Printable Small Estate Affidavit Form for Idaho

In the beautiful state of Idaho, when a loved one passes away with a relatively modest estate, the burden of formal probate can often be bypassed thanks to the Idaho Small Estate Affidavit form. This essential document serves as a streamlined option, allowing for the transferral of assets to rightful heirs without the complexities and extended timelines typically associated with traditional probate proceedings. Designed for situations where the deceased’s estate falls below a certain monetary threshold, the form simplifies the legal process significantly. It’s imperative for applicants to understand which assets qualify, the limits set by Idaho law, and the obligations and responsibilities of the affiant – the person completing and submitting the form. By providing a path that avoids the probate court, the Idaho Small Estate Affiliation form embodies a practical solution for small estate management, ensuring that assets are distributed according to the decedent’s wishes in a timely and efficient manner.

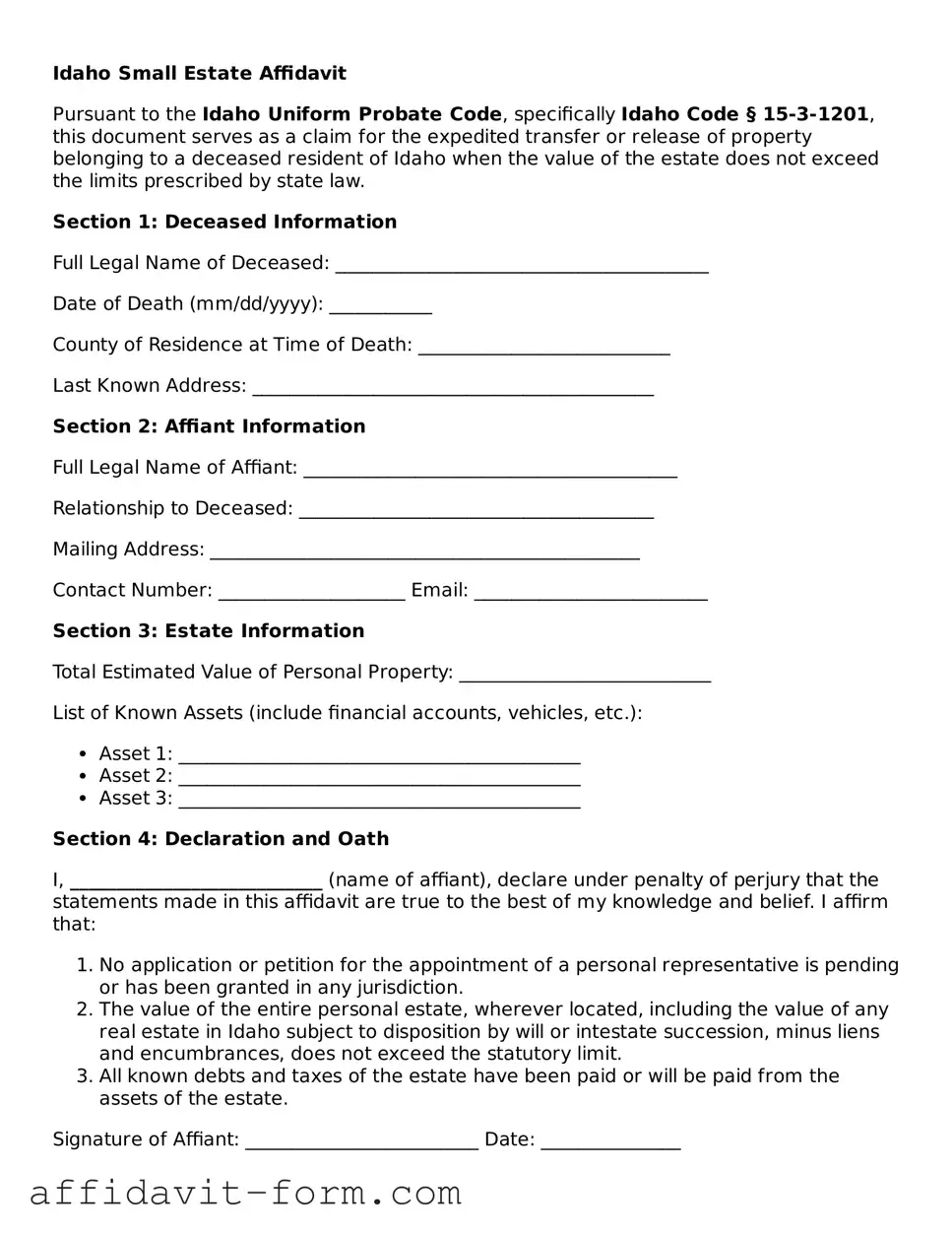

Form Example

Idaho Small Estate Affidavit

Pursuant to the Idaho Uniform Probate Code, specifically Idaho Code § 15-3-1201, this document serves as a claim for the expedited transfer or release of property belonging to a deceased resident of Idaho when the value of the estate does not exceed the limits prescribed by state law.

