Printable Affidavit of Gift Form for Missouri

In the state of Missouri, the process of gifting a vehicle, which can be an overwhelmingly generous act, is accompanied by specific documentation to ensure that the transaction is recognized legally. One key document in this procedure is the Missouri Affidavit of Gift form. This particular form plays a critical role in officially transferring ownership of a vehicle from one person to another without any exchange of money. It is designed to provide a clear and legal pathway for the gift of a vehicle to be recognized by the Missouri Department of Revenue. The affidavit serves to affirm that the vehicle is indeed a gift, helping to exempt the recipient from paying sales tax on the transaction. Furthermore, it captures important details about the gifter, the recipient, and the vehicle itself, thereby reducing the risk of potential legal complications down the road. Completing this form requires careful attention to detail and an understanding of its significance in the broader context of vehicle gifting. By properly acknowledging the transfer of ownership through this affidavit, both parties can ensure a smoother transition, safeguarding their interests and adhering to state regulations.

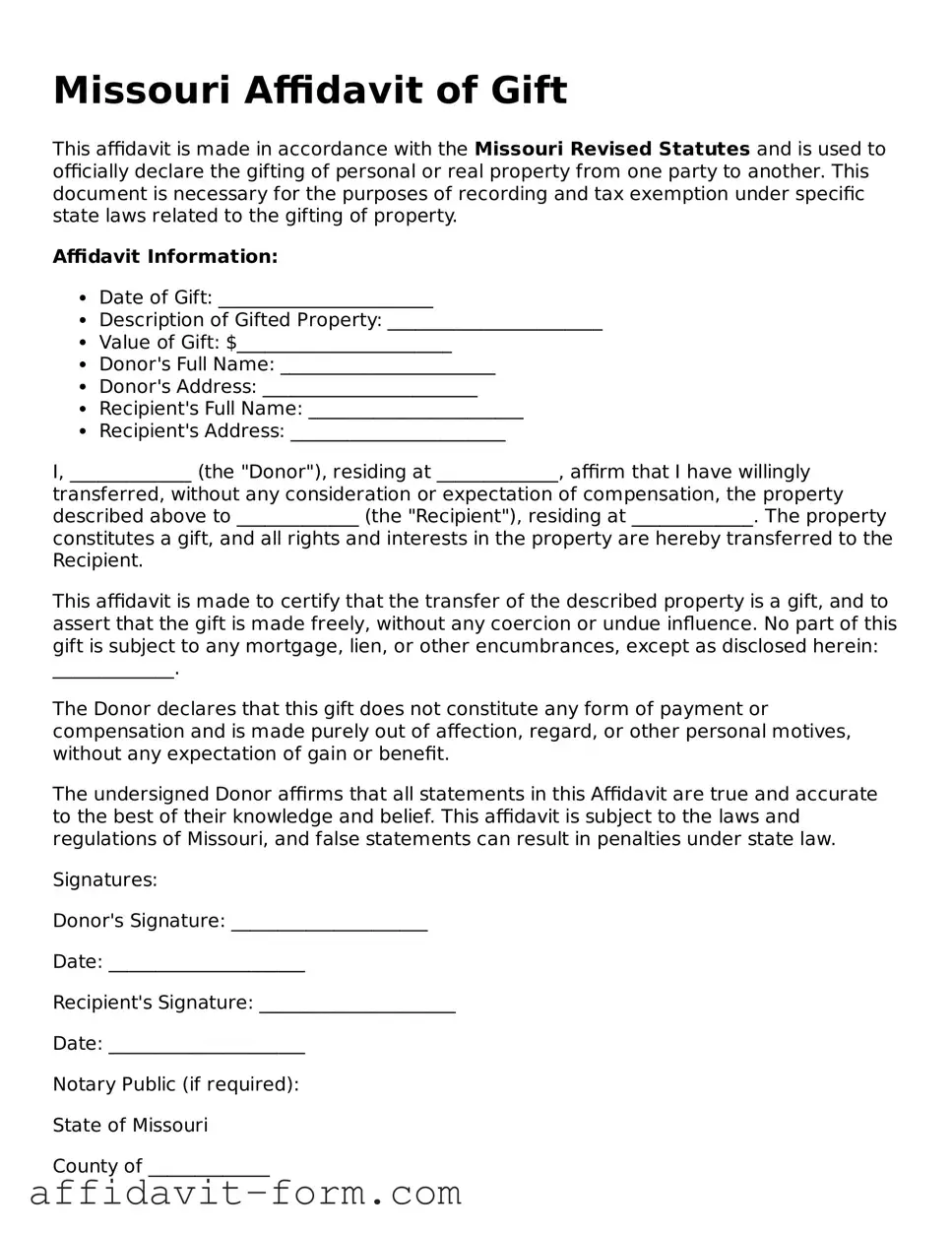

Form Example

Missouri Affidavit of Gift

This affidavit is made in accordance with the Missouri Revised Statutes and is used to officially declare the gifting of personal or real property from one party to another. This document is necessary for the purposes of recording and tax exemption under specific state laws related to the gifting of property.

Affidavit Information:

- Date of Gift: _______________________

- Description of Gifted Property: _______________________

- Value of Gift: $_______________________

- Donor's Full Name: _______________________

- Donor's Address: _______________________

- Recipient's Full Name: _______________________

- Recipient's Address: _______________________

I, _____________ (the "Donor"), residing at _____________, affirm that I have willingly transferred, without any consideration or expectation of compensation, the property described above to _____________ (the "Recipient"), residing at _____________. The property constitutes a gift, and all rights and interests in the property are hereby transferred to the Recipient.

This affidavit is made to certify that the transfer of the described property is a gift, and to assert that the gift is made freely, without any coercion or undue influence. No part of this gift is subject to any mortgage, lien, or other encumbrances, except as disclosed herein: _____________.

The Donor declares that this gift does not constitute any form of payment or compensation and is made purely out of affection, regard, or other personal motives, without any expectation of gain or benefit.

The undersigned Donor affirms that all statements in this Affidavit are true and accurate to the best of their knowledge and belief. This affidavit is subject to the laws and regulations of Missouri, and false statements can result in penalties under state law.

