Printable Small Estate Affidavit Form for Connecticut

When someone passes away, their assets need to be distributed according to their wishes, or if no wishes have been recorded, according to state law. This process can often be complex and time-consuming. However, residents of Connecticut have a tool designed to simplify this process for smaller estates - the Small Estate Affidavit form. This straightforward document allows certain individuals, typically next of kin or legal heirs, to claim property without the need for a prolonged probate process. It's applicable when the deceased's estate falls under a specific value threshold, making it a considerably faster and less complicated way to distribute assets to the beneficiaries rightfully. Not only does it offer a streamlined method for asset distribution, but it also significantly cuts down on legal fees and court times. The form itself requires detailed information, including a comprehensive list of the deceased's assets, debts, and the intended distribution plan among the heirs. It's a powerful document that, when used correctly, can expedite the often daunting task of estate settlement, providing relief and clarity during a difficult time.

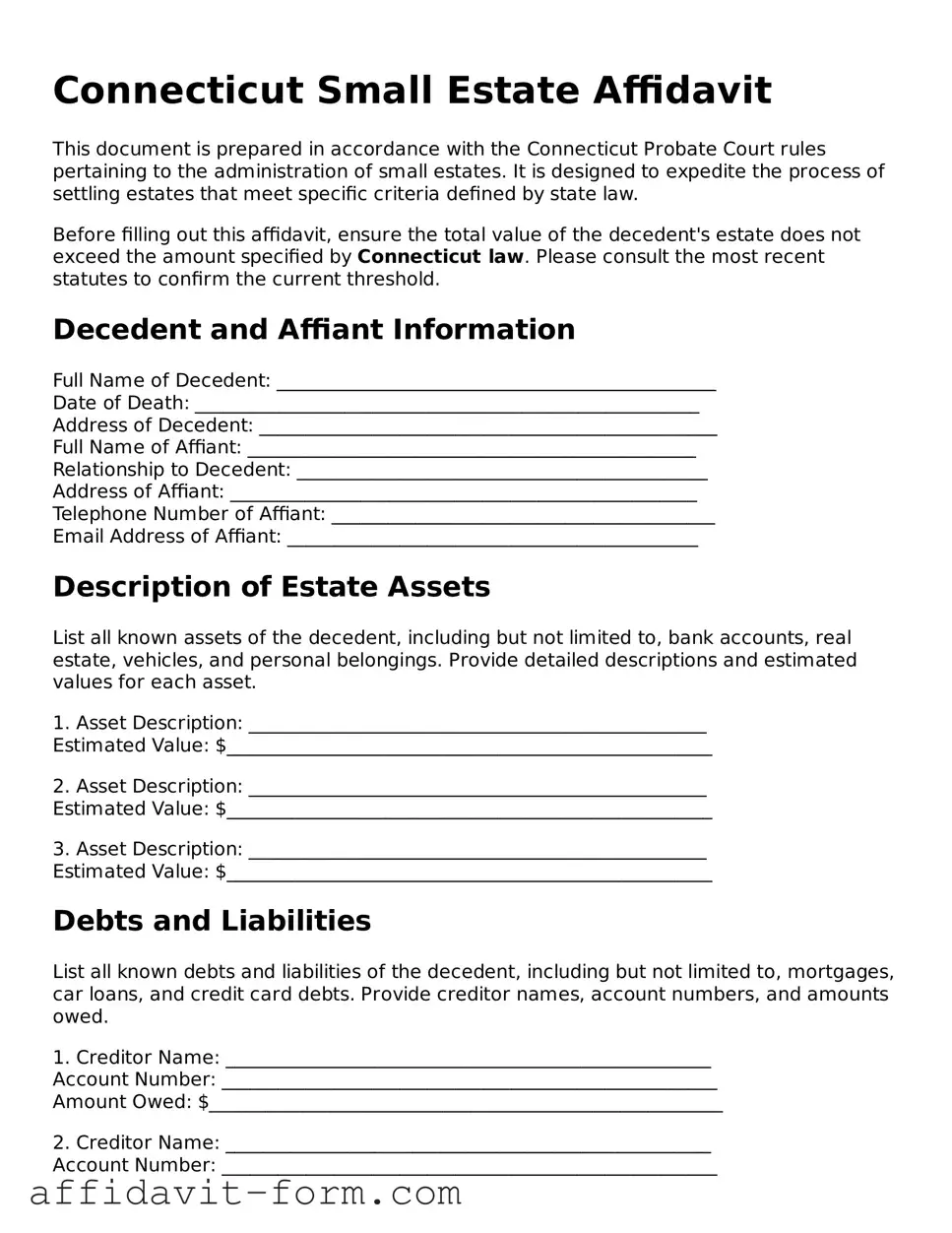

Form Example

Connecticut Small Estate Affidavit

This document is prepared in accordance with the Connecticut Probate Court rules pertaining to the administration of small estates. It is designed to expedite the process of settling estates that meet specific criteria defined by state law.

Before filling out this affidavit, ensure the total value of the decedent's estate does not exceed the amount specified by Connecticut law. Please consult the most recent statutes to confirm the current threshold.

Decedent and Affiant Information

Full Name of Decedent: _______________________________________________

Date of Death: ______________________________________________________

Address of Decedent: _________________________________________________

Full Name of Affiant: ________________________________________________

Relationship to Decedent: ____________________________________________

Address of Affiant: __________________________________________________

Telephone Number of Affiant: _________________________________________

Email Address of Affiant: ____________________________________________

Description of Estate Assets

List all known assets of the decedent, including but not limited to, bank accounts, real estate, vehicles, and personal belongings. Provide detailed descriptions and estimated values for each asset.

1. Asset Description: _________________________________________________

Estimated Value: $____________________________________________________

2. Asset Description: _________________________________________________

Estimated Value: $____________________________________________________

3. Asset Description: _________________________________________________

Estimated Value: $____________________________________________________

