Printable Small Estate Affidavit Form for Michigan

In the vibrant state of Michigan, when a loved one departs, navigating the complexities of settling their estate can feel overwhelming, especially amidst the haze of grief. For estates that fall under a certain threshold - specifically, those valued at $15,000 or less, adjusted periodically for inflation - the Michigan Small Estate Affidavit provides a beacon of hope and simplicity. This form, a critical tool in the probate process, streamlines the way assets are transferred to rightful heirs or beneficiaries, bypassing the need for a full-blown probate proceeding. Designed with the intention of alleviating the administrative burden on families during difficult times, the Small Estate Affidavit prompts the completion of a straightforward document, filled with essential details about the deceased's estate. Crucially, it demands honesty and accuracy, as the person completing the form must attest to the truth of the information provided under penalty of perjury. The form's utility extends to tangible personal property and sums of money due to the decedent, offering a path to closure without the usual complexity and expense associated with probate court. Yet, it's vital for potential users to understand its specific qualification criteria, the procedural steps for its submission, and the responsibilities that come along with its execution to ensure a smooth transfer of assets and peace of mind for all involved.

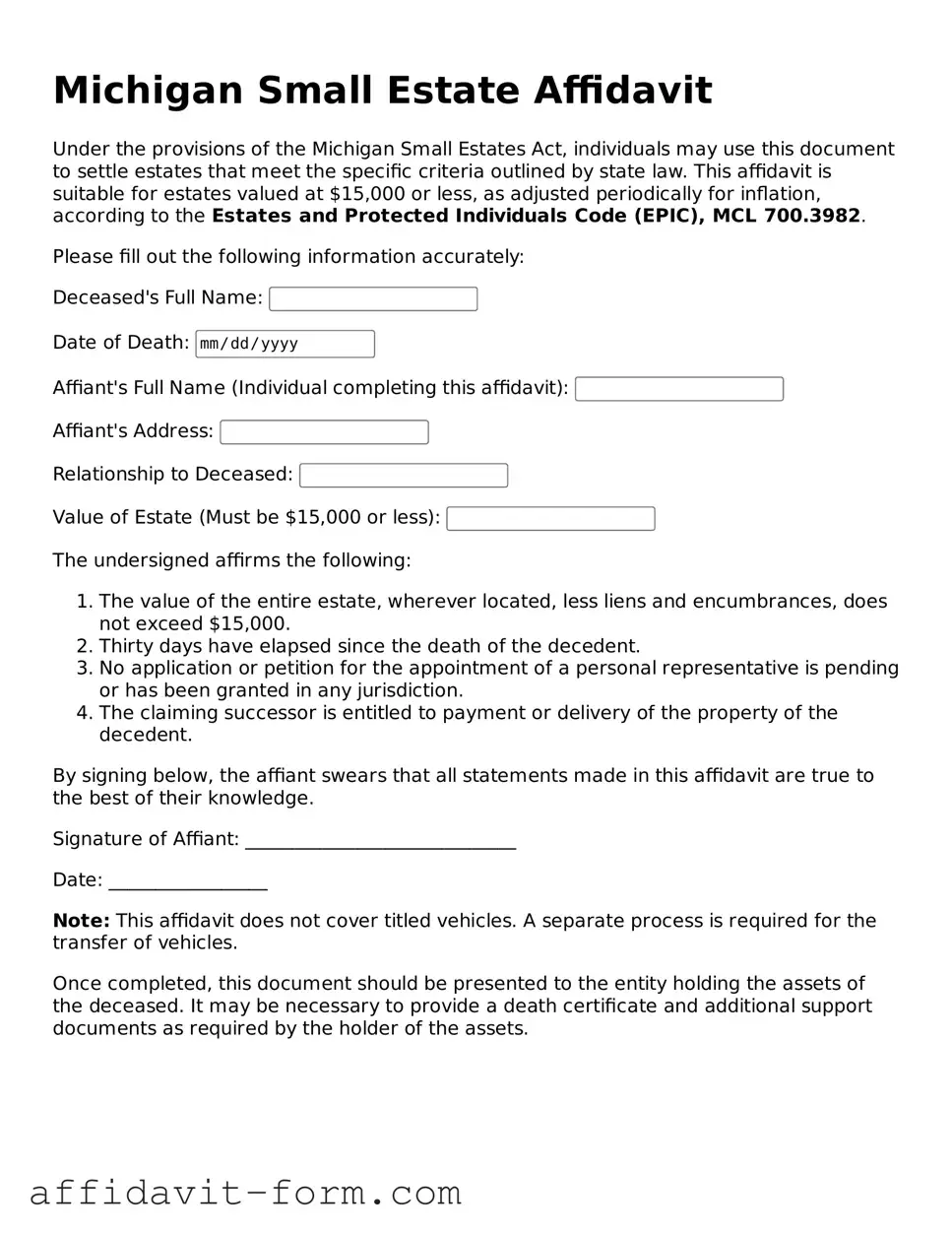

Form Example

Michigan Small Estate Affidavit

Under the provisions of the Michigan Small Estates Act, individuals may use this document to settle estates that meet the specific criteria outlined by state law. This affidavit is suitable for estates valued at $15,000 or less, as adjusted periodically for inflation, according to the Estates and Protected Individuals Code (EPIC), MCL 700.3982.

Please fill out the following information accurately:

Note: This affidavit does not cover titled vehicles. A separate process is required for the transfer of vehicles.

Once completed, this document should be presented to the entity holding the assets of the deceased. It may be necessary to provide a death certificate and additional support documents as required by the holder of the assets.

Document Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Michigan Small Estate Affidavit is governed by Michigan law, specifically under section 700.3982 of the Michigan Compiled Laws. |

| 2 | This form is used to settle estates that do not exceed a certain value threshold, which as of the last update is $24,000. |

| 3 | It can be filed by the surviving spouse or, if there is no spouse, by a family member, to obtain assets of the deceased without going through the full probate process. |

| 4 | The form allows for the transfer of assets such as bank accounts, automobiles, and stocks that were owned by the deceased. |

| 5 | Before filing, a 28-day waiting period must be observed from the date of death to the filing of the Small Estate Affidavit. |

| 6 | Claimants must attest that all debts of the deceased, including funeral and burial expenses, have been paid or provided for. |

