Printable Affidavit of Gift Form for Florida

When navigating the legal landscape of gift giving in Florida, particularly when that gift involves something as significant as a vehicle, boat, or property, understanding the purpose and requirements of the Florida Affidavit of Gift form becomes essential. This document plays a pivotal role in the process, ensuring that the transfer of ownership from one person to another is recognized by the state, clear of any sales tax obligations that often accompany such transactions. By completing this form, the giver certifies that the item is indeed a gift, requiring no compensation from the receiver. It's a straightforward document, but filling it out correctly is crucial to avoid any potential legal hiccups. Additionally, this form not only simplifies the transfer process but also serves as a legal record of the change in ownership, providing both parties with peace of mind. As a key component in the transfer of valuable assets, understanding each aspect of the form and adhering to its requirements can help ensure the process is handled smoothly and efficiently.

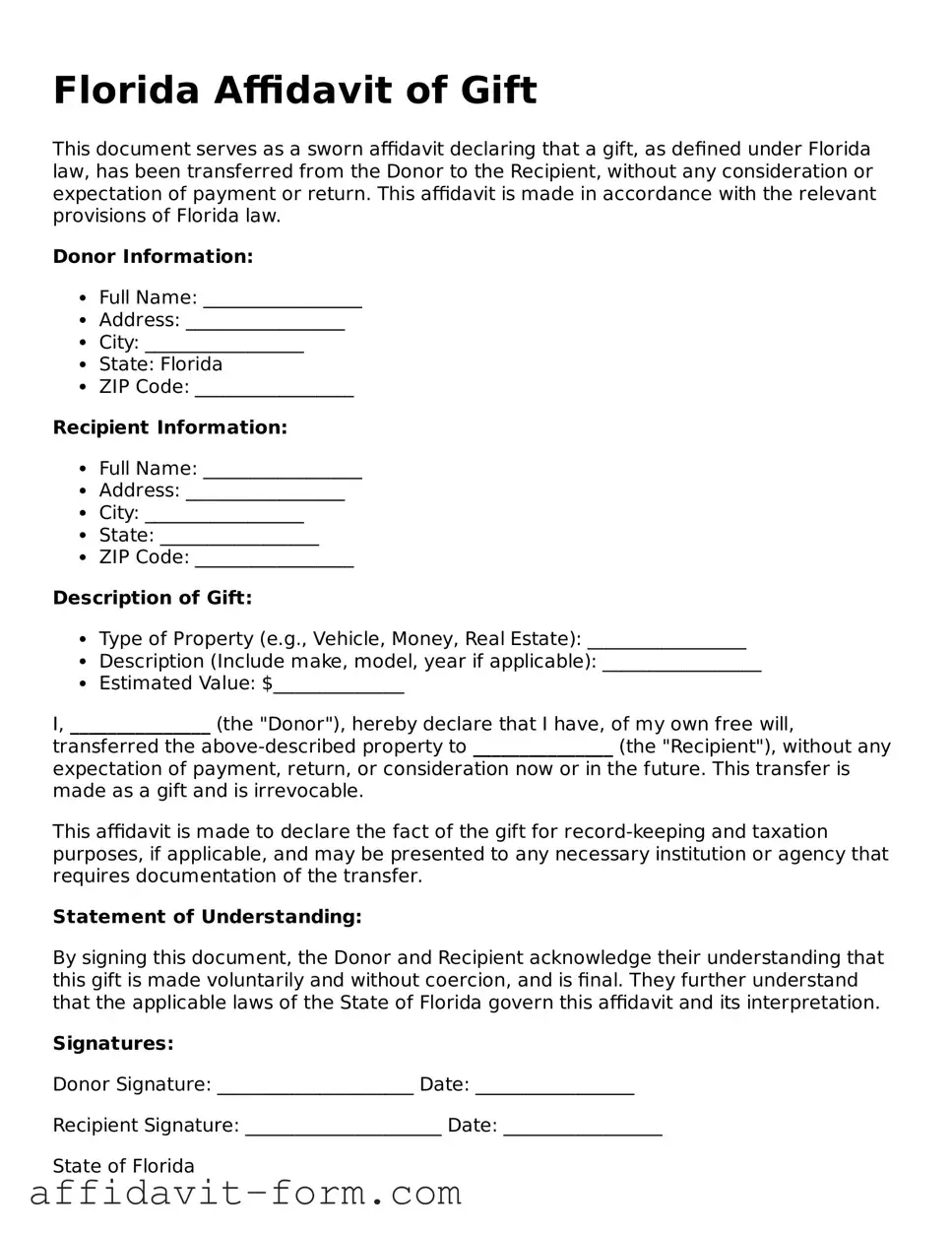

Form Example

Florida Affidavit of Gift

This document serves as a sworn affidavit declaring that a gift, as defined under Florida law, has been transferred from the Donor to the Recipient, without any consideration or expectation of payment or return. This affidavit is made in accordance with the relevant provisions of Florida law.

