Printable Small Estate Affidavit Form for Louisiana

When someone passes away, their loved ones are faced with the task of managing their estate. This process can be daunting, especially during a time of grief. In Louisiana, a tool called the Small Estate Affidavit form simplifies this task for estates that meet certain criteria. This legal document is designed to help expedite the transfer of the deceased's assets to their rightful heirs without the need for a prolonged probate process. It outlines a more straightforward path for small estates, defining eligibility around the total value of the estate and the types of properties it includes. By using this form, individuals can efficiently manage the distribution of assets, such as bank accounts and personal property, ensuring that the deceased's wishes are honored quickly and with less bureaucratic hassle. The form is particularly beneficial for those who are navigating the legal and emotional complexities of estate management for the first time, offering a beacon of clarity and support.

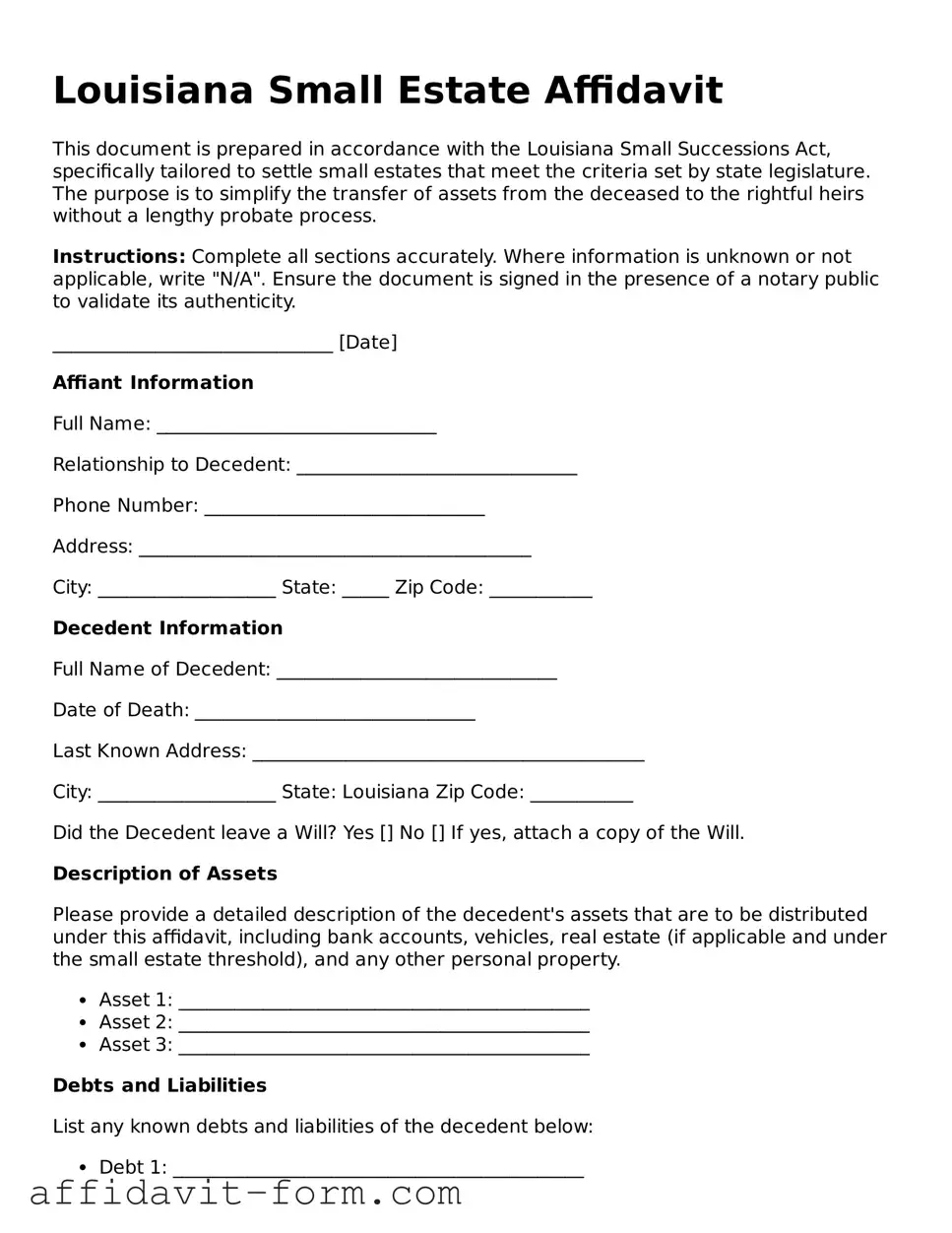

Form Example

Louisiana Small Estate Affidavit

This document is prepared in accordance with the Louisiana Small Successions Act, specifically tailored to settle small estates that meet the criteria set by state legislature. The purpose is to simplify the transfer of assets from the deceased to the rightful heirs without a lengthy probate process.

Instructions: Complete all sections accurately. Where information is unknown or not applicable, write "N/A". Ensure the document is signed in the presence of a notary public to validate its authenticity.

______________________________ [Date]

Affiant Information

Full Name: ______________________________

Relationship to Decedent: ______________________________

Phone Number: ______________________________

Address: __________________________________________

City: ___________________ State: _____ Zip Code: ___________

Decedent Information

Full Name of Decedent: ______________________________

Date of Death: ______________________________

Last Known Address: __________________________________________

City: ___________________ State: Louisiana Zip Code: ___________

Did the Decedent leave a Will? Yes [] No [] If yes, attach a copy of the Will.

Description of Assets

Please provide a detailed description of the decedent's assets that are to be distributed under this affidavit, including bank accounts, vehicles, real estate (if applicable and under the small estate threshold), and any other personal property.

- Asset 1: ____________________________________________

- Asset 2: ____________________________________________

- Asset 3: ____________________________________________

Debts and Liabilities

List any known debts and liabilities of the decedent below:

- Debt 1: ____________________________________________

- Debt 2: ____________________________________________

- Debt 3: ____________________________________________

Heir Information

Provide the name(s) and relationship(s) of the heir(s) entitled to the estate.

- Heir 1: Name __________________________, Relationship ____________________

- Heir 2: Name __________________________, Relationship ____________________

- Heir 3: Name __________________________, Relationship ____________________

Declaration

I, ______________________________ [Affiant’s Name], swear (or affirm) that the information provided in this affidavit is true and correct to the best of my knowledge. I understand that any false statement made in this affidavit is subject to penalties for perjury. I further acknowledge that this affidavit is executed under the provisions of the Louisiana Small Estates Act and is intended to collect the small estate of the decedent without formal administration.

Affiant's Signature: ______________________________

Date: ______________________________

Notary Public

State of Louisiana

Parish of _________________________

Subscribed and sworn to before me this ____ day of _________________, 20__.

Notary's Signature: ______________________________ [SEAL]

Commission No.: __________________

Document Details

| Fact Name | Description |

|---|---|

| Eligibility Criteria | The total value of the deceased's estate must not exceed $75,000 to be eligible for the Louisiana Small Estate Affidavit process. |

| Required Wait Time | A period of 30 days must have passed since the death before an affidavit can be submitted. |

| Applicable Legislation | Louisiana succession law, particularly Articles 3421.1 through 3434 of the Louisiana Civil Code, governs the Small Estate Affidavit process. |

| Notarization Requirement | The affidavit must be signed in the presence of a notary public to be considered valid. |

How to Use Louisiana Small Estate Affidavit

When a loved one passes away, dealing with their estate can be a daunting process. In Louisiana, if the deceased person’s estate is considered small under state laws, a shorter and simpler procedure using a Small Estate Affidavit might be available. This process can allow for the distribution of assets without the need for a full probate. Completing the Louisiana Small Estate Affidavit form requires careful attention to detail to ensure the transfer of assets is done correctly and according to Louisiana law.

To fill out the Louisiana Small Estate Affidavit form, follow these steps:

- Start by gathering important information such as the deceased person’s legal name, address, date of death, and a list of all assets. This includes bank accounts, vehicles, and any other personal property of value.

