Printable Small Estate Affidavit Form for Iowa

When someone passes away, the process of settling their estate can seem daunting, especially during a time of grief. Fortunately, for those with smaller or simpler estates, Iowa offers a more streamlined approach that can lessen the emotional and financial strain on the survivors. The Iowa Small Estate Affidavit form stands as a crucial tool in this process, providing a legal avenue for the quick and efficient transfer of assets to beneficiaries without the need for a lengthy and often costly probate court process. This form is applicable in cases where the total value of the deceased's estate does not exceed a specific threshold, making it an ideal solution for many families seeking to resolve estate matters swiftly. By completing this affidavit, the rightful heirs can claim property, bank accounts, and other assets, thereby simplifying what is typically a complex legal ordeal. Nevertheless, navigating the requirements and ensuring compliance with Iowa law necessitates a clear understanding of the form's elements, the qualifying conditions, and the procedural steps involved in its execution. The form not only signifies a means to expedite the disbursement of assets but also represents a significant component of estate planning and management in Iowa, highlighting the importance of preparedness and informed decision-making in these delicate matters.

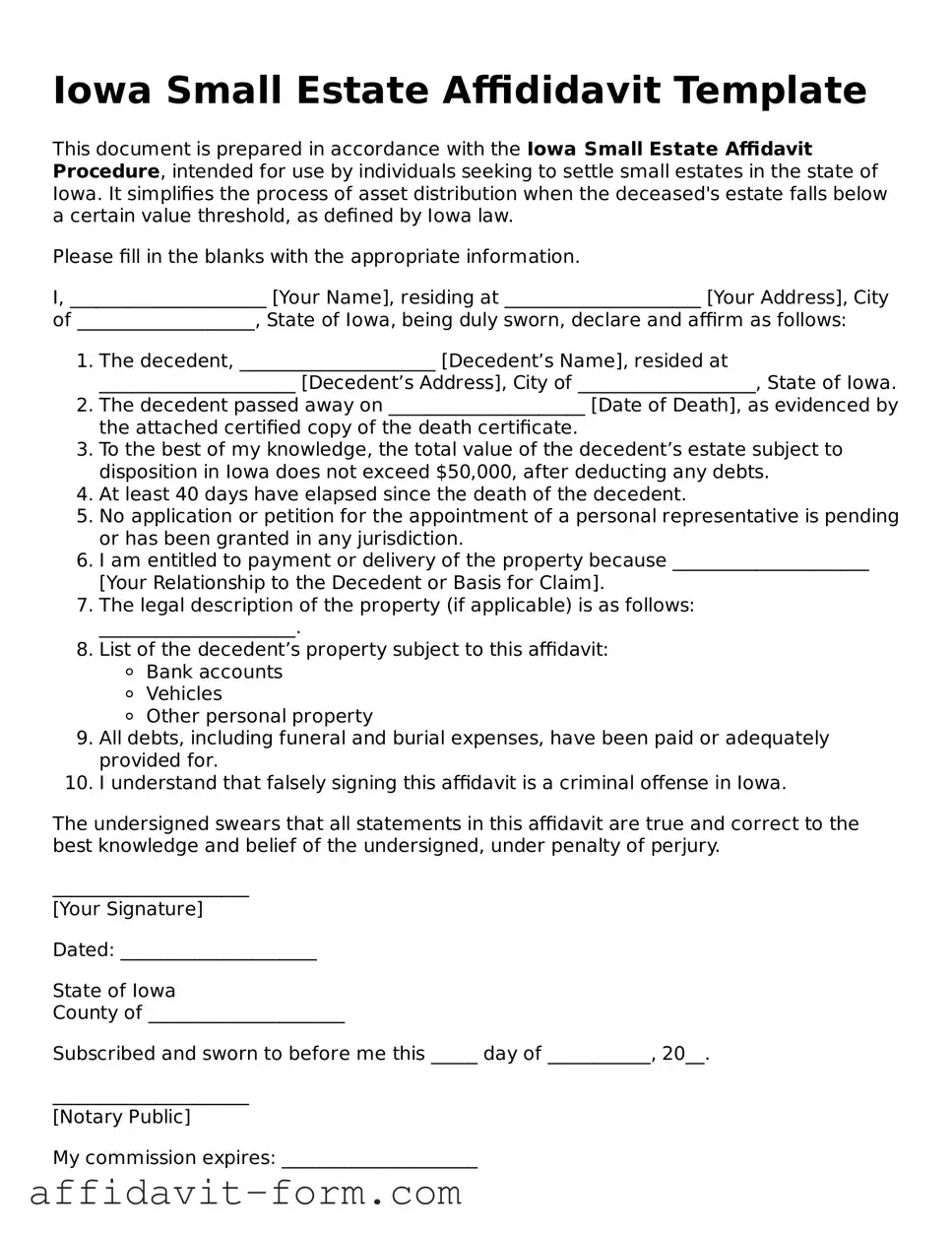

Form Example

Iowa Small Estate Affididavit Template

This document is prepared in accordance with the Iowa Small Estate Affidavit Procedure, intended for use by individuals seeking to settle small estates in the state of Iowa. It simplifies the process of asset distribution when the deceased's estate falls below a certain value threshold, as defined by Iowa law.

Please fill in the blanks with the appropriate information.

I, _____________________ [Your Name], residing at _____________________ [Your Address], City of ___________________, State of Iowa, being duly sworn, declare and affirm as follows:

- The decedent, _____________________ [Decedent’s Name], resided at _____________________ [Decedent’s Address], City of ___________________, State of Iowa.

- The decedent passed away on _____________________ [Date of Death], as evidenced by the attached certified copy of the death certificate.

- To the best of my knowledge, the total value of the decedent’s estate subject to disposition in Iowa does not exceed $50,000, after deducting any debts.

- At least 40 days have elapsed since the death of the decedent.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- I am entitled to payment or delivery of the property because _____________________ [Your Relationship to the Decedent or Basis for Claim].

- The legal description of the property (if applicable) is as follows: _____________________.

- List of the decedent’s property subject to this affidavit:

- Bank accounts

- Vehicles

- Other personal property

- All debts, including funeral and burial expenses, have been paid or adequately provided for.