Signatures:

Donor's Signature: _____________________

Date: _____________________

Recipient's Signature: _____________________

Date: _____________________

Notary Public (if required):

State of Missouri

County of _____________

On this _____ day of _____________, 20___, before me appeared _____________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public's Signature: _____________________

Commission Expires: _____________________

Document Details

| Fact Number | Detail |

|---|---|

| 1 | The Missouri Affidavit of Gift form is utilized to officially document the act of giving a gift, explicitly permitting the transfer of personal or real property from one individual to another without any financial exchange. |

| 2 | This form often serves a critical role in the exemption from sales or gift tax that may otherwise be applicable to the transfer of certain assets within the state of Missouri. |

| 3 | Governing laws for the Missouri Affidavit of Gift form include, but are not limited to, the Missouri Revised Statutes, particularly sections that pertain to gifts and their taxation. |

| 4 | Completion of the form requires detailed information about both the donor (the person giving the gift) and the recipient (the person receiving the gift), ensuring clear identification of all parties involved. |

| 5 | The form must be signed by the donor in the presence of a notary public to verify the authenticity of the gift and the identity of the signing party, adding a layer of legal validity and protection against disputes. |

| 6 | For the transfer of motor vehicles, boats, or other titled property, the Missouri Affidavit of Gift is particularly significant, as it helps in the reassignment of titles without the standard financial considerations typical of such transactions. |

| 7 | There is no standardized state-provided form for all types of gifts; therefore, the specificity of the document may vary based on the nature of the gift and the advice of legal counsel. |

| 8 | Filing requirements and subsequent steps following the completion of an affidavit of gift can differ by county and the type of property being gifted, necessitating direct consultation with local authorities or a legal expert. |

How to Use Missouri Affidavit of Gift

Filling out the Missouri Affidavit of Gift form is a necessary step when transferring ownership of a vehicle or any other significant property without a sale. This document primarily serves to assure that the transfer is a genuine gift, thereby exempting it from certain taxes. Successfully completing and submitting this form requires attention to detail and accuracy. Follow the steps below to ensure the form is filled out correctly.

- Locate the official Missouri Affidavit of Gift form. This can often be found online on the Missouri Department of Revenue's website or by visiting a local office.

- Enter the full name and address of the donor (the person giving the gift) in the designated spaces at the top of the form.

