Printable Small Estate Affidavit Form for Missouri

When a loved one passes away, managing their estate can often become a daunting task, especially during a period of mourning. In Missouri, the Small Estate Affidavit form presents a simpler method for handling the affairs of individuals who have died with a smaller amount of assets. This document allows for the transfer of property without the need for a lengthy and often complex probate process. It's designed for estates that do not exceed a certain value threshold, significantly easing the burden on the surviving family members or heirs. Key to its usefulness, the form outlines a more direct path for claiming assets, underlining the qualifications needed to use it, such as the total value of the estate and the specific types of property it encompasses. By filling out this affidavit, eligible individuals can efficiently distribute the deceased's property, including personal belongings, bank accounts, and real estate, provided it meets Missouri's guidelines. This mechanism not only simplifies the estate settlement process but also accelerates the timeframe in which assets can be transferred, offering a beacon of relief during a challenging time.

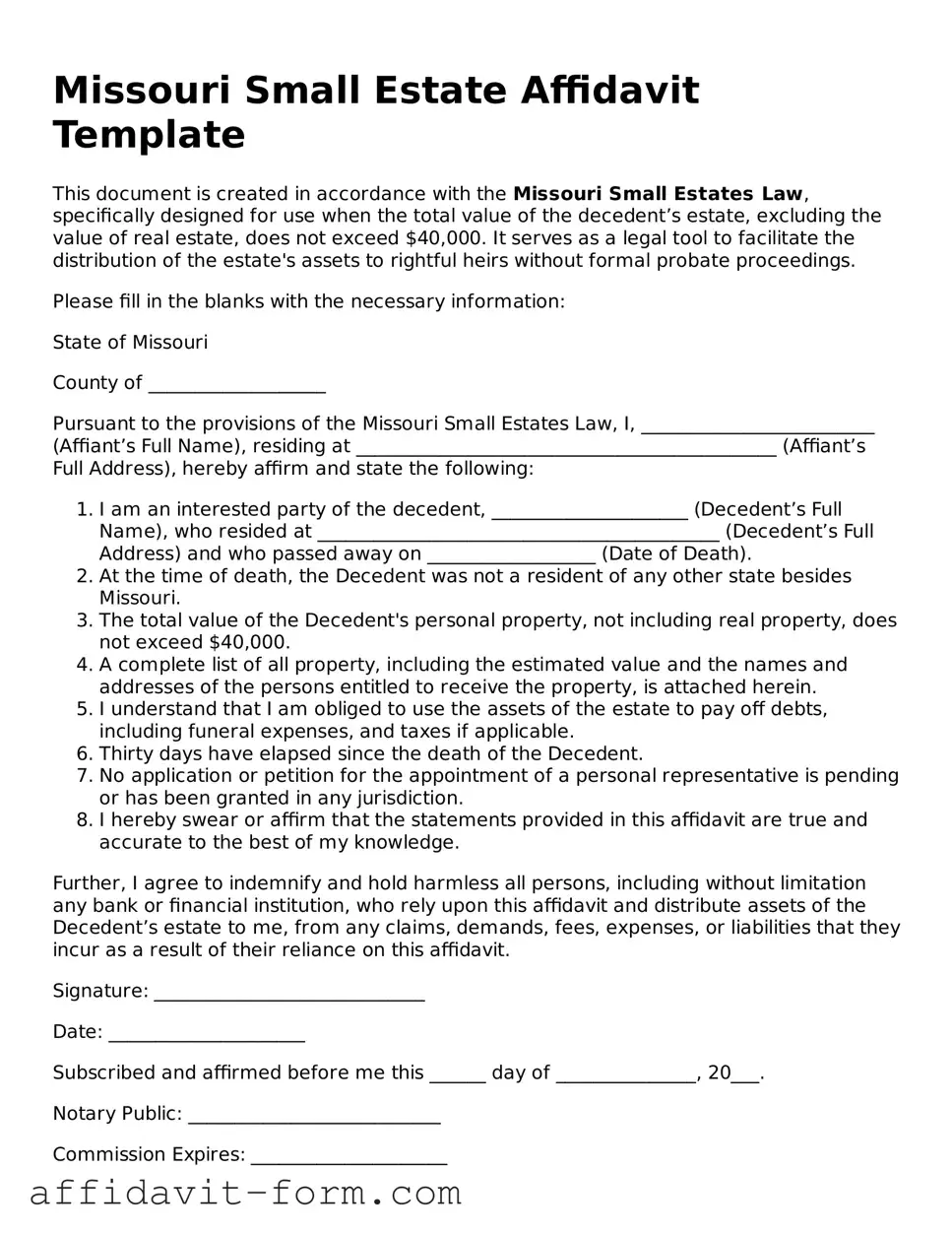

Form Example

Missouri Small Estate Affidavit Template

This document is created in accordance with the Missouri Small Estates Law, specifically designed for use when the total value of the decedent’s estate, excluding the value of real estate, does not exceed $40,000. It serves as a legal tool to facilitate the distribution of the estate's assets to rightful heirs without formal probate proceedings.

