Printable Small Estate Affidavit Form for Mississippi

When someone passes away, the process of settling their estate can seem daunting, especially amid the grief of losing a loved one. However, in Mississippi, the Small Estate Affidavit presents a simplified procedure for handling estates that do not qualify under the traditional probate process, typically because they fall below a certain value threshold. This legal document allows the estate's assets to be distributed quickly and without the need for a lengthy court process, provided specific requirements are met. It's designed to help those left behind navigate the financial aspects of their loss with less burden, making it possible to transfer property and assets to rightful heirs or beneficiaries without the complexity and cost associated with conventional probate. Understanding how this form works, who qualifies to use it, and the limitations and benefits it offers can significantly ease the estate settlement process for small estates in Mississippi.

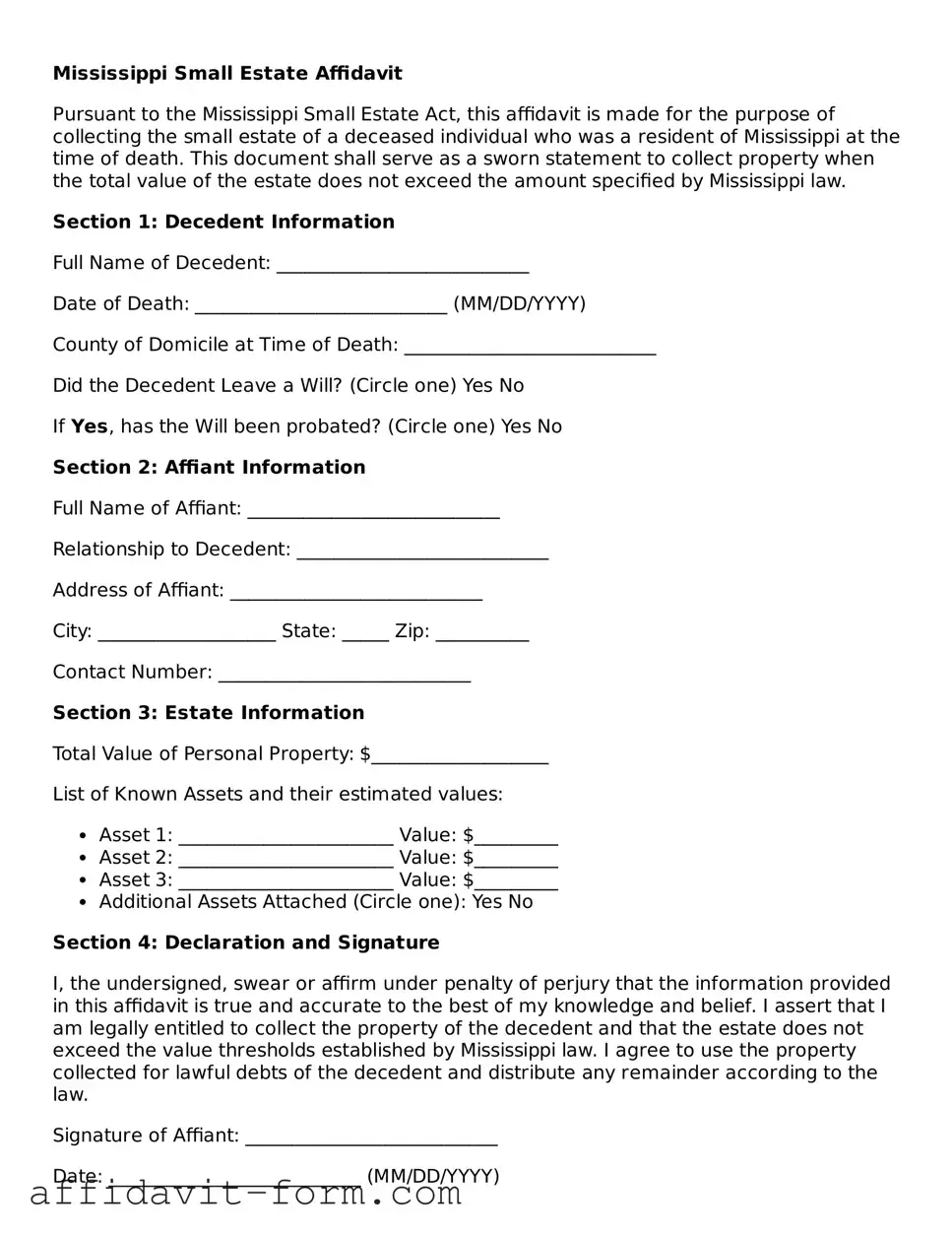

Form Example

Mississippi Small Estate Affidavit

Pursuant to the Mississippi Small Estate Act, this affidavit is made for the purpose of collecting the small estate of a deceased individual who was a resident of Mississippi at the time of death. This document shall serve as a sworn statement to collect property when the total value of the estate does not exceed the amount specified by Mississippi law.

Section 1: Decedent Information

Full Name of Decedent: ___________________________

Date of Death: ___________________________ (MM/DD/YYYY)

County of Domicile at Time of Death: ___________________________

Did the Decedent Leave a Will? (Circle one) Yes No

If Yes, has the Will been probated? (Circle one) Yes No

Section 2: Affiant Information

Full Name of Affiant: ___________________________

Relationship to Decedent: ___________________________

Address of Affiant: ___________________________

City: ___________________ State: _____ Zip: __________

Contact Number: ___________________________

Section 3: Estate Information

Total Value of Personal Property: $___________________

List of Known Assets and their estimated values:

- Asset 1: _______________________ Value: $_________

- Asset 2: _______________________ Value: $_________

- Asset 3: _______________________ Value: $_________

- Additional Assets Attached (Circle one): Yes No

Section 4: Declaration and Signature

I, the undersigned, swear or affirm under penalty of perjury that the information provided in this affidavit is true and accurate to the best of my knowledge and belief. I assert that I am legally entitled to collect the property of the decedent and that the estate does not exceed the value thresholds established by Mississippi law. I agree to use the property collected for lawful debts of the decedent and distribute any remainder according to the law.

