Printable Small Estate Affidavit Form for New Hampshire

The process of managing a loved one's estate after their passing can be a significant responsibility, often fraught with complexity and emotional challenges. When an estate is smaller and does not meet the thresholds that necessitate formal probate proceedings, New Hampshire offers a simpler, less time-consuming alternative through the Small Estate Affidavit form. This legal document facilitates the distribution of assets to rightful heirs without the need for a protracted court process. It is specifically designed for estates that fall below a certain value, making it an invaluable resource for families seeking a straightforward path to settle the financial affairs of the deceased. Understanding the key aspects of this form, including when it is applicable, the specific criteria it requires, and the step-by-step process for its completion and submission, is crucial for individuals navigating the aftermath of a loss. By providing a streamlined method for asset distribution, the Small Estate Affidavit form represents a compassionate acknowledgement of the need for a more accessible resolution during such difficult times.

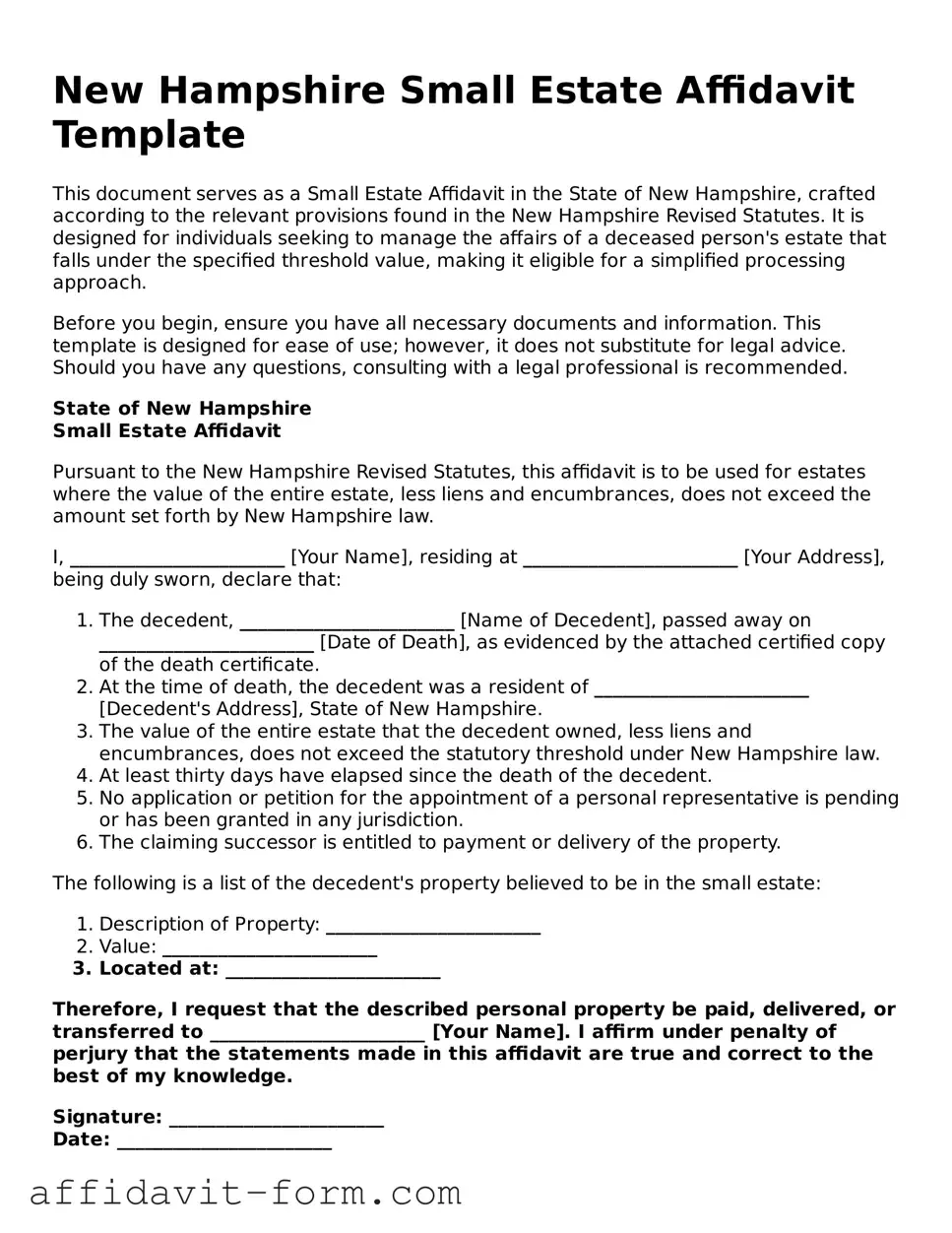

Form Example

New Hampshire Small Estate Affidavit Template

This document serves as a Small Estate Affidavit in the State of New Hampshire, crafted according to the relevant provisions found in the New Hampshire Revised Statutes. It is designed for individuals seeking to manage the affairs of a deceased person's estate that falls under the specified threshold value, making it eligible for a simplified processing approach.

