Printable Small Estate Affidavit Form for Kentucky

In the intricate tapestry of Kentucky law, the Small Estate Affidavit form stands out as both a beacon of simplicity and a testament to practicality for those navigating the aftermath of a loved one's passing. This document, while modest in appearance, plays a pivotal role in the probate process, especially when dealing with estates that fall below a certain threshold in value. It is tailored to minimize legal hurdles and facilitate a smoother transition of assets, bypassentially bypassing the more cumbersome and traditional probate proceedings. The essence of the form lies in its capacity to expedite the transfer of property to beneficiaries, making it an invaluable tool for heirs who seek to settle estate matters efficiently and without undue delay. By providing a clear, straightforward pathway, the Kentucky Small Estate Affidavit form encapsulates the legal system's ability to adapt to the needs of individuals during moments of vulnerability, ensuring that the process of asset distribution is not only accessible but also grounded in a sense of compassion and consideration for the bereaved.

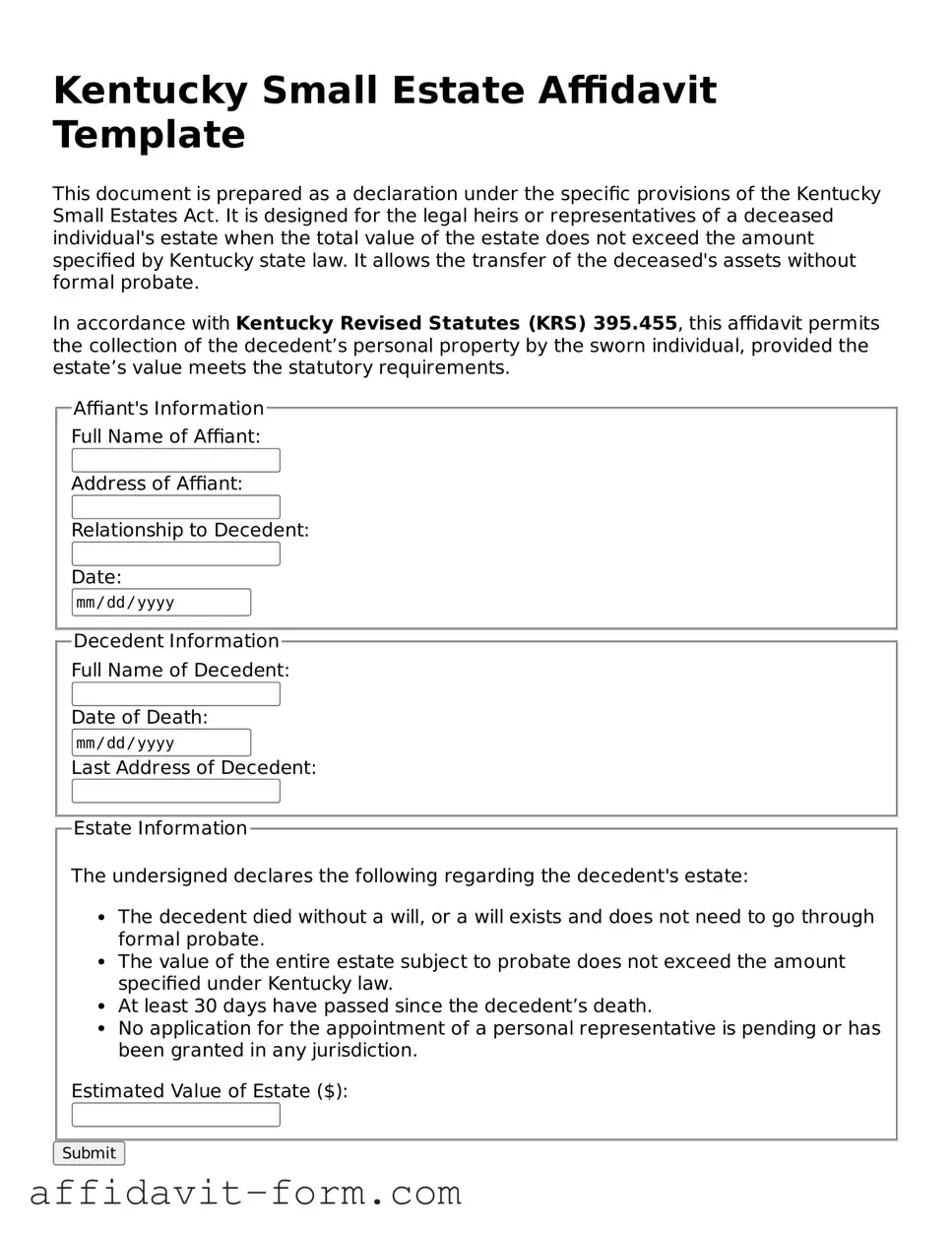

Form Example

Kentucky Small Estate Affidavit Template

This document is prepared as a declaration under the specific provisions of the Kentucky Small Estates Act. It is designed for the legal heirs or representatives of a deceased individual's estate when the total value of the estate does not exceed the amount specified by Kentucky state law. It allows the transfer of the deceased's assets without formal probate.

