Printable Small Estate Affidavit Form for Nevada

When someone passes away with a relatively small amount of assets, their loved ones can face the challenging task of settling their estate. In Nevada, a tool designed to simplify this process is the Small Estate Affidavit form. This document enables heirs to collect the deceased person's assets without going through the often lengthy and costly probate process. It's applicable when the total value of the estate meets the criteria set by Nevada law, currently defined as estates valued below a specific threshold. By completing this form, claimants can access funds in bank accounts, transfer titles, and manage other assets straightforwardly. The form requires detailed information about the deceased, the assets in question, and the legal heirs. It serves as a testament to the rightful ownership of the estate's assets, providing a streamlined way to settle small estates with efficiency and less bureaucracy.

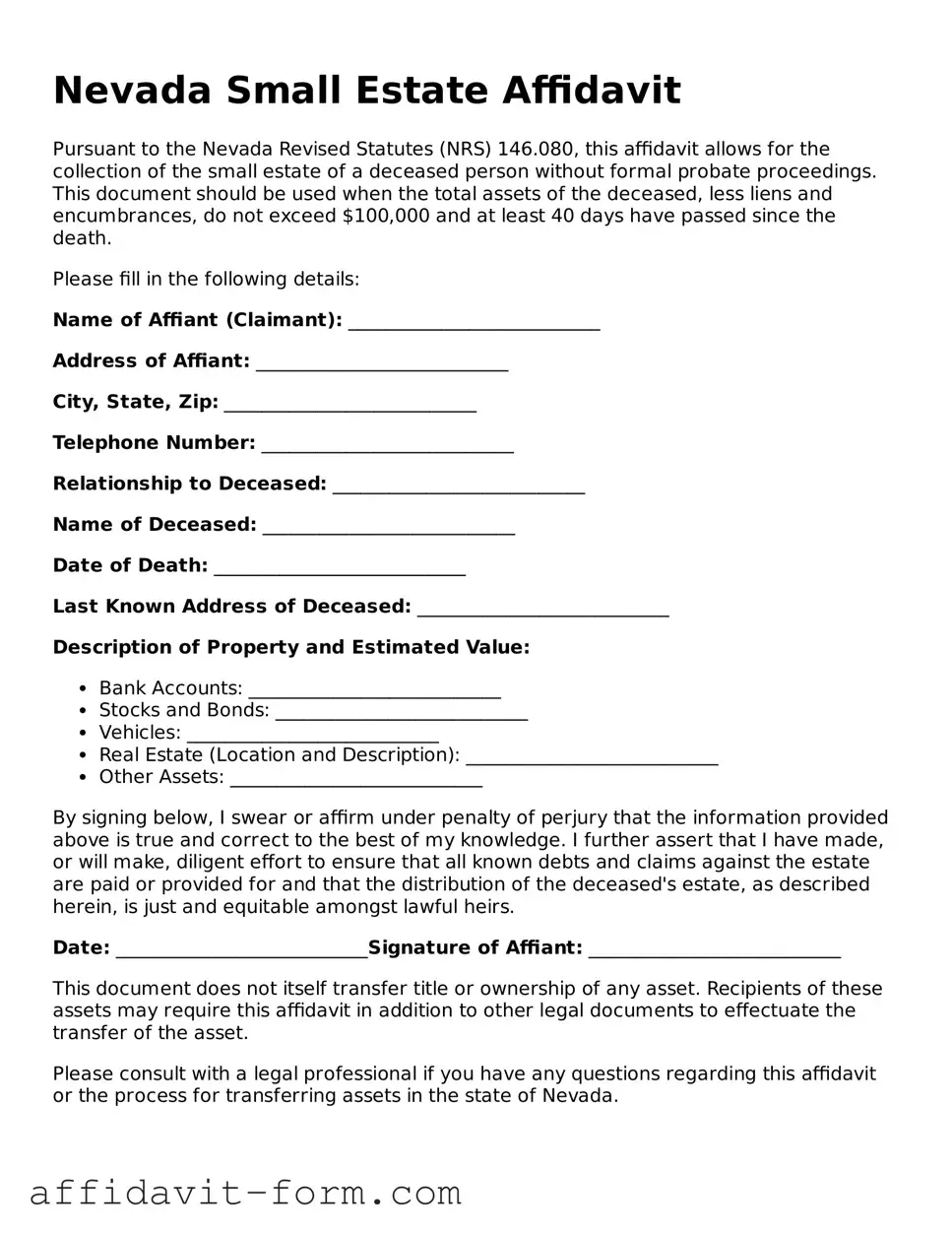

Form Example

Nevada Small Estate Affidavit

Pursuant to the Nevada Revised Statutes (NRS) 146.080, this affidavit allows for the collection of the small estate of a deceased person without formal probate proceedings. This document should be used when the total assets of the deceased, less liens and encumbrances, do not exceed $100,000 and at least 40 days have passed since the death.

