Printable Small Estate Affidavit Form for California

In the intricate tapestry of estate management, the California Small Estate Affidavit form emerges as a beacon of simplicity and efficiency, designed for those situations where a loved one's estate does not meet the threshold necessitating a full probate process. This pivotal document, endowed with the power to streamline the transfer of assets from the deceased to their rightful heirs or beneficiaries, embodies both a testament to thoughtful legislation and a practical solution for many grieving families. Its creation was guided by the intent to alleviate the administrative burden and financial strain often associated with the distribution of small estates, marking a significant departure from the more cumbersome, traditional probate proceedings. The form's parameters, elegantly circumscribed by state laws, delineate the specific conditions under which it can be utilized, encapsulating both the monetary value and types of assets eligible for this expedited process. Through this innovative legal instrument, California offers a navigable path for the bereft, ensuring the deceased's wishes are honored with dignity and respect, while minimizing the legal complexities for the survivors. Essential information, including how to correctly fill out and submit the form, alongside an understanding of its limitations and the responsibilities it entails, is paramount for those seeking its advantages, embodying a blend of legal foresight and compassionate consideration for the challenges faced by individuals in times of loss.

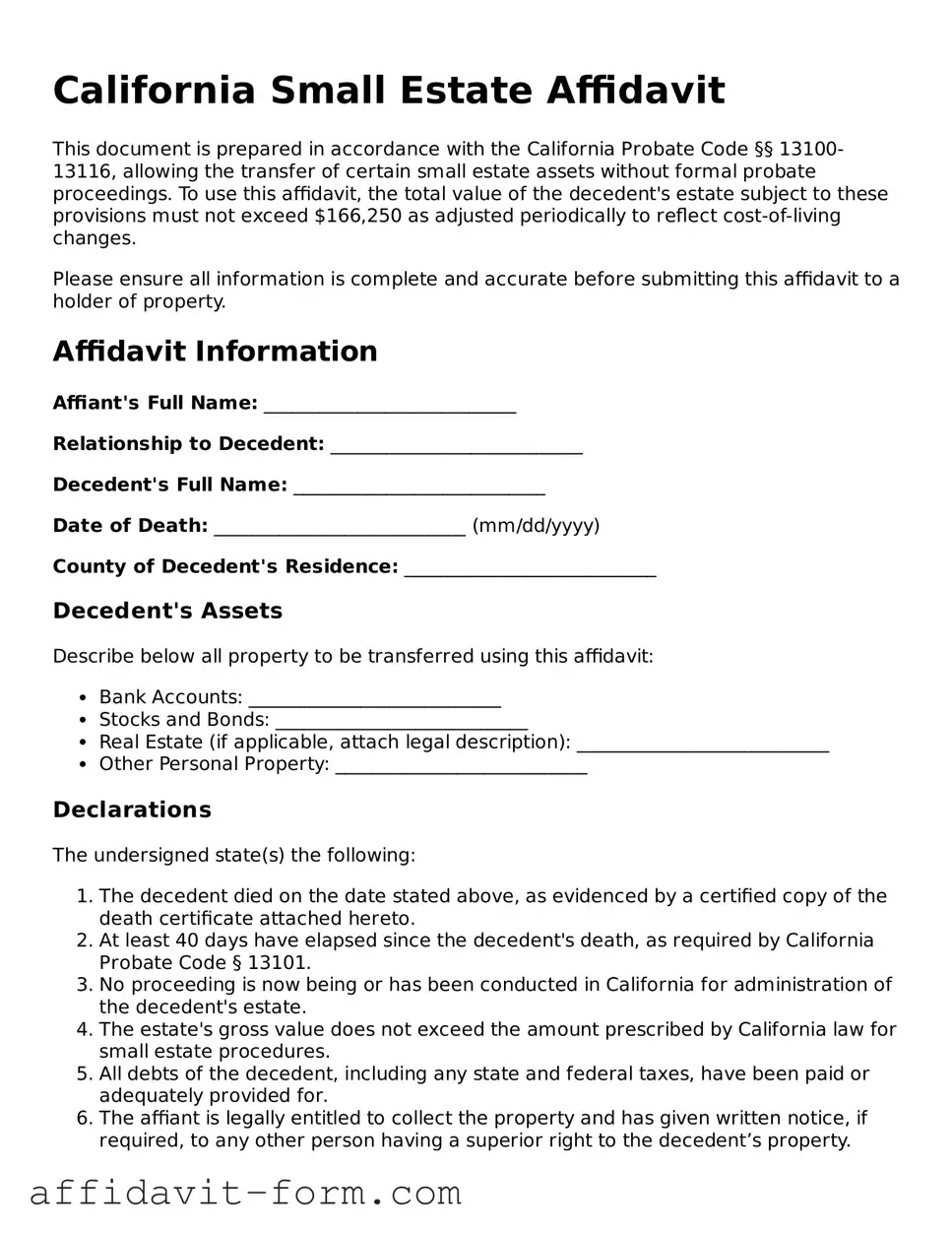

Form Example

California Small Estate Affidavit

This document is prepared in accordance with the California Probate Code §§ 13100-13116, allowing the transfer of certain small estate assets without formal probate proceedings. To use this affidavit, the total value of the decedent's estate subject to these provisions must not exceed $166,250 as adjusted periodically to reflect cost-of-living changes.

Please ensure all information is complete and accurate before submitting this affidavit to a holder of property.

Affidavit Information

Affiant's Full Name: ___________________________

Relationship to Decedent: ___________________________

Decedent's Full Name: ___________________________

Date of Death: ___________________________ (mm/dd/yyyy)

County of Decedent's Residence: ___________________________

Decedent's Assets

Describe below all property to be transferred using this affidavit:

- Bank Accounts: ___________________________

- Stocks and Bonds: ___________________________

- Real Estate (if applicable, attach legal description): ___________________________

- Other Personal Property: ___________________________

Declarations

The undersigned state(s) the following:

- The decedent died on the date stated above, as evidenced by a certified copy of the death certificate attached hereto.

- At least 40 days have elapsed since the decedent's death, as required by California Probate Code § 13101.

- No proceeding is now being or has been conducted in California for administration of the decedent's estate.

- The estate's gross value does not exceed the amount prescribed by California law for small estate procedures.

- All debts of the decedent, including any state and federal taxes, have been paid or adequately provided for.

- The affiant is legally entitled to collect the property and has given written notice, if required, to any other person having a superior right to the decedent’s property.

Acknowledgment

