Printable Small Estate Affidavit Form for New Jersey

Dealing with the loss of a loved one is never easy, and the thought of navigating through legal paperwork during such times can be daunting. In New Jersey, the Small Estate Affidavit form serves as a beacon of relief for those who find themselves in this delicate position. Essentially, this form allows individuals to bypass the often lengthy and complicated probate process if the estate in question falls below a certain value threshold. This streamlined approach not only helps in expediting the transfer of assets to the rightful heirs but also significantly reduces the stress and financial burden associated with probate proceedings. Moreover, it's designed to be user-friendly, ensuring that people without a legal background can manage its requirements with ease. The form covers various types of assets, including personal property, bank accounts, and even certain types of real estate, making it a versatile tool for many families. However, understanding the eligibility criteria, the types of assets that can be included, and the legal implications of using the form are crucial steps in ensuring that the process goes smoothly.

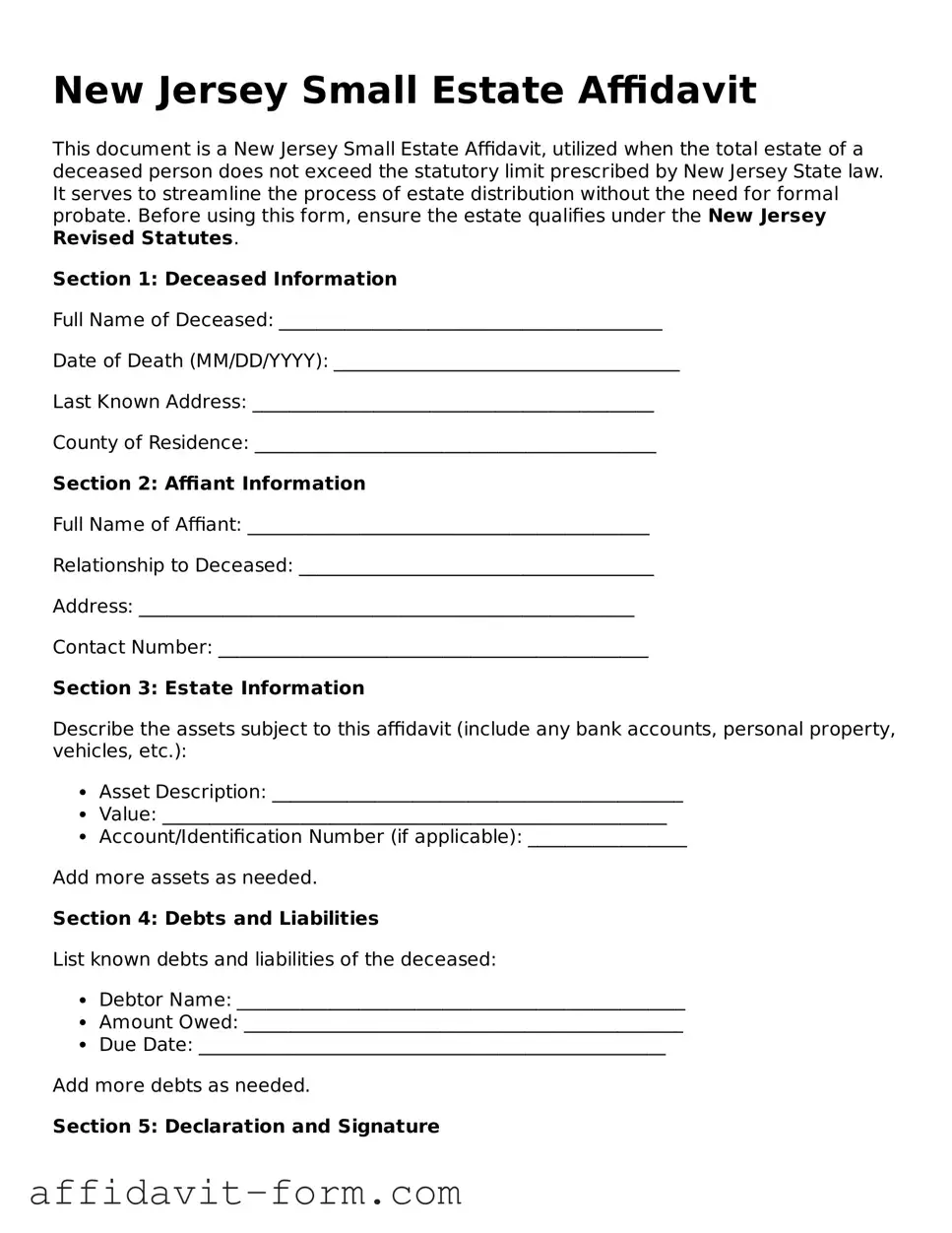

Form Example

New Jersey Small Estate Affidavit

This document is a New Jersey Small Estate Affidavit, utilized when the total estate of a deceased person does not exceed the statutory limit prescribed by New Jersey State law. It serves to streamline the process of estate distribution without the need for formal probate. Before using this form, ensure the estate qualifies under the New Jersey Revised Statutes.

Section 1: Deceased Information

Full Name of Deceased: _________________________________________

Date of Death (MM/DD/YYYY): _____________________________________

Last Known Address: ___________________________________________

County of Residence: ___________________________________________

Section 2: Affiant Information

Full Name of Affiant: ___________________________________________

Relationship to Deceased: ______________________________________

Address: _____________________________________________________

Contact Number: ______________________________________________

Section 3: Estate Information

Describe the assets subject to this affidavit (include any bank accounts, personal property, vehicles, etc.):

- Asset Description: ____________________________________________

- Value: ______________________________________________________

- Account/Identification Number (if applicable): _________________

Add more assets as needed.

Section 4: Debts and Liabilities

List known debts and liabilities of the deceased:

- Debtor Name: ________________________________________________

- Amount Owed: _______________________________________________

