Printable Small Estate Affidavit Form for Kansas

Dealing with the aftermath of a loved one's passing can be a trying and complex process, especially when it comes to managing their estate. For those navigating this path in Kansas, the Small Estate Affidavit form emerges as a beacon of simplicity amidst the legal thicket. This form serves as a streamlined tool for the transfer of property to rightful heirs without the need for a probate process, provided the total value of the estate meets the state's defined threshold. It's designed to aid individuals in swiftly and efficiently claiming assets like bank accounts, stocks, and tangible property, thereby reducing the administrative burden and emotional strain during an already difficult time. By understanding the prerequisites, properly filling out the form, and knowing which assets it can and cannot cover, heirs can expediate the transfer of assets with minimal fuss. The importance of this document cannot be understated, as it encapsulates the legal framework designed to assist in the closure of a loved one's fiscal chapter, allowing families to focus more on their healing journey.

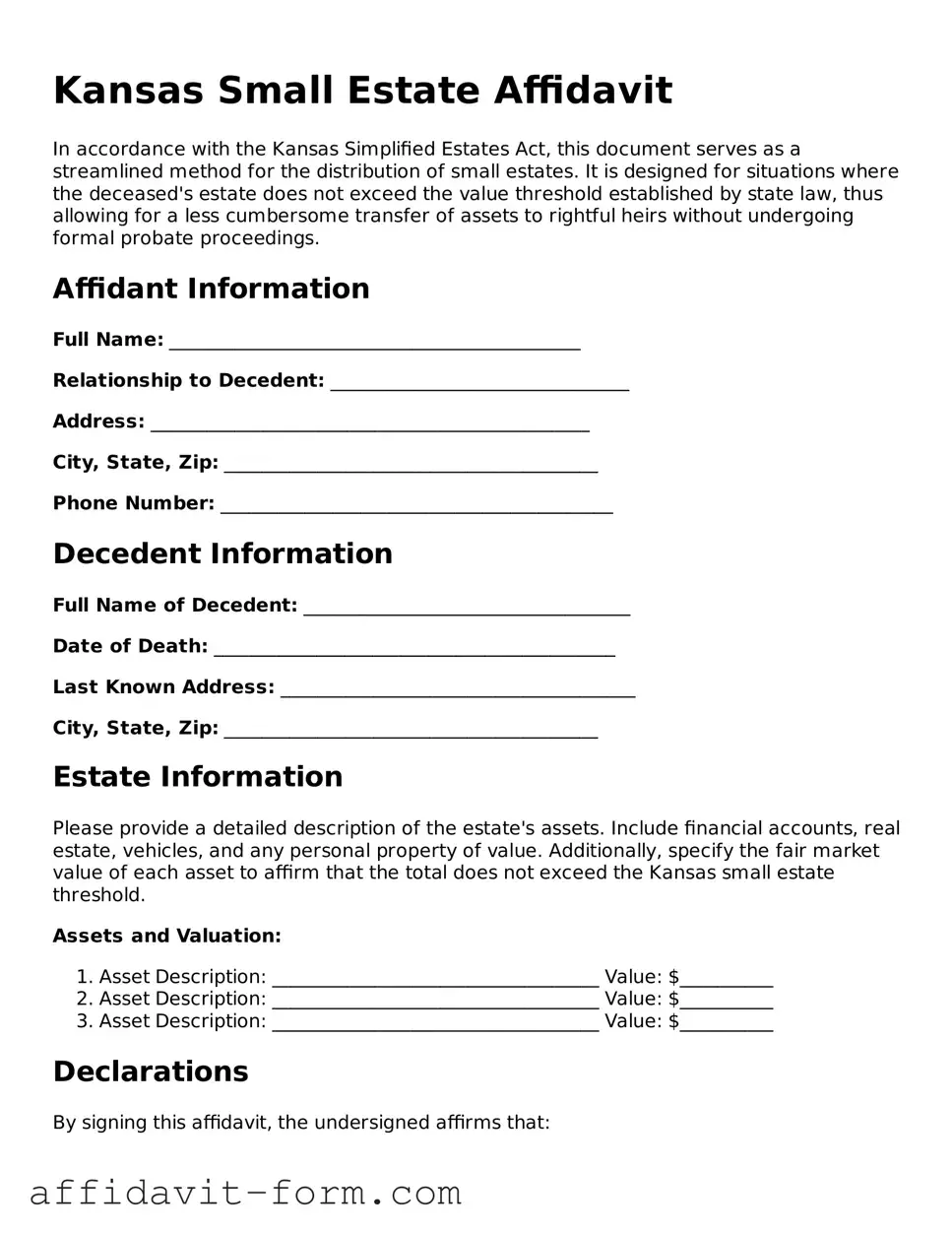

Form Example

Kansas Small Estate Affidavit

In accordance with the Kansas Simplified Estates Act, this document serves as a streamlined method for the distribution of small estates. It is designed for situations where the deceased's estate does not exceed the value threshold established by state law, thus allowing for a less cumbersome transfer of assets to rightful heirs without undergoing formal probate proceedings.

Affidant Information

Full Name: ____________________________________________

Relationship to Decedent: ________________________________

Address: _______________________________________________

City, State, Zip: ________________________________________

Phone Number: __________________________________________

Decedent Information

Full Name of Decedent: ___________________________________

Date of Death: ___________________________________________

Last Known Address: ______________________________________

City, State, Zip: ________________________________________

Estate Information

Please provide a detailed description of the estate's assets. Include financial accounts, real estate, vehicles, and any personal property of value. Additionally, specify the fair market value of each asset to affirm that the total does not exceed the Kansas small estate threshold.

Assets and Valuation:

- Asset Description: ___________________________________ Value: $__________

