Printable Small Estate Affidavit Form for New York

When a loved one passes away with a relatively modest estate, families are often faced with the question of how to legally proceed with the distribution of assets without undergoing the often lengthy and costly probate process. In the State of New York, the Small Estate Affidavit form serves as a streamlined solution for such situations. This legal document is designed to help beneficiaries and heirs efficiently manage and distribute the assets of estates that fall below a specified monetary threshold. It simplifies the legal process by allowing the transfer of property to rightful heirs without the need for a formal probate proceeding. The form, which outlines the assets, debts, and beneficiaries of the estate, is a critical tool for those seeking a more direct method of settling their loved one's affairs. Its usage, while subject to state-specific regulations, underscores the state's commitment to alleviating the administrative burden on families during a time of grief. The form's importance cannot be understated, as it not only facilitates a smoother transition of assets but also provides a sense of closure for those coping with loss.

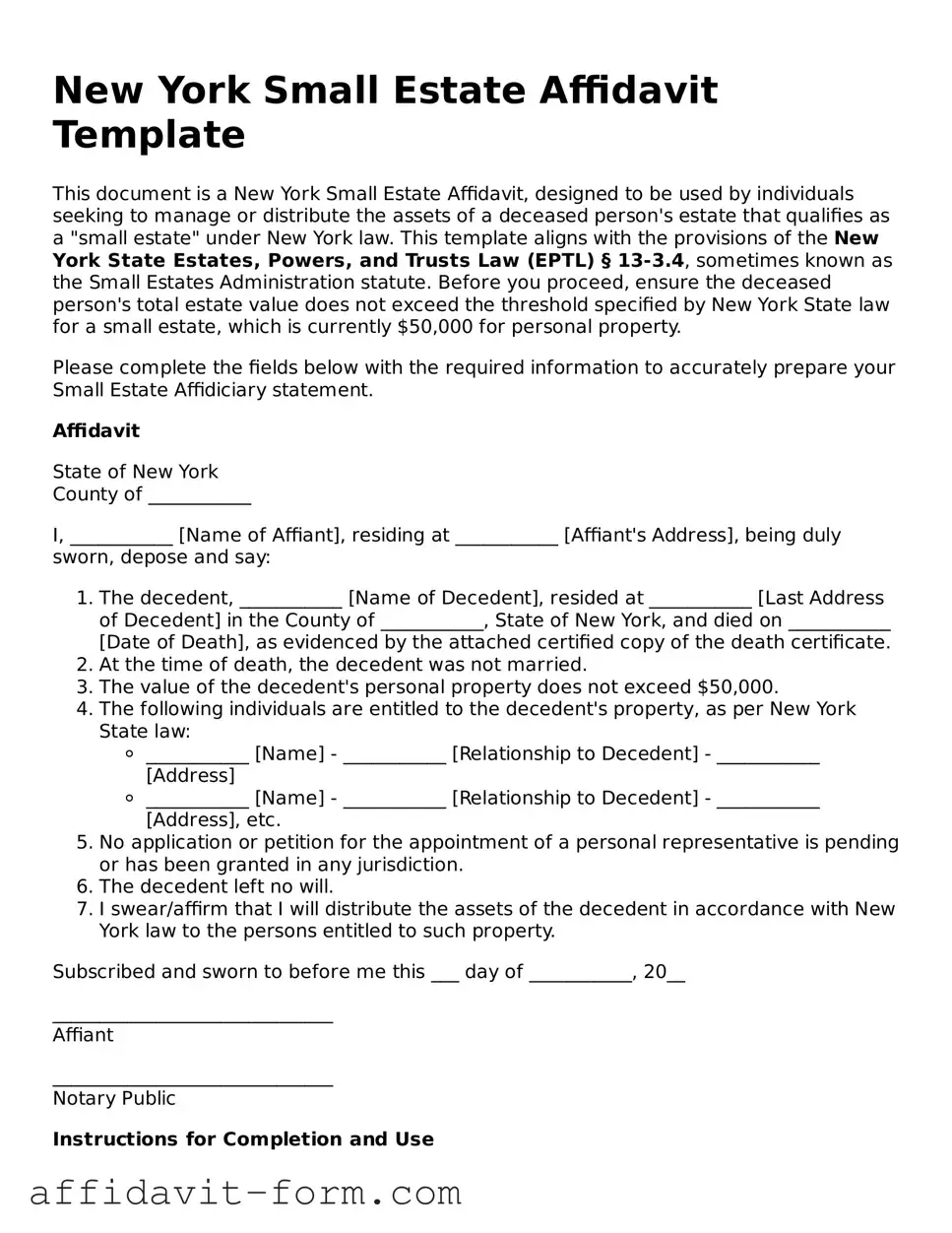

Form Example

New York Small Estate Affidavit Template

This document is a New York Small Estate Affidavit, designed to be used by individuals seeking to manage or distribute the assets of a deceased person's estate that qualifies as a "small estate" under New York law. This template aligns with the provisions of the New York State Estates, Powers, and Trusts Law (EPTL) § 13-3.4, sometimes known as the Small Estates Administration statute. Before you proceed, ensure the deceased person's total estate value does not exceed the threshold specified by New York State law for a small estate, which is currently $50,000 for personal property.

Please complete the fields below with the required information to accurately prepare your Small Estate Affidiciary statement.

Affidavit

State of New York

County of ___________

I, ___________ [Name of Affiant], residing at ___________ [Affiant's Address], being duly sworn, depose and say:

- The decedent, ___________ [Name of Decedent], resided at ___________ [Last Address of Decedent] in the County of ___________, State of New York, and died on ___________ [Date of Death], as evidenced by the attached certified copy of the death certificate.

- At the time of death, the decedent was not married.

- The value of the decedent's personal property does not exceed $50,000.

- The following individuals are entitled to the decedent's property, as per New York State law:

- ___________ [Name] - ___________ [Relationship to Decedent] - ___________ [Address]

- ___________ [Name] - ___________ [Relationship to Decedent] - ___________ [Address], etc.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The decedent left no will.

- I swear/affirm that I will distribute the assets of the decedent in accordance with New York law to the persons entitled to such property.

Subscribed and sworn to before me this ___ day of ___________, 20__

______________________________

Affiant

______________________________

Notary Public

Instructions for Completion and Use

- Fill in all the blank spaces with the appropriate information.

- Ensure you have attached a certified copy of the death certificate of the decedent.

