Printable Small Estate Affidavit Form for Colorado

In the beautiful state of Colorado, when a loved one passes away, their assets and personal property must be transferred to the rightful heirs or beneficiaries. This process can often be complex and emotionally taxing. However, for estates that meet specific criteria, there exists a streamlined method known as the Colorado Small Estate Affidavit form. This legal document serves as a simplified way for heirs to claim property without the need for a lengthy probate process. Especially beneficial for smaller estates, it provides a cost-effective and quicker mechanism for transferring assets. The use of the Small Estate Affidavit is subject to certain conditions, such as the total value of the estate not exceeding a predetermined threshold. Additionally, the form requires detailed information about the deceased, the assets to be transferred, and the entitled beneficiaries. Understanding and completing this form accurately is crucial for heirs to effectively manage and settle small estates in accordance with Colorado law.

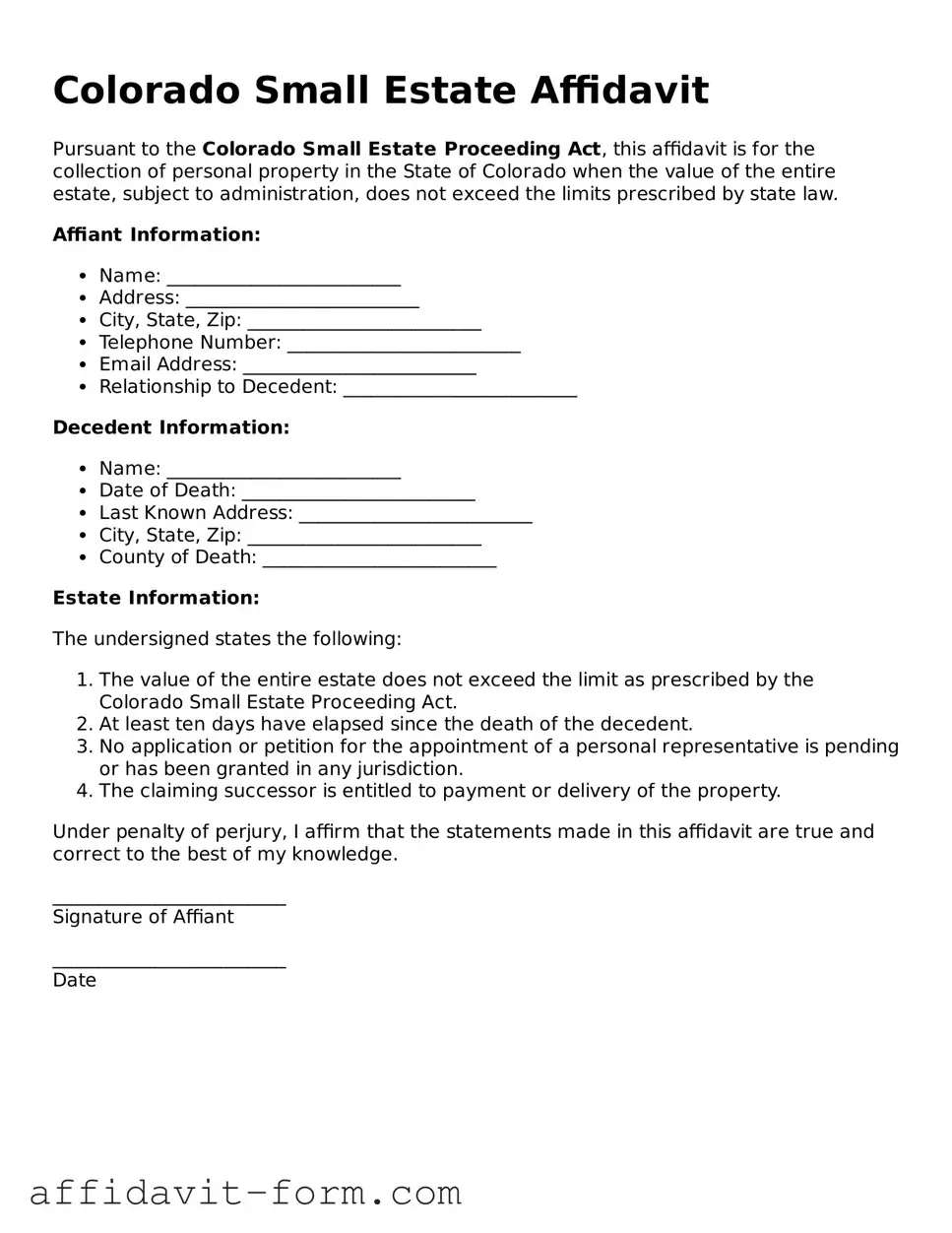

Form Example

Colorado Small Estate Affidavit

Pursuant to the Colorado Small Estate Proceeding Act, this affidavit is for the collection of personal property in the State of Colorado when the value of the entire estate, subject to administration, does not exceed the limits prescribed by state law.

