Printable Small Estate Affidavit Form for Minnesota

When a loved one passes away, the process of sorting through their assets can be a daunting task, especially during a time of grief. In Minnesota, the Small Estate Affidavit form serves as a simplified method for transferring the deceased's assets to their rightful heirs without the need for a lengthy probate process. This legal document is particularly useful for estates that fall below a certain value threshold, allowing for a more expedient and less costly transfer of property. Its main aspects include the criteria that must be met for eligibility, the types of assets that can be transferred using this form, and the specific steps that need to be followed to complete the process. With the right information and guidance, individuals can navigate through this procedure with greater ease, ensuring that the deceased's assets are distributed according to their wishes in a timely manner.

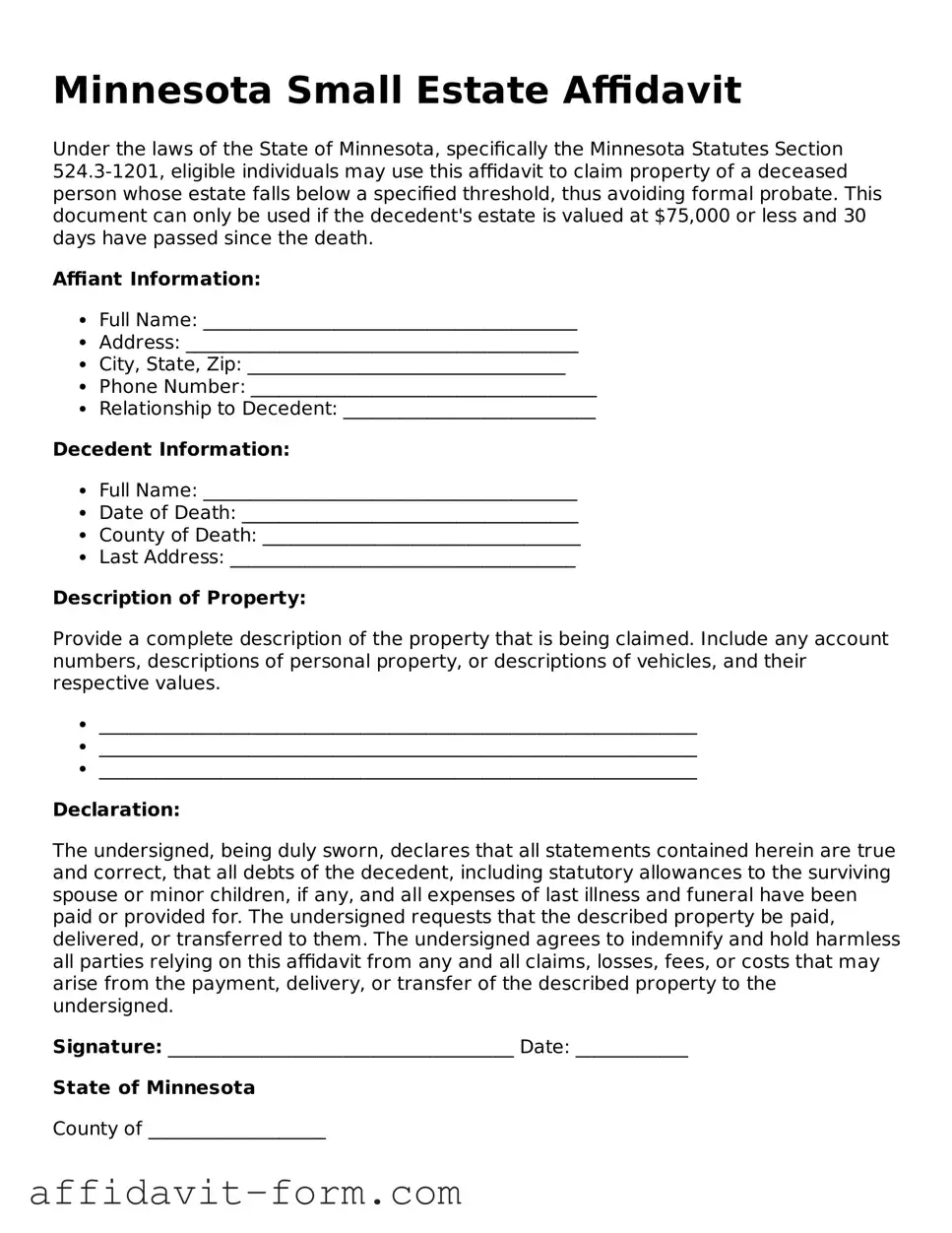

Form Example

Minnesota Small Estate Affidavit

Under the laws of the State of Minnesota, specifically the Minnesota Statutes Section 524.3-1201, eligible individuals may use this affidavit to claim property of a deceased person whose estate falls below a specified threshold, thus avoiding formal probate. This document can only be used if the decedent's estate is valued at $75,000 or less and 30 days have passed since the death.