Before you begin, ensure you have all necessary documents and information. This template is designed for ease of use; however, it does not substitute for legal advice. Should you have any questions, consulting with a legal professional is recommended.

State of New Hampshire

Small Estate Affidavit

Pursuant to the New Hampshire Revised Statutes, this affidavit is to be used for estates where the value of the entire estate, less liens and encumbrances, does not exceed the amount set forth by New Hampshire law.

I, _______________________ [Your Name], residing at _______________________ [Your Address], being duly sworn, declare that:

- The decedent, _______________________ [Name of Decedent], passed away on _______________________ [Date of Death], as evidenced by the attached certified copy of the death certificate.

- At the time of death, the decedent was a resident of _______________________ [Decedent's Address], State of New Hampshire.

- The value of the entire estate that the decedent owned, less liens and encumbrances, does not exceed the statutory threshold under New Hampshire law.

- At least thirty days have elapsed since the death of the decedent.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The claiming successor is entitled to payment or delivery of the property.

The following is a list of the decedent's property believed to be in the small estate:

- Description of Property: _______________________

- Value: _______________________

- Located at: _______________________

Therefore, I request that the described personal property be paid, delivered, or transferred to _______________________ [Your Name]. I affirm under penalty of perjury that the statements made in this affidavit are true and correct to the best of my knowledge.

Signature: _______________________

Date: _______________________

State of New Hampshire

County of _______________________ [Your County]

Subscribed and sworn to (or affirmed) before me on this day _______________________ [Date], by _______________________ [Your Name], proving to be the person whose name is subscribed to the within instrument.

Witness my hand and official seal,

Notary Public: _______________________

My commission expires: _______________________

This template is provided as a guide and does not constitute legal advice. It is advisable to review all sections and ensure compliance with New Hampshire laws and guidelines specific to small estates.

Document Details

| Fact | Description |

|---|---|

| Name of Form | New Hampshire Small Estate Affidavit |

| Purpose | Used to handle small estates without formal probate proceedings |

| Eligibility | Estates valued at $10,000 or less, not including the value of one motor vehicle |

| Governing Law | New Hampshire Revised Statutes Annotated (RSA) 553:32 |

| Who can file | Typically filed by a surviving spouse or next of kin |

| Waiting Period | Must wait 30 days after the decedent's death to file |

How to Use New Hampshire Small Estate Affidavit

Navigating the process of handling a loved one's estate can feel daunting, especially during a time of grief. For New Hampshire residents, the Small Estate Affidavit presents a less complicated pathway for settling small estates. This legal document allows the transfer of the deceased's property to their heirs without a formal probate process. It's crucial to follow the required steps meticulously to ensure the process goes smoothly and the legal requirements are satisfied.

Here's how to fill out the New Hampshire Small Estate Affidavit form:

- Identify the document as the New Hampshire Small Estate Affidavit by checking the form's title at the top.

- Gather necessary information including the deceased's full legal name, date of death, and a detailed list of the estate's assets.

- Enter the full legal name of the deceased in the section titled "Decedent's Information."

- Fill in the date of the deceased’s death in the designated spot within the same section.

- List all known assets of the deceased in the appropriate section. This may include bank accounts, vehicles, and personal property, ensuring you specify the value of each asset.

- If applicable, detail any debts owed by the estate, including funeral expenses, taxes, and outstanding bills.

- Include the names, relationships, and addresses of all legal heirs. If there is a will, ensure it does not contradict the distribution outlined in the affidavit.

- Review the affidavit statement which explains the executor’s oath and the legal basis for the document. Verify that all conditions are met.

- Sign the affidavit in front of a notary public. This may require visiting a bank, legal office, or other locations where notary services are offered.

- Attach a certified copy of the death certificate to the affidavit along with any other required documents as specified by New Hampshire law or the institution requesting the affidavit.