Debts and Liabilities

List all known debts and liabilities of the decedent, including but not limited to, mortgages, car loans, and credit card debts. Provide creditor names, account numbers, and amounts owed.

1. Creditor Name: ____________________________________________________

Account Number: _____________________________________________________

Amount Owed: $_______________________________________________________

2. Creditor Name: ____________________________________________________

Account Number: _____________________________________________________

Amount Owed: $_______________________________________________________

Oath or Affirmation of Affiant

I, _________________________, solemnly swear or affirm that the information provided in this affidavit is true and accurate to the best of my knowledge and belief. I understand that any false statement made herein may subject me to penalties under the law.

Signature of Affiant: ___________________________ Date: _______________

Notary Acknowledgment

This section must be completed by a Notary Public.

State of Connecticut

County of _______________________

On this _____ day of ___________, 20___, before me, __________________________ (name of notary), personally appeared __________________________ (name of affiant), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal.

_________________________________

Notary Public

My Commission Expires: ______________

Document Details

| Fact Name | Description |

|---|---|

| Purpose | Used for the collection of personal property by successors of a deceased person's estate when the total value does not exceed the state-specific threshold. |

| Value Threshold | The estate must not be valued more than $40,000 to qualify for the use of this form in Connecticut. |

| Governing Law | Connecticut General Statutes, specifically sections 45a-273 to 45a-305, provide the legal basis for the small estate affidavit process in Connecticut. |

| Waiting Period | There is a required waiting period of 30 days after the death of the estate owner before the small estate affidavit can be submitted to the appropriate authority. |

How to Use Connecticut Small Estate Affidavit

When a loved one passes away with a relatively small amount of property, often a quicker, simpler process is available for distributing their assets. This process involves using a small estate affidavit, a document that allows property to be transferred without formal probate in some cases. In Connecticut, individuals may use this form under specific conditions to expedite the distribution of an estate. The following step-by-step guide is designed to help you navigate the completion of the Connecticut Small Estate Affidavit form, ensuring clarity and compliance with state requirements.

- Start by gathering all necessary information about the deceased person's estate, including a list of all assets, their estimated value, and any debts or obligations the estate owes.

