Printable Small Estate Affidavit Form for Hawaii

When a loved one passes away in Hawaii, navigating the legal landscape can feel overwhelming, especially during a time of grief. However, for estates that qualify as "small," the Hawaii Small Estate Affidacity form presents a simplified method to settle estates that might not need the full probate process. This important document, although it seems daunting at first glance, offers a streamlined pathway for the transfer of property to the rightful heirs or beneficiaries. It is designed for situations where the total value of the deceased person's assets falls below a certain threshold, making it unnecessary for the estate to go through the often lengthy and complex probate proceedings. With this form, eligible parties can efficiently claim assets like bank accounts, securities, and even real estate, under specific conditions. Understanding the eligibility criteria, the types of assets that can be transferred, and the legal implications of using the Hawaii Small Estate Affidavit form is vital for anyone wishing to utilize this process. It not just simplifies the procedure but also significantly accelerates the timeframe for distributing a deceased person’s assets, thereby providing a measure of relief during a difficult time.

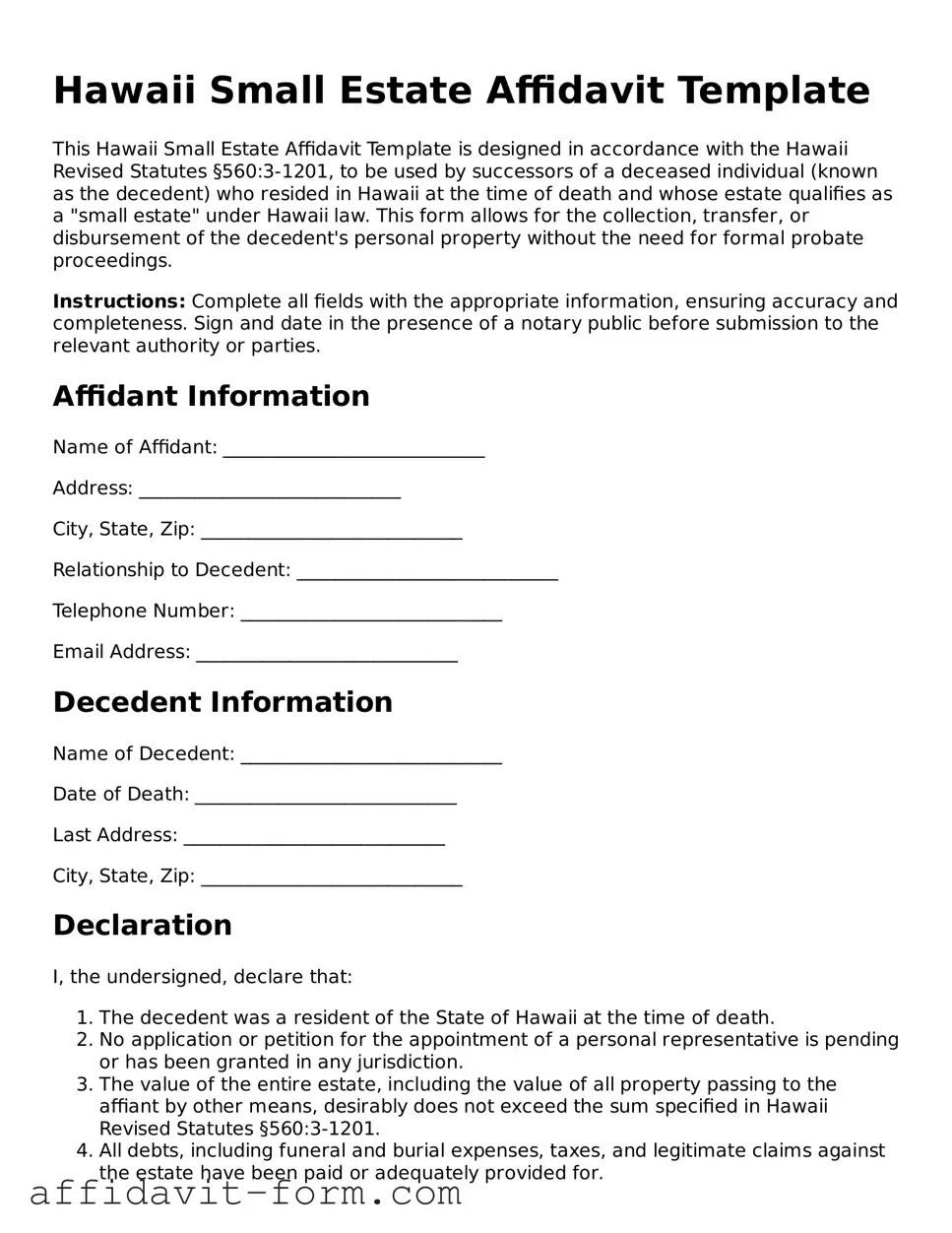

Form Example

Hawaii Small Estate Affidavit Template

This Hawaii Small Estate Affidavit Template is designed in accordance with the Hawaii Revised Statutes §560:3-1201, to be used by successors of a deceased individual (known as the decedent) who resided in Hawaii at the time of death and whose estate qualifies as a "small estate" under Hawaii law. This form allows for the collection, transfer, or disbursement of the decedent's personal property without the need for formal probate proceedings.

Instructions: Complete all fields with the appropriate information, ensuring accuracy and completeness. Sign and date in the presence of a notary public before submission to the relevant authority or parties.

Affidant Information

Name of Affidant: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Relationship to Decedent: ____________________________

Telephone Number: ____________________________

Email Address: ____________________________

Decedent Information

Name of Decedent: ____________________________

Date of Death: ____________________________

Last Address: ____________________________

City, State, Zip: ____________________________

Declaration

I, the undersigned, declare that:

- The decedent was a resident of the State of Hawaii at the time of death.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The value of the entire estate, including the value of all property passing to the affiant by other means, desirably does not exceed the sum specified in Hawaii Revised Statutes §560:3-1201.

- All debts, including funeral and burial expenses, taxes, and legitimate claims against the estate have been paid or adequately provided for.

