Printable Small Estate Affidavit Form for Maryland

The process of managing a loved one's estate after their passing can often be complex and emotionally challenging. In Maryland, however, the Small Estate Affidavit form offers a streamlined approach for certain situations, easing the burden on surviving relatives. This legal document is a crucial tool for those overseeing small estates, enabling them to distribute assets without the often lengthy and costly probate process typically required for larger estates. It applies specifically to situations where the total value of the estate does not exceed a certain financial threshold, emphasizing a more direct path to closure for families. The form requires detailed information about the deceased, their assets, debts, and designated beneficiaries, ensuring a clear and lawful transfer of property. Understanding the eligibility criteria, the required documentation, and the procedural steps is essential for anyone considering this option, as these elements ensure compliance with Maryland state laws while minimizing potential disputes among heirs or beneficiaries.

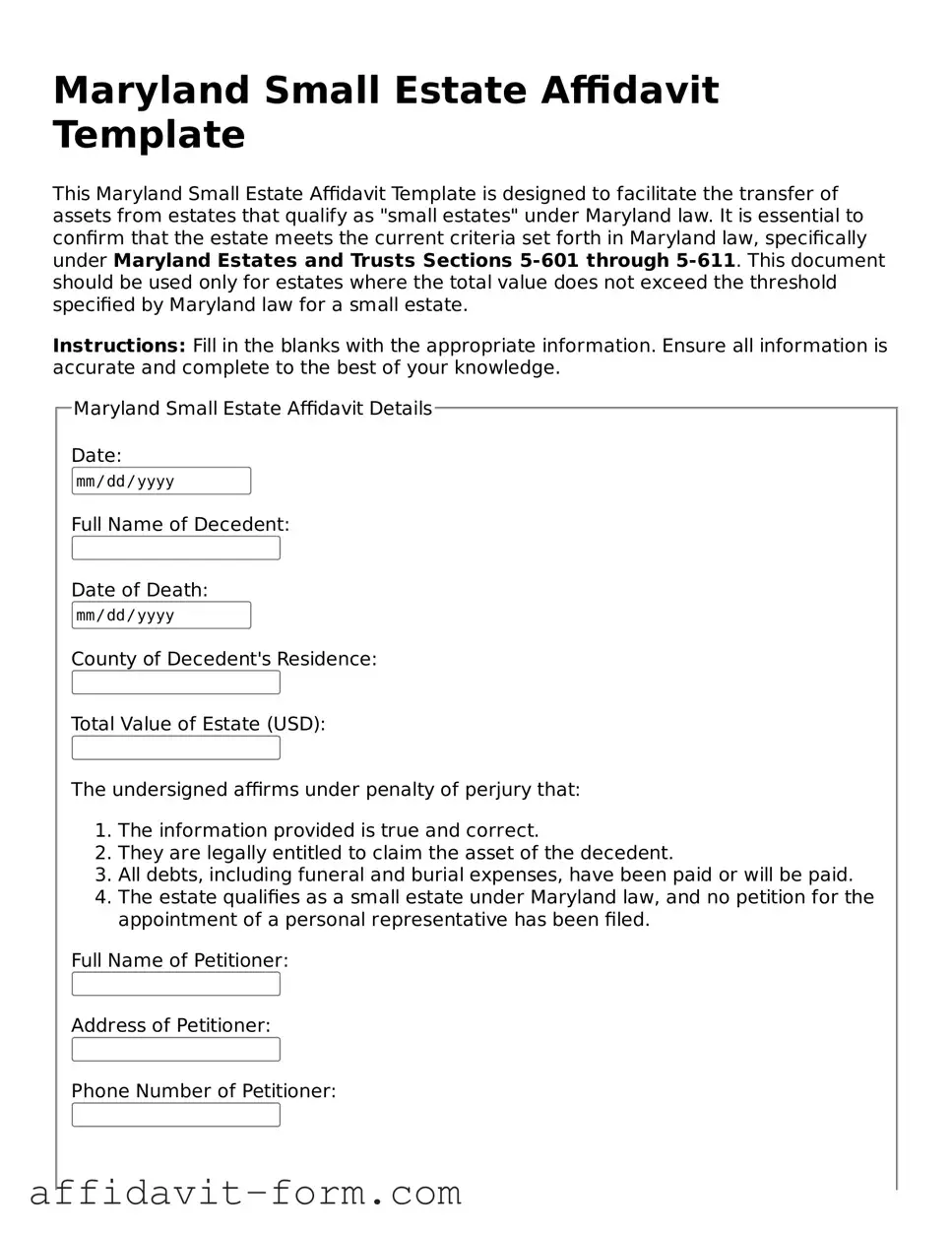

Form Example

Maryland Small Estate Affidavit Template

This Maryland Small Estate Affidavit Template is designed to facilitate the transfer of assets from estates that qualify as "small estates" under Maryland law. It is essential to confirm that the estate meets the current criteria set forth in Maryland law, specifically under Maryland Estates and Trusts Sections 5-601 through 5-611. This document should be used only for estates where the total value does not exceed the threshold specified by Maryland law for a small estate.

Instructions: Fill in the blanks with the appropriate information. Ensure all information is accurate and complete to the best of your knowledge.

Document Details

| Fact Name | Description |

|---|---|

| Definition | A Maryland Small Estate Affidavit form is used to simplify the administration of estates that are considered small under Maryland law. |

| Eligibility Criteria | The estate must be valued at $50,000 or less, or $100,000 or less if the spouse is the sole legatee or heir. |

| Governing Law | This process is governed by the Estates and Trusts Article of the Maryland Annotated Code. |

| Excluded Assets | Assets that typically do not count towards the estate's value include life insurance proceeds and jointly owned property. |

| Required Documentation | Applicants must provide a detailed list of the deceased's property, including the value of each item, and verify that the estate qualifies as a small estate. |

| Probate Avoidance | Using the Small Estate Affidavit can help in avoiding the more lengthy and complex formal probate process. |

| Filing Deadline | The affidavit must be filed with the local Register of Wills office in the county where the decedent lived, typically within a reasonable time after the person's death. |

| Forms and Instructions | Forms and further instructions are available on the Maryland Register of Wills’ official website. |

How to Use Maryland Small Estate Affidavit

