Printable Affidavit of Death Form for California

In the intricate web of legal documents necessary during the trying times of a loved one's passing, the California Affidavit of Death form emerges as a critical yet underappreciated tool. Tailored to streamline the often complex and emotionally taxing process of transferring property ownership, this document serves as a legal testament affirming the death of an individual and the subsequent shift in property rights. Primarily used in conjunction with joint tenancy, community property, and in certain cases, trust properties, the Affidavit of Death is pivotal in avoiding the protracted proceedings of probate court. Its importance extends beyond mere paperwork; it embodies a legal bridge facilitating the transfer of assets, ensuring that the deceased's property finds its way to the rightful heir or successor without undue delay. This mechanism, while straightforward in its execution, demands a precise adherence to legality and procedure, making it a subject of interest for beneficiaries, legal practitioners, and scholars alike. Its role in the context of asset distribution highlights the intersection of law, personal rights, and the mourning process, offering a glimpse into the delicate balance of addressing both legal obligations and human emotions during times of loss.

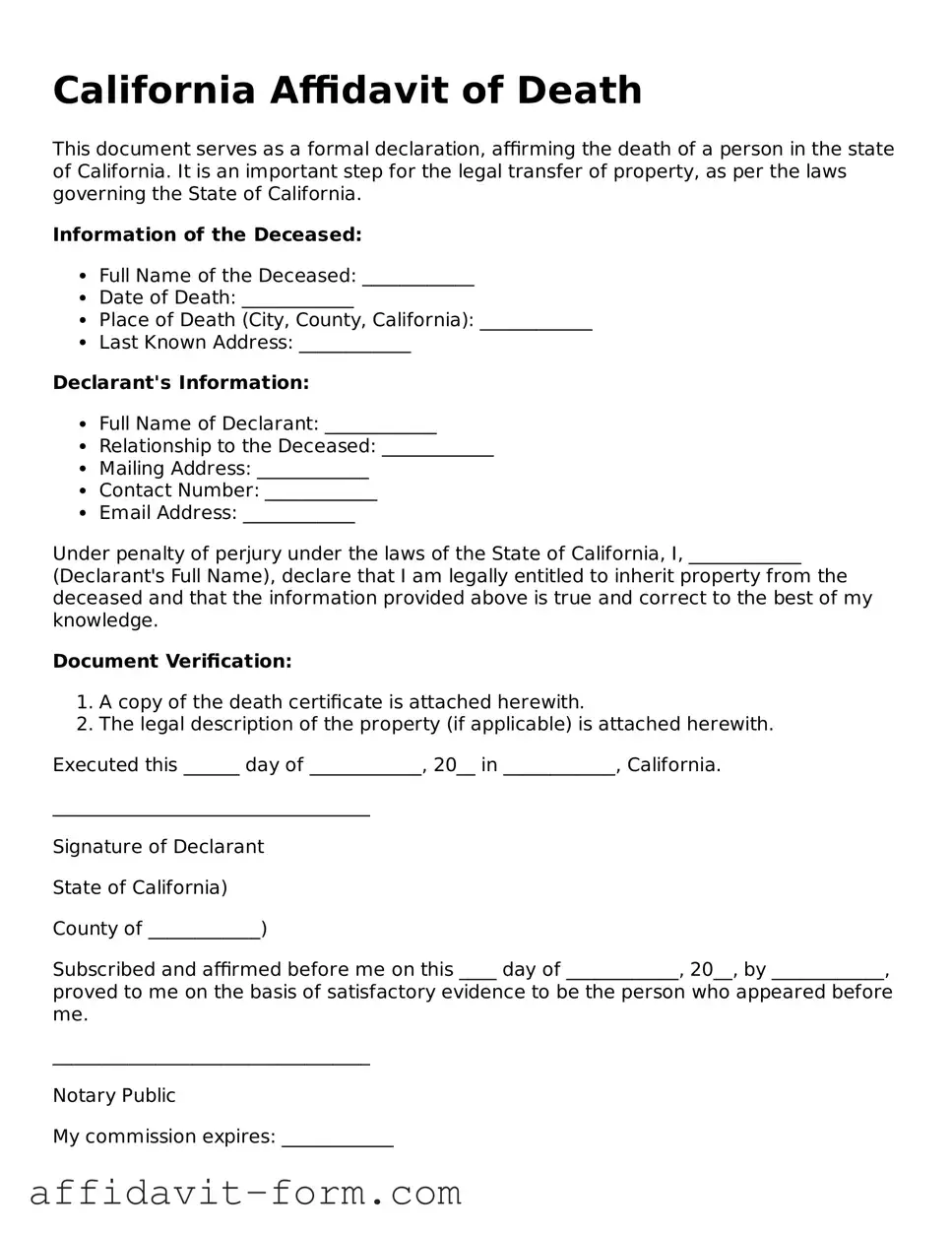

Form Example

California Affidavit of Death

This document serves as a formal declaration, affirming the death of a person in the state of California. It is an important step for the legal transfer of property, as per the laws governing the State of California.

Information of the Deceased:

- Full Name of the Deceased: ____________

- Date of Death: ____________

- Place of Death (City, County, California): ____________

- Last Known Address: ____________

Declarant's Information:

- Full Name of Declarant: ____________

- Relationship to the Deceased: ____________

- Mailing Address: ____________

- Contact Number: ____________

- Email Address: ____________

Under penalty of perjury under the laws of the State of California, I, ____________ (Declarant's Full Name), declare that I am legally entitled to inherit property from the deceased and that the information provided above is true and correct to the best of my knowledge.

Document Verification:

- A copy of the death certificate is attached herewith.

- The legal description of the property (if applicable) is attached herewith.

Executed this ______ day of ____________, 20__ in ____________, California.

__________________________________

Signature of Declarant

State of California)

County of ____________)

Subscribed and affirmed before me on this ____ day of ____________, 20__, by ____________, proved to me on the basis of satisfactory evidence to be the person who appeared before me.