In accordance with Kentucky Revised Statutes (KRS) 395.455, this affidavit permits the collection of the decedent’s personal property by the sworn individual, provided the estate’s value meets the statutory requirements.

This affidavit must be signed in the presence of a notary public or other official authorized by the state of Kentucky to administer oaths. By executing this document, the affiant affirms that all information provided is true and accurate to the best of their knowledge and belief.

Document Details

| Fact | Description |

|---|---|

| Definition | A Kentucky Small Estate Affidavit is a legal document used to settle small estates quickly when a person passes away without a will. |

| Governing Law | In Kentucky, the Small Estate Affidavit process is governed by the Kentucky Revised Statutes, KRS Chapter 395. |

| Eligibility | The estate must be valued at $30,000 or less, after subtracting the value of the property that transfers outside of probate. |

| Property Types Allowed | It can cover personal property, including bank accounts, but cannot be used for real estate. |

| Required Signatures | The affidavit must be signed by the surviving spouse or, if there is none, by the next of kin. |

| Waiting Period | There is a 45-day waiting period after the death before the affidavit can be filed with the appropriate district court. |

| Filing Fee | Filing fees for the affidavit can vary by county, so it's recommended to check with the local district court. |

| Effect | Once accepted, the affidavit allows the transfer of the deceased's personal property to the rightful heirs without the need for a formal probate process. |

How to Use Kentucky Small Estate Affidavit

Filling out the Kentucky Small Estate Affidavit form is a necessary step when settling the affairs of a person who has passed away with a small estate, according to the state's definition. This document allows the assets of the deceased to be distributed without a formal probate process. Correctly completing this form is crucial for a smooth and legal transfer of assets. Here's a structured guide to help you accurately fill out the Kentucky Small Estate Affidavit form.

- Start by gathering all necessary information, including the full legal name and address of the deceased, the date of death, and a detailed list of the estate's assets and their values.

- Enter the deceased's full legal name at the top of the form where indicated.

- Fill in the date of death in the designated space.

- List all known heirs, their relationship to the deceased, and their addresses in the respective section.

- Detail all assets of the estate, including bank accounts, real estate, vehicles, and personal property, with their fair market value at the time of the deceased’s death.

- Indicate any debts the estate owes, such as funeral expenses, taxes, or outstanding bills.

- Sign and date the form in the presence of a notary public. Ensure the Affidavit is notarized to validate its authenticity.

- File the completed Kentucky Small Estate Affidavit form with the local county court where the deceased was residing at the time of death. A filing fee may apply, so it’s advisable to confirm the amount with the court in advance.

Once the form has been successfully submitted, the court will review the affidavit to ensure compliance with Kentucky laws. If approved, the document serves as authorization to distribute the estate's assets accordingly. It’s essential to follow these steps meticulously to avoid delays in the process and ensure the lawful transfer of the deceased’s assets to the rightful heirs.

Listed Questions and Answers

What is a Kentucky Small Estate Affidavit?

A Kentucky Small Estate Affidavitis a legal document used when someone passes away leaving a small amount of assets. It allows the deceased person’s property to be transferred to their heirs without the need for a full probate process. This form is particularly useful in cases where the deceased person’s estate is below a certain value threshold.

Who is eligible to use a Kentucky Small Estate Affidavit?

Eligibility to use this form typically requires the deceased person’s estate to not exceed a specific financial threshold, which may vary. Additionally, the applicant must be an interested party such as a surviving spouse, adult child, or other relative. The specific rules regarding who can file this affidavit are governed by Kentucky state law.

What is the value limit for an estate to be considered "small" in Kentucky?

In Kentucky, an estate is considered "small" if the total value of the assets does not surpass a certain limit, which is periodically adjusted for inflation and statutory changes. To find the most current limit, it is advised to consult the latest Kentucky statutes or an experienced legal professional.

Which assets can be transferred using the Kentucky Small Estate Affidavit?

The types of assets that can be transferred with a Kentucky Small Estate Affidavit may include, but are not limited to:

- Personal property such as vehicles, jewelry, and furnishings

- Bank accounts holding only a small amount of money

- Stocks and bonds

Are there any assets that cannot be transferred using this form?

