Printable Small Estate Affidavit Form for Massachusetts

When a loved one passes away, navigating the process of settling their estate can appear daunting, especially during a time of grief. However, for those handling an estate in Massachusetts valued under a certain threshold, the Small Estate Affidavit form presents a simplified path forward. This form is designed to expedite the process by which assets are distributed without requiring a full probate proceeding, which is typically a more time-consuming and complex process. The Small Estate Affidavit, utilized when the total value of the deceased's estate (excluding certain types of assets) does not exceed the specified limit, allows for a quicker, less formal transfer of property to heirs or beneficiaries. Key aspects of this form include eligibility criteria, necessary documentation, and explicit instructions on the form's submission process. Understanding the requirements and correctly completing the form are critical steps to ensure that property is transferred efficiently and according to the deceased's wishes or, in the absence of a will, state laws.

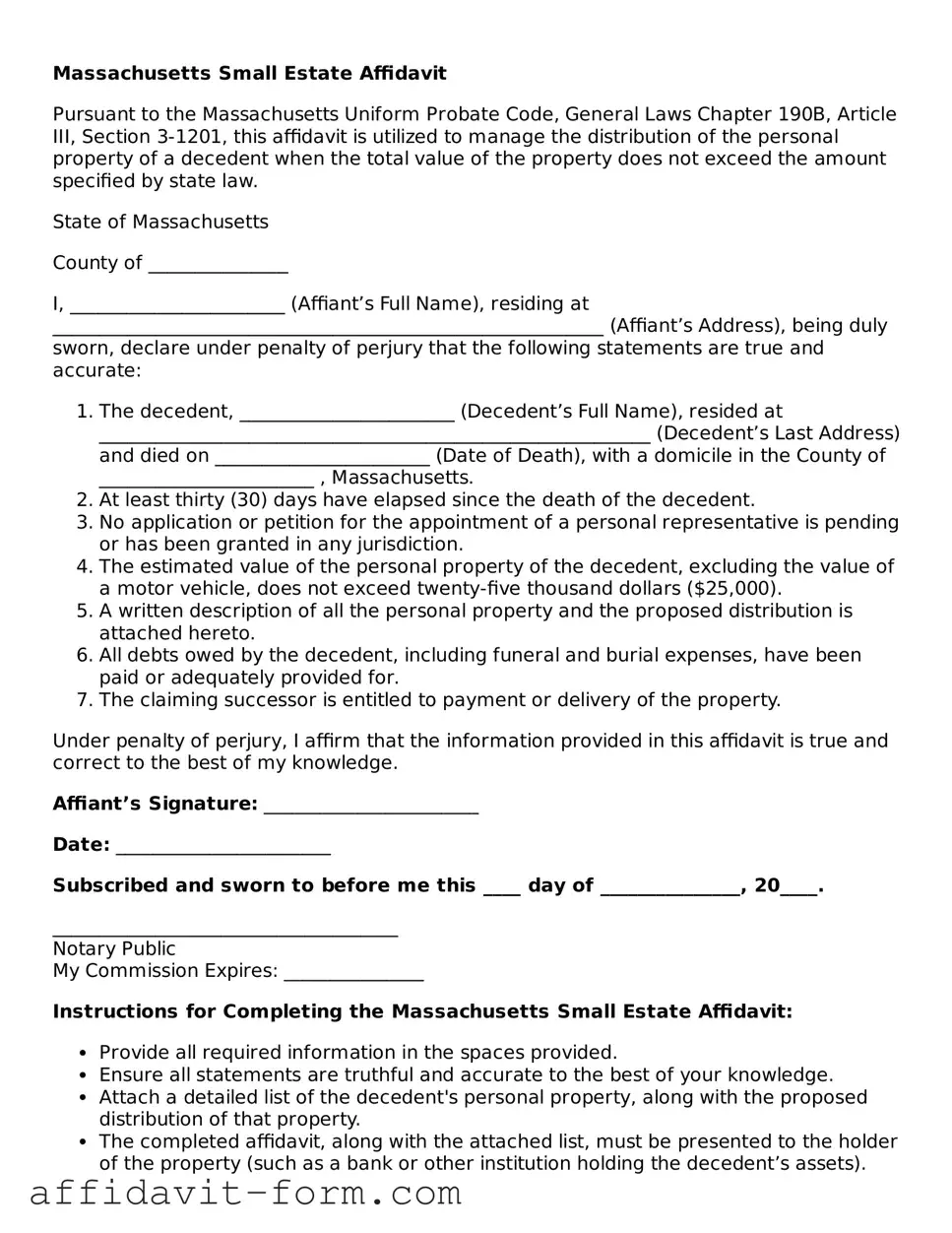

Form Example

Massachusetts Small Estate Affidavit

Pursuant to the Massachusetts Uniform Probate Code, General Laws Chapter 190B, Article III, Section 3-1201, this affidavit is utilized to manage the distribution of the personal property of a decedent when the total value of the property does not exceed the amount specified by state law.

State of Massachusetts

County of _______________

I, _______________________ (Affiant’s Full Name), residing at ___________________________________________________________ (Affiant’s Address), being duly sworn, declare under penalty of perjury that the following statements are true and accurate:

- The decedent, _______________________ (Decedent’s Full Name), resided at ___________________________________________________________ (Decedent’s Last Address) and died on _______________________ (Date of Death), with a domicile in the County of _______________________ , Massachusetts.

- At least thirty (30) days have elapsed since the death of the decedent.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The estimated value of the personal property of the decedent, excluding the value of a motor vehicle, does not exceed twenty-five thousand dollars ($25,000).

- A written description of all the personal property and the proposed distribution is attached hereto.

- All debts owed by the decedent, including funeral and burial expenses, have been paid or adequately provided for.

- The claiming successor is entitled to payment or delivery of the property.

