Printable Small Estate Affidavit Form for Illinois

In Illinois, the process of handling a deceased person's estate can be simplified for small estates through the use of the Small Estate Affidavit form. This legal document allows for the transfer of the decedent's property to beneficiaries without the need for a formal probate process, provided the total value of the estate does not exceed a certain threshold. The form is a valuable tool for families seeking a more straightforward method of asset distribution, enabling them to bypass the often lengthy and costly court proceedings associated with traditional probate. It is designed to be user-friendly, requiring the affiant, who is the person completing the form, to declare their relationship to the deceased, list the assets, and certify that the estate qualifies under state law limitations. Key elements include identifying the assets to be transferred, ensuring debts and taxes are paid, and distributing what remains to rightful heirs or legatees according to the will or state succession laws. The Small Estate Affidavit is thus an important document for individuals dealing with small estates, aiming to make the process more efficient while still adhering to Illinois laws.

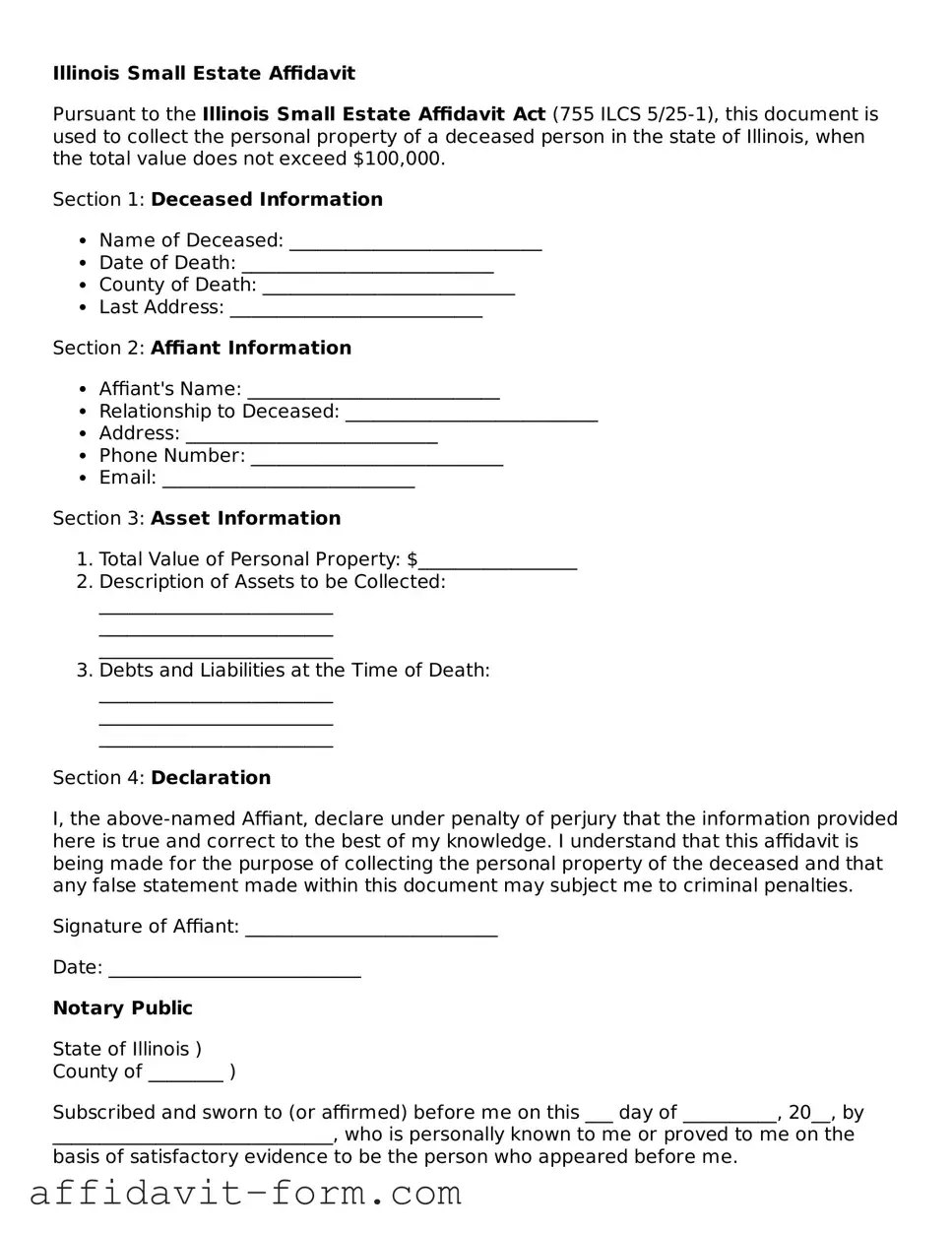

Form Example

Illinois Small Estate Affidavit

Pursuant to the Illinois Small Estate Affidavit Act (755 ILCS 5/25-1), this document is used to collect the personal property of a deceased person in the state of Illinois, when the total value does not exceed $100,000.

