Printable Small Estate Affidavit Form for North Carolina

When someone passes away in North Carolina without a will, or with a relatively simple estate, navigating the probate process can seem daunting. However, there's a more straightforward path for the heirs or the executor: the North Carolina Small Estate Affidavit form. This tool simplifies the legal procedures required to distribute the deceased's assets, bypassing the more complex and time-consuming aspects of the state's probate process. Designed for estates that fall below a certain value threshold, this affidavit allows for an expedited process, enabling faster access to assets for those entitled. It’s particularly beneficial for small asset holders and can significantly reduce legal fees and administrative burdens. However, understanding its criteria, limitations, and the specific steps to correctly file the affidavit is essential for those seeking to use it, ensuring a smooth and efficient transfer of assets in compliance with North Carolina law.

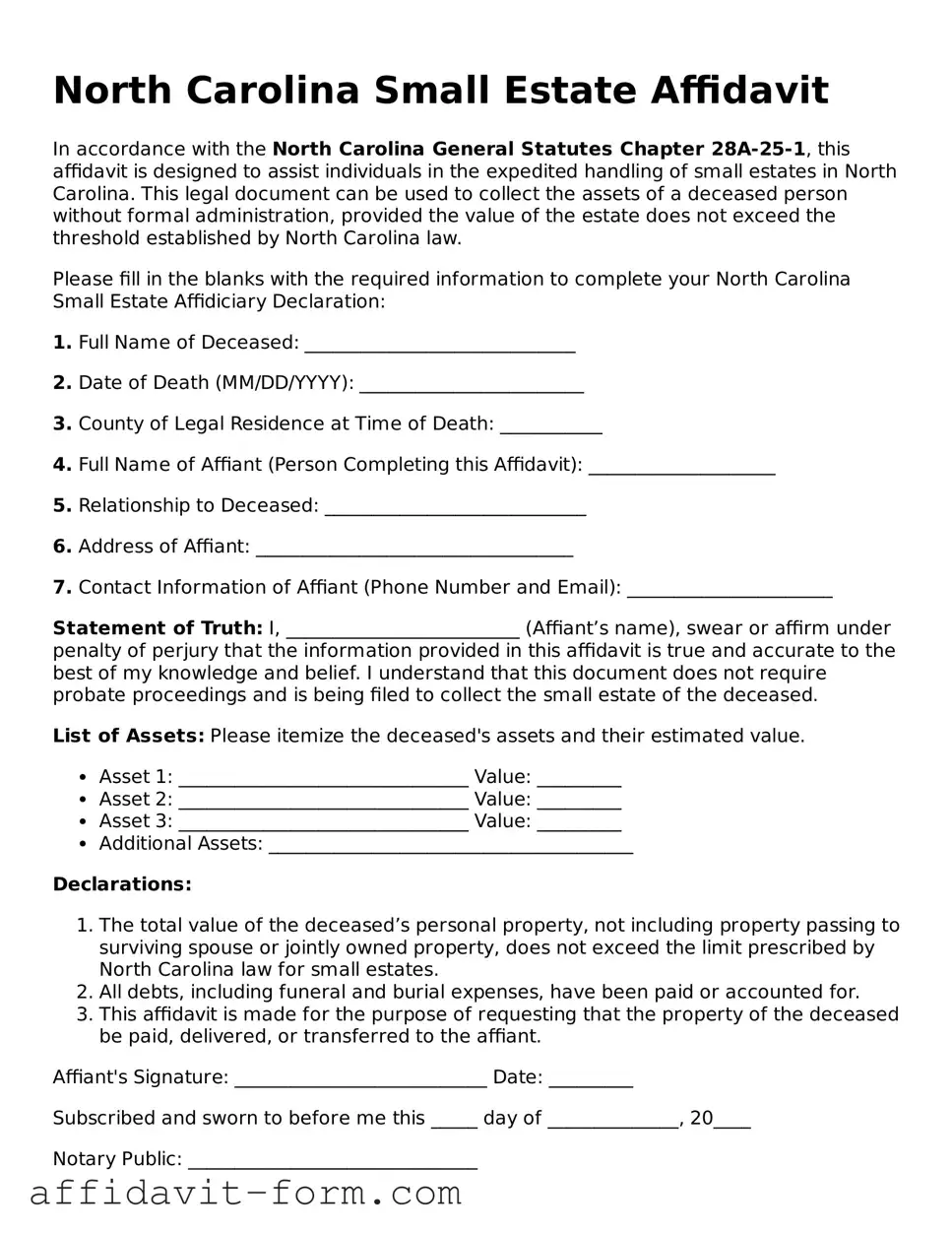

Form Example

North Carolina Small Estate Affidavit

In accordance with the North Carolina General Statutes Chapter 28A-25-1, this affidavit is designed to assist individuals in the expedited handling of small estates in North Carolina. This legal document can be used to collect the assets of a deceased person without formal administration, provided the value of the estate does not exceed the threshold established by North Carolina law.

Please fill in the blanks with the required information to complete your North Carolina Small Estate Affidiciary Declaration:

1. Full Name of Deceased: _____________________________

2. Date of Death (MM/DD/YYYY): ________________________

3. County of Legal Residence at Time of Death: ___________

4. Full Name of Affiant (Person Completing this Affidavit): ____________________

5. Relationship to Deceased: ____________________________

6. Address of Affiant: __________________________________

7. Contact Information of Affiant (Phone Number and Email): ______________________

Statement of Truth: I, _________________________ (Affiant’s name), swear or affirm under penalty of perjury that the information provided in this affidavit is true and accurate to the best of my knowledge and belief. I understand that this document does not require probate proceedings and is being filed to collect the small estate of the deceased.

List of Assets: Please itemize the deceased's assets and their estimated value.