- Asset Description: ___________________________________ Value: $__________

- Asset Description: ___________________________________ Value: $__________

Declarations

By signing this affidavit, the undersigned affirms that:

- All information provided herein is accurate and complete to the best of their knowledge.

- The estate’s total value does not exceed the threshold set forth by Kansas law.

- There are no disputes among potential heirs regarding the distribution of the estate.

- They will distribute the assets of the estate according to Kansas law and the wishes of the decedent if known.

Signature of Affiant: _______________________________ Date: ____________

This document must be notarized to ensure its validity. Please bring this completed form to a qualified notary public.

Notary Information

State of Kansas

County of ________________________

Subscribed and sworn to (or affirmed) before me on this ___ day of _______________, 20___, by (name of affiant) _______________________________________, who is personally known to me or has produced _________________________________________ as identification.

Notary Signature: ___________________________________

Seal:

Document Details

| Fact | Description |

|---|---|

| Eligibility | Estates valued at $40,000 or less may qualify for the Kansas Small Estate Affidavit process. |

| Governing Law(s) | Kansas Statutes Annotated §§ 59-1507b is the primary law governing the Small Estate Affidavit process in Kansas. |

| Waiting Period | There is a waiting period of 30 days after the decedent's death before the affidavit can be filed. |

| Required Information | The affidavit must include detailed information about the decedent, their assets, debts, and the distributing heirs. |

| Asset Types | Assets that can be transferred using this process include personal property, bank accounts, and vehicles. |

| Filing Location | The affidavit is typically filed with the district court in the county where the decedent lived or where the property is located. |

How to Use Kansas Small Estate Affidavit

Completing a Kansas Small Estate Affidavit form is an essential step for those who are handling a loved one's estate without going through a full probate process. This affidavit allows for the collection of the deceased's assets by their successors without the need for a court-issued letters of administration, as long as the estate falls under a specified value threshold. To ensure the form is filled out correctly and accurately reflects the estate's details, follow the steps outlined below. Remember, accuracy and thoroughness are key to a smooth process.

