Printable Small Estate Affidavit Form for Montana

When dealing with the passing of a loved one in Montana, the process of settling their estate can feel overwhelming. It's in these moments that the Montana Small Estate Affidaid form becomes a vital tool for simplifying the process. This form is specifically designed for situations where the deceased's estate falls below a certain value threshold, allowing for a more straightforward and less costly way to transfer property to heirs. It helps avoid the often lengthy and complex probate process, providing a sense of relief and clarity during a difficult time. The form itself requires detailed information about the deceased, the assets to be distributed, and the rightful heirs. This approach not only speeds up the process of asset distribution but also ensures that the decedent's wishes are honored with minimal legal hurdles. Understanding the major aspects, eligibility criteria, and the correct procedure for completing and filing the Montana Small Estate Affidavit form is the first step in utilizing this effective tool for estate management.

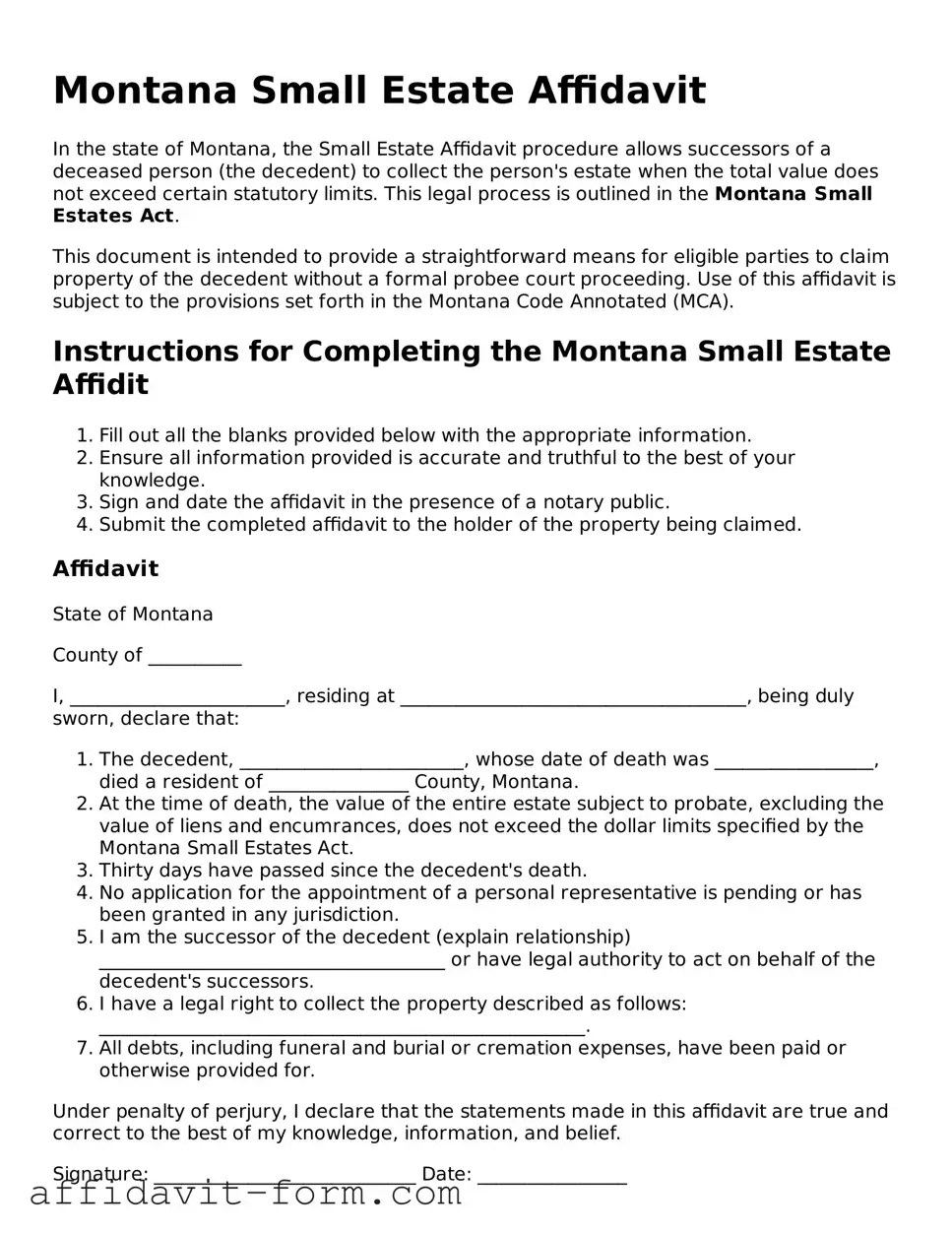

Form Example

Montana Small Estate Affidavit

In the state of Montana, the Small Estate Affidavit procedure allows successors of a deceased person (the decedent) to collect the person's estate when the total value does not exceed certain statutory limits. This legal process is outlined in the Montana Small Estates Act.

This document is intended to provide a straightforward means for eligible parties to claim property of the decedent without a formal probee court proceeding. Use of this affidavit is subject to the provisions set forth in the Montana Code Annotated (MCA).

Instructions for Completing the Montana Small Estate Affidit

- Fill out all the blanks provided below with the appropriate information.

- Ensure all information provided is accurate and truthful to the best of your knowledge.

- Sign and date the affidavit in the presence of a notary public.

- Submit the completed affidavit to the holder of the property being claimed.

Affidavit

State of Montana

County of __________

I, _______________________, residing at _____________________________________, being duly sworn, declare that:

- The decedent, ________________________, whose date of death was _________________, died a resident of _______________ County, Montana.

- At the time of death, the value of the entire estate subject to probate, excluding the value of liens and encumrances, does not exceed the dollar limits specified by the Montana Small Estates Act.

- Thirty days have passed since the decedent's death.

- No application for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- I am the successor of the decedent (explain relationship) _____________________________________ or have legal authority to act on behalf of the decedent's successors.

- I have a legal right to collect the property described as follows: ____________________________________________________.

- All debts, including funeral and burial or cremation expenses, have been paid or otherwise provided for.

