Blank Ftc Identity Theft Affidavit PDF Template

When individuals find themselves ensnared in the complexities of identity theft, navigating the aftermath can be daunting. The FTC Identity Theft Affidavit form emerges as a vital tool in such trying times, offering a structured means for victims to articulate the specifics of their ordeal. Designed to be used in tandem with filing reports with law enforcement and engaging with credit reporting agencies and creditors, this form aids in disputing fraudulent activities and restoring financial integrity. With an average completion time of just 10 minutes, the form prompts for detailed information about the victim, including personal identification and addresses at the time of the fraud. It also inquires whether the victim authorized the use of their information, received any benefits from the fraudulent activities, and if they are willing to assist law enforcement in pursuing charges against the perpetrators. Crucially, the form serves as a declaration of the victim's desire to dispute unauthorized or incorrect information in their credit report, guiding them through detailing the inaccuracies and providing documentation to verify their identity. Furthermore, it allows individuals to list fraudulent accounts opened in their name, detailing the type of fraud committed, financial losses incurred, and any related contacts at the financial institutions involved. By completing the affidavit, victims take a pivotal step towards reclaiming their financial health and security, making it an indispensable component of the recovery process from identity theft.

Form Example

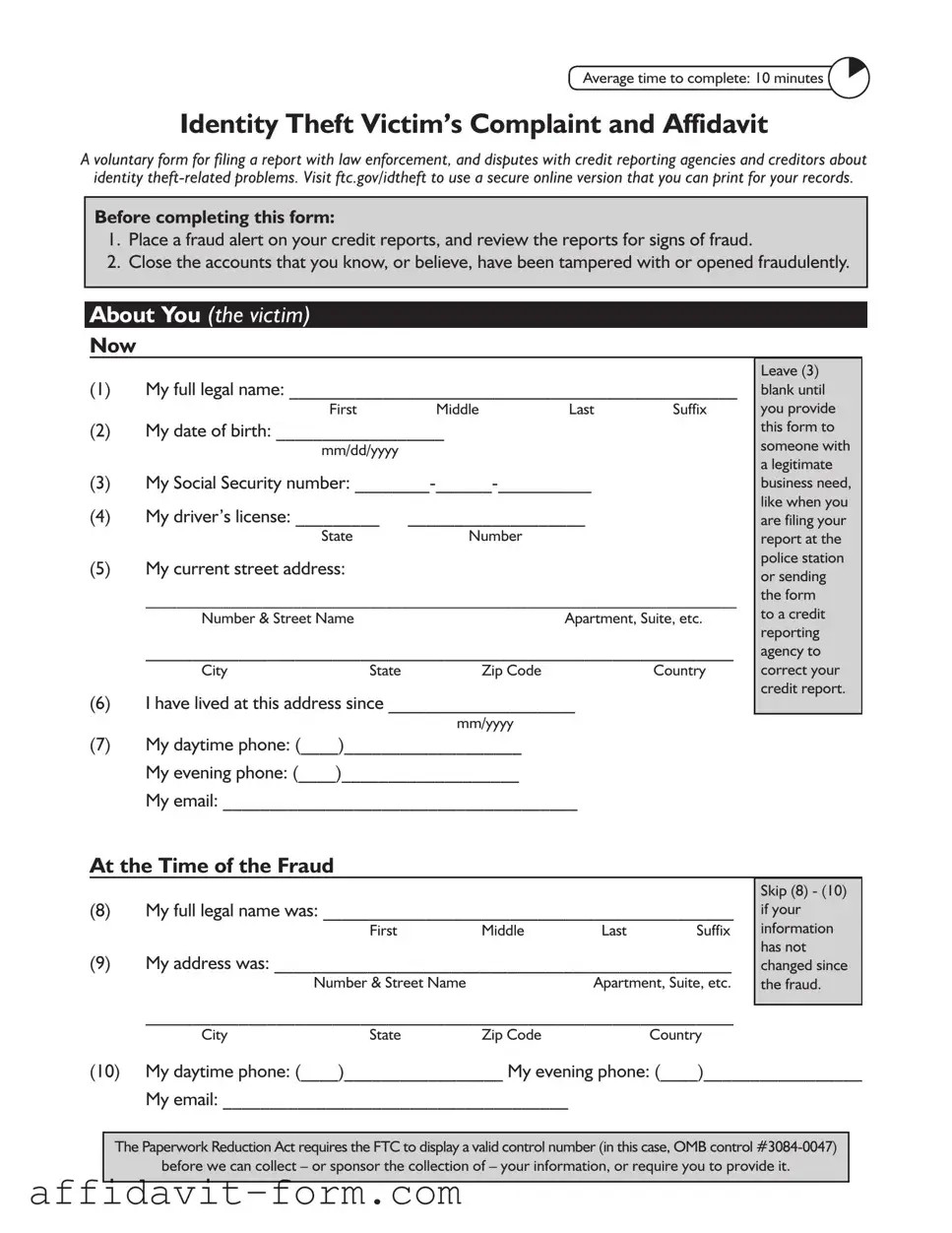

Average time to complete: 10 minutes

Identity Theft Victim’s Complaint and Affidavit

A voluntary form for filing a report with law enforcement, and disputes with credit reporting agencies and creditors about identity

Before completing this form:

1.Place a fraud alert on your credit reports, and review the reports for signs of fraud.

2.Close the accounts that you know, or believe, have been tampered with or opened fraudulently.

About You (the victim)

Now

(1)My full legal name: ________________________________________________

First |

Middle |

Last |

Suffix |

(2)My date of birth: __________________

mm/dd/yyyy

(3)My Social Security number:

(4) |

My driver’s license: _________ |

___________________ |

|

State |

Number |

(5)My current street address:

____________________________________________________________________________

Number & Street NameApartment, Suite, etc.

_______________________________________________________________

City |

State |

Zip Code |

Country |

(6)I have lived at this address since ____________________

mm/yyyy

