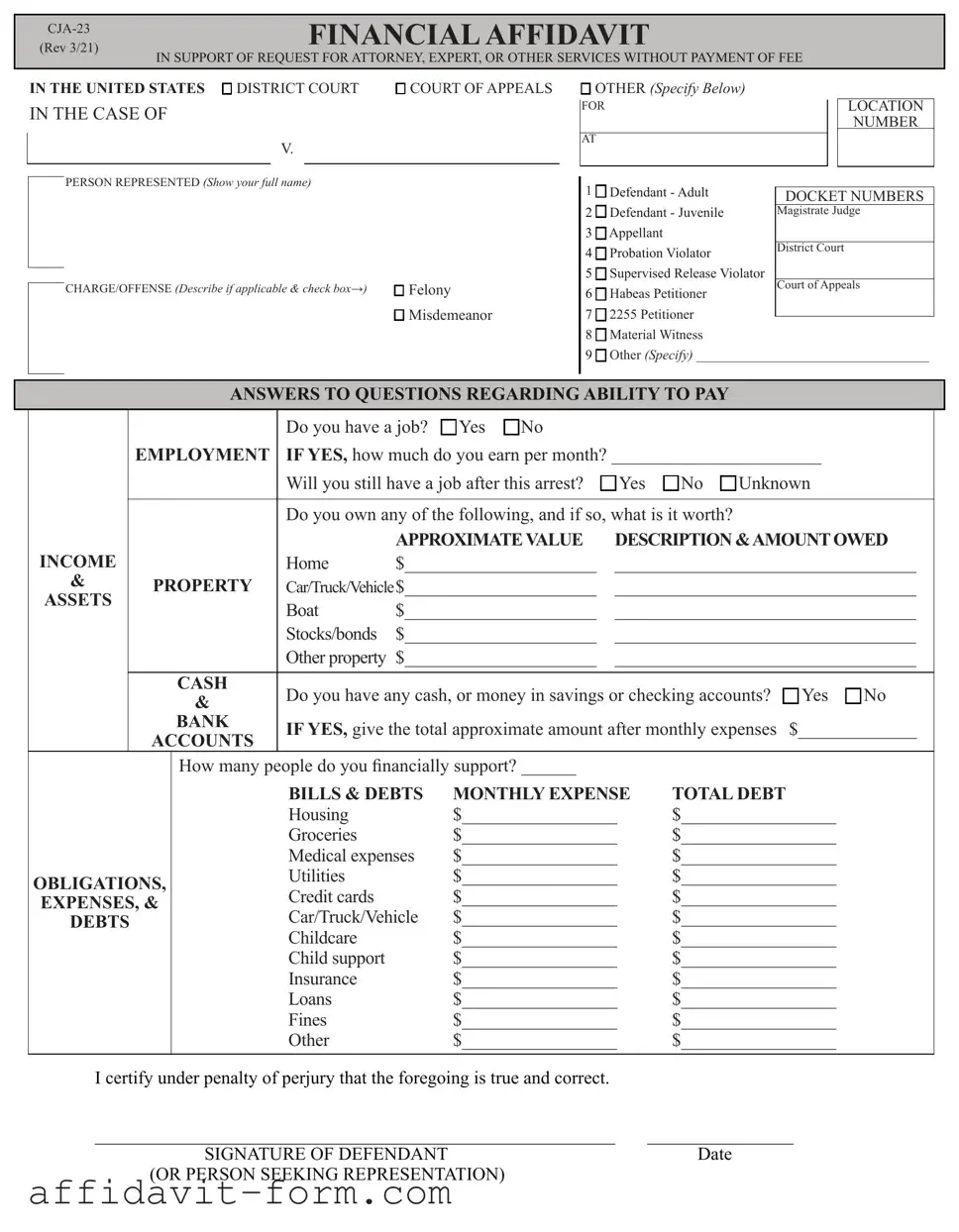

Blank Financial Affidavit CJA-23 PDF Template

The importance of understanding the CJA-23 form cannot be overstated for those navigating the complexities of the legal system, specifically in the context of federal criminal cases. This document plays a pivotal role in determining an individual’s eligibility for court-appointed counsel, based on their financial situation. When someone is accused of a crime and cannot afford to hire an attorney, completing this financial affidavit accurately provides the court with the necessary information to decide if the government should bear the legal costs. The process involves a thorough examination of an individual's income, assets, expenses, and liabilities, ensuring that only those who truly need assistance receive it. It's a crucial step in upholding the constitutional right to legal representation, regardless of financial status. By requiring detailed financial information, the form seeks to maintain a fair balance, ensuring that the resources are allocated to those in greatest need, while also safeguarding the integrity of the judicial system.

Form Example

FINANCIAL AFFIDAVIT |

|

(Rev 3/21) |

|

|

IN SUPPORT OF REQUEST FOR ATTORNEY, EXPERT, OR OTHER SERVICES WITHOUT PAYMENT OF FEE |

IN THE UNITED STATES |

DISTRICT COURT |

COURT OF APPEALS |

IN THE CASE OF

V.

PERSON REPRESENTED (Show your full name)