Section 1: Deceased Information

- Name of Deceased: ___________________________

- Date of Death: ___________________________

- County of Death: ___________________________

- Last Address: ___________________________

Section 2: Affiant Information

- Affiant's Name: ___________________________

- Relationship to Deceased: ___________________________

- Address: ___________________________

- Phone Number: ___________________________

- Email: ___________________________

Section 3: Asset Information

- Total Value of Personal Property: $_________________

- Description of Assets to be Collected:

_________________________

_________________________

_________________________ - Debts and Liabilities at the Time of Death:

_________________________

_________________________

_________________________

Section 4: Declaration

I, the above-named Affiant, declare under penalty of perjury that the information provided here is true and correct to the best of my knowledge. I understand that this affidavit is being made for the purpose of collecting the personal property of the deceased and that any false statement made within this document may subject me to criminal penalties.

Signature of Affiant: ___________________________

Date: ___________________________

Notary Public

State of Illinois )

County of ________ )

Subscribed and sworn to (or affirmed) before me on this ___ day of __________, 20__, by ______________________________, who is personally known to me or proved to me on the basis of satisfactory evidence to be the person who appeared before me.

Signature of Notary Public: _________________________

Seal:

Document Details

| Fact | Detail |

|---|---|

| Governing Law | Illinois Probate Act, specifically 755 ILCS 5/25-1 |

| Purpose | To administer estates with personal property valued at $100,000 or less without going through probate. |

| Eligibility | Estate must consist of personal property valued at $100,000 or less, and not include real estate. |

| Required Information | Deceased’s personal information, a detailed description of the property, and the names and addresses of those entitled to the property. |

| Usage | Used by successors to collect the property of the deceased without a formal probate proceeding. |

| Filing Requirement | Must be filed with the decedent’s assets holders, such as banks or other financial institutions. |

| Validity Period | There is no specified expiration for the form once executed, but some institutions may require a recent affidavit. |

| Limitations | Cannot be used to transfer title of real estate or settle disputes among heirs or creditors. |

| Witness Requirement | No witness signing is mandated by the Illinois Probate Act, but the form must be notarized. |

| Modification | Once submitted, modifications to the affidavit require legal proceedings to correct any inaccuracies or fraud. |

How to Use Illinois Small Estate Affidavit

When someone passes away without a will, their assets can often be distributed through a simplified process known as a Small Estate Affidavit. This option is available in Illinois if the total value of the estate is $100,000 or less and doesn't include real estate. The person who completes this form, often a close relative or friend, is seeking authority to distribute the deceased person's property according to state laws. This task can seem daunting, but by following a clear, step-by-step guide, it can be manageable and straightforward.

Here are the steps needed to fill out the Illinois Small Estate Affidavit form:

- Start by entering the full legal name of the deceased, also known as the decedent, at the top of the form where indicated.

- Fill in the decedent’s date of death in the space provided, ensuring the date format matches that requested on the form (usually month-day-year).

- List the total value of the decedent’s personal property (this includes bank accounts, vehicles, stocks, and other assets but not real estate) to confirm it does not exceed the $100,000 threshold. Write this amount in the designated area.

- Provide your full name and address, as you are the affiant, or the person filling out this form. By doing this, you're affirming your relationship to the estate and your intention to handle the decedent’s assets responsibly.

- Detail the names, addresses, and relationships of all heirs and legatees (those named in a will, if one exists) including yourself, if applicable. Use additional sheets if necessary, ensuring each person is accounted for.

- Include a descriptive list of the personal property to be distributed through the affidavit. This step requires careful attention as each item must be identified along with its value. Be as specific as possible.

- State whether there is known unpaid funeral and burial expenses, specifying the amount and to whom it is owed. This information is crucial for determining the allocation of the estate’s assets.

- If applicable, indicate any debts owed by the decedent, including creditor names, addresses, and the amount of debt. This helps ensure debts are paid from the estate before distribution to heirs.

- Review the affidavit statements at the end of the form. Ensure that each statement is true and accurate to the best of your knowledge. This section typically requires your agreement that the estate owes no federal or state taxes.