Signature of Affiant: ___________________________

Date: ___________________________ (MM/DD/YYYY)

Notarization

This document was sworn to (or affirmed) before me on this ___ day of ___________, 20__, by ___________________________ (name of affiant), who is personally known to me or has produced ___________________________ as identification.

Notary Public: ___________________________

My commission expires: ___________________

Instructions:

- Complete all sections of the affidavit with accurate information.

- Ensure the total value of the personal property listed does not exceed the amount specified by Mississippi law for small estates.

- Sign the affidavit in the presence of a notary public.

- Submit the completed affidavit to the appropriate institution or authority as required to collect the decedent's property.

Please note, this form is intended for informational purposes only and may not cover all scenarios or meet all requirements for every individual case. It is important to seek legal advice if there are any uncertainties or complex issues with the estate.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Mississippi Small Estate Affidavit form is used to simplify the probate process for estates considered "small" under state law. |

| Governing Law | This form is governed by Section 91-7-322 of the Mississippi Code. |

| Eligibility | Estate assets must not exceed a specific value defined by Mississippi law, $50,000 as of the last update. |

| Required Information | Information about the deceased, a list of the estate's assets, and the names and addresses of the heirs must be included. |

| Waiting Period | A minimum waiting period of 30 days after the death is required before the affidavit can be filed. |

| Heir Entitlement | The form allows the direct transfer of the deceased's assets to their legal heirs without a formal probate process. |

| Filing Location | The affidavit must be filed with the Chancery Court in the county where the deceased lived. |

| Benefits | Using the affidavit expedites asset distribution and minimizes legal and court costs. |

How to Use Mississippi Small Estate Affidavit

Filing a Mississippi Small Estate Affidavit is a crucial step for eligible parties seeking a simpler method of estate distribution for a deceased person's assets. In the absence of a will, or when the estate qualifies as "small" under Mississippi law, this document allows the transfer of assets without a full probate process. Processing this form requires careful attention to detail to ensure that all parties' rights are honored and the estate is distributed correctly.

