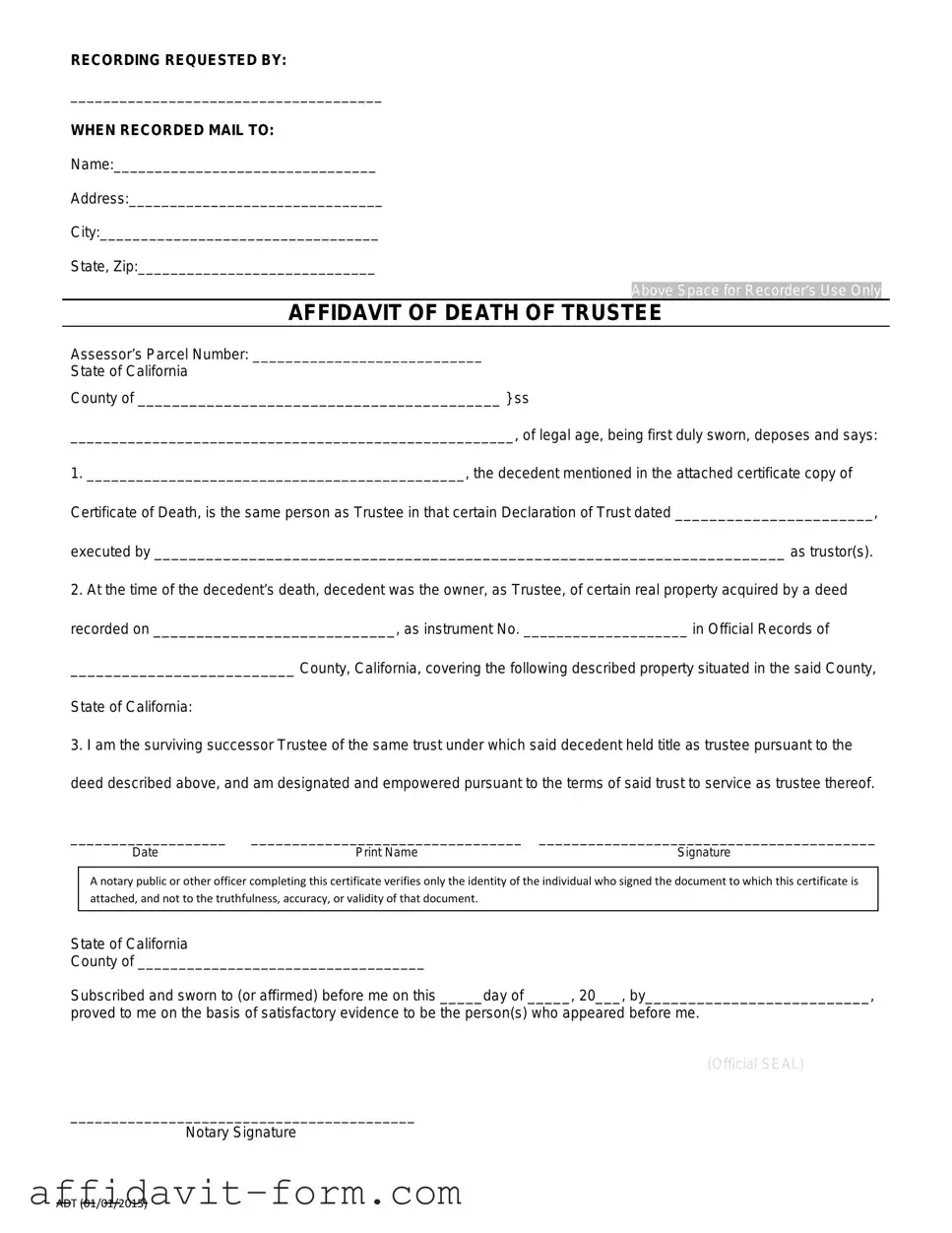

Blank California Affidavit of Death of a Trustee PDF Template

When a trustee passes away, a critical step for effectively managing and transferring property held in a trust involves the California Affiditate of Death of a Trustee form. This document serves as a formal notification of the trustee's death and is vital for the timely and smooth transition of property control within the state of California. It confirms to financial institutions, courts, and other relevant parties that the trustee has deceased and that the successor trustee, named within the trust, now has the legal authority to manage the trust's assets. The form not only facilitates the legal transfer of asset ownership but also helps to prevent potential disputes among beneficiaries by providing clear documentation of the change in trusteeship. Understanding how to properly complete and use this form is essential for trustees, beneficiaries, and legal professionals involved in trust administration to ensure compliance with state laws and the wishes of the trust's creator.

Form Example

RECORDING REQUESTED BY:

______________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:_______________________________

City:__________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF TRUSTEE

Assessor’s Parcel Number: ____________________________

State of California

County of __________________________________________ } ss

______________________________________________________, of legal age, being first duly sworn, deposes and says:

1.______________________________________________, the decedent mentioned in the attached certificate copy of Certificate of Death, is the same person as Trustee in that certain Declaration of Trust dated _______________________, executed by _________________________________________________________________________ as trustor(s).

2.At the time of the decedent’s death, decedent was the owner, as Trustee, of certain real property acquired by a deed recorded on ____________________________, as instrument No. ____________________ in Official Records of

__________________________ County, California, covering the following described property situated in the said County,

State of California:

3.I am the surviving successor Trustee of the same trust under which said decedent held title as trustee pursuant to the deed described above, and am designated and empowered pursuant to the terms of said trust to service as trustee thereof.

___________________ |

_________________________________ |

_________________________________________ |

Date |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

__________________________________________

Notary Signature

ADT (01/01/2015)

Document Features

| Fact | Detail |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee form is used to formalize the death of a trustee, facilitating the transfer of control over assets within a trust. |