CHARGE/OFFENSE (Describe if applicable & check box→) |

Felony |

|

Misdemeanor |

|

OTHER (Specify Below) |

|

|

|

|

|

FOR |

|

|

|

LOCATION |

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

AT |

|

|

|

|

|

|

|

|

|

|

|

1 |

Defendant - Adult |

|

|

|

|

|

||||

|

DOCKET NUMBERS |

||||

|

2 |

Defendant - Juvenile |

Magistrate Judge |

||

|

3 |

Appellant |

|

|

|

|

4 |

Probation Violator |

District Court |

||

|

|

|

|

||

|

5 |

Supervised Release Violator |

|

|

|

|

6 |

Habeas Petitioner |

Court of Appeals |

||

|

|

|

|

||

|

7 |

2255 Petitioner |

|

|

|

|

|

|

|

||

|

8 |

Material Witness |

|

|

|

|

9 |

Other (Specify) __________________________________ |

|||

|

|

|

|

|

|

ANSWERS TO QUESTIONS REGARDING ABILITY TO PAY

|

|

|

|

Do you have a job? |

� Yes � No |

|

|

|

|

|

|

EMPLOYMENT |

IF YES, how much do you earn per month? _______________________ |

||||||

|

|

|

|

Will you still have a job after this arrest? |

� Yes |

� No � Unknown |

|||

|

|

|

|

|

|

||||

|

|

|

|

Do you own any of the following, and if so, what is it worth? |

|

||||

INCOME |

|

|

|

|

APPROXIMATEVALUE |

DESCRIPTION &AMOUNTOWED |

|||

|

|

|

Home |

$_____________________ |

_________________________________ |

||||

& |

|

PROPERTY |

Car/Truck/Vehicle$_____________________ |

_________________________________ |

|||||

ASSETS |

|

|

|

Boat |

$_____________________ |

_________________________________ |

|||

|

|

|

|

||||||

|

|

|

|

Stocks/bonds |

$_____________________ |

_________________________________ |

|||

|

|

|

|

Other property $_____________________ |

_________________________________ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH |

Do you have any cash, or money in savings or checking accounts? |

� Yes � No |

||||

|

|

& |

|||||||

|

|

|

BANK |

IF YES, give the total approximate amount after monthly expenses |

$_____________ |

||||

|

|

ACCOUNTS |

|||||||

|

|

|

|

|

|

|

|

||

|

|

|

How many people do you financially support? ______ |

|

|

|

|||

|

|

|

|

BILLS & DEBTS |

MONTHLY EXPENSE |

TOTAL DEBT |

|||

|

|

|

|

Housing |

|

$_________________ |

$_________________ |

||

|

|

|

|

Groceries |

|

$_________________ |

$_________________ |

||

|

|

|

|

Medical expenses |

$_________________ |

$_________________ |

|||

OBLIGATIONS, |

|

Utilities |

|

$_________________ |

$_________________ |

||||

|

Credit cards |

|

$_________________ |

$_________________ |

|||||

EXPENSES, & |

|

|

|||||||

DEBTS |

|

|

Car/Truck/Vehicle |

$_________________ |

$_________________ |

||||

|

|

|

|

Childcare |

|

$_________________ |

$_________________ |

||

|

|

|

|

Child support |

|

$_________________ |

$_________________ |

||

|

|

|

|

Insurance |

|

$_________________ |

$_________________ |

||

|

|

|

|

Loans |

|

$_________________ |

$_________________ |

||

|

|

|

|

Fines |

|

$_________________ |

$_________________ |

||

|

|

|

|

Other |

|

$_________________ |

$_________________ |

||

I certify under penalty of perjury that the foregoing is true and correct.

_________________________________________________________ |

________________ |

SIGNATURE OF DEFENDANT |

Date |

(OR PERSON SEEKING REPRESENTATION) |

|

Instructions for CJA Form 23 Financial Affidavit