Under penalty of perjury, I declare that the statements made in this affidavit are true and correct to the best of my knowledge, information, and belief.

Signature: ____________________________ Date: ________________

Print Name: ___________________________

Subscribed and sworn to before me this _____ day of ______________, 20__.

Notary Public: ___________________________________

My commission expires: ___________________________

This Montana Small Estate Affidavit template is intended as a general guide and does not constitute legal advice. The requirements for a small estate affidavit may vary depending on specific circumstances, and it may be advisable to consult with a legal professional to ensure compliance with all applicable laws and procedural rules.

Document Details

| Fact Name | Detail |

|---|---|

| Governing Law | The Montana Small Estate Affidavit form is governed by Montana Code Annotated (MCA) Title 72, Chapter 3, Part 11. |

| Eligibility | To be eligible for the use of the Small Estate Affidavit in Montana, the total value of the estate must not exceed $50,000. |

| Waiting Period | There is a 30-day waiting period after the death of the decedent before the Small Estate Affidavit can be filed in Montana. |

| Property Types Included | The Small Estate Affidavit can be used for tangible personal property, including motor vehicles, and does not apply to real estate. |

How to Use Montana Small Estate Affidavit

The Montana Small Estate Affidavit is a useful document for those seeking to handle the estate of a deceased person without going through a lengthy probate process. This can be particularly beneficial when the estate in question falls below a certain value threshold. Filling out this document correctly is crucial, as it enables the transfer of property to the decedents’ rightful heirs smoothly. Here’s how to approach the task step by step, ensuring that each part of the form is completed accurately and in compliance with Montana state laws.

- Start with personal details by entering your full name and address in the designated sections of the form, identifying yourself as the affiant – the person who is completing the affidavit.

- Provide the full name and last address of the deceased, also known as the decedent, making sure to double-check the spelling and details for accuracy.

- List the date of the decedent’s passing, as this is critical for determining if the small estate process is applicable based on Montana law.

- Include a detailed description of the property that is part of the estate. Be as specific as possible, including account numbers, vehicle identification numbers, and descriptions of any personal items.

- Value the estate accurately. Montana law specifies a maximum value for the estate to qualify as "small". Calculate the total value of the property listed and ensure it falls below this threshold.

- Identify the rightful heirs or beneficiaries. Names, relationships to the decedent, and their respective shares of the estate should be listed clearly.

