Printable Small Estate Affidavit Form for New Mexico

In New Mexico, navigating the complexities of dealing with a loved one's estate can be streamlined for smaller estates through the use of a Small Estate Affidavit form. This essential document serves as a tool for heirs or designated beneficiaries to claim assets of the deceased without the need for a lengthy probate process. It is particularly useful when the total value of the estate falls beneath a certain threshold, making it ideal for situations where the assets are straightforward and disputes among heirs are unlikely. The form simplifies the transfer of property, including bank accounts and personal property, to rightful heirs efficiently. Its implementation reflects New Mexico's recognition of the need for a more accessible means for individuals to settle small estates, ensuring that the process is not only expedited but also cost-effective. By understanding the major aspects of the Small Estate Affidavit form, individuals are better equipped to manage the estate settlement process with confidence, knowing they can bypass the complexities often associated with probate court.

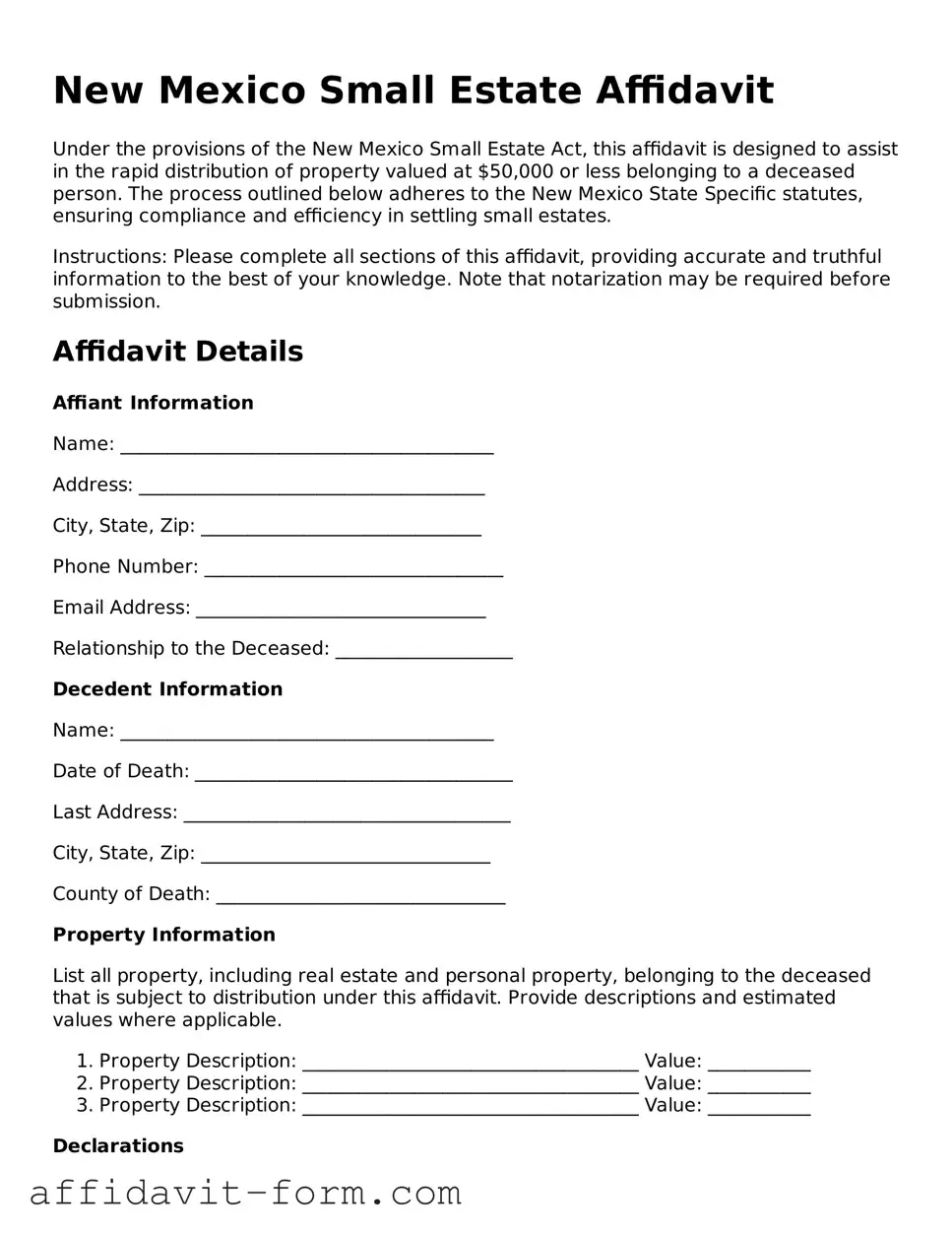

Form Example

New Mexico Small Estate Affidavit

Under the provisions of the New Mexico Small Estate Act, this affidavit is designed to assist in the rapid distribution of property valued at $50,000 or less belonging to a deceased person. The process outlined below adheres to the New Mexico State Specific statutes, ensuring compliance and efficiency in settling small estates.