When a loved one passes away, managing their estate can feel overwhelming amid your grief. In Maryland, if the estate is considered "small" by legal standards, the Small Estate Affidavit form offers a simplified process to distribute the deceased's assets. This streamlined approach bypasses the more complex and time-consuming process of standard probate. Filling out the Small Estate Affidavit accurately is critical to facilitate a smooth transition of the deceased's belongings to their rightful inheritors. Below are the steps to fill out this form with the appropriate care required.

- Gather all necessary documents related to the deceased’s assets, debts, and proof of death (e.g., death certificate).

- Confirm the total value of the estate does not exceed Maryland’s threshold for a "small estate." This threshold may vary, so it's important to verify the current limit.

- Obtain the Maryland Small Estate Affidavit form. This can usually be found online on the website of the Maryland Judiciary or at your local courthouse.

- Fill in the date of death of the deceased in the designated space.

- Provide the legal name of the deceased, as well as any aliases they might have used, in the appropriate fields.

- List your name and address, indicating your relationship to the deceased and your eligibility to serve as the representative for the estate.

- Detail all known assets of the estate, including but not limited to bank accounts, personal property, real estate in Maryland, stocks, and bonds. Include the value of each asset.

- Outline all known debts and liabilities of the estate, such as mortgages, loans, credit card debts, and final expenses.

- Identify all heirs and legatees (those named in the will, if one exists) and their respective shares of the estate.

- Sign and date the form in the presence of a notary public. The form must be notarized to be valid.

- Submit the completed form along with any required supporting documents and the applicable filing fee to the Register of Wills in the county where the deceased resided.

Completing the Maryland Small Estate Affidavit with thoroughness and precision is a step forward in honoring the final wishes of your loved one. This document is instrumental in ensuring their assets are distributed according to Maryland law with minimal delay. Remember, accuracy is key to avoiding complications that could stall the process. If at any point you feel uncertain, consulting with a legal professional experienced in Maryland's probate laws can provide guidance and peace of mind.

Listed Questions and Answers

What is a Maryland Small Estate Affidavit?

A Maryland Small Estate Affidavit is a legal document used to simplify the estate administration process for estates that fall below a certain value threshold. If qualified, it allows the assets of the deceased to be distributed without the full probate process, potentially saving time and reducing expenses.

Who can file a Maryland Small Estate Affidavit?

Typically, the affidavit can be filed by a surviving spouse, adult children of the deceased, or other relatives in a priority order defined by Maryland law. If no relatives are available or willing, a creditor of the deceased may also file, under certain conditions.