- Identify all potential heirs and gather their contact information. These are the people entitled under law to receive the assets of the deceased.

- On the form, fill in the deceased person's name, date of death, and your relationship to them.

- Complete the section on the form that requires a full description of all assets. Be precise, including account numbers, vehicle identification numbers (VINs), and an estimate of each asset's value.

- List the names, addresses, and relationship of all heirs to the deceased. This part is crucial to ensure that the assets are distributed according to state law.

- If the form requires it, declare your oath that the information provided is true to the best of your knowledge and that you will distribute the assets according to Louisiana laws.

- Check if the form needs to be notarized. If so, sign the form in front of a notary public. Many banks provide notary services for their customers.

- File the completed form with the appropriate local court. There may be a filing fee, which varies depending on the parish.

- Once the form is filed and approved, use the certified copies from the court to distribute the assets to the entitled heirs.

Completing and filing the Louisiana Small Estate Affidication form is a responsibility that carries legal weight. It is essential to accurately report all information and follow the steps diligently. In some cases, it might be beneficial to seek legal advice to navigate any complexities or to ensure compliance with Louisiana estate laws. This straightforward process, when executed properly, can provide a timely resolution to distributing a loved one's assets, allowing families to focus on healing and remembrance.

Listed Questions and Answers

What is a Louisiana Small Estate Affidavit?

A Louisiana Small Estate Affidavit is a legal document used to handle small estates of deceased individuals in Louisiana. If the total value of the deceased's estate is below a certain threshold, this affidavit allows the transfer of their assets without the need for a formal probate process. It's a simpler, faster way to settle small estates, designed to make the distribution of assets less burdensome for the heirs.

Who is eligible to use the Louisiana Small Estate Affidavit?

The eligibility to use a Louisiana Small Estate Affidavit depends on several factors:

- The total value of the deceased's estate must not exceed the threshold set by Louisiana law.

- The person applying must be an heir or legally recognized successor of the deceased.

- A certain period must have passed since the death of the deceased, as specified by state law.

What is the maximum value for an estate to qualify as "small" in Louisiana?

The maximum value that qualifies an estate as "small" in Louisiana can vary. It's important to consult the most recent state laws or a legal professional to obtain the current threshold. This threshold is subject to change, but it generally aims to include only those estates that do not have the complexity or asset value that would necessitate a full probate process.

What documents are required to file a Louisiana Small Estate Affidavit?

When filing a Louisiana Small Estate Affidavit, several documents are typically required:

- The completed Small Estate Affidavit form.

- A certified copy of the death certificate of the deceased.

- Documentation verifying the value of the estate's assets.

- Any other documentation that may be required by the specific circumstances of the estate or by law.

How is the Louisiana Small Estate Affidavit filed?

The process for filing a Louisiana Small Estate Affidavit involves several steps. First, the appropriate form must be completed accurately and in detail. Next, the affidavit, along with all required supporting documents, should be filed with the local court that has jurisdiction over the estate. There may be filing fees associated with this process. It is often advisable to seek guidance from a legal professional to ensure that all procedures are followed correctly and efficiently.

How long does it take for the Louisiana Small Estate Affidavit to be processed?

The processing time for a Louisiana Small Estate Affidavit can vary depending on several factors, such as the workload of the court, the completeness and accuracy of the submitted forms, and whether any issues arise during the review process. Typically, if everything is in order, the process can be relatively quick, allowing for the distribution of the estate's assets in a timely manner. However, it's wise to prepare for potential delays and consult with a legal professional for an estimated timeline based on the specifics of the case.

Common mistakes

Filling out the Louisiana Small Estate Affidavit form is an important process that allows individuals to manage the estate of someone who has passed away without going through the formal probate process. However, there are common mistakes that can complicate or delay this process.

Failing to Verify Eligibility: Before using the Small Estate Affidavit form in Louisiana, one must ensure the estate meets the state's specific criteria, such as the total value of the estate. Not all estates qualify for this simplified procedure, and overlooking this crucial step can lead to wasted effort and time.