Please fill in the blanks with the necessary information:

State of Missouri

County of ___________________

Pursuant to the provisions of the Missouri Small Estates Law, I, _________________________ (Affiant’s Full Name), residing at _____________________________________________ (Affiant’s Full Address), hereby affirm and state the following:

- I am an interested party of the decedent, _____________________ (Decedent’s Full Name), who resided at ___________________________________________ (Decedent’s Full Address) and who passed away on __________________ (Date of Death).

- At the time of death, the Decedent was not a resident of any other state besides Missouri.

- The total value of the Decedent's personal property, not including real property, does not exceed $40,000.

- A complete list of all property, including the estimated value and the names and addresses of the persons entitled to receive the property, is attached herein.

- I understand that I am obliged to use the assets of the estate to pay off debts, including funeral expenses, and taxes if applicable.

- Thirty days have elapsed since the death of the Decedent.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- I hereby swear or affirm that the statements provided in this affidavit are true and accurate to the best of my knowledge.

Further, I agree to indemnify and hold harmless all persons, including without limitation any bank or financial institution, who rely upon this affidavit and distribute assets of the Decedent’s estate to me, from any claims, demands, fees, expenses, or liabilities that they incur as a result of their reliance on this affidavit.

Signature: _____________________________

Date: _____________________

Subscribed and affirmed before me this ______ day of _______________, 20___.

Notary Public: ___________________________

Commission Expires: _____________________

Document Details

| Fact Name | Description |

|---|---|

| Eligibility Criteria | The total value of the estate must not exceed $40,000 to qualify for the use of the Missouri Small Estate Affidavit. |

| Governing Law | The process is governed by Missouri Revised Statutes, Section 473.097. |

| Waiting Period | There is a mandatory 30-day waiting period after the decedent's death before the affidavit can be filed. |

| Applicable Assets | Only personal property, such as bank accounts, stocks, and tangible items, may be transferred; real estate is excluded. |

| Filing Location | The affidavit is filed with a probate court in the county where the decedent lived or where the property is located. |

| Notarization Requirement | The affidavit must be signed in the presence of a notary public to be legally binding. |

| Heir Distribution | Assets are distributed to rightful heirs or legatees according to Missouri law or the decedent's will, if applicable. |

| Fee Structure | Court filing fees vary by county but are generally required upon submission of the affidavit. |

| Timeframe for Asset Distribution | Once approved, the assets can typically be distributed immediately, though the exact timeframe may vary. |

How to Use Missouri Small Estate Affidavit

Preparing a Small Estate Affidavit in Missouri is a pivotal step for those handling the estate of someone who has passed away, provided the total value of the estate meets the state's criteria for being considered "small." This process allows for the distribution of the deceased's assets without the necessity of a formal probate proceeding, thereby streamlining the legal process involved in asset distribution. It's important for individuals to approach this document with care, ensuring accuracy and completeness to avoid potential delays. The steps outlined below are designed to guide you through the process of filling out the Missouri Small Estate Affidavit form.

- Begin by gathering all necessary information regarding the deceased's estate, including asset values, debts, and the names and addresses of beneficiaries.

- Fill in the top part of the form with the deceased's full legal name and the date of death. Make sure this information exactly matches the death certificate.

- Provide your personal information in the designated sections, including your name, address, and relationship to the deceased.

- List all known assets belonging to the estate, including but not limited to bank accounts, real estate, vehicles, and personal property. Be specific and provide detailed descriptions when possible.

- Calculate the total value of the estate's assets and ensure it does not exceed the threshold set by Missouri law for a small estate. This threshold can change, so verify the current limit before proceeding.

- Detail any debts or claims against the estate, including outstanding bills, loans, and other obligations.

- Identify each heir or beneficiary, their relationship to the deceased, and the portion of the estate they are to receive. Be as clear as possible to prevent any confusion.

- If the form requires, provide information about whether the deceased owned real estate solely in his or her name. Special considerations may apply to these assets, requiring additional documentation.

