Printable Self-Proving Affidavit Form for Illinois

In the heart of estate planning within Illinois, there exists a document that significantly streamlines the probate process, ensuring that the intentions of a deceased's will are executed efficiently and without unnecessary delay. This document, known as the Self-Proving Affidavit form, serves as a powerful adjunct to a will, allowing the individuals who witnessed the will signing to affirm their presence and the authenticity of the document without the need to be physically present in court. It's a testament to ease and convenience in the somber and often complex proceedings following a person's passing. Not only does the Self-Proving Affidavit expedite the validation process of a will, but it also stands as a bulwark against potential legal challenges that may arise, questioning the will's legitimacy. By completing this affidavit, which must be notarized and accompany the will, the executor of the estate can navigate the probate landscape more smoothly, with fewer obstacles in fulfilling the final wishes of the deceased. The significance of this document in Illinois cannot be overstated, as it encapsulates both the foresight of legal preparation and the compassionate understanding of the bereavement period families face.

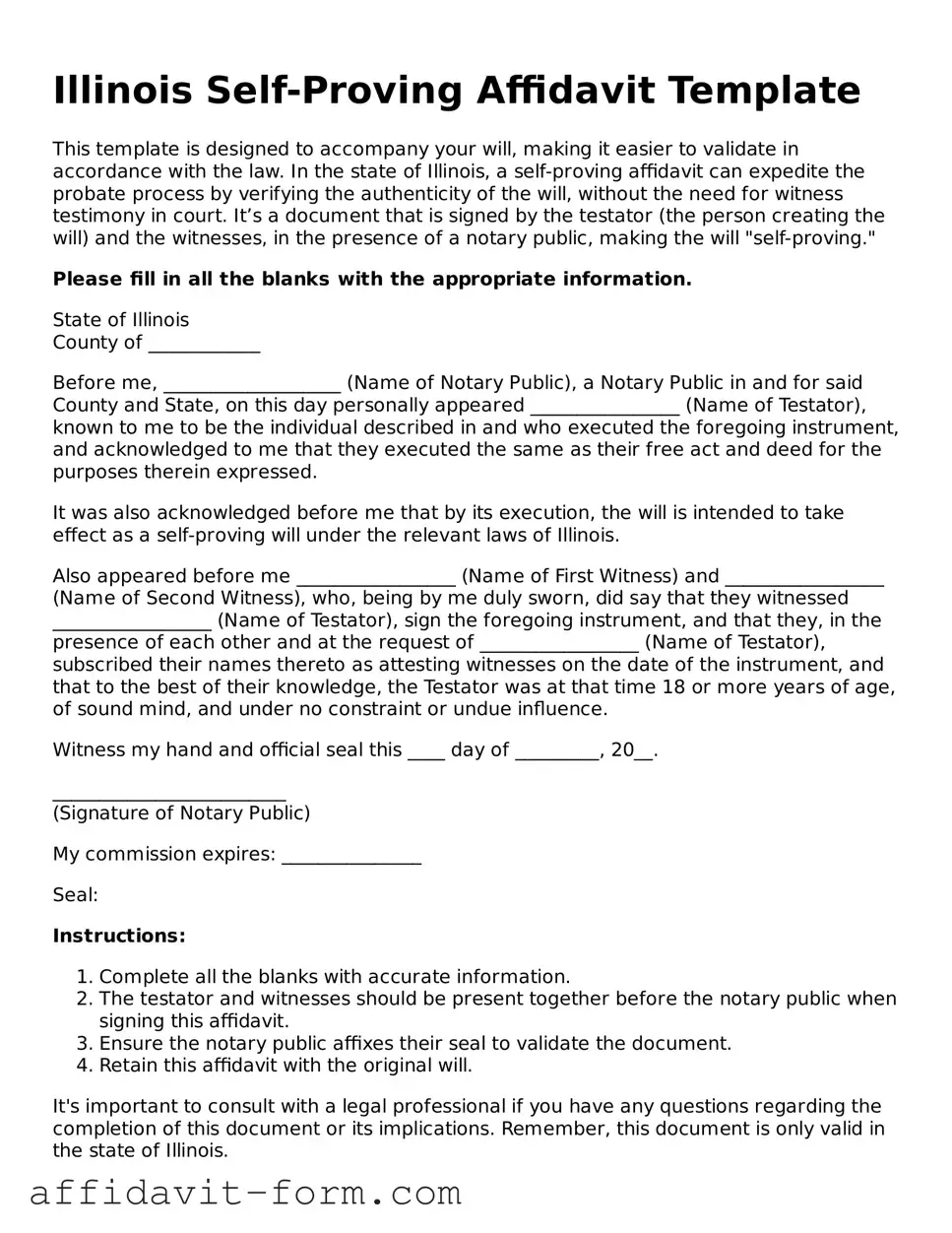

Form Example

Illinois Self-Proving Affidavit Template

This template is designed to accompany your will, making it easier to validate in accordance with the law. In the state of Illinois, a self-proving affidavit can expedite the probate process by verifying the authenticity of the will, without the need for witness testimony in court. It’s a document that is signed by the testator (the person creating the will) and the witnesses, in the presence of a notary public, making the will "self-proving."

Please fill in all the blanks with the appropriate information.

State of Illinois

County of ____________

Before me, ___________________ (Name of Notary Public), a Notary Public in and for said County and State, on this day personally appeared ________________ (Name of Testator), known to me to be the individual described in and who executed the foregoing instrument, and acknowledged to me that they executed the same as their free act and deed for the purposes therein expressed.

It was also acknowledged before me that by its execution, the will is intended to take effect as a self-proving will under the relevant laws of Illinois.

Also appeared before me _________________ (Name of First Witness) and _________________ (Name of Second Witness), who, being by me duly sworn, did say that they witnessed _________________ (Name of Testator), sign the foregoing instrument, and that they, in the presence of each other and at the request of _________________ (Name of Testator), subscribed their names thereto as attesting witnesses on the date of the instrument, and that to the best of their knowledge, the Testator was at that time 18 or more years of age, of sound mind, and under no constraint or undue influence.

Witness my hand and official seal this ____ day of _________, 20__.

_________________________

(Signature of Notary Public)

My commission expires: _______________

Seal:

Instructions:

- Complete all the blanks with accurate information.

- The testator and witnesses should be present together before the notary public when signing this affidavit.

