Printable Small Estate Affidavit Form for North Dakota

When a loved one passes away, navigating the aftermath can be a complex maze of legal requirements and emotional hurdles. In North Dakota, the Small Estate Affidavit form serves as a beacon of streamlined efficiency for those dealing with the estate of someone who has died. This form is particularly relevant for estates that fall below a certain monetary threshold, sparing beneficiaries from the often lengthy and convoluted probate process. Its very essence is to furnish a faster, less cumbersome path for the transfer of property to the rightful heirs or legatees. Consequently, the significance of understanding how and when to utilize this document cannot be overstated, as it encompasses aspects such as eligibility criteria, the scope of assets it covers, and the legal implications of its execution. By providing a simplified method for asset distribution, the Small Estate Affidavit form reflects North Dakota's commitment to making the probate process less daunting for its residents, thereby allowing them to focus on healing and moving forward during a difficult time.

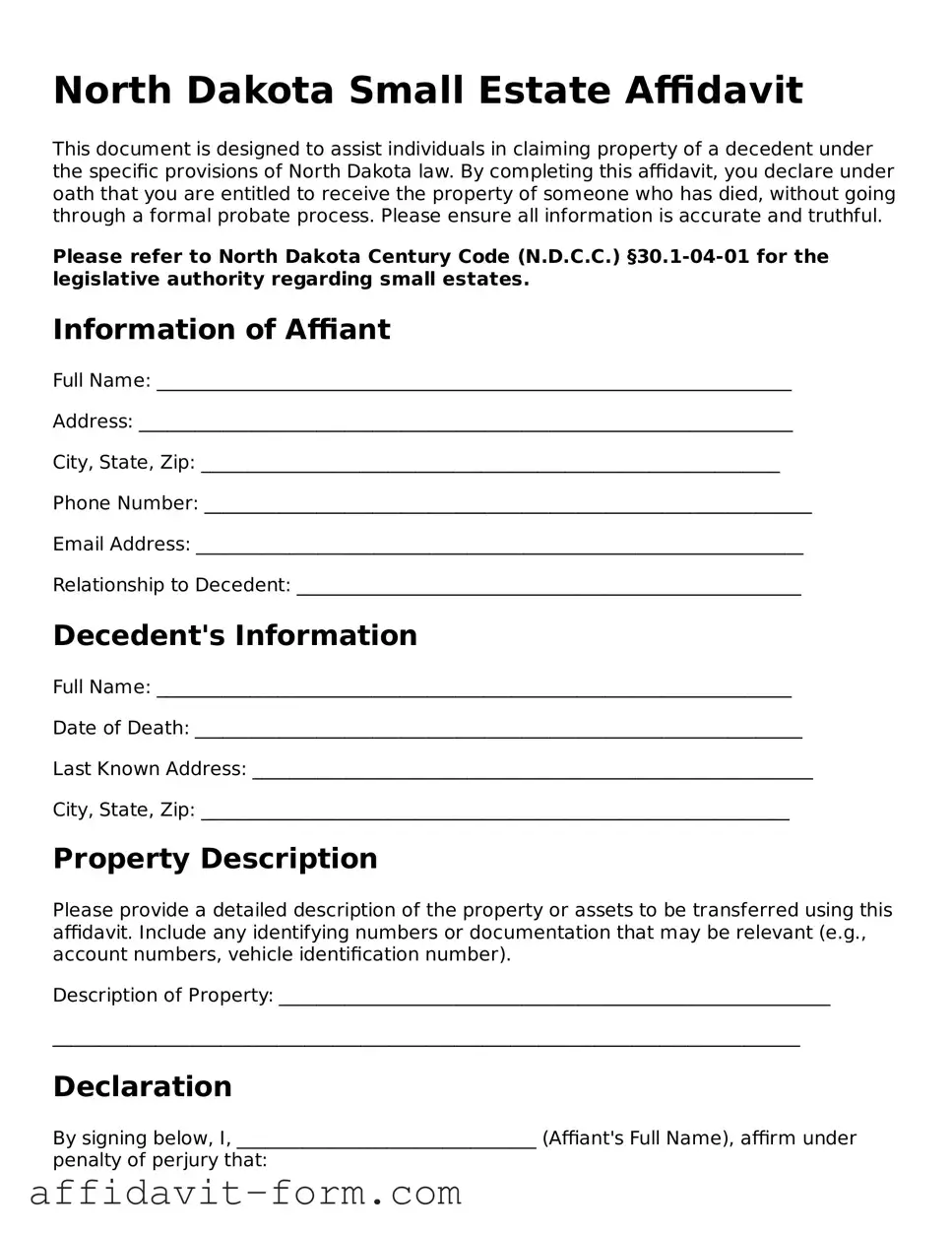

Form Example

North Dakota Small Estate Affidavit

This document is designed to assist individuals in claiming property of a decedent under the specific provisions of North Dakota law. By completing this affidavit, you declare under oath that you are entitled to receive the property of someone who has died, without going through a formal probate process. Please ensure all information is accurate and truthful.

Please refer to North Dakota Century Code (N.D.C.C.) §30.1-04-01 for the legislative authority regarding small estates.

Information of Affiant

Full Name: ____________________________________________________________________

Address: ______________________________________________________________________

City, State, Zip: ______________________________________________________________

Phone Number: _________________________________________________________________

Email Address: _________________________________________________________________

Relationship to Decedent: ______________________________________________________

Decedent's Information

Full Name: ____________________________________________________________________

Date of Death: _________________________________________________________________

Last Known Address: ____________________________________________________________

City, State, Zip: _______________________________________________________________

Property Description

Please provide a detailed description of the property or assets to be transferred using this affidavit. Include any identifying numbers or documentation that may be relevant (e.g., account numbers, vehicle identification number).

Description of Property: ___________________________________________________________

________________________________________________________________________________

Declaration

