Printable Small Estate Affidavit Form for Indiana

When a loved one passes away, managing their estate can seem like a daunting task, especially during a period of grief. In Indiana, the Small Estate Affidavit form serves as a beacon of relief for those navigating the murky waters of estate administration without a will. This pivotal document allows eligible individuals to expedite the process of asset distribution, bypassing the often lengthy and complicated probate process. Specifically designed for estates that fall below a certain value threshold, the Small Estate Affidavit empowers heirs and beneficiaries to claim property swiftly and with minimal court involvement. Understanding the eligibility criteria, necessary documentation, and specific procedural steps can significantly simplify the estate settlement process, ensuring that the deceased's assets are distributed according to their wishes or state law, in the absence of a will. This form not only streamlines the distribution of smaller estates but also underscores Indiana's commitment to making the legal aspects of bereavement as uncomplicated as possible. Engaging with the Small Estate Affidavit form, therefore, is a crucial step for eligible parties looking to navigate the post-loss period with grace and efficiency.

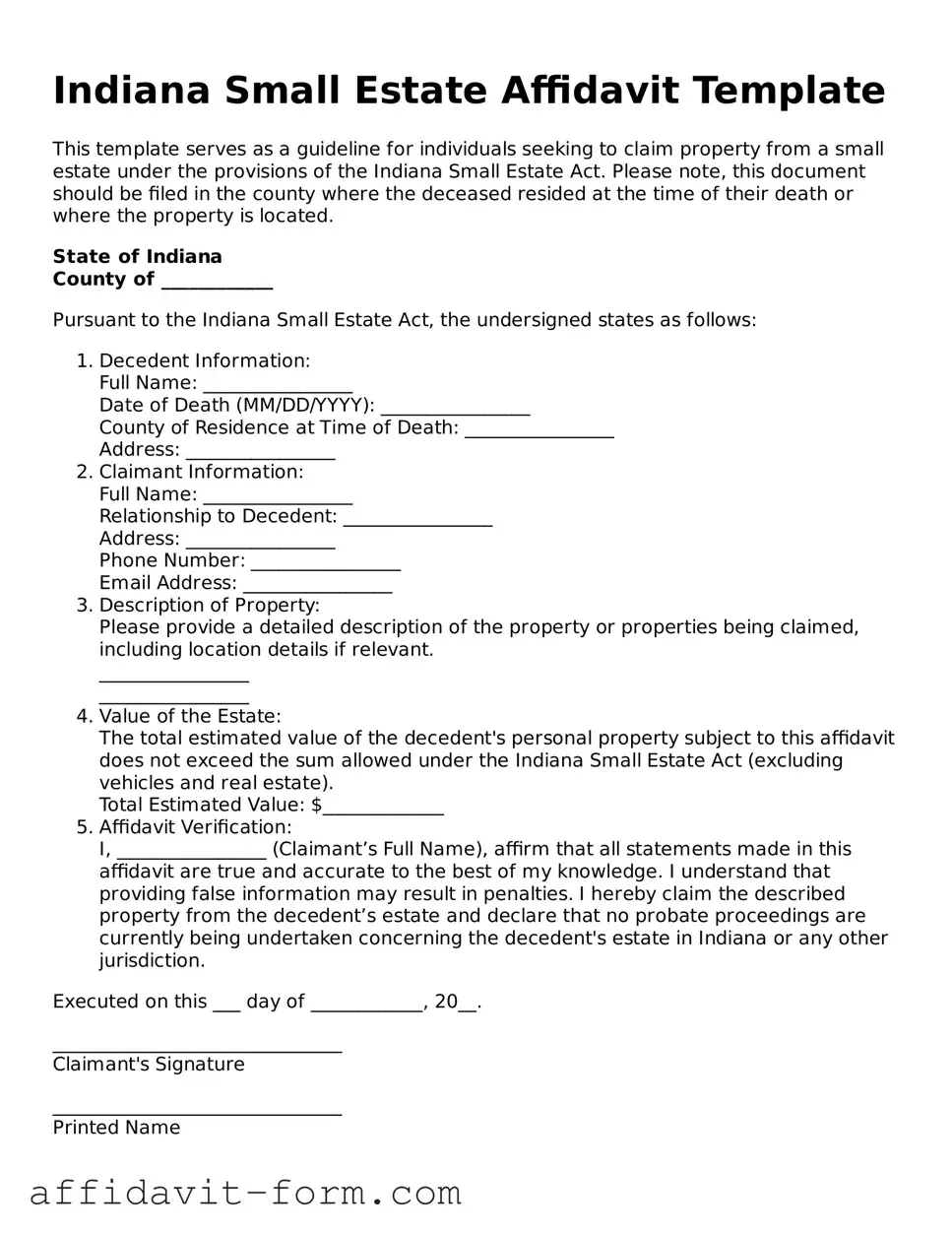

Form Example

Indiana Small Estate Affidavit Template

This template serves as a guideline for individuals seeking to claim property from a small estate under the provisions of the Indiana Small Estate Act. Please note, this document should be filed in the county where the deceased resided at the time of their death or where the property is located.

State of Indiana

County of ____________

Pursuant to the Indiana Small Estate Act, the undersigned states as follows:

- Decedent Information:

Full Name: ________________

Date of Death (MM/DD/YYYY): ________________

County of Residence at Time of Death: ________________

Address: ________________

- Claimant Information:

Full Name: ________________

Relationship to Decedent: ________________

Address: ________________

Phone Number: ________________

Email Address: ________________

- Description of Property:

Please provide a detailed description of the property or properties being claimed, including location details if relevant.

________________

________________

- Value of the Estate:

The total estimated value of the decedent's personal property subject to this affidavit does not exceed the sum allowed under the Indiana Small Estate Act (excluding vehicles and real estate).

Total Estimated Value: $_____________

- Affidavit Verification:

I, ________________ (Claimant’s Full Name), affirm that all statements made in this affidavit are true and accurate to the best of my knowledge. I understand that providing false information may result in penalties. I hereby claim the described property from the decedent’s estate and declare that no probate proceedings are currently being undertaken concerning the decedent's estate in Indiana or any other jurisdiction.

Executed on this ___ day of ____________, 20__.

_______________________________

Claimant's Signature

_______________________________

Printed Name

State of Indiana}

County of ____________}

Subscribed and sworn to (or affirmed) before me on this ___ day of ____________, 20__, by ________________ (name of the claimant).

_______________________________

Notary Public

My commission expires: ____________

Document Details

| # | Fact | Description |

|---|---|---|

| 1 | Purpose | The Indiana Small Estate Affidavit is used to manage the assets of a deceased person without formal probate when the estate is considered small under state law. |

| 2 | Governing Law | The form is governed by Indiana Code IC 29-1-8-1, which outlines the conditions under which a small estate affidavit can be used. |

| 3 | Value Limit | The estate must not exceed $50,000 in value to qualify for the use of the Small Estate Affidavit in Indiana. |

| 4 | Waiting Period | There is a 45-day waiting period after the death of the estate owner before the affidavit can be submitted to financial institutions or other entities holding the assets. |

| 5 | Required Signatures | The affidavit must be signed by all rightful heirs or by a designated representative if the heirs have come to a consensus on distribution. |

| 6 | Asset Types | The form can be used for a variety of assets, including but not limited to bank accounts, stocks, and personal property excluding real estate. |

| 7 | Filing | The affidavit does not need to be filed with a court but should be presented directly to the institution or party holding the estate's assets. |

| 8 | Real Estate Exclusion | Real estate cannot be transferred using the Small Estate Affidavit in Indiana; a different legal process is required for real estate assets. |

How to Use Indiana Small Estate Affidavit

When a loved one passes away, managing their estate can seem like a daunting task. However, for smaller estates, the state of Indiana offers a streamlined process that relieves some of this burden. The Indiana Small Estate Affidavit form is designed for situations where the deceased’s estate does not necessitate a full probate process. This procedure can considerably expedite the transfer of the deceased's assets to their rightful inheritors. The form itself is straightforward, but attention to detail is crucial to ensure its proper completion and acceptance by financial institutions, courts, or whoever else may require it.