- Asset 1: _______________________________ Value: _________

- Asset 2: _______________________________ Value: _________

- Asset 3: _______________________________ Value: _________

- Additional Assets: _______________________________________

Declarations:

- The total value of the deceased’s personal property, not including property passing to surviving spouse or jointly owned property, does not exceed the limit prescribed by North Carolina law for small estates.

- All debts, including funeral and burial expenses, have been paid or accounted for.

- This affidavit is made for the purpose of requesting that the property of the deceased be paid, delivered, or transferred to the affiant.

Affiant's Signature: ___________________________ Date: _________

Subscribed and sworn to before me this _____ day of ______________, 20____

Notary Public: _______________________________

My Commission Expires: _______________________

Document Details

| Fact Number | Description |

|---|---|

| 1 | Purpose: The North Carolina Small Estate Affidavit form is utilized to simplify the administration of estates valued at $20,000 or less, or $30,000 if the surviving spouse is the sole heir. |

| 2 | Eligibility: It can only be filed by a surviving spouse, family member, or other person entitled to the estate's assets, 30 days after the decedent's death. |

| 3 | Governing Law: The form and procedure are governed by the North Carolina General Statutes, Chapter 28A, Article 25. |

| 4 | Asset Limit: The estate must not contain real estate owned by the decedent and must be valued at less than the statutory limit, taking into account only personal property. |

| 5 | Required Information: The affidavit requires detailed information about the decedent, the estate's assets, and the affiant, along with any debts and claims against the estate. |

| 6 | Filing Procedure: The completed affidavit must be filed with the Clerk of Superior Court in the county where the decedent lived at the time of their death. |

| 7 | Costs: While the form itself may be free, counties may charge a filing fee. Additional costs can include the cost of certified copies of the death certificate and any legal advice sought. |

| 8 | Benefits: Using the Small Estate Affidavit can significantly speed up the process of estate administration, allowing for quicker distribution of assets to heirs. |

| 9 | Limitations: While expedient, this process cannot be used if the estate qualifies for regular probate, often due to its size or complexity, or if there's real estate involved. |