Under penalty of perjury, I affirm that the information provided in this affidavit is true and correct to the best of my knowledge.

Affiant’s Signature: _______________________

Date: _______________________

Subscribed and sworn to before me this ____ day of _______________, 20____.

_____________________________________

Notary Public

My Commission Expires: _______________

Instructions for Completing the Massachusetts Small Estate Affidavit:

- Provide all required information in the spaces provided.

- Ensure all statements are truthful and accurate to the best of your knowledge.

- Attach a detailed list of the decedent's personal property, along with the proposed distribution of that property.

- The completed affidavit, along with the attached list, must be presented to the holder of the property (such as a bank or other institution holding the decedent’s assets).

- Consult with a legal professional if you have any questions regarding the completion or use of this affidavit.

Document Details

| Fact Name | Detail |

|---|---|

| Eligibility Criteria | To use the Massachusetts Small Estate Affidavit form, the total value of the personal estate must not exceed $25,000, excluding the value of a vehicle. |

| Waiting Period | There is a 30-day waiting period from the date of death before the affidavit can be filed. |

| Required Documents | A certified copy of the death certificate and a detailed list of the estate's assets must accompany the affidavit. |

| Governing Law | The process is governed by Massachusetts General Laws, Chapter 190B, Article III, Section 3-1201. |

| Real Estate Exclusions | The affidavit process cannot be used for transferring real estate ownership. |

| Vehicle Title Transfer | Although the affidavit excludes the value of a vehicle, it can be used to transfer the title of up to two vehicles owned by the decedent. |

| Limitations and Liabilities | Persons who falsely represent themselves in the affidavit can be held legally accountable. This includes reimbursement of the estate value to rightful heirs. |

How to Use Massachusetts Small Estate Affidavit

Filling out a Massachusetts Small Estate Affidavit form is a crucial step for individuals seeking to manage or distribute a deceased person's estate that falls below a certain value threshold. This document simplifies the legal process, allowing for a more expedited transfer of assets to the rightful heirs without the need for a prolonged probate court proceeding. To accurately complete this form, it's important to follow each step carefully, ensuring all the provided information is correct and substantiated by the appropriate documentation.