What are the qualifications for using a Maryland Small Estate Affidavit?

To qualify for using a Maryland Small Estate Affidavit:

- The total value of the estate must not exceed the threshold established by Maryland law, currently set at $50,000, or $100,000 if the sole heir is a surviving spouse.

- The estate consists of personal property only, such as bank accounts, vehicles, or household items. Real estate is not covered under the small estate process in Maryland.

What information is required to complete the Maryland Small Estate Affidavit?

The form requires detailed information about the deceased, the assets, the affidavit filer, and the heirs. This includes the full name and date of death of the deceased, a description and value of the assets, the legal name and relationship of the heirs to the deceased, and the filer's contact information and signature.

How do I submit the Maryland Small Estate Affidavit?

The completed affidavit, along with any required documentation such as death certificates and asset statements, should be submitted to the Register of Wills in the county where the deceased resided. It's also advisable to check with the local office for any county-specific submission requirements.

Is there a filing fee for the Maryland Small Estate Affidavit?

Yes, there is a filing fee, which varies depending on the county. The fee is based on the value of the estate but is generally lower than the fees associated with the full probate process. Contact the local Register of Wills office for the exact fee applicable to your situation.

How long does it take to process a Maryland Small Estate Affidavit?

The processing time can vary significantly based on the county, the correctness of the submitted affidavit, and other factors. Typically, it can take several weeks, but the local Register of Wills office can provide a more specific timeframe.

Can real estate be transferred using a Maryland Small Estate Affidavit?

No, real estate cannot be transferred using a Maryland Small Estate Affidavit. This process is solely for the transfer of personal property. Estate involving real estate must go through the standard probate process or other legal proceedings specific to real estate.

What happens after the Maryland Small Estate Affiditat is submitted?

Once the affidavit is submitted and the filing fee is paid, the Register of Wills reviews the documents. If everything is in order, the office will issue an order authorizing the distribution of assets according to the affidavit. The person filing the affidavit is then responsible for distributing the assets and providing proof of distribution to the Register of Wills.

Can a Maryland Small Estate Affidavit be contested?

Yes, if an heir or interested party believes the affidavit was filed incorrectly or fraudulently, they can contest the affidavit in court. They would need to provide evidence supporting their claim, and the court would investigate the matter further.

Common mistakes

When dealing with the Maryland Small Estate Affidavit form, it's important to handle the details with care. Errors can delay the process and create unnecessary complications. Here are seven common mistakes people often make:

Not verifying eligibility for using the form. Small estates in Maryland have specific requirements based on the total value of the estate. It's a mistake to start filling out the form without confirming that the estate qualifies as a small estate under Maryland law.

Skipping required information. Every field in the form is important. Leaving blanks or not providing complete information can lead to the form being rejected or the need for additional documentation, which can slow down the process.

Misunderstanding the value of assets. The value of assets needs to be accurately reported. Some people underestimate or overestimate the value of assets, especially when it comes to personal property and real estate, which can affect eligibility and the correctness of the affidavit.

Forgetting to attach necessary documents. The affidavit requires certain documents to be attached, such as a copy of the death certificate and proof of entitlement to the property. Failing to attach these can cause delays.

Incorrectly listing debts and liabilities. It's crucial to list all of the decedent's debts and liabilities accurately. Missing out on any debts or not listing them in detail can create problems in the estate settlement process.

Not securing signatures from all necessary parties. All heirs and interested parties need to be in agreement and sign the form where required. Overlooking a necessary signature can invalidate the form.

Submitting the form to the wrong office. The Maryland Small Estate Affidavit must be filed with the appropriate local office. Sometimes, people mistakenly send it to the wrong place, which can result in significant delays.

By avoiding these mistakes, you can ensure a smoother process in handling the Maryland Small Estate Affidavit. Paying attention to detail and understanding the requirements will help in successfully managing the small estate process.

Documents used along the form

When handling a small estate in Maryland, the Small Estate Affidavit form is a crucial step for streamlining the process of asset distribution to heirs or beneficiaries. This document allows for a simpler and faster way to settle estates that fall under a certain value threshold. However, to effectively complete this process, several other documents often accompany the Small Estate Affidavit. Each document serves a unique purpose, ensuring compliance with Maryland's laws and helping to facilitate a smooth transfer of the decedent's assets.

- Death Certificate: A certified copy of the decedent’s death certificate is typically required to prove the death. It is a primary document used to initiate the process of transferring assets and settling the estate.