I, the undersigned, declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Executed on ________________________ (date) at ________________________, California.

Signature: ___________________________

Print Name: ___________________________

This document does not itself transfer the property. Instead, it must be presented to the entity currently holding the property (e.g., a bank or brokerage) along with any other required documents. Each entity may have its own additional requirements for transferring the property.

Document Details

| Fact | Description |

|---|---|

| Governing Law | The California Small Estate Affidavit is governed by California Probate Code sections 13100-13116. |

| Purpose | It is used by successors to collect the personal property of a deceased person without formal probate. |

| Eligibility | Estates must be valued at $166,250 or less (as of 2021) to qualify for the use of this affidavit. |

| Waiting Period | A 40-day waiting period after the death is required before the affidavit can be legally used. |

| Property Types Covered | Types of property that can be transferred include bank accounts, stocks, bonds, and other personal property. |

| Limitations | Real estate is not transferable using the California Small Estate Affidavit. |

| Requirement of Affidavit | The affidavit must state that the decedent's estate qualifies under California law and that the claimant is rightfully entitled to the property. |

| Signatures | The affidavit requires signatures of all legally entitled successors or a declaration of their consent. |

| Notarization | The affidavit must be notarized to be considered valid and legally binding. |

| Effectiveness | Once completed and verified, the affidavit allows transfer of ownership without needing a court order. |

How to Use California Small Estate Affidavit

In California, the Small Estate Affidavit procedure is a convenient way for inheritors to claim assets from a deceased person's estate without going through a lengthy probate process. This method is only applicable if the total value of the assets meets certain criteria and is intended to streamline the transfer of personal property. The following steps will guide you through completing the Small Estate Affidavit form, ensuring clarity and compliance with state laws. It's important to complete this form with accurate information, as any discrepancies could delay the asset transfer process.

- Verify eligibility by ensuring the total estate value does not exceed the amount specified by California law for the Small Estate Affidavit process.

- Gather necessary documents, including a certified copy of the death certificate and documentation proving the value of the estate's assets.

- Locate the most current version of the Small Estate Affidavit form. This can typically be found through county court websites or by contacting the court directly.

- Fill in the decedent's full name and date of death in the designated sections at the top of the form.

- Provide your personal information, including your full name, address, and relation to the deceased, in the sections that request the claimant's details.

- Detail the assets being claimed under the affidavit, including type, value, and any identifying information such as account numbers or descriptions. Be thorough and precise.

- State your relationship to the decedent and your right to the property being claimed. This may require checking specific boxes or providing a written explanation.

- If necessary, attach additional documentation that supports your claim to the assets, such as a will or death certificate.

