Printable Small Estate Affidavit Form for Ohio

When a loved one passes away, navigating through the complex process of settling their estate can be a daunting task, especially during a time of grief. The Ohio Small Estate Affidavit form presents an efficient solution for those dealing with smaller estates, offering a streamlined alternative to the often lengthy probate process. This legal document allows for the transfer of the deceased's assets to their rightful heirs without the need for a prolonged court procedure, contingent upon the estate's value falling below a specified threshold. Understanding this form's requirements, the qualifying criteria for estates, and the specific assets that can be transferred using this method is crucial for individuals seeking to utilize this option. Furthermore, the implications of using such an affidavit, including potential tax responsibilities and the impact on debt obligations, are important considerations for anyone stepping into this process. By providing a gateway to a more straightforward procedure, the Ohio Small Estate Affidavit form becomes a critical tool for beneficiaries aiming to honor their loved one's legacy with respect and dignity.

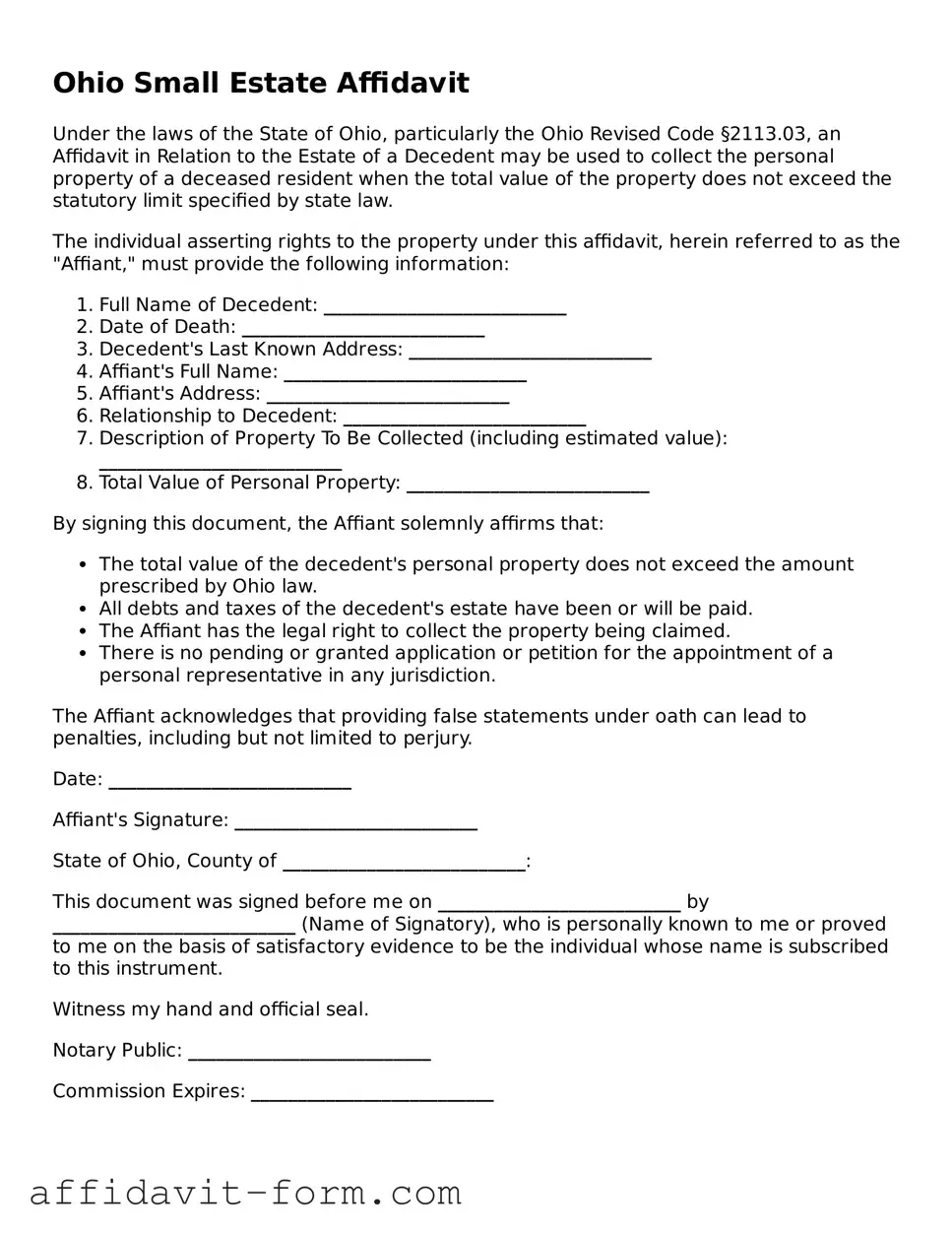

Form Example

Ohio Small Estate Affidavit

Under the laws of the State of Ohio, particularly the Ohio Revised Code §2113.03, an Affidavit in Relation to the Estate of a Decedent may be used to collect the personal property of a deceased resident when the total value of the property does not exceed the statutory limit specified by state law.