- Gather all necessary information regarding the deceased's estate, including assets, debts, and the names and addresses of all potential heirs.

- Confirm that the total value of the personal property in the estate does not exceed the statutory limit set by Massachusetts law.

- Download the latest version of the Massachusetts Small Estate Affidavit form from the Massachusetts Court System's official website.

- Read the entire form carefully before you start filling it out to ensure you understand the requirements and implications.

- Fill in the deceased person's full name and date of death in the designated sections at the top of the form.

- Provide your full name and address, establishing your relationship to the deceased and your right to act on behalf of the estate.

- List all of the deceased's assets, including bank accounts, securities, and personal property, along with their estimated values.

- Identify any outstanding debts or claims against the estate, including funeral expenses, taxes, and any other creditor claims.

- Include the names, addresses, and relationships of all heirs to the estate, specifying the distribution of assets among them.

- Sign and date the form in the presence of a notary public, who will also need to sign and affix their official seal.

- Attach any required supporting documents, such as a certified copy of the death certificate and proof of your relationship to the deceased.

- File the completed affidavit with the local probate court in the county where the deceased person lived or owned property.

- Send copies of the filed affidavit to all listed heirs and any known creditors of the estate.

After submitting the Massachusetts Small Estate Affidavit form, the process of distributing the deceased's assets can formally begin. This may involve transferring ownership of property, closing accounts, and fulfilling the wishes outlined in the affidavit. It's advisable to keep records of all transactions and communications related to the estate to ensure a transparent and fair distribution process. If disputes or challenges arise, consider consulting with a legal professional to guide you through the necessary steps.

Listed Questions and Answers

What is a Massachusetts Small Estate Affidavit?

A Massachusetts Small Estate Affidavit is a legal document used to facilitate the distribution of assets from an estate that falls below a certain value threshold. It allows the transfer of property to heirs or beneficiaries without the need for a formal probate process. This document is typically utilized when the deceased person's estate is considered "small" under Massachusetts law.

Who is eligible to file a Small Estate Affidavit in Massachusetts?

Eligibility to file a Small Estate Affidavit in Massachusetts is primarily determined by the total value of the decedent's personal property. To be eligible, the value of the estate must not exceed the threshold amount specified by Massachusetts law, which is subject to periodic adjustments. Additionally, the person filing the affidavit is usually an heir or legally recognized representative of the decedent.

What is the current threshold value for using a Small Estate Affidavit in Massachusetts?

The threshold value for using a Small Estate Affidavit in Massachusetts changes over time due to legislative updates or adjustments for inflation. Therefore, it is important to consult the most current legal resources or a legal professional to determine the exact value at the time of filing.

What assets can be transferred using a Small Estate Affidariat?

- Bank accounts

- Vehicles

- Stocks and bonds

- Small real estate interests, subject to specific limitations

- Miscellaneous personal property not exceeding the specified threshold in total value

What information is needed to complete a Small Estate Affidavit in Massachusetts?

To complete a Small Estate Affidavit in Massachusetts, you will need detailed information about the decedent, their assets, and the legal heirs or beneficiaries. This typically includes the decedent's full legal name, date of death, description of assets, names and addresses of heirs, and any debts owed by the estate.

Are there any fees associated with filing a Small Estate Affidavit in Massachusetts?

Yes, there may be filing fees associated with submitting a Small Estate Affidavit in Massachusetts. These fees can vary depending on the county in which the affidavit is filed. It's advisable to contact the local probate court for specific information on current filing fees.

How long does it take to process a Small Estate Affidavit in Massachusetts?

The processing time for a Small Estate Affidavit in Massachusetts can vary based on the specific circumstances of the estate and the workload of the probate court at the time of filing. Generally, it may take several weeks from the time of submission for the transfer of assets to be completed.