Section 1: Deceased Information

Full Legal Name of Deceased: ________________________________________

Date of Death (mm/dd/yyyy): ___________

County of Residence at Time of Death: ___________________________

Last Known Address: ___________________________________________

Section 2: Affiant Information

Full Legal Name of Affiant: ________________________________________

Relationship to Deceased: ______________________________________

Mailing Address: ______________________________________________

Contact Number: ____________________ Email: _________________________

Section 3: Estate Information

Total Estimated Value of Personal Property: ___________________________

List of Known Assets (include financial accounts, vehicles, etc.):

- Asset 1: ___________________________________________

- Asset 2: ___________________________________________

- Asset 3: ___________________________________________

Section 4: Declaration and Oath

I, ___________________________ (name of affiant), declare under penalty of perjury that the statements made in this affidavit are true to the best of my knowledge and belief. I affirm that:

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The value of the entire personal estate, wherever located, including the value of any real estate in Idaho subject to disposition by will or intestate succession, minus liens and encumbrances, does not exceed the statutory limit.

- All known debts and taxes of the estate have been paid or will be paid from the assets of the estate.

Signature of Affiant: _________________________ Date: _______________

State of Idaho

County of _______________

Subscribed and sworn to (or affirmed) before me on this ___ day of ___________, 20___, by ______________________________________________ (name of affiant).

____________________________________

Notary Public

My commission expires: _______________

This template provides a straightforward approach for individuals in Idaho who are handling small estates to ensure compliance with state law. It includes sections for detailing information about the deceased, the affiant, and the estate, as well as a declaration that must be notarized. This document is helpful for simplifying the legal process during a challenging time.Document Details

| Fact | Detail |

|---|---|

| Name of Form | Idaho Small Estate Affidavit |

| Purpose | To expedite the transfer of assets from a deceased person’s estate without formal probate. |

| Eligibility Criteria | Estate's personal property value must not exceed $100,000 and there shouldn't be real estate. |

| Governing Law | Idaho Code § 15-3-1201 |

| Waiting Period | Thirty days must pass after the decedent's death before the form is filed. |

| Required Information | Decedent's personal and estate details, including assets and debts. |

| Filing Procedure | The form must be signed in the presence of a notary public before submission to the relevant entity holding the assets. |

| Document Must Include | A sworn statement that the claimant is entitled to the assets and that all debts and taxes of the estate will be paid. |

| Notable Limitation | Cannot be used if the assets include real estate or if the estate qualifies for formal probate proceedings. |

How to Use Idaho Small Estate Affidavit

Filling out the Small Estate Affidavit form in Idaho is a legal way to handle a deceased person's estate when it falls under a certain value threshold, making it unnecessary to go through the standard probate process. This can significantly simplify the legal procedures for the heirs or lawful successors, enabling them to claim the deceased's property quickly and with less paperwork. The key to a smooth process lies in correctly completing the form with precise details and understanding the steps that follow submission.

Steps to Fill Out the Idaho Small Estate Affidavit Form

- Begin by reading through the entire form to familiarize yourself with the required information.

- Enter the full legal name of the deceased person (referred to as the "Decedent") at the top of the form, where it requests this information.

- Provide the Decedent's date of death in the designated space. Make sure this matches the date listed on the death certificate.

- Fill in the Decedent's last known address, ensuring accuracy as this might affect the proceeding.

- List all assets belonging to the estate. Be specific, including account numbers, descriptions of property, and estimated values. The form may provide spaces for different types of assets, such as real estate, vehicles, bank accounts, and personal property.

- Identify all debts owed by the Decedent, including funeral expenses, final bills, and outstanding loans. There may be a specific section on the form to list these debts.

- Include the legal names and addresses of all heirs or lawful successors, detailing their relationship to the Decedent. This is crucial for establishing the rightful claimants to the estate.

- Review the form and ensure all provided information is accurate and complete. Inaccuracies can cause delays or legal complications.

- Sign and date the form in the presence of a notary public. The presence of a notary is required to validate the affidavit legally.

- Submit the completed and notarized form to the appropriate local court or entity as directed by Idaho law. This may vary depending on the county and the specific type of assets involved.