Affiant Information:

- Full Name: ________________________________________

- Address: __________________________________________

- City, State, Zip: __________________________________

- Phone Number: _____________________________________

- Relationship to Decedent: ___________________________

Decedent Information:

- Full Name: ________________________________________

- Date of Death: ____________________________________

- County of Death: __________________________________

- Last Address: _____________________________________

Description of Property:

Provide a complete description of the property that is being claimed. Include any account numbers, descriptions of personal property, or descriptions of vehicles, and their respective values.

- ________________________________________________________________

- ________________________________________________________________

- ________________________________________________________________

Declaration:

The undersigned, being duly sworn, declares that all statements contained herein are true and correct, that all debts of the decedent, including statutory allowances to the surviving spouse or minor children, if any, and all expenses of last illness and funeral have been paid or provided for. The undersigned requests that the described property be paid, delivered, or transferred to them. The undersigned agrees to indemnify and hold harmless all parties relying on this affidavit from any and all claims, losses, fees, or costs that may arise from the payment, delivery, or transfer of the described property to the undersigned.

Signature: _____________________________________ Date: ____________

State of Minnesota

County of ___________________

Subscribed and sworn to (or affirmed) before me on this ___ day of ___________, 20__ by _________________________________, who is personally known to me or has produced identification as proof of identity.

Notary Public: ___________________________________

My Commission Expires: ________________

Document Details

| Fact | Detail |

|---|---|

| Governing Law | Minnesota Statutes, Section 524.3-1201 |

| Eligibility | Decedent's personal property must be valued at $75,000 or less. |

| Waiting Period | 30 days after the death of the decedent. |

| Notary Requirement | The form must be signed in the presence of a Notary Public. |

| Who May File | Successors or interested parties who are entitled to the property of the decedent. |

| Property Types Included | Personal property such as bank accounts, stocks, and vehicles. |

| Real Estate Inclusion | Real estate cannot be transferred using this form. |

| How to File | Complete the form and present it to the entity holding the decedent’s property. |

| Legal Effect | The affiant is authorized to collect the property up to the value mentioned without probate. |

How to Use Minnesota Small Estate Affidavit

When someone passes away with a small estate in Minnesota, there's a simpler process for settling their affairs without a formal probate. The Small Estate Affidacy is a key part of this process. It allows qualifying individuals to collect the deceased's property by using an affidavit, circumventing the need for a lengthy court process. Here's how you can fill out the Minnesota Small Estate Affidavit form, step by step, to facilitate this process. Following these steps carefully will help ensure that the form is completed accurately, reducing the likelihood of delays in claiming the deceased's assets.

- Start by carefully reading through the entire form to understand what information is required and how you should provide it. This helps ensure that you fill out the form correctly and completely.

- Fill in the deceased person's full legal name and the date of their death at the top of the form.

- Enter your name, address, and relationship to the deceased in the designated sections. This identifies you as the person filling out the affidavit.

- Provide a detailed list of the assets that you're claiming through the affidavit. This could include bank account balances, vehicle titles, or personal property items, among other assets. Be precise and use exact values where possible.

- Include a statement that confirms the estate’s value is below the threshold specified by Minnesota law for small estates. This amount can be subject to change, so it's important to verify the current limit before completing the affidavit.

- If necessary, attach additional documentation that supports your claim to the assets. This could be death certificates, titles, or account statements, depending on what you're claiming.

- Read the affidavit's declarations and waivers section carefully. This section includes important legal statements that you're agreeing to by signing the form.

- Sign and date the form in front of a notary public. The notary will need to notarize the form, providing an official stamp and their signature.

After completing the Small Estate Affidavit form, you'll be ready to submit it to the appropriate institution or authority holding the assets you're claiming. This could be a bank, the Department of Motor Vehicles, or another entity. They will review your affidavit and, if everything is in order, release the assets to you. Remember, the accuracy and completeness of your affidavit can significantly impact how smoothly this process goes, so it's worth taking the time to ensure everything is filled out correctly.

Listed Questions and Answers

What is a Small Estate Affidavit in Minnesota?

