Printable Small Estate Affidavit Form for Georgia

In the state of Georgia, the process of handling a deceased person's estate can be streamlined for smaller estates by using a Small Estate Affidavit form. This form serves as a simplified tool for the rightful heirs or beneficiaries to claim the deceased's property without the need for a prolonged probate process. It's intended for use when the total value of the estate does not exceed certain financial thresholds set by state law, making it a valuable option for those looking to settle affairs efficiently and with minimal legal intervention. The Small Estate Affaidavit form necessitates the provision of detailed information about the decedent's assets, the claiming individual's relationship to the deceased, and any outstanding debts. By completing this form, individuals affirm under oath their right to collect the property, aiming to facilitate a smoother transition of assets. However, it's crucial to understand the specific criteria and stipulations involved in this process to ensure it's the appropriate legal course to take. This introduction touches upon the fundamentals of the Georgia Small Estate Affidavit form, highlighting its purpose, requirements, and the potential benefits it offers during a time that can be both emotionally and administratively challenging.

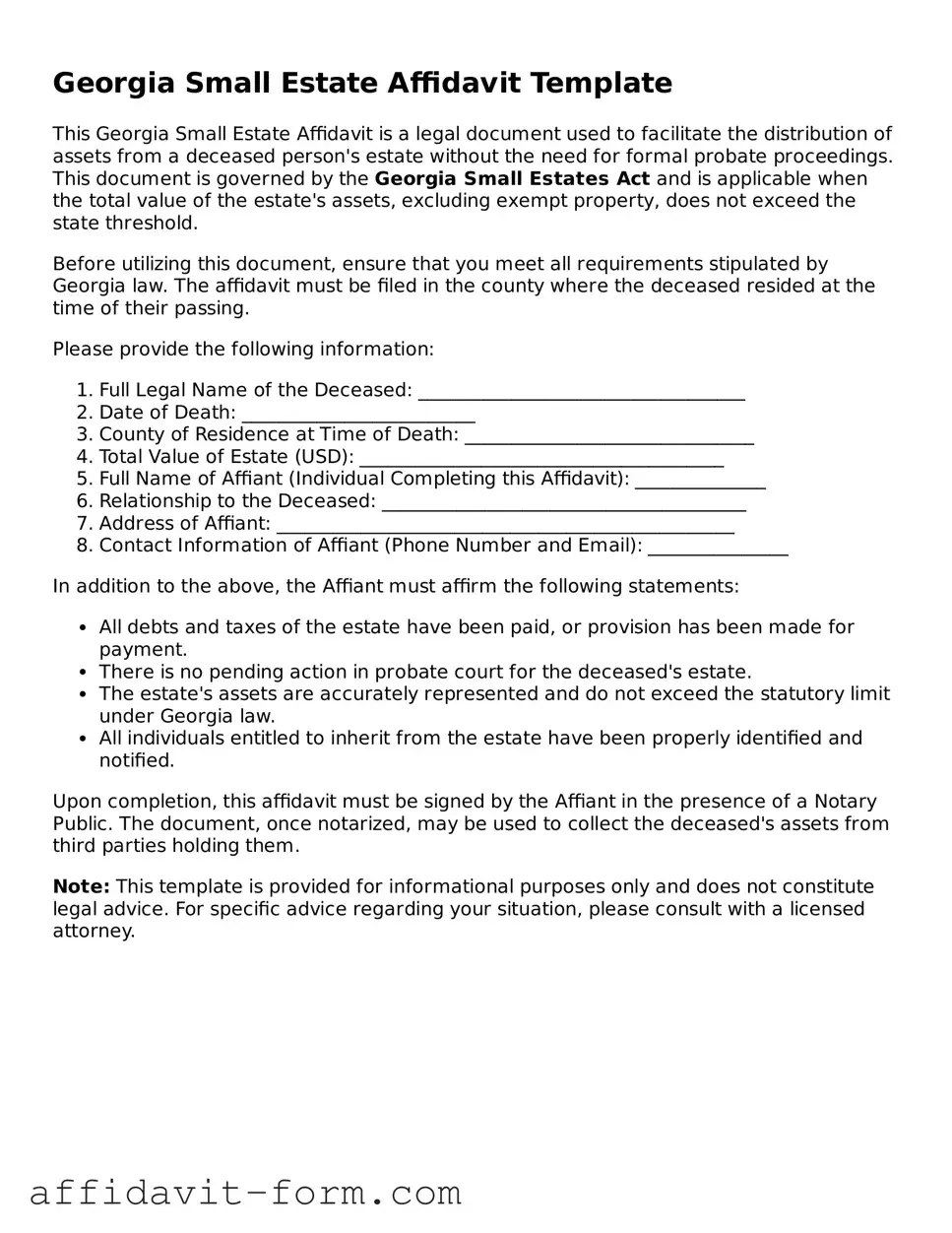

Form Example

Georgia Small Estate Affidavit Template

This Georgia Small Estate Affidavit is a legal document used to facilitate the distribution of assets from a deceased person's estate without the need for formal probate proceedings. This document is governed by the Georgia Small Estates Act and is applicable when the total value of the estate's assets, excluding exempt property, does not exceed the state threshold.

Before utilizing this document, ensure that you meet all requirements stipulated by Georgia law. The affidavit must be filed in the county where the deceased resided at the time of their passing.

Please provide the following information:

- Full Legal Name of the Deceased: ___________________________________

- Date of Death: _________________________

- County of Residence at Time of Death: _______________________________

- Total Value of Estate (USD): _______________________________________

- Full Name of Affiant (Individual Completing this Affidavit): ______________

- Relationship to the Deceased: _______________________________________

- Address of Affiant: _________________________________________________

- Contact Information of Affiant (Phone Number and Email): _______________

In addition to the above, the Affiant must affirm the following statements:

- All debts and taxes of the estate have been paid, or provision has been made for payment.

- There is no pending action in probate court for the deceased's estate.

- The estate's assets are accurately represented and do not exceed the statutory limit under Georgia law.

- All individuals entitled to inherit from the estate have been properly identified and notified.