While it's not strictly necessary to have a lawyer to file a Small Estate Affidavit in Massachusetts, consulting with a legal professional can be beneficial. A lawyer can provide guidance on the process, help ensure that the affidavit is completed correctly, and advise on any potential legal issues that could arise.

Can real estate be transferred using a Small Estate Affidavit in Massachusetts?

Real estate may be transferred using a Small Estate Affidavit in Massachusetts, but there are specific conditions that must be met, and limitations apply. It's important to consult legal resources or a professional to understand how these rules pertain to your particular situation.

What are the next steps after filing a Small Estate Affidavit in Massachusetts?

- Notification of interested parties: Legal heirs or beneficiaries should be notified about the affidavit and the intended distribution of assets.

- Resolution of debts: Any outstanding debts of the decedent must be addressed and, if possible, settled from the assets of the estate.

- Distribution of assets: Once debts have been settled and the affidavit has been processed, the assets can be distributed to the rightful heirs or beneficiaries.

Common mistakes

When managing the responsibilities of handling a loved one’s estate, the Massachusetts Small Estate Affidavit form is a document many turn to for simplifying the process. However, errors can occur during completion, which can lead to significant delays or complications. To assist, here is an expanded look into common mistakes that should be avoided:

-

Not verifying eligibility requirements: Before filling out the form, it's vital to ensure that the estate qualifies under Massachusetts law based on its value and the types of assets involved.

-

Inaccurate asset valuation: Failing to accurately assess and report the value of the decedent's assets can lead to legal issues or delays in the process.

-

Omitting necessary documentation: It’s crucial to attach all required documents, such as the death certificate and proof of entitlement, to support the affidavit.

-

Incorrectly identifying heirs or beneficiaries: Precise identification and notification of all legal heirs or beneficiaries as per the decedent's will or state law is mandatory.

-

Overlooking debts and liabilities: All existing debts and liabilities of the decedent must be disclosed and addressed in accordance with Massachusetts law.

-

Forgetting to sign in the presence of a notary: The affidavit requires notarization to be legally valid, and signing it without a notary present makes it void.

-

Not using the most current form: State forms can be updated. Using an outdated version may result in rejection.

-

Mishandling real estate assets: Real estate is often subject to different rules, and incorrectly including or excluding these assets can complicate the estate settlement process.

Avoiding these mistakes requires meticulous attention to detail and a deep understanding of the assets within an estate. It’s often beneficial to consult with a legal professional to ensure the process is handled accurately and efficiently.

Documents used along the form

When a loved one passes away, handling their estate can be a challenging process. In Massachusetts, the Small Estate Affidavit form is often used to simplify this process for estates valued at $25,000 or less. However, completing the estate administration often requires additional documents, each serving a distinct purpose. Below is a list of four forms and documents commonly used alongside the Massachusetts Small Estate Affidavit form.

- Death Certificate: This is an official document issued by the government to certify the death of an individual. It is crucial for verifying the death with financial institutions, insurance companies, and for legal purposes related to the estate.

- Will: If the deceased left a will, it specifies their wishes regarding the distribution of their assets and the care of any dependents. The will can provide guidance on how the assets listed in the Small Estate Affidavit should be distributed.

- Inventory of Assets: This document lists all assets owned by the deceased at the time of death. It includes bank accounts, securities, real estate, and personal property. The Inventory of Assets helps in assessing whether the estate qualifies as a small estate under Massachusetts law.

- Receipts and Disbursements Ledger: This ledger records all financial transactions related to the estate, including payments of debts and distribution of assets to heirs. It ensures transparency and accountability in the handling of the estate’s finances.

Each of these documents plays a vital role in the estate administration process. They work in conjunction with the Small Estate Affidavit to ensure the deceased's assets are distributed according to their wishes and legal requirements. Compassion and due diligence during this time can significantly ease the emotional and administrative burden on grieving families.