- Confirm eligibility for using the small estate affidavit process in Connecticut, which typically involves the total value of the estate not exceeding a certain threshold as specified by state law.

- Locate the official Connecticut Small Estate Affidavit form. This can often be found online on the Connecticut court's official website or by visiting a local probate court to obtain a paper copy.

- Fill in the deceased person's full legal name and the date of their death in the designated spaces on the form.

- Provide your own information, including your full legal name, address, and relationship to the deceased, in the sections provided.

- List all known assets of the estate, including but not limited to bank accounts, stocks, real estate, and personal property, with their corresponding values in the appropriate section of the form.

- Detail any debts or obligations the estate is responsible for, including funeral expenses, remaining bills, or legal fees.

- Read through the affidavit statements on the form carefully, ensuring understanding and agreement with each statement. These typically affirm your right to act on behalf of the estate and declare that the information provided is accurate to the best of your knowledge.

- Sign the affidavit in the presence of a notary public. The form must be notarized to be considered legally valid.

- File the completed and notarized small estate affidavit with the appropriate Connecticut probate court. The filing process may involve submitting the form in person, mailing it, or filing online, depending on the court's options.

- Once the form is filed and approved, follow any additional steps as directed by the court to distribute the assets accordingly.

Completing the Connecticut Small Estate Affidavit form is a critical step in managing a small estate under state law. By carefully following these instructions, you can ensure that the estate is distributed correctly and efficiently. Remember, this process is designed to simplify estate settlement for smaller estates, making it easier for surviving family members and loved ones to handle their affairs during a challenging time.

Listed Questions and Answers

What is a Connecticut Small Estate Affidavit?

In Connecticut, a Small Estate Affidavit is a legal document that allows the assets of a deceased person's estate to be distributed without formal probate if the total value of the estate is below a certain threshold. This process simplifies the transfer of assets to heirs or beneficiaries.

Who is eligible to use the Small Estate Affair in Connecticut?

The eligibility to use the Small Estate Affidavit in Connecticut depends on the total value of the deceased person's estate. If the estate's total value does not exceed the state's specified limit, and it contains no real estate, then an heir or legally recognized successor might be eligible to use this form.

What is the maximum value for a small estate in Connecticut?

As of the last update, Connecticut sets the maximum value threshold for a small estate at $40,000. The value considers the total sum of the deceased person's assets that are subject to probate and does not include certain assets like life insurance policies payable to a named beneficiary.

How does one file a Small Estate Affidavit in Connecticut?

To file a Small Estate Affidavit in Connecticut, one must complete the form accurately, attach any required documentation such as a death certificate and a list of the estate's assets, and submit it to the probate court in the district where the deceased resided. It's advisable to contact the court beforehand to confirm any specific requirements or fees.

Are there any fees associated with filing a Small Estate Affidavit in Connecticut?

Yes, there are filing fees when submitting a Small Estate Affidavit in Connecticut. These fees can vary depending on the specific circumstances of the estate and the court's requirements. It's recommended to check with the local probate court for the most current fee structure.

What documents are needed to accompany a Small Estate Affidavit in Connecticut?

When filing a Small Estate Affidavit in Connecticut, several documents need to accompany the form:

- Death Certificate of the deceased

- An inventory list of the deceased's assets subject to distribution

- Proof of the filer's relationship to the deceased or legal right to file the affidavit

- Any other documents requested by the probate court

How long does the process take after filing the form?

The processing time can vary based on the probate court's workload and the specifics of the estate in question. Generally, it takes a few weeks from the submission of the Small Estate Affidavit and all required documents for the assets to be distributed to the rightful heirs or beneficiaries.

Can real estate be transferred using a Small Estate Affidavit in Connecticut?

No, real estate cannot be transferred through the use of a Small Estate Affidavit in Connecticut. This process is strictly limited to personal property, such as bank accounts, stocks, and tangible items. The transfer of real estate must be handled through a different legal process.

What happens if the estate exceeds the small estate threshold in Connecticut?