How to Use North Carolina Small Estate Affidavit

After a loved one passes away, managing their estate can seem like a daunting task. If you're handling an estate in North Carolina and it qualifies as "small" by legal standards, completing a Small Estate Affidavit form may be a necessary step. This document streamlines the process, allowing you to distribute the deceased's assets without a lengthy court probate process. Here's a step-by-step guide to filling out the North Carolina Small Estate Affidavit form, presented in a manner to assist you through this important yet sometimes complex endeavor.

- Gather necessary documents: Before you start, make sure you have a copy of the death certificate and an inventory list of the deceased's assets. This will help you accurately complete the form.

- Access the form: Obtain the North Carolina Small Estate Affidavit form. This can typically be found online on the North Carolina court's website or by visiting the local clerk of court’s office.

- Read the instructions carefully: Each form comes with a set of specific instructions. These guide you on how to correctly fill out the form and what documents need to be attached.

- Fill out the decedent’s information: Provide the full legal name of the deceased, including any aliases, their date of death, and the county of death.

- Provide your information: As the affiant (the person filling out the form), enter your full name, relationship to the deceased, and contact information.

- List the assets: Detail all assets belonging to the deceased at the time of death that do not automatically transfer to another person, such as bank accounts without a designated beneficiary. Ensure accuracy for both descriptions and values.

- Identify the heirs: List all known heirs and their relationship to the deceased. This includes anyone who has a right to inherit the deceased's assets under state law.

- Attach additional documentation: Depending on your situation, you may need to attach additional documents, such as the death certificate or proof of your right to act on behalf of the estate.

- Sign and notarize the form: Once you've completed the form and checked all the information for accuracy, sign it in front of a notary public. The notary will then notarize the document, making it officially recognized.

- Submit the form: Deliver the completed form and any attachments to the clerk of court in the county where the deceased lived. You may be required to pay a filing fee at this time.

Completing the North Carolina Small Estate Affidavit form is a significant step in managing a small estate. It may seem complex at first, but by following these steps carefully, you can ensure that the process is as smooth and error-free as possible. Understanding and respecting the legal process honors the memory of the deceased while protecting the rights and interests of all involved.

Listed Questions and Answers

What is a North Carolina Small Estate Affidavit?

A North Carolina Small Estate Affidavit is a legal document used to handle small estates in North Carolina. It provides a simpler and more expedited way to distribute the assets of a deceased individual, known as the decedent, when those assets fall under a certain value limit. This form is especially valuable for those cases where the decedent did not leave a will.

Who can file a Small Estate Affidavit in North Carolina?

Typically, the person entitled to file a Small Estate Affidavit in North Carolina is the surviving spouse, if applicable, or a close relative of the decedent. If the decedent has no family, a creditor who has a valid claim against the estate can file. However, the applicant must first obtain the role of executor or administrator of the estate to proceed with this process.

What are the requirements for filing a Small Estate Affidavid in North Carolina?

To qualify for filing a North Carolina Small Estate Affidavit, the total value of the decedent's personal property, excluding real estate, must not exceed $20,000, or $30,000 if the surviving spouse is the sole heir. Additionally, at least 30 days must have passed since the decedent’s death before the affidavit can be filed with the court.

What documents are needed to accompany the Small Estate Affidavit?

When filing a Small Estate Affidavit, you'll need to provide several documents, including:

- A certified copy of the death certificate.

- A complete list of the decedent's assets and their estimated value.

- Documentation of any debts owed by the decedent.

- Proof of the filer's right to act on behalf of the estate, such as a will naming them as executor or legal documents appointing them as administrator.

How is the Small Estate Affidavit filed in North Carolina?