In every type of proceeding where appointment of counsel is authorized under 18 U.S.C. § 3006A(a) and related statutes, the United States magistrate judge or the court shall advise the person of their right to be represented by counsel and that counsel will be appointed if the person is financially unable to obtain counsel. Unless the person waives representation by counsel, the United States magistrate judge or the court, if satisfied after appropriate inquiry that the person is financially unable to obtain counsel, shall appoint counsel to represent the individual.

Determination of eligibility for representation under the CJA is a judicial function, however the court may designate court employees to obtain or verify the facts relevant to the financial eligibility determination. Employees of law enforcement agencies, including the United States Attorney’s Office, should not participate in the completion of the financial affidavit or seek to obtain information concerning financial eligibility from a person requesting the appointment of counsel. When practicable, employees of the federal public defender office should discuss with the person who indicates that he or she is not financially able to secure representation the right to appointed counsel and, if appointment of counsel seems likely, assist in completion of the financial affidavit.

Counsel must be appointed if the person seeking representation is “financially unable to obtain counsel.” 18 U.S.C. §3006A(b). (While courts often use “indigency”

as a shorthand expression to describe financial eligibility, indigency is not the standard for appointing counsel under the Criminal Justice Act.) In determining

whether a person is “financially unable to obtain counsel,” consideration should be

given to the cost of providing the person and his or her dependents with the necessities of life, the cost of securing pretrial release, asset encumbrance, and the likely cost of retained counsel. The initial determination of eligibility must be made

without regard to the financial ability of the person’s family to retain counsel,

unless their family indicates willingness and ability to do so promptly. Any doubts

about a person’s eligibility should be resolved in the person’s favor; erroneous

determinations of eligibility may be corrected at a later time. For additional guidance, see the Guide to Judiciary Policy, Volume 7A, Guidelines for Administering the CJA and Related Statutes (CJA Guidelines).

The CJA Form 23 is not a required statutory form. It is an administrative tool used to assist the court in appointing counsel. When a colorable claim is asserted that disclosure to the government of a completed CJA 23 would be

court may not adopt an unconditional requirement that the defendant complete the CJA 23 before his application for appointment of counsel will be considered. To do so may place the defendant in the constitutionally untenable position of having to choose between his Sixth Amendment right to counsel and his Fifth Amendment privilege against

Pursuant to Judicial Conference policy, financial affidavits seeking the appointment of counsel should not be included in the public case file and should not be made available to the public at the courthouse or via remote electronic access. If the financial affidavit is docketed it should be filed under seal. See, Guide to Judiciary Policy, Vol. 10, §340, Judicial Conference Policy on Privacy and Public Access to Electronic Case Files (March 2008) and Administrative Office of U.S. Courts Information Bulletin on Revised Judicial Conference Privacy Policy (May 2008).