- Provide the full name and address of the recipient (the person receiving the gift) in the next section of the form.

- Identify the gifted property. If it is a vehicle, include the make, model, year, and Vehicle Identification Number (VIN).

- Specify the relationship between the donor and the recipient, such as parent-child, spouses, or friends.

- State the value of the gift. Even though money may not have been exchanged, an estimated value of the gifted property must be listed.

- Both the donor and the recipient must sign and date the form in the presence of a notary public. The notary will also need to sign and affix their seal to the affidavit, formally notarizing the document.

- Review the affidavit to ensure all information is accurate and complete. Any errors or omissions may result in delays or rejection of the document.

- Submit the completed affidavit to the Missouri Department of Revenue, following any additional instructions provided by the department. This may involve visiting a local office or mailing the document.

- Keep a copy of the notarized affidavit for your records. It may be needed for future reference, especially in matters concerning the property's taxation or ownership.

By meticulously following these steps, you can accurately complete the Missouri Affidavit of Gift form. This process is crucial for documenting the transfer of property as a gift, potentially exempting it from certain taxes and legal complications. Always ensure to check with the Missouri Department of Revenue for the most current form and submission requirements to avoid any processing delays.

Listed Questions and Answers

What is the Missouri Affidavit of Gift Form?

The Missouri Affidavit of Gift Form is a legal document used when someone gives another person a vehicle or trailer as a gift in Missouri. This form proves that the vehicle was not sold but given as a gift, which is important for tax purposes and for transferring the vehicle's title without a sale price.

Who needs to fill out the Missouri Affidavit of Gift Form?

Both the giver (donor) and the receiver (donee) of the vehicle or trailer must fill out the form. It's necessary for the transfer of ownership to take place without the exchange of money, and it ensures that all parties are clear about the gift transaction.

Where can you find the Missouri Affidavit of Gift Form?

The form is available through the Missouri Department of Revenue. You can download it from their official website or pick up a copy at a local office. It's important to make sure you're using the most current form to avoid any processing delays.

What information do you need to complete the form?

- The vehicle or trailer's make, model, and year

- The Vehicle Identification Number (VIN)

- The name and address of the donor

- The name and address of the donee

- The date of the gift

- Signatures from both the donor and the donee

Filling out the form accurately is crucial. Any incorrect information can result in delays or the rejection of the transfer application.

Common mistakes

Filling out the Missouri Affidavit of Gift form requires attention to detail. People often run into problems because of common mistakes that can easily be avoided. Being aware of these errors can help ensure the process goes smoothly and the document is accepted without issues. Here are five mistakes frequently made when completing the form:

Not providing all the required information: Every field in the form is there for a reason. Skipping any section or not providing complete details can lead to the rejection of the form. It's essential to review the entire form carefully and make sure no information is left out.

Failing to verify the accuracy of details provided: Incorrect information can invalidate the affidavit. Double-check details like the vehicle identification number (VIN), make and model of the vehicle, and the gifter and recipient’s personal information to ensure accuracy.

Forgetting to date the affidavit: The date of the gift plays a crucial role in the document's validity. Missing out on including the date or writing an incorrect one can cause unnecessary delays or even the nullification of the affidavit.

Not obtaining the necessary signatures: For the affidavit to hold any legal weight, it must be signed by both the giver and the receiver of the gift. Missing signatures make the document incomplete and legally ineffective.

Omitting notarization: A common oversight is failing to get the affidavit notarized. While not all states require this, Missouri demands it for the document to be legally binding. A notarized affidavit confirms the identity of the signatories and authenticates the document.

Avoiding these mistakes not only saves time but also ensures that the process of gifting a vehicle in Missouri is compliant with state regulations. By paying close attention to detail and following the form's instructions precisely, individuals can navigate the process successfully.

Documents used along the form

When transferring ownership of a vehicle as a gift in Missouri, an Affidavit of Gift form is just the starting point. Such transactions often require additional paperwork to ensure a smooth and legally compliant transfer. This necessity arises from the need to document the transfer for tax purposes, verify the vehicle's condition and ownership, and safeguard both the giver's and receiver's interests. Understanding these documents and their functions can make the process more straightforward.