| 7 | Correctly completing and filing the affidavit requires providing detailed information about the deceased's assets, including account numbers and descriptions of property. |

| 8 | The affidavit must then be presented to entities holding the assets (like banks or DMVs) to transfer ownership. |

| 9 | Filing a Michigan Small Estate Affidavit generally avoids the lengthy and more complicated probate process. |

| 10 | Despite its benefits for small estates, legal advice may still be beneficial to ensure the form is completed and filed correctly and to address any potential complications. |

How to Use Michigan Small Estate Affidavit

Filling out the Michigan Small Estate Affidavit form is a procedure that allows individuals to claim property from a deceased person's estate without going through a full probate process. This streamlined method is available when the total value of the estate falls below a certain threshold, established by Michigan law. To ensure the form is completed accurately, it's essential to follow a clear set of steps. By gathering the necessary information before beginning and paying close attention to detail, you can accurately fill out the form to facilitate the transfer of assets.

- Gather necessary documents including the deceased's death certificate, a list of the estate's assets, and any outstanding debts related to the estate.

- Confirm the total value of the estate does not exceed the Michigan small estate limit. This information can be found through the State of Michigan's legal resources or by consulting a legal professional.

- Obtain the Small Estate Affidavit form specific to Michigan. Make sure it's the most current version by checking the Michigan Courts or a reputable legal forms website.

- Fill in the deceased's full legal name and date of death in the designated spots at the top of the form.

- List your full legal name, address, and your relationship to the deceased, demonstrating your claim to the estate.

- Provide a detailed list of the estate's assets, including but not limited to bank accounts, vehicles, and real estate. Include the value of each asset.

- Detail any known debts of the estate, including funeral expenses, outstanding bills, or other liabilities.

- Sign the affidavit in front of a notary public. This step often requires you to swear to the truth of the statements within the document under penalty of perjury.

- File the completed affidavit with the appropriate local court, if required, or present it to entities holding the estate's assets to transfer ownership.

After the Small Estate Affidavit form is properly filled out and signed, the next steps often involve presenting this document to banks, government offices, or companies holding the deceased’s property. These institutions may require the affidavit along with the death certificate to release assets to the rightful heir. It’s crucial to understand each institution may have additional requirements or forms to complete the transfer process. Timeliness, attention to detail, and clear communication will aid in a smooth transition of assets.