By signing below, I, ________________________________ (Affiant's Full Name), affirm under penalty of perjury that:

- The value of the entire estate subject to disposition does not exceed the statutory threshold specified in N.D.C.C. §30.1-04-01.

- At least forty days have elapsed since the death of the decedent.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- I have a legal right to claim the property described above and have provided notice to all parties having an interest in the estate.

- All debts of the decedent, including funeral and burial expenses, have been paid or adequately provided for.

- I indemnify and hold harmless all parties relying upon this affidavit from all claims, demands, and other liability that may arise as a result of their reliance on this document.

Date: ___________________________

Signature of Affiant: ________________________________

State of North Dakota

County of _________________________

Subscribed and sworn to (or affirmed) before me this ______ day of _______________, 20____, by ________________________________________ (Affiant's Full Name).

______________________________________

(SEAL) Notary Public

My Commission Expires: __________________

Document Details

| Fact | Detail |

|---|---|

| 1. Purpose | The North Dakota Small Estate Affidavit form is used to settle small estates without formal probate. |

| 2. Eligibility | Estate value must not exceed $50,000 in North Dakota. |

| 3. Waiting Period | A waiting period of 30 days after the decedent's death is required before the affidavit can be filed. |

| 4. Governing Law | Governed by North Dakota Century Code, Section 30.1-23-01. |

| 5. Required Information | Information necessary includes decedent's legal name, date of death, description of assets, and claimant's relationship to the deceased. |

| 6. Beneficiary Requirements | Beneficiaries must be identified and can include surviving spouse, children, or other entitled relatives under state law. |

| 7. Notarization | The affidavit must be signed in the presence of a Notary Public to be legally valid. |

| 8. Filing Location | The completed and notarized affidavit is filed with the local county court in the jurisdiction where the decedent lived. |

| 9. Real Estate | The Small Estate Affidavit cannot be used for transferring ownership of real estate in North Dakota. |

| 10. Cost | There may be a filing fee, which varies by county. |

How to Use North Dakota Small Estate Affidavit

Filling out a North Dakota Small Estate Affidavit form is a necessary process when claiming assets from a small estate without formal probate. This document allows individuals to collect the deceased person's assets by providing proof of entitlement under state laws. The process requires attention to detail and accurate information about the deceased, their assets, and the heirs. Following the steps below will help ensure the form is completed correctly and efficiently.