- Review the affidavit carefully, ensuring all information provided is accurate and complete. Misinformation or omissions can lead to delays or legal complications.

- Sign the affidavit in front of a notary public. Most financial institutions and law offices can provide notary services. Ensure the notary stamps and signs the document as required.

Once the Small Estate Affidavit is fully prepared and notarized, it can be presented to the relevant institutions or entities to facilitate the transfer of the deceased's assets. This might include banks, the Department of Motor Vehicles, or the local real estate records office, depending on the assets in question. It is advisable to make several certified copies of the affidavit, as some organizations may require a copy for their records. By carefully following these steps, you will successfully navigate the process of settling a small estate in Missouri, honoring the decedent's wishes and providing for their beneficiaries.

Listed Questions and Answers

What is a Missouri Small Estate Affidavit?

A Missouri Small Estate Affidavit is a legal document used to expedite the process of estate distribution for estates valued at less than $40,000. This document allows inheritors to collect the deceased person's assets without going through formal probate court proceedings, making it a faster and less expensive option for settling small estates.

Who can file a Missouri Small Estate Affidavit?

Typically, the direct heirs or legally recognized next of kin can file a Missouri Small Estate Affidavit. This includes, but is not limited to, spouses, children, or parents of the deceased. A creditor of the deceased can also file if they have an outstanding claim against the small estate.

What assets can be collected with a Missouri Small Estate Affidiff?

Not all assets can be collected using a Missouri Small Estate Affidavit. Generally, it applies to personal property, such as:

- Bank accounts

- Vehicles

- Stocks and bonds

- Household goods and other personal belongings

Real estate and certain other types of property may not qualify and might require a different procedure.

What is the process for filing a Missouri Small Estate Affidavit?

The process begins by completing the Small Estate Affidavit form accurately, which includes providing details about the deceased, the assets being claimed, and the entitled heirs. Once completed, the form must be signed in the presence of a notary public. Then, it's filed with the probate court in the county where the deceased person lived. The court reviews the affidavit and, if approved, assets can be distributed to the heirs accordingly.

What documents do I need to file a Missouri Small Estate Affidavit?

When filing, you'll need to provide several key documents, including:

- The completed Small Estate Affidavit form.

- A certified copy of the death certificate.

- Proof of the value of the estate's assets.

- Legal identification for the person filing the affidavit.

- Any other documents that the specific court may require.

How long does it take to settle a small estate using an affidavit in Missouri?

The timing can vary depending on the court's workload and the completeness of the submitted documents. In most cases, if everything is in order, the process can be concluded within 30 to 45 days from the filing of the affidavit.

Is there a filing fee for the Missouri Small Estate Affidavit?

Yes, there is usually a filing fee for submitting a Missouri Small Estate Affidiff. The amount can vary by county, so it's advised to check with the local probate court to determine the exact cost.

Can I file a Missouri Small Estate Affidavit if there is a will?

Yes, a Missouri Small Estate Affidavit can be filed whether the deceased had a will or not. The process and requirements remain largely the same; however, the will must be attached to the affidavit if one exists.

What happens if the Small Estate Affdavit is rejected by the court?

If the affidavit is rejected, the court will provide reasons for the rejection. Common reasons might include inaccuracies in the affidavit, the estate exceeding the $40,000 threshold, or disputes among heirs. In such cases, resolving the issues and re-submitting the affidavit or proceeding through formal probate may be necessary.

Common mistakes

Not verifying eligibility before filing. People frequently initiate the affidavit process without confirming whether the estate's total value falls under the legal threshold for a "small estate" in Missouri. This eligibility criterion is paramount to proceed legitimately.

Incorrectly listing assets. It's a common mistake to either omit assets or to document them inaccurately. Every asset, from bank accounts to physical property, must be listed comprehensively and described in detail to meet legal requirements.

Failing to properly notify all heirs. Under Missouri law, all potential heirs or those legally entitled to a portion of the estate must be notified about the affidavit being filed. Neglecting this step can lead to disputes or the affidavit's rejection.

Overlooking the need for witness or notary signatures. The form often requires validation through either witness signatures, notarization, or both, depending on the specifics of the estate and form requirements. Missing this validation step can render the affidavit void or lead to processing delays.

By addressing these common mistakes, individuals can enhance the efficiency and legitimacy of their small estate affidavit filings in Missouri, leading to a smoother legal process.

Documents used along the form

When handling a small estate in Missouri, the Small Estate Affidavit form is often just the first step in the process. Several other documents may be necessary to effectively manage and distribute the deceased's assets. These documents can vary depending on the specifics of the estate and its assets, but each plays a crucial role in ensuring the process is handled correctly and efficiently.

