Printable Small Estate Affidavit Form for Oklahoma

When a loved one passes away in Oklahoma, managing the legal aspects of their estate can be a daunting task, especially for small estates. Fortunately, the Oklahoma Small Estate Affidavit form offers a simplified procedure for those who are handling estates that meet certain criteria, effectively bypassing the often complex and lengthy probate process. Designed to streamline the distribution of assets, this form can be used when the total value of the estate does not exceed a statutory limit and provides a mechanism for transferring property to rightful heirs or beneficiaries without the need for exhaustive court involvement. Understanding the eligibility requirements, the specific steps involved in completing and submitting this form, and the types of assets that can be transferred via this method are crucial for successfully navigating through the estate settlement process in a timely and efficient manner. Additionally, awareness of potential legal implications and the significance of accurately reporting the estate's value is vital for those seeking to utilize the affidavit, ensuring that the process aligns with Oklahoma state laws and protects the interests of all parties involved.

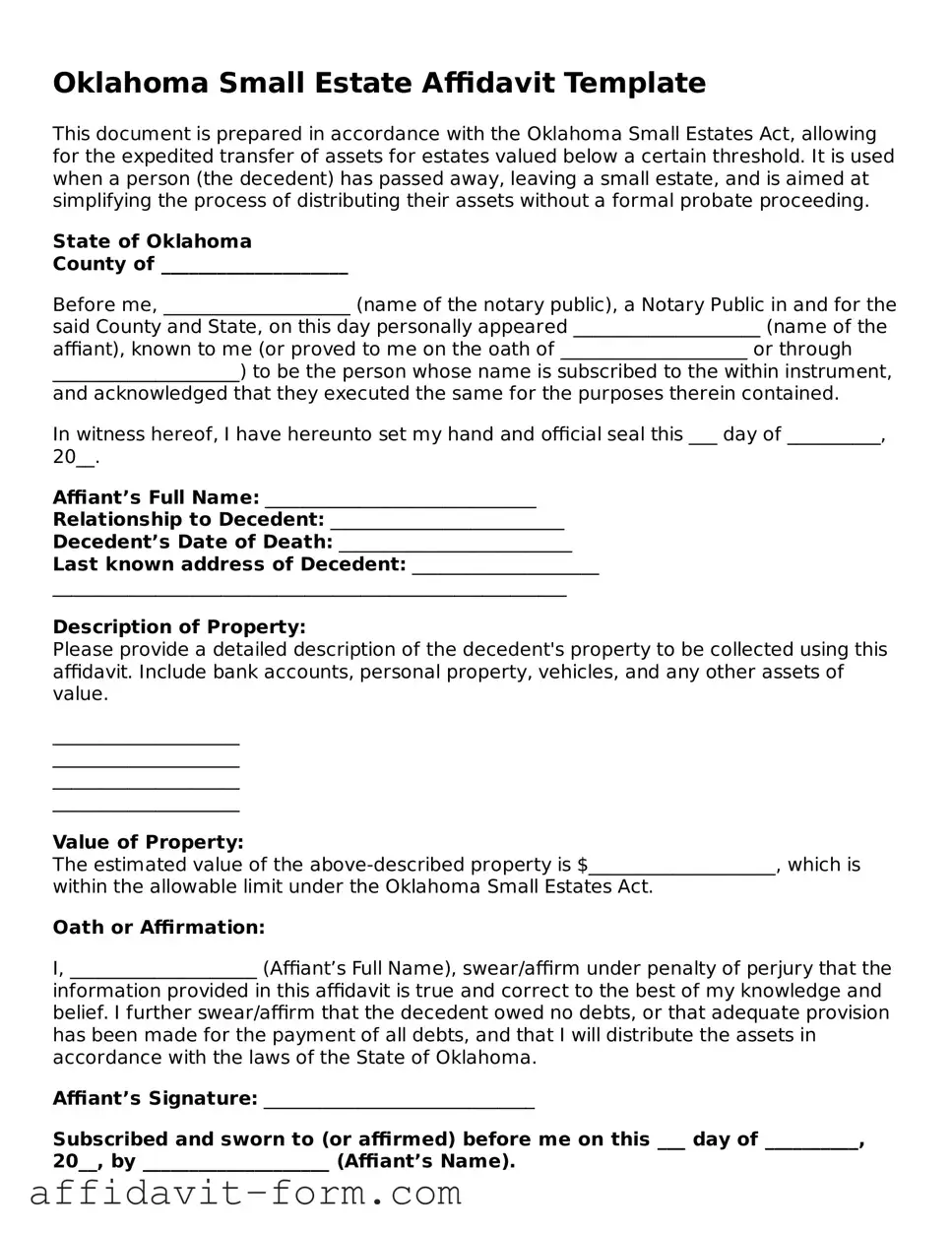

Form Example

Oklahoma Small Estate Affidavit Template

This document is prepared in accordance with the Oklahoma Small Estates Act, allowing for the expedited transfer of assets for estates valued below a certain threshold. It is used when a person (the decedent) has passed away, leaving a small estate, and is aimed at simplifying the process of distributing their assets without a formal probate proceeding.

