Printable Small Estate Affidavit Form for Oregon

Navigating the aftermath of a loved one's passing can be a deeply daunting process, especially when it comes to settling their estate. For those dealing with estates in Oregon valued at $275,000 or less, the Small Estate Affidavit presents a simplified path forward. This form, rooted in Oregon law, enables heirs or designated representatives to bypass the often lengthy and complicated probate process for smaller estates. Through this affidavit, individuals can claim the deceased's assets, distribute property according to the decedent's will or state law, and tie up the financial loose ends of their departed loved one. It is crucial, however, for those considering this option to understand not just the eligibility criteria— which includes a cap on both personal property and real estate values— but also the responsibilities that come with signing the affidavit. Completeness, honesty, and adherence to legal deadlines play pivotal roles in the process, laying the groundwork for a smoother transfer of assets and minimizing the risk of future legal complications.

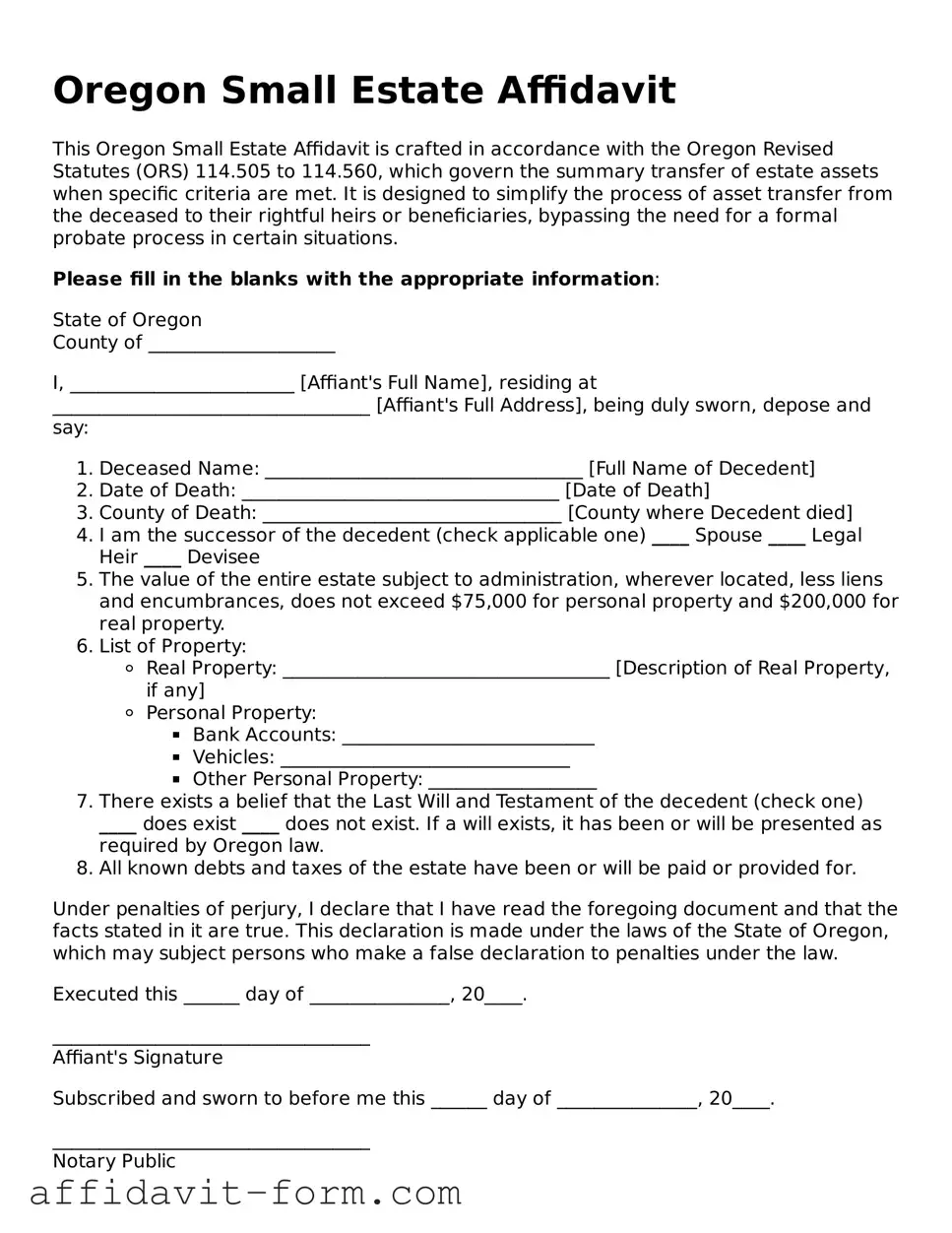

Form Example

Oregon Small Estate Affidavit

This Oregon Small Estate Affidavit is crafted in accordance with the Oregon Revised Statutes (ORS) 114.505 to 114.560, which govern the summary transfer of estate assets when specific criteria are met. It is designed to simplify the process of asset transfer from the deceased to their rightful heirs or beneficiaries, bypassing the need for a formal probate process in certain situations.

Please fill in the blanks with the appropriate information:

State of Oregon

County of ____________________

I, ________________________ [Affiant's Full Name], residing at __________________________________ [Affiant's Full Address], being duly sworn, depose and say:

- Deceased Name: __________________________________ [Full Name of Decedent]

- Date of Death: __________________________________ [Date of Death]

- County of Death: ________________________________ [County where Decedent died]

- I am the successor of the decedent (check applicable one) ____ Spouse ____ Legal Heir ____ Devisee

- The value of the entire estate subject to administration, wherever located, less liens and encumbrances, does not exceed $75,000 for personal property and $200,000 for real property.

- List of Property:

- Real Property: ___________________________________ [Description of Real Property, if any]

- Personal Property:

- Bank Accounts: ___________________________

- Vehicles: _______________________________

- Other Personal Property: __________________

- There exists a belief that the Last Will and Testament of the decedent (check one) ____ does exist ____ does not exist. If a will exists, it has been or will be presented as required by Oregon law.

- All known debts and taxes of the estate have been or will be paid or provided for.