- Ensure the notary public affixes their seal to validate the document.

- Retain this affidavit with the original will.

It's important to consult with a legal professional if you have any questions regarding the completion of this document or its implications. Remember, this document is only valid in the state of Illinois.

Document Details

| Fact | Description |

|---|---|

| Governing Law | The Illinois Self-Proving Affidavit form is governed by the Illinois Compiled Statutes, specifically 755 ILCS 5/6-4. |

| Purpose | It is used to streamline the probate process by authenticating the validity of a will, thus avoiding the need for witness testimony in court. |

| Execution Requirements | The signer of the will and two witnesses must sign the affidavit in the presence of a notary public for it to be considered valid. |

| Notarization | The affidavit must be notarized to certify the identity of the signer and the witnesses, ensuring that the document is legally binding. |

How to Use Illinois Self-Proving Affidavit

When preparing legal documents, particularly those related to estate planning, the importance of accuracy and adherence to formalities cannot be overstated. The Illinois Self-Proving Affidavit form is a useful tool that simplifies the probate process, ensuring that a will is accepted by the court as genuine without the need for witnesses to provide oral testimony. It must be filled out correctly to be effective. The following steps are designed to guide you through the process of completing this form correctly.

- Start by entering the full legal name of the testator (the person making the will) at the top of the document where it indicates. This ensures the affidavit is properly linked to the correct will.

- Next, the testator must declare that the attached document is their will and that they are signing it voluntarily, without any undue influence from others.

- Two witnesses are required for the form. Each witness must write their full legal name, confirming they observed the testator sign the will or that the testator acknowledged their signature on the will.

- Enter the date on which the affidavit is being signed by all parties. The date is crucial as it provides evidence that the witnesses signed in the presence of the testator and vice versa.

- It is essential for the testator and the witnesses to provide their addresses. This information helps in locating them if verification of the will’s authenticity is necessary.

- All parties involved — the testator and the witnesses — must sign the document in the presence of a notary public. Ensure that the signatures are done in the designated spaces for each.

- The notary public will then fill out their section, including the date, their name, and their official seal, which validates the self-proving affidavit.

After completing the form with all the required information and the necessary signatures, the Illinois Self-Proving Affidavit must be kept securely with the will. This document plays a critical role in the probate process, significantly reducing the complexity and duration of validating the will. By following these steps carefully, the integrity of the testamentary document is upheld, honoring the testator's final wishes without unnecessary delay.

Listed Questions and Answers

What is a Self-Proving Affidavit Form in Illinois?