Listed Questions and Answers

What is a Michigan Small Estate Affidavit?

A Michigan Small Estate Affidavit is a legal document used when a loved one's estate is worth $15,000 or less, based on the value of the estate at the time of their death. This form allows the transfer of the deceased's property to their heirs without the need for a formal probate process.

Who can use a Michigan Small Estate Affidavit?

Only the legal heirs or designated representatives of the deceased can use this form. It is primarily for those who are inheriting property from someone who lived in Michigan and had a small estate.

How do I know if the estate qualifies as a "small estate" in Michigan?

An estate qualifies as a "small estate" in Michigan if the total value of the estate's assets, minus the amount of any liens and encumbrances, does not exceed $15,000. To determine this, you must calculate the current market value of all assets left by the deceased.

What information do I need to fill out a Small Estate Affidavit in Michigan?

Completing the affidavit requires detailed information about the deceased, their assets, and the heirs. This includes:

- The full name and address of the deceased

- The date of death

- A list of the assets to be transferred

- The value of each asset

- The names and addresses of the heirs entitled to receive the assets

How do I file a Small Estate Affidavit in Michigan?

After completing the form, you must sign it in front of a notary public. The affidavit is then filed with the probate court in the county where the deceased lived or owned property. There may be a filing fee, which varies by county.

How long does it take to process a Small Estate Affidavit in Michigan?

The processing time can vary. Once filed, the court needs to review the affidavit to ensure it meets all legal requirements. This process can take several weeks to a few months, depending on the county and the correctness of the filed documents.

Are there any assets that cannot be transferred using a Small Estate Affidavit in Michigan?

Yes, there are certain assets that cannot be transferred using a Small Estate Affidavit, such as:

- Real estate that is not listed as a survivorship tenancy

- Vehicles valued over the small estate limit

- Assets that are part of a trust or governed by a separate beneficiary designation (like life insurance policies)

Can I use a Small Estate Affidavit to settle an estate in another state?

No, a Michigan Small Estate Affidavit can only be used to settle estates for persons who were residents of Michigan at the time of their death or owned property located in Michigan. Each state has its own laws and forms for small estates.

Common mistakes

-

Failing to accurately determine the value of the estate's assets is a common mistake. The value must not exceed the state's threshold for a small estate, which requires precise calculation and current market valuations. This error can invalidate the affidavit, leading to unnecessary complications.

-

Incorrectly listing or omitting assets can create significant issues. All assets that fall under the affidavit's coverage should be listed, including but not limited to bank accounts, vehicles, and personal property that belonged to the deceased. Failure to do so can result in an incomplete distribution of assets.

-

Overlooking or misinterpreting the legal descriptions of property, especially real estate, is an error with long-term consequences. The legal description must be accurate to ensure the property is correctly transferred to the rightful heirs or beneficiaries.

-

Not properly identifying the heirs or beneficiaries is a critical mistake. The affidavit requires a detailed list of all individuals entitled to receive property from the estate, including their legal names and relationship to the deceased. Incorrect or incomplete information can lead to disputes or delays in distribution.

-

Submitting the affidavit without the necessary supporting documents, such as death certificates or proof of the deceased's ownership of certain assets, is a major oversight. These documents are essential for validating the affidavit's claims and ensuring a smooth transfer of assets.

Documents used along the form

When dealing with the Michigan Small Estate Affidavit form, individuals may find themselves in need of several other forms and documents to ensure a smooth process. This is especially true when handling the affairs of a deceased loved one's estate, where various documents can help in the verification, distribution, and management of the estate's assets. Below is a list of other forms and documents often used alongside the Michigan Small Estate Affidavit form, designed to provide a clearer understanding and support during such processing.

- Death Certificate: A certified copy of the deceased's death certificate is crucial for legal proceedings, serving as official proof of death and being required by most institutions before they release assets or information.

- Last Will and Testament: If the deceased left a will, it would outline their wishes regarding the distribution of their assets, including who they have designated as the executor of their estate.

- Letters of Authority: For larger estates or when required by financial institutions, Letters of Authority issued by a probate court give the executor or administrator the legal right to handle estate matters.

