Printable Small Estate Affidavit Form for Nebraska

When a loved one passes away in Nebraska, managing their estate can seem like a daunting task. Fortunately, for those situations where the deceased's estate is considered small by legal standards, the Nebraska Small Estate Affidinity form offers a simplified process. This document allows claimants to bypass lengthy probate proceedings, providing a more expedited means to distribute the deceased's assets to rightful heirs or beneficiaries. Essential to those seeking to utilize this form are the criteria defining a "small estate," which include the total value of the estate and the type of assets involved. Moreover, understanding who is eligible to file the affidavit, along with the specific information and documentation required, is crucial. The form not only streamlines the process of asset distribution but also ensures that claimants can handle affairs with clarity and legal backing. Designed to alleviate the burden on grieving families, the Nebraska Small Estate Affidavit is a valuable tool for efficiently dealing with the legal aspects of a loved one's passing.

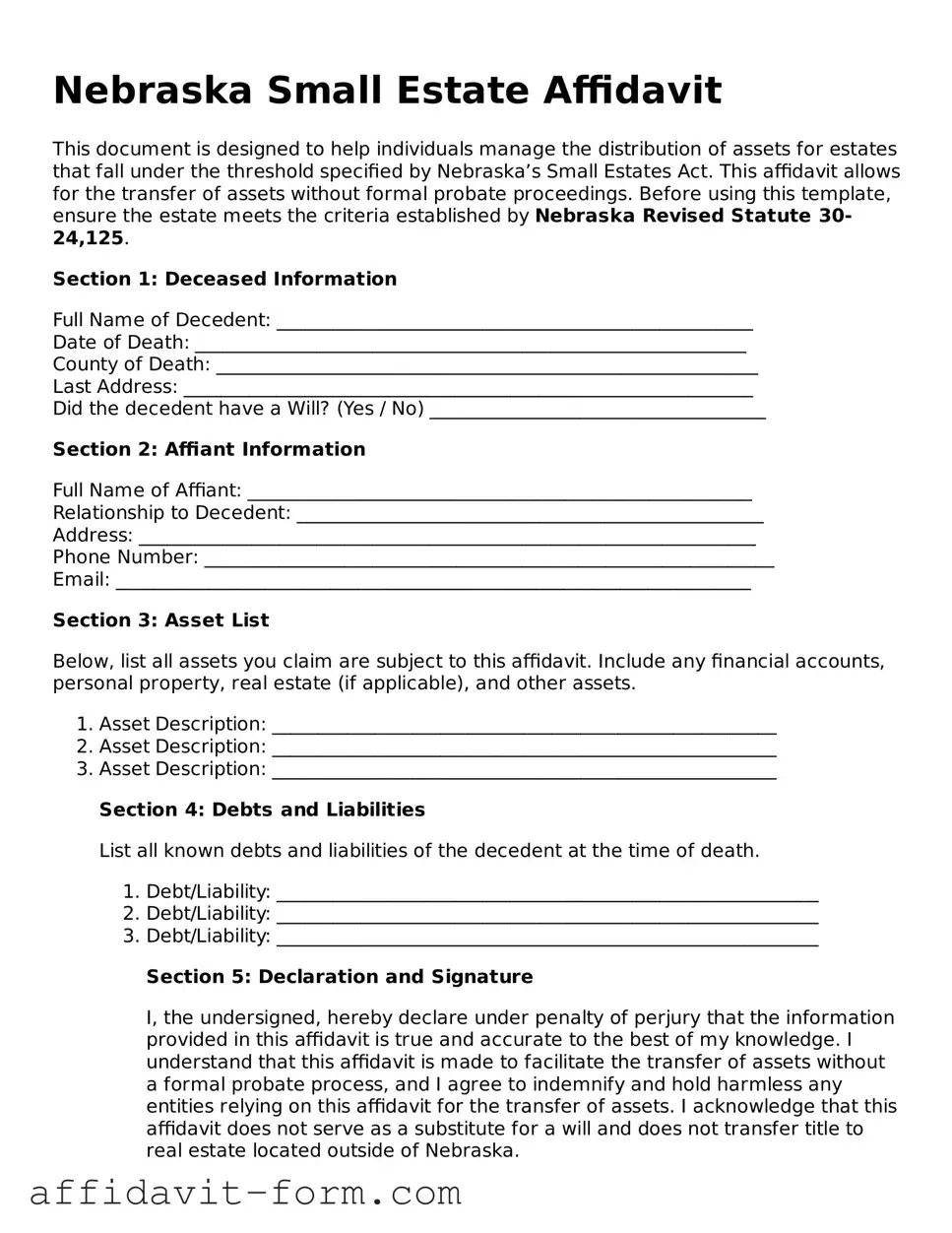

Form Example

Nebraska Small Estate Affidavit

This document is designed to help individuals manage the distribution of assets for estates that fall under the threshold specified by Nebraska’s Small Estates Act. This affidavit allows for the transfer of assets without formal probate proceedings. Before using this template, ensure the estate meets the criteria established by Nebraska Revised Statute 30-24,125.

Section 1: Deceased Information

Full Name of Decedent: ___________________________________________________

Date of Death: ___________________________________________________________

County of Death: __________________________________________________________

Last Address: _____________________________________________________________

Did the decedent have a Will? (Yes / No) ____________________________________

Section 2: Affiant Information

Full Name of Affiant: ______________________________________________________

Relationship to Decedent: __________________________________________________

Address: __________________________________________________________________

Phone Number: _____________________________________________________________

Email: ____________________________________________________________________

Section 3: Asset List

Below, list all assets you claim are subject to this affidavit. Include any financial accounts, personal property, real estate (if applicable), and other assets.

- Asset Description: ______________________________________________________

- Asset Description: ______________________________________________________

- Asset Description: ______________________________________________________

- Debt/Liability: __________________________________________________________

- Debt/Liability: __________________________________________________________

- Debt/Liability: __________________________________________________________

Section 4: Debts and Liabilities

List all known debts and liabilities of the decedent at the time of death.

Section 5: Declaration and Signature