For questions on the use of this form or instructions, please contact the Defender Services Office, Legal and Policy Division at

Document Features

| Fact Name | Description |

|---|---|

| Definition | The Financial Affidavit CJA-23 form is used to assess the financial eligibility of a defendant for court-appointed counsel under the Criminal Justice Act. |

| Function | It collects detailed information about the defendant's financial status, including income, assets, liabilities, and dependents. |

| Requirement | Filling out this form is required for defendants seeking to have a lawyer appointed to them because they cannot afford one. |

| Confidentiality | Information provided on the form is treated with confidentiality but might be shared among court officials as necessary. |

| Outcome Influence | The information provided can determine not only eligibility for a court-appointed attorney but may also influence the type and extent of legal assistance granted. |

| Filing Process | The completed form must be submitted to the court where the defendant's case is being heard, following local rules on filing procedures. |

How to Use Financial Affidavit CJA-23

Completing the Financial Affidavit CJA-23 form might seem like a daunting task, but it's a critical step in ensuring that you're represented fairly and adequately in court, especially if you're seeking appointed counsel due to financial constraints. This form helps the court assess your financial situation to determine if you qualify for a court-appointed attorney. Remember, honesty and accuracy are paramount when filling out this document. Let's walk through the steps needed to complete the form accurately.

- Start by gathering all necessary financial documents. This includes recent pay stubs, bank statements, and a list of assets and liabilities. Having this information at hand will make the process smoother.

- Fill in your personal information at the top of the form. This typically includes your name, address, Social Security number, and case number if known.

- Proceed to detail your employment status. Indicate whether you are employed, unemployed, or retired. If you're employed, provide the name of your employer, your position, and your salary.

- Next, report your income level. Include all sources of income, such as wages, salaries, tips, and any government benefits like unemployment or disability payments.

- Disclose your assets. This section requires you to list any real estate, vehicles, savings accounts, or other significant assets you own. Be sure to estimate the value of these assets accurately.

- List your regular expenses. Include monthly bills such as rent or mortgage, utilities, groceries, insurance premiums, and any other recurring payments.

- Include information about your dependents, if applicable. If you have children or other dependents, provide their names, ages, and your relationship to them.

- Review the form for accuracy. Before signing, ensure all the information you've provided is correct and complete. Any intentional misinformation can have serious legal consequences.

- Sign and date the form. Your signature certifies that the information provided is true to the best of your knowledge.

- Submit the completed form to the designated court official or as directed by the court. Ensure you keep a copy for your records.

After submitting the Financial Affidavit CJA-23 form, the court will review your financial situation to determine if you qualify for a court-appointed attorney. This is a critical step in ensuring that you have fair legal representation, regardless of your financial status. The process might seem complex, but taking it one step at a time will help ensure that everything is completed correctly. Always remember, help is available if you have questions or need assistance at any stage.

Listed Questions and Answers

What is a Financial Affidavit CJA-23 form?

The Financial Affidavit CJA-23 form is a legal document used in the United States federal court system. It helps to determine if an individual qualifies for the appointment of counsel at the government's expense. Defendants or appellants complete this form to report their financial situation, including their income, assets, and liabilities.

Who needs to fill out the Financial Affidavit CJA-23 form?

Any defendant or appellant in a federal court proceeding who seeks to have an attorney appointed due to inability to afford private counsel must fill out the Financial Affidavit CJA-23 form. This form is a necessary step for those requesting court-appointed legal representation.

How do I obtain a Financial Affidavit CJA-23 form?

The form can be obtained from the federal court where the case is being heard. It is also available online through the United States Courts website. Furthermore, court clerks or public defender offices can provide this form.

What information is required on the Financial Affidavit CJA-23 form?

The form requires detailed information about your financial status, including, but not limited to:

- Your employment status and income

- Any other sources of income

- Your assets, such as bank accounts, property, and investments

- Liabilities and debts

- Monthly expenses

How do I submit the Financial Affididavit CJA-23 form?

After completing the form, you should submit it to the court where your case is being handled. The submission process may vary by court, so it's important to follow any specific instructions provided by the court staff or on the court's website. In some instances, you may be required to submit the form directly to the public defender's office.

Is there a fee to file a Financial Affidavit CJA-23 form?