The Small Estate Affidavit must be filed with the Clerk of Superior Court in the county where the decedent lived at the time of their death. The form must be filled out completely and accurately, accompanied by all required documents and the applicable filing fee. It is advisable to contact the court in advance to verify the current fee and acceptability of your documents.

What happens after a Small Estate Affidavit is filed?

Once the Small Estate Affidavit is filed, the court will review the documents. If approved, the court will issue an order that allows the distribution of the decedent's assets according to state law. The assets can then be legally transferred to the rightful heirs without the need for a formal probate process.

Can real estate be transferred using a Small Estate Affidavit in North Carolina?

No, real estate cannot be transferred using a Small Estate Affidavit in North Carolina. This form is only intended for the transfer of personal property, such as bank accounts, stocks, and personal belongings. If the decedent owned real estate, other legal processes might be necessary to transfer ownership.

How long does the process take?

The time it takes to process a Small Estate Affidavit in North Carolina can vary. After the affidavit is filed, it may take a few weeks for the court to review the documents and issue an order. The total time will depend on the court's caseload and whether all necessary documents are provided at the time of filing.

Where can I get a Small Estate Affidavit form?

Small Estate Affidavit forms are available from the Clerk of Superior Court in the county where the decedent resided. Some counties may also offer these forms online through their official websites. It's important to ensure that you are using the most current form and following the specific instructions for your county.

Common mistakes

Filling out the North Carolina Small Estate Affidavit form incorrectly can lead to delays and legal complications. Here are five common mistakes people often make:

Failing to ensure eligibility: Before filling out the form, it's crucial to verify that the estate qualifies as a 'small estate' under North Carolina law. This means the total value of the estate, less the amount of liens and encumbrances, must not exceed the statutory limit.

Incorrectly listing assets: Often, people make the mistake of either omitting assets that should be included or listing assets that do not need to be on the affidavit. Understanding which assets to list is critical for the accurate processing of the affidavit.

Not gathering sufficient documentation: Some individuals submit the affidavit without the necessary documents to support the statements made in the form. Proper documentation, such as death certificates, proof of property value, and accounts statements, is essential for verification purposes.

Forgetting to obtain signatures from all legal heirs: The affidavit requires the signatures of all legal heirs or beneficiaries. Failing to obtain all necessary signatures can result in the affidavit being considered invalid.

Omitting or inaccurately filling out the decedent's debts section: It's a common error to either skip the section regarding the decedent's debts or not to detail them accurately. Full disclosure and accuracy in this section are vital to prevent future legal issues.

Avoiding these mistakes is crucial for the smooth processing of the affidavit and to prevent unnecessary legal hurdles. Individuals should consider seeking professional legal advice to ensure accuracy and compliance with North Carolina laws.

Documents used along the form

In administrating an estate in North Carolina, particularly a small estate, it's crucial to be familiar with various documents that may accompany the Small Estate Affidavit. This form is just one part of a larger process aimed at simplifying the handling of an estate that falls beneath a certain value threshold. Alongside it, several other forms and documents are frequently needed to ensure a thorough and legally sound process. These documents play distinct roles, from validating the deceased's will to addressing outstanding debt and taxes.

- Death Certificate: This official document serves as proof of death, detailing the date, location, and cause of death. It's essential for officially initiating the estate process and is required by financial institutions and other entities to proceed with transferring assets.

- Will: If the deceased left a will, it must be submitted to the court. This document outlines the deceased’s wishes regarding the distribution of their property and the executor of the estate.

- Letters Testamentary or Letters of Administration: These documents are issued by the court to authorize an individual to act on behalf of the deceased's estate. Letters Testamentary are issued when there is a will, while Letters of Administration are issued when there isn’t.

- Notice to Creditors: This is a legal notice placed in a local newspaper that informs potential creditors of the estate administration. It's a step toward settling the deceased's debts and protecting the estate from future claims.

- Inventory of Assets: An itemized list of the deceased’s assets at the time of death. This includes real estate, bank accounts, personal property, and other assets, which helps in understanding the estate's value.