I, the undersigned, hereby declare under penalty of perjury that the information provided in this affidavit is true and accurate to the best of my knowledge. I understand that this affidavit is made to facilitate the transfer of assets without a formal probate process, and I agree to indemnify and hold harmless any entities relying on this affidavit for the transfer of assets. I acknowledge that this affidavit does not serve as a substitute for a will and does not transfer title to real estate located outside of Nebraska.

Signature of Affiant: ____________________________________ Date: ________________

Printed Name: ___________________________________________

Notary Public

State of Nebraska)

)ss

County of ________________)

On this day, ________________ of ________________, 20____, before me,

______________________________________ (Notary public name), personally appeared

______________________________________ (Affiant name), known to me (or satisfactorily proven)

to be the person whose name is subscribed to in the foregoing affidavit, and acknowledged that they executed the same for the purposes contained therein.

Notary Signature: ____________________________________

Printed Name: ________________________________________

My Commission Expires: _______________________________

Document Details

| # | Fact | Description |

|---|---|---|

| 1 | Purpose | Used to expedite the process of distributing the assets of a deceased individual’s estate when it falls under a certain value threshold. |

| 2 | Governing Law | Nebraska Revised Statutes, specifically § 30-24,125 for small estates. |

| 3 | Eligibility Criteria | Estate value must not exceed $50,000 after deductions for debts and liens. |

| 4 | Waiting Period | Affidavit may be filed 30 days after the death of the decedent. |

| 5 | Required Documentation | A certified death certificate and an itemized list of the estate’s assets are needed. |

| 6 | Beneficiaries | Surviving spouses, children, or other lawful heirs may utilize this form under Nebraska law. |

| 7 | Asset Types Covered | |

| 8 | Filing Procedure | The completed affidavit, along with the required documents, must be presented to the entity holding the assets. |

| 9 | Legal Effect | The form authorizes the release of the decedent’s property without a formal probate proceeding. |

How to Use Nebraska Small Estate Affidavit

Completing the Nebraska Small Estate Affidavit form is a straightforward process designed to facilitate the transfer of assets for estates not exceeding the threshold set by state law. This process enables qualified individuals to manage the decedent's estate without formal probate, offering a simpler, faster method to distribute assets to rightful heirs or beneficiaries. The form requires detailed information about the decedent, their estate, and the claimant, so gathering all necessary documentation beforehand is crucial.

To fill out the Nebraska Small Estate Affidavit form correctly, follow these steps:

- Gather all required documents, including the death certificate of the deceased, a list of assets, and any outstanding debts.

- Read the form thoroughly to ensure understanding of what information is required.

- Enter the full legal name of the deceased in the designated section.

- Fill in the date of death as recorded on the death certificate.