To fill out the Indiana Small Estate Affidavit form correctly, follow these steps:

- Start by acquiring the most current version of the Indiana Small Estate Affidavit form. This can typically be found online through Indiana's official court or legal resources websites.

- Enter the full legal name of the deceased, also referred to as the decedent, in the designated space on the form.

- Fill in the date of death of the decedent. This information must be accurate and will be verified against official records.

- Provide the complete address of the decedent's primary residence at the time of their death.

- List all known assets of the decedent. This includes, but is not limited to, bank accounts, real estate, vehicles, and personal property. Be as detailed as possible, specifying account numbers, descriptions of property, and their estimated values.

- State the names and addresses of all potential heirs and beneficiaries. This includes anyone named in the will, if there is one, or otherwise entitled to inheritance under Indiana law.

- Calculate the total value of the decedent’s estate. For an estate to qualify under the Small Estate Affidavit process, its value must fall below the threshold set by Indiana law.

- Carefully read the declarations and statements at the end of the form. By signing, you are affirming under penalty of perjury that all provided information is true and correct to the best of your knowledge.

- Sign and date the form in the presence of a notary public. Some financial institutions or entities may require the affidavit to be notarized before they will release assets.

- Keep a copy of the completed affidavit for your records and provide original copies to financial institutions, courts, or others who require it to release the decedent's assets.

Once the Indiana Small Estate Affidavit form is accurately filled out and submitted where required, the transfer of the decedent's assets can proceed. This process simplifies the distribution of assets, allowing heirs and beneficiaries to focus more on honoring the memory of their loved one rather than navigating complex legal procedures. Although this guide provides a general overview, consulting with a legal professional can ensure compliance with all legal requirements and answer any questions that may arise during the process.

Listed Questions and Answers

What is a Small Estate Affidavit in Indiana?

A Small Estate Affidavit is a legal document used in Indiana to manage and distribute a deceased person's estate when it falls below a certain value, making it unnecessary to go through a formal probate process. This process is designed to simplify the handling of the estate, allowing for an efficient transfer of assets to the rightful heirs or beneficiaries. It's particularly useful for estates that consist mainly of personal property or small bank accounts and do not include real estate.

Who is eligible to use a Small Estate Affidavit in Indiana?

In Indiana, to be eligible to use a Small Estate Affidavit, the total value of the decedent’s personal property must not exceed $50,000. Additionally, it's important to know that this affidavit can be used by successors, which include heirs, certain creditors, or individuals named in the will as beneficiaries. However, before using the affidavit, a waiting period of 45 days after the death of the decedent must have passed. This waiting period ensures that all interested parties are adequately notified.

What are the steps to file a Small Estate Affidaid in Indiana?

Filing a Small Estate Affidavit in Indiana involves a few key steps:

- Ensure that the total value of the decedent’s personal property does not exceed the $50,000 limit and that 45 days have passed since the death.

- Complete the Small Estate Affidavit form, providing detailed information about the decedent, their estate, and the claiming successor(s).

- Attach a certified copy of the death certificate to the affidavit.

- Provide a detailed list of the assets to be transferred, including their estimated value.

- If applicable, ensure that debts and claims against the estate have been satisfied or addressed.

- Sign the affidavit in the presence of a notary public.

- Present the notarized affidavit to the entity or institution holding the assets (e.g., a bank) or to the appropriate court, as required.

Are there any limitations to what a Small Estate Affidavit can cover in Indiana?

Yes, there are limitations to what a Small Estate Affidavit can cover in Indiana. It is important to note that this type of affidavit is only applicable to personal property, such as bank accounts, stocks, and personal belongings. It cannot be used for the transfer of real estate or property held in trust. Additionally, if the decedent had debts that exceed the value of their personal property, the use of a Small Estate Affidavit may not be the best course of action. Creditors have a right to claim against the estate, and distributing assets through a Small Estate Affidavit does not necessarily protect the distributor from claims by creditors not yet paid.