- I understand that falsely signing this affidavit is a criminal offense in Iowa.

The undersigned swears that all statements in this affidavit are true and correct to the best knowledge and belief of the undersigned, under penalty of perjury.

_____________________

[Your Signature]

Dated: _____________________

State of Iowa

County of _____________________

Subscribed and sworn to before me this _____ day of ___________, 20__.

_____________________

[Notary Public]

My commission expires: _____________________

Document Details

| Fact Name | Description |

|---|---|

| Applicability | In Iowa, the Small Estate Affidavit form is utilized to streamline the process of estate distribution for estates deemed small under state law. |

| Governing Laws | The distribution of small estates in Iowa is governed by Chapter 633 of the Iowa Code, particularly sections 633.356 to 633.359, which outline the conditions under which the form can be used. |

| Monetary Threshold | The form is applicable to estates with or without real property, with assets valuing $100,000 or less, as specified by Iowa law. |

| Waiting Period | There is a mandatory waiting period of 40 days after the decedent's death before the Small Estate Affidavit can be filed with the Iowa court system. |

How to Use Iowa Small Estate Affidavit

Filling out the Iowa Small Estate Affidavit form is a crucial process for individuals planning to claim assets from a deceased person's estate without going through a formal probate procedure. This approach is particularly suitable when dealing with estates below a certain value threshold, making the asset transfer process quicker and less complicated. Nevertheless, accuracy and completeness in filling out the form are essential to ensure that the process goes smoothly and effectively. The steps outlined below are designed to guide you through each section of the form, ensuring all necessary information is correctly provided.

- Start by entering the full legal name of the deceased individual at the top of the form, making sure it matches the name as it appears on the death certificate.

- Include the date of the deceased's death next to their name. This date should be verifiable with an official death certificate.

- Fill in your full legal name and address in the section identified for the claimant or affiant. This confirms your identity and how you can be contacted.

- Identify your relationship to the deceased or explain your interest in the estate. This part is essential to establish your legal standing to file the affidavit.

- List the assets you are claiming through the affidavit. Be as specific as possible, including account numbers, descriptions of personal property, or vehicle identification numbers (VIN) for vehicles.

- Provide the estimated value of each asset listed. Ensure that the total value does not exceed the state's threshold for small estate proceedings.

- Indicate whether there is known real estate owned by the deceased within the state. If applicable, a separate process is usually required for transferring real estate assets.