- Will (if applicable): If the decedent left a will, a copy must be provided. This document outlines the decedent’s wishes regarding the distribution of their assets and the appointment of an executor.

- Inventory of Assets: This document lists all assets held in the decedent's name at the time of death. It includes information on bank accounts, real estate, personal property, stocks, and any other assets that will be managed or distributed through the estate.

- Appraisal Reports: For certain assets, especially real estate or valuable personal property, professional appraisal reports may be necessary to establish the fair market value, ensuring that the estate is accurately valued and distributed.

- Creditor's Claims Forms: These forms are used by creditors to file claims against the estate for debts owed by the decedent. Managing these claims is a critical part of resolving the estate’s obligations before assets are distributed to heirs or beneficiaries.

- Receipts and Distributions Schedule: This document records all distributions made from the estate to heirs, beneficiaries, or creditors. It provides a clear account of how each portion of the estate was allocated and disbursed.

Together, these documents complement the Small Estate Affidavit, offering a structured pathway for managing and settling small estates under Maryland law. It's important for individuals navigating this process to gather and prepare these documents carefully, ensuring that all legal requirements are met and that the estate is settled in an orderly fashion.

Similar forms

The Maryland Small Estate Affidavit form is similar to other legal documents designed to simplify the probate process or transfer assets of the deceased without a formal probate proceeding. These documents, while distinct in their application and requirements, share the underlying goal of facilitating quicker, simpler estate resolution processes for smaller estates or under specific conditions. Each document, including the Small Estate Affidavit, plays a crucial role in estate planning and administration, offering a streamlined approach for transferring assets to heirs or beneficiaries.

Affidavit for the Collection of Personal Property is one document similar to the Maryland Small Estate Affidavit. Both documents allow for the transfer of assets without formal probate proceedings. The Affidavit for the Collection of Personal Property is typically used when the deceased's estate consists mainly of personal effects and the total value falls below a certain threshold, similar to the criteria for using the Small Estate Affidavit. The key similarity lies in their purpose: to expedite the distribution of the deceased's assets to their rightful heirs, minimizing the need for court involvement and reducing the administrative burden on the estate's executor or administrator.

Transfer on Death Deed shares similarities with the Maryland Small Estate Affiditalm form in its approach to avoiding lengthy probate processes. This document allows property owners to name beneficiaries who will inherit their property upon the owner's death, bypassing traditional probate proceedings. Like the Small Estate Affidavit, the Transfer on Death Deed simplifies the transfer of assets. However, it's specific to real estate, whereas the Small Estate Affidavit can encompass various types of assets, including personal property and bank accounts. Both documents serve to streamline the transition of assets from the deceased to their beneficiaries, though they apply to different types of assets.

Joint Tenancy Agreement is another document that serves a purpose similar to the Maryland Small Estate Affidavit, in that it can help avoid probate for the assets it covers. Joint tenancy with the right of survivorship means that when one co-owner dies, the surviving co-owner(s) automatically inherit the deceased's share of the property without the need for probate proceedings. While the Small Estate Affidavit and the Joint Tenancy Agreement serve to streamline the transfer of assets after death, the Joint Tenancy Agreement is proactive, establishing the conditions for asset transfer upon death ahead of time.

Dos and Don'ts

When tackling the Maryland Small Estate Affidavit form, individuals are often navigating a process weighted with both legal and emotional significance. Understanding the correct approach not only smooths the procedure but also ensures compliance with state laws, ultimately facilitating a smoother transfer of the deceased's estate to the rightful heirs or beneficiaries. Here's a comprehensive guide on the do's and don'ts while completing this crucial document.

Do:

- Double-check the eligibility criteria for filing a Small Estate Affidavit in Maryland, ensuring the estate’s value falls within the state-specified limits.

- Accurately list all of the estate's assets, including but not limited to bank accounts, vehicles, and personal property, to ensure a thorough and truthful accounting.

- Obtain and attach required documents, such as the death certificate and any relevant deeds or titles, verifying the information provided in the affidavit.

- Consult with a legal advisor or attorney if there are any uncertainties or complexities, to ensure the affidavit is completed correctly and in accordance with Maryland laws.

Don't:

- Attempt to file the affidavit without confirming the total value of the estate meets Maryland’s criteria for "small estate" designation.

- Omit any assets or liabilities, as this can lead to issues with the probate court and potentially delay the process.