Under penalties of perjury, I declare that I have read the foregoing document and that the facts stated in it are true. This declaration is made under the laws of the State of Oregon, which may subject persons who make a false declaration to penalties under the law.

Executed this ______ day of _______________, 20____.

__________________________________

Affiant's Signature

Subscribed and sworn to before me this ______ day of _______________, 20____.

__________________________________

Notary Public

My commission expires: _______________

Document Details

| Fact | Description |

|---|---|

| Governing Law | Oregon Revised Statutes Section 114.515 to 114.555 |

| Eligibility | Available to estates where the value of personal property does not exceed $75,000 and the value of real property does not exceed $200,000. |

| Purpose | It is used to simplify the process of settling small estates in Oregon. |

| When to File | The affidavit can be filed 30 days after the decedent's death. |

| Filing Fee | The fee varies by county but is typically required to file the affidavit with the court. |

| Required Information | Includes decedent's information, a detailed list of property, debts, and the names and addresses of heirs or beneficiaries. |

| Claim Period | Creditors have four months to make a claim against the estate after the affidavit is filed. |

How to Use Oregon Small Estate Affidavit

If you're handling the estate of a loved one in Oregon and it qualifies as "small" by legal standards, using the Small Estate Affidavit can simplify the process significantly. This document allows you to manage and distribute the deceased's assets without going through the more complex and time-consuming probate process. To ensure the form is completed correctly, follow the steps outlined below. This straightforward approach will help you navigate the legal requirements smoothly and efficiently.

- Begin by gathering all necessary information about the deceased’s assets, debts, and beneficiaries. This includes bank account details, property descriptions, and contact information for anyone entitled to inherit.

- Download the latest version of the Oregon Small Estate Affidavit form from the Oregon Judicial Department's website or obtain a copy from the local courthouse.

- Fill in the full legal name and date of death of the deceased at the top of the form.

- List your name and address, stating your relationship to the deceased and your right to handle the estate.

- Provide a detailed list of the deceased's personal property, including the estimated value of each item. Be as specific as possible.

- Include information on any real estate owned by the deceased within Oregon. Mention the property’s legal description, tax lot number, and assessed value.

- Identify all known debts and liabilities of the estate, including creditor names, addresses, and the amounts owed.

- Detail the names, addresses, and relationships of all legal heirs or devisees under the will, if applicable. Specify the portion of the estate each person will receive.