Instructions: Please complete all sections of this affidavit, providing accurate and truthful information to the best of your knowledge. Note that notarization may be required before submission.

Affidavit Details

Affiant Information

Name: ________________________________________

Address: _____________________________________

City, State, Zip: ______________________________

Phone Number: ________________________________

Email Address: _______________________________

Relationship to the Deceased: ___________________

Decedent Information

Name: ________________________________________

Date of Death: __________________________________

Last Address: ___________________________________

City, State, Zip: _______________________________

County of Death: _______________________________

Property Information

List all property, including real estate and personal property, belonging to the deceased that is subject to distribution under this affidavit. Provide descriptions and estimated values where applicable.

- Property Description: ____________________________________ Value: ___________

- Property Description: ____________________________________ Value: ___________

- Property Description: ____________________________________ Value: ___________

Declarations

- The information provided in this affidavit is accurate to the best of my knowledge and belief.

- I understand that false statements may result in penalties under law.

- The value of the entire estate subject to probate, excluding liens and encumbrances, does not exceed $50,000.

- Thirty days have passed since the death of the decedent.

- All debts, including funeral and burial expenses, have been paid or provided for.

- No application for the appointment of a personal representative is pending or has been granted in any jurisdiction.

Signature of Affiant

Date: ____________________________

Signature: _________________________

This document is not a substitute for legal advice. Individuals may wish to consult with a legal professional to ensure compliance with all New Mexico laws and regulations regarding small estates.

Document Details

| Fact | Description |

|---|---|

| Governing Law | The New Mexico Small Estate Affidavit form is governed by the laws of the State of New Mexico, specifically under Sections 45-3-1201 to 45-3-1203, NMSA 1978 of the New Mexico Statutes Annotated. |

| Eligibility Requirements | To be eligible to use the form, the total value of the decedent’s property subject to disposition must not exceed $50,000. Additionally, at least thirty days must have elapsed since the death of the decedent. |

| Purpose | The form simplifies the process of transferring assets of a deceased person to their rightful heirs without the need for a formal probate process. |

| Assets Covered | It typically covers personal property like bank accounts, stocks, and tangible items, but it does not apply to real estate in New Mexico. |

| Filing Procedure | The affidavit should be filed with relevant entities holding the decedent’s assets, such as banks, instead of a court, unless a specific dispute arises. |

| Required Information | Completing the form requires detailed information about the decedent, the assets, and the heirs or legatees entitled to receive the property. |

| Signature Requirements | The affidavit must be signed by the successor(s) of the decedent in the presence of a notary public to ensure its legality and authenticity. |

| Limitations | It only applies to personal property located in New Mexico and has no authority over real estate or assets outside the state’s jurisdiction. |

| Processing Time | While the form can expedite the transfer of assets, the actual processing time can vary depending on the institution and any additional requirements they may have. |

How to Use New Mexico Small Estate Affidavit

Filling out the New Mexico Small Estate Affidavit form is a crucial step for those handling the estate of a loved one who has passed away. This process allows for a simpler, faster way to transfer property to heirs without going through the standard probate process. The affidavit is used when the total value of the estate does not exceed a certain threshold, making it an efficient solution for many families. The following steps will guide you through the completion of this form, ensuring that all the necessary information is accurately provided. It's important to gather all relevant documents and to understand the estate's assets before you begin.

- Start by writing the full legal name of the deceased, also known as the decedent, at the top of the form where indicated.

- Enter the date of death of the decedent, ensuring it matches the date listed on the death certificate.

- Provide the complete address of the decedent at the time of death, including city, state, and zip code.

- List all known assets of the estate, including but not limited to bank accounts, vehicles, and real estate. Be sure to describe each asset clearly and provide any identifying numbers or documents.