Incomplete Information: It is essential to fill out every section of the form with accurate and comprehensive information. Leaving fields blank or providing incomplete data can result in the rejection of the affidavit, requiring the submitter to start over or correct the mistakes.

Misunderstanding Asset Valuation: Accurately valuing the estate's assets is another area where errors commonly occur. Underestimating or overestimating the value can affect the affidavit's acceptance and potentially lead to legal complications. It's often wise to seek a professional valuation for accuracy.

Incorrect Listing of Heirs or Beneficiaries: The Louisiana Small Estate Affidavit requires a precise listing of all heirs or beneficiaries, including their relationship to the deceased. Misidentifying these individuals or failing to list all pertinent parties can lead to disputes or delays in the distribution of the estate.

Not Obtaining Required Signatures: The process involves obtaining signatures from all heirs or beneficiaries, which must be notarized. Skipping this step or not properly notarizing the document can invalidate the affidavit. Ensuring that all required parties sign the document in the presence of a notary is crucial.

Avoiding these mistakes can make the process of handling a small estate in Louisiana smoother and more efficient. When in doubt, consulting with a professional can provide guidance and help ensure that all legal requirements are met.

Documents used along the form

When managing small estates in Louisiana, the Small Estate Affidavit is a crucial document used to simplify the distribution of assets for estates that fall below a certain threshold. However, this document does not stand alone in the process. Various other forms and documents often accompany the Small-estate Affidavit to ensure a smooth and comprehensive handling of the deceased's estate. Each of these documents plays a vital role, contributing to the overall efficiency and legality of the estate management process.

- Death Certificate: This official document certifies the date, location, and cause of death. It's essential for legal and financial processes following an individual's passing.

- Last Will and Testament: If available, the deceased's will provides instructions on the distribution of assets and may nominate an executor for the estate.

- Vehicle Title Transfer Forms: To transfer ownership of any vehicles owned by the deceased, these forms are necessary and must be filed with the appropriate state agency.

- Real Estate Transfer Documents: Required for transferring ownership of any real property as dictated by the will or state law if there is no will.

- Bank Account Closure Forms: To close or transfer the deceased's bank accounts, these forms are often required by financial institutions.

- Stocks and Bonds Transfer Requests: If the deceased owned stocks, bonds, or other securities, transfer request forms from the brokerage or bank are needed.

- Life Insurance Claim Forms: Beneficiaries must submit these forms to claim any life insurance benefits.

- Social Security Administration (SSA) Notification: Not a form, but it's crucial to inform the SSA of the death to stop payments and inquire about any possible survivor benefits.

- Tax Returns: The deceased's final personal income tax return, and possibly estate tax return, might need to be filed, depending on the estate's value and income during the final year.

- Debt Settlement Documentation: If the deceased had outstanding debts, documents related to the settlement of these debts might be required, especially if estate assets are used to pay off these liabilities.

The process of managing a small estate in Louisiana can be complex, requiring careful attention to detail and a thorough understanding of the necessary documentation. The Small Estate Affidavit facilitates a more straightforward distribution of assets, but it is only part of a larger ensemble of documents needed to effectively manage and close an estate. Being prepared with the right forms and understanding their functions can ease the burden during a challenging time, ensuring the estate is settled correctly and efficiently.

Similar forms

The Louisiana Small Estate Affidavit form is similar to several other legal documents that are utilized to manage and settle smaller estates without the need for a full probate process. These documents share common purposes but are distinguished by specific conditions or requirements based on the state laws or the nature of the assets involved. The form helps streamline the process of asset distribution when probate can be avoided, a goal shared by comparable documents across different states. This similarity enhances the overall understanding and efficiency of handling small estates for legal professionals and individuals alike.

Transfer on Death Deed (TODD)

A Transfer on Death Deed (TOD, also known as a beneficiary deed) shares similarities with the Louisiana Small Estate Affidavit in that both facilitate the transfer of property upon the death of the owner. Like the Small Estate Affidavit, a TODD allows real property to bypass probate court and go directly to the named beneficiary. The main difference lies in the type of asset it covers; while the Small Estate Affidavit can encompass various assets, the TODD is specifically for real estate. Preparing a TODD involves naming a beneficiary to whom the property will automatically transfer upon the owner's death, without going through the probate process, thus saving time and legal fees.