- Start by entering the full legal name of the deceased, also known as the decedent, at the top of the form.

- Fill in the date of death of the decedent, ensuring it matches the official death certificate.

- State your relationship to the decedent to establish your legal claim to the estate.

- List the decedent’s last known address, providing a clear indication of their residency at the time of death.

- Include a complete inventory of the decedent's personal property and assets that are part of the small estate. Be specific and provide estimated values for each item.

- Identify all known debts and obligations of the decedent, including any outstanding bills, loans, or taxes due.

- Provide information regarding the decedent’s last will, if applicable. If a will exists, attach a copy to the affidavit.

- Indicate the names and addresses of all legal heirs, specifying their relationship to the decedent and the portion of the estate they are entitled to, if known.

- Sign the affidavit in front of a notary public. The form must be notarized to be considered legally valid. Ensure that you bring a valid form of identification to the notary appointment.

- Finally, submit the completed and notarized affidavit to the appropriate institution (e.g., bank) or agency to claim the assets.

After completing these steps, the institution or agency holding the assets will review the affidavit for compliance with North Dakota laws. They may require additional documentation or information to release the assets. Ensuring the form is filled out thoroughly and accurately will expedite this process, allowing for a smoother transfer of the decedent's assets to the rightful heirs.

Listed Questions and Answers

What is a North Dakota Small Estate Affidavit?

In North Dakota, a Small Estate Affidavit is a legal document that allows the assets of a deceased person, known as the decedent, to be distributed without a formal probate process. It is used when the total value of the decedent's estate does not surpass a specific threshold, making it a simpler, faster method for distributing assets to heirs or beneficiaries.

Who is eligible to file a Small Estate Affidavit in North Dakota?

To be eligible to file a Small Estate Affidate, the individual must be an heir or designated beneficiary of the deceased person's estate. Additionally, the total value of the estate's assets, after deducting any liens or encumbrances, must not exceed North Dakota's statutory limit. It is important to consult current state laws to determine the exact threshold as it may change.

What assets can be transferred using a Small Estate Affidavit?

Assets that can typically be transferred using a Small Estate Affidate in North Dakota include:

- Personal property such as vehicles, furniture, and non-titled belongings.

- Bank account balances, up to a certain limit.

- Certain types of securities and stocks.

Real estate and other titled assets may not qualify for transfer using this process and may require a more formal probate procedure.

What is the process for filing a Small Estate Affidavit in North Dakota?

The process involves several steps:

- Verifying that the total value of the estate falls below the state's threshold.

- Completing the Small Estate Affidavit form, which requires detailed information about the decedent, their assets, and the heirs or beneficiaries.

- Ensuring all necessary signatures are obtained, which may include witnesses or notarization, depending on state requirements.

- Presenting the completed affidavit to the entity or institution holding the assets, such as a bank, for transfer to the rightful heirs or beneficiaries.

Are there any fees associated with filing a Small Estate Affidavit in North Dakota?

While filing a Small Estate Afitte itself may not incur a fee, there may be other associated costs, such as notary fees or costs for obtaining death certificates. Additionally, individual institutions may charge fees for transferring assets. It is advisable to inquire about potential fees in advance.

How long does the process take?

The duration from filing a Small Estate Adit to the distribution of assets can vary widely based on several factors, including the complexity of the estate, the responsiveness of financial institutions, and the completeness of the documentation provided. Typically, the process can be completed within a few weeks, but it may take longer in some cases.

Can a Small Estate Affidavit be contested?

Yes, like any legal process, the use of a Small Estate Afitte can be contested. Challenges may arise if there are disputes over the heirs' identities, the value of the estate, or the interpretation of the decedent's will, if one exists. Such contests can delay or even halt the distribution of assets. It is crucial for parties to seek legal advice if they anticipate or encounter disputes.