- The legal description and/or other adequate description of all personal property and real estate, if any, owned by the decedent at the time of death is as follows (attach an additional sheet if necessary): ____________________________.

Signature

Under penalty of perjury, I hereby affirm that the statements made above are true and correct to the best of my knowledge, understanding, and belief.

Affidant's Signature: ____________________________ Date: _________

State of Hawaii County of _________

Subscribed and sworn to before me this ______ day of ___________, 20__ by _______________________________ (name of affiant).

Notary Public: ____________________________

My commission expires: ____________________________

Document Details

| Fact | Description |

|---|---|

| Eligible Estates | Only estates valued at $100,000 or less are eligible for the Hawaii Small Estate Affidavit procedure. |

| Waiting Period | A waiting period of 30 days after the decedent's death is required before the affidavit can be filed. |

| Required Information | The form must include a detailed list of the decedent’s property, including account numbers and descriptions of assets. |

| Governing Laws | The process is governed by Chapter 560:3-1201 of the Hawaii Revised Statutes. |

| Real Estate Exclusion | Real estate cannot be transferred using the Hawaii Small Estate Affidavit; it only applies to personal property. |

How to Use Hawaii Small Estate Affidavit

Filling out the Hawaii Small Estate Affidavit form is a process used to manage the distribution of a deceased person's estate when the total value falls below a certain threshold. This method streamlines estate management without going through a formal probate process. It is important to provide accurate information and follow each step meticulously to ensure the swift and lawful handling of the estate. Here are the steps to fill out the form correctly:

- Gather all necessary information, including the full legal name and date of death of the deceased, a list of all assets, and their estimated values.

- Confirm eligibility for using the Small Estate Affidavit by ensuring the total value of the estate meets Hawaii's requirements.

- Download the latest version of the Hawaii Small Estate Affidavit form from the relevant Hawaii state judiciary or legal forms website.

- Fill in the decedent’s full legal name and date of death in the designated sections at the top of the form.

- Enter your name and address as the affiant – the person filing the affidavit – in the provided fields.

- List all known heirs of the deceased, their relationship to the deceased, and their respective addresses.

- Describe each asset belonging to the estate, including bank accounts, vehicles, real estate, and personal property, along with their estimated values.

- Sign and date the form in front of a notary public. The notary will then notarize the document, making it legally valid.

- File the completed affidavit with the appropriate Hawaii state court or entity as directed in the form's instructions.

- Present the notarized affidavit to institutions or individuals holding the assets (banks, brokers, etc.), requesting the transfer of assets to the rightful heirs.