Joint Tenancy with Right of Survivorship

Joint Tenancy with Right of Survivorship (JTWROS) is another arrangement that shares a key objective with the Louisiana Small Estate Affidavit — the avoidance of probate. Under a JTWROS agreement, two or more parties hold property together in a manner that ensures upon the death of one joint tenant, the property automatically transfers to the surviving joint tenant(s) without the need for a probate. This method directly parallels the Small Estate Affidavit’s goal of simplifying the asset transfer process after death. However, it specifically applies to co-owned property and requires all owners to hold an equal share of the property in question.

Payable on Death (POD) and Transfer on Death (TOD) Accounts

Payable on Death (POD) accounts and Transfer on Death (TOD) accounts are financial vehicles that, like the Louisiana Small Estate Affidavit, help avoid the probate process for certain assets. With a POD or TOD account, an account holder can designate beneficiaries who will receive the assets in the account upon the holder's death, without those assets having to go through probate. This arrangement is particularly common with bank accounts, retirement accounts, and securities. While the Small Estate Affidavit encompasses a broader range of assets and generally applies when the total value of the estate falls below a certain threshold, POD and TOD accounts are specific to financial assets and allow for a direct transfer to beneficiaries, streamlining the process significantly.

Dos and Don'ts

When dealing with the Louisiana Small Estate Affidavit form, it's crucial to approach the process with attention to detail and accuracy. The document is designed to simplify the transfer of assets for estates below a certain value threshold, without the need for a full probate process. To ensure you complete the form correctly and respect its legal context, consider the following do's and don'ts:

Do:- Verify eligibility: Ensure the estate meets Louisiana's criteria for a small estate in terms of total value and assets included.

- Gather necessary documents: Collect all relevant documents, such as death certificates and asset statements, before filling out the form.

- Provide accurate information: Double-check all entries for accuracy, including full names, addresses, and descriptions of assets.

- Review state law: Familiarize yourself with Louisiana's specific requirements for small estates, as laws may differ from other states.

- Sign in front of a notary: Ensure the affidavit is signed in the presence of a notary public to validate its authenticity.

- Include all heirs: Clearly list all rightful heirs and any specific assets they are entitled to, per the decedent's will or state law.

- Attach supporting documents: Submit the affidavit with all required supporting documents, such as proof of death and asset valuation.

- Keep records: Retain copies of the completed affidavit and all accompanying documents for your records.

- Consult professionals: Consider seeking advice from a legal professional, especially if navigating the process feels overwhelming.

- File timely: Adhere to any deadlines for submitting the affidavit to avoid unnecessary delays.

- Estimate values: Avoid guessing asset values; use exact numbers whenever possible to ensure accuracy.

- Omit assets: Failing to include all assets could lead to complications and disputes among heirs.

- Sign without reviewing: Don't rush through the form; thoroughly review all information before signing to avoid errors.

- Ignore beneficiary designations: Assets with a named beneficiary, such as life insurance policies, should be accurately reported.

- Skip legal advice: Skipping consultation with a legal expert can lead to mistakes, especially in complex estates.

- Use outdated forms: Always use the most current version of the form to ensure compliance with current laws.

- Alter the form: Do not make unauthorized changes or alterations to the affidavit form.

- Forget to notify creditors: Failing to inform creditors may result in legal complications.

- Disregard tax implications: Be aware of any tax obligations or implications related to the estate.

- Rely solely on online resources: While online resources are helpful, they may not cover all nuances of your situation.

Misconceptions

The Louisiana Small Estate Affidavit form can be a useful tool for handling the estates of individuals who have passed away, especially when their assets are below a certain threshold. However, there are several misconceptions about its use and applicability. By clarifying these, individuals can navigate the legal process surrounding an estate more effectively.