After submitting the Small Estate Affidavit, the next steps involve waiting for the form to be processed and approved by the appropriate authority. This can take some time, depending on the workload of the court or entity handling the form and the complexity of the estate. Once approved, the heirs or lawful successors will be authorized to claim the assets listed in the affidavit, distributing them according to the wishes of the Decedent or the laws of Idaho. It's also wise to keep copies of all submitted documents for your records.

Listed Questions and Answers

What is an Idaho Small Estate Affidavit?

An Idaho Small Estate Affidavit is a legal document used by heirs or designated beneficiaries to collect the assets of a deceased person without going through a formal court-supervised probate process. It's applicable in situations where the total value of the estate's assets, excluding certain exemptions, falls below a specific threshold defined by Idaho law.

Who can file an Idaho Small Estate Affidavit?

Under Idaho law, the following individuals may file a Small Estate Affidavit:

- The surviving spouse of the deceased.

- Adult children, parents, or siblings of the deceased if there is no surviving spouse.

- A designated beneficiary named in the deceased's will, if applicable.

- A creditor of the estate, under certain circumstances.

What is the maximum value of an estate to use this form in Idaho?

The maximum value of an estate to qualify for the Idaho Small Estate Affidavit process is subject to change as per Idaho statutes. It is important to consult the most recent legal standards or seek legal advice to confirm the current threshold, which has traditionally been $100,000 or less.

What types of assets can be transferred using the Idaho Small Estate Affidavit?

The types of assets that can be transferred include, but are not limited to:

- Personal property such as vehicles, furniture, and jewelry.

- Bank accounts that were solely in the name of the deceased.

- Stocks, bonds, and other securities.

- Certain types of real estate, under specific conditions.

Are there any assets that cannot be transferred with this form?

Yes, certain types of assets cannot be transferred using the Idaho Small Estate Affidavit. These typically include:

- Real estate held in joint tenancy or as community property with rights of survivorship.

- Assets with designated beneficiaries outside the estate, such as life insurance policies or retirement accounts.

- Assets held in a trust.

How long after a person's death can you file an Idaho Small Estate Affidavit?

In Idaho, you must wait for thirty (30) days after the person's death before filing a Small Estate Affididavit. This waiting period allows time for all potential claims and debts against the estate to be identified.

What documentation is needed to file an Idaho Small Estate Affidavit?

To file an Idaho Small Estate Affidavit, the following documents are generally required:

- A certified copy of the death certificate.

- An inventory and appraisal of the deceased's property.

- Proof of your relationship to the deceased or your right to inherit.

- Any other documents required by the specific financial institutions or entities holding the assets.

Where can you file an Idaho Small Estate Affidavit?

The Idaho Small Estate Affidavit is typically filed with the institution or agencies holding the assets you seek to collect, such as a bank or brokerage. It is not generally filed with a court or government agency but it's important to verify with each institution's policies or consult with a legal professional for guidance tailored to your situation.

Common mistakes

Filling out an Idaho Small Estate Affidavit can seem straightforward, but attention to detail is crucial. Mistakes can result in delays or additional legal complications. Below, four common errors are highlighted to assist in avoiding these pitfalls:

-

Not Checking Eligibility Requirements: Before one starts the process, it's essential to ensure the estate qualifies as a 'small estate' under Idaho law. This typically means the total value of the estate does not exceed a specific limit set by the state. Neglecting to verify this can lead to unnecessary work or the affidavit being rejected.

-

Inaccurate Valuation of Assets: The assets of the estate need to be accurately valued and reported. This includes bank accounts, vehicles, and any other personal property of value. Overestimating or underestimating these assets can cause problems, from delays in processing to issues with heirs or beneficiaries.

-

Failure to Properly Document Debts and Liabilities: Along with assets, any debts or liabilities the deceased had at the time of death must be clearly listed. This detail often gets overlooked, which can complicate the distribution of the estate later on. Ensure all such obligations are recorded to make the process smoother.

-

Omitting Required Signatures or Notarization: The Idaho Small Estate Affidavit requires signatures from all beneficiaries or heirs, and depending on the situation, it may also need to be notarized. Forgetting to include these critical elements can invalidate the document or at the very least, stall its processing.

To summarize, when completing the Idaho Small Estate Affidavit form, one should carefully verify eligibility, provide accurate asset valuations, document all debts and liabilities, and ensure all necessary signatures and notarizations are in place. Paying close attention to these steps can significantly reduce the risk of complications and help expedite the process.