__________________________________

Notary Public

My commission expires: ____________

Document Details

| Fact | Description |

|---|---|

| Use | The California Affidavit of Death form is used to formally declare the passing of a property owner and to help transfer property in accordance with California law. |

| Governing Law | This form is governed by the California Probate Code, specifically sections that deal with the transfer of real and personal property. |

| Who Files | Typically, a surviving family member or the executor of the estate files the affidavit, but it can also be filed by a beneficiary named in a will or trust. |

| Recording Requirement | After completion, the affidavit must be filed with the county recorder's office in the county where the property is located to be effective. |

How to Use California Affidavit of Death

When a loved one passes away, handling their affairs can be a challenging and emotional process. One important step for transferring or affirming real estate ownership is completing an Affidavit of Death form. This document officially records the death and aids in the seamless transition of property rights according to the deceased's wishes or the law. The process of filling out this form requires attention to detail and an understanding of the specific information needed. The following steps are designed to guide individuals through this task with clarity and care.

- Locate the official California Affidavit of Death form. This can typically be found online through county government websites or by visiting the county recorder's office.

- Read the form thoroughly before writing to understand all the required information and instructions.

- Fill in the decedent's (the deceased person's) full legal name as it appears on the real estate deed or property documents.

- Provide the decedent's date of death exactly as it appears on the official death certificate.

- Include the legal description of the property. This can usually be found on the property deed or tax assessment documents. Be precise, as this description legally identifies the property.

- Enter the Assessor’s Parcel Number (APN) of the property, if available. This number is used by the county tax assessor to identify the property for tax purposes.

- Attach a certified copy of the death certificate to the affidavit. This is a crucial step, as it legally substantiates the death.

- Sign the affidavit in front of a notary public. The form must be notarized to be legally valid and accepted by the county recorder.

- File the completed and notarized affidavit along with the death certificate at the county recorder’s office. There may be a filing fee, so it’s advisable to contact the office ahead of time to verify any costs.