(7)My daytime phone: (____)___________________

My evening phone: (____)___________________

My email: ______________________________________

Leave (3) blank until you provide this form to someone with

alegitimate business need, like when you are filing your report at the police station or sending the form

to a credit reporting agency to correct your credit report.

At the Time of the Fraud

(8)My full legal name was: ____________________________________________

First |

Middle |

Last |

Suffix |

(9)My address was: _________________________________________________

Number & Street Name |

Apartment, Suite, etc. |

Skip (8) - (10) if your information has not changed since the fraud.

_______________________________________________________________

City |

State |

Zip Code |

Country |

(10)My daytime phone: (____)_________________ My evening phone: (____)_________________

My email: _____________________________________

The Paperwork Reduction Act requires the FTC to display a valid control number (in this case, OMB control

before we can collect – or sponsor the collection of – your information, or require you to provide it.

Victim’s Name _______________________________ Phone number (____)_________________ Page 2

About You (the victim) (Continued)

Declarations

(11) |

I |

did |

OR |

did not |

authorize anyone to use my name or personal information to |

|

|

|

|

|

obtain money, credit, loans, goods, or services — or for any |

|

|

|

|

|

other purpose — as described in this report. |

(12) |

I |

did |

OR |

did not |

receive any money, goods, services, or other benefit as a |

|

|

|

|

|

result of the events described in this report. |

(13) |

I |

am |

OR |

am not |

willing to work with law enforcement if charges are brought |

|

|

|

|

|

against the person(s) who committed the fraud. |

About the Fraud

(14) I believe the following person used my information or identification |

(14): |

||||

Enter what |

|||||

documents to open new accounts, use my existing accounts, or commit other |

you know |

||||

fraud. |

|

|

|

about anyone |

|

|

|

|

|

you believe |

|

Name: ___________________________________________________ |

was involved |

||||

(even if you |

|||||

First |

Middle |

Last |

Suffix |

||

don’t have |

|||||

|

|

|

|

||

Address: __________________________________________________ |

complete |

||||

information). |

|||||

Number & Street Name |

Apartment, Suite, etc. |

|

|||

__________________________________________________________ |

|

||||

City |

State |

Zip Code |

Country |

|

|

Phone Numbers: (____)_______________ (____)________________

Additional information about this person: _____________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