Common mistakes

When it comes to settling a loved one's estate, the Small Estate Affidavit form in Indiana can streamline the process for estates that qualify. However, it's easy to make mistakes that can delay this process or cause complications. Here are nine common missteps to watch out for:

Not verifying eligibility: Before starting, it's important to ensure that the estate actually qualifies under Indiana's criteria for a small estate. This typically involves the value of the estate not exceeding a certain threshold.

Failing to adequately describe the assets: Each asset needs to be listed with enough detail so that there is no ambiguity about what is being transferred. Generic descriptions can lead to misunderstandings or challenges down the line.

Omitting necessary documentation: Essential documents, such as a certified death certificate or proof of ownership, must accompany the affidavit. Neglecting to include these can result in processing delays.

Incorrect valuations: It's crucial to accurately assess the value of each asset. Over or underestimating values can have legal and tax implications.

Not properly identifying heirs or beneficiaries: The form requires the clear identification of all individuals who are legally entitled to receive assets from the estate. Inaccuracies here can lead to disputes.

Overlooking debts and liabilities: All outstanding debts and liabilities of the estate need to be acknowledged. Failing to do so can complicate the later stages of estate settlement.

Signing without a notary: For the affidavit to be legally binding, it must be signed in the presence of a notary public. Skipping this step invalidates the document.

Submitting forms to the wrong office: The completed affidavit typically needs to be filed with the local probate court or other designated office in the county where the decedent lived. Sending it to the wrong place can result in significant setbacks.

Ignoring the waiting period: Indiana law may require a certain waiting period from the date of death before the affidavit can be submitted. Acting too quickly can mean having to start over.

By paying careful attention to these details, individuals can navigate the Small Estate Affidavit process more smoothly and ensure that the estate is settled as efficiently and accurately as possible.

Documents used along the form

When dealing with the assets of a deceased individual in Indiana using a Small Estate Affidavit, several other forms and documents might be necessary to ensure a smooth process. These documents assist in confirming the affidavit's claims, transferring property, and fulfilling legal obligations. Here's a brief overview of some commonly used forms and documents alongside the Small Estate Affidavit:

- Death Certificate: This official document proves the death of the decedent. It is essential for validating the Small Estate Affidavit and is often required by financial institutions and government agencies to transfer ownership of assets or settle accounts.

- Copy of the Will, if applicable: A will outlines the decedent's wishes regarding how their estate should be distributed. While not always necessary for small estates, if a will exists, it needs to be reviewed to ensure the affidavit distributes the assets according to the decedent’s wishes.

- Vehicle Title Transfer Forms: If the estate includes a vehicle, title transfer forms are necessary to legally transfer ownership to the beneficiary. This process may vary slightly depending on whether the vehicle is paid off or if there is a lienholder involved.

- Real Estate Deeds: For real estate that qualifies under the Small Estate Affidavit, a new deed may need to be filed with the county recorder's office to transfer property to the heirs or designated beneficiaries.

- Bank Account Closure or Transfer Documents: When the deceased has bank accounts, these documents are necessary to either close the account and distribute the funds according to the affidavit or transfer ownership of the accounts to the rightful heirs.

Accompanying the Small Estate Affidavit with the correct forms and documents ensures that the decedent's assets are properly managed and distributed. It's important to gather all necessary paperwork early in the process to help streamline estate settlement and reduce any potential legal or administrative complications.

Similar forms

The Indiana Small Estate Affidavit form is similar to other legal documents that streamline the process of asset distribution without a formal probate proceeding. These documents provide a mechanism for beneficiaries to claim property in a simplified manner, especially when dealing with small or uncomplicated estates. Each has its own set of criteria and legal implications, but at their core, they share the common goal of facilitating a more straightforward approach to estate settlement.