Upon completion, this affidavit must be signed by the Affiant in the presence of a Notary Public. The document, once notarized, may be used to collect the deceased's assets from third parties holding them.

Note: This template is provided for informational purposes only and does not constitute legal advice. For specific advice regarding your situation, please consult with a licensed attorney.

Document Details

| Fact | Description |

|---|---|

| Governing Law | Georgia's small estate procedure is governed by O.C.G.A. § 53-2-40, which outlines the process for utilizing a Small Estate Affidavit. |

| Eligibility | To be eligible to use the Georgia Small Estate Affidavit, the deceased's estate must not exceed $10,000 in value and must not include real estate. |

| Waiting Period | Before filing a Small Estate Affidavit in Georgia, a period of 30 days must have passed since the death of the decedent. |

| Intended Use | The form is specifically geared towards the collection of personal property by a successor without going through the formal probate process. It also can be used to claim wages, bank accounts, and other assets belonging to the deceased. |

How to Use Georgia Small Estate Affidavit

Preparing a Small Estate Affidavit in Georgia is a necessary step for those seeking to manage the assets of a deceased person's estate under certain conditions, bypassing the need for a full probate process. This document allows for the transfer of the decedent’s property to rightful heirs or beneficiaries when the estate falls under a specified value threshold. Recognizing the intricate details and ensuring accuracy throughout the form is crucial for a smooth process. The following steps provide guidance on how to fill out this important document:

- First, gather all necessary information about the deceased person's estate, including asset values and debts. Accurate information is key to determining eligibility for using a Small Estate Affidavit in Georgia.

- Locate the Georgia Small Estate Affidavit form. This can often be found online through the county probate court's website or by visiting the court in person.

- Start by filling in the full legal name of the deceased person (also known as the decedent) at the top of the form.

- Enter your name and address as the affiant, the person completing and submitting the affidavit. Clearly identify your relationship to the decedent or your interest in the estate.

- List all known assets of the decedent within the affidavit. This includes bank accounts, vehicles, real estate located in Georgia, and personal property. Be sure to include the value of each asset.

- Detail any known debts owed by the estate, including funeral expenses, outstanding bills, and taxes. This information helps the court understand the liabilities of the estate.

- Provide the names and addresses of potential heirs, and specify their relationship to the decedent. This part ensures all interested parties are accounted for.

- Read through the affidavit carefully to ensure all the information is accurate and complete. Accuracy is crucial to avoid delays.