Victim’s Name _______________________________ Phone number (____)_________________ Page 3

(15)Additional information about the crime (for example, how the identity thief gained access to your information or which documents or information were used):

________________________________________________________________

________________________________________________________________

________________________________________________________________

(14)and (15): Attach additional sheets as needed.

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

Documentation

(16)I can verify my identity with these documents:

A valid

A valid

If you are under 16 and don’t have a

Proof of residency during the time the disputed charges occurred, the loan was made, or the other event took place (for example, a copy of a rental/lease agreement in my name, a utility bill, or an insurance bill).

Proof of residency during the time the disputed charges occurred, the loan was made, or the other event took place (for example, a copy of a rental/lease agreement in my name, a utility bill, or an insurance bill).

(16): Reminder: Attach copies of your identity documents when sending this form to creditors

and credit reporting agencies.

About the Information or Accounts

(17)The following personal information (like my name, address, Social Security number, or date of birth) in my credit report is inaccurate as a result of this identity theft:

(A)__________________________________________________________________________

(B)__________________________________________________________________________

(C)__________________________________________________________________________

(18)Credit inquiries from these companies appear on my credit report as a result of this identity theft:

Company Name: _______________________________________________________________

Company Name: _______________________________________________________________

Company Name: _______________________________________________________________

Victim’s Name _______________________________ Phone number (____)_________________ Page 4

(19)Below are details about the different frauds committed using my personal information.

___________________________________________________________________

Name of InstitutionContact Person Phone Extension

___________________________________________________________________

Account Number |

|

Routing Number |

Affected Check Number(s) |

|||

Account Type: |

Credit |

Bank |

Phone/Utilities |

Loan |

|

|

|

Government Benefits |

Internet or Email |

Other |

|||

Select ONE:

This account was opened fraudulently.

This account was opened fraudulently.

This was an existing account that someone tampered with.

This was an existing account that someone tampered with.

___________________________________________________________________

Date Opened or Misused (mm/yyyy) Date Discovered (mm/yyyy) Total Amount Obtained ($)

___________________________________________________________________

Name of InstitutionContact Person Phone Extension

___________________________________________________________________

Account Number |

|

Routing Number |

Affected Check Number(s) |

|||

Account Type: |

Credit |

Bank |

Phone/Utilities |

Loan |

|

|

|

Government Benefits |

Internet or Email |

Other |

|||

Select ONE:

This account was opened fraudulently.

This account was opened fraudulently.

This was an existing account that someone tampered with.

This was an existing account that someone tampered with.

___________________________________________________________________

Date Opened or Misused (mm/yyyy) Date Discovered (mm/yyyy) Total Amount Obtained ($)

___________________________________________________________________

Name of InstitutionContact Person Phone Extension

___________________________________________________________________

Account Number |

|

Routing Number |

Affected Check Number(s) |

|||

Account Type: |

Credit |

Bank |

Phone/Utilities |

Loan |

|

|

|

Government Benefits |

Internet or Email |

Other |

|||

Select ONE:

This account was opened fraudulently.

This account was opened fraudulently.

This was an existing account that someone tampered with.

This was an existing account that someone tampered with.

___________________________________________________________________

Date Opened or Misused (mm/yyyy) Date Discovered (mm/yyyy) Total Amount Obtained ($)

(19):

If there were more than three frauds, copy this page blank, and attach as many additional copies as necessary.

Enter any applicable information that you have, even if it is incomplete or an estimate.

If the thief committed two types of fraud at one company, list the company twice, giving the information about the two frauds separately.

Contact Person: Someone you dealt with, whom an investigator can call about this fraud.