Common mistakes

When managing the affairs of a loved one who has passed away, the North Dakota Small Estate Affidavit form can provide a simpler, more expedient process for settling small estates. However, inaccuracies in filling out this form can delay the process, lead to legal complications, or even result in the rejection of the form. Below are seven common mistakes people often make when completing the North Dakota Small Estate Affidavit form.

Not verifying eligibility - Before filling out the form, one must ensure the estate qualifies as a "small estate" under North Dakota law. This typically involves the estate's value not exceeding a certain threshold and meeting other specific criteria.

Filling out the form inaccurately - Every section of the Small Estate Affidavit requires attention to detail. Mistakes such as incorrect names, addresses, or descriptions of assets can lead to delays or rejection.

Omitting required documentation - The affidavit must be accompanied by certain documents, such as a certified copy of the death certificate and any relevant deeds or titles. Failing to attach these documents can halt the process.

Incorrectly listing assets - Assets must be specifically and accurately listed, including correct descriptions and values. Overlooking assets or providing vague descriptions can problematize the settlement of the estate.

Not properly identifying debts - Debts and liabilities of the estate must be acknowledged and detailed. This includes anything from outstanding bills to taxes owed.

Failing to get all necessary signatures - The affidavit requires signatures from all legal heirs and possibly other parties. Missing signatures can invalidate the document.

Not understanding the legal implications - People often fill out the form without fully understanding their rights and duties under the law, which can lead to unintended legal consequences.

Being thorough, accurate, and transparent when completing the North Dakota Small Estate Affidavit form can ensure the process goes smoothly. It’s advisable for individuals to seek legal advice if they have questions or concerns about the process or their specific situation.

Documents used along the form

When someone passes away with a small estate in North Dakota, their surviving relatives or representatives may opt to use a Small Estate Affidavit to simplify the distribution of assets. This is often a straightforward process for estates that qualify under North Dakota law, typically those with a value below a certain threshold and without real estate. However, to complete this process effectively and within legal bounds, several other documents and forms are usually required alongside the North Dakota Small Estate Affidavit. These documents ensure that the process adheres to state laws and that all financial and personal affairs of the decedent are properly settled.

- Death Certificate: An official document issued by the government, confirming the date, location, and cause of death. It is crucial for legally establishing the decedent's passing and is required by many institutions before assets can be distributed.

- Copy of the Will (if available): If the decedent left a will, a copy should be reviewed to understand the wishes of the deceased concerning asset distribution. It might also name the executor or personal representative.

- List of Heirs and/or Beneficiaries: This document outlines who is legally recognized to inherit from the estate under state law, which is especially important if there is no will.

- Inventory of Assets: An itemized list detailing all assets included in the estate. This could range from bank accounts to personal belongings, indicating their value and how they are to be distributed.

- Copies of Debts and Bills: Documentation showing any outstanding debts or bills the estate must settle before distributing any assets to heirs, such as credit card bills, loans, or utility bills.

- Property Titles and Deeds (if applicable): If the estate includes real property or vehicles, titles and deeds proving ownership must be part of the documentation process.

- Bank Statements: Recent statements for any bank accounts owned by the decedent can help in understanding the estate's financial situation and in verifying assets.

- Tax Returns: Copies of recent tax returns may be needed for settling any outstanding tax issues or to provide a clearer picture of the estate's financial history.

Compiling the necessary documents to accompany a North Dakota Small Estate Affidavit can be a detailed process. Each document serves its specific purpose in ensuring the estate is managed and distributed in accordance with the law and the wishes of the deceased. Representatives handling small estates should remain diligent in gathering all requisite forms and information to expedite the process and provide clarity and peace of mind for all involved parties.