After completing these steps, the filled-out Small Estate Affidavit is ready to be submitted according to New Hampshire’s procedures. This could mean presenting the document to a financial institution, the Bureau of Motor Vehicles, or a court, depending on the assets in question. Remember that each institution may have its own additional requirements or forms to accompany the affidavit. Taking careful steps to ensure all information is accurate and complete will facilitate a smoother process in handling the small estate.

Listed Questions and Answers

What is a New Hampshire Small Estate Affidit?

A New Hampshire Small Estate Affidavit is a legal document used to handle the estate of a deceased person, known as a decedent, when the total value of the estate does not exceed a certain limit. This affidavit allows for the transfer of the decedent's property to heirs or beneficiaries without the need for a full, formal probate process.

When can a New Hampshire Small Estate Affidavit be used?

This affidavit can be used if the total value of the decedent's estate, less liens and encumbrances, does not exceed the amount set by New Hampshire law. The assets must primarily consist of personal property, such as bank accounts, vehicles, or household goods. Real estate typically does not qualify under this simplified procedure.

What is the maximum value of an estate for which a New Hampshire Small Estate Affidavit can be filed?

The maximum value of an estate that can be processed using a New Hampshire Small Estate Affidavit varies. Current laws should be consulted to determine this threshold, as it may be subject to legislative changes.

Who can file a New Hampshire Small Estate Affidavit?

The following parties are typically eligible to file a Small Estate Affidavit:

- Spouses of the decedent

- Children or next of kin

- Certain creditors, if applicable

- Other parties as designated by state law

What documents are needed to file a New Hampshire Small Estate Affidavit?

When preparing to file a Small Estate Affidavit, the following documents are generally required:

- The completed Small Estate Affidavit form

- A certified copy of the death certificate

- A detailed list of the estate's assets

- Proof of the relationship to the decedent for the person filing, if applicable

- Documentation of any debts or liens against the estate

How do you file a New Hampshire Small Estate Affidavit?

Filing involves submitting the completed affidavit and supporting documents to the appropriate local court. This may be the probate court in the county where the decedent lived. It's crucial to check with the court for specific filing procedures, fees, and any additional requirements.

How long does it take to process a New Hampshire Small Estate Affidavit?

The processing time can vary depending on the court's workload, the completeness of the submitted documents, and if there are any complications with the estate. Generally, it may take several weeks to several months from the time of filing to when the assets are distributed.

What happens after a New Hampshire Small Estate Affidavit is filed?

After filing, the court reviews the affidavit and the submitted documents. If approved, the person filing may distribute the estate's assets to the rightful heirs or beneficiaries according to the affidavit and any applicable laws. The person distributing the assets may be required to provide a report or accounting to the court.

Can a New Hampshire Small Estate Affidavit be contested?

Yes, like most legal processes, the use of a Small Estate Affidavit can be contested. If someone believes the affidavit was filed improperly or disputes the distribution of assets, they may challenge it in court. In such cases, seeking the advice of a legal professional is recommended.

Common mistakes

When handling the affairs of a loved one who has passed away, the process is both emotionally and technically challenging. In New Hampshire, the use of a Small Estate Affidavit offers a streamlined method for dealing with estates that fall below a certain value threshold. However, even with its relative simplicity, there are common pitfalls that individuals often encounter when completing this form. Properly navigating these mistakes can save time, stress, and potential legal complications.

Failing to determine eligibility: Before filling out the Small Estate Affidavit, it’s crucial to verify that the estate qualifies as 'small' under New Hampshire law. This involves understanding the total value of the estate’s assets, which must not exceed the state’s designated threshold.

Incorrectly listing assets: A common mistake involves inaccuracies in listing the decedent's assets. This includes both undervaluing or overvaluing items, or omitting assets entirely. Each asset needs to be identified and valued accurately to ensure the affidavit is processed correctly.

Omitting required documentation: Accompanying documentation, such as death certificates and proof of relationship to the deceased, is essential. Failure to attach necessary documents can lead to delays or rejection of the affidavit.

Incorrect or incomplete beneficiary information: The affidavit requires detailed information about the heirs or legally recognized beneficiaries. Mistakes or omissions in this section can complicate the estate’s distribution.

Overlooking debts and liabilities: The affidavit must account for the deceased's outstanding debts and liabilities. Neglecting to acknowledge these obligations can misrepresent the estate's true value and potentially mislead beneficiaries.

Not obtaining all necessary signatures: The Small Estate Affidavit requires signatures from all beneficiaries or heirs. Missing signatures can invalidate the document or lead to disputes among the heirs.