Account Number: The number of the credit or debit card, bank account, loan, or other account that was misused.

Dates: Indicate when the thief began to misuse your information and when you discovered the problem.

Amount Obtained: For instance, the total amount purchased with the card or withdrawn from the account.

Victim’s Name _______________________________ Phone number (____)_________________ Page 5

Your Law Enforcement Report

(20)One way to get a credit reporting agency to quickly block identity theft- related information from appearing on your credit report is to submit a detailed law enforcement report (“Identity Theft Report”). You can obtain an Identity Theft Report by taking this form to your local law enforcement office, along with your supporting documentation. Ask an officer to witness your signature and complete the rest of the information in this section. It’s important to get your report number, whether or not you are able to file in person or get a copy of the official law enforcement report. Attach a copy of any confirmation letter or official law enforcement report you receive when sending this form to credit reporting agencies.

Select ONE:

I have not filed a law enforcement report.

I have not filed a law enforcement report.

I was unable to file any law enforcement report.

I was unable to file any law enforcement report.

I filed an automated report with the law enforcement agency listed below.

I filed an automated report with the law enforcement agency listed below.

I filed my report in person with the law enforcement officer and agency listed below.

I filed my report in person with the law enforcement officer and agency listed below.

____________________________________________________________________

Law Enforcement DepartmentState

____________________________ |

_____________________ |

Report Number |

Filing Date (mm/dd/yyyy) |

(20):

Check “I have not...” if you have not yet filed a report with law enforcement or you have chosen not to. Check “I was unable...” if you tried to file a report but law enforcement refused to take it.

Automated report:

Alaw enforcement report filed through an automated system, for example, by telephone, mail, or the Internet, instead of a

____________________________________________________________________

Officer’s Name (please print)Officer’s Signature

____________________________ |

(____)_______________ |

|

|

Badge Number |

Phone Number |

|

|

Did the victim receive a copy of the report from the law enforcement officer? |

Yes OR |

No |

|

Victim’s FTC complaint number (if available): ________________________ |

|

|

|

Victim’s Name _______________________________ Phone number (____)_________________ Page 6

Signature

As applicable, sign and date IN THE PRESENCE OF a law enforcement officer, a notary, or a witness.

(21)I certify that, to the best of my knowledge and belief, all of the information on and attached to this complaint is true, correct, and complete and made in good faith. I understand that this complaint or the information it contains may be made available to federal, state, and/or local law enforcement agencies for such action within their jurisdiction as they deem appropriate. I understand that knowingly making any false or fraudulent statement or representation to the government may violate federal, state, or local criminal statutes, and may result in a fine, imprisonment, or both.

_______________________________________ |

_________________________________________ |

Signature |

Date Signed (mm/dd/yyyy) |

Your Affidavit

(22)If you do not choose to file a report with law enforcement, you may use this form as an Identity Theft Affidavit to prove to each of the companies where the thief misused your information that you are not responsible for the fraud. While many companies accept this affidavit, others require that you submit different forms. Check with each company to see if it accepts this form. You should also check to see if it requires notarization. If so, sign in the presence of a notary. If it does not, please have one witness

_______________________________________

Notary

Witness:

_______________________________________ |

_________________________________________ |

Signature |

Printed Name |

_______________________________________ |

_________________________________________ |

Date |

Telephone Number |

Document Features

| Fact | Description |

|---|---|

| Purpose | The FTC Identity Theft Affidavit form is a voluntary document for reporting identity theft to law enforcement, and disputing issues with credit reporting agencies and creditors. |

| Average Completion Time | It takes an average of 10 minutes to complete the form. |

| Pre-Completion Steps | Before completing the form, individuals are advised to place a fraud alert on their credit reports and close any accounts that have been fraudulently opened or tampered with. |

| Online Availability | A secure online version of the form can be found and completed at ftc.gov/idtheft, which can then be printed for the individual's records. |

How to Use Ftc Identity Theft Affidavit

Filling out the FTC Identity Theft Affidition Affidavit form is a critical step for victims of identity theft to officially report the crime and begin the process of dispute with credit reporting agencies and creditors. This document serves as a sworn statement, evidencing the unauthorized use of your information and aids in the recovery process. Though it may appear daunting at first, completing the form is straightforward if you follow these steps diligently.

