Printable Small Estate Affidavit Form for Delaware

When a loved one passes away, managing their estate can feel like navigating through a complex maze of legal requirements and paperwork. In Delaware, the Small Estate Affidavit form stands out as a beacon for those who find themselves in this challenging situation, especially if the deceased's estate does not include real estate and is valued below a certain threshold. This form allows for a more streamlined process to transfer the deceased’s assets to their rightful heirs or beneficiaries, bypassing the often lengthy and costly process of probate. It is designed to simplify the legal terrain for small estates, making it accessible for individuals without the need for extensive legal assistance. Eligibility criteria, the necessary documentation, and the specific steps required to correctly fill out and submit the form are essential aspects to consider. Additionally, understanding the legal effects of the form, including which assets can be transferred and how it impacts creditor claims against the estate, is crucial for anyone looking to use this process to settle a loved person's estate efficiently and with minimal stress.

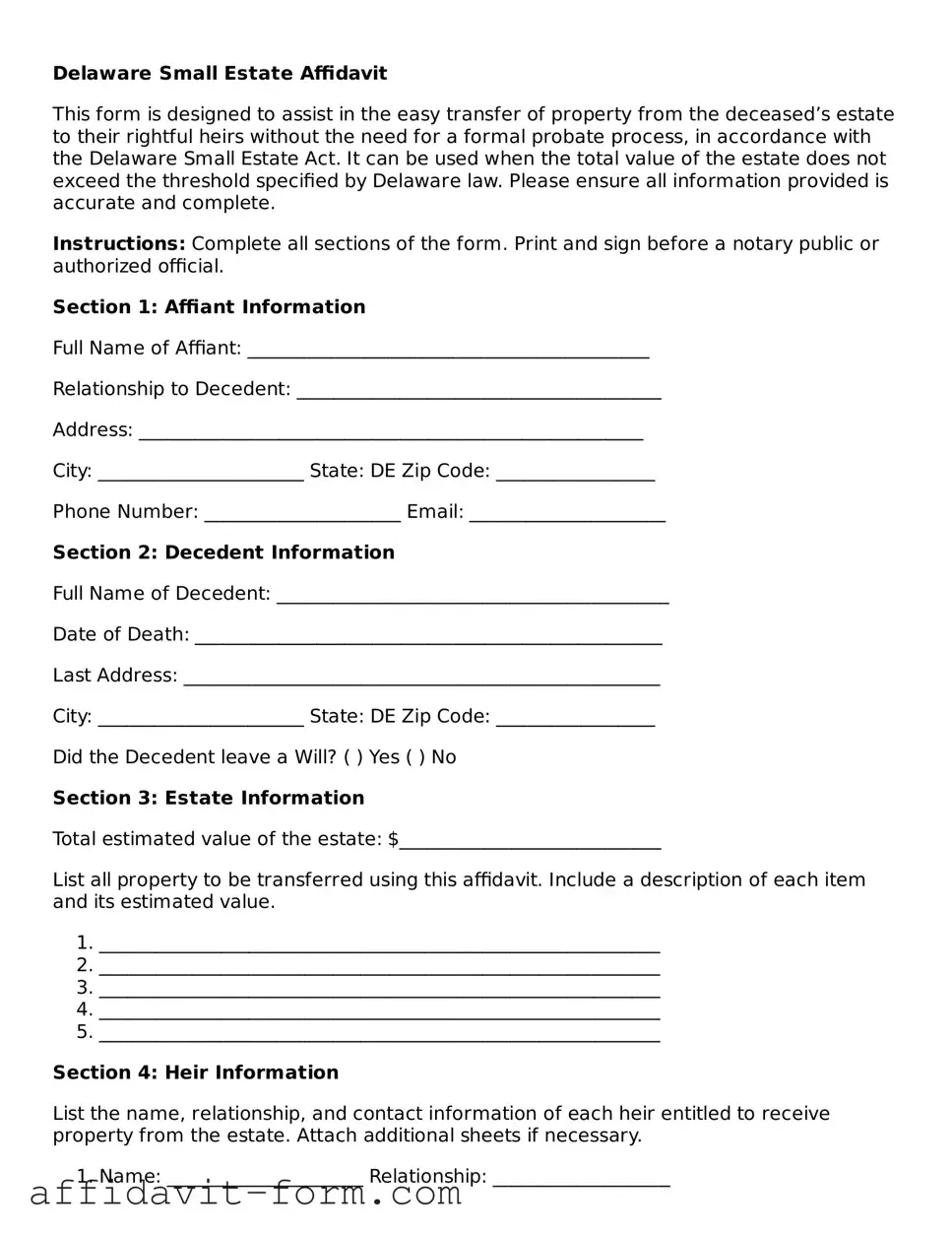

Form Example

Delaware Small Estate Affidavit

This form is designed to assist in the easy transfer of property from the deceased’s estate to their rightful heirs without the need for a formal probate process, in accordance with the Delaware Small Estate Act. It can be used when the total value of the estate does not exceed the threshold specified by Delaware law. Please ensure all information provided is accurate and complete.