Similar forms

The North Dakota Small Estate Affidavit form is similar to other forms used across various jurisdictions for the purpose of simplifying the probate process for small estates. These documents serve to facilitate the legal transfer of property from a deceased person’s estate to their rightful heirs or beneficiaries, bypassing a lengthy court process. While each state may have its own specific requirements and thresholds for what constitutes a "small estate," the underlying principles and purposes of these forms align closely.

Transfer on Death Deed (TODD): The North Dakota Small Estate Affidavit form shares some similarities with a Transfer on Death Deed (TODD). Both are designed to expedite the process of transferring assets upon someone's passing. A TODD allows property owners to name a beneficiary for real estate, enabling the property to pass directly to the beneficiary without going through probate court. Similar to the Small Estate Affidavit, a TODD is a preemptive tool that simplifies asset transfer, though it specifically addresses real estate, and its execution must occur during the owner's lifetime.

Joint Tenancy with Right of Survivorship (JTWROS): Another similar document is the designation of Joint Tenancy with Right of Survivorship (JTWROS). This legal arrangement allows two or more people to hold property together in a manner that, upon the death of one tenant, the interest of the deceased tenant immediately passes to the surviving tenant(s). While not a document processed through probate like the Small Estate Affidavit, JTWROS serves a parallel function by avoiding the probate process for real estate. It underscores a method of direct transfer, which is a foundational aspect shared with the Small Estate Affidancy.

Payable on Death (POD) or Transfer on Death (TOD) Accounts: Similar to the North Dakota Small Estate Affidavit, Payable on Death (POD) or Transfer on Death (TOD) accounts also bypass the probate process. With POD or TOD designations, individuals can name beneficiaries to their bank accounts, brokerage accounts, or other financial vehicles. Upon the account holder's passing, the designated beneficiary can claim the account’s assets directly from the financial institution without needing court intervention. This streamlined process mirrors the Small Estate Affidavit’s role in facilitating easier transfer of assets.

Dos and Don'ts

When dealing with the North Dakota Small Estate Affidavit form, the process requires attention to detail and a deep understanding of legal procedures. It is important for individuals to navigate this process carefully to ensure the decedent's estate is handed over smoothly and lawfully to the rightful heirs or beneficiaries. Below are lists of key actions that should and shouldn't be undertaken when filling out the form.

Things You Should Do:

- Verify eligibility: Ensure the estate qualifies as a "small estate" under North Dakota laws, typically based on the value and type of property involved.

- Collect necessary documents: Gather all required documents and information related to the deceased's assets, debts, and heirs or beneficiaries.

- Be detailed and accurate: Provide comprehensive and precise details about the assets, liabilities, and heirs to avoid delays or legal challenges.

- Sign in front of a notary: Complete the form in the presence of a notary to ensure its legal validity.

- File with the appropriate court: Submit the completed form to the proper county court as stipulated by North Dakota laws.

- Notify interested parties: Inform all heirs, beneficiaries, and known creditors about the affidavit to ensure transparency and fairness in the distribution of the estate.

Things You Shouldn't Do:

- Avoid guessing: Do not make assumptions about values, heirship, or laws; seek accurate information or legal advice if in doubt.

- Skip heirs or creditors: Failing to account for all potential heirs or creditors can result in legal complications and potential liabilities later on.

- Ignore debts and taxes: Ensure that all outstanding debts and taxes are identified and plans for their payment are included in your affidavit process.

- Use outdated forms: Always use the most current version of the Small Estate Affidavit form to comply with the latest state laws and regulations.

- Forget to distribute assets according to the affidavit: Once the affidavit is accepted, proceed with the distribution of assets as outlined, respecting the legal priority of claims.

- Overlook the waiting period: Be aware of any required waiting periods before distributing the estate's assets to ensure compliance with state laws.

By adhering to these guidelines, individuals can navigate the process of settling a small estate in North Dakota with greater confidence and a reduced risk of legal complications. It's always recommended to consult with a legal professional to gain further insight and guidance specific to your situation.