- Review the affidavit thoroughly to ensure all information is accurate and complete. Errors or omissions can cause unnecessary delays.

- Sign and date the affidavit in the presence of a notary. The notary will need to notarize the form, thereby certifying your identity and your acknowledgment of the form's contents.

- Submit the completed and notarized affidavit along with any required attachments to the institution holding the assets (such as a bank) or as directed by the court's instructions.

After submitting the Small Estate Affidavit, the process for transferring assets begins. Depending on the institution and the specific assets, you might receive the assets directly, or further instructions will be provided. Patience is key during this period, as processing times can vary. Keep copies of all submitted documents for your records. Should questions arise during this procedure, consulting with a professional familiar with California estate laws can provide valuable guidance and reassurance.

Listed Questions and Answers

What is a California Small Estate Affidavit?

A California Small Estate Affidavit is a legal document used to simplify the process of settling small estates when a person dies without a will in California. It allows the heirs or beneficiaries to collect the deceased person's property without a formal probate proceeding if the value of the estate meets certain requirements.

Who can use a California Small Estate Affidavit?

Heirs or legally designated beneficiaries of the deceased can use a Small Estate Affidavit if they meet California's requirements, primarily that the total value of the decedent's estate does not exceed $166,250. This total excludes certain types of property, like vehicles and payable-on-death accounts.

What are the requirements for filing a Small Estate Affidavit in California?

To file a Small Estate Affidavit in California, several conditions must be met:

- The decedent must have died without a will, or if there was a will, it does not require formal probate.

- The total value of the decedent’s estate cannot exceed $166,250.

- At least 40 days must have passed since the decedent's death.

- No other probate proceedings must be pending or conducted for the decedent’s estate.

Which assets can be transferred using a Small Estate Affidairy in California?

Assets that can be transferred using a Small Estate Affidavit in California include:

- Personal property like bank accounts, stocks, and bonds.

- Certain types of real estate under specific conditions.

- Contents of safe deposit boxes.

How do you file a Small Estate Affidavit in California?

Filing a Small Estate Affidavit in California involves several steps:

- Ensure the estate meets the value threshold of $166,250 or less.

- Wait at least 40 days after the decedent's death.

- Complete the Small Estate Affidavit form, providing detailed information about the decedent, their estate, and the claiming successor(s).

- Attach any required documents, such as a death certificate and proof of your right to collect the property.

- Submit the completed affidavit directly to the holder of the property (e.g., bank, brokerage firm).

What are the benefits of using a Small Estate Affidavit?

Utilizing a Small Estate Affidavit in California has several benefits:

- It simplifies the process of asset distribution without the need for a lengthy probate proceeding.

- It allows for a quicker distribution of assets to the heirs or beneficiaries.

- It reduces the costs associated with probate, making more of the estate’s assets available to the heirs or beneficiaries.

Common mistakes

When dealing with the California Small Estate Affidavit form, it's crucial to pay attention to detail and understand the process fully. Unfortunately, some common mistakes can complicate the procedure. Being aware of these errors can simplify the process, ensuring a smoother transaction.

Not waiting the required 40-day period after the decedent's death before submitting the affidavit. This waiting period is mandatory and failing to observe it results in the affidavit being invalid.

Failing to correctly determine the estate's value, thereby misjudging eligibility. The estate’s total value must not exceed the threshold specified by California law for small estates. Misestimation can lead to rejection.

Incorrectly identifying or omitting assets that should be included in the estate. Every asset, whether it’s real estate, bank accounts, or personal belongings, must be accounted for accurately.

Overlooking the requirement to obtain and attach a certified copy of the death certificate. This document is essential for the affidavit to be processed.

Forgetting to provide detailed information about heirs and beneficiaries, which is required to ensure that assets are distributed according to the decedent's wishes or state law.

Not securing the necessary signatures. The affidavit must be signed by all legally recognized successors, not just one individual, unless specified elsewhere.

Failing to notarize the affidavit. A notarized affidavit is a requirement for the document to be considered legally valid and binding.

Neglecting to frequently check for updates or changes in the law. Laws governing small estates change, and staying informed about these updates is crucial.

Attempting to use the affidavit for property not covered by California's small estate procedure, such as real estate located outside of California. This mistake can lead to legal complications and further delays.

Understanding and avoiding these mistakes can help individuals navigate the process of managing a small estate with confidence and efficiency. It's always advisable to seek professional guidance when in doubt to ensure compliance with all legal requirements.