A Self-Proving Affidavit Form in Illinois is a legal document that accompanies a last will and testament. Its main role is to verify the authenticity of the will, making it easier and quicker to be admitted to probate upon the death of the testator. The affidavit is signed by the testator and the witnesses, confirming under oath that they observed the signing of the will and believe the testator was of sound mind and not under undue influence.

Why is a Self-Proving Affidavit important in Illinois?

This document is crucial in Illinois because it simplifies the probate process. With a self-proving affidavit, the will can often be admitted to probate without requiring the witnesses to appear in court to attest to its validity. This can dramatically reduce the time and legal expenses involved in settling an estate, ensuring a smoother distribution of assets to the beneficiaries.

Who can act as a witness for a Self-Proving Affidavit in Illinois?

In Illinois, witnesses to a Self-Proving Affidavit must meet these criteria:

- Be at least 18 years old.

- Not be a beneficiary of the will.

- Be considered of sound mind to understand the significance of their act.

How do you create a Self-Proving Affidavit in Illinois?

To create a Self-Proving Affidavit in Illinois, follow these steps:

- Prepare the affidavit in alignment with Illinois law, which typically includes statements attesting to the authenticity of the will and the competency of the testator.

- Have the testator sign the affidavit in the presence of at least two disinterested witnesses (people who are not beneficiaries of the will).

- The witnesses then sign the affidavit, affirming they observed the testator sign the will and that they believe the testaper was of sound mind.

- A notary public must be present to notarize the signatures, making the document legally binding.

Where do you file a Self-Proving Affidavit in Illinois?

The Self-Proving Affidavit does not need to be filed immediately upon creation. Instead, it should be kept in a safe place with the will. Upon the testator's death, the will, along with the Self-Prooving Affidavit, is submitted to the probate court in the county where the decedent lived.

Is a Self-Proving Affidavit required for all wills in Illinois?

While not required by Illinois law for wills to be valid, having a Self-Proving Affidavit is highly recommended. It’s a proactive step that significantly streamlines the probate process by preempting potential legal requirements for witness testimonies regarding the will's authenticity.

Can a Self-Proving Affidavit be added to an existing will in Illinois?

Yes, a Self-Proving Affidavit can be added to an existing will. The process involves the testator and witnesses going through the signing ceremony again in the presence of a notary public. This ceremony must follow all the rules previously mentioned, ensuring the affidavit accurately states that the witnesses and testator understand and affirm the contents of the will.

What if the Self-Proving Affidavit is contested in Illinois?

If the Self-Proving Affidavit is contested, the court will examine the circumstances under which the affidavit was signed and may require testimony from the witnesses or notary public who were present during the signing. The court's aim is to determine the affidavit's and the will's validity, ensuring that the testator's final wishes are upheld in accordance to Illinois law.

Common mistakes

-

Not having the affidavit notarized. A critical step in completing the self-proving affidavit is having it notarized. This process validates the identity of the signatories and confirms they signed the document willingly. Failing to notarize the affidavit renders it invalid.

-

Incorrect information. Another common mistake is providing incorrect information about the witnesses or the person making the will. This includes incorrect names, addresses, or dates. It’s crucial to double-check these details for accuracy.

-

Forgetting to include the affidavit with the will. The Self-Proving Affidavit must be attached to the will. Sometimes people forget to attach it, leading to delays in probate court because the will’s authenticity may need to be proven through other means.

-

Using witnesses who are not considered disinterested. In Illinois, witnesses to a will should not be beneficiaries of the will. Using interested parties can challenge the validity of the will and the affidavit.

-

Not signing in the proper sequence. The person making the will (testator) must sign the affidavit before the witnesses sign it. Signing out of sequence can raise questions about the validity of the affidavits.

-

Using an outdated or incorrect form. Laws change, and so do the forms associated with legal procedures. Using an outdated version of the Self-Proving Affidavit can lead to it being rejected by the court.

-

Not consulting with a legal professional. While it may seem straightforward, filling out a Self-Proving Affidavit without legal advice can result in mistakes. A legal professional can ensure all requirements are met and the document is filled out correctly.

To enhance the understanding of these common mistakes, it’s beneficial to delve into why they happen and how to address them:

Notarization issues: People often underestimate the importance of notarization, thinking it’s just a formality. Notarization acts as a fraud deterrent and is legally required.

Accuracy of information: Simple oversights in filling in personal details can make a significant difference. Taking a moment to review the document can prevent these errors.

Attachment to the will: The physical connection of the affidavit to the will is sometimes overlooked. This simple yet critical step ensures that the documents are processed as a single package.