- Misconception 1: It Allows Immediate Transfer of Property. Many believe that completing a Small Estate Affidavit instantly allows the transfer of the deceased's property to heirs. However, the reality is that this document merely facilitates a simpler process for estate transfer under certain conditions. The process still requires time, and in some cases, the affidavit may need to be presented to a bank, real estate office, or other institutions before property is transferred.

- Misconception 2: It Eliminates the Need for a Will. Another misunderstanding is that the affidavit can replace a will. While it can help distribute the assets of someone who dies without a will (intestate), it doesn't override the instructions laid out in a legally valid will. The affidavit is a tool used when a simplified process is suitable, typically for smaller estates or where the assets are clear and uncontested.

- Misconception 3: It's Applicable Regardless of the Estate's Size. There's a common perception that the Small Estate Affidavit can be used for any estate, regardless of its size. In reality, Louisiana law specifies thresholds regarding the total value of the estate for which this affidavit process can be utilized. Estates exceeding this value may require a more formal probate process.

- Misconception 4: It's Only for Real Estate Transfers. While real estate may indeed be transferred using a Small Estate Affidavit in Louisiana, the form is not limited to such transactions. It can also be used for transferring personal property, such as bank accounts and vehicles, under the estate. Therefore, its utility spans beyond just real estate transactions and can aid in a variety of asset transfers post-mortem.

- Misconception 5: Its Use is Mandatory for Small Estates. Lastly, there is a misconception that if an estate qualifies as "small" under Louisiana law, this affidavit must be used. Instead, it's an optional tool that can simplify the process. Families or heirs may still choose a formal probate process for various reasons, including potential disputes among heirs or the complexity of the estate's assets.

In sum, the Small Estate Affidavit form is an important document that can provide a streamlined process for handling certain estates in Louisiana. By understanding what it can and cannot do, individuals can make informed decisions about managing estate affairs efficiently and legally.

Key takeaways

Filling out and utilizing the Louisiana Small Estate Affidavit form is a streamlined process designed to expedite the distribution of a deceased person's estate in certain circumstances. By providing a simplified method for transferring property, this procedure aids those entitled to a deceased individual's assets, under Louisiana law, without the necessity of a full probate process. Here are key takeaways to consider:

- Eligibility Criteria: The Louisiana Small Estate Affidavit can only be used when the deceased person's estate is valued below a threshold specified by state law. This threshold is adjusted periodically, so it's important to confirm the current limit to ensure eligibility.

- Required Documentation: To fill out the form adequately, you'll need certain documentation, including a certified copy of the death certificate, an appraisal of the estate's value, and documentation proving the claimant's right to the assets. Accurate and complete documentation facilitates a smooth process.

- New Ownership: Through the affidavit, ownership of assets can be transferred to the rightful heirs or legatees directly, bypassing the longer and more complex regular probate procedure. This is particularly helpful for settling estates that mainly consist of personal property or small bank accounts.

- Legal Declaration: The person filling out the affidavit must make a sworn declaration that all information provided is true to the best of their knowledge and that they are rightfully entitled to the assets. This legal declaration deters fraudulent claims and ensures the integrity of the process.

- Limitations and Exceptions: It's critical to understand that the Louisiana Small Estate Affidavit is not applicable to all assets. Certain types of property, such as real estate or assets held in trust, may require a different process or may not qualify for transfer via small estate affidavit. Additionally, if the deceased person had substantial debts, creditors might have claims that affect the distribution.

Utilizing the Louisiana Small Estate Affidavit offers a beneficial pathway for eligible individuals to manage small estates efficiently. However, it's advisable to consult with a legal professional knowledgeable about Louisiana's estate laws to navigate any complexities and ensure compliance with all legal requirements.

Fill out Popular Small Estate Affidavit Forms for Different States

New Jersey Small Estate Affidavit - Simplifies the process for heirs to receive assets like cars, jewelry, and small bank balances.

New Mexico Small Estate Affidavit - It is a legal document used when an individual dies with a small amount of assets.

Nevada Small Estate Affidavit - The affidavit typically covers specifics such as the deceased’s debts, assets, and the claimant's relationship to them.

Kansas Simplified Estates Act - This document serves as a legal tool for heirs to collect assets like bank accounts, securities, and small personal properties.