The individual asserting rights to the property under this affidavit, herein referred to as the "Affiant," must provide the following information:

- Full Name of Decedent: __________________________

- Date of Death: __________________________

- Decedent's Last Known Address: __________________________

- Affiant's Full Name: __________________________

- Affiant's Address: __________________________

- Relationship to Decedent: __________________________

- Description of Property To Be Collected (including estimated value): __________________________

- Total Value of Personal Property: __________________________

By signing this document, the Affiant solemnly affirms that:

- The total value of the decedent's personal property does not exceed the amount prescribed by Ohio law.

- All debts and taxes of the decedent's estate have been or will be paid.

- The Affiant has the legal right to collect the property being claimed.

- There is no pending or granted application or petition for the appointment of a personal representative in any jurisdiction.

The Affiant acknowledges that providing false statements under oath can lead to penalties, including but not limited to perjury.

Date: __________________________

Affiant's Signature: __________________________

State of Ohio, County of __________________________:

This document was signed before me on __________________________ by __________________________ (Name of Signatory), who is personally known to me or proved to me on the basis of satisfactory evidence to be the individual whose name is subscribed to this instrument.

Witness my hand and official seal.

Notary Public: __________________________

Commission Expires: __________________________

Document Details

| Fact Name | Description |

|---|---|

| Eligibility Criteria | In Ohio, to use a Small Estate Affidavit, the total value of the decedent's probate estate must not exceed $35,000 (or $100,000 if the spouse is entitled to all assets). |

| Governing Laws | The Small Estate Affidavit process in Ohio is governed by Sections 2113.03 and 2113.031 of the Ohio Revised Code. |

| Required Information | The affidavit must include a detailed list of the decedent's assets, debts, and beneficiary information, ensuring transparency and compliance. |

| Processing Time | Though the exact timing can vary, the processed affidavit generally allows for the distribution of assets to rightful heirs or devises within a shorter timeframe compared to standard probate proceedings. |

How to Use Ohio Small Estate Affidavit

When a loved one passes away with a smaller estate, managing their assets can be streamlined through the use of an Ohio Small Estate Affidavit. This document allows the transfer of the deceased's property to their rightful heirs without the need for a lengthy probate process. It's a practical option for estates that meet the specified criteria in terms of value, ensuring a quicker distribution of assets to beneficiaries. Preparing this form accurately is crucial to expedite the process. Follow these structured steps to fill out the Ohio Small Estate Affidavit form correctly.

- Gather all necessary documents, including a certified copy of the death certificate, an inventory of the deceased's personal property, and any existing will.

- Ensure the total value of the estate's assets qualifies for the small estate process according to Ohio law.

- Enter the full legal name of the deceased in the designated section at the top of the form.

- Provide your details as the affidavit filer, including your relationship to the deceased.

- List all known heirs and their relationships to the deceased, along with their contact information.

- Detail the assets of the estate, including bank accounts, vehicles, and real estate, ensuring to keep within the allowable limit for a small estate in Ohio.

- Attach a copy of the death certificate to affirm the date of death mentioned in the affidavit.

- Review the form for accuracy and completeness, ensuring all required sections are filled out.

- If applicable, sign the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit along with any other required documents to the appropriate local court or entity as directed by Ohio law.

Once the Ohio Small Estate Affidavit form is submitted, the process for distributing the estate's assets can begin. Adhering closely to the steps outlined above will help ensure that the form is filled out correctly, reducing the likelihood of delays. It's important to note that the rules regarding small estates can vary, so consulting with a legal professional for advice specific to your situation is always a good strategy. By following the proper procedures, you can assist in settling the estate efficiently, allowing for a smoother transition during a difficult time.

Listed Questions and Answers

What is an Ohio Small Estate Affidavit?

An Ohio Small Estate Affidavit is a legal document used when a person dies with a relatively small amount of assets. This form allows the assets of the deceased to be distributed without the formal probate process. It's used to streamline the handing over of assets to the rightful heirs or beneficiaries, making it quicker and less costly than going through probate court.

Who can file a Small Estate Affidavit in Ohio?