Witness requirements: The role of a witness is pivotal. Their disinterest in the will’s outcomes adds integrity to their testimony, supporting the will’s authenticity.

Signing sequence: The order in which the document is signed not only follows legal protocol but also reinforces the willful participation of all parties involved.

Form validity: Keeping abreast of current legal requirements and forms prevents unnecessary delays or rejections by the court.

Legal guidance: Legal advice is invaluable in navigating the nuances of will documentation, ensuring the process is completed efficiently and correctly.

Documents used along the form

When completing an Illinois Self-Proving Affidavit form, it's often just one step in the broader estate planning or will execution process. While the Self-Proving Affidavit helps to expedite the probate process by verifying the authenticity of a will, there are several other documents that individuals should consider preparing alongside it. These forms and documents are crucial for a comprehensive estate plan, ensuring that all legal, financial, and personal matters align with the individual's wishes.

- Last Will and Testament: This document is where you'll outline how you want your assets distributed after you pass away. It's the primary document to which the Self-Proving Affidavit is attached.

- Power of Attorney: This powerful document appoints someone to handle your affairs if you become incapacitated. There are different types for financial matters and health care decisions.

- Living Will: Also known as an advance healthcare directive, it outlines your wishes for medical treatment if you're unable to communicate them yourself.

- Revocable Living Trust: This allows you to maintain control over your assets while you're alive but have them transfer seamlessly to your beneficiaries upon your death, potentially avoiding probate.

- Beneficiary Designations: These are forms you complete with financial accounts (like life insurance, IRAs, and 401(k)s) to specify who will receive the assets in those accounts upon your death.

- Funeral Directive: This document lays out your wishes for your funeral and burial or cremation, easing the burden on your loved ones during a difficult time.

- Property Deeds: If you plan to transfer real estate properties upon your death, having current copies of the property deeds is essential. Some may choose to transfer ownership via a trust or other legal instruments.

Together, these documents form a holistic approach to estate planning, addressing not only the distribution of assets but also decisions regarding health care, financial management, and personal wishes in unforeseen circumstances. It's advisable to consult with a legal professional when preparing these documents to ensure they are properly executed and reflect your intentions accurately.

Similar forms

The Illinois Self-Proving Affidavit form is similar to several other legal documents in purpose and structure, serving to streamline the process of probating a will by verifying the authenticity of the document and the signatures it bears. This affidavit, when properly executed, can significantly speed up legal procedures after someone passes away, ensuring that the wishes detailed in their will are fulfilled without unnecessary delay. The use of such affidavits is common across the United States, though specific requirements may vary from one jurisdiction to another.

Last Will and Testament: The Self-Proving Affidavit form is closely related to a Last Will and Testament in that it often accompanies this document as a testamentary add-on. Like a will, it deals with the matters of estate planning and distribution of assets after someone's death. However, the affidavit specifically serves to authenticate the will, confirming that it was indeed signed and acknowledged by the testator (the person who made the will) and witnesses under their own free will, without any undue influence or coercion. This is similar to the role of witness signatures on a will, but the affidavit provides an extra layer of formal verification.

Notarized Affidavit: The Self-Proving Affidavit form resembles a Notarized Affidavit in its requirement for notarization. Both documents must be signed in the presence of a notary public, who verifies the identity of the signatories and ensures that they are signing voluntarily and under no duress. The key difference is in their applications; while a notarized affidavit can cover a wide range of statements and declarations beyond the scope of wills or estate planning, the self-proving affidavit is specifically designed to affirm the validity of a will and the procedure followed in its signing.

Advance Directive Forms: Similar to an Advance Directive form, the Self-Proving Affidavit is a document that comes into play in planning for the future. Advance Directives outline a person's wishes regarding medical treatment and care in case they become unable to communicate these preferences themselves. Although serving different purposes—Advance Directives for health care decisions and Self-Proving Affidavits for estate planning—both documents share the characteristic of preparing for events that can deeply impact one’s life and the lives of those around them. In both cases, the documents aim to ensure that personal choices are respected and followed through with minimal legal obstacles.

Dos and Don'ts

When completing the Illinois Self-Proving Affidavit form, individuals must follow specific guidelines to ensure the document is legally valid. A self-proving affidavit is designed to streamline the probate process by verifying the authenticity of a will without requiring witness testimony. To assist in this process, here’s a list of dos and don'ts:

Do:- Read the instructions carefully before beginning to fill out the form.

- Use black ink for better legibility and to meet standard legal document requirements.