- Sign and date the form in the presence of a notary public, who will also need to sign, date, and affix their official seal, certifying that you are the person executing the affidavit.

After completing these steps, you will have a document that, when properly executed, provides the legal authority to gather, manage, and distribute the properties and assets of the deceased's estate. Remember, this form does not grant permission to handle real estate transactions and is only valid for estates valued at $100,000 or less. It's also advisable to consult with a legal professional if you encounter any uncertainties during this process. Following the above guidelines will help ensure that the process is carried out smoothly and according to the laws of Illinois.

Listed Questions and Answers

What is an Illinois Small Estate Affidavit?

An Illinois Small Estate Affidavit is a legal document used by the successors of a deceased person's estate, allowing them to collect the deceased's property without a formal probate process. It's applicable when the total value of the estate assets, after debts are deducted, does not exceed $100,000. This affidavit is intended to simplify the process of asset distribution among the rightful heirs or beneficiaries.

Who can use an Illinois Small Estate Affidavit?

The use of an Illinois Small Estate Affidavit is limited to the successors of the deceased. This generally includes the deceased's surviving spouse, adult children, parents, or other relatives who are entitled to inherit the estate according to the state’s succession laws. It’s important that the person using the affidavit has a legitimate claim to the part of the estate they are seeking to collect.

What assets can be collected with an Illinois Small Estate Affidavit?

Assets that can typically be collected with an Illinois Small Estate Affidavit include, but are not limited to:

- Bank accounts owned by the deceased

- Stocks and bonds

- Vehicles

- Personal property items, such as furniture and jewelry

- Life insurance policies and retirement accounts that do not have a named beneficiary

Are there any assets that cannot be collected using an Illinois Small Estate Affidavit?

Yes, certain assets are not eligible for collection via an Illinois Small Estate Affidavit. These include:

- Real estate owned by the deceased

- Any asset that has already been specifically bequeathed in a will to another beneficiary

- Assets that are jointly owned with rights of survivorship

What are the steps to complete an Illinois Small Estate Affidavit?

Completing an Illinois Small Estate Affidavit involves several steps:

- Ensure the estate’s total value does not exceed the $100,000 limit.

- Complete the affidavit form, providing detailed information about the deceased, their assets, and the claiming successor.

- List the known debts of the estate, if any.

- Have the affidavit signed by all successors entitled to the property or a portion of it.

- Notarize the affidavit.

- Present the affidavit to the entity holding the property (e.g., bank, brokerage firm) to transfer ownership.

Is a lawyer needed to fill out an Illinois Small Estate Affidavit?

While you are not required to have a lawyer to fill out an Illinois Small Estate Affidavit, consulting with one can be beneficial. A lawyer can provide guidance, ensure that the form is completed correctly, and offer advice on any potential legal issues that might arise during the asset collection process.

How long after death can an Illinois Small Estate Affidavit be filed?

The Illinois Small Estate Affidavit can be filed 30 days after the death of the estate owner. This waiting period allows time for a more comprehensive accounting of the estate's assets and for potential creditors to make claims against the estate.

Can debts of the deceased be paid using assets collected via an Illinois Small Estate Affidavit?

Yes, debts of the deceased can and should be paid using the assets collected through an Illinois Small Estate Affidavit. It is the responsibility of the person filing the affidavit to ensure that the deceased's legitimate debts are satisfied from the estate’s assets before distributing the remaining property among the successors.

What happens if the value of the estate is later found to exceed $100,000?

If it is later discovered that the value of the estate exceeds $100,000, the Small Estate Affidavit process is deemed inappropriate, and a formal probate process may be required. In such cases, it is advisable to consult with a probate attorney to determine the appropriate steps to take.

Where can I obtain an Illinois Small Estate Affidavit form?

The Illinois Small Estate Affidavit form can typically be obtained from the county clerk's office where the deceased person resided. Additionally, many legal websites and libraries offer downloadable forms that can be used. However, ensure that any form used complies with current Illinois law to avoid potential issues.

Common mistakes

Filling out the Illinois Small Estate Affidavit form is a crucial step for those looking to settle an estate that falls under the state’s small estate limit. However, mistakes can lead to delays and complications. Here are ten common mistakes people make when they fill out this form:

- Not verifying eligibility: People often start filling out the form without confirming if the estate qualifies as a ‘small estate’ under Illinois law. This can lead to wasted efforts if the estate exceeds the value limit.

- Incomplete information: Leaving sections incomplete is a common mistake. Each question needs an answer, even if it's "N/A" (not applicable).