- After completion, submit this affidavit to the relevant institution holding the decedent’s assets (e.g., bank, brokerage firm).

- Consult with a legal professional if you require assistance or have questions about the distribution of assets under New York law.

Document Details

| Fact | Description |

|---|---|

| Purpose | Used to handle small estates of deceased persons in New York without formal probate. |

| Governing Law(s) | New York Estates, Powers, and Trusts Law (EPTL) Section 13-1.1. |

| Eligibility | Estates valued at $50,000 or less, not including certain assets like jointly-owned property. |

| Required Documentation | Death certificate, list of assets, and potential debts of the deceased must be provided. |

| Limitations | Cannot be used if the decedent owned real estate solely in his or her name. |

| Who Can File | Typically filed by a surviving spouse or a child of the deceased. Other relatives may also be eligible. |

| Filing Location | Must be filed in the Surrogate's Court in the county where the deceased resided. |

| Processing Time | Varies by county but usually takes several weeks to a few months to process. |

| Benefits | Provides a simpler, faster way to distribute a small estate's assets without a lengthy probate process. |

How to Use New York Small Estate Affidavit

After losing a loved one, managing their assets can feel like an overwhelming task. The New York Small Estate Affidavit form is a legal document that simplifies this process for estates that fall below a certain value threshold. This form allows the person handling the estate to distribute the deceased's assets without going through a lengthy probate process. Below are detailed steps to accurately complete the New Thork Small Estate Affidavit form. Following this guide will help ensure the process is conducted smoothly, allowing you to focus on what truly matters during this difficult time.

- Start by gathering all necessary information about the deceased's assets, debts, and personal details. This includes their full legal name, address, date of death, and a detailed list of their assets and debts.

- Confirm that the total value of the deceased’s personal property does not exceed the applicable threshold for a small estate under New York law. This is crucial for determining eligibility to use the Small Estate Affidavit form.

- Obtain the correct form for the county in New York where the deceased resided. This form can usually be found on the local court's website or by visiting the courthouse in person.

- Fill in the decedent's full name, address, and date of death in the designated areas on the form. Make sure all information matches the official documents precisely.

- List all known assets of the deceased, such as bank accounts, securities, and tangible personal property, along with their estimated value at the time of death.

- Include information about any known debts, including unpaid bills and obligations.

- Provide your relationship to the deceased and your legal standing to file the affidavit. This could be as an heir, designated executor, or administrator if the deceased did not have a will.

- If applicable, attach a certified death certificate and any other required documents. Each county may have different requirements, so verify these details with the local court.

