Printable Small Estate Affidavit Form for Maine

In the scenic state of Maine, settling the estate of a loved one who has passed away without a will, or with only a modest asset portfolio, can often be streamlined through the use of a Small Estate Affidavit form. This particular instrument serves as a powerful legal tool, enabling eligible parties—typically close relatives or inheritors—to bypass the often lengthy and complex probate court process. The essence of its design is to ensure the swift and efficient transfer of the deceased's assets to their rightful heirs, providing a semblance of solace and financial clarity during what is unquestionably a challenging period. Key aspects covered by this affidavit include the total value threshold of the estate that qualifies under Maine law, the types of assets that may be transferred, the required documentation to support the claim, and the legal obligations of the affiant to act honestly and in good faith. The form itself acts not just as a template but as a guide, leading individuals through the necessary steps to achieve resolution and closure in estate matters with minimal legal intervention.

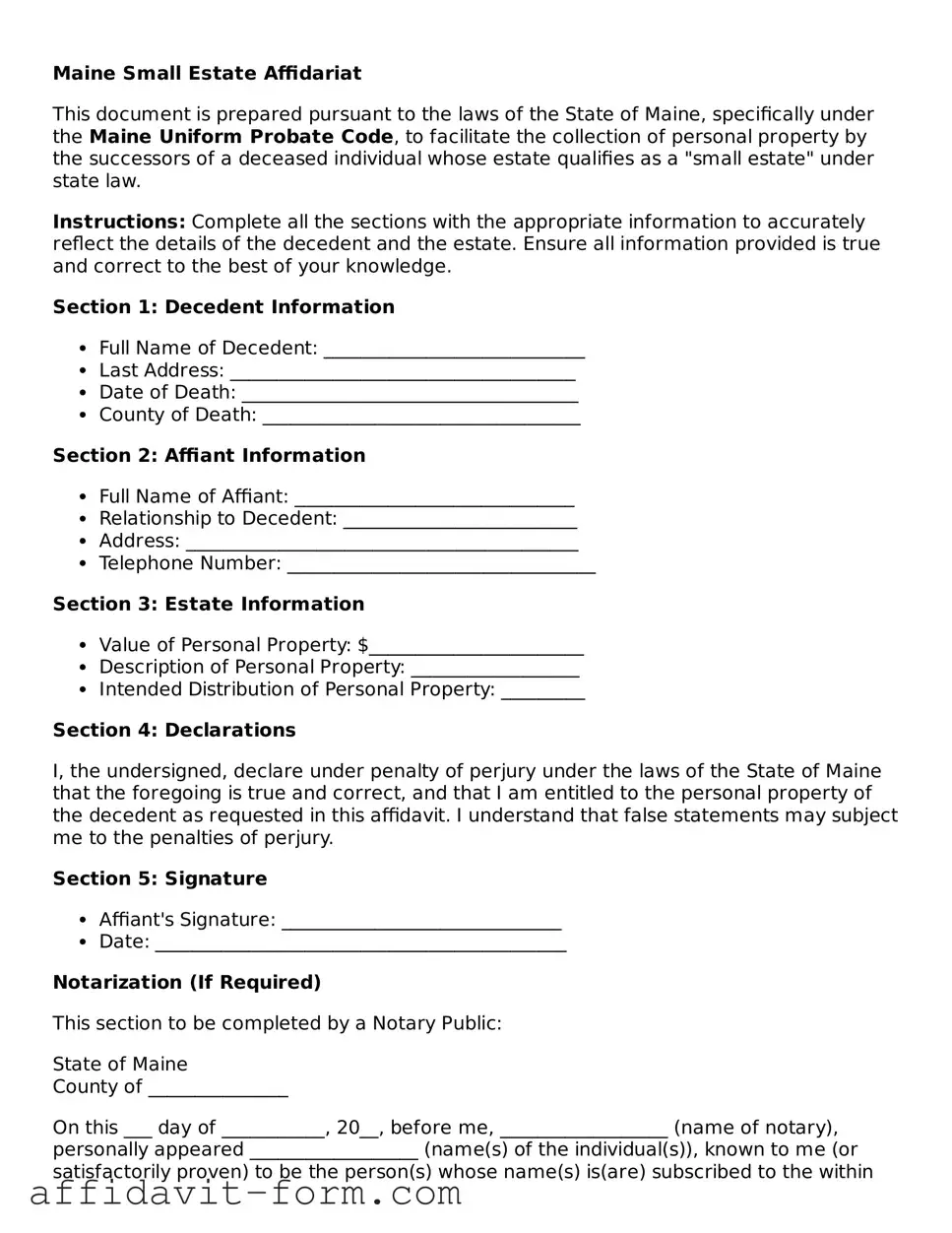

Form Example

Maine Small Estate Affidariat

This document is prepared pursuant to the laws of the State of Maine, specifically under the Maine Uniform Probate Code, to facilitate the collection of personal property by the successors of a deceased individual whose estate qualifies as a "small estate" under state law.

Instructions: Complete all the sections with the appropriate information to accurately reflect the details of the decedent and the estate. Ensure all information provided is true and correct to the best of your knowledge.

Section 1: Decedent Information

- Full Name of Decedent: ____________________________

- Last Address: _____________________________________

- Date of Death: ____________________________________

- County of Death: __________________________________

Section 2: Affiant Information

- Full Name of Affiant: ______________________________

- Relationship to Decedent: _________________________

- Address: __________________________________________

- Telephone Number: _________________________________

Section 3: Estate Information

- Value of Personal Property: $_______________________

- Description of Personal Property: __________________

- Intended Distribution of Personal Property: _________

Section 4: Declarations

I, the undersigned, declare under penalty of perjury under the laws of the State of Maine that the foregoing is true and correct, and that I am entitled to the personal property of the decedent as requested in this affidavit. I understand that false statements may subject me to the penalties of perjury.

Section 5: Signature

- Affiant's Signature: ______________________________