Affiant Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip: _________________________

- Telephone Number: _________________________

- Email Address: _________________________

- Relationship to Decedent: _________________________

Decedent Information:

- Name: _________________________

- Date of Death: _________________________

- Last Known Address: _________________________

- City, State, Zip: _________________________

- County of Death: _________________________

Estate Information:

The undersigned states the following:

- The value of the entire estate does not exceed the limit as prescribed by the Colorado Small Estate Proceeding Act.

- At least ten days have elapsed since the death of the decedent.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The claiming successor is entitled to payment or delivery of the property.

Under penalty of perjury, I affirm that the statements made in this affidavit are true and correct to the best of my knowledge.

_________________________

Signature of Affiant

_________________________

Date

Document Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Colorado Small Estate Affidavit is governed by Colorado Revised Statutes, specifically Section 15-12-1201. |

| 2 | This form allows for the transfer of a deceased person’s property without a formal probate process if the estate is valued at $70,000 or less. |

| 3 | To use the affidavit, at least 10 days must have passed since the death of the estate's owner. |

| 4 | The form requires detailed information about the decedent, the claiming successor, the assets, and any known debts. |

| 5 | Eligible assets include bank accounts, vehicles, and personal property but do not cover real estate holdings in Colorado. |

| 6 | The person completing the affidavit must swear that they are legally entitled to the property and that they will use it to pay the deceased’s debts and distribute any remainder according to the law. |

| 7 | No court filing is needed for the Colorado Small Estate Affidavit, but it must be presented to the institution or person holding the assets. |

| 8 | If real estate is part of the estate, a different process, not the Small Estate Affidavit, must be followed in Colorado. |

| 9 | Using the Small Estate Affidavit can expedite the distribution of assets to heirs or legatees, often within a short time frame. |

How to Use Colorado Small Estate Affidavit

After a loved one passes away, managing their estate can be a daunting task, especially during a time of grief. In Colorado, if the estate is valued below a certain threshold and doesn't include real property, you may bypass the more extended probate process by using a Small Estate Affidavit. This document allows the transfer of the deceased person's assets to their rightful heirs without court supervision. Below is a straightforward guide on how to accurately fill out the Colorado Small Estate Afficavit form to ensure a smoother transfer of assets to the beneficiaries.

- Start by entering the full legal name of the deceased (also known as the decedent) at the top of the form where indicated.

- Fill in the date of death of the deceased as documented on the death certificate.

- Provide your full legal name and address, identifying yourself as the affiant—the person making the affidavit.

- List all known assets of the deceased. Include details like account numbers, descriptions of personal property, vehicle identification numbers for cars, and any other relevant information that accurately depicts the assets to be transferred.

- State the estimated value of each listed asset. Ensure that the total value does not exceed the small estate threshold set by Colorado law.

- Identify all debts owed by the deceased, including funeral expenses, outstanding bills, and any other obligations.

- List the names and addresses of all legal heirs, specifying their relationship to the deceased and the portion of the estate each is entitled to receive.

- Review sections of the form that require declarations or attestations about notifying creditors or paying debts and fill them out according to your situation.

- Confirm that at least ten days have passed since the death of the decedent. This waiting period is a legal requirement before the Small Estate Affidavit can be executed.

- Sign and date the form in the presence of a notary public. The notary will also need to fill in their part of the document, verify your identity, and affix their official seal.

Once the form is completed and notarized, you can present it to institutions holding the deceased's assets for transfer. Remember, this form does not transfer title for real property like homes or land. Each institution may have additional requirements or paperwork, so it's wise to contact them ahead of time to ensure a smooth process. By carefully following these steps, you can efficiently manage the transfer of assets and honor the wishes of your loved one.

Listed Questions and Answers

What is a Colorado Small Estate Affidavit?

A Colorado Small Estate Affidavit is a legal document used to collect and distribute a deceased person's assets without formal probate. It's applicable when the deceased's estate is valued below a certain threshold, specifically $70,000 or less in personal property and does not include real estate.