- Read the declaration section carefully, then sign and date the form in front of a notary public. The affidavit must be notarized to be legally valid.

- Attach a certified copy of the death certificate to the affidavit.

- File the completed affidavit, along with the death certificate and required filing fee, with the appropriate Oregon county court. The specific office and fee can vary, so it’s important to verify this information with the county where the deceased lived.

After filing, you'll wait for official approval before you can distribute the assets according to the details outlined in the affidavit. While this process is more straightforward than formal probate, it's important to carefully follow each step and provide accurate, thorough information to avoid delays and ensure the rightful heirs receive their inheritances properly. If at any point you find yourself uncertain or overwhelmed, don't hesitate to seek legal advice to guide you through.

Listed Questions and Answers

What is an Oregon Small Estate Affidavit?

An Oregon Small Estate Affidavit is a legal form used to manage and distribute the property of a deceased person, known as the decedent, whose estate qualifies as "small" under Oregon law. This process allows for a simpler, quicker way to distribute assets to heirs or beneficiaries without going through a formal probate process.

Who can file an Oregon Small Estate Affidavit?

The Small Estate Affidavit in Oregon can be filed by a surviving spouse, an heir, an individual named in the will as a beneficiary, or a creditor of the decedent. However, the person filing must ensure that the total value of the decedent's estate meets the specific criteria defined under Oregon law for being considered "small."

What are the requirements for an estate to be considered "small" in Oregon?

For an estate to be considered "small" in Oregon, it must meet the following criteria:

- The total value of the decedent's personal property must not exceed $75,000.

- The total value of the decedent's real property must not exceed $200,000.

What information is needed to complete the Small Estate Affidavit form?

To successfully complete the Small Estate Affidit form in Oregon, the following information is necessary:

- The full legal name and date of death of the decedent.

- A detailed list of the decedent’s personal property, including descriptions and values.

- A detailed list of any real property owned by the decedent, including legal descriptions and values.

- The names and addresses of all heirs or beneficiaries.

- Information about any known creditors of the estate.

How can one file an Oregon Small Estate Affidavit?

To file a Small Estate Affidavit in Oregon, the following steps should be taken:

- Gather all required information and documents, including a certified copy of the death certificate.

- Complete the Small Estate Affidavit form, ensuring all information is accurate and thorough.

- Submit the completed form and any accompanying documents, such as the death certificate, to the appropriate county probate court in Oregon.

- Notify all heirs, beneficiaries, and known creditors about the filing of the affidavit.

Common mistakes

When individuals embark on the task of filling out the Oregon Small Estate Affiditable form, it's crucial to approach it with attention to detail and a clear understanding of the requirements. While intended to simplify the process of estate distribution for smaller estates, common pitfalls can complicate matters significantly. Here are six mistakes frequently encountered:

Not verifying eligibility requirements: Before proceeding, one must ensure the estate qualifies as a "small estate" under Oregon law. Overlooking this can lead to unnecessary complications and even the rejection of the affidavit.

Incomplete list of assets: All assets belonging to the estate must be accurately and comprehensively listed. Failure to include certain assets can disrupt the distribution process and may lead to legal challenges.

Incorrect valuation of assets: Accurate valuation is not only crucial for determining if an estate meets the "small estate" criteria but also affects tax implications and equitable distribution. Misestimations can result in significant issues down the line.

Omitting or erroneously identifying heirs and beneficiaries: Each heir and beneficiary must be correctly identified with their current legal information. Mistakes here can delay distributions and may necessitate legal intervention.

Failing to address outstanding debts and taxes: The affidavit requires a statement addressing how debts and taxes will be paid. Neglecting this step or providing inaccurate information can attract legal penalties and complicate estate closure.

Improper or absent signature and notarization: The form must be signed in the presence of a notary public to be considered valid. Skipping this formality or improper execution invalidates the document, necessitating a restart of the process.

Considering these common mistakes can help ensure the Oregon Small Estate Affidavit form is filled out accurately and thoroughly, facilitating a smoother process for all parties involved.

Documents used along the form

In estates that qualify as "small" under Oregon law, the Small Estate Affidavit form becomes a critical document for simplifying the probate process. This form allows certain individuals to collect and distribute the decedent's assets without going through a formal probate proceeding. However, to effectively manage and distribute a decedent's assets, the affidavit is often accompanied by other important forms and documents. Each of these plays a vital role in ensuring that the estate is settled properly and in accordance with the law.

