide you through what you should and shouldn't do when filling out the Arkansas Small Estate Affidate form:

Do:

- Ensure the estate qualifies under Arkansas law as a “small estate”. This generally means the total value of the property does not exceed a certain threshold.

- Thoroughly read the instructions provided with the form to understand the rules and requirements specific to Arkansas.

- Provide complete and accurate information regarding the decedent (the person who has died) and their assets.

- Double-check all listed assets and valuations to ensure they’re accurate and comprehensive, including but not limited to bank accounts, vehicles, and real estate.

- Ensure all debts and liabilities of the estate are accurately recorded and assessed, as these will impact the distribution of assets.

- Secure signatures from all relevant parties, including all legal heirs, as required by law.

- Consult with an experienced estate or probate attorney if you have any questions or uncertainties about the process or your legal obligations.

- Use the form to designate an authorized person (if necessary) who will be responsible for distributing the assets according to the affidavit.

- File the form with the appropriate probate court in Arkansas, typically in the county where the decedent lived.

- Keep copies of the completed affidavit and any other relevant documents for your records and for any future legal proceedings.

Don't:

- Attempt to use the form if the estate exceeds the value limit set by Arkansas law for small estates.

- Overlook or omit any assets or liabilities, as this can lead to legal complications and potential penalties.

- Guess or estimate values of assets; ensure all valuations are as accurate as possible.

- Rush through the paperwork without verifying all information, which could lead to errors or omissions.

- Sign the affidavit without ensuring all heirs are in agreement with the contents and distribution of the estate.

- Assume that filing this form is the final step; follow through by distributing the assets as stipulated and addressing any creditor claims appropriately.

- Ignore the importance of seeking legal advice if there are complications, disputes, or if the estate's status is unclear.

- Forget to keep the court informed of any changes or updates to the estate’s condition or the information initially provided.

- Use the form without fully understanding your legal responsibilities, including tax implications.

- Dismiss the significance of the affidavit; treat it with the same seriousness as any other legal document.

By adhering to these guidelines, you can navigate the process with greater confidence and efficiency, ensuring all legal requirements are met and the estate is handled appropriately. Remember, when in doubt, consulting with a legal professional can provide clarity and peace of mind.

Misconceptions

In the state of Arkansas, the Small Estate Affidavit form facilitates the process of estate management for smaller estates, but misunderstandings about its use are common. Here, we address five prevalent misconceptions to clarify its application and requirements.

Any Estate Can Use the Small Estate Affidavit: A common misconception is that the Small Estate Affidavit is a universal solution for all estates, regardless of size or complexity. In reality, Arkansas law restricts its use to estates where the total value of assets, not counting debts and liens, does not exceed $100,000. This criterion ensures the affidavit process is reserved for genuinely small estates.

Real Estate Cannot Be Transferred: Many believe that real estate transactions cannot be handled through a Small Estate Affidavit. However, this is not the case in Arkansas. If the estate meets the necessary criteria, real estate can indeed be transferred to heirs or legatees using this simplified process, making it a valuable tool for many families.

A Lawyer Must Prepare the Form: The perception that legal assistance is mandatory for preparing a Small Estate Affidavit also persists. While legal advice can be very helpful, especially in more complex situations, Arkansas law does not require a lawyer to fill out or file the form. Individuals can complete it themselves if they feel confident in understanding the estate and assets involved.

It Avoids Probate Entirely: Another widespread belief is that by using a Small Estate Affidavit, the estate will not undergo any form of probate. This is partially inaccurate. While this process simplifies and shortens the probate process for small estates, it does not eliminate the need for some probate proceedings. The affidavit acts as a tool within probate to streamline the transfer of assets.

There Are No Time Restrictions: Finally, there is a notion that executors or administrators can file a Small Estate Affidavit at any time after death. Arkansas law, however, dictates a waiting period. The affidavit can only be filed 45 days after the decedent's death, ensuring all immediate financial obligations and funeral expenses are settled and providing a period for potential creditors to come forward.

By understanding these misconceptions about the Arkansas Small Estate Affidavit form, individuals can better navigate the estate settlement process, ensuring they comply with state laws and regulations.

Key takeaways

Navigating the process of distributing a loved one’s assets can be challenging. For those dealing with estates in Arkansas that meet certain criteria, the Small Estate Affidavit offers a less complex alternative to formal probate. Understanding how to correctly fill out and use this form is crucial to streamline the process. Here are key takeaways to consider:

- Eligibility: The Small Estate Affidavit can only be used in Arkansas if the total value of the decedent's real and personal property does not exceed $100,000. This threshold does not include certain assets like life insurance payable to a named beneficiary.

- Waiting Period: There is a mandatory 45-day waiting period after the decedent's death before the affidavit can be filed. This gives ample time to gather all necessary information and documentation.

- Required Documentation: Alongside the affidavit, you must provide a certified copy of the death certificate, a detailed list of the decedent’s assets and liabilities, and proof of your right to collect the assets.

- Filing Location: The affidavit should be filed with the probate court in the county where the decedent lived or where their property is located.

- Court Fees: Filing fees vary by county, so it’s important to check with the local probate court to determine the exact cost of filing the affidavit.

- No Agent Is Needed: Unlike other legal processes that might require the services of an attorney, the Small Estate Affidavit process is straightforward enough that many individuals can complete it without legal assistance. However, consulting with a legal expert can ensure everything is in order.

- Transfer of Assets: Once the affidavit is approved, it legally authorizes the transfer of the decedent’s assets to the rightful heirs or beneficiaries without the need for a prolonged probate process.

- Limitations: It is important to remember that the Small Estate Affidavit cannot be used to clear title to real estate. However, in certain circumstances, it can facilitate the transfer of motor vehicles and other types of personal property.

- Beneficiary Responsibility: Beneficiaries are responsible for ensuring that the decedent’s debts and obligations are satisfied from the assets transferred under the affidavit. This might include final income taxes, medical bills, or outstanding loans.

Using the Arkansas Small Estate Affidavit can significantly simplify the estate administration process for qualifying estates. By keeping these key points in mind and carefully preparing the necessary documentation, individuals can navigate the process more smoothly and with greater confidence.

Fill out Popular Small Estate Affidavit Forms for Different States

Small Estate Affidavit Massachusetts - Once accepted by a court or relevant authority, the Small Estate Affidavit serves as an authoritative document that financial institutions and others can rely upon to release assets to the claimant.

Small Estate Affidavit Washington - Preparation of this affidavit often requires gathering detailed information about the deceased's assets and debts.

Small Estate Affidavit Georgia - It represents a key resource in the toolkit for handling simple estates and alleviating administrative hurdles for grieving families.

Minnesota Small Estate Affidavit - A form of affidavit that serves to legally recognize the transfer of assets within small estates, reducing the need for probate court’s involvement and streamlining the inheritance process.