In Ohio, a Small Estate Affidavit can be filed by a surviving spouse, next of kin, or a person entitled to the assets of the deceased. The applicant must ensure they are legally qualified to make the claim and are willing to distribute the assets to rightful claimants according to Ohio law.

What are the requirements for a Small Estate Affidavit in Ohio?

The requirements for filing a Small Estate Affidavit in Ohio include:

- The total value of the estate must not exceed the amount specified by Ohio law, excluding the value of certain assets like real estate.

- A certain period must have passed since the death of the deceased, typically 30 days.

- There must be no pending or granted request for the appointment of an executor or administrator for the estate.

- All funeral and burial expenses, as well as debts, have been paid or accounted for.

What is the maximum value of an estate that can use the Small Estate Affidavit process in Ohio?

The maximum value of an estate that can use the Small Estate Affidavit process in Ohio is subject to change according to state law. As such, it's important to consult the most current legal guidelines or speak with a legal professional to determine the current threshold.

What assets can be included in a Small Estate Affidavit in Ohio?

Assets that can typically be included in a Small Estate Affidavit in Ohio are those considered personal property, such as:

- Bank accounts

- Stocks and bonds

- Small personal property items

- Vehicles

How do you file a Small Estate Affidavit in Ohio?

To file a Small Estate Affidavit in Ohio, follow these steps:

- Ensure the estate meets the criteria for using a Small Estate Affidavit.

- Complete the Small Estate Affidavit form, providing detailed information about the deceased, the assets, and the rightful heirs or beneficiaries.

- Attach necessary documents, such as death certificate and proof of assets value.

- Submit the completed form and attached documents to the appropriate local court.

Is there a filing fee for the Small Estate Affidiff in Ohio?

Yes, there is typically a filing fee for submitting a Small Estate Affidavit in Ohio, which can vary by county. Contact the local court where you'll be filing the affidavit to confirm the current fee and acceptable payment methods.

How long does the process take after filing a Small Estate Affidavit in Ohio?

The duration of the process, from filing a Small Estate Affidavit to the distribution of assets, can vary depending on several factors such as county workload and completeness of the application. Generally, once filed, the process can take from a few weeks to a few months.

Can real estate be transferred using a Small Estate Affidavit in Ohio?

Real estate typically cannot be transferred using a Small Estate Affidavit in Ohio. The process is designed primarily for personal property. Transferring real estate often requires a more formal probate process. There are exceptions and specific scenarios where real estate may be handled outside of probate, so consulting with a legal professional is recommended.

What happens if there is a dispute over the Small Estate Affidavit?

If there is a dispute over the Small Estate Affidavit, the matter may need to be resolved in probate court. Disputes can arise over the validity of the affidavit, the distribution of assets, or claims by creditors. In such cases, it’s advisable to seek legal assistance to ensure the rights and interests of all parties are properly represented and protected.

Common mistakes

When managing the affairs of a loved one who has passed away, the Ohio Small Estate Affidavit form can be a streamlined process for small estates. However, mistakes in filling out this form can create delays and complications. Here are some of the most common errors people make:

- Not checking the eligibility requirements: The estate's value must meet specific criteria to qualify for the small estate process in Ohio. People often overlook this step, filing an affidavit for an estate that exceeds the monetary limit set by the state.

- Incorrect or incomplete asset listing: All assets belonging to the deceased must be accurately and completely listed. Omissions or inaccuracies can result in a rejection of the form or later legal complications.

- Failing to properly identify and notify heirs: It's crucial to list all potential heirs and notify them as required by Ohio law. Missing this step can lead to disputes or the form being invalidated.

- Not accounting for debts and liabilities: The affidavit requires a statement of the deceased's debts and liabilities. Neglecting to include this information, or underreporting it, can cause problems down the line.

- Misunderstanding the role of the affiant: Individuals often misunderstand their responsibilities as the affiant. They may not realize they are attesting to the truth of the information provided and can be held legally accountable for inaccuracies.

- Skipping required signatures: Every required signature must be in place, including those of the affiant and, if applicable, witnesses or notaries. Missing signatures can lead to the form being considered incomplete.

- Overlooking the need for court approval: Depending on the estate's specifics, court approval may still be required even after filing the affidavit. Failing to obtain this approval can invalidate the entire process.

- Not using the most current form: The Ohio Small Estate Affidavit form is subject to updates. Using an outdated version can result in the rejection of the form.

Addressing these common mistakes can help ensure the Ohio Small Estate Affidaffidavit form is completed and processed smoothly, allowing estates to be settled as efficiently as possible.