- Ensure all parties, including witnesses, are present at the same time during the signing to comply with Illinois law.

- Provide accurate and complete information in every section to avoid any ambiguities.

- Sign the affidavit in the presence of a notary public to validate its authenticity.

- Confirm that the witnesses meet the legal requirements for witnessing a document in Illinois.

- Keep the affidavit with the will or estate planning documents to which it pertains.

- Review the completed affidavit for any errors or omissions before notarization.

- Make sure the notary public completes their section fully, including their seal and signature.

- Consider consulting with a legal professional if you have any doubts or questions about the form.

- Don’t use pencil or any erasable writing tool, as alterations can raise questions about the document’s integrity.

- Don’t leave any sections blank. If a section doesn’t apply, write “N/A” to indicate this.

- Don’t sign the document until all parties are present and ready to sign together.

- Don’t forget to check the identification of the witnesses to ensure they are who they say they are.

- Don’t neglect the details. Even small mistakes can lead to big problems in legal documents.

- Don’t rush through the process. Taking the time to follow each step carefully is crucial.

- Don’t use witnesses who have a vested interest in the will, as this could lead to challenges later.

- Don’t overlook the notary’s requirements, such as presenting valid I.D., which may vary by state.

- Don’t separate the affidavit from the will, as it serves as an integral part of the estate documentation.

- Don’t hesitate to redo the form if mistakes are made. It’s better to start over than to submit a document with errors.

Misconceptions

In Illinois, the Self-Proving Affidavit form is an essential document that simplifies the probate process for a will. However, there are several misconceptions that people often have about its function and requirements. Understanding these misconceptions is important for anyone looking to include a Self-Proving Affidavit with their will.

- It’s not required for a valid will: A common misconception is that a will must have a Self-Proving Affidavit to be legally valid. In reality, while the affidavit can simplify the probate process by serving as evidence that the will was executed properly, an Illinois will is still valid without it as long as it meets state requirements.

- It eliminates the need for witness testimony during probate: While a Self-Proving Affidavit significantly reduces the need for witnesses to testify about the validity of the will in probate court, it doesn't completely eliminate it. The court can still require witness testimony in certain situations, especially if the will's validity is contested.

- It’s the same in every state: Many believe that a Self-Proving Affidavit form and its requirements are uniform across all states. However, this is not the case. Each state has its rules and regulations governing the execution and recognition of Self-Proving Affidavits. Therefore, an affidavit that is valid in Illinois may not necessarily meet the requirements in another state.

- All witnesses must sign the affidavit: For an affidavit to be self-proving in Illinois, it needs to be signed by the testator (the person making the will) and the witnesses. There's a misunderstanding that all witnesses to the will must also sign the affidavit, but the truth is that only two disinterested witnesses are required to make the will and affidavit valid.

- It’s only for the elderly or sick: Some people mistakenly believe that a Self-Proving Affidavit is only necessary for individuals who are elderly or have a terminal illness. This misconception overlooks the fact that a Self-Proving Affidavit is beneficial for anyone making a will, as it helps ensure the will is efficiently processed through probate, regardless of the testator's health at the time the will is created.

Clarifying these misconceptions about the Illinois Self-Proving Affidavit form is important for anyone involved in estate planning. By understanding what the affidavit does and does not do, individuals can make more informed decisions about incorporating it into their will and ensure a smoother probate process for their heirs.

Key takeaways

When filling out and using the Illinois Self-Proving Affidavit form, it is important to understand its purpose and requirements. Here are four key takeaways to ensure the process is completed correctly:

- The Illinois Self-Proving Affidavit form allows a will to be admitted to probate without the need for witness testimony. This can save time and simplify the probate process after the will maker's death.

- To be valid, the form must be signed by the will maker and two witnesses. All signatures must occur in the presence of a notary public to ensure that each party is willingly and understandingly participating.

- Choosing witnesses who are not beneficiaries of the will is vital. This helps avoid potential conflicts of interest and ensures that the witnesses can objectively attest to the will maker's mental state and intention.

- After completing the form, it should be securely attached to the will. This ensures that the affidavit is readily available and can be promptly used during the probate process, further streamlining the procedure.

Fill out Popular Self-Proving Affidavit Forms for Different States

What Is a Self-proving Affidavit - It is an essential component for anyone seeking to leave a clear, uncontested path for their estate’s distribution upon their passing.

Guardianship Authorization Affidavit California - It is a proactive measure to ensure your will is undisputedly recognized by the courts, saving time and resources.