- Sign the affidavit in front of a notary public. This step makes the document legally binding. Be prepared to provide identification for this process.

- Submit the completed affidavit to the appropriate county’s probate court along with any required filing fees.

Once submitted, the court will review the affidavit. If approved, the document will serve as authorization to collect the decedent’s assets for distribution according to the affidavit’s statements without undergoing the standard, lengthier probate process. Patience during this time is important, as the review period can vary based on the court's caseload and specific details of the estate. Remember, this document is a vital step in managing the small estate efficiently and effectively, paving the way for a streamlined distribution of assets to beneficiaries.

Listed Questions and Answers

What is a Georgia Small Estate Affidavit?

A Georgia Small Estate Affidavit is a legal document used to settle smaller estates without a formal probate process. It allows the transfer of the deceased person's property to their heirs or beneficiaries, given the total value of the estate meets the state-defined threshold and other specific conditions are met.

Who can file a Small Estate Affidavit in Georgia?

In Georgia, the right to file a Small Estate Affidavit typically belongs to a surviving spouse, adult children of the deceased, or other next of kin. In some cases, a creditor of the deceased who has not been paid may also file the affidavit, if no other person has taken on the responsibility to handle the estate within a certain time frame.

What are the requirements for filing a Small Estate Affidavit in Georgia?

To file a Small Estate Affidavit in Georgia, the following conditions must be met:

- The total value of the deceased's estate, excluding the value of the homestead and exempt property, must not exceed a certain threshold set by state law.

- At least 30 days have passed since the death of the estate's owner.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- All known debts and taxes of the estate must have been paid or provided for.

What is the current value threshold for using a Small Estate Affidavit in Georgia?

The value threshold for using a Small Estate Affidavit in Georgia is subject to change according to state law updates. As such, individuals are encouraged to check the latest statutes or consult with a legal professional to get the most current threshold information.

What kind of property can be transferred using a Small Estate Affidaffit in Georgia?

Property that can be transferred using a Small Estate Affidavit in Georgia includes personal property such as bank accounts, stocks, and automobiles. Real estate or other real property cannot typically be transferred using this affidavit in Georgia.

What steps should be taken after completing a Small Estate Affidavit in Georgia?

After completing a Small Estate Affidavit in Georgia, the following steps are typically necessary:

- Ensure the affidavit is signed in the presence of a notary public.

- Present the affidavit to the entity holding the property, such as a bank or other financial institution, to request the transfer of assets.

- Keep a copy of the affidavit for your records.

- If applicable, notify any other potential heirs or interested parties about the affidavit and the transfer of assets.

Common mistakes

When dealing with the Georgia Small Estate Affidavit form, a tool used to manage estates valued under a certain threshold, there are several common mistakes individuals make. It's essential to pay careful attention to the details and instructions to avoid these errors, which can delay the process or lead to the form being rejected. Here are seven of the most common mistakes:

Not waiting the required period after the decedent's death. The state of Georgia mandates a specific waiting period before the affidavit can be filed. Filling out the form too early can lead to automatic rejection.

Failing to accurately list all of the decedent's assets. Every asset, no matter how small, should be included to ensure the affidavit is processed correctly and completely.

Incorrectly valuing the estate. It's crucial to provide an accurate estimation of the total value of the estate to confirm it falls under the small estate threshold in Georgia.

Omitting the required legal documentation. Documents such as the death certificate and any other legal documents verifying the heirs or beneficiaries must be attached, as required by Georgia law.

Not obtaining the necessary signatures. The affidavit requires signatures from all beneficiaries or heirs, and failing to secure all necessary signatures can result in the form being unprocessable.

Using incorrect or outdated forms. The State of Georgia may update the affidavit form. Using an outdated version can lead to rejection. Always check for the most recent version.

Misunderstanding the qualifications for using the affidavit. Not all estates qualify for the small estate process. Misunderstanding the criteria, such as the estate's value or types of assets, can lead to incorrect submissions.

By avoiding these common errors and thoroughly reviewing the form and its requirements, individuals can ensure the smooth processing of the Georgia Small Estate Affidavit. It might also be beneficial to consult with a legal professional to navigate the complexities of estate management and ensure compliance with Georgia laws.