- Start by placing a fraud alert on your credit reports. This action warns creditors of potential fraud within your report, encouraging them to take extra steps to verify your identity before extending credit.

- Review your credit reports carefully for any signs of fraud such as accounts you don't recognize.

- Close any accounts that have been tampered with or opened fraudulently.

- Provide your full legal name, including your first, middle, last name, and any suffix, in the designated section.

- Enter your date of birth in the format mm/dd/yyyy.

- Leave the Social Security number section blank until you are ready to submit the form to a legitimate entity such as law enforcement or a credit reporting agency.

- Fill in your driver's license details, including the state and number. If you do not have a driver's license, you may need to attach an alternative form of identification.

- Input your current street address, including any apartment or suite number, city, state, zip code, and country.

- Indicate how long you have lived at your current address with the format mm/yyyy.

- Provide your daytime and evening phone numbers, alongside your email address.

- If your information at the time of fraud was different from your current information, repeat steps 4 through 10 for the "At the Time of the Fraud" section. If your information has not changed, skip this step.

- Under the Declarations section, mark whether you authorized anyone to use your name or personal information, whether you received any benefits from the events reported, and if you are willing to work with law enforcement.

- In the section about the fraud, detail any individuals you suspect were involved, including their name, address, and any additional information you can provide.

- Provide a description of how the identity thief accessed your information and the specific acts of fraud committed with your identity.

- Attach additional sheets if necessary to provide complete details about the crime and any other relevant information.

- List documents that can verify your identity, such as a government-issued photo ID or proof of residency during the time the fraud occurred.

- Outline the inaccuracies in your credit report caused by the identity theft, including any incorrect personal information or accounts.

- Identify any companies making credit inquiries that appear on your report as a result of the fraud.

- Detail the fraud committed using your personal information, including the names of institutions, contact persons, account numbers, and the nature of the fraud (e.g., opened fraudulently or existing accounts tampered with).

- Proceed to report the identity theft to your local law enforcement agency. Take this form along with your supporting documentation to obtain an Identity Theft Report. Mark the appropriate section to indicate whether you have filed a report, were unable to, or filed an automated report. Ensure to get the officer's name, signature, badge number, and report number.

After filling out the Identity Theft Affidavit, attach copies of all supporting documentation, including any law enforcement reports or confirmation letters received. Send the completed form and attachments to the necessary credit reporting agencies and creditors to officially dispute the fraudulent activity and begin the process of restoring your credit and reclaiming your identity.

Listed Questions and Answers

What is the FTC Identity Theft Affidavit Form?

The FTC Identity Theft Affidavit Form is a document provided by the Federal Trade Commission to help victims of identity theft report information to law enforcement and dispute fraudulent accounts or transactions with credit reporting agencies and creditors. It serves as a comprehensive way to document unauthorized use of personal information for obtaining money, credit, loans, goods, or services.

How long does it take to complete this form?

On average, it takes about 10 minutes to complete the FTC Identity Theft Affidavit Form. This time can vary depending on the specifics of the identity theft incident and how much information the victim can provide.

What steps should I take before filling out this form?

Before filling out the form, you should:

- Place a fraud alert on your credit reports.

- Review your credit reports for signs of fraud.

- Close any accounts that you know or believe have been tampered with or opened fraudulently.

What information do I need to provide in the affidavit?

The affidavit requires detailed personal information, both at the time of completing the form and at the time the fraud occurred. This includes your full legal name, date of birth, Social Security number, driver’s license, current address, and contact details. It also requires information on the unauthorized use of your identity, including details about the fraudster if known, and a descriptive account of the crimes committed using your identity.