- Due Date: __________________________________________________

Add more debts as needed.

Section 5: Declaration and Signature

By signing below, I, _____________________________, affirm under penalty of perjury that the information provided herein is accurate and true to the best of my knowledge. I further declare that, to the best of my knowledge, the deceased's estate does not exceed the monetary threshold specified by New Jersey law for a small estate, and that there is no pending or granted petition for probate for the deceased's estate within the State of New Jersey. I understand that false statements made herein are punishable by law.

Date: ___________________

Signature of Affiant: _______________________________

Printed Name: _____________________________________

Document Details

| Fact | Detail |

|---|---|

| Definition | The New Jersey Small Estate Affidavit is a legal document used by successors to collect the property of a deceased person without formal probate proceedings |

| Governing Law | New Jersey Statutes, specifically N.J.S.A. 3B:10-3 and 3B:10-4, provide the legal foundation for the use and requirements of the small estate affidavit in New Jersey. |

| Monetary Limit | The estate value must not exceed $20,000 if there is a surviving spouse or domestic partner claiming the assets; it is limited to $10,000 for other claimants. |

| Eligible Claimants | Primarily, this form is intended for a surviving spouse or domestic partner. If there is no spouse or domestic partner, then other successors may be entitled to use the form. |

| Waiting Period | There is a mandatory waiting period of 10 days after the death of the decedent before the affidavit can be executed and presented. |

| Required Documentation | An original death certificate, an itemized list of the decedent's personal property, and evidence of entitlement, such as a marriage certificate or birth certificate, are typically required. |

| Special Provisions | In cases where the decedent's assets include real estate, additional procedures and forms, beyond the small estate affidavit, may be necessary to transfer ownership. |

How to Use New Jersey Small Estate Affidavit

When a loved one passes away, handling their estate can be a challenging process, especially during a time of grief. In New Jersey, if the estate is considered "small" by legal standards, you may be able to use a Small Estate Affidavit to simplify this task. This tool allows for the transfer of the deceased’s assets without the need for a formal probate process. It's a straightforward document, but filling it out correctly is crucial to ensure that the process runs smoothly and legally. Here’s a step-by-step guide meant to help you through each section of the New Jersey Small Estate Affidavit form.