No, there is no filing fee required to submit a Financial Affidavit CJA-23 form.

What happens after I submit the form?

After submission, the court will review your financial information to determine if you qualify for a court-appointed attorney. This decision is based on federal guidelines regarding income and financial resources. You will be informed of the court's decision, and if you are deemed eligible, an attorney will be appointed to represent you.

Can I be denied a court-appointed attorney after submitting the CJA-23 form?

Yes, if the court finds that your financial resources are sufficient to afford private counsel, you may be denied a court-appointed attorney. However, if your financial situation changes, you can request a reevaluation of your eligibility.

Is the information I provide on the Financial Affidavit CJA-23 form confidential?

The information you provide on the form is treated as confidential by the court and is used solely for the purpose of assessing your eligibility for court-appointed counsel. However, be aware that falsifying information on this affidavit can lead to criminal charges.

Who can I contact for help with the Financial Affidavit CJA-23 form?

If you have questions or need assistance completing the Financial Affididavit CJA-23 form, you can contact the clerk's office at the federal court where your case is being handled. Additionally, the public defender's office can provide guidance and answer questions regarding the form and the appointment process.

Common mistakes

Filling out the Financial Affidiant CJA-23 form can be a daunting task, especially for those unfamiliar with legal forms. Here are seven common mistakes people often make, highlighting the need for careful attention to detail:

Not verifying personal information for accuracy. It's critical to ensure that personal details such as your name, social security number, and contact information are correct. Mistakes in this area can lead to delays or issues with your application.

Overlooking income sources. Many people forget to include all sources of income, such as part-time jobs, freelance work, or government benefits. Remember, every bit of income must be reported for an accurate assessment.

Underestimating expenses. When listing monthly expenses, it's easy to forget occasional or minor spending. However, accurately reporting all expenses, even those that seem insignificant, gives a more comprehensive picture of your financial situation.

Misunderstanding asset valuation. Assets should be valued correctly; this includes everything from your home to savings accounts. An overvaluation or undervaluation can significantly impact your financial profile.

Failing to update the form when necessary. Financial situations can change rapidly. Failing to update your CJA-23 form to reflect these changes, like a new job or a large purchase, can lead to inaccuracies in your reported information.

Not including liabilities and debts. All current debts and liabilities must be listed, including credit card debt, loans, and any other obligations. Leaving these out can provide a misleading picture of your financial health.

Omitting signatures and dates. A common mistake is forgetting to sign and date the form. Without your signature, the form is incomplete and will likely be returned, causing delays in the process.

To avoid these mistakes, here are some strategies:

Double-check all personal information before submitting.

Maintain a thorough record of income and expenses to ensure nothing is overlooked.

Consult with a legal advisor or financial consultant if there are uncertainties regarding the valuation of assets or debts.

Regularly review and update your financial information to keep it current.

Ensure that all sections of the form are completed and that it is signed and dated.

By being meticulous and thorough, and seeking assistance when needed, individuals can navigate the complexities of the Financial Affidavit CJA-23 form more successfully, reducing the likelihood of errors and their potential consequences.

Documents used along the form

The process of ensuring fairness and providing assistance in the legal system often necessitates the collection of accurate and comprehensive financial information. The Financial Affidavit CJA-23 form is a critical document in this process, especially for those seeking legal representation without the means to afford it. Alongside the CJA-23 form, several other documents play a pivotal role in painting a full picture of an individual's financial situation. These documents are essential for determining eligibility for court-appointed representation and other forms of legal aid.

- Income Verification Documents: These include recent pay stubs, tax returns, and W-2 forms that provide clear evidence of an individual's yearly earnings and are essential for verifying the income declared on the Financial Affidavit.

- Bank Statements: Recent statements from checking, savings, or other bank accounts help evaluate an individual's assets and liquidity, further informing their financial affidavit.

- Expense Reports: Documentation of monthly expenses, such as rent, utilities, insurance, and food, clarifies an individual's cost of living and financial burdens.