- Attach any required documents. This could include the death certificate of the decedent, testamentary letters, or other legal documents that support your claims.

- Sign and date the form in the presence of a notary public. The affidavit must be notarized to be legally valid and accepted by institutions or parties that hold the assets of the deceased.

- Submit the affidavit to the relevant institutions. This may include banks, the Montana Department of Motor Vehicles, or other entities that need the affidavit to release the decedent’s assets.

After the form is completed and submitted, the process of transferring the assets to the intended beneficiaries can begin. It's important to follow up with each institution to ensure they have processed the affidavit as required. This comprehensive approach ensures that the estate is settled efficiently, allowing those involved to focus on healing and moving forward.

Listed Questions and Answers

What is the Montana Small Estate Affidavit Form?

The Montana Small Estate Affidavit Form is a legal document used to facilitate the transfer of assets from a deceased person's estate to their heirs without a formal probate process. It is applicable when the total value of the estate does not exceed certain thresholds defined by Montana law. This form simplifies the handling of small estates, making it quicker and less costly for the heirs to access their inheritance.

Who can use the Montana Small Estate Affidavit Form?

This form can be used by the lawful heirs or designated representatives of a deceased person's estate, provided the total value of the estate meets the criteria for being considered "small" under Montana law. Typically, these are direct relatives, such as spouses, children, or parents, but can also include other beneficiaries named in the will.

What are the requirements to file a Small Estate Affidavit in Montana?

To file a Small Estate Affidavit in Montana, the estate must:

- Have a total value that does not exceed the amount specified by Montana law at the time of filing.

- Not include real estate as part of the estate assets.

- Have passed a certain amount of time since the decedent's death, as required by state law.

What assets can be transferred using the Montana Small Estate Affidavit Form?

Assets that can typically be transferred include:

- Personal property, such as vehicles, furniture, and jewelry.

- Bank accounts and other financial assets, provided they are not jointly owned.

- Stocks and bonds held in the decedent’s name exclusively.

How do you file a Small Estate Affidavit in Montana?

To file, the eligible person must:

- Complete the Montana Small Estate Affidavit Form with accurate information.

- Ensure the estate meets all criteria for a "small estate" under Montana law.

- Attach any required documentation, such as death certificates and asset statements.

- Submit the form and documents to the relevant institutions, like banks or the Department of Motor Vehicles, depending on the assets in question.

Is there a waiting period before filing the form in Montana?

Yes, Montana law requires a specific waiting period after the death of the estate holder before the Small Estate Affidavit can be filed. This period allows for the identification of all potential heirs and the settlement of any outstanding debts or claims against the estate.

Do you need a lawyer to file a Small Estate Affidavit in Montana?

While it is not a legal requirement to have a lawyer to file a Small Estate Affidavit in Montana, consulting with a legal professional can be beneficial. A lawyer can provide guidance on the process, ensure that all legal requirements are met, and help address any potential issues that might arise during the transfer of assets.

What happens after the Small Estate Affidavit is filed in Montana?

After the Small Estate Affidavit is filed, the institutions holding the assets (e.g., banks, brokerage firms) will process the affidavit and, upon verification, release the assets to the rightful heirs. It is the responsibility of the person who filed the affidavit to distribute the assets among the heirs according to the will or the state's succession laws if there is no will.

Common mistakes

When managing the affairs of a loved one who has passed away, the Montana Small Estate Affidavit form can simplify the legal process considerably. However, errors in filling out this form can delay the process, causing undue stress and potentially affecting the distribution of the estate. It's important to approach this task with a clear understanding to avoid common pitfalls. Here's a look at five mistakes people often make:

-

Not verifying eligibility criteria before proceeding. The estate must generally meet certain value limitations and other criteria specified under Montana law. Filing a Small Estate Affidavit without confirming the estate qualifies can result in unnecessary legal complications.

-

Inaccurate asset listing. All assets belonging to the estate should be listed accurately. This includes checking account balances, real estate values, and personal property estimates. Omitting assets or providing incorrect values might lead to disputes or challenges.

-

Failing to properly identify and notify heirs. It is critical to list all potential heirs and provide proper notification as required by law. Misidentifying heirs or neglecting to notify them can not only delay the process but also potentially lead to legal action against the estate.