| Required Documentation | Alongside the affidavit, a certified copy of the death certificate of the deceased trustee is required for processing. |

| Governing Law | The form is governed by the California Probate Code, particularly sections concerning the management and termination of trusts following a trustee’s death. |

| Filing | The completed affidavit, alongside required documents, should be filed with the county recorder’s office in the county where the property is located. |

| Beneficiaries | It allows beneficiaries or successor trustees to establish legal ownership and authority over assets held in the trust without court intervention. |

How to Use California Affidavit of Death of a Trustee

Completing the California Affidavit of Death of a Trustee form is a necessary step in the process to legally notify relevant parties that a trustee has passed away. This document serves as official confirmation of the death, allowing for the transition of responsibilities and assets held in trust to the successor trustee. Careful attention to detail is required to ensure the form is filled out correctly, fostering a smoother transition during a challenging time. Here are the steps to follow:

- Gather the necessary information, including the full name and date of death of the deceased trustee, the legal description of the property held in trust, and the name and address of the successor trustee.

- Locate the official California Affidavit of Death of a Trustee form. This can usually be found online through the California Courts website or by contacting a local legal assistance office.

- Read through the form carefully before you begin filling it out to ensure you understand all the requirements and to verify you have all the necessary information on hand.

- Fill out the deceased trustee’s information, including their full name and the date of their death.

- Enter the legal description of the property held in the trust. This must be precise, so double-check this information for accuracy. If unsure, refer to the original trust document or consult a professional.

- Provide the name and address of the successor trustee, ensuring the information matches their legal documents for identification purposes.

- Review all entries for accuracy, paying special attention to names, dates, and property descriptions to avoid any discrepancies or delays in processing.

- Sign the affidavit in the presence of a notary public. The process requires your signature to be notarized to confirm the authenticity of the document.

- File the completed affidavit with the county recorder’s office where the property is located. This may involve a filing fee, so be prepared to pay the required amount.

- Keep a copy of the filed affidavit for your records, as well as for the successor trustee. It might be needed for future legal or property-related matters.