- Begin by gathering all necessary information about the deceased’s assets, including account numbers, property descriptions, and values. Accurate and detailed information will prevent any potential delays.

- Locate the latest version of the New Jersey Small Estate Affidavit form. This can typically be found on the New Jersey Courts website or by contacting your local county court.

- Clearly write the name of the deceased (referred to as the ‘decedent’) at the top of the form, ensuring it matches the name on their death certificate.

- Fill in your name and address as the ‘affiant’—the person completing the affidavit. Confirm that you’re eligible to act in this capacity, according to New Jersey state law.

- Provide a complete list of the decedent’s assets to be transferred via the affidavit. Include descriptions and the value of each item. Make sure to omit any assets that will be transferred outside the affidavit process, such as those already in a trust or jointly owned.

- If applicable, list the names and addresses of all legal heirs, and specify their relationship to the decedent. This information is necessary to ensure the proper distribution of assets in accordance with New Jersey law.

- Detail any outstanding debts or obligations of the decedent, including final expenses and taxes that should be paid from the estate’s assets.

- Review the affidavit carefully, making sure all the information provided is accurate and truthful to the best of your knowledge.

- Sign the affidavit in front of a notary public. The notary will need to witness your signature and then sign, date, and place their seal on the document, making it legally valid.

- Finally, submit the completed affidavit and any required attachments (such as a certified copy of the death certificate) to the institution or entity holding the assets, like the bank or the county recorder’s office.

Following these steps should provide a clear path toward transferring a small estate in New Jersey. Keep in mind that each case is unique, and specific situations might require additional steps or documentation. For complex estates or if you encounter any legal uncertainties, it is recommended to seek advice from a legal professional. Navigating estate matters can be complex, but understanding the process and your responsibilities can help make the situation as smooth as possible.

Listed Questions and Answers

What is a New Jersey Small Estate Affidavit?

A New Jersey Small Estate Affidavit is a legal document used when an individual, known as the decedent, has passed away with a modest amount of assets. This form allows the transfer of the deceased's property to their rightful heirs without the need for a lengthy probate process. It is designed to simplify the legal proceedings for small estates, making it easier for survivors to settle the decedent's affairs.

When can a New Jersey Small Estate Affidavit be used?

The affidavit can be utilized under specific conditions. The total value of the decedent’s estate, not including real estate, must not exceed $20,000 if there is a surviving spouse or domestic partner who is entitled to inherit under state law. In cases where there is no surviving spouse or domestic partner, the threshold for the estate's total value is $10,000. It is important to ensure these criteria are met before proceeding with the affidavit.

Who is eligible to file a Small Estate Affidavit in New Jersey?

The following individuals are qualified to file:

- The surviving spouse or domestic partner of the decedent, if applicable.

- If there is no surviving spouse or domestic partner, any heir of the decedent may file.

What information is needed to complete the Small Estate Affidit?

To fill out the affidavit accurately, one should gather:

- The decedent’s official death certificate.

- A comprehensive list of the decedent’s assets.

- Proof of the relationship to the decedent (for the surviving spouse, domestic partner, or other heirs).

- An estimate of the value of each asset.

How does one file a Small Estate Affidavit in New Jersey?

Filing involves a few steps. Initially, the eligible person must complete the affidavit form, ensuring all details about the decedent’s assets, their value, and the rightful heirs are accurately provided. The completed form, along with the required documents such as the death certificate and proof of relationship, should then be presented to the institution holding the decedent’s assets (for example, a bank). It's advisable to consult with a legal professional to review the affidavit before submission to avoid any issues.

Is there a waiting period before filing the Small Estate Affidavit in New Jersey?

Yes, there is a mandated waiting period. The affidavit should not be filed until at least ten days have passed since the death of the decedent. This allows sufficient time for all immediate legal matters and notifications of death to be processed.