- Proof of Dependents: Documents like birth certificates and school records for children can be necessary to establish the number of dependents an individual supports, which is crucial for assessing financial need.

- Asset Documentation: Titles and deeds for properties or vehicles, along with statements for retirement accounts or stocks, outline an individual's assets beyond immediate income, offering a comprehensive view of their financial status.

Collecting and accurately presenting these documents alongside the Financial Affidavit CJA-23 form is essential for a thorough evaluation of an individual's eligibility for legal aid. The provided information ensures that legal support is allocated fairly, backing the judiciary's commitment to access to justice for all, regardless of financial standing. When these documents are used effectively, they empower individuals and enable legal professionals to advocate efficiently on their behalf.

Similar forms

The Financial Affidavit CJA-23 form is similar to other documents utilized in legal and financial settings, where individuals must disclose their financial status comprehensively. These resemblances are observed in their purpose, which is to provide an accurate financial snapshot of an individual, often to determine eligibility for services or compliance with legal requirements. Specifically, this form shares similarities with the Uniform Financial Statement and the Individual Tax Return Form 1040, among others. Each of these documents requires detailed financial information from the filer, yet they serve distinct purposes within the financial and legal ecosystems.

The Uniform Financial Statement is akin to the Financial Affidavit CJA-23 form in that both require detailed disclosures of an individual's income, expenses, assets, and liabilities. Used often by banks and lending institutions, the Uniform Financial Statement assesses a borrower's financial capability to repay a loan. Like the CJA-23, it necessitates transparency regarding an individual's financial dealings, including monthly income, debt obligations, and living expenses. However, its primary application is in the lending process, contrasting with the CJA-23's use in determining eligibility for court-appointed representation based on financial need.

The Individual Tax Return Form 1040, while distinct in its primary function from the CJA-23, also demands comprehensive financial information from an individual. This form, required annually by the Internal Revenue Service (IRS), details an individual's income, allows for deductions, and calculates the amount of federal income tax owed. Similarities between the Form 1040 and the CJA-23 include the requirement for detailed income statements and the disclosure of financial liabilities. However, the Form 1040's main goal is to calculate taxes owed to or refunds from the government, whereas the CJA-23 aims to evaluate a person's financial ability to afford legal representation.

Dos and Don'ts

When filling out the Financial Affidavit CJA-23 form, it's essential to approach the task with due diligence and accuracy. This document is crucial for determining eligibility for court-appointed counsel based on financial grounds. To help guide you through this process, here are several dos and don'ts to keep in mind:

- Do read the form instructions carefully before starting. Understanding what is expected can significantly reduce errors and ensure the process goes smoothly.

- Do gather all necessary financial documents beforehand. This includes recent pay stubs, bank statements, and any other relevant financial information to ensure accuracy in reporting.

- Do use a pen with black ink if filling out the form by hand, as this ensures the information is legible and can be scanned or copied if needed.

- Do be honest and accurate in all the information you provide. Misrepresenting your financial situation can have serious legal consequences.

- Do double-check your entries before submitting the form. Ensuring that all information is correct and complete can prevent delays in the consideration process.

- Don't leave any sections blank unless instructed. If a section does not apply to you, it is better to write "N/A" (not applicable) than to leave it empty.

- Don't guess or estimate figures. Use exact numbers wherever possible, as estimates can lead to inaccuracies in your financial assessment.

- Don't forget to sign and date the form. An unsigned or undated form may not be processed, delaying the assessment of your application.

- Don't ignore requests for additional information. If the court or a court official requests further details regarding your finances, provide the requested information promptly to avoid delays in your case.

Adhering to these guidelines can help ensure that the process of filling out the Financial Affidavit CJA-23 form is smooth and effective, ultimately facilitating a fair evaluation of your eligibility for court-appointed counsel. Always remember, the purpose of this form is to provide the court with a clear picture of your financial situation, so accuracy and honesty are paramount.