- Finally, submit the completed and notarized affidavit to the appropriate local court, along with any filing fees. Be sure to keep copies for your records.

Once the New York Small Estate Affidavit is filed and approved, you will be authorized to distribute the assets of the estate according to the deceased’s wishes or New York law if there was no will. The process can bring a sense of closure by resolving financial matters efficiently, which is invaluable during a time of mourning. Remember, this form is a legal document, and accuracy is imperative. If there is any confusion or uncertainty, consulting with a legal professional can provide guidance and peace of mind.

Listed Questions and Answers

What is a New York Small Estate Affididfavit form?

The New York Small Estate Affidavit form, officially known as the Affidavit of Voluntary Administration, is a legal document used in New York State. It allows parties, typically successors of the deceased, to manage and distribute a deceased person's estate without a formal probate process when the value of the estate is $50,000 or less. This form simplifies the legal proceedings required for small estates, making it a quicker and less expensive option for eligible individuals.

Who can file a New York Small Estate Affidavit?

To file a New York Small Estate Affidavit, you must be a successor of the deceased. This includes:

- Spouses

- Children

- Parents

- Siblings

- Other legal heirs

Additionally, the person filing must ensure the total value of the estate’s assets meets the requirement of being $50,000 or less, not including certain exempt properties such as jointly owned assets or life insurance proceeds payable to a named beneficiary.

What documents are required to file a Small Estate Affidavit in New York?

Filing a Small Estate Affidavit in New York requires several documents:

- The original death certificate of the deceased.

- A certified copy of the will, if applicable.

- An inventory list of the deceased's assets within New York.

- Documentation proving the value of each asset.

- Identification documents for the filer, demonstrating their relationship to the deceased.

This list is not exhaustive and additional documents may be requested by the Surrogate's Court handling the estate, based on specific circumstances surrounding the estate.

What steps should be taken after completing the Small Estate Affidavit?

After completing the Small Estate Affidavit, take the following steps:

- File the affidavit and accompanying documents with the appropriate New York Surrogate’s Court.

- Notify all potential heirs and any known creditors of the deceased about the filing.

- Use the affidavit to collect assets, pay debts, and distribute the remaining estate to the rightful heirs.

- Prepare a final accounting of how the estate’s assets were managed and distributed, if required by the court.

It's important to keep detailed records throughout this process to ensure compliance with New York State laws and court requirements.

Common mistakes

Filling out the New York Small Estate Affidavit form requires attention to detail and an understanding of what is being asked. Unfortunately, mistakes can be made that may delay the process or result in the rejection of the affidavit. Here are the ten most common mistakes individuals make when completing this form:

-

Omitting necessary documents: People often forget to attach required documents such as a certified copy of the death certificate or proof of the decedent's assets.

-

Incorrectly identifying assets: It's common to misstate or inaccurately describe the assets owned by the decedent, such as bank accounts or real property, leading to confusion or delays.

-

Failing to list all heirs and beneficiaries: All heirs and beneficiaries must be correctly identified and listed, including their contact information and their relationship to the decedent.

-

Miscalculating the value of the estate: The total value of the decedent's personal property is sometimes inaccurately calculated, either overestimating or underestimating its worth, which is crucial for determining if the estate qualifies as a 'small estate.'

-

Providing incomplete information: Sections of the form are sometimes left blank due to oversight or uncertainty about how to answer, which can lead to the form being returned for completion.

-

Not obtaining a taxpayer identification number for the estate: A taxpayer identification number is often required, but individuals sometimes either forget or are unaware that they need to obtain one.

-

Not using the deceased's legal name: The form must include the decedent's legal name exactly as it appears on official documents. Nicknames or variations can cause issues.

-

Forgetting to sign and date the form: An unsigned or undated form is a common oversight that leads to the immediate rejection of the application.

-

Improperly distributing assets before filing: Assets are sometimes distributed to heirs or beneficiaries before the small estate process is complete, which can complicate or invalidate the process.

-

Lack of notarization: The form requires notarization, but this step is occasionally overlooked, resulting in the need to resubmit the affidavit.

Attention to these details can help ensure that the process of completing the New York Small Estate Affidavit form goes smoothly and without unnecessary delay.

Documents used along the form

When navigating through the intricate processes following a loved one's passing in New grades York, handling the legal and financial aspects can be daunting. The New York Small Estate Affidavit form is a vital document for those cases where the deceased's estate is considered "small" under New York law, simplifying the process of estate distribution. However, to complete the process efficiently and comply with legal requirements, other forms and documents are often needed alongside the Small Estate Affidavit. Each serves its distinct role, ensuring the estate is handled correctly and according to the wishes of the deceased.