- Confirm whether all funeral expenses, debts, and taxes of the estate have been paid or provide a plan for their payment. This information is vital for the legal processing of the claim.

- Enter the names and addresses of any other individuals entitled to a portion of the estate under Iowa law, if applicable. This could include other heirs or individuals named in a will.

- Sign and date the form in front of a notary public. The notarization is a legal requirement that validates your signature and the information provided in the affidavit.

After completing the Iowa Small Estate Affidavit form, the next steps involve submitting it to the correct institution, such as a bank or a court, depending on the type of assets being claimed. It's advisable to make several copies of the completed form and the death certificate, as multiple entities may request them. Each institution has its procedures, so it's important to inquire about the next steps specific to each asset. Timely communication and thorough documentation will help ensure the estate's assets are transferred efficiently and according to Iowa law.

Listed Questions and Answers

What is an Iowa Small Estate Affidavit?

An Iowa Small Estate Affidavit is a legal document used when a person (the decedent) has passed away with a relatively small estate, and the survivors wish to collect the property without a formal probate process. This affidavit allows the transfer of the decedent’s property to the rightful heirs or beneficiaries quickly and with less legal hassle, provided the total value of the estate meets the state's specified threshold.

Who is eligible to file an Iowa Small Estate Affidavit?

To file an Iowa Small Estate Affidavit, the applicant must be an entitled successor of the deceased, such as a spouse, child, parent, or other relative depending on the decedent's will or state law. The total estate value, excluding certain assets like real estate and vehicles, must not exceed the Iowa legal limit for small estates, which is subject to change. Additionally, there must be no pending application or grant for a formal probate process in any jurisdiction.

What are the steps to complete an Iowa Small Estate Affidavit?

- Verify eligibility: Ensure the estate's value is within the threshold and that no probate proceedings are underway or completed.

- Fill out the affidavit: Provide detailed information about the decedent, their estate, and the successor(s) claiming the estate.

- Gather required documents: Collect death certificates, proof of relationship to the decedent, and documents verifying the estate's value.

- Sign the affidavit: The claiming successor(s) must sign the affidavit in front of a notary public.

- Submit the affidavit: Present the completed affidavit and accompanying documents to the holder of the property or the institution managing the assets.

What documents are needed to accompany the Iowa Small Estate Affidavit?

To successfully process an Iowa Small Estate Affidavit, several documents are needed alongside the affidavit itself:

- A certified copy of the death certificate.

- Legal proof of the claimant's relationship to the decedent (such as birth certificates or marriage certificates).

- Documentation evidencing the value of the estate's assets.

- Any other documents required by the specific entity holding the assets (bank, brokerage, etc.).

Common mistakes

When managing the estate of a loved one who has passed away in Iowa, the Small Estate Affidavit can simplify the process significantly. However, there are common mistakes that people tend to make when filling out this form. Awareness and understanding of these errors can help ensure the process is completed smoothly and efficiently.

Not verifying eligibility: Before proceeding, it's crucial to confirm that the estate qualifies as a "small estate" under Iowa law. This often means the total value of the estate does not exceed a certain threshold and that a certain amount of time has passed since the decedent's death.

Incorrectly listing assets: Many people fail to accurately list all of the decedent's assets or misclassify them. Each asset must be listed clearly and correctly, including bank accounts, vehicles, and real property.

Omitting debts: Just as with assets, all of the decedent's debts must be outlined. This includes personal loans, credit cards, and any other liabilities that were outstanding at the time of death.

Failure to properly describe property: Descriptions of property, especially real estate, need to be detailed and precise. Vague descriptions can lead to confusion and potential legal issues down the line.

Not adhering to witness requirements: The form requires witness signatures that comply with state requirements. Failing to meet these can invalidate the affidavit.

Incorrectly calculating the estate's value: Accurately calculating the total value of the estate is essential. Over- or underestimating can lead to issues in the distribution of assets or in fulfilling the requirements of a small estate.

Forgetting to obtain necessary certifications: Certain statements within the affidavit may need to be certified or notarized. Overlooking this step can lead to the rejection of the document.

Failing to distribute assets according to the law: The assets must be distributed according to Iowa law, which often requires paying off debts before distributing the remainder to heirs. Ignoring these rules can result in legal complications.

Not filing the form with the proper authority: Once completed, the affidavit needs to be filed with the appropriate local or state office. Failure to do so, or filing with the wrong office, can delay the process significantly.