- Death Certificate: A certified copy is usually required to establish the death of the individual whose estate is being handled. It is a primary document needed for various transactions and claims.

- Last Will and Testament: If available, this document outlines the deceased's wishes regarding the distribution of their assets and the appointment of an executor.

- Letters Testamentary or Letters of Administration: These are official documents issued by a probate court that grant the executor or administrator the authority to act on behalf of the deceased's estate.

- Inventory and Appraisement Form: This document lists all the assets of the estate and their appraised values. It is often required to ensure a fair distribution of assets among heirs.

- Notice to Creditors: This notice is published in a local newspaper and serves to inform any creditors of the deceased that the estate is being settled, giving them a chance to present claims against the estate.

- Receipts and Release Forms: These are signed by heirs or beneficiaries once they receive their share of the estate, indicating that they acknowledge receipt and release the executor from further liability.

- Affidavit for Collection of Personal Property: In some instances, this document allows for the collection of personal property of the deceased without formal probate.

- Real Estate Transfer Documents: If the estate includes real property, documents such as a new deed or a beneficiary deed may be needed to transfer ownership.

- Settlement Agreement: If disputes arise among the heirs or beneficiaries, a settlement agreement may be necessary to outline the terms of the resolution.

- Final Accounting: This document provides a detailed account of all actions taken, expenses paid, and distributions made by the executor or administrator of the estate.

Together with the Small Estate Affidavit, these documents form a comprehensive toolkit for the lawful and effective management of small estates in Missouri. By preparing and utilizing these documents accurately, those handling an estate can ensure a smoother process for all involved, adhering to legal protocols and respecting the wishes of the deceased.

Similar forms

The Missouri Small Estate Affidavit form is similar to other legal documents used in the process of estate planning and settlement. For those handling the affairs of a deceased individual with a relatively small estate, this form streamlines the process. It bypasses the need for a full probate court proceeding. Let's talk about a couple of documents it shares characteristics with and how they compare.

The Missouri Small Estate Affidavit and the Last Will and Testament: As a vital document, the Last Will and Testament outlines an individual's final wishes for their estate and beneficiaries. While both documents relate to the management of an estate, the Small Estate Affidavit comes into play when the deceased’s estate is small enough to qualify for a simplified handling process. Unlike a will, which may require probate to validate, the affidavit allows for a quicker distribution of assets, assuming the estate falls below a certain value threshold. Both documents ensure the deceased’s assets are distributed according to their wishes or, in the absence of a will, state law.

The Missouri Small Estate Affidavit and Powers of Attorney: Powers of Attorney (POA) allow an individual to appoint someone else to manage their affairs, financial or otherwise, in case they become unable to do so themselves. Though the Small Estate Affidavit and a Power of Attorney serve different purposes, both involve handling someone's assets or legal matters without traditional court involvement. The affidavit is used after death, while a POA is in effect during an individual's lifetime. Both documents streamline the management of affairs, minimizing legal complications and ensuring that matters can be resolved efficiently.

Dos and Don'ts

When handling the Missouri Small Estate Affidavit form, it’s important to pay close attention to detail and follow specific guidelines to ensure the process is completed accurately and efficiently. Below are some key dos and don'ts to keep in mind:

Do:Ensure all information provided is accurate and truthful. Mistakes or inaccuracies can lead to delays or legal issues.

Use black ink or type the information to ensure legibility. This makes the document easier to read and process.

Verify the total value of the estate does not exceed the state’s threshold for small estates, as this determines eligibility.

Include complete contact information for all heirs or beneficiaries. This is crucial for proper notification and distribution.

Attach a certified copy of the death certificate. This is a required document for the process.

Provide a detailed list of the estate’s assets, including account numbers and descriptions, to avoid any confusion.

Double-check that you have signed and dated the form in the presence of a notary public. This step is essential for the document’s validity.

Keep a copy of the completed form and all attachments for your records. This can be helpful for future reference or if any disputes arise.

Seek guidance from a legal professional if you encounter any uncertainties or complexities. Legal advice can prevent costly mistakes.

Submit the form and any required fees to the appropriate local court. Prompt submission can expedite the process.

Do not leave any sections incomplete. An incomplete form can result in rejection or delays.

Avoid guessing or estimating values. Accuracy is crucial when listing assets and their values.

Do not forget to list all known debts of the estate. This information is necessary for proper settlement.

Avoid using white-out or making corrections in a way that isn’t clear. If mistakes are made, it’s best to start with a fresh form.