What types of assets can be transferred using a Small Estate Affidavit?

Assets that may be transferred include, but are not limited to:

- Personal property such as vehicles, jewelry, and household items.

- Bank accounts, as long as the total does not exceed the state’s threshold.

- Stocks, bonds, and other securities.

Are there any fees associated with filing a Small Estate Affidavit in New Jersey?

While there might be minimal fees related to obtaining the necessary documents (such as the death certificate), generally, there is no filing fee for the Small Estate Affidavit itself. However, institutions holding the assets may have their own procedures and potential fees for transferring the assets to the heirs. It is beneficial to inquire directly with these institutions to understand any costs involved.

Common mistakes

Filling out the New Jersey Small Estate Affidavit form can seem straightforward, but mistakes are more common than you might think. These errors can delay the process, leading to unnecessary setbacks when settling a small estate. Being aware of common pitfalls can help ensure the process goes smoothly. Here are five mistakes to avoid:

Not verifying eligibility requirements: Before proceeding, it's crucial to ensure that the estate in question meets New Jersey's specific criteria for being considered "small." This includes the total value of the estate, which should not exceed the threshold set by New Jersey law. Skipping this step can lead to wasted effort if the estate doesn't qualify.

Incomplete information about the decedent's assets: All assets that are part of the small estate must be listed accurately. This includes bank accounts, securities, real estate located in New Jersey, and personal property. Leaving out any assets or failing to describe them in detail can complicate the estate settlement process.

Forgetting to attach necessary documents: The affidavit requires certain documents to be attached, such as the death certificate and, in some cases, proof of entitlement to the assets. Failing to attach these documents can result in delays or even the denial of the affidavit.

Misunderstanding the role of the affidavit: Some people mistakenly believe that the small estate affidavit transfers property immediately upon its completion and submission. However, it is essentially a sworn statement that allows for the transfer of assets without formal probate. Understanding its role is crucial for managing expectations and timelines.

Incorrectly identifying heirs or beneficiaries: Ensuring that all potential heirs and beneficiaries are correctly identified and listed is vital. Mistakes or omissions here can lead to disputes or challenges to the distribution of the estate, causing delays and potentially leading to legal complications.

Avoiding these mistakes not only streamlines the process but also helps in fulfilling the legal and personal responsibilities associated with settling an estate. Paying close attention to detail and being thorough in completing the New Jersey Small Estate Affidavit form can save a lot of time and trouble.

Documents used along the form

When dealing with a small estate in New Jersey, the Small Estate Affidavit form is often just the starting point. Multiple documents may be needed to fully manage a deceased person's assets and liabilities. These documents work in conjunction with each other to ensure the estate is settled correctly and in accordance with the law. Here’s a look at some of the most commonly used documents alongside the New Jersey Small Estate Affidavit form.

- Death Certificate: This is an official document issued by the government that certifies the death of the person. It is required for most legal processes following a death, including the execution of the small estate affidavit.

- Will: If the deceased person left a will, it outlines their wishes regarding the distribution of their assets and the care of any dependents. It's essential to determine the executor of the will and the beneficiaries.

- Letter of Administration: In cases where there is no will, a Letter of Administration may be needed. It grants the administrator the authority to manage and distribute the decedent's assets according to state laws.

- Bank Statements: Recent bank statements of the deceased may be required to show proof of the assets held in their accounts.

- Property Deeds: If the estate includes real property, deeds showing ownership need to be presented. This determines if the property indeed belonged to the deceased.

- Vehicle Title: Similar to property deeds, if the deceased owned a vehicle, the title document is necessary to transfer ownership.

- Stock Certificates: In the event the decedent owned stocks or bonds, certificates or proof of ownership will be essential for transferring these assets to the rightful heirs.

Together, these documents play a pivotal role in the administration of a small estate in New Jersey. They help to ensure that all assets are accounted for, liabilities are settled, and the distribution of the estate is carried out according to the law or the wishes of the deceased. Handling these matters with care and in accordance with legal requirements is vital for the smooth settlement of the estate.