Instructions: Complete all sections of the form. Print and sign before a notary public or authorized official.

Section 1: Affiant Information

Full Name of Affiant: ___________________________________________

Relationship to Decedent: _______________________________________

Address: ______________________________________________________

City: ______________________ State: DE Zip Code: _________________

Phone Number: _____________________ Email: _____________________

Section 2: Decedent Information

Full Name of Decedent: __________________________________________

Date of Death: __________________________________________________

Last Address: ___________________________________________________

City: ______________________ State: DE Zip Code: _________________

Did the Decedent leave a Will? ( ) Yes ( ) No

Section 3: Estate Information

Total estimated value of the estate: $____________________________

List all property to be transferred using this affidavit. Include a description of each item and its estimated value.

- ____________________________________________________________

- ____________________________________________________________

- ____________________________________________________________

- ____________________________________________________________

- ____________________________________________________________

Section 4: Heir Information

List the name, relationship, and contact information of each heir entitled to receive property from the estate. Attach additional sheets if necessary.

- Name: _____________________ Relationship: ___________________

- Address: __________________________________________________________________

- Phone: _____________________ Email: ______________________________________

Section 5: Declaration and Signature

I, the undersigned, state under penalty of perjury that the information provided in this affidavit is true and correct to the best of my knowledge. I understand that this affidavit does not negate any debts owed by the decedent’s estate and that I may be held liable for any false statements or claims.

Signature of Affiant: ___________________________ Date: ____________

Printed Name: _________________________________

Notary Public (or Authorized Official)

State of Delaware

County of ___________________

On this _____ day of ___________, 20____, before me, the undersigned, a notary public (or authorized official), personally appeared ________________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the above affidavit, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Signature of Notary: ___________________________

Commission expires: ___________________________

Document Details

| Fact Name | Description |

|---|---|

| Purpose | Used to manage and distribute a deceased person's estate that falls below a certain value threshold, avoiding the need for formal probate. |

| Eligibility | The total value of the personal property must not exceed $30,000 for the estate to qualify for the small estate process in Delaware. |

| Governing Law | Delaware Code Title 12, Chapters 23 and 23A, govern the use and requirements of the Small Estate Affidavit in Delaware. |

| Waiting Period | There is a 30-day waiting period from the death of the decedent before the affidavit can be filed with the court or used directly with parties holding assets of the estate. |

| Required Information | Includes details like the decedent's date of death, a list of the estate's assets and their values, the names and addresses of heirs, among other necessary information. |

| Signatory Requirements | The affidavit must be signed by the successor of the estate, typically the closest relative or the person designated in the will, under oath in front of a notary public. |

How to Use Delaware Small Estate Affidavit

When a loved one passes away, managing their estate can be a daunting step for families. In Delaware, if the estate is considered small under state guidelines, the process is simplified using a Small Estate Affidavit. This document allows for the distribution of the deceased's estate without the lengthy probate process. Before starting, ensure the estate qualifies as 'small' under Delaware standards. Filling out the Small Estate Affidraft requires attention to detail and accuracy to ensure smooth legal proceedings. Follow these steps to complete the form correctly.

- Gather essential documents and information about the deceased, including their full legal name, date of death, and a list of all assets and their values.

- Confirm the total value of the estate doesn't exceed Delaware's threshold for a 'small estate.' This value changes, so check the current limit before proceeding.

- Download the latest version of the Delaware Small Estate Affidavit form from the official state website or obtain a copy from your local courthouse.

- Fill in the deceased's name, date of birth, and date of death in the designated sections of the form.

- Provide a detailed list of the deceased's assets within the estate. Include bank accounts, vehicles, real property, and any other significant assets along with their estimated values.

- List all known debts of the deceased, including but not limited to credit card bills, loan payments, and utility bills.

- Identify the heirs of the estate based on Delaware law. These may include a spouse, children, parents, or other relatives, depending on who survives the deceased.

- Allocate how the assets will be distributed among the heirs, adhering strictly to Delaware's regulations for inheritance if the deceased did not leave a will.