Do not ignore the requirement for a notarized signature. Without notarization, the form might not be legally recognized.

Do not attempt to conceal assets or debts. Full disclosure is legally required and ensures fair distribution.

Avoid signing the form until you are in the presence of a notary. The notary must witness your signature.

Do not submit the form without reviewing all the provided information for accuracy and completeness.

Do not hesitate to ask for help if the instructions are unclear. Misunderstandings can lead to errors in the form.

Avoid delaying the submission of the form. Timely action is beneficial for all parties involved.

Misconceptions

When the time comes to manage an estate in Missouri, the Small Estate Affidavit form is often mentioned as a simplified option. However, numerous misconceptions surround its use and applicability. Understanding the reality behind these misunderstandings is crucial for those navigating estate management in this state.

Any estate qualifies due to its size. One common misconception is that the size of an estate, as long as it is small, automatically qualifies it for the Small Estate Affidavit process. In reality, Missouri law stipulates that the total value of the estate must not exceed $40,000 after deducing funeral expenses, costs and debts, for it to be eligible.

It eliminates the need for a lawyer. While it's true that the Small Estate Affidavit form can simplify the process, assuming that legal counsel is unnecessary can lead to potential pitfalls. Professional advice can help navigate complex situations and ensure that the form is filled out correctly and the process followed accurately.

Real estate cannot be transferred using this form. Contrary to this belief, real estate can indeed be transferred via a Small Estate Affidait in Missouri, provided the value of the real estate, along with other assets, does not exceed the state’s threshold.

The process is instant. The expectation that the Small Estate Affidavit process is immediate is a misunderstanding. Once submitted, the document must be reviewed and approved, a process that can take some time. Furthermore, claimants must wait at least 30 days from the death of the decedent before filing the affidavit.

It's only for bank accounts. While the Small Estate Affidavit can indeed be used to access the deceased's bank accounts, its use is not limited to this asset type. It is a versatile tool that can facilitate the transfer of various assets, including both personal and real property, within the prescribed limits.

All heirs must agree to use it. A common misconception is that all heirs or beneficiaries must agree to utilize the Small Estate Affidavit form. However, consensus is not always required. An heir or a legally recognized successor can file the affidavit, provided they swear to distribute the assets to the rightful parties according to the law.

Dispelling these misconceptions about the Missouri Small Estate Affidavit form helps ensure that individuals are properly informed about their options for estate management. Professional legal guidance is always recommended to navigate the specifics of each case effectively.

Key takeaways

In Missouri, the Small Estate Affidavit form is a legal document used to handle small estates without a formal probate process. Understanding its proper use and requirements can simplify the process of managing a deceased person's assets. Here are key takeaways to consider:

- The estate's total value must not exceed $40,000 to use the Small Estate Affidavit form in Missouri. This threshold is crucial for determining eligibility.

- At least 30 days must have passed since the decedent's death before the affidavit can be filed. This waiting period is mandated by law.

- The form requires a detailed listing of the decedent's assets, including but not limited to bank accounts, vehicles, and real estate. Accuracy in listing these assets is paramount.

- Debts and liabilities of the estate must also be disclosed in the affidavit. Knowing the estate's financial obligations is essential for proper distribution.

- Legal heirs or beneficiaries must be identified in the document. This includes providing their names, relationships to the decedent, and their entitlement under the law or will.

- The affidavit must be signed in the presence of a notary public. This formalizes the document, ensuring its legitimacy.

- Once completed, the affidavit is filed with the probate court in the county where the decedent lived or where the property is located. The appropriate court jurisdiction is necessary for the document to be recognized.

- Using the Small Estate Affidavit form allows for the transfer of property without the lengthy and often costly probate process. However, it's important to ensure all information is accurate and complete to avoid legal complications.

It is recommended to seek legal advice when dealing with estate matters, especially when the process involves legal documentation such as the Small Estate Affidavit. Professional guidance can help navigate the complexities of estate distribution and ensure compliance with state laws.

Fill out Popular Small Estate Affidavit Forms for Different States

Connecticut Probate Fees - Preparation and filing of the affidavit require a comprehensive understanding of the estate's scope and the heirs' entitlements.

Personal Representative Paperwork - This document requires detailed information on the deceased, their assets, debts, and the inheriting parties for processing.

New Mexico Small Estate Affidavit - It allows for a relatively quick transfer of the decedent's property to heirs, bypassing complex legal hurdles.

Colorado Small Estate Affidavit - A document for simplified estate transfer if the deceased's assets fall below a certain value.