After completing these steps, monitor the transfers closely and keep records of all transactions. Transferring assets through a Small Estate Affidavit should proceed smoothly if each step is followed correctly and all information is accurately provided. This procedure allows heirs to access their inheritance without the lengthy processes often associated with probate court.

Listed Questions and Answers

What is a Hawaii Small Estate Affidavit?

A Hawaii Small Estate Affidavit is a legal form used by heirs or beneficiaries to collect the assets of a deceased person without going through a formal probate process. This document is applicable when the deceased, known as the decedent, had a limited amount of assets. It simplifies the procedure to transfer property to the rightful heirs under Hawaii law. The form requires information about the decedent, the assets involved, and the heirs claiming the estate.

Who can file a Hawaii Small Estate Affidavit?

To file a Hawaii Small Estate Affidavit, an individual must be an heir or a legally recognized beneficiary of the deceased. The ability to use this form is also subject to certain conditions related to the value of the decedent's estate. Generally, the total assets must not exceed a specific threshold set by Hawaii state law. Additionally, there may be a waiting period before the affidavit can be filed, ensuring all debts and claims against the estate have been settled or addressed.

What are the requirements for using a Hawaii Small Estate Affidavit?

The requirements for using a Hawaii Small Estate Affidavit include:

- The total value of the decedent's estate must not exceed the threshold specified by Hawaii law.

- A certain period must have elapsed since the death of the decedent, as mandated by state law.

- The decedent must not have left a will, or if a will exists, it does not mandate a formal probate process.

- All debts and obligations of the decedent must have been settled or adequately provided for.

These conditions ensure that the estate qualifies for the small estate process, streamlining asset distribution to heirs or beneficiaries.

How do you file a Hawaii Small Estate Affidavit?

Filing a Hawaii Small Estate Affidavit involves several steps:

- Correctly completing the affidavit form, including all required details about the decedent, their assets, and the claiming heirs or beneficiaries.

- Ensuring all conditions and requirements for using the affidavit are met, including asset valuation and the passage of the required time since the decedent's death.

- Submitting the completed affidavit to the appropriate entity, which may be a court or financial institution, holding the assets.

It might also be necessary to provide supporting documents, such as death certificates and proof of the heir's relationship to the decedent. The process for filing can vary depending on the specific circumstances of the estate and the type of assets involved.

Common mistakes

Filling out the Hawaii Small Estate Affidavit form is a crucial step in managing the estate of a loved one who has passed away. It's a process that can be emotionally taxing and complex, often leading to simple mistakes that can complicate matters further. Here are seven common errors people make when completing this form:

- Not checking if the estate qualifies - The form is intended for small estates in Hawaii, and there are specific criteria that must be met. It’s important to verify that the estate falls under Hawaii’s definition of a "small estate."

- Incorrectly listing the assets - It’s critical to accurately list all the assets of the deceased. This includes everything from bank accounts to personal property. An incomplete or incorrect list can lead to significant delays.

- Omitting next of kin information - The form requires information about the next of kin. Failing to include this can cause the process to stall, as the court needs this information to properly distribute assets.

- Forgetting to attach required documents - Supporting documents, such as the death certificate and proof of ownership for certain assets, are often required. Not including these can result in the affidavit being rejected.

- Incorrectly valuing assets - The total value of the assets is a key factor in determining whether an estate qualifies as "small" under Hawaii law. Over- or undervaluing assets can lead to issues in the affidavit’s acceptance.

- Failing to get the affidavit notarized - The affidavit must be notarized to be legally binding. Overlooking this step can mean having to start the process over again.

- Rushing through the form without reviewing - It’s easy to make mistakes when you’re overwhelmed. Reviewing the form carefully before submission can catch errors that might otherwise lead to delays or legal complications.

When dealing with the affairs of a loved one who has passed away, attention to detail and careful consideration of the requirements can make the small estate affidavit process smoother and more straightforward. Avoid these common mistakes to help ensure the process goes as smoothly as possible.

Documents used along the form

When managing a small estate in Hawaii, the Small Estate Affidavit form is often just one part of the process. Other documents may be required, depending on the specific circumstances of the estate and the assets involved. Understanding these additional forms and documents can simplify the process, ensuring that all legal requirements are met and helping to distribute the decedent's assets efficiently and effectively.

- Death Certificate: A certified copy of the decedent's death certificate is required to prove the death. This document is essential for transferring assets and is required by financial institutions and other entities.