Yes, there are certain types of assets that typically cannot be transferred using a Kentucky Small Estate Affidavit, including:

- Real estate properties

- Certain retirement accounts, unless specific conditions are met

- Assets held in trust

How do you file a Kentucky Small Estate Affidavit?

To file a Kentucky Small Estate Affidavit, you must complete the form with accurate information about the deceased’s estate, including a detailed list of assets, and their values. After completing the form, it needs to be notarized and then submitted to the appropriate local court. Some counties may require additional documentation, so it’s important to check with the local court clerk.

What information do you need to fill out the form?

To fill out the Kentucky Small Estate Affidavit form, you will need the following information:

- The full name and address of the deceased

- The date of death

- A comprehensive list of the deceased’s assets and their estimated values

- The names and relationships of the heirs or beneficiaries

- Any debts and obligations of the deceased

Is there a waiting period to use the Kentucky Small Estate Affidavit after someone dies?

Yes, in Kentucky, there is typically a required waiting period after the person’s death before the Small Estate Affidavit can be filed. This period is intended to provide time to accurately assess the estate's value and ensure that all potential heirs are properly identified and notified.

Can you file a Kentucky Small Estate Affidavit without a lawyer?

While it is possible to file a Kentucky Small Estate Affidavit without a lawyer, seeking the advice or assistance of a legal professional is highly recommended. A lawyer can help navigate the complexities of estate laws, ensure that the form is filled out correctly, and provide guidance on how to manage the deceased’s assets legally and efficiently.

Where can you find a Kentucky Small Estate Affidavit form?

The Kentucky Small Estate Affidavit form can be obtained from several sources, including the local county court’s office or its website. Sometimes, legal document providers online may also have the form available, but it’s important to use a version that is up-to-date and compliant with Kentucky law.

Common mistakes

When it comes to managing the affairs of a loved one after their passing, the Kentucky Small Estate Affidavit form serves as a critical document for those estates that qualify under state law for simplified processing. Errors in filling out this form can delay the process or lead to its outright rejection. Here are five common mistakes to look out for:

Incorrect or Incomplete Information: One of the first hurdles individuals face is providing information that is either incorrect or incomplete. Every detail, from the full legal name of the deceased to the descriptions of assets, needs to be thoroughly and accurately documented. It’s not uncommon for people to inadvertently misspell names or leave sections blank that require attention.

Failure to List All Known Assets: The purpose of the Small Estate Affidavit is to catalog and distribute the decedent's assets to rightful heirs. A frequent oversight is not listing all known assets or incorrectly valuing them. Every asset, whether it’s real estate, vehicles, or personal property, must be listed to ensure a fair and lawful distribution.

Misunderstanding the Qualification Criteria: Another mistake is misinterpreting the criteria that qualify an estate for affidavit processing. The Kentucky laws have specific requirements for an estate's value that must be met. Some individuals might attempt to use this form for estates that exceed these limits, leading to complications in the legal process.

Incorrectly Identifying Heirs or Beneficiaries: Identifying and listing the rightful heirs or beneficiaries is crucial. Errors in this area, including omitting a lawful heir or misidentifying the relationship to the deceased, can cause significant delays and disputes among potential inheritors.

Not Obtaining Required Signatures: The completion of the Small Estate Affidavit requires the signatures of all heirs in addition to the petitioner’s. Sometimes, individuals forget to collect all necessary signatures before submission, which is compulsory for the affidavit to be legally binding and processed accordingly.

Pro tip: Always double-check the entered information with an extra set of eyes and consult with a professional if there are any doubts or questions. This attention to detail can save a generous amount of time and prevent unnecessary legal complications.

Understanding these common mistakes and taking steps to avoid them can streamline the process of settling a loved one's small estate, making it smoother and less stressful for everyone involved.

Documents used along the form

In situations where a loved one has passed away with a relatively small estate, handling the legal side of things can feel overwhelming. The Kentucky Small Estate Affidavit form is a vital document for simplifying this process, but it often needs to be accompanied by other forms and documents to ensure the estate is managed and distributed correctly. From death certificates to title documents, each serves a unique purpose in the administration of an estate.

- Death Certificate: An official document issued by the county or state, confirming the death. It is required to validate the death to courts and agencies.

- Last Will and Testament: This document outlines the deceased's last wishes, including the distribution of their assets. If this exists, it should accompany the small estate affidavit.

- Proof of Heirship: Documents or affidavits that establish the legal heirs of the deceased are often needed to prove the right to claim the estate.