- Incorrect asset valuation: Accurately valuing the assets of the estate is crucial. Overestimating or underestimating can affect the distribution and taxes.

- Forgetting to list all assets: Sometimes, people overlook or forget to include all of the deceased's assets, like small bank accounts or personal property, which can lead to disputes or claims later.

- Improper debt handling: Not properly listing outstanding debts or failing to notify creditors can create legal complications.

- Failing to obtain necessary signatures: The form requires signatures from relevant parties, and missing signatures can render the document invalid.

- Mixing up beneficiaries and heirs: Beneficiaries (named in a will) and heirs (determined by law if there's no will) must be correctly identified and not confused.

- Incorrectly describing property: Detail is key when describing property. Vague descriptions can lead to misunderstandings or disputes among heirs.

- Not attaching required documents: Supporting documents, like death certificates or titles, are often required but sometimes forgotten.

- Using outdated forms: Laws change, and so do forms. Using an outdated version may result in having to start over with the correct, current form.

By avoiding these common mistakes, the process of using a Small Estate Affidavit in Illinois can be smoother and more efficient, ensuring a timely distribution of the estate to the rightful heirs or beneficiaries.

Documents used along the form

When managing the estate of someone who has passed away in Illinois, the Small Estate Affidavit is a critical document for small estates that need to be settled without formal probate. This process is simplified, but there are other documents that often complement the Small Estate Affidavit to ensure a smooth administration. Below are four additional forms and documents that are frequently used alongside the Small Estate Affidavit form.

- Death Certificate: An official death certificate is essential. It provides proof of death and is required by financial institutions and other entities to transfer ownership or release the deceased's assets.

- Copy of the Will: If the deceased left a will, a copy is needed to verify the beneficiaries and the executor’s authority to distribute the assets as per the deceased's wishes. This is particularly important when the Small Estate Affidavit needs to align with the will’s directions.

- Third Party Affidavit: Some entities may require a Third Party Affidavit to release assets held by them. This legal document, sworn by the affiant, attests to the affiant's belief that the estate qualifies for handling as a small estate under Illinois law.

- Inventory and Appraisal Form: While not always mandatory, having an inventory and appraisal of the deceased's property can be crucial. This document lists all assets and their estimated values, helping to ascertain whether the estate indeed qualifies as a "small estate" under Illinois law.

Together with the Small Estate Affidavit, these documents form a comprehensive toolkit for effectively managing the affairs of a small estate in Illinois. Ensuring all necessary paperwork is in order can significantly streamline the process, making it easier for the deceased's assets to be distributed to their rightful heirs or beneficiaries.

Similar forms

The Illinois Small Estate Affidavit form is similar to other legal documents used to manage and settle the estates of deceased individuals. These documents include the Transfer on Death Instrument (TODI), the Last Will and Testament, and the Revocable Living Trust. Each document has its unique purpose and application but shares a common goal: to facilitate the distribution of assets according to the deceased person's wishes or the law.

The Transfer on Death Instrument (TODI) allows property owners to name beneficiaries who will receive the property upon the owner’s death, without the need for probate. Like the Illinois Small Estate Affidavit, the TODI is designed to simplify the transfer of assets. However, while the Small Estate Affidavit is limited by the total value of the estate, a TODI can be used regardless of the estate's value. Both tools avoid the complexities and costs associated with probate court.

The Last Will and Testament is a document that outlines how a person’s assets should be distributed after death. It is similar to the Illinois Small Estate Affidavit in its purpose to distribute assets but differs in its application and scope. The Last Will requires probate to validate its authenticity and execute its directives, unlike the affidavit, which bypasses probate for smaller estates. The Small Estate Affidavit can sometimes serve to distribute assets not specifically named or addressed in the Last Will, providing a mechanism for managing assets that fall below the probate threshold.

A Revocable Living Trust is an estate planning tool that allows an individual to manage their assets during their lifetime and specify how these should be distributed upon their death. This document shares a similar objective with the Illinois Small Estate Affidavit, aiming to ease the process of transferring assets. However, the living trust is more comprehensive, enabling the grantor to avoid probate for all assets placed within the trust, not just those under a certain value. Although more complex and needing setup during the grantors' lifetime, it complements the Small Estate Affidavit by providing a seamless transition of assets upon death.

Dos and Don'ts

Handling the Illinois Small Estate Affidavit form can simplify the process of settling a small estate. However, it's important to approach this document with care. To ensure a smooth process, here are some dos and don'ts to keep in mind:

What you should do:

Ensure eligibility by confirming that the estate's value does not exceed the threshold established by Illinois state law. This figure is subject to change, so it's vital to verify the current limit.