- Death Certificate: The certified death certificate is a prerequisite for almost all legal proceedings following a person's death. It serves as an official declaration of the death, including vital statistics such as time, place, and cause of death. In the context of the Small Estate Affidavit, it's used to confirm the death to relevant financial institutions and courts, forming the foundation for the legal process of estate handling.

- Copy of the Will (if applicable): If the deceased left a will, a copy must be provided. This document is crucial for understanding the decedent's wishes regarding the distribution of their assets. The Small Estate Affidavit process may vary depending on whether there is a will, affecting the distribution of assets to heirs or beneficiaries specified in the will.

- Inventory of Assets: An inventory list of the deceased's assets within New York is typically required. This list should include all personal property, bank accounts, stocks, and any other assets that did not automatically transfer to a survivor by operation of law. This inventory helps the court and the estate's executor or administrator understand the estate's value, ensuring that it qualifies as a "small estate" under New York law and is distributed accordingly.

- Creditor Notification Letters: These letters may be necessary if the deceased had outstanding debts. They are sent to known creditors, informing them of the decedent’s death and the Small Estate process. It allows creditors an opportunity to claim any outstanding debts against the estate. Managing these claims properly is crucial to prevent legal issues and ensure the estate is disbursed correctly.

Together with the New York Small Estate Affidavit, these documents facilitate a smoother legal journey through the distribution of small estates. While dealing with the loss of a loved one is never easy, being prepared and understanding the required paperwork can alleviate some of the stress. Each document plays a key role in clarifying the estate's details, from verifying the death and understanding the decedent’s final wishes to inventorying assets and dealing with creditors. This comprehensive approach helps ensure the process is handled with the dignity and respect it deserves.

Similar forms

The New York Small Estate Affidavit form is similar to several other legal documents used in the estate planning and administration process. By understanding these similarities, individuals can better navigate through the procedures involved in managing the estate of a loved one. Each document serves a unique purpose but shares the goal of facilitating the distribution of the deceased's assets in accordance with their wishes or the law.

Last Will and Testament: Just like the New York Small Estate Affidavit, a Last Will and Testament is a document that outlines the wishes of the deceased regarding the distribution of their assets. While both serve to guide the legal process of transferring property and assets, the Small Estate Affidavit is specifically used when the total value of the estate is below a certain threshold and thus qualifies for a simplified process. In contrast, a Last Will and Testament can cover estates of any size and requires probate court proceedings to validate the will and oversee the distribution process.

Letters of Administration: These are similar to the Small Estate Affidavit in that they are both used in the absence of a Last Will and Testament. Letters of Administration are issued by the court to appoint an administrator for the estate, giving them the authority to collect and distribute the estate's assets. Like the Small Estate Affidavit, Letters of Administration are instrumental in the process of settling an estate, but they are used when the estate does not qualify for the simplified small estate process due to its size or complexity.

Revocable Living Trust: A document that, like the New York Small Estate Affidavit, deals with the management and distribution of an individual's assets, a Revocable Living Trust allows for the transfer of assets to beneficiaries without going through probate court. While the Small Estate Affidavit simplifies the legal process for small estates, a Revocable Living Trust can be used for estates of any size and offers more control and flexibility over how and when the assets are distributed. Both aim to streamline the process of transferring assets to the rightful heirs or beneficiaries.

Dos and Don'ts

When dealing with the New York Small Estate Affidavit form, a streamlined legal document designed for the disposition of small estates without formal probate proceedings, there are several key practices to observe and pitfalls to avoid. Complying with these do's and don'ts can significantly ease the process of managing a deceased person's assets.

- Do ensure that the total value of the estate falls under the threshold specified by New York State law. This amount is subject to change, so verify the current limit before proceeding.

- Do gather all necessary documents beforehand, including death certificates, wills, and an inventory of the deceased's assets. Accurate and thorough documentation will streamline the process.

- Do accurately list all assets and their values. The affidavit requires a detailed account of the deceased’s assets. Underestimating or overestimating can create legal complications.

- Do involve other potential heirs or beneficiaries in the process, as their rights and interests may be affected by the affidavit. Communication and transparency can prevent conflicts.

- Don’t attempt to include assets that are outside the scope of what can legally be transferred using the Small Estate Affidavit. Real estate, in particular, often cannot be transferred using this document.

