Printable Small Estate Affidavit Form for District of Columbia

In the landscape of estate management and resolution, a critical tool exists for the expedited handling of small estates in the District of Columbia: the Small Estate Affidavit form. This document serves as a streamlined method for certain successors to claim assets of the deceased without the lengthy processes often associated with probate court. Designed to simplify the transfer of property for estates that fall below a specific value threshold, it is both a mechanism of efficiency and a source of solace for grieving families seeking closure. The affidavit not only abbreviates the timeline for asset distribution but also lowers the financial and emotional toll on the decedent's loved ones. By clearly delineating eligibility criteria, required documentation, and the procedural steps to be followed, the form navigates claimants through the potentially complex legal terrain of estate resolution. Furthermore, it underscores the district's commitment to accommodating the needs of its residents, providing a tangible solution to the challenges posed by traditional probate proceedings in managing small estates.

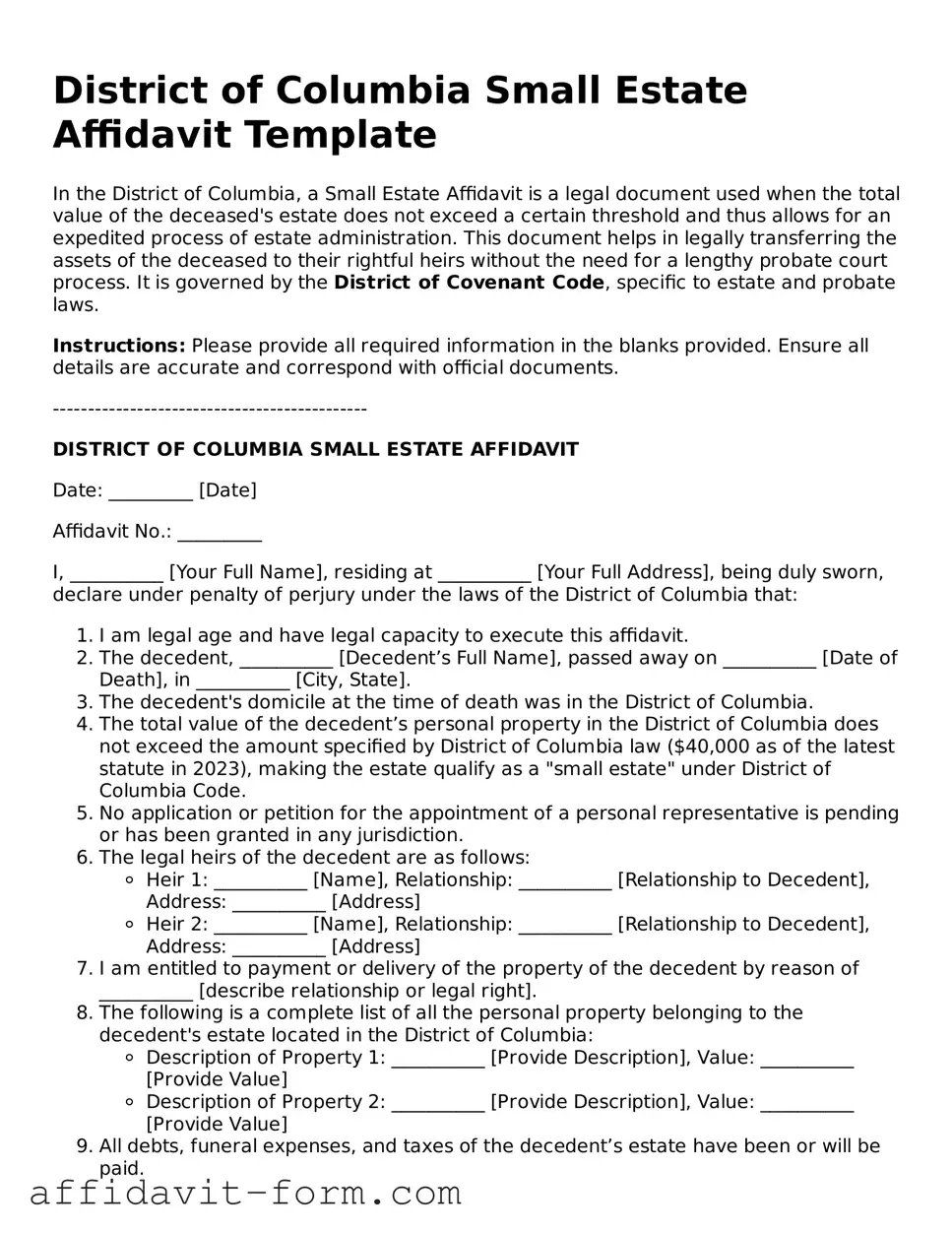

Form Example

District of Columbia Small Estate Affidavit Template

In the District of Columbia, a Small Estate Affidavit is a legal document used when the total value of the deceased's estate does not exceed a certain threshold and thus allows for an expedited process of estate administration. This document helps in legally transferring the assets of the deceased to their rightful heirs without the need for a lengthy probate court process. It is governed by the District of Covenant Code, specific to estate and probate laws.