Once the Affidavit of Death is filed and accepted by the county recorder, the process of transferring or confirming property ownership can proceed. This document plays a critical role by formally updating the property records to reflect the new ownership status. It is a respectful and necessary step in managing the affairs of someone who has passed, ensuring their property is handled according to their wishes or the prevailing laws.

Listed Questions and Answers

What is an Affidavit of Death form?

An Affidavit of Death form is a document utilized to formally declare the death of an individual. It is mainly used to notify certain entities and update records related to property, bank accounts, and other assets. The affidavit is commonly used in legal matters where proving the death of a person is necessary to proceed with transferring assets to heirs or beneficiaries.

Who needs to fill out an Affidavit of Death form in California?

In California, the executor of the estate, a surviving family member, or a beneficiary of the deceased person's property might need to complete an Affidavit of Death form. This is particularly the case when the deceased owned property that needs to be transferred to the living heirs or when there's a need to claim benefits or manage other assets.

What information is required on a California Affidavit of Death form?

To complete an Affidavit of Death form in California, you'll need to provide several key pieces of information including:

- The full name of the deceased

- The date of death

- The place of death

- A statement of your relationship to the deceased or your interest in the estate

- A certified copy of the death certificate

- Details about any property or asset involved

How do I obtain a California Affidavit of Death form?

California Affidavit of Death forms can be obtained from several sources, including online legal document services, county recorder's offices, or by consulting with a legal professional specialized in estate planning or probate law.

Is a lawyer required to file an Affidavit of Death form in California?

While it's not mandatory to hire a lawyer to file an Affidavit of Death form, consulting with one can be beneficial, especially in complex cases involving significant assets or disputes among heirs. A lawyer can provide guidance, ensure the form is filled out correctly, and help navigate any potential legal hurdles.

Where do I file a completed Affidavit of Death form in California?

Once completed, the Affidavit of Death form should be filed with the county recorder's office in the county where the property of the deceased is located. Filing with the correct county ensures that property records are updated to reflect the death.

What is the fee for filing an Affidavit of Death form in California?

Filing fees for an Affidavit of Death form vary by county in California. It's advisable to contact the specific county recorder's office where the document will be filed to get accurate information on current filing fees.

How long does it take for an Affidavit of Death to be processed in California?

The processing time for an Affidavit of Death in California can vary based on the county recorder's operations and workload. Generally, it may take from a few days to several weeks for the form to be processed and for records to be updated.

Can an Affidavit of Death form be rejected, and what are the common reasons for rejection?

Yes, an Affidavit of Death form can be rejected for several reasons, including:

- Incomplete information or missing details on the form

- Lack of a certified copy of the death certificate

- Discrepancies between the information on the form and official records

- Filing with the wrong county recorder's office

Ensuring that the form is completed accurately and includes all required documents can help avoid rejection.

Common mistakes

When filling out the California Affidavit of Death form, there are some common mistakes that can lead to delays or complications in the process. Paying careful attention can save you time and ensure your documents are processed smoothly. Here’s a list of pitfalls to avoid:

- Not using the deceased’s full legal name: It’s crucial to use the person's full legal name as it appears in official documents. Mismatching names can cause confusion or lead to processing delays.

- Incorrect or incomplete property description: For real estate, provide the full legal description of the property. Leaving out details or providing inaccurate information can complicate the transfer process.

- Failing to attach a certified copy of the death certificate: An original or certified copy of the death certificate needs to accompany the affidavit. Photocopies are not accepted and can result in the document being returned.

- Overlooking the notarization requirement: The affidavit must be notarized to be legally valid. Skipping this step means your form won’t be processed until it’s properly notarized.

- Missing signatures: Every required signature must be present. Missing signatures from the filing party or parties can invalidate the document.

- Incorrect date of death: The date of death must match exactly what is on the death certificate. Discrepancies in the date can raise questions about the affidavit’s accuracy.

- Not filing with the appropriate county recorder’s office: The affidavit needs to be filed with the recorder’s office in the county where the property is located. Filing it in the wrong county will result in the document not being processed.