- Vehicle Title and Registration Documents: If the estate includes a vehicle, the title and registration documents are necessary to transfer ownership.

- Real Estate Deeds: Deeds are required for any real estate owned by the deceased, to prove ownership and to transfer property as dictated by the affidavit or will.

- Bank Statements and Account Information: To claim or distribute funds held in the deceased’s bank accounts, recent statements and account details are required.

- Stock Certificates and Investment Records: Similar to bank accounts, any stocks, bonds, or investment accounts need documentation for transfer or liquidation.

- Life Insurance Policies: Policies listing beneficiaries are vital for distributing the proceeds without going through the probate process.

- Funeral Expense Receipts: These are important for reimbursement from the estate, particularly if the estate is responsible for covering these costs.

When managing a small estate in Kentucky, gathering these documents is a crucial step toward fulfilling legal obligations and ensuring that the process goes as smoothly as possible. A comprehensive approach, including understanding each document’s role, can provide clarity and peace of mind during a difficult time.

Similar forms

The Kentucky Small Estate Affidavit form is similar to other documents used in the process of estate management and distribution. These documents share common elements in their structure and purpose, aiming to simplify the legal procedures involved in handling a decedent's estate. While the Kentucky Small Estate Affidavit is designed specifically for smaller estates where probate may not be necessary, it draws parallels with other forms in terms of its function and the information it requires.

Transfer on Death Deed (TOD):

The Kentucky Small Estate Affidavit form shares similarities with the Transfer on Death Deed (TOD). Both documents allow for the bypassing of traditional probate procedures, facilitating a more direct transfer of assets. The TOD specifically allows property owners to name beneficiaries for their real estate, ensuring that upon their passing, the property is transferred directly to the named individuals. Like the Small Estate Affidavit, the TOD aims to simplify the transfer process, although it is specifically focused on real estate while the former encompasses a broader range of assets.

Last Will and Testament:

While fundamentally different in their application and scope, the Kentucky Small Estate Affidacy form also bears resemblance to a Last Will and Testament in certain aspects. Both documents are concerned with the distribution of a decedent's assets following their death. A Last Will outlines the decedent's wishes for their estate and appoints an executor to manage the estate's affairs. The Small Estate Affidavit, on the other hand, is utilized when a Last Will may not be present or when the estate's value falls below a specific threshold, allowing for a simplified distribution process to rightful heirs or beneficiaries.

Joint Tenancy with Right of Survivorship Agreement:

The principle of bypassing the probate process is a key factor that aligns the Kentucky Small Estate Affidavit with the Joint Tenancy with Right of Survivorship Agreement. This agreement allows co-owners of property to automatically pass ownership to the surviving co-owners upon their death, without the need for probate. Though the Small Estate Affidavit and the Joint Tenancy Agreement serve different purposes and apply to different circumstances, their underlying goal of facilitating a smoother transition of assets upon death connects them. Additionally, both provide a legal mechanism to avoid lengthy and potentially costly probate proceedings.

Dos and Don'ts

When handling the paperwork for a small estate in Kentucky, the Small Estate Affidavit form is a crucial document. It can streamline the process of estate administration for estates that meet certain criteria, making it simpler for the rightful heirs or beneficiaries to distribute the assets. However, the process requires attention to detail and an understanding of what you should and should not do. Here are some guidelines to help ensure the process goes as smoothly as possible.

Do:- Verify that the total value of the estate meets the Kentucky small estate threshold. This ensures that the estate qualifies for the simplified processing.

- Accurately list all the assets of the estate. Providing a comprehensive and accurate listing of assets is crucial for a valid affidavit.

- Ensure that all debts of the estate have been settled, if possible, before distributing the assets. This step includes paying any outstanding bills and taxes.

- Get all required signatures on the form. Depending on the estate, this may include beneficiaries and legal heirs.

- Use the official Small Estate Affidavit form designated by Kentucky law to ensure compliance.

- File the form with the appropriate Kentucky county court. The estate is typically filed in the county where the deceased person lived.

- Seek legal advice if there are any complexities or uncertainties about filling out the form or if the estate does not qualify as a "small estate."

- Attempt to use the Small Estate Affidavit if the estate exceeds Kentucky's small estate value limit. This could lead to legal complications.

- Forget to notify all potential heirs and beneficiaries about the estate proceedings. This is a legal requirement.

- Rush through the form without carefully reviewing and understanding each section. Mistakes or omissions can cause delays.

- Distribute any estate assets before ensuring all debts and taxes have been paid. This can protect against personal liability.

- Ignore the need for notarization, if required. Notarizing the document verifies the signatories' identities and their understanding of the affidavit.