State of Oklahoma

County of ____________________

Before me, ____________________ (name of the notary public), a Notary Public in and for the said County and State, on this day personally appeared ____________________ (name of the affiant), known to me (or proved to me on the oath of ____________________ or through ____________________) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness hereof, I have hereunto set my hand and official seal this ___ day of __________, 20__.

Affiant’s Full Name: _____________________________

Relationship to Decedent: _________________________

Decedent’s Date of Death: _________________________

Last known address of Decedent: ____________________

_______________________________________________________

Description of Property:

Please provide a detailed description of the decedent's property to be collected using this affidavit. Include bank accounts, personal property, vehicles, and any other assets of value.

____________________

____________________

____________________

____________________

Value of Property:

The estimated value of the above-described property is $____________________, which is within the allowable limit under the Oklahoma Small Estates Act.

Oath or Affirmation:

I, ____________________ (Affiant’s Full Name), swear/affirm under penalty of perjury that the information provided in this affidavit is true and correct to the best of my knowledge and belief. I further swear/affirm that the decedent owed no debts, or that adequate provision has been made for the payment of all debts, and that I will distribute the assets in accordance with the laws of the State of Oklahoma.

Affiant’s Signature: _____________________________

Subscribed and sworn to (or affirmed) before me on this ___ day of __________, 20__, by ____________________ (Affiant’s Name).

Notary Public’s Signature: _____________________________

My commission expires: _______________________________

Instructions:

- Complete all blank lines on the affidavit with the appropriate information. Access Oklahoma statutes for reference regarding the Oklahoma Small Estates Act.

- Gather and attach proof of the decedent’s death (death certificate) and any other required documents.

- The affidavit must be notarized before it can be used to collect the property.

- Present the completed and notarized affidavit to the entity or entities holding the property.

Note: It is recommended to consult with a legal professional if you have any questions or require assistance with this process.

Document Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Oklahoma Small Estate Affidavit is utilized to manage the estate of a deceased person with assets valued at $50,000 or less. |

| 2 | This form allows the transfer of property to heirs without the need for a formal probate process. |

| 3 | It must be filed in the county where the decedent lived or owned property. |

| 4 | A waiting period of 10 days is required from the date of death before the affidavit can be filed. |

| 5 | To file the form, a detailed description of the decedent’s assets and their values is necessary. |

| 6 | Governing laws for this process are found under Title 58 of the Oklahoma Statutes, Sections 393 to 396. |

| 7 | The affidavit requires signatures from all legal heirs or a designated representative agreeing on the distribution of assets. |

| 8 | Filing fees for the affidavit can vary by county, so it is advised to consult with the local county clerk for specific costs. |

| 9 | Utilization of the Small Estate Affidavit simplifies the asset distribution process, making it quicker and less expensive than formal probate. |

How to Use Oklahoma Small Estate Affidavit

When a loved one passes away with a relatively small estate, handling their affairs doesn't have to involve a prolonged probate process. In Oklahoma, the Small Estate Affidavit procedure offers a streamlined method for survivors to manage the deceased's assets. This document allows for the transfer or distribution of personal property to rightful heirs without the need for a formal probate court proceeding. Filling out the Small Estate Affidavit form requires careful attention to detail and a clear understanding of the deceased's estate and beneficiaries. Here's a step-by-step guide to help you navigate the process, ensuring that the form is completed correctly and efficiently.

- Gather necessary documents, including the death certificate, a list of the deceased’s assets, and proof of your relationship to the deceased.

- Ensure the total value of the estate meets Oklahoma’s threshold for a small estate. The estate must not exceed a certain value, which is subject to change, so check the current limit.

- Visit the Oklahoma State Courts Network website or your local court to obtain the Small Estate Affidavit form. Make sure you are using the most recent version.

- Read the form thoroughly before you start filling it out. Understand each section to prevent mistakes.