- Title Application: This is a critical document used for officially transferring the vehicle's title from the giver to the receiver. By completing a Title Application, the new owner registers the gift with the state, ensuring legal recognition of the ownership transfer. It includes details about the vehicle, such as make, model, and identification number, alongside information about the new owner.

- Odometer Disclosure Statement: Federal and state laws mandate the disclosure of a vehicle's mileage upon transfer of ownership. The Odometer Disclosure Statement serves this purpose, providing a record of the vehicle's mileage at the time of the gift. This statement helps prevent odometer tampering and ensures the buyer is aware of the vehicle's condition.

- Safety Inspection Certificate: Many states, including Missouri, require a recent safety inspection for a vehicle transfer. This certificate verifies that the vehicle meets minimum safety standards. It covers various components such as brakes, lights, and tires, ensuring the vehicle is safe for operation on public roads.

- Bill of Sale: Though the vehicle is a gift and no money is exchanged, a Bill of Sale can still be important. It acts as a receipt for the transaction and can specify that the vehicle was given as a gift. This can be especially useful for tax purposes, as it provides a record of the transfer and its value.

The combination of these documents with the Affidavit of Gift form creates a comprehensive package that aligns with legal requirements and ensures a transparent, smooth transition of vehicle ownership. Each document plays a distinct role in this process, contributing to a seamless and lawful transfer. For anyone involved in gifting a vehicle in Missouri, being acquainted with these forms and their purposes is crucial.

Similar forms

The Missouri Affidavit of Gift form is similar to other legal documents used to transfer ownership without a financial exchange. These documents often share common purposes but are used in different contexts or jurisdictions. They ensure that the transfer of property adheres to legal requirements and records the intention of the donor to give the property as a gift. This affidavit is particularly useful for documenting the transfer of personal or real property from one person to another, helping to avoid potential tax implications or disputes over the transfer.

One such document is the General Gift Deed. Like the Missouri Affidavit of Gift, a General Gift Deed is used to transfer ownership of property from one person to another without any payment. However, while the affidavit explicitly certifies that the item is gifted, meaning no money changes hands, a General Gift Deed is broader and can be used for different types of property, including real estate or vehicles. Both documents serve to legalize the transfer and ensure it is recorded properly, but the General Gift Deed might also require witness signatures and notarization, depending on state laws.

Another similar document is the Motor Vehicle Gift Affidavit. This is particularly used for the transfer of vehicles as gifts and is specific to the motor vehicle departments in many states. Like the Missouri Affidavit of Gift, this affidavit confirms that a vehicle is being given as a gift and that no financial transaction is involved. It is essential for registering the vehicle in the recipient's name and ensuring that the transfer is recognized by the state’s motor vehicle department. Both forms help to clarify that the transfer is a gift, aiming to exempt the recipient from paying sales tax on the transaction.

Dos and Don'ts

When filling out the Missouri Affidavit of Gift form, it's important to approach the task with care. Making a mistake can lead to issues down the line, potentially complicating what should be a straightforward process. Here’s a guide on what you should and shouldn't do to ensure the process goes smoothly.

Things You Should Do

- Double-check the vehicle information, including the Vehicle Identification Number (VIN), make, model, and year, to ensure accuracy.

- Ensure both the giver and the receiver sign the form in the presence of a notary to validate the document.

- Provide a clear, detailed explanation if the gift includes any conditions or is limited in any way.

- Keep a copy of the completed and notarized form for your personal records.

- Verify that all sections of the form are filled out. Incomplete forms may not be accepted.

- Contact your local Department of Revenue office if you have any questions before filing the form.

- Make sure the notary public fills out their section completely, including their seal and signature.

- Include any supporting documentation that may be required, such as proof of relationship, if applicable.

- Update your vehicle insurance and registration as soon as possible after completing the transfer.

- Review the entire form for accuracy before submitting it.

Things You Shouldn't Do

- Do not leave any fields blank. If a section does not apply, fill in “N/A” or “None”.

- Do not sign the form without a notary present, as unnotarized forms are invalid.

- Do not forget to include the gift date. This is vital for processing and legal purposes.

- Avoid making handwritten changes or corrections on the form; instead, fill out a new form if mistakes are made.

- Do not submit the form without ensuring that all parties have a mutual understanding of its contents.

- Do not neglect to inform your insurance company of the change in vehicle ownership.