- Waiver of Bond: Often filed if the executor or administrator of the estate is required to post a bond. This document may be submitted to waive that requirement, typically if the will specifies it or all heirs agree.

- Final Account: A detailed report filed with the court, showing all income to the estate, expenses paid out, and distribution of assets to heirs. This document marks the completion of the estate's administration.

Handling a small estate in North Carolina can appear straightforward, but it involves a series of legal steps and documentation to ensure the process respects the deceased's wishes and adheres to state laws. From confirming death and the will's validity to addressing debts and distributing assets, each document plays a critical role. Understanding these forms and their significance aids in navigating the estate administration process efficiently and accurately.

Similar forms

The North Carolina Small Estate Affidavit form is similar to other estate planning and probate documents, each designed to simplify the estate settlement process under specific circumstances. While they share common goals, distinct features and uses characterize these documents.

One such document is the General Affidavit. Like the Small Estate Affidavit, a General Affidavit is a sworn statement of facts, but it is used in a broader range of legal situations. Both require the signer to attest to the truth of the information provided under penalty of perjury. However, the General Affidavit is more versatile and can be used outside of probate matters, including but not limited to, identity verification, property disputes, and legal declarations.

Another document related to the North Carolina Small Estate Affidavit is the Last Will and Testament. Both serve crucial roles in the management and distribution of an individual's estate upon their death. However, while the Small Estate Affidavit is typically used to expedite the transfer of assets in estates that fall below a certain value threshold, a Last Will and Testament is a comprehensive document that outlines a person’s wishes for their entire estate, regardless of its size. It includes designations for executors, guardians for minor children, and specific bequests among other directives.

The Transfer on Death Deed (TODD) is another estate planning tool with similarities to the Small Estate Affidavit. Both allow for the transfer of assets without the need for traditional probate. A TODD enables an individual to designate beneficiaries to receive real property upon the owner's death, bypassing probate court for that asset. While it only applies to real estate, the Small Estate Affidiform offers a broader application, including personal property, bank accounts, and other assets, for estates that qualify under state law limits.

Dos and Don'ts

Filling out the North Carolina Small Estate Affidavit form can be a straightforward process if done correctly. To assist, here’s a list of best practices and what to avoid to ensure the process is completed efficiently and accurately.

What You Should Do:

- Double-check that the total value of the estate meets the criteria for a "small estate" in North Carolina. This ensures the form is applicable to your situation.

- Gather all necessary documents beforehand, including a certified death certificate and an inventory list of the decedent’s personal property.

- Detail all assets accurately. It is crucial to list every asset with its current value to avoid any discrepancies or legal issues down the line.

- Review the form multiple times before submitting. This is to ensure that all information provided is complete and correct. An error-free submission helps prevent delays.

What You Shouldn't Do:

- Do not guess the value of assets. It’s important to assess or appraise the assets’ value accurately to avoid legal complications. If unsure, consult a professional appraiser.

- Avoid leaving sections of the form blank. If a section does not apply, indicate this with a “N/A” (not applicable) to demonstrate that the question was not overlooked.

- Do not sign the form without verifying that all the information is true and accurate to the best of your knowledge. Providing false information can result in severe legal ramifications.

- Refrain from submitting the form without making sure all required supporting documentation is attached. Incomplete submissions can result in the denial of the affidavit.

Following these guidelines will help ensure a smoother process and avoid common pitfalls when filling out the North Carolina Small Estate Afficavit form. Remember, when in doubt, seeking the advice of a legal professional can provide clarity and confidence in managing the estate affairs properly.

Misconceptions

Many individuals have misconceptions about the North Carolina Small Estate Affidavit form. These misunderstandings can lead to confusion or incorrect handling of an estate. It is crucial to dispel these myths for a smoother process in managing small estates under North Carolina law.