Is there a need to include supporting documentation?

Yes. You should attach copies of documents that verify your identity, such as a government-issued photo ID, proof of residency during the time the fraud occurred, and any other relevant documentation. This helps to substantiate your claim when you submit the form to creditors and credit bureaus.

Can I submit this form online?

While there is a secure online version available that you can print for your records, the FTC recommends visiting ftc.gov/idtheft for guidance on how to use and submit the form securely. This ensures that your sensitive information is protected throughout the process.

What should I do after completing the form?

After completing the form, you should take it to your local law enforcement office with your supporting documentation. Ask an officer to witness your signature and complete the rest of the information in the law enforcement section of the form. Obtaining an official law enforcement report or a detailed Identity Theft Report can help you in dealing with credit reporting agencies and disputing fraudulent information effectively.

What if law enforcement refuses to take a report?

If law enforcement refuses to take a report, you can check the box on the form indicating this issue. It’s important to attempt to file a report since a law enforcement report can be instrumental in removing fraudulent information from your credit report and resolving issues with creditors. Consider contacting another law enforcement agency or your state attorney general’s office if you encounter difficulties in filing a report.

Common mistakes

Filling out the FTC Identity Theft Affidavit form is a critical step for identity theft victims in reclaiming their financial health and personal security. However, mistakes can significantly delay or even derail the process. Understanding the most common errors can help individuals avoid these pitfalls and ensure their affidavits are processed smoothly and efficiently. Here are five typical mistakes:

Not placing a fraud alert on credit reports before completing the form. This oversight can lead to further unauthorized activities and complications with credit reporting agencies.

Leaving sensitive information, like the Social Security number (Item 3), filled out in advance. This form might be sent via mail or carried in public, where it can be lost or stolen, exacerbating the identity theft issue.

Omitting details about the identity theft or not being specific enough in the descriptions. For example, simply stating 'fraudulent activities' instead of providing detailed accounts and evidence can lead to insufficient investigation and resolution.

Forgetting to attach copies of the necessary identity verification documents (Item 16). Without these documents, proving one's identity and the legitimacy of the claim becomes more challenging.

Failing to obtain or unable to provide a law enforcement report number (Item 20). This number is crucial for the credit reporting agencies to quickly block fraudulent information from appearing on the victim's credit report.

To avoid these mistakes:

Always review your credit reports and place a fraud alert on them as soon as you suspect identity theft.

Be meticulous in completing the form; ensure that you do not preemptively fill out sensitive information until it's necessary.

Provide as much specific information about the fraud as you can, including dates, amounts, and how the thief accessed your information.

Remember to attach all required documents, such as your government-issued ID and proof of residence during the time of the fraudulent activities.

Make it a priority to get a law enforcement report and include the report number with your affidavit to aid in the quick processing of your case.

By avoiding these common mistakes, victims of identity theft can assist in ensuring their cases are processed quickly and efficiently, helping to minimize the damage and stress caused by identity theft.

Documents used along the form

When dealing with identity theft, it is crucial to take immediate and comprehensive action to protect one's identity and financial resources. The FTC Identity Theft Affidavit is a vital document for victims, serving as a formal declaration of the situation to various entities, including credit reporting agencies and law enforcement. However, this form often works best when accompanied by other important documents that together provide a fuller picture of the identity theft incident and help facilitate the recovery process.

- Police Report: An official report filed with local law enforcement detailing the identity theft. It lends authority to a victim’s claim and is necessary for certain procedural steps.

- Proof of Identity: A government-issued photo ID, such as a driver's license or passport, confirms the victim's identity when disputing fraudulent accounts and transactions.

- Proof of Address: Utility bills, rental agreements, or insurance statements showing the victim's address at the time of the theft help verify residency and refute fraudulent claims.

- Credit Report: Reports from the three major credit bureaus (Equifax, TransUnion, and Experian) showing all accounts and activities. Victims need these to identify fraudulent accounts and disputes inaccuracies.