- Gather all necessary documents related to the deceased’s estate. This includes bank statements, titles, deeds, and other proofs of ownership or obligation.

- Read the form thoroughly before you begin to fill it out. Understanding every section in advance will help prevent mistakes.

- Enter the full legal name of the deceased (decedent) at the top of the form, exactly as it appears on their death certificate.

- Fill in the date of death in the designated section, ensuring it matches the death certificate.

- List all known assets of the decedent, including but not limited to bank accounts, securities, real estate properties, and personal possessions of value. Ensure you describe each asset clearly and provide any identifiable details like account numbers, VIN numbers, or property addresses.

- Calculate the total value of the assets listed and ensure the sum is below the small estate threshold for Kansas. This threshold can change, so verify the current limit to confirm eligibility.

- Identify and list all persons entitled to receive the decedent's property under state law. Include their full names, addresses, and relationship to the decedent.

- Review the affidavit requirements regarding debts and liabilities of the estate. If applicable, list all known debts, including creditor information and amounts owed.

- Sign and date the form in the presence of a notary public. The notary will seal or stamp the form to authenticate it.

- Make copies of the completed affidavit for your records and for each asset holder (e.g., banks, brokerage firms) from whom you will collect assets.

- Present the original notarized affidavit to each asset holder to transfer ownership of the assets into the names of the rightful heirs or beneficiaries.

Once you have completed the Kansas Small Estate Affidavit form and collected the assets, it's important to manage them according to the instructions provided by law or the wishes of the decedent, if known. This may involve distributing the property and funds to the heirs or using them to pay off any remaining debts of the estate. By following these instructions carefully, you can ensure the process is carried out with respect and in accordance with Kansas statutes.

Listed Questions and Answers

What is a Kansas Small Estate Affidavit?

A Kansas Small Estate Affidavit is a document that allows the heirs of a deceased person, known as the decedent, to collect the decedent's property without going through a formal probate process. This form is used when the total value of the decedent's personal property, not including real estate, falls below a certain threshold. It simplifies the process of asset distribution, making it faster and less costly for the heirs.

Who can use the Kansas Small Estate Affidavit?

Under Kansas law, an heir or multiple heirs can use this form if they meet specific criteria. These criteria typically include the total value of the decedent's estate (it must fall below a certain dollar amount specified by state law), and a certain period of time must have passed since the death of the decedent. Additionally, there should be no pending proceedings for the decedent's estate in any court, and all debts and taxes of the estate must be settled.

What is the value limit for using the Kansas Small Estate Affidait?

The value limit for utilizing the Kansas Small Estate Affidavit is subject to change, reflecting adjustments in state law. As of the last update, the estate, including personal property and vehicles but excluding real estate, must not exceed $40,000. To ensure accuracy, it's recommended to verify the current threshold with the latest provisions in Kansas statutes or seek legal advice.

What information is needed for the Small Estate Affidavit in Kansas?

When filling out the Small Estate Affidavit, the following information is typically required:

- The full name and address of the decedent.

- The date of the decedent's death.

- A detailed list of the decedent's assets, including their estimated value.

- The names and addresses of the heirs entitled to the assets.

- A declaration that taxes and debts of the estate have been paid or a plan to pay them.

- A statement that there are no pending court proceedings for the decedent's estate.

How do you file a Kansas Small Estate Affidavit?

Filing the Small Estate Affidavit involves a few steps:

- Complete the form with all required information, ensuring accuracy to avoid delays.

- Sign the form in the presence of a notary public to notarize the document.

- Submit the notarized affidavit to the relevant institution or entity in possession of the decedent's property. This could be a bank, a brokerage firm, or any other organization holding assets belonging to the decedent.

Is there a waiting period before you can file the Small Estate Affidavit in Kansas?

Yes, Kansas law requires a waiting period before the Small Estate Affidavit can be filed. Typically, the affidavit can be filed 30 days after the death of the decedent. This waiting period is designed to ensure that all interested parties have a chance to come forward and that the estate's debts and obligations are addressed.