- Fill in the decedent’s full legal name and the date of their death in the designated sections.

- Provide your personal details, including your name, address, and relation to the deceased, in the required fields.

- List all of the deceased’s known assets and their estimated value. Be sure to include any real estate, vehicles, bank accounts, and personal property.

- Identify the heirs or legatees entitled to the estate under Oklahoma law. Specify their names, addresses, and their relationship to the deceased.

- Include a statement that verifies there are no pending petitions for appointment of a personal representative in any jurisdiction to the best of your knowledge.

- Confirm that all debts, including funeral expenses, taxes, and medical bills, have been paid or will be paid from the estate's assets.

- Review the form for completeness and accuracy. Ensure that all required sections are filled out and that the information is correct.

- Sign the form in front of a notary public. Some counties may require additional witnesses, so check with your local county court.

- Submit the completed form, along with any required attachments, to the appropriate entity, which could be a bank, a brokerage, or a court, depending on the assets in question.

After successfully submitting the Small Estate Affidavit, the assets listed within the document can be transferred to the heirs without going through a full probate process. This procedure simplifies the aftermath of a loved one's passing, allowing families to focus on healing and remembrance rather than legal intricacies. Remember, it's important to act with diligence and honesty throughout this process, respecting the final wishes of the deceased and the rights of all beneficiaries.

Listed Questions and Answers

What Is an Oklahoma Small Estate Affidavit?

An Oklahoma Small Estate Affidavit is a legal document used by heirs or beneficiaries to collect the assets of a deceased individual, known as the decedent, without the need for formal probate. This is applicable when the total value of the estate does not exceed certain thresholds defined by state law. It simplifies the process of asset distribution among the rightful heirs.

Who Can File an Oklahoma Small Estate Affidavit?

Eligible individuals include surviving spouses, children, parents, siblings, or other lawful heirs according to the priority outlined in Oklahoma succession laws. Additionally, designated beneficiaries on specific assets such as life insurance policies may also file. Representatives authorized by the heirs can file as well, provided they have legal standing to act on behalf of the estate.

What Are the Requirements for Filing a Small Estate Affidavit in Oklahoma?

The estate must meet certain conditions for an affidavit to be filed:

- The total value of the estate must not exceed $50,000, excluding certain exempt assets.

- At least ten days must have passed since the death of the decedent.

- No other petition for the appointment of a personal representative is pending or granted in any jurisdiction.

What Steps Should Be Taken to File the Affidavit?

There are specific steps to follow:

- Confirm the estate’s eligibility based on the above requirements.

- Complete the Oklahoma Small Estate Affidavit form with accurate information about the decedent, the assets, and the heirs.

- Ensure that all heirs sign the affidavit in the presence of a notary public.

- Submit the affidavit to the appropriate entity, such as a financial institution or the county clerk’s office, depending on the type of asset being claimed.

What Are the Legal Effects of Filing This Affidavit?

Once filed, the affidavit allows the transfer of the decedent's assets from the person or entity holding them directly to the designated heirs without probate court involvement. It legally authorizes the distribution and is considered sufficient evidence of the heir's entitlement to the specified property or funds.

Are There Any Associated Costs?

While filing a Small Estate Affidavit in Oklahoma is generally cost-effective compared to probate, there may be minimal filing fees, notary fees, or other administrative expenses depending on the specific circumstances and where the affidavit is filed.

How Long Does the Process Take?

The timeframe can vary significantly based on the complexity of the estate and the responsiveness of the institutions holding the assets. Once the affidavit is properly filed, the transfer of assets can often be completed in a matter of weeks.

Can Real Estate Be Transferred Using a Small Estate Affidavit in Oklahoma?

No, real estate cannot typically be transferred directly using a Small Estate Affidified in Oklahoma. Exceptions may exist if the property is considered a homestead and falls within certain value limits. Legal advice should be sought to explore options for transferring real estate outside of traditional probate.

Where Can I Find an Oklahoma Small Estate Affidavit Form?

The form can be obtained from several sources, including the Oklahoma Bar Association’s website, county clerk's office, or from legal forms providers. It is crucial to ensure that the form complies with the current Oklahoma statutes to be valid when filed.

Common mistakes

Filling out the Oklahoma Small Estate Affidavit form is a task that requires attention to detail. Unfortunately, several common mistakes can occur during this process. Understanding these errors can help individuals avoid them, ensuring a smoother legal process for settling small estates.