To fill out the Mississippi Small Estate Affidavit form correctly, follow these steps:

- Gather all necessary documents related to the deceased's estate, including death certificates, lists of assets, and any debts.

- Identify the legal heirs or beneficiaries. This requires knowing the family structure and understanding Mississippi's laws regarding succession.

- Complete the top section of the form with the decedent's full name, date of death, and the county where the affidavit will be filed.

- List all known assets of the decedent within the affidavit. This includes bank accounts, real estate, vehicles, and personal property. Specify the value of each asset to the best of your knowledge.

- Detail any debts owed by the decedent, including funeral expenses, outstanding bills, and taxes. This information is critical for the correct distribution of the estate.

- State the names and addresses of all legal heirs or beneficiaries, as identified in Step 2. This ensures that all interested parties are properly noted in the affidavit.

- Sign the affidavit in front of a notary public. The form requires the claimant's sworn statement that the information provided is accurate and true.

- File the completed affidavit with the appropriate county court in Mississippi. The exact office may vary depending on the county, so it is important to verify the correct location for filing.

- Once filed, notify all heirs and beneficiaries listed in the affidavit. This may be a legal requirement and also serves as a courtesy to keep interested parties informed.

- Follow up with the institutions or entities holding the assets. Provide them with a copy of the filed affidavit to facilitate the transfer of assets to the rightful heirs or beneficiaries.

After completing these steps, the assets listed in the estate can typically be distributed to the heirs or beneficiaries without the need for a lengthy probate process. It is critical to ensure that the affidavit is thoroughly and accurately completed to avoid delays or legal challenges. If doubts or complex situations arise, consulting with a legal expert familiar with Mississippi estate law can provide guidance and support through the process.

Listed Questions and Answers

What is a Mississippi Small Estate Affidavit?

In Mississippi, a Small Estate Affidavit is a legal document used to handle estates valued at $50,000 or less. This form allows heirs to collect the deceased person's property without going through a formal probate process. By completing this affidavit, the process of distributing assets can be simplified and expedited.

Who can file a Small Estate Affidavit in Mississippi?

Under Mississippi law, the following individuals may file a Small Estate Affidavit:

- Spouses of the deceased,

- Children of the deceased,

- Parents of the deceased, or

- Any person entitled to the property by law if there are no direct heirs.

What are the conditions to use a Small Estate Affidavit in Mississippi?

Several conditions must be met to use a Small Estate Affidavit in Mississippi:

- The total value of the estate must not exceed $50,000 after deducting any debts owed by the deceased.

- At least 30 days have passed since the death of the decedent.

- No application for the appointment of a personal representative or no probate proceedings are pending or have been conducted in Mississippi.

What information is required in a Mississippi Small Estate Affidavit?

The affidavit must contain detailed information, including:

- The full name and address of the affiant (the person filing the affidavit),

- The relationship of the affiant to the deceased,

- A detailed description of all property in the estate,

- The estimated value of each item of property,

- The names and addresses of all persons entitled to inherit the property, and

- A statement that the estate’s value does not exceed the statutory limit of $50,000.

How do you file a Small Estate Affidavit in Mississippi?

To file a Small Estate Affidavit in Mississippi, the affiant should complete the form with all required information, making sure to sign it in the presence of a notary public. Once notarized, the affidavit and any accompanying documents should be presented to the holder of the property (such as banks or other institutions holding the deceased’s assets) or filed with the appropriate local court, as required.

Is a lawyer required to file a Small Estate Affidavit in Mississippi?