Steering clear of these errors will help ensure that your Affidavit of Death is processed without unnecessary delays, making the overall experience smoother for everyone involved.

Documents used along the form

When managing the affairs of a deceased loved one in California, the Affidavit of Death form plays a crucial role. However, this form is often just a starting point. A variety of other documents and forms may be needed to comprehensively address the legal and financial aspects of the deceased's estate. Here's an overview of six additional forms and documents typically used alongside the Affidavit of Death form. Each serves its unique purpose in ensuring the deceased's affairs are settled properly and in accordance with the law.

- Death Certificate: This legal document is issued by a government official and confirms the date, location, and cause of death. It is often required to proceed with various administrative and legal tasks, including settling the estate and accessing or closing bank accounts.

- Will: A will is a document in which the deceased has outlined how they want their property and possessions to be distributed. It may designate an executor who will manage the process of settling the estate.

- Trust Documents: If the deceased had established a trust, these documents are essential for understanding how the assets within the trust should be distributed. Trustees must manage and distribute the trust's assets according to the terms set forth in these documents.

- Letters Testamentary or Letters of Administration: These documents are issued by a probate court and authorize an individual (either the executor named in the will or an administrator if there's no will) to act on behalf of the deceased's estate.

- Notice of Death to Creditors: This is a document that notifies creditors of the death. It is often published in a newspaper and informs creditors of the process to claim any debts owed by the deceased.

- Property Deeds and Titles: If the deceased owned real estate or vehicles, the deeds and titles for these assets would need to be transferred to the new owners as dictated by the will or state law.

This list is not exhaustive but provides a foundation for understanding the types of documents involved in settling an estate. Handling the affairs of a loved one can be a complex and emotional process. Therefore, it's advisable to seek professional guidance to ensure that all legal requirements are met and that the process is handled as smoothly as possible. Engaging with an attorney who specializes in estate planning or probate law can provide invaluable assistance during this challenging time.

Similar forms

The California Affidavit of Death form is similar to other legal documents that are used to make official changes to records or property titles after someone's death. While the content and the purpose of these documents have nuances, they serve in transferring or confirming rights following the demise of an individual.

The Death Certificate: This document is perhaps the most directly comparable. Like the Affidavit of Death, a Death Certificate is an official record indicating a person's death. The key similarities include providing proof of death for legal, property, and financial purposes. Whereas the Death Certificate is typically issued by a governmental body and indicates specific data about the deceased, including the cause of death, the Affidavit of Death is used by individuals to legally assert the death in matters of property and inheritance, usually requiring a witness and notarization.

The Transfer on Death Deed (TODD): The TODD is another document with similarities to the California Affididavit of Death, particularly in its application to real property. Like the Affidavit of Death, a TODD becomes effective upon the owner’s death, transferring property directly to a named beneficiary without the need for probate court. While the TODD is created and filed with the county recorder's office during the property owner's lifetime, specifying the transfer to take place at their death, the Affidavit of Death is utilized after the death occurs, often in conjunction with a TODD, to finalize the transfer process.

The Will: While a will is a rather comprehensive planning document, detailing a person's wishes about the distribution of their assets after death, similarities with the Affididavit of Death arise in the execution of these wishes, particularly regarding property. Both documents are used posthumously, with the Affidavit of Death often serving as a supporting document to the will in proving the death of the property owner, hence facilitating the transfer of titles or assets as stippled in the will.

Dos and Don'ts

Filling out the California Affidavit of Death form is a critical step in the process of managing a deceased individual's estate. It is a legal document that officially records the death and facilitates the transfer of assets according to the deceased's wishes or laws of succession. To ensure that this form is filled out correctly and effectively, there are several do’s and don'ts to consider:

Do’s:- Verify the accuracy of all information before submission, including the decedent’s full name, date of birth, and date of death. Errors can lead to delays or legal complications.

- Include a certified copy of the death certificate with the affidavit. This is a crucial document that legally substantiates the death.

- Consult with a legal professional if there are any uncertainties about how to proceed. The guidance of an expert can help avoid mistakes and ensure that the rights and wishes of all parties are respected.