- Date: ____________________________________________

Notarization (If Required)

This section to be completed by a Notary Public:

State of Maine

County of _______________

On this ___ day of ___________, 20__, before me, __________________ (name of notary), personally appeared __________________ (name(s) of the individual(s)), known to me (or satisfactorily proven) to be the person(s) whose name(s) is(are) subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In Witness Whereof, I hereunto set my hand and official seal.

- Notary's Signature: _______________________________

- Commission Expires: ______________________________

Document Details

| Fact Number | Description |

|---|---|

| 1 | The Maine Small Estate Affidavit form is used for estates that qualify as "small" under Maine law. |

| 2 | Under Maine law, an estate may qualify as "small" if the value of the estate does not exceed a certain financial threshold, which is subject to periodic updates. |

| 3 | This form allows for a simplified probate process, which can be faster and less costly than the traditional probate process. |

| 4 | To be eligible to use the form, the person must have died a resident of Maine, and certain time limits apply from the date of death. |

| 5 | Governing law for the Maine Small Estate Affidavit includes the Maine Revised Statutes, specifically under Title 18-C, Article 3, Part 12. |

| 6 | The form typically requires detailed information about the decedent, their estate, and the claiming successor(s). |

| 7 | A death certificate and a detailed list of the estate assets, along with their values, must usually accompany the completed form submission. |

| 8 | There may be limitations on the types of property that can be transferred using the Maine Small Estate Affidavit form. |

| 9 | Submission of the form generally does not require a court appearance, but it must be filed with the appropriate local probate court. |

| 10 | The process facilitated by this form does not extinguish debt or other liabilities of the estate; creditors may still seek payment from estate assets. |

How to Use Maine Small Estate Affidavit

Once the decision has been made to settle a small estate in Maine, utilizing the Small Estate Affidavit form becomes a crucial step. This form is designed to simplify the process of estate resolution for estates of limited size, providing a pathway to distribute assets without going through the standard probate procedure. Navigating this form requires attention to detail and an understanding of the specific requirements to ensure accurate and complete submission. Below is a guided outline to assist in the thorough and correct completion of the Maine Small Estate Affidavit form. By following these steps, individuals are equipped to move forward in the estate settlement process with confidence.