Documents used along the form

When handling a small estate in Ohio, the Small Estate Affidavit form is a helpful document for successors to claim property without a formal probate process. However, this form is often used alongside various other forms and documents to ensure the estate is settled comprehensively and lawfully. Below are some of the documents that are commonly used in conjunction with the Ohio Small Estate Affidavit form.

- Death Certificate: A certified copy of the death certificate is necessary to prove the death of the deceased. It's required by financial institutions and other entities to transfer assets.

- Copy of the Will (if applicable): If the deceased left a will, a copy might be needed to ensure the assets are distributed according to their wishes, provided it does not necessitate going through the full probate process.

- Vehicle Transfer-on-Death (TOD) Beneficiary Form: This form is used to transfer the ownership of vehicles owned by the deceased to the designated beneficiary without going through probate.

- Real Estate Transfer-on-Death Designation Affidavit: If the deceased owned real estate and designated a beneficiary through a Transfer-on-Death (TOD) affidavit, this document is required to transfer the property without probate.

- Financial Institution Forms: Banks and other financial institutions often have their own forms that need to be completed to release the deceased's assets to the rightful heirs or beneficiaries.

- Personal Property Affidavit: When the estate includes personal property like jewelry, furnishings, or collectibles, this affidavit can be used to distribute these items amongst the heirs or beneficiaries.

Using these documents in conjunction with the Ohio Small Estate Affidavit, it is possible to navigate the process of settling a small estate more smoothly. Each document serves a specific purpose in ensuring the deceased's assets are accurately identified, valued, and transferred according to the law and their wishes. It's always advised to seek clarification or assistance from a legal professional when dealing with estate matters to avoid any legal issues.

Similar forms

The Ohio Small Estate Affidavit form is similar to other legal documents designed to simplify the process of estate resolution for small estates, primarily emphasizing areas like asset distribution and the avoidance of probate court. Among these, two notable documents stand out due to their common objectives and procedural similarities: the Transfer on Death Designation (TOD) and the Simplified Probate Procedure.

Transfer on Death Designation (TOD):

The Transfer on Death Designation (TOD) shares a fundamental goal with the Ohio Small Estate Affidavit: to facilitate the passing of assets upon death without the need for probate court intervention. Specifically, the TOD allows an individual to designate beneficiaries for certain assets, such as real estate or vehicles, which will automatically transfer to the named beneficiary upon the death of the asset holder. This ability to bypass the probate process is where the TOD mirrors the efficiency and purpose of the Small Estate Affidavit. However, while the TOD is proactive, requiring action before death, the Small Estate Affidavit operates posthumously, offering a streamlined method for estate administration for estates that meet specific criteria, such as those with a value below a certain threshold.

Simplified Probate Procedure:

The Simplified Probate Procedure and the Ohio Small Estate Affidavit both aim to offer a faster, less cumbersome alternative to traditional probate for small estates. The Simplified Probate Procedure is an option within the probate court system designed for estates that fall under a certain value, allowing for expedited processing and reduced legal and court costs. Like the Small Estate Affidavit, it minimizes the logistical and financial burdens typically associated with the death of a loved one. While the Simplified Probate Procedure is a court-supervised process, it significantly streamlines the steps required to settle a small estate, similar to how the Small Estate Affidavit provides a method for heirs or beneficiaries to collect assets without the full probate process.

Dos and Don'ts

When dealing with the Ohio Small Estate Affidavit form, it's pivotal to understand the dos and don'ts to ensure a smooth and accurate process. This document is vital in managing the estate of someone who has passed away, with assets below a certain threshold, avoiding the longer probate process. To help simplify this task, here are essential guidelines:

Do:- Ensure the estate's total value does not exceed the Ohio legal threshold for a small estate, which can change over time.

- Gather all necessary documents beforehand, including death certificates, asset valuations, and any debts owed by the estate.

- Accurately list all assets and their values in the affidavit, ensuring nothing is omitted. This includes bank accounts, vehicles, and real estate, if applicable.

- Verify all debts and liabilities of the estate are disclosed, providing a clear picture of the estate's financial responsibilities.

- Consult with a legal advisor if there are any uncertainties or complexities in the estate that might affect the affidavit.

- Double-check the form before submission to ensure all information is correct and no errors have been made.

- Attempt to use the small estate process if the total value of the estate exceeds state limits, as this could lead to legal complications.

- Overlook any assets or debts when completing the form. Omission could result in legal challenges or delays.

- Guess the value of assets. Use appraisals or estimated values based on fair market price where necessary.