Please fill in the following details:

Name of Affiant (Claimant): ___________________________

Address of Affiant: ___________________________

City, State, Zip: ___________________________

Telephone Number: ___________________________

Relationship to Deceased: ___________________________

Name of Deceased: ___________________________

Date of Death: ___________________________

Last Known Address of Deceased: ___________________________

Description of Property and Estimated Value:

- Bank Accounts: ___________________________

- Stocks and Bonds: ___________________________

- Vehicles: ___________________________

- Real Estate (Location and Description): ___________________________

- Other Assets: ___________________________

By signing below, I swear or affirm under penalty of perjury that the information provided above is true and correct to the best of my knowledge. I further assert that I have made, or will make, diligent effort to ensure that all known debts and claims against the estate are paid or provided for and that the distribution of the deceased's estate, as described herein, is just and equitable amongst lawful heirs.

Date: ___________________________Signature of Affiant: ___________________________

This document does not itself transfer title or ownership of any asset. Recipients of these assets may require this affidavit in addition to other legal documents to effectuate the transfer of the asset.

Please consult with a legal professional if you have any questions regarding this affidavit or the process for transferring assets in the state of Nevada.

Document Details

| Fact Number | Detail |

|---|---|

| 1 | The Nevada Small Estate Affidavit form enables the transfer of a deceased person's assets without a formal probate process when the total value of the estate meets specific criteria. |

| 2 | To be eligible, the total value of the deceased person's estate must not exceed $100,000 for personal property and $25,000 for vehicles. |

| 3 | The form requires detailed information about the deceased, their assets, and the claimant, ensuring a thorough legal document. |

| 4 | This affidavit can be used 40 days after the death of the estate owner, allowing for a swift transfer of assets to rightful heirs or claimants. |

| 5 | Governing laws for the Nevada Small Estate Affidavit form include Nevada Revised Statutes sections 146.080 for personal property and 482.092 for vehicles. |

| 6 | Submitting this affidavit effectively releases the assets held by banks, financial institutions, or any party having possession of the deceased's property to the claimant, bypassing lengthy legal processes. |

How to Use Nevada Small Estate Affidavit

Completing the Nevada Small Estate Affidavit form is a necessary step for legally claiming assets from a small estate in Nevada without going through a formal probate process. This procedure is designed for situations where the deceased person's estate is below a certain threshold, making it a simpler and faster method to distribute assets to rightful heirs or beneficiaries. Understanding and accurately completing this form is crucial for a smooth and effective transfer of assets, ensuring that all legal requirements are met. Here are the steps needed to fill out the form:

- Gather necessary documents: Before you start, collect all required information, including the death certificate of the deceased, a list of all assets, and documentation proving your right to claim the assets.

- Identify the appropriate form: Ensure you have the correct version of the Nevada Small Estate Affidavit form for your situation. This can usually be found on the Nevada court's website or by contacting the local court clerk's office.

- Fill in the decedent's details: Enter the full name and last known address of the deceased person, as well as the date and place of death.

- Describe the assets: List all assets you are claiming through the affidavit, including any real estate, vehicles, bank accounts, and personal property. Be specific and use exact values when possible.

- Calculate the estate's value: Determine the total value of the estate, ensuring that it does not exceed the threshold specified by Nevada law for small estates.

- Identify the successors: List the names, relationships, and addresses of all legal heirs or beneficiaries entitled to the assets under Nevada law.

- Provide your information: Include your full name, address, and relationship to the deceased, identifying yourself as the affidavit's claimant.

- Review and sign: Carefully read through the affidavit to ensure all information is accurate and complete. Then, sign the form in front of a notary public. Remember, providing false information on this form is punishable by law.

- File the affidavit: Submit the completed affidavit and any required attachments to the relevant institution holding the assets, such as the bank or Department of Motor Vehicles. Some situations may also require you to file the form with the local probate court.

- Follow up: After submission, stay in contact with the institution or court to confirm the transfer of assets and address any further requirements or questions that may arise.