The form is closely akin to the Transfer on Death Deed (TODD). Both serve to expedite the transfer of assets upon someone's death, bypassing the need for lengthy and costly probate procedures. The Indiana Small Estate Affidavit allows for the transfer of personal property, while a Transfer on Death Deed focuses on real estate. Each document specifies beneficiaries, and upon the death of the owner, the designated assets are transferred to the named individuals, provided the conditions outlined in the document are met. This similarity highlights how both tools aim to simplify the legal transmission of assets.

Another document bearing resemblance is the Joint Tenancy Agreement. This agreement allows two or more people to hold property jointly, with rights of survivorship. It means that upon the death of one joint tenant, their interest in the property automatically passes to the surviving joint tenant(s), similar to how assets are transferred to beneficiaries under the Indiana Small Estate Affidavit. While the affidavit deals with the distribution of assets after death, a Joint Tenancy Agreement sets up the ownership structure in a manner that inherently bypasses probate. Both arrangements reflect a preference for simplifying the process of asset transition after death.

Similarly, the Payable on Death (POD) or Transfer on Death (TOD) accounts share the Indiana Small Estate Affidavit's goal of avoiding probate. These accounts are set up with financial institutions, allowing the account holder to designate beneficiaries who will receive the assets in the account upon the holder’s death. Like the small estate affidavit, POD/TOD accounts streamline the process of transferring assets, making it straightforward for beneficiaries to gain access without navigating through the complexities of probate court. Both documents provide a direct path for asset transfer, optimizing the distribution of the deceased's estate.

Dos and Don'ts

When dealing with the Indiana Small Estate Affidavit form, it is crucial to approach this process with attention to detail and thorough understanding. This document is a legal tool that can simplify the procedure of estate resolution for estates that are under a specific value threshold. The following guidelines are designed to facilitate a smoother experience and ensure compliance with Indiana's legal standards.

Do:

Verify eligibility: Before filling out the form, make sure the estate qualifies as a "small estate" under Indiana law. This typically means that the total value of the estate's assets falls below a certain threshold and that the deceased did not have a formal will.

Gather required documents: Have all necessary documentation, such as death certificates and an inventory of the deceased's assets, readily available. Accurate and comprehensive documentation is key to a successful affidavit process.

Provide complete and accurate information: When filling out the form, ensure every field is completed with the correct information. Inaccuracies can lead to delays or legal complications.

Review the form for errors: Before submitting, review the affidavit thoroughly for any mistakes or omissions. This step is crucial for ensuring the document is accurate and legally sound.

Legibly sign and date the form in the presence of a notary public: Your signature must be witnessed and notarized to verify your identity and the truthfulness of the affidavit's statements.

Seek legal advice if needed: If you are unsure about any part of the process or need clarification on legal points, consulting with a legal professional can provide valuable guidance and peace of mind.

Don't:

Rush through the process: Taking the time to carefully read and understand each part of the form can prevent mistakes that might complicate the estate's resolution.

Ignore state laws and guidelines: Each state has its own rules regarding small estates. Failing to adhere to Indiana's specific requirements can result in the affidavit being rejected.

Omit required information: Leaving sections incomplete can delay the affidavit's approval process or lead to a denial of the application.

Forge or alter documents: Honesty is paramount in legal proceedings. Submitting false information or forged documents is illegal and can have serious consequences.

Attempt to use the form for complex estates: The Small Estate Affidavit is designed for simpler estates. Larger or more complicated estates typically require a different process.

Overlook the need for a notary: Failing to have the affidavit notarized is a common oversight that can invalidate the form. Ensure this step is completed correctly.

By adhering to these dos and don'ts, you can navigate the Small Estate Affidavit process in Indiana with greater ease and confidence. Properly managing this task can help expedite the settling of the deceased's estate, allowing for a more efficient and stress-free resolution for all involved.

Misconceptions

When it comes to managing an estate in Indiana, the Small Estate Affidavit form is often discussed as a simpler route. However, some widespread misconceptions can lead to confusion. Let’s clarify some of these misunderstandings.