Instructions: Please provide all required information in the blanks provided. Ensure all details are accurate and correspond with official documents.

---------------------------------------------

DISTRICT OF COLUMBIA SMALL ESTATE AFFIDAVIT

Date: _________ [Date]

Affidavit No.: _________

I, __________ [Your Full Name], residing at __________ [Your Full Address], being duly sworn, declare under penalty of perjury under the laws of the District of Columbia that:

- I am legal age and have legal capacity to execute this affidavit.

- The decedent, __________ [Decedent’s Full Name], passed away on __________ [Date of Death], in __________ [City, State].

- The decedent's domicile at the time of death was in the District of Columbia.

- The total value of the decedent’s personal property in the District of Columbia does not exceed the amount specified by District of Columbia law ($40,000 as of the latest statute in 2023), making the estate qualify as a "small estate" under District of Columbia Code.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The legal heirs of the decedent are as follows:

- Heir 1: __________ [Name], Relationship: __________ [Relationship to Decedent], Address: __________ [Address]

- Heir 2: __________ [Name], Relationship: __________ [Relationship to Decedent], Address: __________ [Address]

- I am entitled to payment or delivery of the property of the decedent by reason of __________ [describe relationship or legal right].

- The following is a complete list of all the personal property belonging to the decedent's estate located in the District of Columbia:

- Description of Property 1: __________ [Provide Description], Value: __________ [Provide Value]

- Description of Property 2: __________ [Provide Description], Value: __________ [Provide Value]

- All debts, funeral expenses, and taxes of the decedent’s estate have been or will be paid.

- I understand that falsifying information on this affidavit can result in penalties and legal consequences under the District of Columbia law.

Executed this ________ day of __________, 20__.

_____________________________

Signature of Affiant

Subscribed and sworn to before me this ________ day of __________, 20__, by __________ [Affiant’s Name], who is personally known to me or who has produced __________ [Type of Identification] as identification.

_____________________________

Notary Public

My commission expires: __________

Document Details

| Fact Name | Description |

|---|---|

| Definition | A District of Columbia Small Estate Affidavit is a legal document used to simplify the process of estate distribution for estates valued below a certain threshold. |

| Value Limit | The threshold for a small estate in the District of Columbia is $40,000. |

| Applicable Law | This form is governed by the District of Columbia Code, specifically § 20-353.01. |

| Eligibility | To use this form, the applicant must be an entitled successor or a person nominated by the entitled successors. |

| Waiting Period | A waiting period of 30 days after the death is required before the affidavit can be submitted. |

| Required Information | The form requires detailed information about the decedent, the estate's assets, and the affidavit's claimant. |

How to Use District of Columbia Small Estate Affidavit

Filling out the District of Columbia Small Estate Affidavit form is a procedure designed for individuals who need to manage a deceased person's estate without a formal probate process. This can be particularly useful in situations where the estate is relatively small. The accurate completion of this form is vital, as it allows for the legal transfer of the deceased's property to the rightful heirs or beneficiaries. To ensure a smooth process, follow the below steps carefully.

- Begin by gathering all necessary documents related to the deceased's estate, such as death certificates, a list of assets, and any existing wills or trusts.

- Obtain the Small Estate Affidavit form for the District of Columbia. Ensure you have the most current version by checking the District of Columbia's official website or contacting the probate court directly.

- Read through the form thoroughly before filling anything out. This will help you understand the information required and how to accurately provide it.

- In the designated section, fill in your full legal name as the affiant, claiming to be the rightful successor or an interested party of the deceased’s estate.

- Enter the full legal name of the deceased, along with their date of death and the county (or equivalent jurisdiction in DC) where the death certificate was issued.

- List all known assets of the deceased within the district. This includes, but is not limited to, bank accounts, vehicles, and real estate, along with their estimated values. Be sure to specify whether you're aware of any disputes regarding these assets.

- Provide information about known debts of the estate, including creditor names and the amounts owed, if applicable.