- Bank Statements: Providing the most recent bank statements of the deceased can help in establishing the estate's financial status and in the distribution of assets as per the small estate threshold.

- Proof of Ownership: Documents proving ownership of property or assets (e.g., titles, deeds) are necessary to transfer or sell assets legally.

- Vehicle Registration and Title: If the estate includes vehicles, current registration and title documents are needed for transfer to the new owners.

- Stock Certificates and Investment Documents: For estates with investments in stocks, bonds, or mutual funds, these documents will be required to transfer ownership or to liquidate the investments.

- Life Insurance Policies: Identifying any life insurance policies the deceased had is important, as these can contribute to the estate's assets or provide payouts to named beneficiaries outside of the estate.

Understanding and gathering these documents in preparation can significantly streamline the handling of a small estate in Michigan. Not only do they provide essential information for the legal processing of the estate, but they also ensure that the deceased's assets are managed and distributed accurately and in accordance with Michigan law and the decedent’s wishes.

Similar forms

The Michigan Small Estate Affidavit form is similar to other legal documents used in the probate process to simplify the transfer of assets for small estates. These documents, while varied by name and specific requirements, share the fundamental goal of streamlining the estate settlement procedure, making it more accessible and less time-consuming for the decedent's survivors. Notable among these are Transfer on Death Deeds (TODDs) and Payable on Death (POD) accounts.

Transfer on Death Deeds (TODDs) resemble the Michigan Small Estate Affidavit in that they both allow for the direct transfer of assets upon death, bypassing the traditional probate process. A TODD enables an individual to name beneficiaries for their real estate, so that when the owner dies, the property is transferred to the named person or persons without the need for probate court involvement. Similar to the Small Estate Affidate, it's a tool to expedite and simplify asset transfer, but specifically for real estate. The primary distinction lies in the asset type each covers and when they become operative.

Payable on Death (POD) accounts, also known as bank account beneficiaries, share a common purpose with the Michigan Small Estate Affidavit. Both mechanisms allow for the swift transfer of assets to the rightful beneficiaries without the need for extensive legal procedures. A POD account designation lets account holders specify beneficiaries for their bank accounts, ensuring that upon their death, the funds in the account bypass the probate process and go directly to the named individuals. While the Small Estate Affidavit applies to a range of personal property, POD accounts specifically target the contents of financial accounts.

Dos and Don'ts

Filling out the Michigan Small Estate Affidavit form requires careful attention to detail and adherence to certain do's and don'ts to ensure the process is completed accurately and legally. Here are five key actions you should take and five you should avoid during this process.

Things You Should Do

- Verify eligibility: Before filling out the form, ensure that the estate qualifies as a small estate under Michigan law. The total value of the estate must not exceed the threshold set by state law, adjusted periodically for inflation.

- Provide accurate information: When completing the form, make sure all the information about the decedent (the person who passed away) and the assets are accurate. This includes full names, dates, and descriptions of assets.

- Gather required documents: Alongside the Small Estate Affidavit, you might need to attach certain documents, such as a certified copy of the death certificate and proof of ownership for assets listed in the affidavit.

- Notify interested parties: Michigan law requires that certain interested parties, such as heirs and known creditors, are notified about the small estate proceedings. Ensure you follow the state guidelines for notification.

- Consult a legal professional: If you have any doubts or complex issues arise, consulting with an attorney familiar with Michigan estate law can help you navigate the process more smoothly and avoid costly mistakes.

Things You Shouldn't Do

- Overestimate asset value: Avoid inflating the value of the assets in the estate. This can lead to legal complications or disqualify the estate from being processed under the small estate procedure.

- Omit necessary information: Failing to include required information or documents can delay the process or result in the affidavit being rejected by the court or financial institutions.

- Ignore deadlines: Michigan law has specific timelines for when the small estate affidavit can be filed and when assets can be distributed. Missing these deadlines can complicate the estate's administration.

- Fail to consider debts and taxes: Ensure that any outstanding debts, taxes, or final expenses of the estate are acknowledged and addressed in the process. Neglecting these can result in liability for the person filing the affidavit.

- Assume instant access to assets: Even with a properly completed small estate affidavit, some institutions may require additional documentation or have their own procedures for releasing assets. Be prepared for potential delays.