Donor Information:

- Full Name: _________________

- Address: _________________

- City: _________________

- State: Florida

- ZIP Code: _________________

Recipient Information:

- Full Name: _________________

- Address: _________________

- City: _________________

- State: _________________

- ZIP Code: _________________

Description of Gift:

- Type of Property (e.g., Vehicle, Money, Real Estate): _________________

- Description (Include make, model, year if applicable): _________________

- Estimated Value: $______________

I, _______________ (the "Donor"), hereby declare that I have, of my own free will, transferred the above-described property to _______________ (the "Recipient"), without any expectation of payment, return, or consideration now or in the future. This transfer is made as a gift and is irrevocable.

This affidavit is made to declare the fact of the gift for record-keeping and taxation purposes, if applicable, and may be presented to any necessary institution or agency that requires documentation of the transfer.

Statement of Understanding:

By signing this document, the Donor and Recipient acknowledge their understanding that this gift is made voluntarily and without coercion, and is final. They further understand that the applicable laws of the State of Florida govern this affidavit and its interpretation.

Signatures:

Donor Signature: _____________________ Date: _________________

Recipient Signature: _____________________ Date: _________________

State of Florida

County of _________________

On this day, personally appeared before me, an officer duly authorized in the state and county aforesaid to take acknowledgments, the above-named Donor and Recipient, who have satisfactorily identified themselves and acknowledged signing this document of their own free will for the purposes stated herein.

Notary Public: _____________________

Commission Number: _________________

My commission expires: _________________

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Florida Affidavit of Gift form is used to legally document the gifting of personal property from one person to another without any payment or consideration in return. |

| Governing Law | The form is governed by the laws of the State of Florida, ensuring that all gifts are recorded and treated according to state regulations. |

| Requirement for Witnesses or Notarization | In Florida, the Affidavit of Gift form may need to be witnessed or notarized, depending on the nature of the gift and specific legal requirements, to validate the transfer of ownership. |

| Use in Tax Implications | The form can serve as evidence for tax purposes, documenting the transfer of property as a gift, which may be important for both the giver and the recipient when filing taxes. |

How to Use Florida Affidavit of Gift

When you're ready to give a vehicle as a gift in Florida, one important piece of paperwork you'll need to handle is the Florida Affidavit of Gift form. This document proves that a vehicle was given as a gift, meaning no money exchanged hands. It's crucial for both the giver and the receiver to fill out this form accurately to ensure a smooth transfer of ownership. Below, you'll find a straightforward, step-by-step guide to help you complete this form correctly.

- Start by gathering all necessary information about the vehicle, including its make, model, year, and Vehicle Identification Number (VIN).

- Enter the date the gift was or will be given. This date should be accurate, as it will be used to record when the ownership officially changed hands.

- Fill in the full legal name and address of the person who is giving the vehicle as a gift. This information must match what's on their identification and any other related documents.

- Next, provide the full legal name and address of the recipient of the gift. Ensure this information is accurate for a seamless transfer.

- In the section that requires the description of the vehicle, input the gathered information about the make, model, year, and VIN. Double-check these details to avoid any errors.

- If the form asks for an odometer reading, provide the vehicle’s current mileage. This must be exact to comply with state regulations.

- Both the giver and the receiver must sign the form in the designated areas. These signatures are essential for the form’s validity.

- Date your signatures. Both parties should put the date next to their signatures to confirm when they signed the form.

- Review the entire form with the other party to ensure all the provided information is accurate and complete.

- Submit the completed form to the appropriate Florida state department or agency as instructed. Follow any additional steps they provide for the vehicle transfer process.

By accurately following these steps, you'll help ensure that the process of gifting a vehicle in Florida is completed properly. This will aid in making the transition smoother for both the giver and the recipient, avoiding potential issues with the vehicle’s ownership and registration.