Misconceptions

The Financial Affidavit CJA-23 form plays a critical role in the United States legal system, specifically in determining eligibility for court-appointed counsel under the Criminal Justice Act. However, several misconceptions surround its use and implications. Addressing these misunderstandings is essential for individuals navigating the federal court system. Here are eight common misconceptions:

- Misconception #1: The form is only for those with no income. While it's true that low-income individuals may qualify for court-appointed counsel, the CJA-23 form is designed to assess the financial situation comprehensively. This includes evaluating assets, liabilities, and other financial responsibilities to determine eligibility.

- Misconception #2: Filling out the form inaccurately has no penalties. On the contrary, providing false information on the CJA-23 can lead to severe consequences, including criminal charges for perjury. Accuracy and honesty are paramount when completing the affidavit.

- Misconception #3: Only the defendant needs to disclose their financial information. In reality, the form may require information about the financial status of dependents and possibly other household members to accurately assess the defendant's eligibility for a court-appointed attorney.

- Misconception #4: Once filled out, the information on the CJA-23 cannot be updated. Financial situations can change, and the courts recognize this. Defendants should inform their attorney or the court of significant financial changes that may affect their eligibility for appointed counsel.

- Misconception #5: The information provided on the form will be publicly accessible. The financial information disclosed on the CJA-23 is sensitive and is treated as confidential by the court. While some aspects of a legal case might be public, detailed financial information is not disclosed freely.

- Misconception #6: There's no need to disclose assets because the court is only interested in income. The form assesses both income and assets to determine financial eligibility. Failure to disclose assets can lead to an inaccurate assessment and potentially disqualify an individual from receiving court-appointed counsel.

- Misconception #7: Completing the CJA-23 form guarantees the appointment of a lawyer. Submission of the form is just one step in the process. The court reviews the information to decide eligibility, and other factors may influence the decision to appoint counsel.

- Misconception #8: The defense attorney fills out the form for the defendant. It is the responsibility of the defendant to provide accurate and complete information. While a defense attorney can offer guidance on how to complete the form, the defendant must verify and sign the affidavit, affirming its accuracy.

Understanding these misconceptions is crucial for individuals involved in the federal judicial process. Accurate completion of the Financial Affidavit CJA-23 is a key step in securing representation under the Criminal Justice Act, and being well-informed can help navigate the complexities of the legal system more effectively.

Key takeaways

The Financial Affidavit CJA-23 form is a critical document for individuals seeking legal aid under the Criminal Justice Act. It serves the purpose of assessing an individual's financial capacity to afford legal representation. The information provided in this affidavit plays a crucial role in determining eligibility for court-appointed counsel. Here are key takeaways regarding the filling out and use of this important document:

- Accuracy is Paramount: It's essential to provide accurate and truthful information on the CJA-23 form. Inaccurate information can lead to a denial of assistance or later sanctions if discovered after counsel has been appointed. All financial information, including income, assets, and liabilities, should be reported to the best of the applicant's knowledge.

- Comprehensive Disclosure: The form requires a comprehensive disclosure of financial status. This includes all sources of income, whether it's from employment, business operations, government benefits, or any other sources. Assets, such as savings accounts, real estate, vehicles, and other valuable items, must also be disclosed. Likewise, an individual must list all liabilities and regular expenses.

- Supporting Documentation May Be Required: While the completion of the CJA-23 form is a self-declaration of financial status, the court or the appointing authority may request additional documentation to verify the information provided. This could include recent pay stubs, tax returns, bank statements, or other financial records. Being prepared to supply these documents can expedite the review process.

- Confidentiality of Information: The information provided on the CJA-23 form is used exclusively for the purpose of determining eligibility for a court-appointed attorney or other legal aid. It is treated with a high level of confidentiality and is protected under privacy regulations. Individuals should feel secure in providing personal and financial details, knowing they are used strictly for the determination of legal assistance eligibility.

Common PDF Documents

Is Labor Taxed in Washington State - This document helps in the accurate valuation of properties, playing a vital role in the equitable distribution of tax responsibilities.

Gf Number on Deed - The affidavit helps in accelerating negotiations by presenting a clear picture of the property's condition upfront.