Similar forms

The Massachusetts Small Estate Affidavit form is similar to several other legal documents used in the estate planning and administration process. Each document has a unique purpose but shares common features with the Small Estate Affidavit, such as simplifying the procedures required to transfer assets or settle an estate. Understanding how these forms relate and differ can help in choosing the appropriate document for specific circumstances.

Transfer on Death Deed (TODD): The Transfer on Death Deeds enables individuals to designate beneficiaries for real property upon the owner's death, bypassing the probate process. Like the Small Estate Affidavit, TODDs serve to simplify the transfer of assets. However, while the Small Estate Affidavit can apply to various assets and is generally used when the total estate value falls below a certain threshold, TODDs are specifically for real estate. Both documents ensure a more straightforward asset transition to beneficiaries, yet their scopes and applications differ significantly.

Last Will and Testament: A Last Will and Testament is a comprehensive document that outlines the distribution of an individual's assets upon their death and appoints an executor to manage the estate. Although it serves a broader and more detailed purpose compared to the Small Estate Affidat, they share the objective of directing assets to chosen beneficiaries. The key difference is in the estate's size and complexity they are designed to address; small estates may be settled through an affidavit, bypassing the need for probate, something a will cannot do directly.

Revocable Living Trust: This estate planning tool allows individuals to place assets into a trust to be managed by a trustee for the benefit of the beneficiaries. Similar to the Small Estate Affidavit, assets in a Revocable Living Trust can avoid probate, offering a streamlined process for asset distribution upon the grantor's death. While the affidavit is utilized posthumously and for smaller estates, a living trust requires upfront planning and can encapsulate an entire estate of any size, providing greater control over asset distribution and privacy for an estate's details.

Dos and Don'ts

When handling the Massachusetts Small Estate Affidavit form, it's vital to approach the task with great care and attention to detail. The following guidance will help you navigate the process effectively, ensuring that you fulfill the legal requirements efficiently and accurately.

- Do ensure that the estate’s total value does not exceed the legal threshold. Massachusetts law sets a specific monetary limit for what qualifies as a "small estate." Verify that the deceased’s estate falls under this cap before proceeding with this affidavit.

- Don't guess the value of assets. Accurately appraise all property, bank accounts, and other assets. Estimations could lead to legal issues or delays in the affidavit's acceptance.

- Do gather all necessary documents ahead of time. Before filling out the affidavit, collect all relevant documentation, such as death certificates, wills, and property valuations. This preparation will streamline the process.

- Don't overlook any debts or liabilities of the estate. Carefully account for all debts, including funeral expenses, taxes, and outstanding bills. These must be disclosed in the affidavit.

- Do use clear and concise language. When completing the form, be straightforward and precise. Legal forms are not the place for ambiguity or elaborate prose.

- Don't try to navigate complex estates on your own. If the estate involves complicated assets, multiple heirs, or disputes, seek professional legal advice. Small Estate Affidavits are best suited for straightforward estates.

- Do review the affidavit thoroughly before submitting. Check for accuracy, completeness, and ensure that all information presented is current and truthful. Errors can lead to processing delays or legal complications.

- Don't sign the affidavit without a notary public. Massachusetts law requires that the document be notarized to validate the identity of the signer. Signing without a notary present will render the affidavit invalid.

- Do file the affidavit with the appropriate probate court. After completion and notarization, submit the affidavit to the court in the county where the deceased resided. Timely filing is imperative for the efficient resolution of the estate.

Misconceptions

The Massachusetts Small Estate Affidavit form is a tool designed to simplify the probate process for estates that meet certain criteria, often making it easier and faster to distribute assets to heirs. However, there are several misconceptions associated with this form. Understanding these misconceptions is crucial for anyone considering utilizing a Small Estate Affidavit in Massachusetts.