- Sign the document in the presence of a notary public. Notarization is essential for the affidavit to be legally valid.

- Keep a copy of the completed affidavit for personal records. Having your own record can be incredibly helpful for future reference or in case of any disputes.

- Submit the affidavit promptly to the appropriate agencies or institutions, such as county recorders or financial institutions, to ensure the smooth transfer of assets.

- Do not leave any required fields blank. Incomplete forms may be rejected, leading to unnecessary delays in the legal process.

Misconceptions

When dealing with the California Affidavit of Death form, it's easy to encounter misunderstandings. Clearing up these misconceptions is crucial for anyone involved in handling the affairs of a deceased person's estate. Below are six common misconceptions outlined for a better understanding:

- It's only needed for real estate transactions. While often used to transfer real estate ownership without a formal probate process, this affidavit serves other purposes too, like notifying banks or other entities of the death.

- Any family member can sign it. In reality, the person signing the affidavit must be legally entitled to do so, usually the successor of the deceased or an individual named in the deceased's estate plan.

- Filing it with the county recorder is always required. The necessity to file this document with the county recorder's office depends on what the affidavit is being used for. For real estate matters, filing is a common requirement, but it might not be necessary for other uses.

- It serves as a substitute for a will. This is a common misconception. The affidavit of death is a document that verifies the death; it doesn't distribute assets or outline wishes like a will does.

- No legal guidance is needed to complete it. Although completing an affidavit of death might seem straightforward, consulting with a legal professional can help avoid mistakes, especially concerning legal rights and the potential impacts on estate settlement.

- The process is the same in all California counties. While the affidavit of death form is widely used across California, requirements and procedures can vary from county to county. It's always recommended to check local regulations.

Key takeaways

Navigating the legal waters of post-mortem affairs can be a tad overwhelming, especially in the wake of losing a loved one. The California Affidavit of Death is a crucial document that helps streamline the transition of property ownership and other legal matters following someone’s death. Here are key takeaways you should keep in mind when filling out and using this form:

- Understanding its Purpose: The Affidavit of Death serves as a legal testimony that confirms the death of an individual. It is used primarily to facilitate the transfer of property and assets to the rightful heirs or beneficiaries, as per the decedent's will or state law.

- Eligibility to File: Not everyone can file an Affidavit of Death. Typically, the executor of the estate or the beneficiaries named in the will are the ones eligible to complete and file this document. In some cases, close family members may also be allowed to file, if there are no designated executors or beneficiaries.

- Accurate Information is Crucial: When filling out the form, it's imperative to provide accurate information about the deceased, including their full legal name, date of birth, date of death, and other relevant details. Any discrepancy can delay the process or lead to legal complications.

- Death Certificate is Required: A certified copy of the death certificate must accompany the affidavit. This serves as the official proof of death and is necessary for the document to be considered valid and for the transfer process to proceed.

- Notarization is a Must: For the Affidavit of Death to hold legal weight, it must be notarized. This involves signing the document in front of a notary public, who verifies the identity of the signer and ensures that they are signing under their own free will.

- Know Where to File: Once completed and notarized, the Affidavit of Death must be filed with the appropriate county recorder’s office. If it pertains to real property, the document should be filed in the county where the property is located. Each county may have its own filing fees and requirements.

- Legal and Tax Implications: The transfer of property and assets following a death may have legal and tax implications for the beneficiaries. It is advisable to consult with a legal or tax professional to understand these implications fully and to ensure compliance with applicable laws and regulations.

Handling the affairs of a deceased loved person can be a difficult process, both emotionally and legally. However, understanding how to properly fill out and use the California Affidavit of Death can make the process a little easier, ensuring that the legal transition of the decedent's assets is done accurately and respectfully.

Fill out Popular Affidavit of Death Forms for Different States

Affidavit of Death Form Pdf - This form serves as official notice to courts or businesses that a person has passed away.

Petition for Possession Louisiana - A pivotal document in concluding pension or retirement account affairs, transferring or terminating benefits as needed.