Following these steps should facilitate a straightforward process for utilizing the Nevada Small Estate Affidavit. While the form itself is designed to simplify the transfer of assets for small estates, ensuring every step is carefully and accurately completed is essential for the swift and lawful distribution of the deceased person's property. Should complexities or questions arise during this process, seeking legal guidance is advisable to navigate any challenges effectively.

Listed Questions and Answers

What is a Nevada Small Estate Affidavit?

A Nevada Small Estate Affidavit is a legal document used to settle small estates without going through a formal probate process. It allows the transfer of the decedent's assets to their rightful heirs or beneficiaries if the total value of the estate falls below a certain threshold, as defined by Nevada law.

Who can use a Nevada Small Estate Affidavit?

Under Nevada law, the following parties may be eligible to use a Small Estate Affidavit:

- Spouses and domestic partners

- Children or other direct heirs

- Legally appointed guardians or executors, if designated in a will

What is the value limit for using a Small Estate Affididavit in Nevada?

The value limit for using a Small Estate Affidavit in Nevada changes over time. As of the current guidelines, the estate's total value, excluding certain types of property like vehicles, cannot exceed $100,000. To get the most accurate and current limit, checking with a legal expert or the local probate court is recommended.

What assets can be transferred using a Small Estate Affidavit in Nevada?

Not all assets can be transferred using a Small Estate Affidavit. Generally, the following types of property can be included:

- Personal property like clothing, jewelry, and furniture

- Bank accounts that were solely owned by the deceased

- Securities such as stocks and bonds

How does one obtain a Small Estate Affidavit form in Nevada?

The Small Estate Affidavit form can be obtained from several sources in Nevada, including:

- Local probate courts

- Online legal form providers

- Attorneys who specialize in estate planning or probate law

What information is required to fill out the Small Estate Affidavit?

To fill out the Small Estate Affidavit, you will need to provide:

- The full legal name and address of the deceased

- The date of death

- A detailed list of all assets included in the estate

- The estimated value of each asset

- The names and addresses of all heirs or beneficiaries

Is a lawyer required to use a Small Estate Affidavit in Nevada?

While a lawyer is not strictly required to use a Small Estate Affidavit in Nevada, consulting with one is highly recommended. A legal expert can provide guidance on whether this process is appropriate for your situation, help with accurately completing the form, and ensure compliance with all legal requirements.

Once the Small Estate Affidavit is completed, it must be presented to the entity holding the assets, such as a bank or brokerage. The form, often accompanied by a death certificate, authorizes the release of the decedent's assets to the affidavit's signer. It is up to the institution's policies whether additional documentation is required.

What is the timeline for using a Small Estate Affidavit after death in Nevada?

In Nevada, a Small Estate Affidavit can typically be filed 40 days or more after the individual has passed away. This waiting period allows for the necessary documents, like the death certificate, to be obtained and for the estate's value to be accurately assessed.

Can a Small Estate Affidavit be contested or challenged in Nevada?

Yes, a Small Estate Affidavit can be contested or challenged in Nevada, just like any other legal process related to estate settlement. If someone believes they have been wrongfully excluded from the estate or disputes the affidavit's accuracy, they may bring their concerns to the probate court for resolution.

Common mistakes

When managing the distribution of a small estate in Nevada, utilizing the Small Estate Affidavit form can simplify the process significantly. However, careful attention is needed to avoid common mistakes that can complicate or invalidate the procedure. Below are four frequently made errors by individuals when filling out this document:

-

Not verifying eligibility for using the form - Before proceeding, it's crucial to ensure that the estate in question meets Nevada's criteria for being considered "small." These criteria include the total value of the estate not exceeding a certain threshold. Many overlook this step, leading to potential rejection of the affidavit.

-

Incorrect listing of assets - Often, there is a misunderstanding about what constitutes an asset or how to properly list them on the form. This includes forgetting to include certain assets or inaccurately describing them, which can result in legal complications or delays in the distribution process.

-

Omitting necessary documentation - The affidavit requires accompanying documentation, such as death certificates and proof of the right to claim the asset, to be considered valid. Failure to attach these documents or submitting incomplete records can lead to the affidavit being denied.

-

Failure to properly distribute the estate according to Nevada law - The form must reflect an understanding of Nevada's laws on estate distribution. Mistakes in this area include improperly allocating assets or neglecting legal heir rights, which can nullify the affidavit or result in legal challenges.

Avoiding these mistakes requires diligence, a clear understanding of Nevada's laws, and attention to detail when completing the Small Estate Affidavit form. It's often advisable to seek legal guidance to ensure that the process is handled correctly and efficiently, ensuring a smooth transfer of assets to the rightful heirs or claimants.