It can be used for any size estate. One common misconception is that the Small Estate Affidavit can be used for any estate, regardless of its value. In reality, this form is only applicable for estates valued below a certain threshold, which is subject to change and should be verified against current Massachusetts law.

All assets can be transferred using this form. Another misconception is that all types of assets can be transferred using a Small Estate Affidavit. However, there are limitations and exclusions, including certain real estate situations and other types of assets that cannot be transferred using this form.

It negates the need for a will. Some people believe that if they use a Small Estate Affidavit, a will is not necessary. This is incorrect. A will is an important document that provides clear instructions for the distribution of assets and the Small Estate Affidavit does not replace the need for a will.

It allows immediate access to the deceased's assets. Despite the fact that a Small Estate Affidavit simplifies the probate process, it does not grant immediate access to the deceased's assets. There is a mandatory waiting period before the affidavit can be presented to financial institutions or other entities.

The form is the same in every state. While Small Estate Affidavits are available in many states, the forms and the laws governing them vary significantly from one state to another. The Massachusetts Small Estate Affidifavit has specific requirements that are unique to Massachusetts.

No legal guidance is needed to complete the form. Although it's designed to be straightforward, navigating the requirements and ensuring the proper completion of a Small Estate Affidavit can be complex. Legal advice may be necessary to avoid mistakes that could result in delays or additional legal complications.

Using the form eliminates all probate processes. Another misconception is that executing a Small Estate Affidavit completely bypasses the probate process. In reality, it simplifies the process but does not eliminate the need for certain probate steps, such as notifying potential heirs and creditors.

It guarantees the transfer of assets within a specific timeframe. Finally, some people mistakenly believe that using a Small Estate Affidavit guarantees the assets will be transferred to the heirs within a specific timeframe. In practice, the duration can vary based on several factors, including the responsiveness of financial institutions and potential disputes among heirs.

Key takeaways

Filling out and utilizing the Massachusetts Small Estate Affidavit form is a streamlined process designed to settle estates that may not warrant a full probate procedure. Here are key takeaways to ensure the correct completion and use of this form:

- Determine Eligibility: The total value of the personal property in the estate must not exceed the threshold specified by Massachusetts law. It's crucial to understand whether the estate qualifies as a "small estate" under current legal definitions.

- Understand What Constitutes Personal Property: Personal property can include bank accounts, stocks, and other non-real estate assets. It is important to accurately assess what the estate consists of to properly fill out the form.

- Complete the Form with Accuracy: Provide detailed information about the decedent, the assets, and the heirs or beneficiaries. Accuracy is key to ensuring the affidavit is accepted and processed without delay.

- Signature and Notarization: The form requires the signature of the affiant (the person filing the affidavit) in the presence of a notary public. This step is crucial for the form’s legal validity.

- Submit the Form to the Proper Authority: Once completed and notarized, submit the Small Estate Affidavit to the appropriate institution or entity holding the assets, such as a bank or brokerage. The form may also need to be filed with the local probate court, depending on specific requirements.

- Understand the Legal Effect: Filing a Small Estate Affididavit allows for the transfer of the decedent’s property to the rightful heirs or beneficiaries without the need for a full probate process. It is a tool for simplifying estate settlement but carries the same legal obligations and responsibilities as a formal probate process.

In conclusion, the Massachusetts Small Estate Affidavit serves as a beneficial option for those managing small estates. By following these guidelines, individuals can navigate the process more seamlessly, ensuring a proper transfer of assets to beneficiaries in accordance with the law.

Fill out Popular Small Estate Affidavit Forms for Different States

Pa Small Estate Procedure - Filing a Small Estate Affidavit can significantly reduce the time and expense involved in transferring property to heirs.

Small Estate Affidavit Florida - This form simplifies the process of asset distribution for estates that fall under a specific value threshold, according to state laws.

Affidavit for Probate - A cost-effective alternative for transferring property when an estate falls below specific state limits.