Who is eligible to file a Small Estate Affidavit in Colorado?

The right to file is reserved for successors, including surviving spouses, adult children, parents, or other next of kin. If a will exists, the person named as the executor has priority. Should no will be present, the closest living relative usually files the affidavit.

What documents are needed to complete the Colorado Small Estate Affidavit?

To successfully complete the process, the following must be prepared:

- Death Certificate of the deceased

- A detailed list of the deceased's assets

- Legal descriptions and values of the personal property

- Any outstanding debts and creditor information

- A completed Colorado Small Estate Affidavit form

How do I file a Small Estate Affidicaid in Colorado?

Filing involves completing the affidavit form with accurate and truthful information, then signing it in the presence of a notary public. It is not typically filed with a court, but presented to the entity holding the deceased's asset, such as a bank. Proper identification and a certified copy of the death certificate will be required.

Are there any fees associated with filing a Small Estate Affidavit in Colorado?

No state filing fees are associated with a Small Estate Affidavit in Colorado. However, costs may arise related to notarizing the document or obtaining certified copies of the death certificate. These fees vary based on service providers.

How long does the process take?

The timeline can vary, but usually, assets can be released by the holding entity within ten to fifteen business days after presenting the completed affidavit, assuming all documentation is in order. Delays can occur if the affidavit is incomplete or if additional information is requested.

Common mistakes

Navigating the process of filling out a Small Estate Affidavit form in Colorado can be a tricky endeavor. Even with the best intentions, people might make errors that could delay proceedings or complicate the estate settlement. To help you sidestep common pitfalls, let's delve into nine mistakes to avoid:

Not waiting the required period. Colorado law requires a specific waiting period after the decedent's death before you can file a Small Estate Affidavit. Jumping the gun and filing too early is a common mistake.

Failing to accurately value the estate. Underestimating or overestimating the value of the estate can lead to issues, as the Small Estate Affidavit is meant for estates under a certain value threshold.

Overlooking assets. Some assets might be easy to overlook but must be included in the affidavit. This includes everything from bank accounts to personal property and investments.

Incorrectly identifying heirs or beneficiaries. Properly identifying and listing all legal heirs or named beneficiaries is critical and often mishandled.

Omitting necessary documentation. Sometimes, additional documents are required to support the information provided in the affidavit. Skipping these can lead to delays.

Signing in the wrong place or incorrectly. The Colorado Small Estate Affidavit requires specific signing protocols, including notarization in some cases. An incorrect signature can invalidate the form.

Not filing with the correct entity or location. The affidavit needs to be filed in the proper legal venue, and mistakenly filing it with the wrong court or office is a common error.

Misunderstanding the role of the affidavit. Some individuals might think it grants more authority than it actually does, such as the power to settle disputes over the will, which it does not.

Attempting to use the affidavit for ineligible estates. Not all estates qualify for the Small Estate Affidavit process in Colorado. Attempting to use it for an estate that does not meet the criteria can create complications.

Avoiding these mistakes requires careful attention to detail and a thorough understanding of Colorado's small estate process. When in doubt, consulting with a legal professional can help ensure that you complete the process correctly and efficiently.

Documents used along the form

When handling a small estate in Colorado, utilizing the Small Estate Affidavit form often necessitates gathering additional documents. These documents are crucial for various reasons, including validating the decedent's assets, fulfilling legal requirements, and ensuring the rightful transfer of assets. The following list outlines supplementary forms and documents commonly used alongside the Colorado Small Estate Affidavit form, providing a brief description of each.

- Death Certificate: This official document proves the death of the decedent. It is vital for various transactions and legal processes following a person's death.

- Will: If the decedent left a will, it outlines their wishes regarding the distribution of their assets. The will must be reviewed to ensure the Small Estate Affidavit is used appropriately.

- Letters Testamentary: Granted by a court, these letters authorize an executor to act on behalf of the deceased's estate according to the will.

- Letters of Administration: Similar to Letters Testamentary, these are issued when the decedent dies without a will, authorizing an administrator to manage the estate.

- Inventory of Assets: A detailed list of the decedent’s assets. This document helps in determining whether the estate qualifies as a small estate under Colorado law.

- Proof of Account Ownership: Documents such as bank statements or stock certificates that prove the decedent's ownership of certain assets.