Documents used along the form

When dealing with the transfer of assets through a Small Estate Affidavit in California, several other forms and documents may be required to ensure a smooth and legally compliant process. These documents help in verifying the deceased's assets, the legitimacy of the claimants, and ensuring that all procedural requirements are met. The following is a list of documents often used alongside the California Small Estate Affidavit form.

- Death Certificate: This serves as an official record of death and is necessary for legal and financial institutions to process the deceased's assets.

- Copy of the Will: If the deceased left a will, it might need to be reviewed to understand the intentions regarding the distribution of assets, even in cases eligible for a small estate affidavit.

- Property Valuation Report: An appraisal of the deceased's property may be required to ensure the estate’s value falls below the threshold for a small estate procedure in California.

- Bank Statements: To identify and verify the assets held in financial institutions that are to be transferred via the small estate process.

- Proof of Heirship: Documents such as birth certificates, marriage certificates, or other legal paperwork may be required to establish the relationship between the deceased and the claimants.

- DMV Transfer Forms: If the estate includes vehicles, specific forms from the Department of Motor Vehicles may be necessary for the transfer of ownership.

- Real Estate Transfer Declaration: For real estate included in the small estate, this declaration aids in the legal transfer of property titles or deeds.

The use of these documents, in addition to the California Small Estate Affidavit, provides a comprehensive approach to handling small estates. It ensures that the transfer of assets is executed according to both the letter and the spirit of the law, minimizing the potential for disputes and complications in these often-sensitive situations.

Similar forms

The California Small Estate Affidavit form is similar to several other legal documents in specific ways, primarily in its function to simplify the transfer of assets. These comparisons can be particularly helpful in understanding its purpose and utility within estate planning and administration.

Transfer on Death Deed (TODD): Just like the California Small Estate Affidavit, a Transfer on Death Deed allows for the direct transfer of property upon the death of the owner without the need for probate. Both forms are designed to streamline the process of transferring assets, but while the Small Estate Affidavit can apply to various types of property, the Transfer on Death Deed is specifically used for real estate. The TODD must be recorded before the owner's death, directly naming the beneficiary.

Joint Tenancy with Right of Survivorship: This arrangement is also aimed at avoiding the probate process. When one joint tenant passes away, ownership of the property automatically transfers to the surviving joint tenant(s). The California Small Estate Affidavit functions similarly by facilitating asset transfer without probate, but it is used after death and does not require the deceased to have shared ownership of the property with the beneficiary during their lifetime.

Payable on Death (POD) Accounts: POD accounts are similar to the California Small Estate Affidavit in that both allow for the bypassing of probate for the assets in question. With a POD account, a beneficiary is designated by the account owner, and upon the owner’s death, the funds are directly transferred to the beneficiary. The key difference is that POD accounts are specifically for financial assets, whereas the Small Estate Affidavit can encompass a broader range of personal property.

Dos and Don'ts

Filling out a California Small Estate Affidavit form is a practical way to settle smaller estates without going through formal probate. However, to ensure the process goes smoothly, there are specific steps you should follow and some common mistakes you'll want to avoid. Here's a guide to help you navigate filling out the form.

Things You Should Do

- Double-check the eligibility criteria before you start. Ensure the total value of the estate does not exceed the threshold set by California law.

- Gather all necessary documents, such as a certified copy of the death certificate and an accurate list of the deceased person's assets, before you begin filling out the form.

- Be thorough and accurate when listing the assets. Include detailed descriptions and the value of each asset to ensure everything is accounted for correctly.

- Seek legal advice if you encounter any complex issues or if you're unsure about any part of the process. A professional can provide valuable guidance and peace of mind.

Things You Shouldn't Do

- Don't try to use the Small Estate Affidavit if the estate exceeds the monetary limit set by California law. This could lead to legal complications.

- Don't fill out the form without first verifying that all debts and taxes of the estate have been settled. Overlooking this can cause issues down the line.

- Don't provide false information on the form. Falsifying information can lead to legal consequences and potentially delay the settlement of the estate.

- Don't forget to have the form notarized. A notarized affidavit is often required for the document to be considered valid and legally binding.

Misconceptions

When dealing with the passing of a loved one, navigating through legal paperwork is the last thing anyone wants to do. Yet, it's often necessary to manage the deceased's assets. In California, one of the mechanisms to facilitate this process is the Small Estate Affidavit. However, there are several misconceptions surrounding this form that can add to the confusion during a difficult time. Let’s clear up some of these misconceptions.

- It’s a quick fix for all estates. Many people believe that the Small Estate Affidavit is a one-size-fits-all solution for estate transfers, but it is specifically designed for estates valued at $166,250 or less, excluding certain types of assets. This value threshold and the types of assets that can be transferred using this form are often misunderstood.