If the value of the estate exceeds the small estate threshold in Connecticut, the estate must go through the formal probate process. This involves additional paperwork, potentially higher fees, and a more extended timeframe for the distribution of the estate's assets.

5h3>Can a Small Estate Affidavit be contested in Connecticut?Yes, like any legal proceeding, the validity of a Small Estate Affidavit can be contested in Connecticut. If an heir or interested party believes that the affidavit has been improperly filed or that the estate is being mishandled, they may challenge the process in probate court. Legal guidance is recommended in these situations.

Common mistakes

-

Not verifying eligibility requirements. To use the Small Estate Affidavit in Connecticut, the estate in question must meet specific criteria regarding its total value. An incorrect assumption about eligibility can lead to the rejection of the form.

-

Skipping important information. Every question on the form serves a purpose. Leaving sections blank or providing incomplete answers can cause delays, as further documentation or clarification may be required.

-

Failing to list all assets accurately. All personal property, bank accounts, and other assets belonging to the deceased must be clearly listed and described. Mistakes or omissions in this section can call into question the validity of the entire affidavit.

-

Incorrectly identifying heirs or beneficiaries. The affidavit requires the names and relationships of all individuals entitled to inherit from the estate. Errors in this section can result in disputes or the improper distribution of assets.

-

Not obtaining required signatures. The form typically requires signatures from all heirs or beneficiaries, acknowledging their agreement with the affidavit's contents. Missing signatures can invalidate the document.

-

Mishandling debts and liabilities. If the estate has outstanding debts or liabilities, these must be disclosed and addressed appropriately. Ignoring or inaccurately reporting debts can lead to legal complications.

-

Notarization errors. Many affidavits, including Connecticut's Small Estate Affidavit, require notarization to confirm the identity of the person filling out the form. A failure to properly notarize the document can render it ineffective.

-

Delaying the submission of the form. Timeliness is crucial in estate matters. Delaying the filling out or submission of the Small Estate Affidiciary can complicate asset distribution and extend the period of uncertainty for heirs.

Addressing these potential errors with careful attention to detail and full compliance with Connecticut's legal requirements will facilitate a smoother, more efficient estate resolution process.

Documents used along the form

When someone passes away, sorting out their affairs can feel like navigating a labyrinth. Fortunately, for small estates in Connecticut, the process can be streamlined using a Small Estate Affidavit. This document helps to simplify the transfer of assets without a full probate proceeding. However, it's seldom the only form needed. Alongside it, there are several other essential documents and forms that often come into play, each serving a unique purpose in the estate settlement journey. Let's walk through these forms to understand their roles better.

- Death Certificate: An official record of death. This document is crucial for legal transactions and to prove the passing of the deceased. It’s required when filing the Small Estate Affidavit to validate the event.

- Copy of the Will (if applicable): If the decedent left a will, a copy may need to be submitted along with the affidavit. It provides instructions on how the decedent wished their property to be distributed.

- Consent and Waiver Form: Used when all the heirs agree on how the estate should be distributed without strictly following the will or state law. This can streamline the process.

- Inventory and Appraisal Form: Lists and assigns value to the decedent’s assets. This is necessary to ensure that the estate qualifies as "small" under Connecticut law.

- Tax Waiver (Release of Lien) Form: In some cases, estates might owe taxes. This form is used to show that taxes have been paid or to get a release of lien if the estate’s assets need to be transferred to heirs.

- Real Property Affidavit: If the estate includes real property (real estate), this affidavit can be used to transfer property under certain conditions without going through probate.

- Bank Letters: Documentation from banks where the decedent had accounts. These are necessary to release the funds to the proper beneficiaries.

- Vehicle Transfer Forms: If the deceased owned a vehicle, this form is used to legally transfer the ownership to the heirs or buyers as dictated by the estate plan or law.

- Life Insurance Forms: If the decedent had a life insurance policy naming beneficiaries, forms would be needed to claim the benefits.

- Final Utility and Service Bills: Not typically legal forms, but closing out or transferring accounts requires official documentation and notice to service providers.