Any estate can be settled using the Small Estate Affidavit. This is not true. In North Carolina, a Small Estate Affidavit can only be used if the total value of the personal property of the deceased, less liens and encumbrances, does not exceed $20,000 (or $30,000 if the surviving spouse is the sole heir). Real estate transactions cannot be processed through a Small Estate Affidavit in North Carolina.

The Small Estate Affidavit allows immediate access to assets. While it is designed to simplify the process, there's a 30-day waiting period from the date of death before the affidavit can be submitted to the Clerk of Superior Court. This period allows time for any potential disputes or claims against the estate to be addressed.

Completing the Small Estate Affidavit is complicated. The process has been designed to be user-friendly for non-lawyers. The form requires basic information about the deceased’s estate and the heirs. It is essential, however, to ensure that the information provided is accurate and complete to avoid delays.

All assets go through the Small Estate process. This is a common misconception. Some assets, such as those with designated beneficiaries (like life insurance policies or retirement accounts), joint bank accounts, and property owned in joint tenancy, pass outside of the small estate process. It's important to identify which assets are actually part of the estate before proceeding.

A lawyer is required to file a Small Estate Affidavit. In North Carolina, there is no legal requirement for an attorney to complete or file a Small Estate Affidavit. It’s a process that many individuals can complete on their own. However, consulting with a legal professional can provide valuable guidance and ensure that all aspects of the estate are properly addressed.

The same rules apply in all counties within North Carolina. While the general process and requirements are state-wide, some local variations might exist. For instance, specific counties may have their own forms or require different documentation to accompany the Small Estate Affidavit. It's beneficial to check with the local Clerk of Superior Court for any county-specific requirements.

Key takeaways

If you're handling a small estate in North Carolina, using the Small Estate Affidavit form can simplify the process significantly. Here are key takeaways to keep in mind:

- Understanding Eligibility: The North Carolina Small Estate Affidavit can only be used if the total value of the estate's personal property, after debts have been paid, does not exceed a certain threshold. Understanding this criterion is crucial before proceeding.

- Required Documents: Alongside the affidavit, you may need to attach a certified copy of the death certificate and possibly a list of the estate's assets and debts. Ensuring you have all necessary documents upfront can prevent delays.

- Identifying the Affiant: The affidavit must be filled out and signed by an eligible affiant, usually a successor to the deceased or a representative authorized by the successors. Identifying the correct affiant is essential.

- Accuracy of Information: The affidavit requires detailed information about the deceased’s assets and their value. Providing accurate and truthful information is not only a legal requirement but also crucial for the smooth processing of the affidavit.

- Witness and Notarization Requirements: In most cases, the affidavit will need to be notarized and possibly witnessed. Understanding the specific requirements in North Carolina ensures compliance.

- Filing with the Correct Court: The Small Estate Affidavit needs to be filed with the Clerk of Superior Court in the county where the deceased was residing at the time of death. Filing in the correct jurisdiction is important for the affidavit to be processed.

- Handling Real Estate: It’s important to note the affidavit is generally for personal property. In North Carolina, transferring real estate often requires a different process.

- Paying Debts and Distribution: The affiant is responsible for using the estate's assets to pay off debts and distribute the remaining assets according to the will or state law. This duty should be approached with careful consideration to fiduciary responsibilities.

- Seeking Legal Advice: Given the complexities and legal implications, seeking advice from a legal professional familiar with North Carolina's estate laws can provide guidance and help navigate the process effectively.

Fill out Popular Small Estate Affidavit Forms for Different States

Small Estate Affidavit Washington - Intended to streamline the often overwhelming process of dealing with estate matters after a death.

How to File Probate Without a Lawyer - It’s a beneficial option for estates with limited physical assets, enabling a smoother and more direct transfer process for heirs.

Create a Family Trust - By facilitating quick access to assets, it helps ensure that the deceased's financial responsibilities and wishes are honored.