- Calculate and fill in the total estimated value of the estate's assets. Remember, this total should not exceed the threshold set by New Mexico law for small estates.

- Identify all heirs and devisees (people named in the will, if one exists) of the decedent. Provide their full names, addresses, and their relationship to the decedent.

- If applicable, attach a certified copy of the death certificate and any other documents required by New Mexico law to support the claims made in the affidavit.

- Review the affidavit to ensure all information provided is accurate and complete. False statements can lead to penalties under the law.

- Sign the affidavit in front of a Notary Public. The Notary will verify your identity and witness your signature, officiating the document.

- File the completed affidavit with the appropriate local authority, often the county clerk's office, in the county where the decedent lived at the time of their death.

After submitting the form, the next steps will include waiting for any necessary approvals and then proceeding with the distribution of the decedent's assets according to the details outlined in the affidavit. This process will vary depending on the specific assets and the requirements of any institutions holding them (such as banks or the DMV for vehicles). It's recommended to keep in contact with these entities and provide them with copies of the filed affidavit to facilitate the transfer of assets to the rightful heirs.

Listed Questions and Answers

What is a Small Estate Affidavit in New Mexico?

In New Mexico, a Small Estate Affidavit is a legal document used to settle small estates without going through a formal probate process. This document allows successors to collect the deceased's property when the estate's total value does not exceed a certain threshold. It simplifies the transfer of assets to rightful heirs or beneficiaries, provided the estate qualifies under state law guidelines.

Who can use a Small Estate Affidavit in New Mexico?

The use of a Small Estate Affidavit in New Mexico is limited to successors of the deceased. These successors can be heirs, which might include family members like spouses, children, or parents, or other persons named in a will if one exists. To use this affidavit, the total value of the estate must fall beneath the state’s specific threshold, and certain conditions must be met, including the passage of a required waiting period since the deceased’s passing.

What are the requirements for filing a Small Estate Affidavit in New Mexico?

- The deceased must not have left a will that directs the execution of their estate through probate.

- The total value of the estate’s personal property must be below the threshold set by New Mexico law.

- A specific period, usually 30 days, must have passed since the death of the estate's owner.

- All debts and taxes of the estate must have been settled or accounted for before the affidavit is used to distribute the remaining assets.

- There cannot be any ongoing probate proceedings for the estate in question.

How does one file a Small Estate Affidavit in New Mexico?

- Gather all necessary information about the deceased's assets, including their total value and how they are titled.

- Ensure all requirements are met, including the waiting period after the deceased’s passing.

- Complete the Small Estate Affidavit form with accurate information regarding the decedent and their estate.

- Have the form notarized once it is filled out.

- Present the notarized affidavit to the institution or entity holding the assets, such as a bank or a brokerage.

Common mistakes

-

Not verifying eligibility criteria: Before proceeding, one must confirm that the estate falls under the threshold designated for "small estates" in New Mexico. Failing to do this can lead to wasted effort and possible legal challenges.

-

Omitting necessary documents: Besides the affidavit, additional documents, such as death certificates or proof of entitlement, are often required. Overlooking these attachments can stall the process.

-

Incorrectly listing assets: Every asset within the estate needs to be listed clearly and accurately. Mistakes or omissions here can result in delays and legal issues, as assets may be distributed improperly.

-

Providing inadequate descriptions: Vague descriptions of property or assets can create ambiguity. It's imperative to describe each asset in detail to prevent misunderstandings or disputes among claimants.

-

Failing to properly identify heirs: Understanding and correctly identifying who the heirs are is crucial. Misidentifications can cause assets to be wrongfully distributed, creating potential legal complications down the line.

-

Not getting the document notarized: The affidavit needs to be notarized to have legal effect. Skipping this critical step renders the document virtually useless.

-

Delaying the submission of the form: Timely submission is key. Delays can not only prolong the distribution of assets but might also lead to additional complications if the statutory period for claims against the estate has expired.

To avoid these common mistakes, it’s recommended to:

- Thoroughly review the eligibility criteria for small estates in New Mexico.

- Ensure all accompanying documents are complete and attached.

- Provide clear, accurate, and detailed information about each asset.

- Correctly identify and list all potential heirs to the estate.

- Have the document notarized to affirm the statements within are true and accurate.

- Submit the completed affidavit without unnecessary delays.

By paying close attention to these aspects, individuals can navigate the process more smoothly and ensure the estate is resolved promptly and correctly.