- Death Certificate: This is an official document issued by the government, confirming the date, location, and cause of a person's death. It is required to prove the death of the decedent when using the Small Estate Affidavit.

- Copy of the Will (if any): If the decedent left a will, a copy must be provided. This document outlines the decedent's wishes for the distribution of their assets and the appointment of an executor.

- Personal Representative Deed: When real property is involved, this document is used to transfer property ownership from the decedent to the beneficiaries named in the will or to the heirs as determined by law.

- Inventory and Appraisement Form: This form lists all the assets within the estate, including real estate, personal property, and financial accounts, along with their estimated value at the time of the decedent's death.

- Notice to Creditors: This document informs potential creditors of the decedent’s passing and the small estate process, allowing them to file claims for debts owed to them by the decedent within a specified period.

- Tax Forms: Depending on the value of the estate and the types of assets involved, various tax forms may be needed to report income, satisfy creditor claims, and address any estate or inheritance taxes due.

While the Small Estate Affidavit simplifies the settlement of small estates, understanding and completing these accompanying documents is crucial. They provide a structured way to settle an estate transparently, ensure that assets are distributed correctly, and help avoid potential legal issues. Whether used by family members or designated representatives, the correct use and filing of these documents ensure the estate's smooth and lawful transition according to the wishes of the deceased and state law.

Similar forms

The Oregon Small Estate Affidavit form is similar to other legal documents used to settle smaller estates without the need for a full probate process. This document allows individuals, often surviving family members, to claim ownership of the deceased's assets in a streamlined manner. Just as with other forms designed for estate management, the Oregon Small Estate Affiffdavit requires detailed information about the deceased's assets, debts, and beneficiaries.

One such document the Oregon Small Estate Affidavit resembles is the Transfer on Death Deed (TODD). Much like the affidavit, a TODD allows property owners to pass on their real estate to a beneficiary without the property having to go through probate. Both documents function to simplify the transfer of assets upon someone's death. However, while the affidavit deals with the estate after death, a TODD is prepared and recorded while the property owner is still alive.

Another document akin to the Oregon Small Estate Affidavit is the Joint Tenancy Agreement. This agreement allows property to pass directly to the other person named in the tenancy upon death, bypassing the probate process similarly to the affidavit. The key difference lies in the timing and applicability; a Joint Tenancy Agreement is prepared before death and applies only to individuals who co-own property. In contrast, the affidavit is used after death and can encompass various assets, not just real estate.

The affidavit also shares similarities with a Payable on Death (POD) account designation. Both the Oregon Small Estate Affidavit and POD designations allow assets to be transferred to beneficiaries without the need for probate. However, a POD designation is specific to financial accounts, meaning it's a way for account holders to name who should receive the funds in the account after their death. Unlike the affidavit, which can cover a broad range of assets, POD designations apply strictly to financial accounts.

Dos and Don'ts

Filling out the Oregon Small Estate Affidavit form requires careful attention to detail. It's designed for the straightforward transfer of property to heirs or beneficiaries when an estate is under a certain value. The form has specific eligibility criteria and steps to follow. Below are essential dos and don'ts to help guide you through the process effectively:

Do:- Verify that the total value of the estate meets the small estate criteria in Oregon. The estate's value should not exceed the threshold established by state law.

- Accurately list all the assets of the estate. This includes bank accounts, vehicles, and real property that the deceased owned at the time of death.

- Ensure all debts and liabilities of the estate are known and listed. This can include mortgages, personal loans, and final expenses.

- Gather the required documents, such as the death certificate and proof of your relationship to the deceased.

- Fill out the form completely, providing all requested information such as the decedent’s full name, date of death, and your relationship to the deceased.

- Review the form for accuracy before submitting. Even minor mistakes can cause delays.

- Sign the affidavit in front of a notary public to validate its authenticity.

- Attempt to use the form if the estate exceeds Oregon’s small estate threshold. It is intended only for smaller estates.

- Exclude any assets or debts. Failure to disclose all relevant information can lead to legal penalties.