Failure to file with the proper court: It must be filed in the appropriate New Hampshire probate court, usually in the county where the decedent lived. Filing in the wrong jurisdiction can result in the rejection of the affidavit.

Avoiding these pitfalls requires attention to detail, a clear understanding of New Hampshire law, and sometimes, the guidance of a legal professional. By carefully navigating these common mistakes, individuals can ensure that the small estate process is completed efficiently and correctly.

Documents used along the form

When a loved one passes away, managing their estate can seem like a daunting task. In New Hampshire, the Small Estate Affidavit form is a simplified process used for estates under a certain value, allowing for a more streamlined transfer of assets. However, this form is often not the only document needed to manage the deceased's affairs. Several other forms and documents play a crucial role in this process, ensuring that all legal and financial aspects are correctly handled.

- Certificate of Death: This is a vital record issued by a government official, such as a registrar, that officially declares the date, location, and cause of death. It is often required to prove the death of the decedent when transferring assets or claiming benefits.

- Copy of the Will: If the deceased person left a will, a copy is needed to guide the distribution of assets according to their wishes. It can also appoint an executor who has the authority to manage the estate's affairs.

- Letters of Administration or Letters Testamentary: These documents are issued by the probate court, giving the appointed executor or administrator the legal authority to act on behalf of the deceased’s estate.

- Inventory of Assets: This comprehensive list details all assets owned by the deceased at the time of death, including bank accounts, real estate, stocks, and personal property. It helps in the accurate distribution of the estate.

- Tax Forms: Various tax forms may be required, such as the final income tax return for the deceased, estate tax forms, and possibly gift tax forms. These documents ensure that all tax obligations are met.

While the Small Estate Affidavit form initiates the process, these additional documents play a significant role in the comprehensive management of the deceased’s estate. Each fulfills a specific legal or financial requirement, ensuring a smoother transition during a difficult time. Handling these matters with care and proper documentation can help alleviate some of the stress associated with the death of a loved one.

Similar forms

The New Hampshire Small Estate Affidavit form is similar to other legal documents designed to streamline the process of estate management, particularly in cases where the estate is not large enough to warrant a full probate proceeding. These forms are beneficial as they provide a simpler, more cost-effective way for beneficiaries to claim assets from a deceased's estate. Below, we will discuss how the Small Estate Affidavit compares to other similar documents.

Affidavit for Collection of Personal Property - The New Hampshire Small Estate Affidavit and the Affidavit for Collection of Personal Property share common ground in both their purpose and general structure. Both aim to facilitate the transfer of the decedent's property to rightful heirs without a formal probate process. These documents require the claimant to affirm their right to the assets under oath. However, the specific conditions under which they are used can vary, including the maximum value of the estate they apply to, which is determined by state law.

Simplified Probate Proceedings - Compared to simplified probate proceedings, the New Hampshire Small Estate Affidavit offers a more straightforward route for managing small estates. Simplified probate proceedings are a shortened version of the traditional probate process that may still involve court appearances and a legal review. In contrast, the Small Estate Affidavit typically does not require a court appearance, making it a faster and less costly option. Nonetheless, both serve the purpose of legalizing the transfer of the decedent's assets to their heirs.

Transfer on Death Deed (TODD) - A Transfer on Death Deed allows property owners to name a beneficiary to whom the property will transfer upon their death, bypassing the need for probate. While distinct in purpose from the New Hampshire Small Estate Affidavit, which deals with the assets of someone who has already passed away, both TODDs and Small Estate Affidavits streamline the process of transferring assets. The key difference lies in when each is executed; TODDs are prepared and signed by the property owner while they are alive, whereas Small Estate Affidavits are used after the property owner's death.

Dos and Don'ts

When navigating the process of filling out the New Hampshire Small Estate Affidavit form, it's important to adhere to some key practices to ensure the form is completed correctly and effectively. Below is a list of do's and don'ts to consider:

Do:Double-check the eligibility criteria for using a Small Estate Affidavit in New Hampshire to ensure it matches the estate's situation.

Gather all necessary documents related to the deceased's assets, including bank statements, titles, and property deeds, before filling out the form.

Accurately calculate the value of the estate to confirm it falls below the threshold specified by New Hampshire law for small estates.

Provide complete and truthful information about the deceased's assets, and make sure to include all required details as per the form's instructions.

Review the completed form thoroughly to catch any errors or missing information before submitting it.

Attempt to use the Small Estate Affidavit if the estate exceeds the value limit set by New Hampshire law, as this can lead to legal complications.