Not obtaining or attaching required documentation. Depending on the estate's complexity and the specific assets involved, additional documentation such as death certificates, proof of account ownership, or appraisal documents may be necessary. These should be gathered and attached as required.

-

Overlooking the need for witnesses or notarization. Depending on the circumstances, the form may need to be signed in the presence of a notary and/or witnesses. Failing to comply with these requirements can invalidate the affidavit, necessitating a restart of the process.

Approaching the Montana Small Estate Affidavit form with diligence and attention to detail ensures a smoother, more efficient process for all involved. By avoiding these common mistakes, individuals can uphold the intentions of the deceased and uphold the law. If you’re unsure about any aspect of filling out this form, consider seeking legal advice to guide you.

Documents used along the form

In Montana, the process of settling small estates can be simplified with the use of a Small Estate Affidavit. This approach is often faster and less expensive than going through probate court. Alongside the Small Estate Affidavit, several other important documents may be required to effectively manage and settle a small estate. Understanding these documents is crucial for ensuring a smooth process.

- Certificate of Title: If the deceased owned a vehicle, a Certificate of Title is necessary to transfer ownership. This document proves the ownership of the vehicle and will need to be presented to the Montana Motor Vehicle Division along with the Small Estate Affidavit.

- Death Certificate: A certified copy of the death certificate is almost always required. It verifies the death of the person whose estate is being settled. Various institutions and agencies will request this document to process the transfer of assets or benefits properly.

- Real Property Deed: For estates that include real property such as land or homes, the deed to the property is crucial. This document is needed to confirm ownership and to transfer the property to the rightful heirs or beneficiaries as dictated by the Small Estate Affidavit.

- Account Statements: Financial institutions will often require the most recent account statements for any bank accounts, investments, or other assets held by the deceased. These statements help in determining the value of the estate and in facilitating the transfer of these assets to the heirs.

Each of these documents plays a key role in the administration of a small estate in Montana. Collectively, they help to ensure that property and assets are transferred efficiently and legally to the rightful beneficiaries. It is advisable for individuals to gather these documents promptly and to seek guidance when needed to navigate the process smoothly.

Similar forms

The Montana Small Estate Affidavit form is similar to other legal documents used in the administration of estates, although it serves a unique purpose in allowing the transfer of assets without formal probate. Specifically, it shares features with Transfer on Death Deeds (TODD) and Joint Tenancy with Right of Survivorship (JTWROS) agreements. Each of these documents facilitates the passing of assets upon death, but they operate under different circumstances and legal frameworks.

Like the Montana Small Estate Affidavit, a Transfer on Death Deed (TODD) allows property owners to name beneficiaries to whom the property will pass upon their death, bypassing the need for the property to go through probate. Both documents simplify the process of transferring assets to beneficiaries. However, while the small estate affidavit is used after someone has passed away to distribute their assets, a TODD is prepared and recorded before death, setting up a direct transfer upon death. This pre-planning tool is specific to real estate and does not apply to other types of assets.

Similarly, the concept of Joint Tenancy with Right of Survivorship (JTWROS) shares a common purpose with the small estate affidavit in terms of avoiding probate. In a JTWROS agreement, property is owned jointly by two or more parties in such a manner that upon the death of one joint tenant, the deceased tenant's interest in the property automatically transfers to the surviving joint tenants. This immediate transfer of property rights is akin to how assets can be quickly transferred to beneficiaries through a small estate affidavit. However, a JTWROS requires the property to be owned jointly from the start, and its application is limited to the co-owners, unlike the small estate affidavit, which can apply to various assets and does not require prior joint ownership.

Dos and Don'ts

Filling out the Montana Small Estate Affidavit form requires careful attention. To ensure a smooth process, here are crucial dos and don’ts to consider:

- Do verify that the estate's total value qualifies under Montana's small estate threshold.

- Do gather all necessary documents, such as the death certificate and any property titles, before starting the form.

- Do provide accurate and truthful information about the deceased’s assets, debts, and heirs.

- Do double-check the form for completeness and correctness before submitting it.

- Do not attempt to file the affidavit until 30 days have passed since the death, as Montana law requires this waiting period.

- Do not guess or omit information regarding the assets; ensure all values are estimated to the best of your ability.