Listed Questions and Answers

What is a Florida Affidavit of Gift form?

An Affidavit of Gift form in Florida is a legal document used when one person decides to give another person a gift of significant value, such as a car, with no expectation of payment or compensation. This document is crucial for tax purposes and to legally transfer ownership without undergoing the usual sale and purchase process. It officially records the gift transaction, ensuring that it's recognized by law.

When do I need to use an Affidavit of Gift form in Florida?

You need to use an Affidavit of Gift form in Florida when you intend to give someone a significant gift, especially a motor vehicle, and want to formalize the transfer of ownership in a way that is recognized by the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) and the Internal Revenue Service (IRS). Situations may include gifting a car to a family member or donating it to a nonprofit. This form helps in avoiding the usual tax implications of buying or selling property.

What information is required to complete a Florida Affidavit of Gift?

To complete an Affidavit of Gift in Florida, the following information is usually required:

- The full legal name and address of the giver (donor).

- The full legal name and address of the recipient (donee).

- A detailed description of the gift, including make, model, year, and VIN if applicable (e.g., when gifting a car).

- The date the gift was given.

- Statements affirming that the gift is given freely, without any expectation of payment or compensation.

- Signatures of both the donor and the donee, sometimes required to be notarized.

Is it necessary to have the Affidavit of Gift notarized in Florida?

In many cases, it is necessary to have the Affidavit of Gift notarized in Florida, particularly when the gift involves a motor vehicle. A notarized affidavit helps to verify the identity of the parties involved and adds a level of legal formality to the document, ensuring it is accepted by the FLHSMV and other agencies. Always check the latest state requirements and consider consulting with a legal professional to ensure compliance.

How does giving a gift using an Affididavit affect taxes in Florida?

Giving a gift using an Affidavit of Gift can have tax implications, both for the donor and the donee. For the donor, there can be federal tax considerations, as the IRS requires reporting gifts of a certain value, using Form 709, and may impose taxes if the gift exceeds the annual or lifetime exemption limits. However, Florida does not impose a state gift tax, so there are no state tax obligations for the giver. The recipient, on the other hand, generally does not pay taxes on the gift received but should consult with a tax professional for advice specific to their situation.

Can I retract an Affidavit of Gift once it's been executed and the gift has been transferred?

Once an Affidavit of Gift has been executed and the gift has been transferred, retracting the affidavit and reversing the transfer can be extremely difficult, if not legally impossible, without the recipient's consent. This transfer is often considered final, especially if the affidavit has been notarized and the official ownership documents have been updated to reflect the new owner. Before executing the affidavit, ensure that you are certain of your decision to give the gift, and consider consulting with a legal advisor to understand all implications.

Common mistakes

When individuals attempt to complete the Florida Affidavit of Gift form, a document intended to clearly document the gift of personal or real property from one person to another without any payment in return, errors can often occur. The form serves a crucial role in legal and tax implications, making it paramount that the information provided is accurate and complete. Below are five common mistakes that people frequently make when filling out this form:

Not providing complete information about the donor and recipient: One of the most common mistakes is failing to include full and accurate details of both the donor and the recipient. This includes their full names, addresses, and, if applicable, their relationship to each which is vital for records and potential tax purposes.

Incorrect description of the gifted property: Often, individuals do not adequately describe the property being gifted. It is essential to include a thorough description, including serial numbers or identification numbers for vehicles or detailed descriptions for real estate to ensure there is no ambiguity about what is being transferred.

Forgetting to specify the date of the gift: The date of the gift is crucial for various reasons, including tax implications. It determines the valuation period for the gift and is essential for the document to be legally valid. Without this, the affidavit may not be considered legitimate.

Omitting signatures or notary acknowledgment: Another critical oversight is failing to have the form signed by the donor and, depending on state requirements, witnessed or notarized. This step is imperative for the affidavit to hold legal weight. Without these, the document could be considered invalid.

Not checking for state-specific requirements: While the form is used in Florida, there could be additional requirements or variations based on county laws or specific circumstances surrounding the gift. Not researching and adhering to these can result in the affidavit being incomplete or not compliant with all necessary legal standards.

Correctly filling out the Florida Affidavit of Gift form is essential for ensuring that the property transfer is legally recognized and that both parties comply with state law and tax regulations. Avoiding these mistakes helps in safeguarding against potential legal issues or financial penalties for both the donor and the recipient.