- Sign the affidavit without ensuring all information is accurate and complete—mistakes can be costly and time-consuming to rectify.

- Overlook the need to notify potential creditors, as required by Maryland law, which could lead to legal challenges against the estate.

Completing the Maryland Small Estate Affidavit form with diligence and attention to detail is crucial. By adhering to these guidelines, individuals can navigate the process more efficiently, ensuring the deceased's estate is managed and distributed according to the legal framework, thereby honoring their final wishes with respect and integrity.

Misconceptions

Understanding the Maryland Small Estate Affidavit form is crucial for those navigating the estate settlement process. However, misconceptions often arise, leading to confusion and delays. By debunking these common misunderstandings, individuals can approach this legal document with greater clarity and confidence.

A common misconception is that the Maryland Small Estate Affidavit form is a one-size-fits-all document. However, its applicability depends on specific criteria, such as the value of the estate not exceeding a certain amount, which as of the last update, is set by Maryland law.

Another misunderstanding is that completing this form will instantly transfer property to the heirs. In reality, the process involves submitting the form to the proper local office, potentially alongside other required documents, and may require approval before any transfer of assets occurs.

Many believe that the Maryland Small Estate Affidavit is only for the distribution of personal property. Contrary to this belief, it can also pertain to real property under certain conditions stipulated by Maryland law.

There's a misconception that if an estate qualifies as a "small estate" under Maryland law, no probate process is necessary. While the process is simplified, it still involves a form of probate, albeit a quicker and less complicated one.

Some think that anyone can file the Maryland Small Estate Affidavit. It's important to understand that only an authorized person, typically the surviving spouse or other close relative, is eligible to file this document, depending on the decedent's estate plan and Maryland's laws on intestate succession.

It's mistakenly believed that all debts of the deceased are automatically taken care of upon the filing of the Small Estate Affidavit. Creditors have a right to claim against the estate, and certain debts may need to be settled before the distribution of assets.

Lastly, the belief that a lawyer is unnecessary when handling a small estate can lead to errors. While it's true that the process is designed to be simpler, legal guidance can help avoid mistakes, ensure compliance with Maryland law, and navigate any complexities that may arise.

Approaching the Maryland Small Estate Affidavit with accurate information empowers individuals to handle estate matters more effectively and with less stress, ensuring a smoother transition during a challenging time.

Key takeaways

The Maryland Small Estate Affidavit form is an essential document for those handling the estate of a deceased person when the total value falls below a specific limit. It simplifies the process of estate administration, enabling the assets to be distributed without a lengthy probate process. Here are key takeaways to ensure its proper use:

- Eligibility Criteria: To use the Maryland Small Estate Affidavit, the total value of the estate must not exceed $50,000, or $100,000 if the spouse is the sole heir.

- Required Documentation: Alongside the affidavit, you must provide a certified death certificate and a detailed list of the estate's assets, including their value.

- Filing Location: The affidavit should be filed with the Register of Wills in the county where the decedent lived. If the decedent owned real estate in another county, additional steps may be necessary.

- Legal Authority: Once the affidavit is approved, the person who filed it (the affiant) is authorized to collect and distribute the estate's assets as per the decedent’s will or Maryland's intestacy laws.

- Notifications: Creditors and heirs must be notified about the estate proceeding, typically involving publishing a notice in a local newspaper and sending direct notifications.

- Debts and Taxes: The affiant is responsible for ensuring the estate’s debts and taxes are paid from the estate assets before distribution to heirs.

- Asset Distribution: Assets can only be distributed after debts and taxes are settled, and according to the will or state law if there is no will.

- Record Keeping: Documentation of all transactions made on behalf of the estate must be kept, including payments of debts, sale of assets, and distribution to heirs, for potential future reference or audits.

Properly completing and using the Maryland Small Estate Affidavit can significantly streamline the process of managing small estates, but careful attention to detail and adherence to the requirements are critical for a smooth procedure.

Fill out Popular Small Estate Affidavit Forms for Different States

Small Estate Affidavit Georgia - It can be used to claim assets such as bank accounts, stocks, and personal property.

Affidavit for Collection of Small Estate - Personal representatives or successors should consult with legal experts to ensure its correct use and implementation.

How Long Does Probate Take in Tennessee - The form serves as a legal tool for small estate proceedings, making it easier for beneficiaries to claim assets.

Affidavit for Probate - Streamlines the process for heirs to legally claim and distribute assets from small estates.