After the affidavit is filed, it will be processed by the county recorder's office. This acts as an official record of the trustee's death and the change in trusteeship, ensuring that the successor trustee can legally manage, sell, or distribute the property held in the trust according to the terms set forth by the trust document. While this process doesn't transfer property, it does formalize the change in responsibility from the deceased trustee to the successor. The completion and filing of this document are critical steps in maintaining the continuity of the trust's administration and its assets.

Listed Questions and Answers

What is a California Affidavit of Death of a Trustee?

An Affidavit of Death of a Trustee is a legal document used in California to formally notify relevant parties and authorities when a trustee of a trust passes away. This document is essential for the process of legally transferring control and management of trust assets from the deceased trustee to the successor trustee, as outlined in the trust document.

Who needs to file an Affidavit of Death of a Trustee?

The responsibility to file this affidavit generally falls on the successor trustee. The successor trustee is the person named in the trust document to take over management of the trust assets upon the death of the original trustee. It's a critical step for the successor trustee to carry out their duties effectively and within legal boundaries.

What information is required on the form?

Completing the form requires several pieces of information, including:

- The name and date of death of the deceased trustee

- The name of the successor trustee

- Details about the trust, including its name and date of formation

- A legal description of the trust property affected

This information helps ensure that the transition of trusteeship is accurately recorded and recognized by law.

Where do you file the form once completed?

Once filled out, the Affidavit of Death of a Trustee should be filed with the county recorder's office in the county where the trust property is located. This step is crucial for the document to be officially recognized and for any real estate within the trust to be properly transferred to the control of the successor trustee.

Is there a deadline for filing the Affidavit of Death of a Trustee?

While California law does not specify a strict deadline for filing the affidavit, it's recommended to file it as soon as reasonably possible after the trustee's death. Delay in filing can complicate the management of the trust assets and potentially delay distributions to beneficiaries.

Common mistakes

Filling out legal forms can be tricky, especially when dealing with something as delicate as the California Affidavit of Death of a Trustee form. This document is important for many reasons, including the formal transfer of control and ownership of property within a trust after a trustee has passed away. Here are nine common mistakes people make when completing this form:

- Not double-checking the deceased trustee's name for spelling errors. It’s crucial this information matches official documents.

- Forgetting to include the date of death. This date should be accurate and correspond with death certificates and other official records.

- Overlooking the need to attach a certified copy of the death certificate. This is often required to prove the death of the trustee.

- Misidentifying the successor trustee. It’s important to correctly name the person or entity taking over as trustee.

- Incorrectly listing the trust property. All items controlled by the trust should be listed accurately, including real estate and accounts.

- Failing to sign the form in the presence of a notary public. Notarization is a critical step for the document to be legally binding.

- Skimming over or not fully understanding the instructions. Each step should be carefully followed to avoid mistakes.

- Not using the legal description for real estate. Legal descriptions are specific and must be used when listing real estate owned by the trust.

- Forgetting to file the form with the proper county recorder’s office. The affidavit needs to be recorded in the county where the property is located.

Avoiding these mistakes can save a lot of time and prevent legal headaches. Taking the time to carefully review and accurately complete the California Affidavit of Death of a Trustee form is an important step in ensuring the smooth transfer of trust properties.

Documents used along the form

When managing the affairs of a deceased trustee in California, the Affidavit of Death of a Trustee form is crucial. This document formally recognizes the change in trustee status due to death. In addition to this affidavit, there are several other documents and forms that often accompany or follow its use to ensure that the trust is properly managed and legal requirements are met. Here is a brief overview of some of those forms and documents.

- Certified Death Certificate: Provides legal proof of the trustee’s death, necessary for validating the Affidavit of Death of a Trustee.

- Trust Certification: Summarizes the trust's key elements, verifying the trust exists and outlines the acting trustees after the original trustee’s death.

- Deed of Assent: Used to transfer real property from the deceased trustee to the successor trustee or to the beneficiaries directly, as outlined in the trust.