- Do not forget to obtain and include the consent of all heirs, if applicable, as this may be required for the process.

Adhering to these guidelines will help facilitate a smoother, more efficient handling of the small estate process in Montana. Always remember to consult with a legal professional if you encounter uncertainties or complex issues during the process.

Misconceptions

Misconceptions about legal forms, including the Montana Small Estate Affidavit, can complicate the estate settlement process. Understanding these misconceptions can help individuals navigate the legal landscape more effectively. Here are six common misconceptions about the Montana Small Estate Affidavit form:

- It's a universal solution for all estates. The Montana Small Estate Affidavit form is not a one-size-fits-all solution. It is specifically designed for small estates in Montana, typically those under a certain value threshold and without real estate. Larger estates or those involving more complex assets may require formal probate proceedings.

- Completion of the form transfers property automatically. While filling out the form is a critical step, it does not instantly transfer property. The form must be submitted to the appropriate institutions or parties, such as banks or brokerage firms, to facilitate the transfer of assets.

- No court involvement is necessary. Although the process is designed to be simpler than formal probate, court involvement may still be necessary in certain situations. For example, if there's a dispute over the estate or if the affidavit does not get accepted by a financial institution, court intervention might be required.

- There are no limits on the types of assets that can be transferred. The Montana Small Estate Affidavit form is not applicable for all types of property. Certain assets, notably real estate and those governed by specific legal rules, might not be transferable using this form. Understanding the limitations is crucial for effective estate planning and execution.

- It avoids all taxes and fees. While the process may lead to lower costs compared to a full probate proceeding, it does not entirely eliminate possible taxes or fees associated with transferring the deceased's assets. Estate taxes, inheritance taxes, and other potential fees might still apply, depending on the nature and value of the assets.

- Legal advice is not necessary. Even for small estates, consulting with a legal professional can provide significant benefits. Legal advice might be crucial in understanding the nuances of the Small Estate Affidavit, ensuring compliance with all relevant laws, and addressing any unexpected complexities that arise during the process.

Dispelling these misconceptions is essential for anyone dealing with a small estate in Montana. While the Small Estate Affidavit form offers a streamlined process for certain estates, understanding its limitations and requirements is key to ensuring that the estate settlement process goes as smoothly as possible.

Key takeaways

The Montana Small Estate Affidavit form is an important document for those handling the estate of a deceased person without going through a formal probate process. It simplifies the way assets are distributed to rightful heirs when the total value of the estate meets certain criteria. Here are five key takeaways to understand when filling out and using this form:

- Eligibility Requirements: To use the Montana Small Estate Affidavit, the total value of the estate must not exceed a specific amount set by state law. Additionally, a certain time period must have passed since the death of the property owner.

- Necessary Information: Completing the form requires detailed information, including the deceased’s personal details, a list of assets, the names and addresses of the heirs, and any debts owed by the estate. Accuracy is crucial to avoid delays.

- Documentation: Along with the affidavit, it’s necessary to provide supporting documentation. This may include a certified copy of the death certificate and proof of the value of the estate assets.

- Legal Authority: Filing the affidavit grants legal authority to the person filing it to collect, manage, and distribute the assets of the estate according to Montana law and the wishes of the deceased, as outlined in their will, if available.

- Filing Procedure: The completed affidavit must be filed with the appropriate local court in Montana. Depending on the specifics of the estate, it may also need to be presented to financial institutions, government agencies, and others who hold the estate's assets.

Handling an estate through the Small Estate Affidavit can significantly streamline the process for eligible estates, reducing the need for lengthy and potentially costly probate proceedings. It’s a valuable tool for heirs and representatives, but it’s important to ensure all requirements are met and procedures correctly followed to facilitate a smooth transfer of assets.

Fill out Popular Small Estate Affidavit Forms for Different States

Small Estate Affidavit Georgia - It often necessitates the submission of a certified death certificate alongside the affidavit.

How to Avoid Probate in South Carolina - It represents a legally binding promise that no probate proceedings are necessary for the estate.

How Do I Get a Small Estate Affidavit in California? - The affidavit requires a detailed listing of the estate's assets, ensuring a clear division among beneficiaries.

How Long Does Probate Take Indiana - For those unsure about their ability to fill out the form accurately, legal aid societies can offer assistance and guidance.