- Fraud Alert Requests: Documentation that the victim has requested a fraud alert to be placed on their credit files as a preventive measure against further fraud.

- Account Statements: Copies of statements for any accounts that have been tampered with. These are essential for proving unauthorized transactions.

- Credit Freeze Confirmation: Documents confirming that the victim has placed a freeze on their credit, preventing new accounts from being opened in their name.

- Dispute Letters: Correspondence sent to credit bureaus and creditors disputing fraudulent accounts or transactions. These letters should reference the FTC Identity Theft Affidavit and any police reports filed.

Together, these documents build a comprehensive package that victims can use to reclaim their identity and rectify their financial history. Each document plays a specific role in the recovery process, from proving the victim's identity and residency to disputing fraudulent transactions and safeguarding against future theft. It's therefore imperative for individuals to compile these documents as rapidly and thoroughly as possible following the discovery of identity theft.

Similar forms

The FTC Identity Theft Affidavit form is similar to other important documents used in legal and financial settings for verifying identity and disputing unauthorized transactions. Two notable examples are the Police Report for Identity Theft and the Dispute Letter to Credit Bureaus. Each document, while serving its specific purpose, shares commonalities in protecting individuals from the implications of identity theft.

The Police Report for Identity Theft is an essential document that victims must file when their identity is stolen. Like the FTC Identity Theft Affidavit, it serves as an official statement to law enforcement detailing the identity theft incident. Both documents are crucial for establishing the legitimacy of one’s claim. However, the police report specifically ties the incident to law enforcement, attesting to the seriousness of the matter and triggering a formal investigation. It often includes detailed information about the theft, similar to the affidavit, but it is endorsed by a police officer, which can add an additional layer of official recognition when disputing fraudulent transactions or accounts opened in the victim’s name.

A Dispute Letter to Credit Bureau

Dos and Don'ts

When filling out the FTC Identity Theft Affidavit form, there are important steps to follow and mistakes to avoid to ensure your information is accurately reported and your identity protection is initiated correctly. Here are five dos and don'ts:

- Do place a fraud alert on your credit reports before filling out the form. This step is crucial in preventing further misuse of your personal information.

- Do review your credit reports for any signs of fraud. Look for accounts or transactions you don't recognize, as these could be indications of identity theft.

- Do close any accounts that have been tampered with or opened fraudulently. It's important to take action to minimize damage and prevent further unauthorized use of your information.

- Do provide detailed information about the identity theft, including any accounts opened or misused in your name. Providing as much information as possible can help in the investigation and resolution of your case.

- Do attach copies of your identity documents when sending this form to creditors and credit reporting agencies, as recommended. This helps verify your identity and supports your affidavit.

- Don't leave the Social Security number field filled out when making copies or if you're unsure of the form's security. The form suggests leaving it blank until necessary for a legitimate business need.

- Don't skip the step of filing a law enforcement report. A detailed law enforcement report can expedite the removal of fraudulent information from your credit report.

- Don't forget to review and correct any inaccuracies in your personal information section of the form, such as your name, address, and contact information, to ensure communication about your case can be accurately directed to you.

- Don't neglect to indicate whether or not you authorized someone to use your name or personal information, as this information is critical in distinguishing fraudulent activities from authorized ones.

- Don't withhold any information you have about the identity thief, even if it's incomplete. Any detail can be valuable in the investigation of your case.

Misconceptions

When it comes to identity theft, the process of documenting and reporting the incident can be overwhelming. The Federal Trade Commission (FTC) Identity Theft Affidavit is a crucial tool in this process, yet there are several misconceptions about how it should be used and what it accomplishes. Here are ten common misunderstandings:

It's only for reporting to the FTC: While the FTC Identity Theft Affidavit is primarily designed for reporting identity theft to the FTC, it's also used to report the incident to creditors, credit reporting agencies, and law enforcement, assisting in disputed claims and removing fraudulent information from credit reports.