What happens after the Small Estate Affidavit is filed?

Once the Small Estate Affidavit is filed and accepted by the holder of the assets, the property can be distributed to the heirs according to the declarations made in the affidavit. The recipient institution usually releases the assets to the heirs promptly after verifying the affidavit's validity. However, the heirs may be responsible for ensuring that all debts and taxes are paid before distributing the assets among themselves. It’s important for heirs to understand that they may be held liable if the estate's debts are not properly settled.

Common mistakes

Filing a Kansas Small Estate Affidavit can be a practical way to settle an estate without a lengthy probate process. However, mistakes in completing the form can lead to delays, legal complications, or even the rejection of the affidavit. Here are nine common mistakes to avoid:

Not verifying eligibility criteria: Before filling out the form, it's essential to ensure the estate qualifies under Kansas laws, which generally means the total value of the estate falls under a certain threshold.

Failing to provide accurate information about the decedent: Including incorrect information about the deceased person, such as their full name or date of death, can cause significant issues.

Omitting necessary documents: Skipping the attachment of required documents like the death certificate or proof of entitlement can invalidate the affidavit.

Incorrectly listing assets: Not properly identifying or valuing the assets of the deceased can lead to an inaccurate assessment of the estate, potentially disqualifying it from the small estate process.

Misunderstanding the form’s instructions: Misinterpreting the directions for filling out the form can lead to errors in completion, causing delays.

Overlooking the need for witness or notary signatures: Depending on the requirements, failing to have the form witnessed or notarized can nullify it.

Not consulting with those entitled to the property: Neglecting to communicate with other heirs or beneficiaries can result in disputes or challenges to the affidavit.

Forgetting to file within the required timeframe: Kansas law might stipulate a specific period within which the affidavit must be filed after the death, missing this window can preclude the use of this process.

Incorrect distribution of assets: Misallocating the deceased’s assets contrary to legal requirements or failing to settle debts properly can lead to legal issues.

When completing a Kansas Small Estate Affidavit, attention to detail and an understanding of the legal requirements are paramount. To avoid these common mistakes, one might consider consulting with a legal professional. This ensures the estate is settled efficiently, respecting both the letter of the law and the decedent's wishes.

Documents used along the form

When dealing with the estate of a deceased individual in Kansas, particularly small estates, the Small Estate Affidavit form is commonly utilized to simplify the process. However, it's not the only document needed to effectively manage and settle an estate under these circumstances. Several other forms and documents often accompany the Small Estate Affidariat to ensure a comprehensive and legally sound management of the decedent's assets. Here is an elucidation of these essential documents.

- Death Certificate: A certified copy of the decedent's death certificate is pivotal. It serves as official proof of death and is required by financial institutions, courts, and governmental agencies to process any claims or changes in the ownership of the decedent's assets.

- Last Will and Testament: If the decedent left a will, this document outlines their final wishes regarding the distribution of their assets and the care of any dependents. It is crucial in guiding the process, even in the context of a small estate.

- Letters Testamentary or Letters of Administration: These documents are issued by the court and grant the executor or administrator the authority to act on behalf of the decedent's estate. They are necessary for conducting transactions that involve the estate's assets.

- Vehicle Title Transfer Forms: If the estate includes vehicles, specific forms are required to transfer ownership. These forms vary depending on whether the vehicle is being claimed by a beneficiary or sold.

- Real Estate Deeds and Transfer Documents: When real estate is part of an estate, legal documents that transfer ownership or interest in the property are required. These must be filed with the appropriate government office.

- Bank Account Closure or Transfer Forms: To access or redistribute funds held in the decedent's bank accounts, the financial institution may require specific forms in addition to the Small Estate Affidavit.

- Investment Account Transfer Forms: Similar to bank accounts, transferring or accessing the decedent's investments often necessitates forms that detail the beneficiary information and ensure the proper transfer of assets.