- List all known assets of the deceased, including but not limited to bank accounts, vehicles, and real estate, along with their approximate values.

- Provide information regarding any debts or obligations of the estate, including funeral expenses or unpaid bills.

- Indicate the relationship of the affidavit to the deceased, confirming eligibility under state law to file this affidavit.

- Make sure to include your full legal name, address, and contact information where indicated.

- Review the affidavit carefully to ensure all the information provided is accurate and complete.

- Sign the affidavit in the presence of a notary public. Ensure the document is notarized, as this is required for the document to be legally binding.

Following these steps meticulously will help ensure the Small Estate Affidavit form is filled out correctly. Once completed and notarized, the document should be submitted to the relevant institution or agency as directed by Nebraska law, which may include banks, the Department of Motor Vehicles, or the County Court. Doing so is the next step towards the distribution of the decedent’s assets according to their wishes or the state’s succession laws.

Listed Questions and Answers

What is the Nebraska Small Estate Affidavit?

A Nebraska Small Estate Affidavit is a legal document that allows the heirs of a deceased person (the decedent) to collect the decedent's assets without a formal probate process. It can be used when the total value of the decedent's estate does not exceed a certain amount specified by Nebraska law.

Who can file a Nebraska Small Estate Affidact?

An affidavit can be filed by the surviving spouse, a descendant, or an heir of the decedent. Additionally, creditors or individuals entrusted by the heirs to act on their behalf may also file the affidavit if they meet certain criteria established by state law.

What are the requirements for filing a Small Estate Affidavit in Nebraska?

To file a Small Estate Affidavit in Nebraska, the following criteria must be met:

- The total value of the decedent's estate does not exceed $50,000.

- Thirty days have passed since the death of the decedent.

- No application or petition for appointment of a personal representative is pending or has been granted in any jurisdiction.

What information is needed to complete the Small Estate Affidavit?

To complete a Small Estate Affidavit, you will need:

- The full legal name and address of the decedent.

- The date of death of the decedent.

- A detailed list of the decedent’s assets that are subject to the affidavit procedure.

- The name, relationship, and addresses of the legal heirs.

- The value of the estate’s personal property and real estate, if applicable.

How is the Nebraska Small Estate Affidavit filed?

The Small Estate Affidavit is filed with the county court in the county where the decedent resided at the time of their death or where the decedent's property is located. The person filing must swear to the truthfulness of the information provided in the affidavit and typically must provide a death certificate along with the affidavit.

What happens after filing the Small Estate Affidavit?

Once the affidavit is properly filed, the person who filed it is given the authority to collect the decedent's assets as described in the affidavit. They are responsible for distributing those assets to the rightful heirs according to the laws of Nebraska. It's important to note that the person collecting the assets may be held liable to the decedent's creditors to the extent of the value of the assets collected.

Common mistakes

Filling out the Nebraska Small Estate Affidavit form seems straightforward, but the devil is often in the details. This document is pivotal for those handling the distribution of assets from an estate that falls under Nebraska's threshold for probate. However, common errors can delay this process, leading to unnecessary headaches and delays. Here's a closer look at nine missteps to avoid.

-

Not waiting the required period. Nebraska law stipulates a waiting period after the decedent's death before an affidavit can be filed. Overlooking this timeframe is a common pitfall that can invalidate your submission.

-

Misunderstanding the value threshold. The state sets a maximum value for estates eligible for the small estate process. Incorrectly appraising the estate's value or misunderstanding these limits can result in rejection.

-

Failing to attach necessary documents. Essential documents, like the death certificate or proof of entitlement to the assets, are often overlooked but are crucial for the form's acceptance.

-

Incorrectly identifying assets. Assets need to be clearly and accurately listed. This includes distinguishing between probate and non-probate assets, a distinction that is frequently misunderstood.

-

Forgetting to detail debts. Outstanding debts of the estate must be listed in the affidavit. Failure to do so can complicate or delay the process.

-

Omitting signatures. All required parties must sign the affidavit. Missing signatures are a simple but critical error that can render the document non-submissible.

-

Overlooking the notarization requirement. This form must be notarized to be valid. Skipping this step is a mistake that can stall the entire process.

-

Providing incomplete information about the decedent. Full and accurate details about the deceased, such as their full legal name and date of death, are essential. Incompleteness here can lead to processing delays.