To navigate the process of completing a Small Estate Affidavit in Iowa effectively, individuals are encouraged to seek guidance and ensure they understand each step clearly. Mistakes can lead to delays, additional costs, or legal challenges, but with careful attention to detail, these issues can generally be avoided.

Documents used along the form

When processing a small estate in Iowa, the Small Estate Affidavit is a crucial document utilized to expedite the distribution of the estate of a deceased person, provided the estate falls below a certain value threshold. However, this form often necessitates accompanying documents to fully complete the estate transfer process. The following list covers key forms and documents that are commonly used in conjunction with the Iowa Small Estate Affidavit, providing a streamlined approach for handling smaller estates.

- Death Certificate: An official government-issued document confirming the date, location, and cause of death. It is required to prove the death of the estate's owner.

- Copy of the Will: If the deceased left a will, a copy needs to be provided to prove the heirs and legatees, as well as the executor named by the deceased.

- Inventory of Assets: A detailed list of the deceased's assets that fall under the estate, including bank accounts, personal property, and real estate, to name a few.

- Real Estate Deeds: If the estate includes real estate, the deed or deeds showing ownership must be included.

- Vehicle Titles: Titles for any vehicles owned by the deceased that are part of the estate.

- Account Statements: Recent statements for bank accounts, retirement accounts, and other financial assets owned by the deceased.

- Life Insurance Policies: Documents pertaining to life insurance policies, if any, that name beneficiaries or the estate as the beneficiary.

- Funeral Bills: Receipts or bills for funeral expenses, which are often prioritized for payment from the estate.

- Debts and Bills Documentation: Documentation of any outstanding debts or bills owed by the deceased, including credit cards, loans, and utility bills.

- Letter of Indemnity: In some cases, a letter of indemnity may be required to protect the institution transferring assets from liability.

The completion of the Iowa Small Estate Affidavit, along with the correct supplementary documents, serves as a simplifying measure for estate management, facilitating a smoother transition of assets to rightful heirs or beneficiaries. This process underscores the importance of thorough documentation and legal compliance in estate proceedings, ensuring that all parties' rights and interests are adequately protected and obligations duly met.

Similar forms

The Iowa Small Estate Affidavit form is similar to other legal documents designed to simplify the transfer of assets from a deceased person to their beneficiaries. Specifically, it is akin to the Transfer on Death Deed (TODD) and the Simplified Probate Process. Each of these documents shares the common goal of avoiding the lengthy and costly probate court process, but they do so for slightly different assets and under different conditions.

Transfer on Death Deed (TODD)

The Transfer on Death Deed (TODD) is a document used to pass the ownership of real property, like a house or land, directly to a beneficiary when the owner dies, without going through probate. Similar to the Iowa Small Estate Affidavit, which is used for the transfer of personal property and small estates without probate, the TODD allows for a smooth transition of real estate assets. Both documents effectively bypass the probate process, making the transfer of assets quicker and less expensive. However, while the Small Estate Affidavit covers various types of personal property and small estates up to a certain value, the TODD specifically targets real estate and does not have a value limit.

Simplified Probate Process

The Simplified Probate Process is another legal procedure similar to the Iowa Small Estate Affidavit but is typically used for slightly larger estates that still don't meet the usual criteria for full probate. Like the Small Estate Affidavit, it simplifies the transfer of the deceased's assets to their beneficiaries. The main difference lies in the scope and the criteria for eligibility. The Simplified Probate Process may require a bit more paperwork and time than the Small Estate Affidavit, but it ultimately provides a faster resolution than the traditional probate process. Both aim to reduce the administrative burden on the surviving family members and expedite the distribution of assets.

Dos and Don'ts

When filling out the Iowa Small Estate Affidavit form, it is crucial to ensure accuracy and completeness. There are specific actions you should take to facilitate a smooth process, as well as common pitfalls to avoid. Below are the recommended dos and don’ts:

Do:- Verify eligibility by ensuring the value of the estate meets the criteria defined for “small estates” in Iowa law.

- Complete the form thoroughly, providing all requested information accurately to prevent delays.

- Confirm all debts and claims against the estate are listed, as failure to do so can result in legal complications.

- Ensure the affidavit is signed in the presence of a notary public to validate its authenticity.

- Keep a copy of the completed form for your records and provide necessary copies to relevant financial institutions or entities.