- Forget to sign and date the affidavit in front of a notary public, as this is a legal requirement for the document's validity.

- Submit the form without reviewing it with all interested parties, such as heirs or legatees, to ensure accuracy and agreement.

- Ignore state-specific requirements or deadlines associated with the filing of the affidavit, as these can vary and impact the process.

Following these guidelines diligently will help streamline the process of managing a small estate in Ohio. Always remember the importance of accuracy and thoroughness when dealing with legal documents and proceedings.

Misconceptions

When it comes to handling an estate in Ohio, the Small Estate Affidavit form is a helpful tool for transferring assets of a deceased person without formal probate. However, there are misconceptions about it that can lead to confusion. Let’s clear up some of these misunderstandings:

All estates qualify for the Small Estate Affidavit. This is not true. In Ohio, to use the Small Estate Affidavit, the total value of the estate must not exceed a certain threshold, which is currently set at $35,000 (or $100,000 if the spouse is the sole heir). Larger estates require a more formal probate process.

Real estate can be transferred using the Small Estate Affidavit. Actually, the Small Estate Affidavit in Ohio cannot be used to transfer title to real estate. It is designed for personal property, like bank accounts and vehicles, not for real estate holdings.

The process is immediate. Despite being faster than formal probate, the process still requires submitting the form to the relevant authority and can take several weeks to complete. The time frame depends on the specifics of the estate and the efficiency of the court or institution handling the estate assets.

Completing the form is all you need to do. Filling out the form is just one step. You'll also need to gather supporting documents, such as death certificates and asset statements, and you may need to notify creditors and pay the deceased's debts before assets can be distributed.

Any heir can file the form. Ohio law specifies who can file a Small Estate Affidavit. Typically, it is the surviving spouse or next of kin, but there’s an order of priority and not just anyone can step in to claim the estate.

There are no costs involved. While using a Small Estate Affidavit is less costly than formal probate, there may be filing fees or other minor costs involved. These vary by county, so it’s important to check local requirements.

The form covers all types of personal property. While the Small Estate Affidavit can be used for a variety of assets, there are exceptions. Certain types of personal property, like specific financial accounts, may have their own designation or beneficiary processes that bypass the estate entirely.

Understanding these aspects of the Ohio Small Estate Affidavit can simplify the process of managing a loved one’s estate. It’s always a good idea to consult with a legal expert to navigate these matters effectively.

Key takeaways

Filling out and using the Ohio Small Estate Affidavit form is an important process for those handling the estate of a loved one who has passed away. If the total value of the estate is relatively small, this form allows for a more straightforward administration. Understanding the key points can ensure that the process is handled correctly and efficiently.

- Eligibility Requirements: Before using the Ohio Small Estate Affidavit, it’s essential to verify that the estate qualifies as "small" under state law. Generally, this means that the estate's value must fall below a specific threshold, excluding certain assets. This threshold can change, so it's crucial to check the current criteria.

- Gather Necessary Documentation: To complete the form accurately, you will need to gather various documents. These include a certified copy of the death certificate, documents proving your right to act on behalf of the estate (such as a will naming you as executor), and a comprehensive list of the estate's assets and their estimated values.

- Completing the Form: When filling out the Small Estate Affidavit, be sure to provide all requested information clearly and accurately. This includes the decedent's personal information, a detailed list of the estate assets, and the names and addresses of heirs or beneficiaries.

- Submission Process: After completing the form, it must be submitted to the appropriate local court. The submission process may vary slightly depending on the county, so it's advisable to contact the county probate court where the deceased was a resident for specific guidance on where and how to submit the affidavit.

- Legal and Financial Implications: Using the Small Estate Affidavit can significantly simplify the estate administration process, but it comes with legal and financial responsibilities. Those submitting the affidavit may be held liable for any inaccuracies or omissions. It’s also important to be aware that successfully submitting the affidavit allows for the distribution of assets to rightful heirs or beneficiaries without going through a lengthy probate process.

Approaching the Ohio Small Estate Affidavit with a detailed understanding and careful preparation can alleviate many challenges associated with estate settlement, ensuring that assets are distributed according to the decedent's wishes in a timely and efficient manner.

Fill out Popular Small Estate Affidavit Forms for Different States

Small State Affidavit - Designed to help families conclude estate matters quickly and with minimal legal intervention.

Affidavit of Succession - Despite its convenience, the effectiveness and requirements of the Small Estate Affidavit depend heavily on individual state laws.

Clay County Probate Forms - This approach to estate settlement is not only time-efficient but also cost-effective, offering a relieving alternative to traditional probate for small estate administrators and heirs.