Anyone can file a Small Estate Affidavit immediately after a person's death. This statement is misleading. In Indiana, the law requires a waiting period of at least 45 days after the death before you can file a Small Estate Affidavit. This period allows for the proper settlement of the deceased's affairs and ensures that no will emerges that might dictate a different course of action.

The form grants instant access to all of the deceased's assets. This is not entirely accurate. While the Small Estate Affidavit can indeed simplify the process of asset transfer for estates that meet the specific criteria, it doesn’t provide immediate access to all assets. Financial institutions, for example, might have their requirements and timelines for releasing funds even after the affidavit is presented.

Using a Small Estate Affidavit negates the need for a lawyer. While it's true that the form is designed to be straightforward, the complexities of individual estates can still benefit from legal advice. A lawyer can help navigate any potential pitfalls, ensuring compliance with Indiana law and possibly identifying more efficient ways to settle the estate.

There is no limit to the value of the estate for using this affidavit. In reality, Indiana law stipulates a threshold for what constitutes a “small estate.” As of the last update, an estate must be valued at $50,000 or less (excluding certain exempt assets) to qualify for the Small Estate Affraisal procedure. This cap is subject to updates, so it’s essential to check the most current laws.

It resolves all debts and claims against the estate. This understanding is incorrect. Filing a Small Estate Affidavit transfers assets to the heirs but does not absolve the estate of any outstanding debts or claims. Creditors may still pursue claims against the estate, and it is the responsibility of the person who filed the affidavit to ensure that valid debts are paid from the estate’s assets.

For those navigating the process of settling an estate in Indiana, understanding the real implications and limitations of the Small Estate Affidavit can save time and prevent legal complications. When in doubt, consulting with a professional can provide clarity and confidence.

Key takeaways

When dealing with an Indiana Small Estate Affidavit form, it's essential to approach the process with understanding and attention to detail. Here are eight key takeaways for anyone filling out or using this form:

- The Indiana Small Estate Affidavit form is designed for use when the total estate, excluding real estate, does not exceed $50,000. This makes it a simpler option for transferring property from a deceased person’s estate to their heirs or beneficiaries without going through probate court.

- To use the Small Estate Affidavit in Indiana, at least 45 days must have elapsed since the death of the estate's owner. This waiting period is mandatory and respects the legal process of estate settlement in the state.

- Accuracy is crucial when completing the form. The person filling it out must include detailed information about the deceased, their assets, and the rightful heirs. Any mistakes or omissions might invalidate the affidavit or delay the transfer of assets.

- Legal identification and documentation of the deceased's assets are necessary. This includes account statements, titles, and other proof of ownership that will need to be attached to the affidavit to substantiate the claims made in the document.

- The affiant, the person swearing to the affidavit, must sign the document in the presence of a notary public. This step is vital for the affidavit's legal validity. A notary’s seal and signature ensure that the affiant's identity has been verified and that they swore or affirmed the truth of the information in the affidavit under penalty of perjury.

- The Small Estate Affidoll make sure these requirements are met.

- The completed and notarized affidavit is then typically submitted to institutions holding the deceased’s assets, such as banks. They will review the affidavit before releasing any funds or transferring ownership. Each institution may have its own procedures and requirements for releasing assets, so it's advisable to contact them beforehand to ensure all necessary paperwork is in order.

- It is highly recommended to seek legal advice when dealing with estate matters. While the Small Estate Affidavit provides a more streamlined process for small estates, understanding your legal rights and obligations can be complex. A legal professional can offer guidance tailored to your situation.

Fill out Popular Small Estate Affidavit Forms for Different States

Small Estate Affidavit Delaware - It aids in the quick transfer of property to beneficiaries without the necessity for a prolonged probate procedure.

Illinois Affidavit Requirements - Allows for the direct transfer of assets like bank accounts and personal property to the rightful heirs.

New Mexico Small Estate Affidavit - The document often necessitates listing the deceased's assets, debts, and designated recipients.

Small Estate Affidavit Montana - This legal tool helps in bypassing the complexities of probate by directly transferring assets from the deceased to their rightful heirs.