- Attempt to use the form if the estate’s value exceeds the limit set by Iowa law, as this may result in legal and financial repercussions.

- Leave sections incomplete or provide inaccurate information, which could invalidate the affidavit or delay the process.

- Forget to notify all potential heirs or beneficiaries about the affidavit, as this is a legal requirement.

- Sign the affidavit before having it notarized, as the notary must witness your signature

- Overlook the requirement to file the affidavit with the appropriate county court, if required, as failing to do so may hinder access to the assets.

Misconceptions

When managing the assets of a loved one who has passed away, the Iowa Small Estate Affidavit form can simplify the process under certain conditions. However, misconceptions about this document are common. Clarifying these misunderstandings ensures individuals can navigate through this period with a clearer understanding and appropriate expectations.

- Misconception 1: The form grants immediate access to a deceased person's assets. In reality, there is a mandatory waiting period after the decedent's death before the form can be filed, ensuring all statutory procedures are followed.

- Misconception 2: Many believe that using an Iowa Small Estate Affidavit avoids probate under all circumstances. However, this document is only applicable if the value of the estate falls below a specific threshold, as defined by Iowa law.

- Misconception 3: Another common misunderstanding is that the affidavit can transfer title to real estate. This form is primarily used for personal property and cannot be used to transfer or sell real property in Iowa.

- Misconception 4: There's a belief that completing the Small Estate Affidavit is complicated and requires legal representation. While legal guidance can be helpful, the form is designed to be user-friendly for non-professionals.

- Misconception 5: Some think that the form is universally accepted by all institutions. Financial institutions and others may have specific requirements or additional documentation before they release assets.

- Misconception 6: A misconception exists that an Iowa Small Estate Affidavit can resolve debts or taxes owed by the decedent. The form does not absolve the estate from debts; creditors can still make claims against the estate within a specified period.

- Misconception 7: It's mistakenly believed that the affidavit itself distributes the assets. While it facilitates access to assets, distribution should be in accordance with the will or Iowa's succession laws if there is no will.

- Misconception 8: Lastly, there's an incorrect assumption that there is no need to file the affidavit with any court. Depending on the circumstances, filing with the appropriate Iowa court may be necessary, especially if there is any dispute among potential heirs.

Understanding these misconceptions about the Iowa Small Estate Affidavit form can help individuals efficiently manage small estates. It's always advisable to consult with a professional to navigate specific legal requirements and ensure the process is handled correctly.

Key takeaways

Filing out and using the Iowa Small Estate Affidavit form can streamline the process of settling a small estate in Iowa. This helpful tool allows for the handling of the decedent’s property without the need for a lengthy probate process. Here are five key takeaways when considering this option:

- Eligibility Criteria: Not all estates qualify for the Small Estate Affidavit process. In Iowa, the total value of the estate's assets must not exceed a certain threshold. It's important to confirm that the estate meets this criterion before proceeding.

- Asset Types: The Small Estate Affidavit can be used for various types of property, but there are exceptions. Understanding which assets can and cannot be transferred using this form is crucial. Typically, it applies to personal property such as bank accounts and vehicles, but real estate may require a different procedure.

- Waiting Period: Iowa law might require a waiting period after the decedent's death before the Small Estate Affidavit can be filed. Being aware of any such timeline is vital to ensure compliance with state regulations.

- Documentation: Completing the Small Estate Affidavit requires accurate and detailed information about the decedent’s assets, creditors, and heirs. Collecting this information beforehand can significantly simplify the process.

- Legal and Financial Implications: Using the Small Estate Affidavit carries certain legal and financial responsibilities. Individuals filing the form may be required to pay the decedent's debts and distribute the assets according to state law. Understanding these obligations is essential to avoid potential legal complications.

Properly utilizing the Iowa Small Estate Affidavit can provide a more efficient means of managing a loved one’s estate. However, it's advisable to consult with a legal professional to navigate the process accurately and to ensure all legal requirements are met.

Fill out Popular Small Estate Affidavit Forms for Different States

Louisiana Small Succession Affidavit - A crucial benefit of the Small Estate Affidavit is its contribution to reducing the emotional and financial strain on bereaved families by facilitating a smoother legal process.

Virginia Small Estate Affidavit Pdf - Not applicable for larger estates or when there are disputes among heirs or creditors.