Documents used along the form

Navigating through the process of managing a small estate in New Mexico requires not only the Small Estate Affidavit but also a handful of other important documents. These documents complement the affidavit by fulfilling various legal requirements and ensuring a smoother transition of the estate. Here’s a look at some of them, which often are used together to ensure that all bases are covered.

- Certified Death Certificate: This is an official document issued by the state verifying the death of the deceased. It's required when filing a Small Estate Affidavit as proof of death. The certificate is necessary for legal and financial institutions to proceed with estate administration and asset distribution.

- Will (if applicable): While not always necessary, if the deceased left a will, it outlines their final wishes regarding the distribution of their assets. The presence of a will can influence how assets are distributed and may need to be filed with the probate court, even in the context of a small estate affidavit process.

- Letters of Administration: If the estate goes through formal probate or if an executor needs to be officially appointed by a court, Letters of Administration may be issued. These legal documents grant the executor the authority to act on behalf of the deceased’s estate, including gathering assets, paying debts, and distributing inheritances.

- Real Estate Transfer Documents: For estates that include real property (like houses or land), specific documents are needed to transfer ownership. These can include a deed with a transfer-on-death designation, which passes real property directly to a beneficiary upon death, bypassing the probate process.

- Personal Property Affidavit: Similar to the Small Estate Affidavit but specifically for tangible personal property (such as vehicles, jewelry, or furniture), this document allows for the transfer of personal property without formal probate. Requirements for when and how it can be used vary by state.

Using these documents in conjunction with the Small Estate Affidariat can simplify and expedite the process of estate settlement. Each plays a crucial role in its own right, ensuring that all procedural and legal aspects of estate management are addressed appropriately. Understanding and preparing these documents beforehand can provide a seamless pathway through the complexities of estate administration.

Similar forms

The New Mexico Small Estate Affidavit form is similar to other legal documents that are designed to simplify the transfer of assets from a deceased person to their heirs or beneficiaries. These forms allow for a more straightforward and less time-consuming process than going through a full probate proceeding. While each document has its unique uses and requirements depending on the circumstances, they all share the goal of facilitating easier transfer of assets.

Transfer on Death Deed (TODD): This form is akin to the New Mexico Small Estate Affidavit in its purpose of sidestepping the need for a lengthy probate process. Both documents enable the direct transfer of assets to a named beneficiary upon the death of the asset holder. The Transfer on Death Deed specifically applies to real estate properties. An essential similarity is that both forms become operative upon death and are revocable until that time, allowing the owner to change their mind at any moment.

Payable on Death (POD) Account Forms: Similar to the Small Estate Affidavit, these forms allow assets within financial accounts to be transferred directly to named beneficiaries upon the account holder's death. The key similarity lies in the bypass of traditional probate proceedings, directly transferring assets without the need for court intervention. Both documents facilitate a smoother and faster transfer process, but the Payable on Death form is specific to financial assets like bank accounts.

Joint Tenancy with Rights of Survivorship (JTWROS) Agreement: Though not a form in the traditional sense, this agreement between co-owners of property or assets shares a common goal with the Small Estate Affidavit: avoiding probate. Upon the death of one joint tenant, ownership automatically transfers to the surviving joint tenant(s) without the need for a court order. The similarity lies in the seamless transition of assets upon death, though this agreement applies during the lifetime of the owners and extends beyond death until only one owner remains.

Dos and Don'ts

Filling out the New Mexico Small Estate Affidavit form requires attention to detail and an understanding of the legal process. When navigating through this procedure, individuals should heed the following dos and don'ts to ensure the process is handled correctly and efficiently.

What You Should Do:- Read the instructions carefully: Before filling out the form, thoroughly review the guidelines provided to ensure a clear understanding of the requirements and process.

- Gather accurate information: Verify all information, including asset values and debts of the estate, to ensure the affidavit is filled out correctly.

- Consult with an attorney: If there is any uncertainty regarding the form or if the estate involves complex issues, consider consulting a legal professional who specializes in estate law.

- Use black ink: Fill out the form in black ink to make sure that it is legible and can be easily copied or scanned for official records.

- Double-check for errors: Review the affidavit thoroughly before submission to avoid any inaccuracies that could delay the process.

- Do not rush: Taking your time to fill out the form accurately is crucial. Rushing through the process may lead to mistakes or omissions.

- Do not guess information: If uncertain about specific details, verify them before providing the information on the form. Guessing can lead to inaccuracies that may complicate the estate process.