-

Not meeting eligibility requirements: One critical mistake is misjudging whether the estate in question qualifies as a "small estate" under Oklahoma law. This misjudgment can stem from an incorrect assessment of the estate's total value or misunderstanding the types of assets that can be included.

-

Incomplete information: Many people mistakenly submit the form with incomplete information. Every section of the Oklahoma Small Estate Affidavit requires attention, including details about the deceased, their assets, debts, and the heirs. Omitting information can lead to delays or the need to resubmit the form.

-

Failing to attach necessary documents: The form often requires the attachment of additional documents, such as the death certificate of the deceased and proof of the heir's relationship to the deceased. Failure to attach these documents is a common oversight that can hinder the process.

-

Incorrectly distributing assets: The form requires details on how the deceased's assets will be distributed among the heirs. Misunderstandings or mistakes in this area can not only delay proceedings but might also necessitate legal intervention to correct. It's crucial for individuals to understand the legal order of precedence and to distribute assets accordingly.

By avoiding these common mistakes, individuals can facilitate a smoother process in handling the affairs of a loved one's estate, ensuring that assets are distributed correctly and in a timely manner.

Documents used along the form

When managing the affairs of a loved one who has passed away, particularly in Oklahoma, the Small Estate Affidavit form serves as a crucial document for those cases where the deceased's estate is below a certain value threshold. However, this form is often just one piece of the puzzle. Several other forms and documents may be needed to fully complete this process. The following list details some of the most commonly required documents that accompany the Small Estate Affidavit form, offering a brief description of each to help you understand their purpose and importance.

- Death Certificate: An official document issued by the government that proves the death of the individual. It includes vital information such as the date, location, and cause of death. This certificate is essential for legal and financial processes following an individual's death.

- Copy of the Will: If the deceased left a will, a copy may be necessary to accompany the Small Estate Affidavit. This document outlines the deceased's wishes for distributing their assets and may identify an executor to manage the process.

- Proof of Relationship to the Deceased: Documents such as birth certificates, marriage certificates, or court documents may be required to establish the legal relationship between the affiant and the deceased, particularly if the estate is to be distributed to next of kin.

- Notice to Creditors: In some cases, notices may need to be sent out to potential creditors to inform them of the decedent's passing and to invite claims against the estate. This step is important for settling debts before distributing the remainder of the assets.

- Final Tax Returns: The filing of the deceased's final state and federal tax returns is a necessary step to ensure that all financial obligations are met before the estate is closed. This can also include the filing of an estate tax return, if applicable.

Together, these documents complement the Oklahoma Small Estate Affidavit, allowing for a smoother transition during what is often a challenging time. Understanding the role and requirement of each document can significantly aid in the efficient handling of a loved one's final affairs, ensuring that legal and financial responsibilities are met with diligence and care.

Similar forms

The Oklahoma Small Estate Affidavit form is similar to other legal documents used in various jurisdictions for the expedited transfer of estate assets without formal probate. These documents, although they go by different names and might have slight variations in requirements, share the underlying purpose of simplifying the process of asset distribution when an estate falls below a certain size. Among these are the Affidavit for Collection of Small Estate by Distributee and the Simplified Probate Procedure.

Affidavit for Collection of Small Estate by Distributee: This document, much like the Oklahoma Small Estate Affidavit, provides a mechanism for the heirs or beneficiaries of a deceased person's estate to collect assets without undergoing a full probate process. Both require the estate's value to be below a specified threshold and involve submitting a sworn statement to a relevant authority, usually a financial institution or a court. The primary similarity lies in their function to facilitate a quicker resolution for small estates, thereby reducing the time and financial burden on the beneficiaries.

Simplified Probate Procedure: While not an affidavit in itself, the Simplified Probate Procedure shares many of the objectives of the Oklahoma Small Estate Affidavit. Both are designed to streamline the process of settling an estate that does not meet the usual thresholds for complex probate processing. These procedures typically involve less paperwork, reduced court involvement, and a faster timeline for distributing the deceased's assets. Unlike the affidavit, however, the simplified probate might require a minimal level of court oversight, even as it eschews the full probate process. The core similarity is the shared goal of expedient asset distribution in straightforward estate situations.

Dos and Don'ts

When dealing with the Oklahoma Small Estate Affidavit form, there are several important dos and don'ts to keep in mind. These guidelines are designed to help individuals navigate the process smoothly and effectively.

Do:

Ensure that the total value of the estate meets the criterion for a small estate under Oklahoma law. This typically means that the estate's value, after debts have been subtracted, does not exceed a certain threshold.