While it is not mandatory to have a lawyer to file a Small Estate Affidavit in Mississippi, consulting with a legal professional can provide guidance and ensure that all legal requirements are met. This can be particularly useful in cases where the estate’s distribution may be complex or disputed.

What is the cost to file a Small Estate Affididavit in Mississippi?

The cost to file a Small Estate Affidavit may vary depending on the county. In addition, there may be other costs associated with notarizing the affidavit and obtaining certified copies of the death certificate. It is advisable to contact the local court clerk’s office for the most current filing fees and associated costs.

How long does the process take?

The duration of the process for a Small Estate Affidavit in Mississippi can vary. Once the affidavit is properly completed, notarized, and submitted, the time it takes to access the deceased person's assets can depend on the responsiveness of the institutions holding these assets. However, this process is generally quicker than going through formal probate, which can take several months to over a year.

Common mistakes

In Mississippi, navigating the process of managing a small estate can be simplified through the accurate completion of a Small Estate Affidavit form. However, individuals often encounter hurdles that can complicate matters further. Identifying these common mistakes can help in ensuring the process is as smooth and error-free as possible.

-

Not verifying eligibility requirements: Before proceeding, it's crucial to confirm that the estate in question qualifies as a "small estate" under Mississippi law. This typically involves factors like the estate's total value not surpassing a certain threshold.

-

Incorrect or incomplete identification of assets: Every asset that forms part of the estate needs to be clearly and accurately listed. Omitting assets or providing vague descriptions can lead to delays and further complications.

-

Failing to properly identify and notify heirs: All potential heirs must be identified and informed. Skipping this step can invalidate the process, potentially causing disputes among family members or other beneficiaries.

-

Miscalculating the estate's value: Accurately determining the estate's total value is essential, including the appraisal of personal and real property. Misestimations can affect the affidavit's validity.

-

Not settling debts: Before distribution, any outstanding debts of the estate must be addressed. Neglecting this step can lead to legal complications for the heirs.

-

Improperly signed or notarized document: The Small Estate Affidavit must be signed in the presence of a notary. Any mistakes in this process can lead to the affidavit being questioned or dismissed.

-

Using outdated forms: Laws and regulations change, and so do forms. Using an outdated version can mean your application is not processed or is outright rejected.

-

Failure to file with the correct court: The affidavit needs to be filed in the county where the decedent lived. Filing in the wrong county can delay the process unnecessarily.

Understanding and avoiding these common mistakes can greatly influence the success of a Small Estate Affidavit process in Mississippi. It's always advisable to seek the guidance of a legal professional when dealing with matters of estate to ensure compliance with all state laws and requirements.

Documents used along the form

When managing the assets of a deceased individual in Mississippi, particularly under circumstances where the estate qualifies as "small" by legal definitions, a Small Estate Affidavit form is often utilized. This form simplifies the process, allowing for a more straightforward transfer of assets to beneficiaries without a full probate proceeding. However, to efficiently complete this process, several other forms and documents typically accompany the Small Estate Affidavit form. Each document plays a crucial role in ensuring compliance with state laws and facilitating the transfer of assets.

- Death Certificate: A certified copy of the death certificate is a crucial document that verifies the death of the individual whose estate is being managed. It is required by financial institutions and other entities to confirm the decedent's identity and the fact of death.

- Inventory of Assets: This document lists all the assets owned by the deceased at the time of death, which may include bank accounts, securities, real estate, and personal property. It provides a clear picture of what constitutes the small estate and assists in determining its value.

- Heirship Affidavit: In cases where there is no will, an Heirship Affidavit may be necessary. This legal document identifies the rightful heirs to the estate under state law, ensuring that assets are distributed according to statutory inheritance rules.

- Release and Indemnification Agreement: This agreement might be required by entities holding the estate's assets. It serves to protect these entities by requiring heirs to agree not to hold them liable for the distribution of assets as directed by the Small Estate Affidavit.