-

Ignoring subsequent legal requirements. Successfully filing the affidavit is not the end. There may be additional steps required by the state, such as filing with specific government offices or notifying creditors, which are often overlooked.

Avoiding these common errors can smooth the path toward settling small estates under Nebraska law. It underscores the importance of careful attention to detail and a thorough understanding of legal requirements. When in doubt, seeking legal guidance can prevent these and other potential mistakes.

Documents used along the form

When handling a small estate in Nebraska, the Small Estate Affidavit form simplifies the process of transferring the deceased's property to their rightful heirs. However, to ensure that the procedure runs smoothly and all legal requirements are satisfied, other forms and documents may be necessary alongside the Small Estate Affidivate. Understanding these documents and their functions can provide valuable guidance during what is often a difficult time.

- Certified Copy of the Death Certificate: This document is essential for legal and financial processes following a death, serving as proof of death for the estate proceedings.

- Copy of the Will: If the deceased left a will, it specifies the decedent’s wishes regarding the distribution of their estate. Even in the case of a small estate affidavit, having a copy of the will can clarify the intentions of the deceased.

- Letters of Administration or Letters Testamentary: These documents are issued by the court, authorizing an individual to act on behalf of the deceased’s estate, essential for estates that require formal probate.

- Notice to Creditors: When handling an estate, it's often necessary to notify any potential creditors of the decedent’s passing and the ongoing estate proceedings, providing them with an opportunity to claim debts owed by the deceased.

- Inventory of Assets: This document lists all assets within the estate. It is helpful in determining whether the estate qualifies as "small" under Nebraska law and for equitable distribution to heirs.

- Waiver of Bond: This form may be used if the appointed representative is required to post a bond (a form of insurance for the estate) and beneficiaries agree to waive this requirement.

- Receipts of Distribution: After the estate’s assets are distributed, recipients may be asked to sign receipts. These provide a record that the heirs received their share of the estate, closing the distribution process.

Each of these documents plays a vital role in managing and finalizing a small estate, ensuring that the process adheres to the law while honoring the wishes of the deceased. Navigating through these steps can be challenging, but understanding the purpose and importance of each document can make the process more manageable. It's always advisable to seek legal assistance to ensure all requirements are met and to provide support and guidance throughout the estate administration process.

Similar forms

The Nebraska Small Estate Affidavit form is similar to other legal documents used to manage and settle small estates without the need for a lengthy probate process. This form simplifies the transfer of assets to rightful heirs or beneficiaries when an estate falls under a certain value threshold. It shares key characteristics with documents like the Transfer on Death Deed (TODD) and the Payable on Death (POD) account designation, providing a means to expedite the distribution process in specific circumstances.

Transfer on Death Deed (TODD): The Transfer on Death Deed allows property owners to name beneficiaries who will receive the property upon the owner’s death, bypassing the probate process. Like the Nebraska Small Estate Affidavit, TODDs serve to simplify the transfer of assets. However, while the Small Estate Affidavit applies to various types of property within an estate that meets the small estate criteria, TODDs are exclusively for real estate. Both documents facilitate a smoother transition of assets to beneficiaries but are used for different types of property under distinct conditions.

Payable on Death (POD) Account Designation: This designation is often used with bank accounts, allowing account holders to specify beneficiaries who will receive the funds in the account upon the holder's death. Similar to the Nebraska Small Estate Affidavit, the POD designation aims to streamline the process of transferring assets to beneficiaries without going through probate. Both mechanisms are designed to make the transfer of small amounts of assets simpler and quicker. However, the Small Estate Affidaidat can encompass a broader range of assets within an estate, while POD designations are specific to financial accounts.

Dos and Don'ts

When dealing with the complexities of the Nebraska Small Estate Affidavit form, attention to detail is both a necessity and a virtue. This document has considerable legal sway, guiding the distribution of assets for estates not exceeding a certain value threshold. Below are pointedly curated dos and don'ts that significantly impact the ease and legality of your filing process.

- Do ensure that the estate in question qualifies under Nebraska's small estate threshold. This pre-requisite must be confirmed before any documentation is initiated.

- Do meticulously gather and prepare all necessary documents that substantiate the assets and liabilities of the estate. This preparation includes bank statements, property deeds, and outstanding bills, among others.

- Do accurately identify and list all potential successors to the estate, adhering to the hierarchy established by Nebraska law.

- Do verify that you are legally authorized to act on behalf of the estate, an essential step to ensure the legitimacy of your actions and the affidavit.