Completely and accurately fill out the form. Provide all requested details regarding the decedent, their assets, debts, and beneficiaries.

Obtain a certified copy of the death certificate to accompany the affidavit form.

Verify that 45 days have elapsed since the death before filing the affidavit, as per Oklahoma statutes.

Ensure all beneficiaries named in the affidavit sign the form, indicating their agreement and understanding.

Don't:

Attempt to use the Small Estate Affidavit if the estate exceeds the small estate threshold established by Oklahoma law.

Leave any sections of the form blank, as incomplete forms may lead to delays or outright rejection.

Sign the affidavit without ensuring all the information is true and correct. Providing false information can lead to legal penalties.

Forget to include the legal description of any real estate owned by the decedent if applicable. This is crucial for the proper transfer of real property.

Misconceptions

When dealing with the Oklahoma Small Estate Affidavit form, many people hold onto certain misunderstandings about its use and implications. Here are five common misconceptions explained:

- Anyone can use it immediately after a death. Actually, there’s a waiting period. In Oklahoma, the affidavit can only be used if it has been at least 45 days since the decedent's death. This time allows for the settling of immediate affairs and claims against the estate.

- It transfers all types of property. This form does not apply to all assets. Real estate, for example, is not typically transferable through a Small Estate Affidavit in Oklahoma. The form is primarily used for the transfer of personal property like bank accounts and vehicles.

- It eliminates the need for probate. While it's designed to simplify the process for smaller estates, using an Oklahoma Small Estate Affidavit does not always avoid probate entirely. It can, however, allow for the transfer of assets without a full probate proceeding for qualifying estates.

- There is no financial limit. Contrary to what some might think, there is a cap on the value of the estate for which this affidavit can be used. In Oklahoma, the total estate value (excluding certain exemptions like homestead property) must not exceed $50,000 to qualify.

- It grants immediate access to the decedent’s assets. Even with an affidavit, banks and other institutions may require additional documentation or time to release assets. The process involves verifying the affidavit and ensuring that all legal requirements are satisfied before distributing assets.

Key takeaways

Filling out the Oklahoma Small Estate Affidavit form is a straightforward process intended for the efficient handling of estates that fall below a certain value threshold. This document allows for the transfer of a deceased person’s assets without the need for a lengthy probate process. Here are the key takeaways to keep in mind when dealing with this form:

- Eligibility Criteria: To use an Oklahoma Small Estate Affidavit, the total value of the deceased's estate must not exceed $50,000, excluding the value of certain assets like homestead property and vehicles.

- Waiting Period: There is a mandatory waiting period of 10 days after the death before the affidavit can be filed. This period is designed to ensure all interested parties are aware and can object if necessary.

- Documentation Required: The person filing the affidavit must present a certified copy of the death certificate and provide a detailed list of the estate's assets alongside their estimated values.

- Heirs and Beneficiaries: The affidavit requires a thorough listing of all known heirs and beneficiaries. It is crucial to include accurate contact information for each.

- Debts and Obligations: Any outstanding debts or obligations of the deceased must be disclosed. The affidavit form generally includes a section for listing these liabilities.

- Legal Signatures: All heirs must sign the affidavit in the presence of a notary public, indicating their agreement to the distribution of assets as specified in the document.

- Filing with the Court: While the Small Estate Affidiciary does not go through the standard probate process, it still must be filed with the appropriate local court in Oklahoma. This filing is essential for the legal transfer of assets.

- Fees: There may be a nominal fee associated with filing the affidavit. It’s advisable to check with the local court or a legal professional to clarify the exact amount.

Filing the affidavit: Once the affidavit is filled out completely and accurately, it should be filed with the clerk of the county court where the deceased resided. This legal step is crucial for the transfer of asset ownership.

Using the Oklahoma Small Estate Affidavit form provides a streamlined process for the transfer of assets for estates that meet specific criteria. Cautious attention to detail and accuracy in completing the form will help to ensure that the estate is settled quickly and efficiently, minimizing stress for all involved parties during a difficult time.

Fill out Popular Small Estate Affidavit Forms for Different States

Minnesota Small Estate Affidavit - A small estate affidavit simplifies the asset collection from a deceased person by legally declaring the claimant’s right to inherit, aligning with specific state guidelines on estate size.

How Long Does Probate Take Indiana - Filling out a Small Estate Affidavit involves listing the assets of the deceased and their estimated values accurately.

Affidavit of Succession - A Small Estate Affidavit is a legal document used when a person passes away without a will, allowing for the collection of their assets without going through a lengthy probate process.