Navigating the aftermath of a loved one's passing is inherently challenging. Knowing the documents that may be required when using a Small Estate Affidavit in Connecticut can remove uncertainty from one aspect of the process. Each form plays a pivotal role in ensuring the estate is settled smoothly and according to the laws of the state. While the journey through estate administration can be complex, understanding these tools can provide a roadmap through this difficult time.

Similar forms

The Connecticut Small Estate Affidavit form is similar to several other documents used in the probate and estate planning processes. These documents, while diverse in their applications, share commonalities in simplifying or bypassing traditional, more complex legal pathways for specific circumstances. Examples include Simplified Probate Procedures, Transfer on Death (TOD) Deeds, and Payable on Death (POD) Accounts. Each serves a unique purpose but is designed to streamline the legal processes involved in estate planning and execution.

Simplified Probate Procedures share a core similarity with the Connecticut Small Estate Affidavit in their goal to expedite the probate process. Traditional probate can be time-consuming and expensive, often requiring extensive court involvement. Simplified Probate Procedures, available in many states, allow for an expedited process for small estates, reducing the burden on the survivors. Both this and the Small Estate Affidavit aim to minimize legal hurdles, but Simplified Probate Procedures can encompass a broader range of assets and might still require some court oversight, albeit in a reduced capacity.

Transfer on Death (TOD) Deeds are another document with similarities to the Connecticut Small Estate Affidavit. TOD Deeds allow property owners to designate beneficiaries to whom the property will transfer upon the owner’s death, without going through probate. Like the Small Estate Affidavit, TOD Deeds bypass traditional estate distribution channels, offering a streamlined process. However, TOD Deeds are specifically for real estate assets and require the property owner to take action before their death, unlike the Small Estate Affidavit, which is filed by the beneficiaries after the death.

Payable on Death (POD) Accounts function under a principle similar to that of the Connecticut Small Estate Affidavit by avoiding the probate process for specific assets. When an account holder designates a beneficiary on a bank or investment account, the assets in the account are transferred directly to the beneficiary upon the account holder’s death, without probate. This is akin to the Small Estate Affidavit’s ability to transfer assets without the need for a lengthy court process. However, POD Accounts are limited to financial assets, whereas the Small Estate Affidavit can encompass a wider range of property types.

Dos and Don'ts

When dealing with the Connecticut Small Estate Affidavit form, the process requires attention to detail and a clear understanding of the steps involved. Below are lists of the essential dos and don'ts to assist individuals in navigating this legal procedure efficiently.

Do:

- Verify eligibility: Ensure the estate in question qualifies under Connecticut's definition of a "small estate." The total value of the estate must not exceed the specified limit set by state law.

- Provide accurate information: Fill out the form with precise and correct details about the deceased, their assets, and any debts they owed. Accuracy is vital to avoid any legal complications.

- Gather necessary documents: Before filling out the form, collect all relevant documents, such as the death certificate, asset statements, and any existing will.

- Understand the assets covered: Know which assets can be transferred using the Small Estate Affidavit. Some assets might be governed by separate legal processes.

- Sign in the presence of a notary: Ensure the affidavit is signed before a notary public to validate the document legally.

- File promptly: Submit the completed affidavit to the appropriate local court or entity as required by Connecticut law in a timely manner.

- Keep records: Retain a copy of the affidavit and any correspondence or documents submitted with it for your records.

Don't:

- Ignore deadlines: Failing to adhere to any timeline set forth by Connecticut law can result in penalties or delays in the estate's distribution.

- Attempt to include non-probate assets: Non-probate assets, like those with named beneficiaries (e.g., life insurance, retirement accounts), should not be listed in the affidavit.

- Omit creditors: Neglecting to account for the deceased's debts in the affidavit can lead to legal issues down the line.

- Guess on values: Estimating the value of assets without proper appraisals or accurate financial statements can cause inaccuracies and potential disputes.

- Forge signatures: Falsifying a signature or information on the affidavit is illegal and can result in criminal charges.