- Identify the Deceased: Start by listing the full legal name of the deceased individual, also referred to as the decedent. Include any aliases or nicknames used, ensuring the name matches the one on death certificates and other official documents.

- Date of Death: Clearly write the date on which the decedent passed away. This date is critical for legal timelines and must be accurate.

- County of Residence: Provide the name of the county in Maine where the decedent lived at the time of their death. This determines the jurisdiction in which the affidavit will be filed.

- Assets List: Create a detailed list of the decedent’s assets that do not automatically transfer to another person upon death. Include bank accounts, vehicles, and personal property, among other assets. Specify the value of each asset, aiming for accuracy.

- Debts and Obligations: Enumerate any known debts or financial obligations the decedent had. This includes, but is not limited to, credit card debts, mortgages, and personal loans.

- Heirs and Beneficiaries: Compile a list of the decedent's heirs and/or legally recognized beneficiaries. Include their full names, addresses, and their relationship to the deceased.

- Swear to the Truth: The individual completing the form must swear to the truthfulness of the information provided. This is typically enforced through a legally recognized oath or affirmation.

- Notarization: The affidavit must be signed in the presence of a Notary Public. The Notary will verify the identity of the signer and affix a stamp or seal to authenticate the document.

- Filing with the Local Court: Once completed and notarized, the Small Estate Affidavit must be submitted to the appropriate Maine court based on the county of the decedent’s residence. The court’s office will provide guidance on any applicable filing fees and additional required documents.

- Notice to Creditors: In some circumstances, you may be required to publish a notice to creditors or otherwise notify them directly. This step is contingent on local requirements and should be verified with the court.

Following these steps does not guarantee that the estate will be settled without challenge, but it does provide a clear guide to navigating the process. As situations and legal requirements can vary widely, consulting with a professional may be beneficial to address any complexities or questions that arise. Completing the Maine Small Estate Affidavit is a significant step toward the resolution of the decedent’s estate, and careful attention to each detail will contribute to a smoother process.

Listed Questions and Answers

What is a Small Estate Affidavit in Maine?

A Small Estate Affidavit in Maine is a legal document used to manage and distribute the assets of a deceased person's estate when those assets are valued below a specific threshold. This process allows for a simplified transfer of the deceased individual's property to their heirs without the need for a formal probate court process. It's intended to be a quicker, less costly option for families dealing with smaller estates.

Who is eligible to use a Small Estate Affidavit in Maine?

To be eligible to use a Small Estate Affidavit in Maine, the total value of the deceased person's estate must not exceed a certain limit set by the state law. Additionally, a certain amount of time must have passed since the individual's death. The person filing the affidavit must be an entitled successor, such as a spouse, child, or another close relative, or a person designated in the deceased's will. It's important to check the most current laws or consult with a legal professional to understand the specific eligibility requirements, as these can change.

What documents are needed to file a Small Estate Affidavit in Maine?

To file a Small Estate Affidavit in Maine, several documents are typically required, including:

- The completed Small Estate Affidavit form.

- A certified copy of the death certificate.

- Documentation of the deceased's assets.

- Proof of the filer's right to inherit the assets, such as a will, if available, or legal documents establishing the relationship to the deceased.

Ensure to gather all necessary documents before filing the affidavit to prevent delays in the process.

How is a Small Estate Affidavit filed in Maine?

In Maine, the Small Estate Affidavit is filed with the probate court in the county where the deceased person lived. The process involves submitting the completed affidavit form along with all required supporting documentation. There may be a filing fee, which varies by county. After the affidavit is filed, the court will review the documents and, if everything is in order, will issue an order allowing the transfer of the assets to the rightful heirs. It is advisable to contact the local probate court for detailed instructions on filing procedures and fees.

What happens after a Small Estate Affidavit is filed in Maine?