Forget to attach necessary documentation that supports the information provided in the affidavit, such as proof of death and asset valuation.

Adhering to these guidelines can streamline the process, reduce the risk of rejection, and help ensure that the estate is settled in a timely and efficient manner. Always remember to consult with a legal advisor if you encounter uncertainties or require assistance during the process.

Misconceptions

Dealing with the estate of someone who has passed away can be overwhelming, and it's easy to run into misconceptions about how the process works, especially when it comes to the New Hampshire Small Estate Affidavit form. Let's address some of these misunderstandings to help clarify their use and requirements.

It avoids the probate process completely. While the Small Estate Affidavit can simplify the estate settlement process, it doesn't avoid probate entirely. It's designed for estates that fall below a certain value threshold and meets specific criteria, speeding up the process rather than bypassing it.

Any family member can file it. Not just any family member is eligible to file the Small Estate Affidavit. The law gives priority to certain relatives, starting with the surviving spouse and then to other heirs according to state succession laws.

The form is valid without notarization. The document requires notarization to be legally valid. The presence of a notary public ensures that the signature on the affidavit is genuine and helps prevent fraud.

There's no value limit for using the affidavit. Contrary to this belief, there is indeed a value limit on the estates that can be settled using a Small Estate Affidavit in New Hampshire. This limit is set by state law and it's important to check the current threshold to see if the estate qualifies.

It can be used immediately after death. There's a waiting period before the Small Estate Affidavit can be used. This allows time for all claims against the estate to be identified. In New Hampshire, the waiting period is a specific number of days after the decedent's death.

All assets can be transferred using it. Certain assets cannot be transferred using a Small Estate Affidavit. Typically, real estate and certain types of personal property might not be eligible for transfer through this simplified process and may require a more formal probate procedure.

It transfers title to vehicles. While the Small Estate Affidavit can be used for the transfer of some assets, the ability to transfer title to vehicles may be subject to additional requirements or limitations set by the New Hampshire Department of Motor Vehicles or other regulatory bodies.

No need for an attorney's assistance. Even though the Small Estate Affidavit process is designed to be simpler, consulting an attorney can help navigate the complexities of estate law, ensure the form is filled out correctly, and that all legal requirements are met. They can provide peace of mind by guiding you through the process.

Clearing up these misconceptions about the New Hampshire Small Estate Affidavit form can help make the process of handling a small estate more understandable and manageable. Remember, every situation is unique, so while the process is designed to be straightforward, seeking professional advice is always recommended to address specific concerns or legal questions.

Key takeaways

Filing a Small Estate Affidavit in New Hampshire can provide a simplified process for settling an estate that meets certain requirements. This method is often faster and less costly than going through a formal probate process. To navigate this efficiently, it's important for individuals to understand the key elements involved. Here are some critical takeaways to consider:

- Eligibility Criteria: To utilize the Small Estate Affidavit in New Hampshire, the total value of the estate must not exceed a specific threshold, which is subject to change. It's pivotal to ensure that the estate falls within the monetary limits established by state law. Additionally, there is typically a waiting period after the decedent's death before the affidavit can be filed, underscoring the importance of timing.

- Required Documentation: Completing the Small Estate Affidavit necessitates gathering and presenting various documents. These may include a certified copy of the death certificate, a detailed list of the estate's assets, and documentation proving the claimant's right to the property. Accuracy in this documentation is crucial to facilitate the process.

- Limitations of the Affidavit: While the Small Estate Affidavit simplifies the estate settlement process, it does not apply to all assets. Certain types of property, such as real estate, might require a different approach or the involvement of the probate court. Understanding the limitations of what can and cannot be transferred via this affidavit is essential.

- Legal Implications and Responsibilities: Individuals filing a Small Estate Affidait must be aware of their legal responsibilities, including the truthful representation of the estate's value and the fair distribution of assets among heirs or beneficiaries. Misrepresentation can result in legal consequences. Therefore, it's advisable to seek legal guidance to ensure compliance with all relevant laws and regulations.

Fill out Popular Small Estate Affidavit Forms for Different States

Kansas Simplified Estates Act - For estates that do not necessitate a full probate process, this affidavit provides a streamlined, efficient alternative for asset distribution.

Probate Forms Ri - An essential step in estate planning and settlement, tailored for situations where a will does not exist or is deemed unnecessary.

Aoc-e-203b - This document helps expedite the transfer of property to heirs when an estate falls under a certain value threshold.