- Detail the names and relationships of all heirs or beneficiaries entitled to the estate under law or by the will, if one exists. If possible, include their contact information.

- Check whether a funeral or burial has taken place and if any expenses related to the deceased’s last illness or funeral have been paid. If so, include documentation such as receipts or invoices.

- Sign and date the form in front of a notary public. The notary will also need to sign, date, and affix their official seal to the affidavit, thereby notarizing the document.

- File the completed form with the appropriate district court or entity as indicated by District of Columbia law. This may involve paying a filing fee.

After the form is filed, the court or relevant entity will review the affidavit and the accompanying documents. If approved, they will issue an order allowing for the distribution of the estate’s assets according to the affidavit. This process simplifies the transfer of assets to heirs or beneficiaries without the need for a lengthy probate process. Keep a copy of all documents submitted for your records.

Listed Questions and Answers

What is a District of Columbia Small Estate Affidavit?

A District of Columbia Small Estate Affidavit is a legal document used to facilitate the transfer of assets from a deceased individual's estate to their heirs without the need for formal probate court proceedings. This document is applicable when the total value of the estate falls below a specific threshold, making it a simpler, faster way to settle small estates.

Who can file a District of Columbia Small Estate Affidavit?

The following individuals may file a Small Estate Affidavit in the District of Columbia:

- An heir of the deceased person.

- A legal representative of an heir.

- A creditor, under certain circumstances.

What are the requirements for filing a Small Estate Affidavit in the District of Columbia?

To file a Small Estate Affidavit in the District of Columbia, the estate must meet certain conditions:

- The total value of the estate should not exceed a specified monetary limit set by D.C. law.

- There should be no pending court proceedings relevant to the estate in D.C. or another jurisdiction.

- A certain period of time must have elapsed since the death of the property owner, as determined by local laws.

What assets can be transferred using a Small Estate Affidavit in D.C.?

The types of assets that can be transferred with a Small Estate Affidavit in D.C. include, but are not limited to:

- Personal property, such as furniture and jewelry.

- Bank accounts belonging to the deceased.

- Stocks and bonds.

- Certain real estate holdings, under specific conditions.

How does one file a Small Estate Affidiah opened in their name.vit in the District of Columbia?

To file a Small Estate Affidavit in D.C., one must follow a series of steps:

- Ensure the estate meets the small estate criteria for value and no contesting legal processes are underway.

- Complete the Small Estate Affidavit form, which includes providing a detailed inventory of the estate's assets and their values.

- Submit the completed form to the appropriate local court, along with any required filing fees and supporting documents, such as a death certificate.

- Notify potential heirs and creditors about the affidavit filing.

Common mistakes

When individuals attempt to navigate the process of settling a small estate in the District of Columbia, the completion of the Small Estate Affidavit form is a critical step. This document allows for the expedited handling of estates that meet certain conditions, avoiding the lengthy probate process. However, mistakes can easily be made during this process, causing delays or complications in the estate settlement. Below are five common errors encountered when filling out the District of Columbia Small Estate Affidavit form:

-

Not verifying eligibility requirements:

One of the foremost mistakes is neglecting to confirm whether the estate qualifies as a 'small estate' under District of Columbia law. There are specific criteria, such as the total value of the estate, that dictate eligibility. Failure to meet these conditions means the Small Estate Affidavit cannot be used, yet many proceed without this verification.

-

Incomplete or inaccurate information:

Filling out the form demands attention to detail. Every section must be completed fully and accurately. Omissions or errors in details such as the deceased's full legal name, date of death, or listing of assets can invalidate the form or cause avoidable delays in the estate's administration.

-

Incorrectly listing assets:

Another common error involves the improper listing of assets. This includes failing to detail all assets within the estate or misunderstanding which assets are subject to probate and thus should be included in the affidavit. Some individuals mistakenly include non-probate assets, leading to confusion and potential legal challenges.

-

Not obtaining necessary attachments:

The form often requires supplementary documents, such as death certificates, to be attached at the time of submission. Overlooking or assuming these aren’t necessary can render the affidavit incomplete, necessitating additional steps and prolonging the process.

-

Faulty distribution details:

Properly identifying heirs and correctly outlining the distribution of assets are critical steps in the process. Errors in this area, whether due to misunderstanding the law or simply typographical mistakes, can lead to disputes among potential heirs or even require legal intervention to resolve.

Accurately completing the Small Estate Affidavit requires a thorough understanding of the law, a meticulous review of the estate's assets, and an awareness of the procedural requirements. By avoiding these common mistakes, individuals can ensure a smoother, more efficient process in settling small estates in the District of Columbia.