Documents used along the form

When dealing with the estate of a deceased person in Georgia, especially when it is valued at a threshold that qualifies it as a "small estate," the Georgia Small Estate Affidavit form becomes crucial for a simpler, expedited process. However, there are several other documents usually required or utilized alongside this form to ensure the deceased's assets are lawfully distributed to their rightful heirs or to settle any outstanding debts. These documents, varied in their purposes, play pivotal roles in the comprehensive execution of a small estate's legal and financial matters. Descriptions of up to five of these documents highlight their significance in the broader context of estate management.

- Certificate of Death: This government-issued document serves as official proof of death and is fundamental in initiating almost all estates' administrative procedures. It is required to access bank accounts, file for life insurance claims, and execute the Small Estate Affidavit among other legal transactions.

- Will: If the deceased left a will, it details their final wishes regarding the distribution of assets and the guardianship of any dependents. Wills are crucial for guiding the execution of the estate, though in the case of a small estate affidavit, may not always directly affect the affidavit process, especially if the estate falls under laws of intestacy or if the assets bypass probate.

- Letters of Administration or Letters Testamentary: These documents are granted by the probate court, authorizing a person (the executor or administrator) to conduct transactions on behalf of the estate. They are necessary when the Small Estate Affidavit requires formal probate proceedings or when there is a need to express legal authority beyond what the affidavit provides.

- Bank Statements and Financial Records: Recent bank statements and other financial records of the deceased are often required to ascertain the estate's value. They provide a factual basis for the Small Estate Affidavit by detailing the assets in the estate and ensuring that they do not exceed the threshold for a small estate under Georgia law.

- Real Estate Deeds: If the estate includes real property, deeds and other records proving ownership are essential. These documents confirm the estate's interest in the property and may be necessary to transfer ownership or sell the property as part of the estate settlement process.

Together, these documents form a comprehensive framework for the management and execution of a small estate in Georgia. Each plays a distinct role in ensuring that the affair is conducted according to the laws of the state, the wishes of the deceased, and the best interests of the heirs. Navigating through the process requires attention to detail and an understanding of how these documents interrelate within the larger scope of estate administration.

Similar forms

The Georgia Small Estate Affidavit form is similar to a number of other legal documents used to manage and settle personal and estate affairs. Each document serves distinct purposes, but they all streamline processes that might otherwise be cumbersome and time-consuming. These documents ensure that the rights of individuals are protected, while also adhering to state laws and regulations. Among these, the most notable are the Transfer on Death Deed and the Durable Power of Attorney for Finances.

Transfer on Death Deed (TODD): This legal document allows property owners to designate beneficiaries to receive their property upon their death, bypassing the probate process. Like the Georgia Small Estate Affidavit, the TODD offers a more straightforward means of transferring assets. However, while the Small Estate Affidavit is used to claim assets from a deceased person's estate under certain monetary thresholds, the TODD specifically deals with real estate ownership transfer upon the owner's death. Both instruments avoid probate but are applied in different contexts: one for a variety of assets up to a certain value, and the other exclusively for real estate.

Durable Power of Attorney for Finances (DPOA): This document enables an individual to authorize another person to make financial decisions on their behalf, typically in the event they become incapacitated. Although the DPOA is used while the individual is alive and the Small Estate Affidavit is used after death, both streamline the management of assets by circumventing lengthy processes. The DPOA allows for immediate financial management without court intervention, similar to how a Small Estate Affidavit expedites asset distribution without probate. Both documents facilitate ease in asset management but at different stages of an individual's life.

Dos and Don'ts

In Georgia, the Small Estate Affidavit is a helpful form for settling estates that are not large enough to necessitate a full probate process. When filling out this form, being thorough and accurate is critical to ensure a smooth procedure. Here are some dos and don’ts to keep in mind:

Do:

- Verify eligibility: Ensure the estate qualifies under Georgia law for the Small Estate Affidavit process. The total value of the estate must not exceed certain thresholds, and enough time must have passed since the decedent's death.

- Gather accurate information: Collect all necessary information about the decedent’s assets, debts, and heirs. This information should be precise to avoid any misunderstandings or legal issues.

- Consult with a legal professional: Although the process seems straightforward, consulting with a legal advisor can help navigate any complexities and ensure the form is filled out correctly.

- Check for errors: Before submitting the form, review it thoroughly for any mistakes or omissions. Accurate and complete information will expedite the process.