- Notice of Trust Administration: Sent to all beneficiaries and heirs, informing them of the trustee’s death and the commencement of trust administration.

- Change of Ownership Statement: Filed with the county recorder’s office, stating that the ownership of property has changed due to the trustee’s death.

- Successor Trustee Acceptance: Document wherein the successor trustee formally accepts their duties and responsibilities as the new trustee.

- Inventory and Appraisal Forms: Utilized to catalog and appraise all assets held within the trust, essential for accurate trust management and distribution.

- Trust Transfer Deed: Utilized specifically for transferring real estate properties held in the trust to the beneficiaries according to the trust's terms.

- Tax Affidavit: Required in some cases to exempt certain transfers of property from reassessment under California property tax laws.

Each document plays a pivotal role in the administration of a trust following a trustee's death. From providing proof of death and validating successors to transferring assets and notifying interested parties, these documents collectively ensure that the trustee’s responsibilities are effectively passed on and that the trust's assets are handled in accordance with the trust documents and state laws.

Similar forms

The California Affidavit of Death of a Trustee form is similar to other legal documents designed to notify relevant parties of a significant change, such as the death of an individual in a specific role. This type of form is crucial in the context of estate management, where it serves to formally signify the transition of trustee responsibilities following a death. The documents it resembles include the Affidavit of Death of Joint Tenant and the Affidavit of Death of a Spouse. Each serves a unique but analogous purpose in the legal landscape around property, estate management, and the notification of death.

Affidavit of Death of Joint Tenant: This document is nearly a direct parallel to the California Affidavit of Death of a Trustee in its function and structure. Both documents are employed to officially record and communicate the death of an important individual tied to property or estate. Where the Affidavit of Death of a Trustee is specific to the passing of a trustee, the Affidavit of Death of Joint Tenant is utilized to declare the death of one owner in a joint tenancy property arrangement. This declaration is crucial for the survivor to remove the deceased's name from the title, effectively transferring full ownership to the surviving joint tenant(s) under the right of survivorship principle.

Affidavit of Death of a Spouse: Similar to the Affidavit of Death of a Trustee, the Affidavit of Death of a Spouse plays a significant role in notifying relevant entities about the demise of a married individual. The primary purpose is to facilitate the transfer or realignment of assets and property rights, reflective of the deceased's will or, in the absence of such, the state's succession laws. Through this affidavit, the surviving spouse can prove their right to inherit property, especially when said property was held in the deceased spouse's name. Analogous to the Trustee and Joint Tenant affidavits, this document ensures the orderly management of the deceased's estate, honoring their legacy and intents posthumously.

Dos and Don'ts

When handling the California Affidavit of Death of a Trustee form, it's vital to approach the task with the appropriate level of care and diligence. This document plays a crucial role in the process of legally transferring control over assets within a trust, following the death of a trustee. Here are key do's and don'ts to keep in mind:

- Do: Thoroughly review the entire form before you start filling it out. Understanding all the requirements can prevent mistakes and ensure the process runs smoothly.

- Do: Be meticulous in providing accurate information about the deceased trustee, including their full legal name, the date of death, and any other details required by the form. Accuracy here is paramount.

- Do: Make sure you have official documents on hand, such as a certified copy of the death certificate, as you'll need to attach these to the affidavit in most cases.

- Do: Consult with legal counsel if you have any doubts or questions while filling out the form. Estate laws can be complex, and professional guidance is invaluable.

- Don't: Rush through the process. Taking your time to ensure every section is completed correctly can save you from potential legal problems down the line.

- Don't: Sign the form without ensuring all included information is correct and complete. Your signature attests to the accuracy of the document, and errors or omissions can have legal consequences.

Adhering to these guidelines can help facilitate a smoother transition of trust administration following the loss of a trustee. By paying close attention to detail and seeking professional advice when needed, you can navigate this process with confidence and precision.