Documents used along the form

When dealing with a small estate in Nevada, filling out a Small Estate Affidavit form is a common step to help transfer assets of a deceased person to their rightful heirs without going through a formal probate process. This form is pivotal but often just one part of a larger collection of necessary documents. These documents can help ensure that all financial, legal, and personal affairs of the deceased are settled according to Nevada law. Here’s a list of other forms and documents frequently used in conjunction with the Nevada Small Estate Affidavit form.

- Death Certificate: A certified copy of the death certificate is essential. It serves as an official record of death and is required by financial institutions and courts to prove the death of the decedent.

- Copy of the Will: If the deceased left a will, a copy is necessary to ensure the estate is distributed according to their wishes. It also identifies the executor and beneficiaries.

- Inventory of Assets: A detailed list of the assets belonging to the estate helps in determining if the estate qualifies as "small" under Nevada law and aids in the proper distribution of assets.

- Debts and Liabilities Statement: Documentation of any outstanding debts or liabilities the estate needs to settle before distribution to heirs or beneficiaries.

- Tax Documents: These could include the decedent’s final income tax return, estate tax forms, and any other relevant tax documents necessary for settling the estate’s tax responsibilities.

- Property Titles and Deeds: For real estate or vehicles owned by the deceased, titles and deeds are necessary to transfer ownership to the heirs or sell the property.

- Bank Account Statements: These are crucial for identifying the assets of the deceased held in banks. They are used to access and distribute funds according to the affidavit and any existing will.

Gathering these documents in addition to completing the Nevada Small Estate Affidavit form is a critical step in successfully managing a small estate. Each document plays a specific role in clarifying the estate's scope, the decedent’s wishes, and the legal requirements for asset distribution. Careful preparation and attention to detail in this process can help minimize stress and confusion during a challenging time.

Similar forms

The Nevada Small Estate Affidavit form is similar to other legal documents that streamline the process of asset transfer upon death. These documents vary in their applicability and requirements based on the state's law and the nature of the assets. While the Nevada Small Estate Affidavit serves a specific purpose in Nevada, it closely resembles Transfer on Death Deeds (TODDs) and Payable on Death (POD) account forms in its function and objectives.

Transfer on Death Deeds (TODDs): This legal document allows property owners to name a beneficiary who will inherit their property after they die without the need for a formal probate process. Like the Nevada Small Estate Affidavit, TODDs simplify the transfer of assets, specifically real estate, directly to beneficiaries. Both documents avoid probate, but while the Small Estate Affidavit is used for estates under a certain value threshold, TODDs are specifically designed for real estate and do not have a value limit.

Payable on Death (POD) account forms: These forms are used by financial institutions to allow account holders to designate beneficiaries for assets like bank accounts and certificates of deposit. Similar to the Nevada Small Estate Affidavit, POD forms enable assets to bypass the probate process and go directly to named beneficiaries upon the account holder's death. The key similarity lies in the avoidance of prolonged legal proceedings, providing a straightforward method for transferring assets. However, unlike the Small Estate Affidavit, POD forms are exclusively for financial accounts and do not cover personal property or real estate.

Dos and Don'ts

When managing the Nevada Small Estate Affidavit form, it is critical to approach the process with attentiveness and precision. The goal is to ensure that the document accurately reflects the particulars of the small estate in question. Below are essential do's and don'ts to consider:

- Do review the eligibility requirements for a small estate in Nevada thoroughly to confirm the estate qualifies under state law.

- Do gather all necessary information about the deceased's assets, debts, and intended beneficiaries before filling out the form to ensure accuracy.

- Do double-check the form for specific filing instructions, including whether it needs to be notarized or witnessed, which can vary from one jurisdiction to another within Nevada.

- Do ensure that all provided information is truthful and accurate to the best of your knowledge, as providing false information can have serious legal consequences.

- Do retain a copy of the filed affidavit for your records and provide copies to relevant financial institutions or entities as required.

- Don't attempt to use the Small Estate Affidavit form to transfer assets that do not qualify under Nevada's small estate criteria.

- Don't fill out the form in haste; take your time to read and understand each section to prevent errors that could delay the process.

- Don't forget to report all known debts of the decedent, as failing to do so could lead to legal complications with creditors later on.

- Don't hesitate to consult with a legal professional if you encounter any uncertainties or complexities during the preparation of the form. Understanding the nuances of estate law can be challenging, and professional guidance can help ensure the process is completed correctly.