Once the Small Estate Affidavit is filed and approved by the court in Maine, the filer is authorized to distribute the deceased's assets to the rightful heirs. This involves transferring ownership of property, closing accounts, and performing any other actions necessary to settle the deceased's estate according to the affidavit's declarations and state laws. It is important to keep thorough records of all transactions and distributions made under the affidavit's authority to ensure compliance with the law and to protect against legal challenges.

Common mistakes

Filling out the Maine Small Estate Affidavit form might seem straightforward, but several common mistakes can lead to delays or complications. Being aware of these pitfalls is key to smoothly navigating this process.

Not verifying eligibility: Before starting the process, it’s crucial to ensure the estate meets the criteria set for "small estates" in Maine. Eligibility is typically based on the value of the estate, and overlooking this step can invalidate the affidavit.

Skipping required information: Every field in the form is important. Leaving out information such as the deceased's legal name, date of death, or a complete list of assets can result in the affidavit being rejected or delays in its processing.

Incorrect asset valuation: Accurately valuing the estate's assets is essential. Overestimating or underestimating these values can impact the affidavit’s validity and the legal transition of assets.

Failure to notify potential heirs: Maine law requires that all potential heirs or beneficiaries are notified about the affidavit. Neglecting to do so not only goes against legal requirements but might also lead to disputes or legal challenges.

Improper documentation: Submitting the affidavit without the necessary supporting documentation, such as the death certificate or proof of asset ownership, will likely lead to a denial. Ensuring all required documents are attached is critical.

Not waiting the required period: Maine law may require a certain waiting period after the death before the affidavit can be filed. Filing too early can result in the form being returned or the process being delayed.

Misunderstanding the successor’s rights: Often, individuals filling out the affidavit might not fully grasp the legal limits of a "successor’s" rights versus those of a formally named executor or administrator. This misunderstanding can cause complications in the handling and distribution of assets.

By avoiding these common mistakes, the process of filling out the Maine Small Estate Affidavit form can be smoother and lead to a quicker resolution, allowing the decedent’s assets to be distributed with less stress and delay.

Documents used along the form

When dealing with the processing of a small estate in Maine, a Small Estate Affidavit form is often not the only document required to efficiently manage and distribute a deceased person's assets. The legal procedure typically involves several additional forms and documents that help ensure compliance with state law, provide detailed information about the deceased's estate, and fulfill the requirements of various institutions or agencies. Here are ten other forms and documents that are frequently used alongside the Maine Small Estate Affidavit form.

- Death Certificate: This is an official document issued by the government, certifying the date, location, and cause of death. It is crucial for legal and financial matters following a person’s passing.

- Last Will and Testament: If the deceased left a will, it outlines their wishes regarding the distribution of their assets and may appoint an executor to manage this process.

- Letters of Administration: When there is no will, or an executor is not named, these court-issued documents grant authority to an individual (typically next of kin) to act as the estate's administrator.

- Inventory of Assets: This document lists all assets belonging to the deceased person's estate, including property, bank accounts, personal belongings, and investments, which is essential for proper distribution.

- Notice to Creditors: Posted in a newspaper or sent directly, this notice informs creditors of the decedent's death and invites them to file claims against the estate for debts owed.

- Release and Waiver Forms: These forms may be used when heirs or beneficiaries choose to waive their rights to certain assets or disclaim their inheritance.

- Tax Forms: Depending on the value of the estate and income generated during the final year of the deceased's life, various state and federal tax forms may need to be filed.

- Bank Statements: Recent statements from the deceased's bank accounts are often necessary to show account balances at the time of death.

- Real Estate Deeds: If the deceased owned real property, the deeds are necessary to transfer ownership or sell the property as dictated by the will or state law.

- Vehicle Titles: Titles for any vehicles owned by the deceased are needed to transfer ownership according to the deceased’s wishes or the laws of intestate succession.