A Small Estate Affidavit in Minnesota is a legal document used to settle small estates without formal probate. It's designed for situations where the deceased person's total assets do not exceed a certain threshold. This document allows the heirs or beneficiaries to collect the decedent's assets through a simplified process, by affirming their right to the assets and avoiding the longer, more complicated probate procedure.

Who is eligible to use a Small Estate Affidavit in Minnesota?

Eligibility to use a Small Estate Affidavit in Minnesota hinges on several factors:

- The value of the estate must not exceed the state-specified threshold, which is subject to change, so it's crucial to check the current limit.

- It must be used by the legal heirs or designated beneficiaries of the deceased.

- A certain period must have passed since the death of the estate's owner; this timeframe is defined by state law.

What are the steps to file a Small Estate Affidavit in Minnesota?

To file a Small Estate Affidavit in Minnesota, you generally need to:

- Verify that the total value of the estate is within the threshold allowed by state law for small estates.

- Ensure that the required time period has elapsed since the death of the estate owner.

- Complete the Small Estate Affidavit form, providing accurate information about the deceased, the assets, and the claiming successor(s).

- Sign the affidavit in front of a notary public.

- Present the notarized affidavit to the entity holding the assets, such as a bank.

What types of assets can be collected with a Small Estate Affididavit in Minnesota?

Assets that can typically be collected with a Small Estate Affidavit include but are not limited to:

- Personal property like clothing, jewelry, and furniture.

- Bank accounts, if they are not jointly owned and do not have a designated beneficiary.

- Stocks and bonds.

- Motor vehicles, up to a certain value.

Is there a filing fee for a Small Estate Affidavit in Minnesota?

Typically, there is no filing fee to submit a Small Estate Affidavis directly to asset holders like banks or investment firms. However, if you need to file the affidavit with a court or other government body, there may be applicable fees. These fees can vary, so it's advisable to consult the specific court or agency to ascertain the exact costs you might encounter.

Can a Small Estate Affidavit be contested in Minnesota?

Yes, a Small Estate Affidavit can be contested in Minnesota, just like any other legal document. If someone believes the affidavit was filed fraudulently, that the estate's value exceeds the small estate threshold, or that they have a superior claim to the estate, they can challenge the affidavit's validity in court. Challenges typically require presenting evidence to support the claim that the affidavit should not be honored. In such cases, seeking legal advice to navigate the complexities of estate law is highly recommended.

Common mistakes

Filling out the Minnesota Small Estate Affidavit form can be straightforward, yet errors can occur. These mistakes can delay the process of settling a small estate. Here are six common errors to avoid:

Failing to verify eligibility. The form is applicable only if the estate's value falls below a certain threshold, as specified by Minnesota law. Applicants sometimes overlook this rule, completing the form for estates that exceed the financial limit.

Incorrectly listing assets. Some individuals mistakenly include or exclude assets; for example, jointly owned assets or those designated to transfer upon death should not be listed, whereas all eligible assets of the estate must be accurately itemized.

Not properly identifying heirs and beneficiaries. It's critical to accurately list all individuals entitled to the estate under law, including named beneficiaries and legal heirs, which sometimes gets overlooked.

Overlooking signatures and notarization requirements. The form must be signed in the presence of a notary public. Skipping this step or forgetting to get the notary seal renders the affidavit invalid.

Submitting the form too early. Minnesota law requires a waiting period after the decedent's death before filing the affidavit. Processing the form too soon can result in its rejection.

Incomplete description of debts and obligations. The affidavit requires a detailed account of the decedent's debts, including any funeral expenses. Neglecting to provide a comprehensive list can complicate the settlement process.

In addition to these common errors, it is also important to consult the most recent version of the form and check with local jurisdictions for any specific requirements. Taking the time to review and accurately complete the Minnesota Small Estate Affidavit can save time and reduce potential complications in estate settlement.

Documents used along the form

When it comes to managing small estates in Minnesota, the Small Estate Affidavit form is indispensable for simplifying the process. However, this form rarely works in isolation. Various other forms and documents are often required to complement its purpose and ensure a comprehensive approach to estate management. These additional forms contribute significantly to facilitating a smoother transfer of assets, ensuring all legal requirements are met efficiently.

- Certified Death Certificate: This vital document serves as official proof of death. It’s used to validate the decedent's demise with financial institutions, government agencies, and courts. It's indispensable for activities necessitating legal proof of death.

- Copy of the Will: If the decedent left a will, a copy is necessary. It outlines the decedent’s wishes regarding the distribution of their assets. This document guides the execution of the estate, ensuring the decedent's wishes are upheld.