- Do not delay in submitting the completed form. Prompt submission can avoid potential legal issues.

- Avoid using unofficial forms. Always use the most recent version provided by the state of Missouri.

- Do not exclude detailed information about the gift if there are special circumstances involved.

- Do not underestimate the importance of keeping a copy of the notarized form for your records.

Misconceptions

When discussing the Missouri Affidavit of Gift form, several misconceptions frequently emerge. These misconceptions can lead to confusion about how the form is used and its legal implications. Below are five common misconceptions clarified to assist in understanding its proper use and legal standing.

- It requires a witness or notarization to be legally valid. Many people believe that for the Missouri Affidavit of Gift form to be legally binding, it must be witnessed or notarized. However, this belief is incorrect. While notarization can add a layer of validity and prevent fraud, the absence of a notary or a witness does not automatically invalidate the document.

- It is only applicable for motor vehicles. Another common misconception is that this form is exclusively used for the gifting of motor vehicles. In reality, the form is versatile and can be utilized for transferring ownership of a variety of items, provided the document clearly describes the item being gifted and adheres to any specific legal requirements for particularly regulated items, such as vehicles or real estate.

- It allows the recipient to avoid paying taxes. Some believe that receiving a gift through the Missouri Affidavit of Gift form exempts the recipient from any tax obligations. This is not entirely accurate. While gifting can offer tax advantages, such as avoiding sales tax at the time of transfer, it may not shield the recipient from other tax liabilities, such as federal gift tax, depending on the value of the gift and the cumulative amount gifted within the tax year.

- The form grants immediate ownership. While the Missouri Affidavit of Gift form is instrumental in transferring ownership, the mere act of filling out and signing the form does not instantaneously transfer ownership of the item. In some cases, additional documentation or steps may be required to fully effectuate the transfer, especially for high-value items or those with a title or deed.

- It's an official legal document recognized in all states. Finally, there is a misconception that the Missouri Affidavit of Gift form is recognized and accepted in all states. While many states have similar forms or processes, each state has its own rules and regulations regarding gift affidavits. The Missouri form is specifically designed to comply with Missouri state law and may not be suitable or recognized for use in transferring ownership of property located in or governed by the laws of another state.

Understanding these misconceptions is crucial for anyone considering using the Missouri Affidavit of Gift form to ensure the process of gifting is done accurately and within the bounds of the law. Always consult legal guidance relevant to the specific circumstances and local laws for the most accurate advice.

Key takeaways

The Missouri Affidavit of Gift form is an essential document for residents of Missouri who wish to gift a vehicle or another form of personal property without expecting payment in return. It's critical to understand the proper way to fill out and use this form to ensure the transaction is recognized and processed by the appropriate state authorities. Below are key takeaways to guide individuals in the correct completion and use of the form:

- Accurate completion is crucial: The form must be filled out accurately, providing detailed information about both the giver and the recipient of the gift. This includes full legal names, addresses, and specific details about the item being gifted.

- Notarization is required: For the affidavit to be valid, it must be notarized. This involves signing the document in the presence of a notary public, who will verify the identity of the signatory and ensure that the signature is genuine.

- Description of the gift: The form requires a complete description of the item being gifted. For vehicles, this includes the make, model, year, VIN (Vehicle Identification Number), and odometer reading at the time of the gift.

- No monetary exchange: The affidavit is specifically used for gifts, which means no money should exchange hands between the giver and the recipient for the transaction detailed in the form.

- Tax implications: While the form facilitates the gifting process, it's important for both parties to be aware of any tax implications. The value of the gift may affect tax liabilities, and it's advisable to consult with a tax professional for guidance.

- Submission to the state: After the form is completed and notarized, it must be submitted to the appropriate Missouri state department for processing. This step is necessary for the official transfer of ownership and to update state records.

Understanding and following these guidelines ensures that the process of gifting personal property in Missouri is conducted smoothly and in compliance with state requirements. The Missouri Affidavit of Gift form is a valuable tool for documenting the transfer of gifts, helping both parties avoid potential legal and tax pitfalls.

Fill out Popular Affidavit of Gift Forms for Different States

Can You Gift a Car to a Non Family Member in Washington State - In the context of business, transferring assets through a gift can be documented clearly to avoid implications of insider trading or conflicts of interest.