Documents used along the form

When handling a small estate in the District of Columbia, several forms and documents generally accompany the Small Estate Affidavit form. These additional documents are necessary for different purposes, ranging from validating the deceased's will to closing accounts and transferring ownership of assets. Here is an overview of some of the other forms and documents you might need.

- Death Certificate: This official document proves the death of the decedent. It is essential for various transactions, such as claiming life insurance benefits and transferring the deceased's property.

- Will: If the decedent left a will, it should accompany the Small Estate Affidavit. It outlines the decedent's wishes regarding the distribution of their estate.

- Letters of Administration: This document is necessary when there is no will. It grants the administrator the authority to manage and distribute the decedent's estate according to the law.

- Inventory and Appraisement Form: This form lists all the assets within the estate and their estimated value. It helps in determining if the estate qualifies as a small estate under DC law.

- Notice to Creditors: This notice informs creditors of the decedent's death, allowing them to make claims against the estate for debts owed.

- Receipts and Releases Form: This form is used to document the acceptance and distribution of assets from the estate to the rightful heirs or beneficiaries.

- Certificate of Transfer for Motor Vehicles: If the decedent owned a vehicle, this form is needed to transfer the title to the new owner, as specified in the will or as per the laws of intestacy.

Each of these documents plays a crucial role in the process of administering a small estate in the District of Columbia. Depending on the specific circumstances of the estate, additional forms and documents may be required. The Small Estate Affidavit form is just the beginning. It is advisable to consult with a legal professional experienced in estate planning and probate law in the District of Columbia to ensure that all necessary paperwork is completed accurately and timely.

Similar forms

The District of Columbia Small Estate Affidavit form is similar to other legal documents used to manage and distribute a person's estate after they pass away, especially when dealing with smaller estates or when formal probate proceedings may not be necessary. These documents serve an essential function in ensuring that property and assets are transferred according to the deceased person's wishes or the law, should they die without a will.

Transfer on Death Deed (TODD): This form allows property owners to name a beneficiary who will receive their real estate upon their death, without the need for probate. Like the Small Estate Affidavit, a TODD simplifies the process of transferring property. However, it is executed while the property owner is still alive and takes effect upon their death, ensuring a direct transfer to the named beneficiary. Both documents help avoid the lengthy and potentially costly probate process by designating beneficiaries or claimants directly.

Payable on Death (POD) Account Forms: Often used for bank accounts or securities, these forms let account holders specify beneficiaries who will receive the funds in the account upon the holder’s death, bypassing probate. Like the Small Estate Affidavit, POD forms streamline the transfer of assets to beneficiaries without getting caught up in the complexities of probate. They differ primarily in their use; while the Small Estate Affidavit can apply broadly to various types of personal property within an estate, POD forms are specific to financial accounts.

Dos and Don'ts

Filling out the District of Columbia Small Estate Affidavit form requires attention to detail and an understanding of the process. Here are a few guidelines to help you complete the form accurately and effectively:

Do:Review the entire form before you start filling it out. This helps you understand what information you'll need.

Gather the necessary documents, such as the death certificate and proof of your relationship to the deceased, before beginning.

Use black ink when filling out the form, as this ensures legibility and official acceptance.

Be precise and concise in your responses. Make sure the information you provide is accurate and directly answers the questions asked.

Check the eligibility requirements for filing a Small Estate Affidavit in the District of Columbia, as there are specific criteria regarding the estate's value and your relationship to the deceased.

Sign the form in front of a notary public. This step is crucial for the affidavit's legal validation.

File the completed affidavit with the appropriate probate court or office as dictated by District of Columbia law.

Don’t skip sections or leave blanks unless the form expressly instructs you to do so.

Avoid guessing or estimating values and other information. If you're uncertain, seek out the correct information before submitting.

Don't use correction fluid or tape. If you make a mistake, it's better to start over on a new form to ensure the document's integrity.

Resist the temptation to provide unnecessary or irrelevant information. Stick to the requirements of the form.

Don’t sign the affidavit without a notary present. Doing so may invalidate the document or require you to complete the process again.

Avoid filing the affidavit without ensuring all required accompanying documents are attached. Incomplete submissions can lead to delays or denial.

Don't ignore deadlines. Submitting the affidavit in a timely manner is important to avoid potential complications.

Misconceptions

The District of Columbia's Small Estate Affidavit form often confuses those who are navigating the probate process in a time of grief. There are several misconceptions about this document, leading to confusion and frustration. Below, we clarify some common misunderstandings to offer guidance.

- Misconception 1: It's available for all estates regardless of value.