- Real Estate Deeds: For estates that include real property, deeds are necessary to prove ownership. These documents are crucial for the transfer of real estate to the rightful beneficiaries under the small estate proceedings.

- Vehicle Title and Registration Documents: When the estate includes vehicles, title and registration documents are needed. They facilitate the transfer of ownership to the beneficiaries, ensuring that all motor vehicles are legally accounted for.

- Bank Statements and Financial Records: Providing recent statements helps identify the assets under the decedent’s name. These documents are vital for a comprehensive understanding of the estate's financial standing, aiding in the accurate distribution of assets.

- Life Insurance Policies: These documents are necessary when the estate includes life insurance proceeds. They provide details on the beneficiaries and the amount they are entitled to, ensuring the proceeds are distributed accordingly.

In conclusion, while the Minnesota Small Estate Affidavit form is a key document for handling small estates, it is just a part of the document ecosystem required for thorough estate management. The supporting documents, such as the certified death certificate, the copy of the will, real estate deeds, vehicle titles and registrations, financial records, and life insurance policies, play essential roles. Together, they ensure that the estate is administered smoothly, and the decedent's assets are distributed according to their wishes and the law. Each document contributes to a seamless legal process, minimizing complexities for the grieving families during a challenging time.

Similar forms

The Minnesota Small Estate Affidavit form is similar to a simplified probate process document, like the Affidavit for Collection of Personal Property. Both tools are designed to help individuals settle smaller estates without the need for a lengthy courtroom process. They allow for the direct transfer of the deceased's assets to their rightful heirs or beneficiaries. The main difference lies in the thresholds for estate values that qualify for each process and the specific types of assets that can be transferred. For example, the Affidavit for Collection of Personal Property is typically utilized when an estate consists mainly of personal belongings, bank accounts, and stocks, and its total value does not exceed a certain amount set by state law.

Another document it mirrors is the Transfer on Death Deed (TODD) form, but with a key distinction in applicability and timing. The TODD is a proactive legal document that allows a property owner to designate a beneficiary to receive their property upon the owner's death, bypassing the probate process. Although both serve the purpose of simplifying the transfer of assets upon death, the TODD is executed by the property owner while alive, while the Small Estate Affidavit is used by the heirs or beneficiaries after the death has occurred. This delineation emphasizes the importance of planning ahead with a TODD versus utilizing the Small Estate Affidavit as a postmortem tool for asset distribution.

Lastly, it is comparable to an Executor's Deed in purpose but simpler in execution. An Executor's Deed is utilized when an executor of an estate is authorized by a will or court to transfer real estate to a beneficiary. This deed is part of the larger probate process and requires court involvement to validate the executor's authority to act. The Small Estate Affidavit, on the other hand, offers a more streamlined approach for the transfer of assets without the need for court validation, provided the estate falls under the small estate threshold. The Executor's Deed is necessary for handling more complex estates or when real estate is involved and a Small Estate Affidavit is not applicable.

Dos and Don'ts

When it comes to settling an estate in Minnesota, using a Small Estate Affidavit can streamline the process for estates considered small under state law. However, filling out this form correctly is crucial to ensure a smooth and successful procedure. Here are some essential dos and don'ts to keep in mind:

Do:- Verify eligibility: Before you start, make sure the estate qualifies as a small estate under Minnesota law. This typically means the total value of the estate doesn't exceed a certain threshold, and sufficient time has passed since the decedent's death.

- Provide accurate information: Double-check all the details you include on the form, such as the decedent's full name, date of death, and the description and value of the estate assets. Accuracy is key to preventing delays or legal challenges.

- Follow Minnesota guidelines: Each state has its own rules for small estates. Ensure you're using the correct form and following Minnesota's specific instructions and guidelines for completion and submission.

- Seek legal advice if necessary: If you have any doubts or complex issues arise, don't hesitate to consult with a legal professional. They can provide valuable guidance tailored to your situation.

- Estimate asset values: Guessing or estimating the value of the assets can lead to inaccuracies and potential legal problems. Use actual values based on appraisals or recent statements whenever possible.

- Ignore debts and liabilities: Failing to account for the decedent's outstanding debts and liabilities can complicate the estate settlement process. Be thorough in listing all known debts in the affidavit.

- Miss out on required documentation: The affidavit might need to be accompanied by additional documents, such as a certified death certificate or titles for certain assets. Ensure all required attachments are included when you submit the form.

- Rush the process: Although using a Small Estate Affiditary is generally faster and simpler than going through probate, don't rush through the form. Careful and thoughtful completion is necessary to avoid issues that could delay the distribution of the estate.