Together with the Small Estate Affidavit, these documents create a comprehensive package that addresses the legal requirements for transferring assets of small estates in Mississippi. It's important for individuals handling such matters to gather and prepare these documents carefully to ensure a smooth and lawful transfer of assets to the beneficiaries. By doing so, they honor the decedent's legacy and provide for the timely distribution of their belongings.

Similar forms

The Mississippi Small Estate Affidavit form is similar to other legal documents that streamline the transfer of assets without a formal probate process. These documents play a crucial role in helping families manage the estate of a deceased loved one with fewer complications and legal hurdles. Among these, the Affidavit for Collection of Personal Property and the Transfer on Death Deed stand out for their similarities in purpose and procedure, though they have distinct applications and requirements.

Affidavit for Collection of Personal Property is one document that shares a common purpose with the Mississippi Small Estate Affidavit. Both are used to simplify the process of transferring assets to beneficiaries without undergoing the full probate process. The key similarity lies in their aim to expedite the legal transfer of assets. However, the Affidavit for Collection of Personal Property is specifically designed for personal items and accounts, and its use is typically limited by the overall value of the property being transferred. This document allows the rightful heirs to claim ownership of assets like bank accounts, vehicles, and personal belongings by presenting a signed affidavit to the institution or party holding the assets.

Transfer on Death Deed is another document that, while different in form, shares the Mississippi Small Estate Affidavit’s goal of avoiding a lengthy probate process. This particular deed is used to convey real estate ownership automatically upon the death of the property owner to a named beneficiary. Similar to the small estate affidavit, it simplifies the process of transferring assets. However, the Transfer on Death Deed is proactive, requiring the property owner to complete and record the deed prior to their death. It distinctly differs in that it is specifically for real estate and must be appropriately recorded in county records to be effective. This planning tool ensures that property can be seamlessly and directly transferred to beneficiaries without being entangled in probate proceedings.

Dos and Don'ts

Filling out a Small Estate Affidavit form in Mississippi is an essential step in managing the estate of a deceased person who didn't leave a will or had a relatively small estate. Approaching this document with precision and care is crucial to ensure the process runs smoothly. Below are 10 guiding points—five things you should do and five things you should avoid—to help you complete the Mississippi Small Estate Affidavit form accurately.

Do's:- Verify eligibility: Ensure the estate meets Mississippi's requirements for a Small Estate Affidavit, which typically involves the total value of the estate falling below a specific threshold.

- Gather necessary information before starting: Have all pertinent details such as asset values, debts, and beneficiary information at hand to streamline the filling process.

- Provide accurate and truthful information: Mistakes or falsehoods can lead to delays, legal complications, and even penalties.

- Review the form for completeness: Before submitting, double-check to make sure all fields are filled out and that the information is complete and accurate.

- Seek legal advice if unsure: If any part of the form or process is unclear, consulting with a legal professional can prevent errors and ensure the affidavit is correctly executed.

- Avoid guessing: If you do not know the exact value of an asset or debt, it's better to verify first rather than guess. Incorrect information can cause issues later.

- Do not overlook any debts: Be thorough in listing all the debts of the estate, as failing to do so could result in legal complications.

- Resist the urge to distribute assets prematurely: Wait until the affidavit is properly processed and you have the legal authority to distribute the assets.

- Don't forget to notify all interested parties: All potential heirs and beneficiaries should be informed about the affidavit and the estate's distribution.

- Avoid using informal agreements: Stick to the legal process outlined by Mississippi law. Informal agreements regarding asset distribution can result in disputes and legal challenges.

By carefully adhering to these guidelines, you can help ensure that the Small Estate Affidavit process is conducted smoothly and efficiently. Taking the time to do things right can save a great deal of time and trouble in the long run.

Misconceptions

When dealing with the aftermath of a loved one's passing in Mississippi, the process of settling their estate can seem daunting. Particularly, there are some common misconceptions about the Mississippi Small Estate Affidavit form that need clarification. Understanding these can help in easing the process and ensuring that everything proceeds as smoothly as possible.