Misconceptions

When it comes to managing the affairs of a trust following the death of a trustee in California, the Affidavit of Death of a Trustee form plays a pivotal role. However, there are several misconceptions about this document that can create confusion. Here are four common myths debunked:

- It Immediately Transfers Property: Many people believe that simply filing the Affidavit of Death of a Trustee with the county recorder's office will instantaneously transfer property held in the trust to the beneficiaries. In truth, this document serves as a notification that the trustee has died and identifies the successor trustee. The actual transfer of property requires additional steps, including the successor trustee managing the trust assets according to the trust’s terms.

- It's Only Necessary for Real Estate: While it's true that this affidavit is often used in the context of real estate to clear title, its utility isn't confined to real property. The form is important for notifying financial institutions and other entities that the trustee has changed, which is critical for accessing and managing all types of assets held in the trust.

- It Avoids Probate: There's a common misunderstanding that filing an Affidavit of Death of a Trustee means the trust’s assets will bypass probate. However, the reality is that the trust itself—properly funded and managed—is what potentially avoids probate. The affidavit is simply part of the administrative process, confirming who has the authority to manage the trust after the trustee's death.

- No Legal Guidance Is Required: Finally, there's the notion that completing and filing the affidavit is straightforward and doesn't necessitate legal advice. Given the complexities involved in trust administration, particularly after a trustee's death, seeking guidance from a legal professional can prevent errors. A lawyer can help ensure that the transition of trusteeship is carried out smoothly and in accordance with the law.

Key takeaways

Transferring property after the death of a trustee in California is a process steeped in procedural rules, often necessitating the use of specific legal forms. One such important form is the California Affidavit of Death of a Trustee. This document serves as a critical link in the chain of legal steps required to ensure the smooth transition of assets held in trust. Here are key takeaways to understand when filling out and using this form:

- Accuracy is paramount. When completing the Affidavit of Death of a Trustee, every piece of information needs to be precise. This includes the decedent's full name, the date of death, and details about the trust itself. Incorrect information can lead to unnecessary delays and complications.

- Legal requirements vary. Understanding the regional legal nuances is vital. California law has specific demands regarding the notarization of the document and the subsequent steps for filing. Consulting with a local estate or trust attorney can clarify these requirements.

- Prior to submission, supporting documents should be attached. This usually includes a certified copy of the death certificate of the deceased trustee. In some cases, the original trust agreement or sections of it may also need to be attached.

- The form acts as a notification. Once filed, the California Affidavit of Death of a Trustee serves as a formal announcement of the trustee's death to all relevant parties. This includes financial institutions, title companies, and county records departments.

- One of the primary purposes of the affidavit is to facilitate the transfer of real property. By recording the affidavit with the county recorder’s office where the property is located, legal title to the real property can be officially passed to the successor trustee or beneficiaries, in accordance with the terms of the trust.

- Filing fees are part of the process. While the costs may vary by county, anticipating and preparing for these expenses is important. Fees are generally required when submitting the affidavit for recording.

- Lastly, the process of using the California Affidavit of Death of a Trustee paces the transfer of property, but it’s not the final step. It's advisable to continue engaging with legal advice to ensure compliance with all subsequent legal and tax implications.

The administration of a trust post-trustee's death encompasses more than just paperwork; it involves a detailed understanding of legal requirements and procedural nuances. The California Affidavit of Death of a Trustee form is a significant element in the tapestry of trust administration, serving not just as a document, but as a procedural step towards fulfilling the decedent's wishes regarding their trust.

Common PDF Documents

Can a Father Sign Over His Rights in South Carolina - Structured document for the voluntary cessation of parental rights, highlighting legal responsibilities, child’s details, and revocation rights.

Dmv Dl 44 Form Pdf - The affidavit confirms the owner's responsibility and right over the vehicle, acting as a cornerstone document in cases where ownership evidence is required.

Affidavit of Correction Ga - A proactive measure for sellers to correct title assignment errors before complications arise.