These documents collectively facilitate the smooth administration of a small estate in Kansas. They serve to validate the estate's executor or administrator's authority, establish the legal transfer of assets, and ensure that the decedent's wishes are fulfilled in accordance with the law. Handling a small estate requires attention to detail and an understanding of the legal framework that governs these processes. By securing and accurately completing these forms and documents, individuals can manage the estate's affairs efficiently and within legal bounds.

Similar forms

The Kansas Small Estate Affidavit form is similar to other legal documents intended to simplify estate handling processes, but each serves distinct purposes under specific circumstances. Particularly, this form shares commonalities with Transfer on Death Deed (TODD) and Simplified Probate Procedures. These documents are crafted to ease the transfer of assets, avoiding the often long and costly probate process.

The Transfer on Death Deed (TODD) is a document used to automatically transfer the ownership of real estate upon the death of the owner to a designated beneficiary without the need for probate. Both the Kansas Small Estate Affidavit and the TODD are designed to bypass the traditional probate process, but they differ in the type of assets they address. The Small Estate Affidavit is used for personal property, such as bank accounts and vehicles, whereas the TODD is specifically for real estate assets. Furthermore, the TODD must be recorded before the owner's death and specifically deals with real estate, while the Small Estate Affidavit is filed after death and addresses a broader range of properties.

Simplified Probate Procedures, another alternative, are designed for small estates, offering a more streamlined and less time-consuming process than regular probate. Similar to the Kansas Small Estate Affidait, these procedures may involve less paperwork and can sometimes be managed without the assistance of an attorney. However, the eligibility criteria for simplified probate procedures are typically more rigid, often involving limits on the value of the estate that can vary from state to state. In contrast, the Small Estate Affidavit's applicability hinges on the total value of the estate meeting specific requirements, providing flexibility and accessibility in handling small estates.

Dos and Don'ts

When filling out the Kansas Small Estate Affidavit form, navigating the process correctly is crucial. A properly completed affidavit can streamline asset distribution for estates that qualify under Kansas law. To assist with this, here are lists of things you should and shouldn't do.

Do:

- Double-check the eligibility criteria for using the Small Estate Affidavit in Kansas to ensure the estate qualifies based on its total value and the types of assets involved.

- Thoroughly read and understand every section of the form before beginning to fill it out, to prevent any misunderstanding of what information is required.

- Provide accurate and complete information for every field in the affidavit, including full legal names, descriptions of assets, and their values, to ensure there are no delays due to incomplete or inaccurate information.

- Sign the affidavit in the presence of a notary public to affirm the truthfulness and accuracy of the information provided, as this is a legal requirement for the document to be considered valid.

- Keep a copy of the completed affidavit and any attachments for your records and for any future reference, especially if disputes arise during the asset distribution process.

Don't:

- Attempt to use the Small Estate Affidavit if the estate exceeds Kansas’s value limit for small estates or if it doesn't meet other specific requirements set by state law.

- Rush through filling out the form without verifying the accuracy of the information, which can lead to errors that might invalidate the affidavit or cause other legal complications.

- Omit any required attachments or supporting documents, like death certificates or proof of entitlement to certain assets, as these are critical for establishing the legal right to administer the estate.

- Sign the affidavit without a notary public present. An unnotarized affidavit will not be legally effective and will be rejected by institutions requiring the document.

- Forget to distribute the assets according to the decedent's will (if one exists) or Kansas state law, as failing to do so can result in personal liability.

Misconceptions

When it comes to settling small estates in Kansas, the Small Estate Affidavit form can be a helpful tool. However, there are a number of misconceptions about its use and scope. Let's clear up some of these misunderstandings to ensure that both legal practitioners and the general public have accurate information.

- Misconception 1: Any estate can qualify for the Kansas Small Estate Affidavit. In reality, only estates with a value below a certain threshold (as specified by Kansas law) can utilize this simplified process.