Documents used along the form

When processing a transfer of property or vehicle through a gift in Florida, the Affidavit of Gift form plays a crucial role. However, to ensure a seamless and legally sound transaction, several other documents are regularly used in conjunction with this affidavit. These documents support the affidavit in establishing the legitimacy of the gift, the identities of the involved parties, and the compliance with state laws. Below is a list and brief description of some of these essential documents.

- Bill of Sale: This document acts as evidence of the transaction, detailing the transfer of property from one party to another. It often includes important information such as the date of sale, descriptions of the items sold, and the agreed-upon price, if any.

- Title Transfer Documents: When the gift involves a vehicle, transferring the title is essential. These documents formally record the change of ownership with the state’s Department of Motor Vehicles (DMV).

- Proof of Relationship: To substantiate the claim that the transfer is a gift, especially between family members, documents proving the relationship between the giver and the recipient may be required.

- Odometer Disclosure Statement: For vehicle gifts, this statement records the vehicle's mileage at the time of the transfer, ensuring full disclosure of the vehicle's condition.

- Release of Liability: This form is used by the giver to notify the DMV that the vehicle has been transferred, releasing them from future liability for tickets, accidents, or other violations involving the vehicle.

- Registration and Insurance Documents: New ownership often requires the update of registration and insurance documents to reflect the current holder, ensuring legal operation of the vehicle.

Together with the Florida Affidavit of Gift, these documents form a comprehensive package that supports the legal transfer of property or vehicles as gifts. They help protect the interests of both the giver and the recipient by providing a clear, recorded history of the transaction and ensuring adherence to state regulations. For individuals navigating these transactions, understanding and compiling the necessary paperwork is a critical step towards finalizing their generous acts.

Similar forms

The Florida Affidavit of Gift form is similar to other legal documents used in the transfer of property without monetary exchange. These documents often serve similar purposes but are used in slightly different contexts or jurisdictions. Understanding these similarities helps in recognizing the broader legal framework surrounding gifts and transfers of ownership.

Bill of Sale: This document is closely related to the Florida Affidavit of Gift form in its function to transfer ownership of property from one person to another. While a Bill of Sale typically involves a transaction where money is exchanged for goods, the Affidavit of Gift serves a similar purpose but without the exchange of money. Both documents require detailed information about the item being transferred and the parties involved in the transfer. They must be signed by both the giver and the receiver to be considered valid and binding. The key difference lies in the financial consideration involved in the transaction.

Deed of Gift: Very similar to the Affidavit of Gift, a Deed of Gift is used to transfer property ownership without any payment. It is commonly used in the transfer of real estate between family members or to a charity. Both the Deed of Gift and the Affidavit of Gift require the donor's intention to give the property as a gift and the acceptance of the recipient. Furthermore, both documents need to be signed in the presence of witnesses or a notary to be legally binding. The primary difference between these documents is that a Deed of Gift is often recorded with a local government entity to show change in ownership, especially for real estate transactions.

Gift Letter: A Gift Letter is another document that has similarities with the Florida Affidavit of Gift form, particularly because it is used to prove that money or property was given to someone without expecting repayment. It is most often used in financial transactions, like when a family member provides a down payment for a home purchase. While both documents formalize the process of gifting, the Gift Letter focuses more on financial transactions or monetary gifts. It typically includes details such as the donor's name, the amount given, the recipient's name, and a statement that no repayment is expected or required.

Dos and Don'ts

Filling out the Florida Affidavit of Gift form is an important step when gifting a vehicle, and it needs to be done correctly to ensure the process goes smoothly. Here are some essential dos and don'ts to keep in mind.

Do:

- Make sure all parties are clear about the intention to gift, not sell, the vehicle. The affidavit is a legal document that substantiates this intent.

- Gather all necessary information about the vehicle, including make, model, year, and VIN (Vehicle Identification Number), before filling out the form.

- Provide accurate information about both the giver (donor) and the recipient (donee). This includes full legal names, addresses, and contact details.

- Sign and date the form in the presence of a Notary Public. This step is crucial as it validates the form.

- Keep copies of the completed affidavit for both the giver and the recipient’s records. It may be needed for future reference, such as tax purposes or title transfer.

Don't:

- Leave blanks on the form. If a section does not apply, enter “N/A” (not applicable) to indicate this. Leaving sections blank can cause issues or delays.