- Don’t sign the affidavit until you are in the presence of a notary public. The document must be notarized to have legal effect.

- Don’t overlook the necessity of obtaining Tax Waivers from the New York State Department of Taxation and Finance if applicable. Failing to clear up tax matters can halt the transfer of certain assets.

- Don’t delay in filing the affidavit with the appropriate court. Timeliness is crucial in estate matters, and delays can complicate or even compromise the process.

Adhering to these guidelines when completing the New York Small Estate Affidavit form can make the difference between a straightforward transfer of assets and potential legal entanglements. Always consider consulting with a legal professional to navigate any uncertainties or complexities that arise during the estate settlement process.

Misconceptions

Dealing with the estate of a loved one who has passed can be a daunting task, filled with legal terms and documents that can easily confuse anyone not familiar with the process. Among these, the New York Small Estate Affidavit form, designed to simplify the estate settlement process for smaller estates, is often misunderstood. Let's clarify some common misconceptions to help individuals navigate this process more smoothly.

It's only for bank accounts: A prevailing misconception is that the New York Small Estate Affidavit form is exclusively for accessing the deceased's bank accounts. In reality, this form can be used to collect a variety of assets belonging to the deceased, not limited to bank accounts. It may include personal property, stocks, and other assets, as long as they fall within the estate's value limit set by New York law.

There's no monetary limit: Some believe there's no upper limit to the value of the estate for which the Small Estate Affidavit can be used. However, in New York, the estate's value must not exceed a specific threshold (currently $50,000), excluding certain assets such as property the deceased owned jointly with rights of survivorship.

Real estate can be transferred using this form: Another common misunderstanding is that real estate can be transferred through a Small Estate Affidavit. The form is not designed for transferring real estate ownership. Other legal processes are in place for handling real estate after someone's death.

It grants immediate access to assets: Some people mistakenly believe that completing the Small Estate Affidavit provides immediate access to the deceased's assets. The process involves submitting the form to the appropriate court and possibly notifying creditors, which can take some time before assets are released.

It eliminates the need for a will: There's a misconception that if you use a Small Estate Affidavit, the deceased's will becomes irrelevant. This is not the case; the will's directions still guide the distribution of assets, and the affidavit is simply a tool to facilitate the process under certain circumstances.

It avoids all estate taxes: Some people incorrectly assume that using a Small Estate Affidavit will allow the estate to avoid taxes. While the estate may be smaller and therefore potentially subject to less tax, the affidavit itself does not exempt the estate from applicable state or federal taxes.

Any family member can file: A final misconception is that any family member can file the affidavit. In reality, New York State law prioritizes who is eligible to file the affidavit, usually starting with the spouse, then children, and so on, depending on the deceased's surviving relatives. Each person's ability to file is subject to specific legal stipulations.

Understanding these nuances can be critical for those navigating the aftermath of a loved one's passing. When in doubt, consulting with a legal professional familiar with New York estate law can provide clarity and guidance, ensuring that the process is handled correctly and in accordance with the law.

Key takeaways

Understanding eligibility is crucial before attempting to use the New York Small Estate Affidavit form. This document is intended for the estates of individuals who have died with $50,000 or less in personal property. Real estate is not included in this threshold. This form allows for a simpler, more streamlined process for the small estates to be settled without a formal probate procedure.

Gather all necessary information and documents before filling out the Small Estate Affidavit. You will need a certified copy of the death certificate, a list of all the deceased person's property and debts, the names and addresses of all heirs, and any will, if it exists. Having all pertinent information at hand makes the process smoother and ensures accuracy in the affidavit.

Accuracy and completeness when filling out the form are non-negotiable. The affidavit requires detailed information about the deceased's assets, debts, and the beneficiaries. Any error or omission can delay the process, and inaccurately reporting assets can have legal repercussions. Double-check the form before submission to avoid potential issues.

Understand the process for filing the Small Estate Affidavit in New York. Once the form is completed, it must be filed with the Surrogate's Court in the county where the deceased person lived. There may be a filing fee involved, which varies by county. After filing, the court will review the affidavit and, if everything is in order, issue a decree that allows for the distribution of the estate's assets according to the filed affidavit.

Fill out Popular Small Estate Affidavit Forms for Different States

Register Car in Mississippi From Out-of-state - Completing a Small Estate Affidavit typically requires detailed information about the deceased and their estate.

Affidavit of Heirship Alabama - State-specific, the Small Estate Affidavit must meet local legal thresholds regarding the maximum value of the estate it applies to.