Misconceptions

When dealing with the distribution of assets after a loved one has passed away, the Minnesota Small Estate Affidavit form is a valuable tool for simplifying the process. However, there are several common misconceptions about this form and its use. Clarifying these misunderstandings can help you navigate your responsibilities with greater confidence and ease.

- Misconception #1: The form can be used regardless of the estate’s value.

Many people believe that the Minnesota Small Estate Affidavit form can be utilized for any estate, regardless of its total value. However, this tool is specifically designed for situations where the deceased's estate does not exceed a certain threshold, currently set at $75,000. This limit includes both real and personal property but excludes assets that directly pass to a beneficiary, such as life insurance policies or retirement accounts.

- Misconception #2: It grants immediate access to the deceased’s assets.

Another common misunderstanding is that completing the Small Estate Affidavit form will immediately grant access to the deceased's assets. In reality, the form must first be presented to the institution holding the assets, such as a bank, and they might require a waiting period or additional documentation before the assets can be released. The process is often quicker than going through probate, but it is not instantaneous.

- Misconception #3: The form eliminates the need for probate.

Some people mistakenly believe that using a Small Estate Affidavit means the estate will not go through probate. While this form can simplify the process and may eliminate the need for a formal probate proceeding for smaller estates, it does not remove all probate requirements. For example, if there is real estate involved or contested claims against the estate, probate proceedings might still be necessary.

- Misconception #4: It can transfer real estate ownership.

There is a misconception that the Small Estate Affidavit allows for the transfer of real estate ownership. In Minnesota, this form is typically used for personal property only. Transferring ownership of real estate often requires a different legal process or documentation, such as a Transfer on Death Deed or formal probate proceedings, depending on the specifics of the estate.

- Misconception #5: Only family members can file the form.

Finally, it's often believed that only family members of the deceased can file the Small Estate Affidavit. In reality, Minnesota law allows any interested party who has a legal right to the estate's assets to file the form. This could include relatives, but also creditors or other individuals who have been named in the will as beneficiaries.

Understanding these misconceptions about the Minnesota Small Estate Affidavit form can help ensure that the process of managing a loved one's estate goes as smoothly as possible. It’s always beneficial to consult with a legal professional to navigate the specifics of your situation and to make well-informed decisions.

Key takeaways

When dealing with the aftermath of a loved one's passing in Minnesota, the Small Estate Affidavit form can be an essential tool for the efficient management of the deceased's estate. By understanding how to properly use this form, individuals can navigate the legal landscape with greater ease. Here are seven key takeaways to consider when filling out and utilizing the Minnesota Small Estate Affidavit form.

- Eligibility Criteria: To use the form, the total value of the deceased's estate should not exceed the threshold set by Minnesota law, which is subject to periodic updates. It's important to ensure the estate qualifies as a "small estate" under current standards.

- Accuracy is Critical: The information provided on the form must be accurate and complete. This includes the deceased's personal details, the assets to be collected, and the debts owed by the estate.

- Documentation: Alongside the Small Estate Affidacy form, additional documents may be required. These could include a certified copy of the death certificate, proof of the estate's value, and documentation of any debts and assets.

- Waiting Period: Minnesota law stipulates a waiting period before the form can be filed. This is to ensure all interested parties are aware of the estate's impending distribution.

- Debts and Claims: Before assets can be distributed to heirs, all legitimate debts and claims against the estate must be addressed. The affidavit should detail how these obligations will be met.

- Legal Responsibility: The person filing the affidavit assumes responsibility for accurately distributing the estate's assets according to the law. Mismanagement or misappropriation of assets can have legal consequences.

- Seek Professional Advice: Given the complexities of estate law, it might be wise to consult with an attorney. This is especially true if the estate involves complicated assets, debts, or potential disputes among heirs.

Navigating the small estate process in Minnesota can be streamlined with the Small Estate Affidavit form, but it's important to approach the process with diligence and care. By keeping these key takeaways in mind, individuals can help ensure the estate is handled correctly and in accordance with the law.

Fill out Popular Small Estate Affidavit Forms for Different States

Small Estate Affidavit Washington - It often involves a waiting period after the death before it can be filed to ensure all claims against the estate are accounted for.

Create a Family Trust - To use a Small Estate Affidavit, the total value of the estate must be below a certain amount, varying by state laws.

Louisiana Small Succession Affidavit - The form is a manifestation of the law’s pragmatism, striving to balance the solemnity of death with the practical necessity of asset distribution.

South Dakota Small Estate Affidavit - This legal document is widely recognized and accepted by financial institutions, easing the transfer of assets.