- Will (if applicable): If the decedent left a will, it might need to be filed with the probate court, even if the estate qualifies for the small estate process. The will outlines the decedent's wishes regarding asset distribution.

- Letters of Testamentary or Letters of Administration: These documents are issued by the court, authorizing an individual (the executor or administrator) to act on behalf of the estate.

- Notice to Creditors: This notice may need to be published in a local newspaper and/or sent directly to known creditors, informing them of the decedent’s death and the estate administration process.

- Inventory of Assets: A detailed list of the estate's assets, including real estate, personal property, bank accounts, and other assets, is often required to ensure all property is accounted for and properly distributed.

- Appraisal Reports: For certain assets, professional appraisals may be necessary to determine the fair market value, which is important for tax purposes and equitable distribution.

- Final Tax Returns: Filing the decedent’s final state and federal income tax returns is necessary to ensure all tax liabilities are satisfied.

- Estate Tax Return: In some cases, an estate tax return may be required, depending on the total value of the estate and the tax regulations in effect at the time of the decedent’s death.

- Release and Waiver Forms: Beneficiaries may be asked to sign these forms, indicating that they have received their inheritance and waive any further claims against the estate.

- Closing Statement: This document signifies the formal closure of the estate, showing that all assets have been distributed, all debts and taxes have been paid, and no further action is necessary.

Navigating the aftermath of a loved one's passing can be challenging. By understanding the various forms and documents that may be necessary alongside the Hawaii Small Estate Affidavit, individuals can manage their responsibilities more effectively, ensuring a smoother transition during this difficult time.

Similar forms

The Hawaii Small Estate Affidavit form is similar to other legal documents that streamline the process of asset transfer after someone's death. These documents generally serve to simplify legal procedures that otherwise might require a more complex probate process. Specifically, this form shares similarities with the Transfer on Death Deed (TODD) and the Joint Tenancy Agreement. Both these documents, like the Small Estate Affidavit, are designed to bypass the traditional probate process, making the transition of assets more straightforward for the beneficiaries.

The Transfer on Death Deed (TODD) is a document that allows a property owner to name a beneficiary who will inherit the property upon the owner's death, without the property having to go through probate. Similar to the Hawaii Small Estate Affidavit, the TODD is a non-probate tool, enabling a direct transfer of assets. However, while the Small Estate Affidavit can be used for a variety of assets, the TODD strictly pertains to real estate. Both forms require proper completion and, for the TODD, recording with the appropriate county office to be effective.

The Joint Tenancy Agreement establishes a form of ownership in which two or more people own a piece of property together, with rights of survivorship. This means that upon the death of one joint tenant, the property automatically passes to the surviving joint tenant(s), bypassing the probate process. The Hawaii Small Estate Affidavit operates under a similar principle for assets within a small estate, serving to transfer ownership without the need for probate court. However, the key distinction lies in the fact that with a Joint Tenancy Agreement, the automatic transfer applies specifically to property owned in joint tenancy, while the Small Estate Affidavit can cover a broader range of personal property assets.

Dos and Don'ts

When dealing with a Hawaii Small Estate Affidavit form, it’s essential to approach with care and attention. Below are the dos and don'ts to ensure the process is handled effectively and respectfully.

Dos:

- Ensure all information is accurate before submission. Double-check all details, including the spelling of names, addresses, and account numbers related to the estate.

- Research and comply with Hawaii's specific requirements for a Small Estate Affidavit, including the estate's value limit and any necessary waiting periods.

- Gather and attach all required documents, such as the death certificate and an inventory list of assets, to the affidavit form.

- Use clear and precise language that mirrors the terminology used in the form to avoid any confusion or misinterpretation.

- Seek legal advice if there are any aspects of the form or process that are unclear. A professional can provide guidance tailored to your unique situation.

- Review the completed form for any errors or omissions. It’s important to ensure that every section is filled out completely and correctly.

Don'ts:

- Avoid rushing through the form. Taking the time to carefully read and understand each section will help prevent mistakes.

- Do not leave any fields blank. If a section does not apply, indicate with a "N/A" (not applicable) to show that it has been acknowledged.

- Resist the temptation to estimate values or information. Ensure all data provided is based on actual documentation and accurate records.

- Do not forget to sign and date the form. An unsigned or undated form can lead to delays or rejection of the affidavit.