- Real Estate Deed: If real property is part of the estate, the deed verifies ownership and can be crucial in transferring property.

- Vehicle Title and Registration: Necessary for transferring ownership of vehicles owned by the decedent.

- Debt and Obligation List: A compilation of the decedent’s debts, including mortgages, personal loans, and credit card debts, used to settle liabilities.

- Beneficiary Designations: Documents that specify individuals or entities designated to receive specific assets, bypassing the will.

Compiling these documents in conjunction with the Colorado Small Estate Affidavit form simplifies the process of settling a small estate. This preparation ensures that all legal, financial, and personal aspects of the estate are correctly addressed, facilitating a smoother transition of assets to the rightful beneficiaries.

Similar forms

The Colorado Small Estate Affidavit form is similar to other legal documents used in the process of estate administration. These documents include the Transfer on Death Deed (TODD), Simplified Probate Procedure, and the Last Will and Testament. Each of these documents plays a unique role in managing and distributing a person's assets after they pass away, but they share common elements with the Colorado Small Estate Affidavit in terms of simplifying the estate settlement process.

Transfer on Death Deed (TODD): Much like the Colorado Small Estate Affidavit, a Transfer on Death Deed allows for the direct transfer of property upon the owner's death to a designated beneficiary, bypassing the need for traditional probate. Both documents are designed to streamline the process of transferring assets, making it quicker and less complicated. The main difference lies in the type of asset each document deals with—real property in the case of TODD and personal property for the Small Estate Affidavit.

Simplified Probate Procedure: This process is another approach that, similar to the Small Estate Affidavit, aims to expedite the settlement of an estate. The Simplified Probate Procedure is available for estates that fall below a certain value threshold, thereby reducing the amount of time and paperwork required to distribute assets to heirs. Both mechanisms are designed with efficiency in mind, offering a faster alternative to traditional probate. However, Simplified Probate still involves court oversight, unlike the somewhat more autonomous process of the Small Estate Affidavit.

Last Will and Testament: The Last Will and Testament is a comprehensive document outlining how a person’s assets should be distributed upon their death. Like the Colorado Small Estate Affidavit, it serves as a way to communicate the final wishes of the deceased, but it covers a broader range of assets and instructions. While the Last Will requires probate to validate its terms and oversee the distribution of assets, the Small Estate Affidavit allows for the direct transfer of assets without probate, provided the estate meets specific criteria. The shared purpose between these documents is to provide clarity and direction for the distribution of the deceased's assets, although they operate under different legal frameworks.

Dos and Don'ts

When navigating the process of dealing with a small estate in Colorado, the use of a Small Estate Affidavit can simplify settling the estate of a deceased person without the need for a formal probate process. However, it's crucial to approach this document with care and thoroughness. Below is a list of dos and don’ts to keep in mind when filling out the Colorado Small Estate Affidavit form.

- Do ensure that the total value of the estate does not exceed the limit set by Colorado law for small estates. This threshold can change, so verify the current limit before proceeding.

- Do wait the required period after the decedent's passing before filing the affidavit. Colorado law stipulates a waiting period to ensure all aspects of the estate are accounted for.

- Do accurately list all of the decedent's assets, including but not limited to bank accounts, vehicles, and personal property. Precision is key to a smooth process.

- Do provide comprehensive information about any debts owed by the decedent, as this will affect the distribution of the estate.

- Don't use the Small Estate Affidavit if the decedent owned real estate solely in their name. This form is typically not suitable for transferring real estate titles and may require a different process.

- Don't omit any heirs or beneficiaries when completing the form. It's important to include everyone who has a legal claim or interest in the estate.

- Don't attempt to navigate complicated estates with this form. If the estate involves complex assets, disputes among heirs, or other complicating factors, seeking legal advice is prudent.

- Don't sign the affidavit without ensuring that all information provided is correct and complete. The person completing the affidavit may be held legally responsible for any inaccuracies.

By adhering to these guidelines, individuals can utilize the Colorado Small Estate Affidavit form effectively, ensuring a smoother transition of assets while complying with state laws. When in doubt, consulting with an attorney who specializes in estate planning or probate law in Colorado can provide guidance tailored to the specific circumstances of the estate.

Misconceptions

When dealing with the estate of a loved one who has passed away, the Colorado Small Estate Affidavit can appear as a straightforward solution. However, there are several misconceptions surrounding this form. Understanding these misconceptions is crucial for those navigating this sensitive and important process.