Provide complete and accurate information about the deceased, their assets, debts, and beneficiaries. Inaccuracies can lead to delays or legal complications.

Sign the form in the presence of a notary public. This step is crucial for the document to have legal validity.

Keep copies of the completed form and any supporting documents. Having these records on hand can be helpful in resolving any questions or issues that may arise later.

What you shouldn't do:

Don't attempt to use the form if the estate exceeds the small estate threshold. In such cases, a more formal probate process may be necessary.

Don't provide incomplete or false information. This can lead to significant legal problems, including penalties for perjury.

Don't overlook creditor claims. Ensure that all debts and claims against the estate are acknowledged and addressed appropriately.

Don't forget to distribute the assets according to the deceased's wishes, if known, or as dictated by state law if there is no will.

Approaching the Illinois Small Estate Affidavit form with these key points in mind can help streamline the estate settlement process, making it as smooth and trouble-free as possible.

Misconceptions

When someone passes away in Illinois, managing their estate can sometimes be simplified through a Small Estate Affidavit. This process is often misunderstood, leading to several misconceptions.

It eliminates the need for a lawyer. While the Small Estate Affidavit is designed to be straightforward, legal advice can ensure the form is filled out correctly and the estate is distributed according to the law. Missteps without legal guidance could lead to personal liability.

It’s applicable to all estates under $100,000. While it's true that this affidavit can be used for estates valued at $100,000 or less, not all assets qualify. For example, real estate and certain other assets might require formal probate, regardless of the total estate value.

It grants immediate access to the deceased’s assets. Even with a Small Estate Affidavit, financial institutions and other entities may have procedures that delay access. Additionally, claim periods for creditors could affect the timing of distribution.

Assets are automatically distributed equally. The affidavit does not override the deceased’s will or the laws of intestate succession. The document helps facilitate the transfer of assets according to the existing legal directives or, in their absence, the state’s succession laws.

It avoids taxes and debts. The use of a Small Estate Affidavit does not exempt an estate from paying owed taxes or debts. The person signing the affidavit may even become personally liable for ensuring these obligations are met.

One form fits all situations. While Illinois provides a standard form, its applicability may vary based on the specific circumstances of the estate, such as the type and location of assets. Tailoring might be necessary to address these unique aspects effectively.

Understanding these misconceptions can aid in navigating the process more effectively and ensure a smoother transfer of assets. Consulting with a professional can provide personalized advice and peace of mind during a difficult time.

Key takeaways

When navigating through the process of managing a small estate in Illinois, it is crucial to understand how to properly fill out and utilize the Illinois Small Estate Affidavit form. This document serves as a supportive tool for individuals dealing with estates that fall under the threshold specified by Illinois law. Here are key takeaways to ensure the process is handled efficiently and according to legal requirements:

- Eligibility Criteria: Confirm that the total value of the estate does not exceed the current small estate limit set by Illinois law. This ensures that the Small Estate Affidavit procedure is applicable to your situation.

- Accurate and Complete Information: Provide precise and comprehensive details about the decedent’s assets, debts, and heirs. Filling out the form with incorrect or incomplete information can lead to delays or legal complications.

- Signature and Notarization: The affidavit must be signed in the presence of a notary public. This formalizes the document, making it legally binding and acceptable to entities that hold the deceased's assets.

- Understand the Assets Covered: Not all assets can be transferred using the Small Estate Affidavit. Familiarize yourself with the types of assets that are eligible for transfer under this procedure to avoid any misunderstandings.

- Filing Requirements: While the Small Estate Affidavit does not generally need to be filed with the court, it is necessary to present it to institutions or individuals holding the estate's assets. Knowing where and when to present the affidavit is essential for a smooth transfer of assets.

- Seeking Legal Advice: Given the complexities associated with estate affairs, consulting with a legal professional can provide clarification and guidance. This is especially important if the estate involves complicated assets or potential disputes among heirs.

Adhering to these guidelines will help individuals manage a small estate more effectively, ensuring that the decedent’s assets are distributed to the rightful heirs in accordance with Illinois law. Remember, the Illinois Small Estate Affidavit is a tool designed to simplify the process, but it requires careful attention to detail to be used correctly.

Fill out Popular Small Estate Affidavit Forms for Different States

How Long Does Probate Take Indiana - The form requires meticulous attention to detail, as omissions or errors can complicate the estate settlement.

Aoc-e-203b - Helps in reducing legal fees and court costs associated with the transfer of estate assets.