- Refrain from submitting the form without ensuring that all state-specific requirements have been met, including notary public acknowledgment if necessary.

- Avoid handling estate affairs that may be beyond your legal authority or understanding without consulting a legal professional first.

Misconceptions

When it comes to navigating the terrain of legal forms, particularly in the context of managing small estates within Hawaii, several misconceptions commonly emerge. Misunderstandings about the Hawaii Small Estate Affidavit form can complicate what might be an otherwise straightforward process. Below, we explore and clarify some of these misconceptions to provide clearer guidance.

- Any Estate Can Use this Form: Many believe that the Hawaii Small Estate Affidavit can be applied to any estate, regardless of its size or complexity. However, it is specifically designed for small estates in Hawaii that meet certain criteria, including the total value of the deceased's property.

- Legal Representation is Not Needed: While it’s true that the form is designed to simplify the process, legal advice can be vital. Misunderstanding legal terms or improperly filling out the form can lead to issues down the line. Professional guidance ensures that all steps are correctly followed.

- It Transfers Property Immediately: Some assume that filling out and submitting this form will instantly transfer property. In reality, the process includes a mandatory waiting period, during which claims against the estate can be made.

- It Avoids Probate Entirely: A common misconception is that the Hawaii Small Estate Affidavit completely bypasses the probate process. While it simplifies probate for small estates, ensuring legal ownership changes and obligations are met is still part of the process.

- It’s Only for Real Estate: This form is not limited to real estate but includes other types of property as well. Understanding the scope of assets that can be transferred using this affidavit is crucial.

- Jointly Owned Property Can Be Transferred: Jointly owned property typically passes to the surviving owner directly and is not usually part of the small estate process. The affidavit cannot be used to transfer such property.

- There are No Limits on the Value of the Estate: There are indeed limits on the value of the estate that can use the Small Estate Affidavit process. These limits are set by Hawaiian law and are subject to change, so keeping informed is important.

- Any Family Member Can Submit the Form: While family members often submit the affidavit, not every relative is eligible. Hawaiian law specifies who can file based on their relationship to the deceased and their legal standing.

Understanding these nuances is essential for anyone navigating the probate process with a small estate in Hawaii. By debunking these misconceptions, individuals can approach the Hawaii Small Estate Affidavit with clearer expectations and greater confidence, ensuring that the estate is managed in accordance with legal requirements.

Key takeaways

Filling out and using the Hawaii Small Estate Affidavit form requires attention to detail and an understanding of its significance. Here are key takeaways to keep in mind:

- Eligibility Criteria: Make sure the estate meets Hawaii’s requirements for being considered small. This usually involves the total value of the estate not exceeding a specific threshold.

- Accuracy is Crucial: All information provided in the affidavit must be accurate and truthful. Errors or omissions can lead to delays or legal complications.

- Documentation: Gather all necessary documents, such as death certificates and proof of ownership of assets. These are required to complete the form correctly.

- Timeframe: Be aware of any time restrictions. Hawaii law may specify a waiting period before the affidavit can be filed after the decedent's death.

- Beneficiaries: Clearly identify all legal heirs or beneficiaries entitled to the property. Ensure their information is complete and correct.

- Property Valuation: Obtain an accurate valuation of the estate's assets. This may require professional appraisals to ensure compliance with the threshold for a small estate.

- Legal Advice: Consider consulting with a lawyer. They can provide guidance and ensure that the process is handled correctly, avoiding potential legal issues.

- Filing: Submit the completed affidavit to the appropriate local court. Be prepared to pay any filing fees associated with the submission.

Understanding these key points can simplify the process of using a Small Estate Affidavit in Hawaii, ensuring that the estate is settled quickly and in accordance with state laws.

Fill out Popular Small Estate Affidavit Forms for Different States

Survivorship Affidavit Utah - For many families, the Small Estate Affidavit provides a welcome relief from the complexities of traditional estate settlement.

Small Estate Affidavit Massachusetts - Before proceeding, it is vital for claimants to inventory the deceased’s assets comprehensively to determine the applicability of the Small Estate Affidavit in their particular case.

Affidavit of Heirship Alabama - An affidavit of this nature can sometimes lead to immediate access to funds critical for covering funeral expenses and other urgent costs.

Virginia Small Estate Affidavit Pdf - Used when the value of the estate falls below a specific threshold defined by state law.