Similar forms

The New Jersey Small Estate Affidavit form is similar to several other legal documents used in the estate planning and administration process. These documents, though varying by purpose and detail, share common goals: to facilitate the transfer of assets, simplify legal procedures, and ensure a person's wishes are honored after their passing. Among these, the two that closely resemble the New Jersey Small Estate Affidavit form in their objectives and sometimes their structure are the Transfer on Death Deed (TOD) and the Last Will and Testament.

Transfer on Death Deed (TOD): This document allows individuals to name beneficiaries for their real estate, enabling the property to transfer directly to the beneficiaries upon the owner's death without the need for probate court proceedings. Similar to the New Jersey Small Estate Affidavit, the TOD helps expedite the transfer of assets to the rightful heirs, bypassing the often lengthy and complicated probate process. Both documents focus on simplifying asset distribution, but while the TOD deals specifically with real estate, the Small Estate Affidavit can apply to a broader range of assets, including personal property and bank accounts.

Last Will and Testament: Often simply known as a will, this crucial document outlines a person's wishes regarding the distribution of their assets and the care of any minor children upon their death. Like the New Jersey Small Estate Affidavit, a will plays a pivotal role in the estate planning process, serving as a guide for the allocation of the deceased's belongings. However, the execution of a will usually requires going through probate, contrasting with the Small Estate Affidate which aims to avoid or minimize this process for estates that fall under a specific threshold. Despite this difference, both documents share the essential function of ensuring that personal assets are transferred according to the deceased's wishes.

Dos and Don'ts

Filling out the New Jersey Small Estate Affidavit form is a critical step for those handling the estates of loved ones who have passed away. To ensure the process is completed correctly and smoothly, there are certain practices you should follow and others you should avoid. Here is a list of do's and don'ts when completing this form:

Do's:

- Verify eligibility. Before filling out the form, make sure the estate qualifies as a small estate under New Jersey law. This involves ensuring the total value of the property does not exceed the state’s specified limit.

- Provide accurate information. It's crucial to fill out the form with precise details about the deceased’s assets, debts, and beneficiaries. Double-check all information for accuracy to avoid any legal complications.

- Attach necessary documents. Depending on the specifics of the estate, you may need to attach additional documents, such as a certified copy of the death certificate or proof of your relationship to the deceased.

- Seek legal advice if needed. If any part of the process is unclear or if the estate involves complex assets, consulting with a legal professional can provide guidance and help avoid mistakes.

Don'ts:

- Do not guess on values. Estimating or guessing the value of assets can lead to inaccuracies and potential challenges. Use appraisals or actual account statements to report values accurately.

- Avoid skipping any sections. Each part of the form is important and requires attention. Leaving sections blank can result in processing delays or the form being returned for completion.

- Do not ignore state-specific rules. New Jersey has its own laws regarding small estates, and failure to comply with these rules can invalidate the affidavit or lead to legal issues.

- Refrain from distributing assets too soon. It’s important to wait until you have the legal authority to distribute the assets. Distributing assets prematurely can result in personal liability if done incorrectly.

Misconceptions

When it comes to wrapping up a loved one’s affairs, the New Jersey Small Estate Affidavit form is a simpler option than going through probate. However, several misconceptions can make dealing with this document seem more daunting than it actually is. Here, we'll clear up some common misunderstandings.

- Only family members can file the form: While it's commonly believed that only family members can file for a Small Estate Affidavit, in New Jersey, anyone who is entitled to inherit the assets can actually file. This includes not just relatives but also friends named in the will.

- There's no limit to the estate's value: Contrary to what some might think, there is indeed a cap on the value of the estate for which a Small Estate Affidavit can be used. The estate must not exceed a certain value threshold, which is subject to change, so it’s important to verify the current limit with local regulations.