Documents used along the form

When settling a small estate in Idaho, using the Small Estate Affidavit form is a critical step towards a streamlined process. However, this form does not work in isolation. Several other documents play a pivotal role, complementing the affidavit and ensuring that the process adheres to legal requirements while safeguarding the interests of all parties involved. These documents span a range of needs, from verifying the deceased's assets to confirming the rightful heirs or beneficiaries.

- Death Certificate: A certified copy of the death certificate is essential. It serves as official proof of death, verifying the decedent’s identity and the date of their passing. This document is fundamental in initiating the estate settlement process.

- Last Will and Testament: If the deceased left a will, a copy is necessary. It outlines the decedent's final wishes regarding the disposition of their property and may specify an executor.

- Letters of Administration: In cases where there is no will, or an executor is not designated, Letters of Administration may be required to appoint an administrator for the estate.

- Inventory of Assets: A comprehensive list of the deceased's assets included in the small estate. This inventory helps in the accurate valuation of the estate, ensuring that it qualifies under Idaho’s small estate threshold.

- Notice to Creditors: This document notifies potential creditors of the decedent’s passing and the estate settlement process, allowing them to make claims against the estate if necessary.

- Receipts of Distribution: These are acknowledgments from heirs or beneficiaries, confirming they received their entitled assets from the estate. It serves as proof that the assets were distributed according to the decedent’s wishes or state law.

- Real Estate Transfer Documents: If the estate includes real property, documents such as a new deed or affidavit of real property may be needed to transfer ownership according to the small estate procedures.

Together, these documents facilitate a smooth and legally sound process for managing small estates in Idaho. Familiarity with each one ensures that individuals can navigate estate settlement with confidence, providing peace of mind during a challenging time. Utilizing the Small Estate Affidavit form alongside these essential documents allows for an efficient transfer of assets, minimizing the burden on all involved.

Similar forms

The Idaho Small Estate Affidavit form is similar to other legal documents that facilitate the transfer of property under certain conditions. These documents generally bypass the probate process, which can be lengthy and costly. While each document serves a somewhat different purpose, they share common features in terms of simplifying the legal proceedings associated with the transfer of assets upon someone's death.

Affidavit for Collection of Personal Property - This document is closely aligned with the Small Estate Affidavit in terms of its objective and functionality. Like the Small Estate Affidavit, the Affidavit for Collection of Personal Property allows for the distribution of assets without probate. Specifically, it permits the direct transfer of personal property such as bank accounts, securities, and tangible items to beneficiaries. The main similarity lies in their use to expedite the asset transfer process when the total value falls below a certain threshold, as specified by state laws. Both forms require an affidavit to be signed, often in the presence of a notary, attesting to the right to collect the property.

Transfer on Death Deed - While the Transfer on Death Deed (TODD) functions differently, it shares the goal of avoiding the probate process, much like the Small Estate Affidavit. The TODD allows a property owner to designate a beneficiary to receive real estate upon the owner’s death, without the property having to go through probate court. This document, executed during the lifetime of the property owner, specifies who will inherit the property, akin to how the Small Estate Affidacet specifies to whom the assets will be distributed. The key similarity is their preventive approach in planning for the transfer of assets, circumventing the need for court intervention.

Joint Tenancy with Right of Survivorship - This arrangement is more a form of holding title than a document per se, but it parallels the Small Estate Affidavit in its effect of transferring property outside of probate. When two or more individuals hold property as joint tenants, the surviving owner(s) automatically inherit the deceased's share of the property, seamlessly transitioning full ownership without court proceedings. Simultaneously, Small Estate Affidavits and joint tenancy arrangements minimize legal complications and ensure a swift transfer of assets following the death of a property owner.

Dos and Don'ts

When it comes to managing the assets of a loved one who has passed away, the Idaho Small Estate Affidavit form can be an efficient way to bypass probate for estates below a certain value. However, it’s essential to approach this document with care to ensure the process goes smoothly. Here are some do's and don'ts to guide you through properly filling out this form.

Do:- Verify eligibility: Make sure the estate qualifies as a "small estate" under Idaho law. The value of the estate must not exceed the specific threshold set by the state.

- Wait the required period: Idaho law may require you to wait a certain period after the decedent's death before filing the affidavit. Ensure this period has passed.

- Include all required information: Fill out every field of the form accurately. Missing information can delay the process.

- Provide accurate valuations: List the assets of the estate and provide an honest assessment of their value.

- Confirm heirship: Clearly state your relationship to the deceased and confirm that you are legally entitled to inherit.

- Check for debts: Ensure all debts and taxes of the estate are known and reported on the affidavit, following Idaho’s laws on priority of payments.