- Real estate cannot be transferred using the Small Estate Affidavit. This is not entirely true. In California, real estate valued under the specified threshold can indeed be transferred using this form, but conditions apply, and not all real estate qualifies. It's important to verify property types and values.

- It avoids the probate process entirely. While using a Small Estate Affidavit can simplify the transfer of assets and may avoid a full probate process, it does not eliminate the need for all probate procedures in every case. The affidavit can speed up and simplify the process, but some legal steps may still be required.

- The form is instantly effective. Another misconception is the belief that as soon as the Small Estate Affidavit form is completed and notarized, it’s effective immediately. In reality, California law requires a waiting period of 40 days after the deceased's death before the form can be presented to collect the assets.

- Any family member can complete the form. While it’s true that the form does not have to be completed by a legal professional, not just any family member can fill it out. The right to claim assets via a Small Estate Affidavit follows California’s succession laws, which generally give priority to spouses, children, and then possibly other relatives.

- It can be used to transfer all types of personal property. The Small Estate Affidavits have limitations on what types of assets they can transfer. It is commonly used for transferring personal property, but there are exceptions, such as property held in trust or designated to transfer upon death to a named beneficiary.

- Submitting the completed form to the court is necessary. This is usually not the case. The Small Estate Affidavit is often presented directly to the institution holding the asset, such as a bank, rather than being filed with the court. However, instructions sometimes vary, which can be confusing.

- A lawyer is not needed for the Small Estate Affidavit process. While it's true that a lawyer is not strictly necessary to utilize a Small Estate Affidavit, legal advice can be incredibly helpful. Given the complexities and potential for misunderstandings related to estate value calculations and eligible assets, consulting with an attorney can ensure that the process is handled correctly and efficiently.

Understanding these key points can help navigate the use of a Small Estate Affidavit in California with greater clarity and confidence. However, given the nuances of estate law, seeking professional advice is always recommended to ensure compliance and the smooth transfer of assets.

Key takeaways

When dealing with the aftermath of a loved one's passing, navigating the legalities of their estate can be both emotionally and logistically challenging. In California, the Small Estate Affidavit offers a streamlined process for settling smaller estates, avoiding the often lengthy and complex probate process. Here are four key takeaways to understand when filling out and using the California Small Estate Affidavit form:

- Eligibility Criteria: It's essential to determine whether the estate qualifies as 'small' under California law, which typically means the total value of the assets doesn't exceed a certain threshold. As of the latest legal updates, an estate may be considered small if the total asset value is $166,250 or less. This includes personal property, bank accounts, and certain types of real estate.

- Accuracy is Crucial: When completing the California Small Estate Affidavit, accuracy cannot be overstated. The form requires detailed information about the deceased’s assets, debts, and beneficiaries. Providing incorrect information can lead to delays, legal complications, or even penalties. It’s often helpful to gather all necessary documents and double-check figures before filling out the form.

- Proper Documentation: Attaching the right documents is a critical step in this process. This may include a certified copy of the death certificate, proof of the asset’s value (such as bank statements or appraisal reports for real estate), and any other relevant legal documents that support the claim. The requirements can vary depending on the assets involved, so consulting with a legal professional can provide valuable guidance.

- Legal and Filing Procedures: Understanding where and how to file the affidavit, as well as knowing any associated legal procedures, is vital. In California, the affidavit can typically be presented directly to the entity holding the asset (like a bank or brokerage). However, specific instructions may vary, so it’s important to research or seek advice on the correct steps for your situation. Additionally, there may be waiting periods or additional forms required depending on the type of asset or the institution’s policies.

Ultimately, while the California Small Estate Affidavit form simplifies the process for transferring assets of smaller estates, navigating the specifics can still be complex. Consulting with a legal expert can ensure that you meet all legal requirements, prevent issues, and expedite the distribution of assets according to California law.

Fill out Popular Small Estate Affidavit Forms for Different States

Colorado Small Estate Affidavit - Designed to alleviate the burdens of probate for small estates, ensuring quicker distribution of assets to heirs.

Louisiana Small Succession Affidavit - This document underscores the practicality of estate planning, even for those with relatively modest assets, by providing a mechanism for their swift distribution post mortem.

Probate Forms Ri - Preparation involves listing the deceased's assets, confirming their value falls under the legal limit for a small estate.

Washington Dc Probate Court - Using a Small Estate Affidavit can help avoid the need to appoint an executor or administrator, simplifying the estate settlement process.