Misconceptions

In navigating through the legal processes following the loss of a loved one, individuals often come across the term 'Michigan Small Estate Affidavit.' It's a document designed to simplify settling estates that fall beneath a certain threshold of value. However, misconceptions surrounding its use and applicability are widespread. Clarifying these can help individuals better understand when and how the Small Estate Affidavit can be utilized in Michigan.

Myth 1: The Small Estate Affidavit can be used for any estate, regardless of its value.

There's a common belief that the Small Estate Affidavit is a one-size-fits-all solution for bypassing the regular probate process, irrespective of the estate's worth. In reality, Michigan law strictly applies this form to estates that do not exceed a specific value threshold—$15,000 initially, but this figure is periodically adjusted for inflation. It's critical for individuals to verify the current threshold to determine eligibility.Myth 2: Real estate can be transferred using the Small Estate Affidavit.

Another misconception is the idea that real estate holdings can be transferred to heirs through the Small Estate Affidavit. However, this document is primarily used for the distribution of personal property, such as bank accounts, stocks, and tangible personal items. In Michigan, the transfer of real estate ownership typically requires a more formal probate process or other legal instruments.Myth 3: The affidavit can be utilized immediately after a death.

Many believe that the Small Estate Affidavit can be completed and submitted instantly following a person's death. This is not the case. Michigan law mandates a waiting period of at least 28 days after the death to file the affidavit. This period allows sufficient time for other potential claimants to come forward or for other estate settlement processes to be initiated.Myth 4: Completion of the Small Estate Affidavit eliminates the need for a lawyer.

It's often presumed that the simplicity of the Small Estate Affidavit process negates the need for legal advice or representation. While it is designed to streamline the process for smaller, less complex estates, navigating the nuances of Michigan's estate laws can still be challenging. Professional legal guidance can help in correctly completing the affidavit, ensuring all eligible assets are included, and addressing any potential disputes or complications that may arise.

Understanding these misconceptions clarifies the Small Estate Affidavit's purpose and limitations, empowering individuals with the knowledge to effectively manage the estate settlement process. When in doubt, consulting with legal professionals can provide further assurance and guidance tailored to each unique situation.

Key takeaways

When handling small estates in the state of Michigan, the Small Estate Affidavit form provides a simplified process. This method allows for the distribution of a deceased person's assets without going through the standard probate court process, which can be lengthy and complicated. Here are key takeaways for individuals looking to use the Michigan Small Estate Affidaffidavitit form:

- The Small Estate Affidavit can be used if the value of the entire estate, not including the value of certain assets, does not exceed $15,000 after funeral and burial expenses are deducted.

- To qualify for using this form, at least 28 days must have passed since the death of the deceased.

- It is not applicable if the deceased left a will that dictates a different process for handling the estate.

- The person filling out the affidavit must swear to the accuracy of the information provided, under penalty of perjury.

- The assets covered can include personal property, such as bank accounts, stocks, and vehicles.

- Real estate cannot be transferred using the Small Estate Affidavit.

- The form requires a detailed list of the deceased's assets, including their value at the time of death.

- The person completing the form may be required to provide legal notice to potential heirs or individuals who may have a claim against the estate.

- Signing the affidavit typically must be done in the presence of a notary public to ensure its validity.

- Once completed and properly executed, the affidavit is presented to the institution holding the assets (like a bank) for the transfer of property.

- It’s advisable to keep a copy of the completed affidavit for your records and to provide copies to relevant financial institutions or parties involved.

- Consulting with a legal professional knowledgeable in Michigan estate law is recommended to ensure compliance with all applicable laws and procedures.

Understanding these key aspects of the Michigan Small Estate Affidavit form helps simplify the process of managing small estates, ensuring that the assets of the deceased are distributed according to law and without unnecessary delay.

Fill out Popular Small Estate Affidavit Forms for Different States

Create a Family Trust - As a crucial document in estate planning and settlement, its effective use requires careful attention to legal details and accuracy in reporting.

Small Estate Affidavit Montana - It’s a valuable document for immediate family members or beneficiaries looking to settle an estate with minimal legal hurdles.

How to File Probate Without a Lawyer - In many states, using a Small Estate Affidavit can significantly reduce the time and expense involved in settling an estate.