Misconceptions

Managing the estate of a deceased loved one is a challenging process filled with legal nuances, especially so in North Dakota where the Small Estate Affidavit form simplifies the ordeal for smaller estates. However, misconceptions abound, leading to confusion and potential missteps. Here are nine common misconceptions about the North Dakota Small Estate Affidavit form and clarifications to help guide you.

It can be used regardless of the estate’s value. There’s a common belief that the Small Estate Affidavit form applies to all estates, regardless of their value. In reality, North Dakota law limits its use to estates where the total value does not exceed a specific threshold, adjusted periodically.

It avoids the probate process entirely. While using this form simplifies the process, it doesn’t entirely bypass probate. It's designed for quicker resolution and less complexity, not to completely eliminate the need for probate for small estates.

Real estate can always be transferred using this form. Not all types of property can be transferred with a Small Estate Affidavit. Specifically, transferring title of real estate often requires a more formal probate process.

Anyone can file the affidavit. Only an authorized person, such as a surviving spouse or an heir, is permitted to file this form. Proper identification and relationship to the deceased are mandatory.

The form grants immediate access to assets. While it simplifies access to the estate, there's still a mandatory waiting period after the death before the affidavit can be filed, and financial institutions may have additional requirements.

It’s only for bank accounts. A misconception is that the affidavit is exclusively for accessing bank accounts of the deceased. In reality, it may also be used for salaries owed, vehicles, and certain other personal property within legal value limits.

There’s no need for an attorney. While it's designed to be a straightforward process, consulting with an attorney is advisable to ensure all legal requirements are met and to navigate any potential complications.

Filing the affidavit is a lengthy and complex process. Contrary to what some believe, filing a Small Estate Affidavit in North Dakota is relatively simple and designed to be completed without undue burden, particularly compared to a full probate process.

Use of the form limits future legal action. Some think that using this affidavit method restricts heirs or executors from taking future legal actions regarding the estate. However, the form's use is just a facilitation for asset distribution and does not preclude necessary legal action if disputes arise later.

Understanding these misconceptions and the actual protocol of the North Dakota Small Estate Affidavit can significantly ease the process of managing a loved one’s final affairs. It’s a tool designed to reduce stress during a difficult time, but like any legal document, it requires careful consideration and, often, professional guidance.

Key takeaways

When dealing with the North Dakota Small Estate Affidavit form, it's essential to understand several key points. This form serves as a streamlined method for handling estates that fall under a certain value threshold, bypassing the often lengthy probate process. Here are the takeaways you need to know:

The value limit is crucial. In North Dakota, an estate qualifies as 'small' if its total value doesn't exceed a specific amount set by state law. If the estate's worth is over this threshold, the small estate affidavit cannot be used, and traditional probate might be necessary.

Eligibility requirements must be carefully considered. Only certain individuals, such as surviving spouses or next of kin, are typically allowed to use this form. Additionally, there might be a waiting period after the decedent's death before the form can be submitted.

Accurate documentation is key. When filling out the small estate affidavit, it's important to list all of the decedent's assets accurately and provide estimated values. Any missing or incorrect information can delay the process or impact the legality of the transfer.

Understanding the implications for property transfer is essential. The completion and approval of a small estate affidavit enable the transfer of the deceased's property to the rightful heirs or claimants. However, it may not cover certain types of assets, like those held in a trust. Knowing what the affidavit covers can help in planning how to handle other assets not included under its authority.

Handling a small estate in North Dakota can be significantly simplified with the small estate affidavit form, but it's important to approach the process with thoroughness and care. Understanding the form's limitations, requirements, and the specific steps needed to complete it properly ensures that the estate is settled as smoothly and quickly as possible.

Fill out Popular Small Estate Affidavit Forms for Different States

Iowa Probate Laws - By clarifying the heir's entitlement to the estate’s assets, the Small Estate Affidavit minimizes the legal obstacles often encountered in the wake of a family member's death.

Register Car in Mississippi From Out-of-state - It is beneficial for small asset holders, ensuring their estate is settled without court proceedings.