It immediately fixes your credit report: Submitting an Identity Theft Affidavit is an important step, but it doesn't instantly resolve all issues. It's the beginning of a process involving investigation and dispute resolution by credit reporting agencies and creditors.

The process is quick: The average time to complete the form is around 10 minutes, but resolving identity theft can take significantly longer, depending on the complexity and severity of the fraud.

You need a police report to file it: Filing a police report is advisable but not mandatory to submit an Identity Theft Affidavit. However, having a police report can strengthen your case and assist in removing fraudulent information.

All fields must be completed: Some sections of the form instruct you to leave them blank if they do not apply to your situation, such as certain personal information or details about the fraud. It's crucial to provide accurate and applicable information.

It guarantees the prevention of future theft: While the affidavit is instrumental in dealing with current instances of identity theft, it doesn't ensure protection against future occurrences. Continuous monitoring of your accounts and credit reports is essential.

You must mail it to the FTC: The FTC encourages filing the affidavit online through their secure website, which also allows you to print a copy for your records. Mailing is an option but not a requirement.

It replaces a credit freeze: The affidavit is a report of identity theft, whereas a credit freeze is a tool to restrict access to your credit report, preventing new accounts from being opened in your name. Both are important but serve different purposes.

Submitting the form will automatically close fraudulent accounts: While the affidavit assists in disputing fraudulent accounts, it's up to the individual to contact creditors and follow through to ensure accounts are closed or corrected.

It’s only for adults: Minors can also be victims of identity theft, and their guardians can fill out the affidavit on their behalf, using alternative documentation for verification, such as birth certificates or school records, when photo ID is not available.

Understanding these common misconceptions about the FTC Identity Theft Affidavit can help victims of identity theft navigate the process more effectively and take appropriate steps towards resolution.

Key takeaways

Falling victim to identity theft can be a distressing experience, but taking decisive actions can help mitigate the damage. One crucial step is filling out the FTC Identity Theft Affidavit form. This form plays a pivotal role in the recovery process, providing victims with a standardized way to report the theft to various agencies and dispute fraudulent transactions or accounts opened in their name. Here are key takeaways to remember when dealing with this important document:

- Start by placing a fraud alert on your credit reports before filling out the affidavit, and make sure to review your credit reports for any signs of unauthorized activities.

- Securely complete the form online at ftc.gov/idtheft to have a digital record that's easy to share with law enforcement and creditors, while also retaining a printed copy for your files.

- When providing personal information, leave sensitive fields like your Social Security number blank until you're sure it's required and being submitted to a legitimate entity.

- The affidavit requires detailed information about the theft, including any accounts opened or tampered with fraudulently. Providing as much information as possible can assist in the investigation and resolution of your case.

- Documentation is key. Attach copies of any identity documents (like your driver's license or passport) when you send this form to creditors and credit reporting agencies, as proof of your identity and residency during the time the fraud occurred.

- Update your personal information if it has changed since the time of the fraud to ensure accurate records on file with law enforcement and credit agencies.

- It's imperative to report the identity theft to local law enforcement and obtain a report number. A detailed law enforcement report can expedite the removal of fraudulent information from your credit report.

- Declare whether you authorized anyone to use your information for obtaining money, goods, or services, and state whether you received any benefit from the fraudulently opened accounts or transactions.

- Be prepared to work with law enforcement, as expressing your willingness to cooperate can be crucial in prosecuting the perpetrators.

Addressing identity theft is no small feat, yet with the FTC Identity Theft Affidavit and the right approach, victims can take significant strides towards reclaiming their financial safety and security. Remember, it's not only about disputing fraudulent charges or accounts but also about protecting oneself against future fraud. Vigilance and prompt action are your best defenses.

Common PDF Documents

Green Card Affidavit of Support - The I-864A binds a household member and a sponsor together in a mutual commitment to support an immigrant.

Florida Divorce Financial Affidavit - Contains sections for detailed reporting of both gross income and monthly deductions to arrive at net monthly income.