- Forget to notify the DMV. After completing the affidavit, make sure you notify the Florida Department of Motor Vehicles about the change of ownership.

- Misrepresent the gift as a sale or transaction that involves payment. If there’s an exchange of money, it’s not considered a gift, and different rules and taxes apply.

- Overlook state-specific requirements. Although this guide is tailored for Florida, it’s important to check for any additional or unique requirements within the state regarding vehicle gifting.

Accurately filling out and understanding the Florida Affidavit of Gift form is an essential part of gifting a vehicle. By following these guidelines, you can ensure a seamless and lawful transition of ownership.

Misconceptions

When dealing with the Florida Affidavit of Gift form, various misunderstandings frequently arise. Below are ten misconceptions explained clearly to enhance understanding and ensure individuals are well-informed.

- It automatically transfers ownership of property or assets. Merely completing the form does not execute the transfer. The document must be properly submitted and processed by relevant authorities or institutions.

- It covers the transfer of any type of property. The form is typically used for specific assets, such as vehicles or real estate, within Florida. It may not be applicable for transferring other types of personal property or assets located outside of Florida.

- It exempts the recipient from all taxes. While it may relieve the recipient from paying sales tax on the item received as a gift, other taxes, like federal gift tax implications, might still apply depending on the value of the gift.

- Notarization is optional. The form often requires notarization to verify the identity of the person signing the affidavit, making it a crucial step for the document to be considered legally valid.

- Any family member can sign the affidavit on behalf of another. Typically, the person giving the gift must sign the affidavit. If they are unable to do so, specific legal requirements must be met for someone else to sign on their behalf.

- A verbal declaration of gifting suffices in place of the form. Verbal agreements might not meet legal standards for transferring ownership of the property. A written and properly executed affidavit is essential for legally documenting the transfer.

- It's the only document needed to transfer ownership. Other documentation, such as a title or deed, often needs to accompany the affidavit to complete the transfer of ownership.

- The form is valid in every state. The Florida Affidavit of Gift form is specific to Florida and may not be recognized or suitable for use in other states, which may have their own forms and requirements.

- It can be used to transfer ownership of illegal items. The form is intended for lawful gifts only. Transferring ownership of illegal items through an affidavit of gift is against the law.

- It overrides a will or pre-existing legal claims. The form cannot be used to circumvent or alter the terms of a will or legal claims against the property by third parties. Any conflicts typically require resolution through legal processes.

Key takeaways

When completing and utilizing the Florida Affidavit of Gift form, it is essential to pay attention to detail and follow the required procedures to ensure the legal transfer of property or vehicles. Here are seven key takeaways that individuals should keep in mind:

- Accuracy Is Key: The information provided on the Florida Affidavit of Gift form must be accurate and complete. Misrepresenting details or providing inaccurate data can lead to legal complications or the invalidation of the affidavit.

- Complete Identification Details: The form requires detailed identification of both the donor (the person giving the gift) and the recipient. This includes full legal names, addresses, and sometimes additional identifying information.

- No Monetary Exchange: A crucial aspect of this document is the declaration that no money or consideration is exchanged for the gift. The form typically necessitates a statement affirming that the gift is given freely, without any expectation of compensation.

- Description of the Gift: The affidavit requires a clear and thorough description of the item being gifted. For vehicles, this includes the make, model, year, VIN (Vehicle Identification Number), and current mileage.

- Notarization May Be Required: Depending on the jurisdiction and the specific requirements, the Florida Affidavit of Gift form may need to be notarized. This process adds a layer of legal authentication, confirming the identities of the parties involved and their signatures.

- Submit to Appropriate Authority: Once filled out, the form needs to be submitted to the relevant authority or department, often the Department of Motor Vehicles (DMV) if the gift is a vehicle. Timely submission is crucial to facilitate the transfer of title and registration.

- Keep Records: It is advisable for both the donor and recipient to keep copies of the completed affidavit for their records. This documentation can serve as proof of the transfer and may be important for future reference, especially for tax or legal inquiries.

Understanding and following these key points can smooth the process of gifting personal property in Florida, ensuring that all legal requirements are met and the transaction is properly documented and executed.

Fill out Popular Affidavit of Gift Forms for Different States

Title Transfer Texas - The affidavit can streamline the process of changing titles or registrations, particularly with items like cars or property.