- Write your name, address, and relationship to the deceased in the affidavit's section designated for the affiant—the person filling out the form.

- Review all entered information for accuracy. Make any necessary adjustments to ensure all details are current and correct.

- Sign the affidavit in front of a notary public. Many banks offer notary services, often at no cost if you're a customer.

- File the completed affidavit with the probate court or appropriate state entity in Delaware. A filing fee may apply, so it's a good idea to verify the amount beforehand.

Once the Small Estate Affidavit is filed, the designated official will review the document. If everything is in order, they will issue an order allowing the distribution of the estate's assets according to the details specified in the affidavit. This step significantly reduces the time and complexity involved in distributing an estate, making it a valuable option for eligible families. While the process can still be emotional, understanding how to correctly fill out and file the Small to Estate Affidavit in Delaware can provide a clear path during a challenging time.

Listed Questions and Answers

What is a Delaware Small Estate Affidavit?

A Delaware Small Estate Affidavit is a legal document used to manage the distribution of a deceased person's estate when that estate is considered 'small' by Delaware laws. This document allows the transfer of the deceased's property to heirs without the need for a formal probate process. It's a quicker, less complex way to settle an estate when the total value of the assets meets the state-defined threshold.

Who can use a Delaware Small Estate Affidavit?

In Delaware, a Small Estate Affidavit can be used by the lawful heirs or designated beneficiaries of the deceased. This includes spouses, children, or other family members as specified in the will, or by the state's succession laws if there's no will. To use this form, the applicant must ensure the estate's value does not exceed the limit set by Delaware law, currently requiring the estate to be valued at less than a specific amount that can change, so it's important to verify the current threshold.

What are the requirements for filing a Small Estate Affidavit in Delaware?

- The deceased must have been a resident of Delaware at the time of death.

- The total value of the deceased's personal property must not exceed the state-specified limit.

- A certain period, often several weeks, must have passed since the death.

- All funeral expenses and debts should be paid off or accounted for before distribution.

- The person filing the affidavit must swear under oath to adhere to the laws governing the distribution of the estate.

What documents are needed to accompany a Delaware Small Estate Affidavit?

- Death Certificate: A certified copy of the deceased's death certificate.

- Proof of Residency: Documents proving the deceased was a resident of Delaware.

- List of Heirs: A detailed list identifying the rightful heirs and their relationship to the deceased.

- Asset List: A comprehensive list of the deceased's assets included in the estate.

- Proof of Debts Paid: Documentation showing that all of the deceased's debts and obligations have been settled.

How to file a Delaware Small Estate Affidavit?

To file a Delaware Small Estate Affidavit, locate and complete the form with accurate information regarding the deceased and their estate. Attach the required documents, such as the death certificate and lists of heirs and assets. It's often advisable to consult with a legal professional to ensure accuracy and compliance with Delaware laws. Once completed and signed, submit the affidavit, along with any filing fees, to the appropriate local court for review. If accepted, the court will provide authorization to distribute the deceased's assets according to the affidavit.

Common mistakes

Filling out a Delaware Small Estate Affidavit form can often be a daunting task, fraught with potential pitfalls for individuals who might not be fully versed in legal document preparation. The form serves as a crucial tool for the administration of small estates in Delaware, allowing for the bypassing of a more complex probate process. Mistakes made during this process can lead to delays, increased costs, or even the rejection of the application. Here are four common errors that people encounter:

-

Not Meeting Eligibility Requirements: Before even starting the form, an often-overlooked mistake is the failure to verify whether the estate in question actually qualifies as a 'small estate' under Delaware law. This includes understanding the threshold for the estate's value and ensuring that the time period since the decedent's passing meets statutory requirements.

-

Incorrect or Incomplete Information: Filling out the form requires both precision and completeness. Individuals sometimes enter incorrect information regarding the decedent's assets, debts, or beneficiaries, or they might leave critical sections of the form blank. Such inaccuracies or omissions can significantly hold up the process.

-

Failure to Attach Required Documentation: The affidavit process demands the attachment of certain documents, such as the death certificate and proof of the decedent's assets. Neglecting to attach these documents, or providing insufficient documentation, is a common oversight that can derail the entire process.

-

Not Obtaining the Necessary Signatures: The completion of the form typically requires the signatures of all heirs or beneficiaries, and in some cases, a notarization. Missing signatures or failing to properly notarize the document can invalidate the affidavit, necessitating a re-submission and, thus, further delaying asset distribution.