Don’t:

- Omit any assets or debts: Failing to list all assets and debts can lead to legal complications. Make sure to include everything, regardless of size or type.

- Guess on details: If you’re unsure about specific information, it's better to find out the correct details rather than guessing. Inaccurate information can delay the process or affect the distribution of the estate.

- Assume the process is the same in every county: While Georgia law provides the framework, the process might vary slightly from one county to another. Check with local county probate courts for any specific requirements or variations.

Misconceptions

When dealing with the Georgia Small Estate Affidavit form, people often stumble upon misconceptions that can complicate the process. Understanding these misconceptions is the first step towards completing the form correctly and making informed decisions.

- The form grants immediate access to the decedent's assets. Many believe that once the Georgia Small Estate Affidavit form is filed, they can instantly access the decedent's assets. However, there is a mandatory waiting period intended to ensure all claims against the estate are accounted for before distribution.

- It is only for bank accounts. While the form is frequently used to access funds in the decedent's bank accounts, it also applies to other types of personal property. This misconception often leads people to overlook assets that could be claimed under the affidavit.

- There's no upper limit on the value of the estate. Many assume that any sized estate can be settled using the small estate affidavit. In reality, Georgia law sets a cap on the total value of the estate's assets that can be processed through this simplified procedure.

- The form eliminates the need for a probate attorney. While the affidavit is designed to simplify the process of settling a small estate without a will, legal complexities may still arise. In such cases, consulting a probate attorney is advisable to navigate any potential issues effectively.

- Any family member can file the affidavit. The belief that any relative can file the form is incorrect. Georgia law specifies who is eligible to file the affidavit, prioritizing spouses, children, and then other relatives, based on their legal relationship to the deceased.

- A notary's signature is all that's needed to validate the form. While notarization is a crucial step in finalizing the affidavit, the form must also be filed with the appropriate local court. The filing ensures that the affidavit is officially recorded and recognized as part of the estate settlement process.

Dispelling these misconceptions can smooth the path for those navigating the challenging process of settling a small estate in Georgia. By understanding the affidavit's limitations and requirements, individuals can approach the task with greater confidence and efficiency.

Key takeaways

Filling out and using the Georgia Small Estate Affidavit form can seem complex, but understanding the key points can simplify the process. This form is used to settle small estates without going through the full probate process, which can save time and expense for the heirs or beneficiaries. Below are seven key takeaways to guide you through filling out and using this form.

- Eligibility Criteria: The total value of the estate’s assets must not exceed the limit specified by Georgia law, which is subject to change. Only personal property is considered; real estate is excluded from this process.

- Timeframe: There is a mandatory waiting period after the decedent's death before the form can be filed. This ensures all debts and claims against the estate can be identified.

- Documentation: Accurate and thorough documentation of the deceased's assets is required. This includes bank accounts, vehicles, and any other personal property.

- Filing with the Proper Court: The affidavit must be filed in the county where the decedent lived. If the decedent did not live in Georgia but owned property within the state, the form should be filed in the county where the property is located.

- Claims Against the Estate: The person filing the affidavit is responsible for ensuring all debts and claims against the estate are satisfied. This responsibility should be taken seriously to avoid personal liability.

- Witnesses and Notarization: Georgia law requires the affidavit to be signed in the presence of a notary public. Some counties may also require witnesses.

- Legal Advice: While the Small Estate Affidavit can be straightforward, seeking legal advice is recommended to avoid errors. A professional can guide you through the process, ensuring compliance with Georgia law and that all necessary steps are completed efficiently.

If you are managing a small estate in Georgia, these key takeaways can help you navigate the process more confidently. Remember, attention to detail and strict adherence to state laws are paramount in successfully using the Georgia Small Estate Affidavit form.

Fill out Popular Small Estate Affidavit Forms for Different States

Small Estate Affidavit Florida - Depending on the jurisdiction, certain assets like real estate may not be transferable via this form, focusing instead on personal property.

Minnesota Small Estate Affidavit - An efficient legal pathway for eligible individuals to access and distribute a deceased person’s property, by certifying their entitlement through a sworn affidavit instead of court processes.

Iowa Probate Laws - It circumvents traditional probate by allowing direct claim of assets, beneficial for small estates and streamlining the distribution process for survivors.