It can be used immediately after a person's death. Many believe that the Small Estate Affidavit can be executed right after a person’s passing. In reality, Colorado law requires a waiting period of 10 days after the death to use this document, ensuring all parties have ample time to understand their rights and obligations.

All assets can be transferred using this form. This belief is incorrect. The Small Estate Affidavit only applies to personal property like bank accounts, stocks, and vehicles, and cannot be used for real estate or certain other assets.

There's no limit to the value of the estate. In fact, the Colorado Small Estate Affidavit is only valid for estates valued at $70,000 or less, after subtracting liens and encumbrances. This cap is important to ensure that the process is used only for smaller estates.

It overrides a will. Some people mistakenly think that a Small Estate Affidavit can override the decedent’s will. However, this document is used in cases where the deceased did not leave a will, or in conjunction with a will, to distribute assets not covered by the will, respecting the will’s directives.

It avoids probate court entirely. While it's true that the Small Estate Affididavit process is designed to simplify matters and avoid the full probate process, it does not eliminate the need for some court involvement in certain circumstances. For example, if disputes arise over the affidavit or the estate, court intervention may be necessary.

A legal representative must file it. There’s a common misunderstanding that only an attorney or executor can file the Small Estate Affidavit. In reality, any successor of the deceased—someone who has a legal right to the estate—can file it, provided they meet certain requirements.

Using this form settles all debts. Filing a Small Estate Affidavit does not absolve the estate of debts. Creditors still have the right to claim debts against the estate. It is essential to understand that the affidavit simply facilitates the transfer of assets and does not impact creditors’ claims.

It grants immediate access to funds. While the Small Estate Affidavit process is indeed quicker than going through probate, it does not grant immediate access to the deceased's funds. Banks and other institutions may have additional requirements or processing times before releasing assets.

Understanding these misconceptions is key to effectively using the Colorado Small Estate Affidavit and ensuring the process goes as smoothly as possible. Individuals are encouraged to seek guidance to navigate this process effectively, ensuring all legal obligations are met and rights protected.

Key takeaways

When dealing with the Colorado Small Estate Affidavit form, understanding its purpose and the correct way to fill it out is essential for a straightforward process. This document is used to settle small estates without formal probate, making it a valuable tool for those who qualify. Here are key takeaways to consider:

- The Colorado Small Estate Affidavit is specifically designed for estates that do not exceed a certain value threshold, which is subject to change. It is crucial to verify the current limit before proceeding.

- To use this form, the deceased must have been a resident of Colorado or owned property within the state. This includes both real and personal property.

- An important stipulation is that at least ten days must have passed since the death before the affidavit can be filed. This waiting period allows for a more accurate assessment of the deceased's assets.

- Completing the form requires a detailed list of the deceased's assets, including but not limited to bank accounts, vehicles, and real estate. Accurate reporting ensures a smoother process.

- Debts and taxes owed by the estate need to be disclosed in the affidavit. Any liabilities against the estate are typically settled from the estate assets before distribution to heirs.

- The form must be signed in the presence of a notary public to validate the affidavit. This step is a legal requirement that confirms the authenticity of the document and the signer’s identity.

- Beneficiaries or heirs must agree on how the assets are distributed if there is more than one. The small estate affidavit offers a mechanism to distribute assets without the need for a probate court's intervention, but consensus is key.

- Once completed and notarized, the affidavit allows the person filing (the affiant) to collect and distribute the deceased's assets according to Colorado law. However, presenting the affidavit to institutions holding the assets (such as banks or the Department of Motor Vehicles) is necessary to claim them.

Understanding these key aspects of the Colorado Small Estate Affidavit form can greatly simplify the process of managing small estates. It provides a means for heirs and beneficiaries to settle estates efficiently, avoiding the complexity and expense of a formal probate proceeding when possible.

Fill out Popular Small Estate Affidavit Forms for Different States

Kansas Simplified Estates Act - As a document that helps to validate the claimant's right to the estate, it serves as a practical solution for reallocating assets swiftly.

South Dakota Small Estate Affidavit - A Small Estate Affidavit is beneficial in cases where the estate consists mainly of personal belongings with minimal financial value.

Affidavit of Heirship Alabama - In some states, the affidavit may also require notarization to add an extra layer of legal credibility and authenticity.

Iowa Probate Laws - It verifies the claimant's right to certain assets without the need for a drawn-out probate process, ideal for when the total estate value falls below a state-specific cap.