Each of these documents plays a specific role in the administration of a small estate in Maine. Collectively, they provide the necessary legal foundation to ensure that the distribution of the decedent's assets is conducted fairly, according to their wishes as expressed in a will, or in accordance with state laws when no will exists. Handling these documents correctly is crucial for the settlement of the estate and for helping the deceased's loved ones navigate through what is often a challenging time.

Similar forms

The Maine Small Estate Affidavit form is similar to other probate shortcut documents used throughout the United States to expedite the transfer of assets of a deceased person to their rightful heirs or beneficiaries without going through a prolonged probate process. Each document, while serving a similar purpose, varies slightly in format, terminology, and applicability based on the jurisdiction it is used in. The resemblance is primarily in their function to simplify the settling of small estates.

The document shares similarities with the California Small Estate Affidavit. Both are designed to sidestep the comprehensive probate procedure for estates that fall below a certain value threshold. They allow for the collection, transfer, or disbursement of the decedent's property to heirs or rightful recipients quickly and with minimal court intervention. The primary difference lies in the monetary threshold and specific documentation required by state laws to deem an estate "small" and thus eligible for this expedited process.

Another analogous document is the Texas Affidavit of Heirship. This affidavit serves a similar purpose in allowing for the transfer of property without formal probate proceedings. However, it focuses more on establishing the rightful heirs of real estate property when the deceased left no will. While both documents aim to simplify the estate settlement process, the Affidavit of Heirship is more narrowly applied to matters of real property and requires detailed information about family history and heirship to be provided.

Similarities can also be found with the New York Small Estate Affidavit, also known as the "voluntary administration" form. Like Maine's, New York's version is utilized for settling estates that are considered "small" under state law. Each requires the submission of detailed information regarding the deceased's assets, debts, and heirs. However, the criteria defining a "small estate" and the types of assets that can be transferred using the affidavit may differ, reflecting each state’s legal requirements and estate value limits.

Dos and Don'ts

Filling out the Maine Small Estate Affidavit form requires attention to detail and an understanding of the legal implications. Below are key dos and don'ts to keep in mind to ensure the process goes smoothly and accurately.

- Do verify that the estate qualifies as a "small estate" under Maine law. This typically means that the total value of the estate does not exceed a certain threshold.

- Do gather all necessary documents before starting the affidavit, including death certificate, asset statements, and any relevant account numbers.

- Do ensure that you are the rightful successor or legally authorized representative entitled to file the affidavit. Only individuals with a certain degree of relationship or legal standing can file.

- Do fill out the form accurately, providing clear and truthful information about the decedent's assets and debts.

- Do double-check all entries for accuracy and completeness. Mistakes or omissions could delay the process or impact the legal transfer of assets.

- Don't attempt to use the Small Estate Affidavit if the estate exceeds the value limits defined by Maine law. In such cases, a more formal probate process may be required.

- Don't forget to sign the affidavit in front of a notary public. An unsigned or improperly notarized affidavit will not be accepted.

- Don't ignore potential creditors. Be aware that the estate may have outstanding debts that need to be addressed.

- Don't distribute assets until the affidavit is properly filed and accepted, and all statutory waiting periods have passed. Premature distribution can lead to legal complications.

Misconceptions

In the realm of estate management within Maine, the Small Estate Affidavit form stands as a tool designed to streamline the probate process in certain situations. Nevertheless, a swirl of misconceptions clouds its application and utility. Here, we seek to clarify its true nature and use.

- Misconception 1: The Small Estate Affidavit is suitable for all estates of deceased individuals in Maine. In reality, this tool is specifically for estates that are considered 'small' under Maine law, typically involving personal property below a certain value threshold and with or without real estate under specific conditions.

- Misconception 2: Filling out the Small Estate Affidavit form allows immediate access to the deceased’s assets. In truth, there's a waiting period that must be observed after the decedent's passing before the form can be legally effective.

- Misconception 3: The Small Estate Affidavit can transfer title of real estate. This is a misunderstanding; the process for transferring real estate involves additional steps and documents that go beyond the scope of a simple affidavit.