- The process is immediate: Some may be under the impression that using a Small Estate Affidavit means assets can be transferred immediately. However, there's a mandatory waiting period after the decedent’s death before the form can be filed, ensuring all claims are appropriately handled.

- All assets can be transferred using the form: Not all assets can be transferred with a Small Estate Affidavit. Typically, this form applies to personal property only. Real estate and certain other assets might not qualify and may require a different process.

- The form negates the need for a will: Using a Small Estate Affidavit does not override the need for a will. If a will exists, it still plays a crucial role in determining how the assets are distributed, in accordance with the decedent’s wishes. The form is merely a tool for simplifying the process for smaller estates.

- There are no fees associated with filing: Though filing a Small Estate Affidavit is generally less costly than going through traditional probate, there may still be fees involved in the process. These can include court filing fees or costs associated with obtaining necessary documents.

Understanding the specifics of the New Jersey Small Estate Affidavit can significantly ease the stress during a difficult time. By dispelling these myths, individuals can navigate the process more smoothly and ensure their loved one's assets are handled correctly and efficiently.

Key takeaways

In the state of New Jersey, navigating the process of settling a small estate can be made simpler with the Small Estate Affidavit form. This tool is designed to help individuals efficiently manage the assets of a loved one who has passed away, without the need for a prolonged probate process. The nuances of this form are critical to grasp, ensuring that the process is conducted smoothly and within legal bounds. Here are ten key takeaways to keep in mind when filling out and using the New Jersey Small Estate Affidavit form:

- Eligibility Criteria: Not all estates qualify for the Small Estate Affidavit process. In New Jersey, the total value of the estate, excluding certain assets like jointly owned property, must not exceed a specific threshold. Understanding these criteria is imperative to determine eligibility.

- Accurate Valuation: It is essential to accurately value the estate's assets. This step not only determines eligibility but also ensures that the distribution to heirs is done fairly, based on the decedent's will or the state's intestacy laws.

- Documentation: Gather all necessary documentation, including death certificates, titles, and account statements. These documents support the claims made in the affidavit and are often required by institutions when transferring ownership.

- Completing the Form: Fill out the Small Estate Affidavit form with precision, providing complete and accurate information. Any errors or omissions can result in delays or legal challenges.

- Legal Requirements: Familiarize yourself with New Jersey’s specific legal requirements for small estates. This includes the form's submission timeline, which assets qualify, and how debts of the estate are to be handled.

- Debts and Liabilities: Understand how debts and liabilities affect the estate. In some cases, the value of the estate may need to be used to settle outstanding debts before any distributions to heirs.

- Heir Distribution: Make sure the distribution of assets aligns with the decedent’s will or, if there is no will, the state's intestacy laws. Knowing how these laws apply is essential for the equitable distribution of the estate.

- Filing the Affidavit: Identify where to file the Small Estate Affidavit. In some instances, it may need to be filed with a specific court or directly with the holder of the assets, such as banks or brokerage firms.

- Legal Advice: Consider consulting with a legal professional. While the Small Estate Affidavit form is designed to simplify the process, complex estates or those with potential legal issues benefit from professional advice.

- Follow-up: After submitting the affidavit, be prepared to follow up with institutions to ensure the transfer of assets is completed. Some may require additional documentation or have specific procedures to follow.

The Small Estate Affidavit form serves as a valuable tool in New Jersey for the expedited handling of small estates, reducing the time and expense typically associated with probate. By understanding and carefully navigating this process, individuals can ensure that their loved one’s assets are managed and distributed according to their wishes with respect and dignity. As with any legal process, meticulous attention to detail and a thorough understanding of the requirements are critical for a smooth and successful execution.

Fill out Popular Small Estate Affidavit Forms for Different States

How to File Probate Without a Lawyer - Among its benefits, the Small Estate Affidavit can prevent the need for selling off assets to cover legal and court costs associated with probate.

How Long Does an Executor Have to Settle an Estate in Maryland - The process and parameters for using a Small Estate Affidavit can vary significantly, highlighting the importance of consulting up-to-date local regulations.