To navigate the complexities of the Delaware Small Estate Affidavit successfully, a meticulous approach to document preparation is imperative. By avoiding these common mistakes, individuals can streamline the process, ensuring a smoother transition of assets and reducing the administrative burden during what is often a challenging time.

Documents used along the form

When handling a small estate in Delaware, the Small Estate Affidavit form is a crucial document designed to simplify the process of asset distribution for estates that fall under a certain value threshold. However, this form rarely stands alone. A range of other documents and forms often accompany it to ensure compliance with state laws and facilitate the smooth transfer of the decedent's assets. Below, we'll explore some of these additional documents that are commonly utilized alongside the Small Estate Affidavit form.

- Death Certificate: This official document is vital as it provides proof of the decedent's passing. It's often required to validate the initiation of the estate handling process.

- Will (if applicable): If the decedent left a will, it would guide the distribution of their assets as per their wishes. It may also designate an executor for the estate.

- Letter of Testamentary: When a will is present, this court-issued document grants the executor the authority to act on behalf of the deceased's estate.

- Inventory of Assets: A detailed list of the decedent's assets, including bank accounts, securities, real property, and personal property, facilitates a clear understanding of the estate's value.

- Appraisal Reports: For certain assets, professional appraisals may be necessary to determine their fair market value accurately.

- Bank Statements: Recent statements can help in identifying the decedent's assets and liabilities as of the date of their passing.

- Insurance Policies: Life insurance and other relevant policies are critical for understanding potential payouts and beneficiaries outside of the estate's direct assets.

- Debts and Bills: A record of the decedent's outstanding debts and recurring bills is essential to ensure that creditors are paid from the estate, if applicable.

- Tax Returns: Recent tax documents can provide insight into the decedent's financial history and are necessary for settling any outstanding tax obligations with state and federal authorities.

- Title and Deed Documents: For any real estate owned by the decedent, these documents are necessary to establish ownership and facilitate the transfer of property.

Navigating the process of managing a small estate requires careful attention to detail and often, the completion of several forms and documents beyond the Small Estate Affidavit. Each additional document plays a specific role in creating a comprehensive picture of the decedent's financial landscape, ensuring legal compliance, and ultimately, honoring their legacy through the proper distribution of their assets. Consulting with a legal advisor who is knowledgeable about Delaware's specific requirements can provide invaluable assistance through this process.

Similar forms

The Delaware Small Estate Affidavit form is similar to other legal documents that facilitate the transfer of a deceased person's assets. These documents are designed to streamline the probate process or serve in situations where formal probate may not be required. The form shares features with several key documents, which likewise aim to simplify or circumvent the traditional and more prolonged probate proceedings.

Affidavit for the Transfer of Personal Property Without Probate: This document is perhaps the closest in intent and function to the Delaware Small Estate Affidavit form. Both serve to expedite the transfer of assets from the deceased to their lawful heirs or designated beneficiaries. They are utilized when the total value of the estate falls below a specific threshold, negating the need for a formal probate process. The primary difference lies in jurisdictional use and specific legal requirements that may vary from one location to another, but the core purpose of avoiding lengthy probate proceedings unifies them.

Affidavit of Heirship: Similarly, an Affidavit of Heirship focuses on identifying and legally recognizing the heirs of the deceased. While it is primarily used for the direct transfer of real property, such as homes and land, its objectives align closely with those of the Small Estate Affidavit by simplifying the transfer process. Both documents require a comprehensive listing of the deceased's assets, any debts, and the claimant's relationship to the deceased. They streamline asset transfer to rightful heirs without the need for probate court proceedings, saving time and resources.

Transfer on Death Deed (TODD): Although a Transfer on Death Deed is used specifically for real estate, its preventive approach to asset transfer is akin to the philosophy behind the Small Estate Affidact. TODDs allow property owners to name beneficiaries for their real estate, effectively transferring ownership upon the owner’s death without necessitating probate. Whilst differing in application—TODDs are proactive and the Small Estate Affidavit is reactive, post-death—their ultimate purpose is to ensure a swift and simplified transfer of assets, bypassing the traditional probate process.

Dos and Don'ts

When dealing with the Delaware Small Estate Affidavit form, it's important to approach the process with attention to detail and accuracy. To help guide you through the completion of this form, here's a list of dos and don'ts:

- Do thoroughly review the entire form before you start filling it out to ensure you have all the necessary information at hand.

- Do double-check the eligibility criteria for using the Small Estate Affidavit in Delaware to confirm it applies to your situation.

- Do fill out the form using a blue or black ink pen to ensure that the information is legible and can be properly scanned or photocopied.