The Small Estate Affidavit form in the District of Columbia is actually designated for estates valued at or below a specific threshold, contrary to the belief that it applies to all estates regardless of their total value. This threshold is subject to change, so it's crucial to verify the current limit with local authorities. - Misconception 2: Completion of the form avoids the probate process entirely.

While the form simplifies the process for smaller estates, it doesn't eliminate the need for all probate proceedings. Some assets may still require formal probate, especially if there are disputes among heirs or creditors. - Misconception 3: Only family members can file the Small Estate Affidavit.

In reality, while family members are commonly the filers, any person who has a lawful claim or is acting on behalf of the decedent's estate can file the affidavit, provided they comply with the District's regulations. - Misconception 4: The form grants immediate access to the decedent's assets.

Access to assets is not immediate. There are procedures and waiting periods designed to ensure all claims are appropriately handled. The form facilitates the process but does not serve as an instant gateway to asset distribution. - Misconception 5: There's no need to notify creditors when using this form.

The law requires that creditors be notified about the estate's proceedings, even when a Small Estate Affidavit is used. This ensures that any outstanding debts are settled before assets are distributed to heirs. - Misconception 6: Real estate can be transferred using the Small Estate Affidavit.

In the District of Columbia, the Small Estate Affidavit typically does not allow for the transfer of real estate. The handling of real property often requires a separate and more formal probate process. - Misconception 7: The form is overly complex and requires an attorney to complete.

While legal guidance can be helpful, especially in more complicated estates, many find the form straightforward. Resources are available to help individuals understand and complete the form without legal assistance. - Misconception 8: The affidavit can be used to distribute assets among heirs as desired.

The distribution of assets must adhere to the decedent's will or, if there is no will, the District of Columbia's laws of intestacy. The affidavit does not grant the filer the freedom to allocate assets based on personal preferences. - Misconception 9: Once filed, no additional paperwork is required.

Filing the Small Estate Affidavit is a significant step, but it may not be the final one. Depending on the estate, additional documentation and filings with the court or other entities may be necessary to fully settle the estate.

Understanding these misconceptions about the District of Columbia Small Estate Affidact form can greatly assist those involved in managing a decedent's estate. By clarifying these common misunderstandings, individuals can navigate the process with greater confidence and efficiency.

Key takeaways

The District of Columbia's Small Estate Affidavit form offers a streamlined process for the settlement of small estates, which facilitates a quicker and simpler transfer of assets to rightful heirs or beneficiaries. Knowing how to accurately complete and utilize this form is crucial for those handling the estate of a deceased individual who had a small amount of personal property. Below are the key takeaways to keep in mind when dealing with the Small Estate Affidavit form in the District of Columbia.

- Eligibility requirements are essential: Before using the Small Estate Affidavit form, it's important to confirm that the estate qualifies as a "small estate" under District of Columbia law. This generally means that the total value of the estate's assets does not exceed a certain threshold, which is subject to change. Verifying eligibility will ensure that the affidavit process can be utilized effectively.

- Accurate information is key: Complete the form with precise details about the deceased's assets, debts, and heirs or beneficiaries. Accurate information helps to prevent delays and ensures that the assets are distributed to the rightful parties without unnecessary legal challenges.

- Understand the distribution of assets: Assets listed in the Small Estate Affidavit can typically bypass the probate process, allowing for a more direct transfer to heirs or beneficiaries. Having a clear understanding of which assets can be included and how they will be distributed can help in filling out the form correctly and setting realistic expectations for all parties involved.

- Seek professional advice if necessary: While the Small Estate Affidavit form is designed to simplify the process of estate settlement, certain situations may still require professional advice. Consulting with an attorney or a legal document preparer can provide clarity and guidance, ensuring that the form is filled out properly and that all legal requirements are met.

Taking the time to comprehend and correctly utilize the District of Columbia Small Estate Affidavit form simplifies the process of asset distribution, reducing the burden on those managing the decedent's affairs. By adhering to the guidelines and requirements set forth, the transfer of assets can be executed smoothly and efficiently, honoring the decedent's wishes and upholding the rights of the beneficiaries.

Fill out Popular Small Estate Affidavit Forms for Different States

What Is Probate in Oregon - Typically filed with financial institutions or entities holding the deceased's assets, requesting release to the rightful heirs.

Create a Family Trust - The Small Estate Affidavit embodies the legal system's flexibility in accommodating the diverse needs of estates of varying sizes.

Illinois Affidavit Requirements - Facilitates the legal process of transferring a small estate's assets to the rightful beneficiaries.