- Skip legal advice: If unsure about any part of the process, consulting with a legal professional can prevent mistakes and ensure compliance with state laws.

- Disregard state-specific requirements: Each state, including Connecticut, has unique rules for small estates. Overlooking these can invalidate the affidavit process.

Misconceptions

When dealing with the Connecticut Small Estate Affidavit form, several misconceptions commonly arise. It's crucial to correct these misunderstandings to navigate the process accurately and efficiently.

Anyone can file the form: A common mistake is the belief that any individual can file the Connecticut Small Estate Affidavit form. In reality, this privilege is typically reserved for the deceased person's surviving spouse, next of kin, or a creditor, under specific conditions. Proper authorization or standing is essential.

It grants immediate access to assets: Many people mistakenly think that filing this affidavit instantly grants access to the deceased's assets. The truth is, there is a mandatory waiting period. This interval allows for the proper administration of the estate and ensures all claims are appropriately managed.

It eliminates the need for a lawyer: It's a common misconception that with the Small Estate Affidavit, legal representation is unnecessary. While it's true that this process is streamlined, there are situations where legal advice is invaluable, especially in complex estates or when disputes arise.

No limit on the value of the estate: Another misunderstanding is that the Small Estate Affidavit can be used regardless of the estate's value. Connecticut laws stipulate a cap on the estate's value that can be processed through this affidavit, aiming to simplify the process for smaller estates only.

It covers all types of assets: Finally, there's a misconception that the Small Estate Affidavit applies to all the deceased's assets. Certain assets, such as those held in joint tenancy or with named beneficiaries (like insurance policies), typically bypass the estate process and are not covered by this affidavit.

Understanding these misconceptions about the Connecticut Small Estate Affidavit is critical for anyone navigating the aftermath of a loved one's passing. Accurate knowledge ensures smoother processing, proper legal compliance, and ultimately, peace of mind during a challenging time.

Key takeaways

The Connecticut Small Estate Affidavit form simplifies the probate process for small estates, making it critical for individuals dealing with the assets of a deceased person whose estate falls under a certain value threshold. Here are key takeaways about how to properly fill out and use this form:

- Eligibility Criteria: To use the Small Estate Affidavit form in Connecticut, the total estate value must not exceed the amount specified by state law. This includes both real and personal property.

- Accurate Valuation: It's imperative to accurately value the assets of the estate. Underestimating or overestimating can lead to complications or legal repercussions.

- Documentation is Key: Supporting documents, such as death certificates, property appraisals, and account statements, should accompany the Small Estate Affidavit. This paperwork substantiates the claims made in the affidavit.

- Legal Description of Property: If the estate includes real property, a legal description of the property must be provided. This involves more than just the address and may require professional assistance.

- Debts and Liabilities: The affidavit requires a listing of the decedent's debts and liabilities. It’s important to be thorough and honest, as creditors have rights to the estate's assets for payment of debts.

- Signatures and Notarization: The affidavit must be signed by the affiant in the presence of a notary public. This formalizes the document and attests to the accuracy of the information provided.

- Filing with the Probate Court: Once completed and notarized, the Small Estate Affidavit must be filed with the appropriate Connecticut probate court. The court’s review and approval are necessary to legally distribute the assets.

By understanding and following these guidelines, individuals can efficiently handle small estates, ensuring that the assets are distributed according to the decedent’s wishes or state law, in the absence of a will. This process significantly reduces the complexity and time typically involved in settling an estate through probate.

Fill out Popular Small Estate Affidavit Forms for Different States

Wisconsin Small Estate Affidavit Form Pr-1831 - It not only simplifies asset transfer but also aids in the closure process for families by resolving estate matters more promptly.

How to Avoid Probate in South Carolina - Completing this form correctly is crucial for a hassle-free process in claiming inheritance.

Nevada Small Estate Affidavit - The document is a sworn statement confirming the signatory's right to receive the deceased person's assets.

New Jersey Small Estate Affidavit - A simplified legal document for transferring property of a deceased person with a small estate.