- Do provide accurate and complete information for every section to avoid delays or rejections of your affidavit.

- Don't leave any fields blank; if a section does not apply, mark it with “N/A” to indicate that it is not applicable to your situation.

- Don't guess or approximate values, especially when reporting the assets of the estate. Accuracy is key to a smooth process.

- Don't forget to sign and date the form in front of a notary public to validate the affidavit. This step is crucial.

- Don't hesitate to seek legal advice if you have any questions or uncertainties about filling out the form or the process itself. It’s better to consult a professional than to make an error.

Misconceptions

In the realm of estate management within Delaware, the Small Estate Affidavit form is a critical tool designed for the simplified handling of estates. However, misunderstandings about its application and requirements are common. Highlighted below are four prevalent misconceptions, accompanied by explanations meant to dispel these inaccuracies.

-

The Small Estate Affidavit form is applicable regardless of the estate's value.

This assumption is incorrect. The Delaware Small Estate Affidavit is specifically designed for estates of limited value. The law stipulates a maximum value threshold; estates exceeding this amount cannot utilize this simplified procedure, hence requiring a more formal probate process.

-

Once filed, the Small Estate Affidavit grants immediate access to the decedent's assets.

Despite its streamlined approach, the affidavit does not provide instant access to the deceased's assets. It requires review and acceptance by a court or relevant authority. Additionally, certain assets may have specific release conditions or require additional documentation.

-

The form eliminates the need for a will.

This statement is a misconception. The presence of a will does not negate the need for a Small Estate Affidavit if the estate's value falls within the permissible range. The affidavit complements the will by potentially simplifying the asset distribution process outlined within the will, assuming it adheres to Delaware’s legal thresholds for a small estate.

-

Any family member can file the Delware Small Estate Affidavit.

While family members are often involved in filing the affidavit, Delaware law typically specifies eligibility criteria for who can submit the form. This role is usually reserved for legally recognized successors or those appointed by the court. It's not merely a matter of familial relation but of legal standing and priority as determined under state law.

Key takeaways

When navigating the process of dealing with a loved one's estate in Delaware, particularly if it is considered a small estate, the Small Estate Affidatum forms a crucial tool. This process can greatly simplify the transfer of assets to beneficiaries without the need for a protracted probate process. Here are six key takeaways to consider when filling out and utilizing the Delaware Small Estate Affidavit form.

- Eligibility Requirements: It's important to understand whether the estate in question qualifies as a small estate under Delaware law. The criteria involve the total value of the estate's assets, and these requirements may change. Make sure the estate's total value does not exceed the threshold set by Delaware law at the time of the decedent's death.

- Correct Form Filling: Accuracy is crucial when completing the Small Estate Affidavit. The form requires detailed information about the deceased, the assets in the estate, and the heirs. Any errors or omissions can delay the process or impact the legal transfer of assets.

- Understanding the Assets Covered: Not all assets can be transferred using a Small Estate Affidavit in Delaware. Typically, this form is used for personal property like bank accounts and other non-titled assets. Real estate and certain other assets may require a different process.

- Signing Requirements: The Small Estate Affidavit must be signed by the appropriate person or persons. This may include an executor named in the will or, if no will exists, by the rightful heirs according to Delaware's succession laws. The signature often needs to be notarized to confirm its authenticity.

- The Role of the Affidavit: Once properly filled out and signed, the Small Estate Affidavit serves as a legal document that authorizes the transfer of the deceased’s assets as specified by the affidavit. It essentially bypasses the need for a lengthier probate process, allowing for a more straightforward asset distribution.

- Potential for Complications: While the Small Estate Affidavit can simplify the estate settlement process, complications can arise, particularly if the affidavit is contested or if errors in the paperwork are discovered. It’s wise to have the affidavit reviewed by a legal professional familiar with Delaware estate law to mitigate potential issues.

In conclusion, the Delaware Small Estate Affidavit form is a valuable tool for expediting the transfer of assets in smaller estates. By following the legal requirements and seeking appropriate guidance, one can navigate this process with greater ease and confidence, ensuring that the decedent's assets are distributed according to their wishes with minimal delay.

Fill out Popular Small Estate Affidavit Forms for Different States

How to Avoid Probate in South Carolina - It is essential for heirs to meet specific state guidelines for their affidavit to be valid.

What Is Probate in Oregon - Useful for collecting salaries, commissions, or other wages owed to the deceased, subject to state limits.

How Long Does Probate Take in Tennessee - The form is a significant timesaver, allowing for the direct claim of assets without getting entangled in legal proceedings.