Misconceptions

When discussing the Nevada Small Estate Affidavit form, several misconceptions may arise due to its legal nature and the procedural nuances associated with estate management. Understanding these misconceptions can help individuals navigate the process more effectively.

The form is universally applicable for all small estates in Nevada. This is a significant misunderstanding. The applicability of the Small Estate Affidavit in Nevada depends on the total value of the deceased's estate. Nevada law specifies a threshold that the estate must not exceed for the form to be used, which is subject to periodic updates.

It circumvents the need for probate entirely. While the Small Estate Affidavit is designed to simplify the settlement of small estates, it does not eliminate the need for probate in every situation. If the estate includes certain types of assets or if disputes arise, probate proceedings may still be necessary.

The form grants immediate access to all of the decedent’s assets. Even with a completed Small Estate Affidavit, accessing the decedent's assets may require additional steps, such as notifying banks and transferring titles, which can take time.

Any family member can file the affidavit. Nevada law specifies which individuals may file the Small Estate Affidavit, typically prioritizing spouses, children, or other close relatives in a particular order of priority. It’s not a free-for-all for any family member.

Filing the form is the final step in the process. The completion and filing of the Small Estate Affidavit are integral parts of managing a small estate. However, the filer also needs to ensure proper distribution of assets according to the affidavit and state law.

There is no time limit for filing the affidavit. Contrary to this belief, Nevada law imposes a waiting period after the decedent's death before the affidavit can be filed. This period allows for all claims against the estate to emerge.

Using the affidavit avoids estate taxes. The use of a Small Estate Affidavit does not inherently protect an estate from federal or state taxes. Tax liability depends on the value of the estate and specific tax laws in effect at the time.

The form is simple and requires no legal guidance to complete. While designed to be less complex than full probate proceedings, completing a Small Estate Affidavit accurately requires careful attention to detail and understanding of the relevant laws. Legal advice can be crucial, especially in complicated estates.

Filling out the affidavit immediately transfers property to the beneficiaries. The affidavit is a statement to authorities about the estate's eligibility for small estate processing. Transferring property titles, especially for real estate, may require additional steps and documentation.

Dispelling these misconceptions can assist individuals in managing their expectations and responsibilities when handling a small estate in Nevada. It is always advisable to consult with a legal professional to navigate the specifics of estate law and ensure compliance with all legal requirements.

Key takeaways

Filling out and using the Nevada Small Estate Affidavit form is an important process for individuals managing the estate of a deceased person in Nevada, particularly when the estate is considered small by legal standards. Here are key takeaways to keep in mind:

- Eligibility: The estate must meet specific criteria to qualify as a "small estate" under Nevada law. This usually involves the total value of the estate not exceeding a certain threshold.

- Assets: Only certain types of assets can be transferred using the Small Estate Affidavit. These typically exclude real estate and are limited to personal property, bank accounts, and securities.

- Value Assessment: An accurate assessment of the estate's value is crucial. This should reflect the fair market value of the assets at the time of the decedent's death.

- Waiting Period: Nevada law may require a waiting period after the death before the Small Estate Affidavit can be filed. This period is intended to ensure all debts and claims against the estate are identified.

- Documentation: Filling out the form accurately is essential. This includes providing complete information about the deceased, the assets involved, and the rightful heirs or beneficiaries.

- Avoidance of Probate: Using a Small Estate Affidavit can often bypass the need for formal probate, simplifying the process and reducing the time and expense involved in distributing the estate.

- Liability: Persons signing the affidavit may be held responsible if the information provided is incorrect or if they improperly distribute the assets.

- Filing Location: The affidavit typically needs to be filed in the county where the decedent lived or where the property is located.

- Legal Advice: Seeking legal advice is advisable to ensure compliance with Nevada law and to navigate any potential complexities involved in filing the affidavit.

- Updates: Laws and regulations governing small estates and the use of affidavits can change. Keeping informed of any updates to Nevada law is important to ensure the process is handled correctly.

Fill out Popular Small Estate Affidavit Forms for Different States

Texas Small Estate Affidavit Pdf - Beneficiaries must ensure they follow the correct legal process, including properly distributing any owed debts from the estate before asset allocation.

Iowa Probate Laws - This document is a compassionate consideration by the legal system, allowing heirs to avoid prolonged probate proceedings in the case of small or uncomplicated estates.

Small Estate Affidavit Georgia - It helps avoid the potential complexities and costs associated with traditional probate proceedings.