- Do not leave blank spaces: Ensure all fields are completed. If a particular section does not apply, consider filling it with "N/A" or "Not Applicable" to indicate that it was not overlooked.

- Do not forget to sign the form: An unsigned form is not valid. Ensure that all required parties sign the affidavit in the presence of a notary public, when necessary.

- Do not ignore state-specific requirements: New Mexico may have unique requirements for small estate affidavits. Ensure all state-specific criteria are met to prevent the form from being rejected.

Misconceptions

When dealing with the distribution of assets of a deceased person in New Mexico, a Small Estate Affidavit form is a tool that can simplify the process. However, there are several misconceptions about this form and its use. Let’s dispel some of these misunderstandings.

- Misconception #1: The Small Estate Affidavit can be used immediately after the death.

It's a common belief that this form can be utilized right after a person passes away. However, in New Mexico, there is a mandatory waiting period of 30 days after the death before the affidavit can be used. This waiting period allows for the proper notification of heirs and the settlement of any outstanding matters. - Misconception #2: There is no value limit to what constitutes a 'small estate'.

Another misunderstanding is that the Small Estate Affidavit can apply to any estate, regardless of its value. In reality, New Mexico law stipulates that the total value of the property qualifying for transfer using this affidavit must not exceed a certain amount, which is subject to change and should be confirmed based on current laws. - Misconception #3: The form allows for the transfer of all types of property.

Some might think that the Small Estate Affidiciary allows for the transfer of any and all types of property. This isn't true; certain types of assets, such as real estate and vehicles, may have specific requirements or may not qualify for transfer via this affidavit, depending on the current New Mexico statutes and regulations. - Misconception #4: Completing the Small Estate Affidavit negates the need for a will.

This is a significant misconception. The use of a Small Estate Affidavit does not override the existence or necessity of a will. If the decedent left a will, it still needs to be filed with the appropriate New Mexico probate court, and the affidavit can only be used for assets that do not undergo the probate process. In essence, the affidavit is a tool for specific circumstances, not a substitute for a will or proper estate planning.

Understanding the specifics of the Small Estate Affidavit in New Mexico is crucial for those looking to use it effectively. It’s always recommended to seek expert guidance or legal advice to navigate the process accurately and to ensure compliance with all applicable laws and regulations.

Key takeaways

The New Mexico Small Estate Affidavit form is an important document used to handle the estate of a person who has passed away when the estate's value falls below a certain threshold. It provides a faster, simpler way of transferring property to heirs without the need for a lengthy probate process. Here are seven key takeaways about filling out and using this form:

- Eligibility Requirements: To use the Small Estate Affidavit in New Mexico, the total estate value must not exceed the limit set by state law. It is crucial to understand this threshold to determine if you're eligible to use the form.

- Accurate Information: Providing accurate and complete information on the affidavit is essential. Errors or omissions can lead to legal complications, delaying the property transfer process.

- Documentation: Attach necessary documents, such as the death certificate and proof of ownership of the assets, when submitting the affidavit. This documentation proves the estate's assets and your right to claim them.

- Notarization: The affidavit must be notarized. This means you'll need to sign the form in front of a Notary Public, who verifies your identity and acknowledges that you are signing voluntarily.

- Property Types: Understand which types of property can be transferred using the Small Estate Affidavit. Not all assets may qualify, so it's important to know which items you can include.

- Filing the Affidavit: Once completed and notarized, file the affidavit with the appropriate local court or entity as dictated by New Mexico law. Filing procedures may vary by county, so check with local courts to ensure compliance.

- Legal Advice: Considering consulting a legal expert. While the Small Estate Affidavit process is designed to be straightforward, seeking advice from a legal professional can help navigate any complexities specific to your situation.

Using a Small Estate Affidavit can significantly ease the burden of managing a loved one's estate during a difficult time. By following these guidelines, you can ensure the process is completed smoothly and according to New Mexico law.

Fill out Popular Small Estate Affidavit Forms for Different States

Create a Family Trust - This form requires detailed information about the deceased, the assets involved, and the heirs or beneficiaries.

Small Estate Affidavit Massachusetts - This document offers a practical solution for individuals aiming to collect the deceased’s property quickly, especially when no contested will or disputes are anticipated among potential heirs.

Personal Representative Paperwork - This streamlined process is beneficial for small estates, making it easier for heirs to settle financial matters swiftly.