- Misconception 1: Anyone can file a Small Estate Affidavit. In reality, Mississippi law specifies that only certain individuals are eligible to file this form. Typically, this includes the surviving spouse, close relatives, or a representative of the deceased person’s estate. It’s important to verify eligibility before attempting to file.

- Misconception 2: A Small Estate Affidavit transfers property immediately. While this form is a useful tool in streamlining the process of transferring property without going through traditional probate, it doesn’t result in an immediate transfer. There's a waiting period and other legal requirements that must be met.

- Misconception 3: All assets can be transferred using this affidavit. Not all assets can be handled through a Small Estate Affidavit. In Mississippi, there are specific types and values of assets that qualify. Assets exceeding a certain value or those not considered “small estates” require more formal probate procedures.

- Misconception 4: The form negates the need for a will. The existence of a will does not preclude the necessity for a Small Estate Affidavit, and vice versa. A will may dictate the distribution of assets, but the affidavit can still be required for the actual transfer of eligible assets to beneficiaries.

- Misconception 5: Filing a Small Estate Affidavit is always the best option. While it can streamline the process for eligible estates, it might not be the most efficient or effective method in every circumstance. Legal advice can help determine the best course of action based on the specifics of the deceased person’s estate.

Understanding the specifics of the Mississippi Small Estate Affidavit can significantly ease the burden during a time of loss. It is recommended to seek the guidance of a legal professional to navigate these waters effectively, ensuring that the deceased's assets are distributed according to their wishes and in compliance with state laws.

Key takeaways

When dealing with the aftermath of a loved one's passing in Mississippi, managing their estate without formal probate can sometimes be an option through the use of a Small Estate Affidavit. This tool offers a simpler, more direct way to handle estates that meet certain criteria. Here are seven key takeaways about filling out and using the Mississippi Small Estate Affidavit form:

- The Mississippi Small Estate Affidavit is designed for estates that are valued at $50,000 or less, after deducting the value of exempt property and any debts owed by the estate.

- To use this form, the deceased must have died without a will (intestate) or the executor named in the will must be willing to forgo administration, assuming the estate qualifies under the small estate threshold.

- It’s important to wait at least 30 days after the death of the decedent before submitting the affidavit to the appropriate court. This waiting period allows time for all potential claims against the estate to be identified.

- Accurate information is crucial. The person filling out the affidavit needs to list all of the assets of the estate, as well as debts, and ensure this information is true and correct to the best of their knowledge.

- The affidavit must be filed in the county where the deceased person lived at the time of their death. If the deceased person owned real property in a different county, additional steps may be necessary.

- All heirs or beneficiaries must either sign the affidavit or be duly notified in accordance with the state laws. This ensures transparency and agreement among potential heirs about the estate's distribution.

- Once the affidavit is properly completed and submitted, and assuming no objections are raised, the assets can be distributed among the heirs according to the state’s succession laws. This can significantly shorten the time and reduce the expenses usually associated with distributing an estate.

Utilizing a Small Estate Affidavit in Mississippi provides a way for families to manage small estates efficiently and with less financial burden. However, it’s also essential to ensure that the process is conducted correctly to avoid any legal complications. Consulting with a legal professional who is familiar with Mississippi estate laws can provide guidance and peace of mind throughout this process.

Fill out Popular Small Estate Affidavit Forms for Different States

How Long Does an Executor Have to Settle an Estate in Maryland - Employing this document might require consultations with legal professionals to navigate state-specific nuances and ensure all legal criteria are met.

South Dakota Small Estate Affidavit - Filing a Small Estate Affidavit can expedite the asset distribution process, making it easier for families to settle estates.

How to File Probate Without a Lawyer - Its concise format is designed to facilitate an understandable and manageable process for those grieving and dealing with estate affairs.