- Misconception 4: Anyone can file a Small Estate Affidavit in Maine. The privilege to file this affidavit is typically reserved for successors of the deceased or individuals who are legally entitled to the estate, as defined by Maine's laws.

- Misconception 5: There's no need for a witness when filing the affidavit. Contrarily, Maine law requires the affidavit to be signed in the presence of a notary, ensuring its authenticity and the signatory’s identity.

- Misconception 6: The affidavit gives the filer total control over the deceased’s estate. The document indeed grants the filer authority to collect the deceased's personal property, but it must be distributed according to the deceased’s will or, in its absence, Maine's intestacy laws.

- Misconception 7: The Small Estate Affidavit process is completely free. While filing fees are relatively low compared to other probate processes, there typically are costs involved, including notary fees or potentially legal consultation fees.

- Misconception 8: The form must be filed in the county where the decedent lived. It's more accurate that the affidavit should be filed in the county where the decedent's property is located, which may not always be their place of residence.

- Misconception 9: Using the Small Estate Affidavit form means avoiding court altogether. While it minimizes involvement with the court, it doesn't eliminate it entirely, particularly if disputes arise regarding the affidavit’s validity or asset distribution.

- Misconception 10: The form, once completed, is irrevocable. Should circumstances change, such as discovering additional assets or debts, the process may need to be revisited and potentially revised to meet legal and statutory obligations.

Understanding these nuances ensures that individuals navigating the aftermath of a loved one's passing can utilize the Small Estate Affidavit with clarity and correctness, aligning expectations with the legal realities of estate administration in Maine.

Key takeaways

The Maine Small Estate Affidavit form is a legal document used to simplify the process of estate settlement for small estates in Maine. Understanding the right way to fill out and use this form ensures that the assets of a deceased person can be distributed to their heirs more efficiently and with fewer complications. Here are seven key takeaways about utilizing the Maine Small Estate Affidavit form:

- Eligibility Criteria: The form is specifically designed for estates considered "small" under Maine law, which typically means that the total value of the estate does not exceed a certain threshold. It is essential to verify current limits and criteria to ensure eligibility.

- Accurate Information: Providing accurate and complete information on the form is crucial. This includes the full legal names of the deceased, the applicant, details about the assets, and the rightful heirs. Mistakes or omissions can delay the process or lead to legal challenges.

- Documentation Required: Alongside the Small Estate Affidavit, other documents might be required, such as a certified copy of the death certificate and proof of the right to the assets. Prepare all necessary documents in advance.

- Legal Signature: The form must be signed in the presence of a notary public. This step is essential for the document to have legal standing, ensuring that the affidavit is formally recognized by financial institutions and courts.

- Filing with the Court: In some cases, the completed affidavit needs to be filed with the appropriate local court. The exact requirements can vary, so it’s important to check the specific filing procedures in Maine.

- Timeframe for Filing: Maine law might specify a waiting period from the date of the deceased's death before the small estate affidavit can be filed or used. Adhering to this timeline is necessary to comply with state laws.

- Use of the Affidavit: Once completed and, if required, filed, the affidavit allows the person managing the estate (the "affiant") to collect, transfer, or disburse the deceased's assets according to the affidavit statements without going through a lengthy probate process. This tool is invaluable for simplifying estate resolutions.

Properly using the Maine Small Estate Affidavit form can significantly ease the burden of managing a small estate, allowing heirs to receive their inheritances more quickly and with fewer legal hurdles. However, always consider consulting with a legal professional to ensure the process complies with all applicable laws and guidelines.

Fill out Popular Small Estate Affidavit Forms for Different States

How Long Does Probate Take in Tennessee - The use of a Small Estate Affidavit is crucial for quick access to funds or property that the deceased left behind.

How Do I Get a Small Estate Affidavit in California? - It's a cost-effective alternative for small estate administration, avoiding expensive legal fees.

Texas Small Estate Affidavit Pdf - The Small Estate Affidavit is an essential tool for heirs wishing to settle estates quickly, generally resolved within a shorter timeframe than probate.