- Sign in the presence of a notary: Your signature will likely need to be notarized. Do this step in the presence of a qualified notary public.

- File with the appropriate court: Submit the completed affidavit to the correct county court, as per Idaho law.

- Keep copies: Always keep a copy of the affidavit and any related documents for your records.

- Consult with an attorney: If you’re unsure about any part of the process, it’s wise to seek legal advice from an attorney familiar with Idaho estate laws.

- Attempt to use the form if the estate exceeds Idaho’s value limit for small estates. This could result in legal complications.

- Forget to notify all entitled heirs about the affidavit and the estate administration process.

- Misrepresent any information on the form. Dishonesty can lead to serious legal consequences.

- Overlook any assets that should be included in the estate. Everything from personal property to bank accounts should be accounted for.

- Ignore the priority of debts as outlined by law. Failing to properly address debts can result in legal action against the estate.

- Sign the form without thoroughly reading and understanding every part of it. Misunderstandings can cause delays or errors in the process.

- Skip the notarization step. An unnotarized affidavit may be considered invalid.

- File the affidavit with the wrong county court. This mistake can significantly delay the estate settlement.

- Assume the form is the only document needed. Depending on the estate, additional paperwork may be necessary.

- Proceed without considering the potential tax implications of inheriting assets. Some inherited assets may have tax consequences that should be understood upfront.

Misconceptions

It's a quick fix for all estates. Many believe that the Idaho Small Estate Affidavit form speeds up the transfer of all types of assets for any estate. However, this form is specifically designed for small estates that meet particular criteria, like the value of the estate being below a certain threshold.

It eliminates the need for a will. Some people think this affidavit can replace a will. In truth, its purpose is to simplify the process of asset transfer for small estates without going through a full probate process. A will might still be necessary to address other elements of estate planning.

Anyone can file it. There's a misconception that any relative or interested party can file the affidavit. In Idaho, only successors who are legally entitled, according to the state's succession laws, or named in a will, can file it.

It grants immediate access to bank accounts. While the affidavit is designed to simplify asset transfer, banks and other institutions may have additional requirements or processing times before granting access to funds or accounts.

All debts are automatically handled. Filing this form doesn't mean the estate's debts are automatically paid off or dismissed. Creditors may still have claims, and specific procedures must be followed to address any outstanding debts.

There's no need for an attorney. People often assume they don't need legal advice when using the Small Estate Affidavit form. While it's designed for simplicity, consulting with an attorney can help navigate the process more effectively, especially for complex situations.

It works the same in every state. The rules, thresholds, and processes for small estate affidavits vary by state. The Idaho Small Estate Affidavit has specific requirements that do not necessarily align with those of other states.

Key takeaways

The Idaho Small Estate Affidavit form allows individuals to manage the assets of a deceased person's estate in a simplified manner if it meets certain requirements. Understanding the key aspects of this form and its use can streamline the process of asset distribution. Here are seven key takeaways:

- Eligibility is based on the total value of the estate. To use the Small Estate Affidavit in Idaho, the total value of the estate must not exceed a specific threshold as defined by state law.

- The form requires detailed information about the deceased, known as the decedent, including their full name, date of death, and a list of assets. Complete accuracy is critical when providing this information.

- Not all assets can be transferred using the Small Estate Affidavit. Typically, this form is applicable to personal property like bank accounts, vehicles, and household goods, but does not apply to real estate holdings.

- Claimants must wait a statutory period before they can file the affidavit. This waiting period begins from the date of the decedent’s death.

- Signing the Small Estate Affidavit requires a notary public. The document must be notarized to be considered legally binding and valid for use.

- The affidavit allows for the bypassing of formal probate. By using this form, the estate can avoid the lengthy and potentially costly probate process.

- Submission rules vary by institution. Banks, DMV offices, and other entities have their own procedures for accepting a Small Estate Affidavit, so it’s important to check with them before submission.

Understanding these key points ensures that individuals are well-prepared to use the Idaho Small Estate Affidavit form effectively and in accordance with state law.

Fill out Popular Small Estate Affidavit Forms for Different States

Affidavit of Heirship Alabama - It provides a pragmatic method for dealing with small estates, reflecting an understanding of the varying complexities of estate sizes.

Small Estate Affidavit Georgia - Filing a Small Estate Affidavit can sometimes require also notifying other potential heirs or claimants.

Small Estate Affidavit Montana - This documentation is crucial for those without a will, creating a legally recognized means to distribute assets according to state laws.

Affidavit for Probate - Reduces legal hurdles for small estate heirs, providing a direct route to asset acquisition.