- Misconception 2: The form can be used immediately after the death of a property owner. There's actually a waiting period required by Kansas law before the affidavit can be submitted. This ensures that all aspects of the estate are properly accounted for.

- Misconception 3: Real estate can be transferred using the Kansas Small Estate Affidavit. The reality is that this form is primarily used for the transfer of personal property, not real estate.

- Misconception 4: A Small Estate Affidavit in Kansas is a complex and lengthy document. Quite the contrary, the form is designed to be straightforward and easy to complete for individuals without extensive legal training.

- Misconception 5: Using a Small Estate Affidavit avoids probate entirely. While it's true that this process can simplify and expedite the transfer of assets, it doesn't completely negate the need for probate in all cases, especially if legal disputes arise.

- Misconception 6: Only family members can file a Kansas Small Estate Affidavit. In fact, while family members are commonly the ones who file, others who are legally entitled to the assets may also file under certain circumstances.

- Misconception 7: There are no filing fees associated with the Kansas Small Estate Affidavit. Although it's a cost-effective option compared to formal probate, there may still be filing or court fees applicable, depending on the county.

- Misconception 8: A lawyer is not needed to complete or file the Small Estate Affidavit in Kansas. While legal counsel is not a requirement, consulting with an attorney can help navigate the complexities of estate law and avoid future legal issues.

- Misconception 9: The affidavit can be used to settle debts against the estate. The primary purpose of the form is to transfer property, not to settle the decedent’s debts, although some liabilities might indirectly be addressed through the process.

- Misconception 10: Once filed, the process is instant. The process can be quicker than formal probate, but it still requires time for administrative actions, including review and approval by relevant entities or courts.

Understanding these misconceptions can help individuals navigate the process of using a Kansas Small Estate Affidavit more effectively, ensuring that they comply with state law and avoid potential pitfalls.

Key takeaways

When dealing with the passing of a loved one, the Kansas Small Estate Affidavit form can be a useful document for handling their estate. This form simplifies the process, making it quicker and less expensive than probate for small estates. Here are key takeaways about filling out and using this form:

- Eligibility Criteria: To use the Kansas Small Estate Affidavit, the total value of the deceased's estate must not exceed a specific threshold. It is important to confirm this value, as it may change over time. Assets typically included are personal property, vehicles, and bank accounts, excluding real estate.

- Required Documentation: Gather all necessary documentation about the deceased’s assets. This includes bank statements, titles, and deeds. Proof of death, usually a certified copy of the death certificate, is also required to complete the affidavit.

- Completing the Form: Accuracy is crucial when filling out the Small Estate Affidavit. Ensure that all information provided, from the deceased's personal details to a thorough listing of assets, is precise and truthful. Mistakes can lead to delays or legal complications.

- Notarization: Once the form is completed, it must be notarized to be legally valid. This process involves signing the document in front of a notary public. It's a step that validates the identity of the person signing the affidavit and their acknowledgment of its contents.

- Filing and Using the Affidavit: The notarized affidavit is then filed with the relevant institution, such as a bank, to claim the assets. It may also need to be presented to other entities holding the deceased’s assets. The affidavit allows for the transfer of the deceased's property to the rightful heirs or beneficiaries without the need for a formal probate process.

It's crucial to handle these matters with attention to detail and respect for the legal process to ensure the smooth transfer of assets and fulfill the final wishes of the deceased.

Fill out Popular Small Estate Affidavit Forms for Different States

How to File Probate Without a Lawyer - This legal shortcut is instrumental for many families, enabling them to honor the deceased’s wishes with fewer obstacles and uncertainties.

Small State Affidavit - Streamlines the process for heirs to gain access to the deceased individual's bank accounts and personal property.

Small Estate Affidavit Georgia - Legal guidance may be advisable to ensure compliance with specific state requirements and accurate form completion.

Vermont Will Requirements - It empowers heirs to manage estate resolution independently, often without the need for an attorney, making it an accessible option for many families.