- Do take your time when filling out the form, corroborating every detail for accuracy to sidestep potential legal pitfalls down the line.

- Don't overlook the requirement to provide a full accounting of the estate’s assets. This oversight can lead to legal complications and delays in the disbursement of the estate.

- Don't attempt to file the affidavit until you’ve waited the legally specified period following the decedent's death. This waiting period is crucial for compliance with Nebraska statutes.

- Don't misrepresent any facts or figures on the form. Integrity in reporting is paramount in legal documents, and any falsification can have severe consequences.

- Don't hesitate to seek legal assistance if any aspect of the small estate process is unclear. Professional advice can prevent errors and ensure that the affidavit reflects the true intentions for the estate’s distribution.

Misconceptions

The Nebraska Small Estate Affidavit form is often misunderstood. Here are nine common misconceptions about this legal document and the truths behind them.

- It's only for vehicles. While the form can be used to transfer ownership of vehicles, it's also applicable to other personal property, including bank accounts, stocks, and tangible items, as long as the total value meets the state's specified threshold.

- There's no value limit. In fact, Nebraska has a specific threshold for the total value of the decedent's estate that can be transferred using this affidavit. The estate must not exceed a certain dollar amount, as defined by state law.

- It avoids probate completely. Using the Small Estate Affidavit can simplify the process and may negate the need for a full probate. However, it does not remove all aspects of probate. Some assets might still require formal probate proceedings.

- Anyone can file it. Not everyone is eligible to file the Small Estate Affidavit. Typically, it must be a surviving spouse, next of kin, or a person named in the will (if there is one) who can file the affidavit, following state guidelines.

- It transfers real estate. The Nebraska Small Estate Affidavit does not permit the transfer of real estate. It applies only to personal property. A different legal process is required for transferring real estate.

- Immediate access to assets is granted. Even though this process is faster than a traditional probate, there is still a required waiting period before the assets can be distributed. This period allows for the filing of any claims against the estate.

- A lawyer is required. Legal counsel can be helpful, especially in complex cases, but it's not mandatory to have a lawyer to complete or file a Small Estate Affidavit in Nebraska. Guidance is provided by the state for individuals choosing to proceed without an attorney.

- It's a public record. While the affidavit does become part of the public record once filed, certain personal information is protected and kept confidential, ensuring a degree of privacy for the estate and its beneficiaries.

- No tax obligations exist. Filing a Small Estate Affidacy does not exempt the estate from tax obligations. The person handling the estate must ensure all applicable taxes are paid, including any estate or inheritance taxes, if they apply.

Key takeaways

Filling out and utilizing the Nebraska Small Estate Affidavit form is a streamlined process designed to help individuals handle a deceased person's estate when it falls under a certain value. Here are key takeaways to guide you through this process:

- Eligibility is determined by the total value of the estate not exceeding $50,000, not including certain assets.

- At least 30 days must have passed since the death of the estate owner before the affidavit can be submitted.

- The person filling out the form must swear to the truthfulness of the information provided, under penalty of perjury.

- No probate court proceeding is necessary if the requirements for a small estate are met, streamlining the process substantially.

- It's essential to accurately list all assets and their estimated value as part of the affidavit to ensure legality.

- Debts and taxes owed by the estate must still be paid from the estate's assets before distribution to heirs.

- The affidavit can be used to collect assets, such as bank accounts, owed wages, and personal property belonging to the deceased.

- A successor – typically a close family member or heir – must be named in the affidavit who is entitled to receive the estate's assets.

- Witness signatures may be required to validate the affidavit, depending on the financial institutions or entities releasing assets.

- Once completed and accepted, the affidavit serves as official documentation granting the right to collect and distribute the deceased's assets.

- Filing fees for the affidavit are relatively low, making this a cost-effective option for eligible estates.

Understanding and following the guidelines for the Nebraska Small Estate Affidomain Affidavit can significantly simplify the estate settlement process for small estates. This enables families to bypass the often lengthy and costly probate process, easing the burden during a difficult time.

Fill out Popular Small Estate Affidavit Forms for Different States

How Much Does a Small Estate Affidavit Cost - Designed for simplicity, this affidavit allows for the direct distribution of a deceased's assets, ensuring a streamlined approach for small estates.

How to File Probate Without a Lawyer - For individuals entitled to inherit personal property or sums of money, this document serves as a direct path to claim their inheritance.