- Overlook the possibility that some assets may not be covered by the Small Estate Affidavit, such as certain personal or real property.

- Dismiss the need for professional guidance, especially in estates that may seem simple but have unique circumstances.

Misconceptions

Discussing the Kentucky Small Estate Affidavit form involves clearing up common misconceptions that often arise. This form is used to settle estates that fall below a certain value threshold, making it simpler to transfer the deceased's assets without a full probate process. However, misunderstandings can complicate what should be a straightforward procedure.

Misconception: The form is automatically valid once filled out. Truth: The Small Estate Affidavit form must be submitted to and approved by the probate court in the county where the deceased resided. Simply filling out the form does not grant it legal authority.

Misconception: It allows immediate access to the deceased's assets. There is often a waiting period required by law, allowing creditors to make claims against the estate. The assets cannot be distributed immediately upon completion and submission of the form.

Misconception: Any family member can file the form. While many family members might be eligible, the right to file the form typically starts with the surviving spouse, followed by other heirs in a priority order defined by state law.

Misconception: It transfers all types of assets. Certain assets, such as real estate or vehicles titled in another state, may not be transferrable via this form. The form typically covers personal property and possibly some bank accounts, but not all asset types.

Misconception: There's no cost involved. Filing a Small Estate Affidavit often requires a filing fee at the county probate court. Additionally, there may be other costs associated with collecting and distributing the assets.

Misconception: It's only for Kentucky residents. The deceased must have been a resident of Kentucky or owned property within the state. A similar affidavit might exist in other states, but each has its own rules and forms.

Misconception: It circumvents the need for a will. While it can simplify asset transfer without a will, the existence of a will does not necessarily negate the usefulness of a Small Estate Affidavit, but it may affect how assets are distributed.

Misconception: There's no limit to the estate's value. Kentucky law specifies a maximum value for estates that can qualify for small estate processing. This cap is set by statute and excludes certain types of assets in calculating the total estate value.

Misconception: It resolves all estate-related matters. The form facilitates the transfer of specific assets but does not address all legal obligations of the estate, such as final tax filings or settlement of the deceased's debts.

Key takeaways

When dealing with the settling of a small estate in Kentucky, the Small Estate Affidavit form plays a crucial role. This form is particularly helpful in streamlining the process for estates that qualify under the state's criteria for "small estates." Understanding how to properly fill out and use this form is essential for a smooth legal process. Here are key takeaways to consider:

- Eligibility Criteria: Before proceeding, it’s crucial to determine whether the estate in question meets Kentucky’s definition of a small estate. This typically involves the total value of the estate being under a certain threshold, not including certain exempt properties.

- Gathering Necessary Information: You must collect all relevant information about the deceased's assets, debts, and beneficiaries. Accurate and complete information is vital for the affidavit to be processed smoothly.

- Completing the Form: Fill out the Small Estate Affidavit form carefully, ensuring that all fields are completed truthfully and accurately. Any mistakes or omissions can delay the process or lead to legal complications.

- Legal Declarations: Be prepared to make legal declarations about your relationship to the deceased, your knowledge of the estate, and your affirmations that the information provided is correct to the best of your knowledge.

- Required Attachments: Certain documents, such as the death certificate and proof of your right to claim the estate, may need to be attached to the affidavit. Check the specific requirements and include all necessary documents.

- Notarization: In most cases, the affidavit will need to be signed in the presence of a notary public. This step is crucial for the form's validity.

- Filing with the Appropriate Court: After completing the form, file it with the probate court in the county where the deceased resided. Each county may have specific filing requirements or fees.

- Notifications: You might be required to notify other potential heirs or creditors of the estate about your filing. Understanding the notification process is important to comply with legal requirements.

- Distribution of Assets: Once the affidavit is approved, assets can be distributed among the rightful heirs according to the decedent's will or state law, should there be no will.

- Legal Advice: While the Small Estate Affidavit process is designed to be straightforward, seeking the advice of a legal professional can help navigate any complexities or questions that arise.

Using the Kentucky Small Estate Affidavit form is a responsibility that requires attention to detail and an understanding of legal obligations. By following these key takeaways, individuals can more confidently and effectively manage the small estate process.

Fill out Popular Small Estate Affidavit Forms for Different States

Survivorship Affidavit Utah - It offers a pathway for heirs to resolve an estate's matters without needing a will.

Probate Forms Ri - Oriented towards providing a straightforward solution for those facing the daunting task of estate settlement.

What Is Probate in Oregon - It may include details such as the deceased’s personal information, a list of assets, and the claiming heir’s relationship to the deceased.