- Forget to notify known creditors of the estate. In Oregon, you may be required to publish notice or directly notify creditors.

- Overlook the distribution laws. Make sure you are aware of how assets are to be divided among heirs or beneficiaries according to state law.

- Fill out the form hastily without double-checking the legal requirements specified by Oregon law.

- Ignore the need for a notary. A notarized affidavit is a requirement for it to be legally binding.

- Delay submitting the completed form. Timely filing is important to expedite the process of asset distribution.

Misconceptions

In Oregon, the process of settling small estates through the use of an affidavit form is often misunderstood. This approach provides a streamlined method to manage and distribute a decedent's assets without the need for a formal probate process. However, several misconceptions exist regarding the Small Estate Affidavit process in Oregon. Understanding these misunderstandings is key to navigating the process more effectively.

- Any estate can be settled using a Small Estate Affidavit. In fact, the use of a Small Estate Affidavit in Oregon is limited to estates where the total value of personal property is $75,000 or less and the value of real property is $200,000 or less. This threshold is strictly enforced and excludes many larger estates from using this simpler process.

- The Small Estate Affidavit process is immediate. While it is a quicker option compared to formal probate, it still requires time. After filing the affidavit with the appropriate court, there is a mandatory waiting period of 10 days before any action can be taken to distribute the assets.

- All assets can be transferred using a Small Estate Affidavit. Certain assets, such as those held in trust or with designated beneficiaries (like life insurance policies and retirement accounts), usually bypass the estate and cannot be transferred through this process.

- The form is simple and requires no legal knowledge to complete. Although it's designed to be less complicated than probate, completing a Small Estate Affidavit requires careful attention to detail and an understanding of legal definitions. Incorrectly filled forms or failure to notify potential creditors appropriately can invalidate the process.

- Only family members can file a Small Estate Affidavit. While it's common for close relatives to handle the process, Oregon law allows any person indebted to or possessing the property of the deceased, or acting on behalf of those entitled to the property, to file the affidavit. This includes friends and, in some cases, creditors.

- Using a Small Estate Affidavit avoids all estate-related fees. While filing for a small estate affidavit is generally less costly than formal probate, there are still filing fees and possible publication fees in Oregon. Additionally, the representative may need to pay for certified copies of the death certificate and for any legal advice sought during the process.

Understanding the actual requirements and limitations of the Small Estate Affidavit process in Oregon is crucial for those seeking to manage a small estate efficiently and legally. Clarity on these misconceptions can save time, reduce potential legal complications, and ensure the decedent's assets are distributed according to their wishes and state laws.

Key takeaways

When dealing with the Oregon Small Estate Affidavit form, it is essential to understand its purpose and the procedural requirements involved. This document is used to facilitate the distribution of a deceased person's estate under Oregon law without the need for a formal probate process. Here are six key takeaways to consider:

- The estate must not exceed a certain value threshold. In Oregon, the total value of personal property subject to the affidavit process must not exceed $75,000, and the real property must not exceed $200,000. This criteria ensures the estate qualifies as a "small estate" under Oregon law.

- Filing the form must occur in the correct county. The affidavit should be filed in the county where the deceased person lived or owned real estate. This geographical qualifier is vital for the form's proper legal standing and subsequent processes.

- There is a mandatory waiting period. Oregon law requires a 30-day waiting period after the death of the estate holder before the small estate affidavit can be filed. This time allows for gathering necessary documents and valuables.

- Accurate reporting of assets and debts is crucial. The form requires detailed information about the deceased person's assets and debts. Accuracy in reporting is critical to the legal process and ensures fair distribution among rightful heirs or beneficiaries.

- Legal documentation of heirship or beneficiary status may be needed. Those filing must be able to prove their legal right to the estate, whether as heirs or designated beneficiaries. Supporting documents, including death certificates and wills, should accompany the affidavit form.

- Filing the form incurs a fee. Submission of the Oregon Small Estate Affidavit form requires a filing fee. The amount varies by county, so it's important to verify the current fee with the local court where the filing will occur.

Understanding these key aspects of the Oregon Small Estate Affidavit form can help streamline the process, ensuring that the distribution of assets is handled efficiently and in accordance with Oregon law.

Fill out Popular Small Estate Affidavit Forms for Different States

Louisiana Small Succession Affidavit - This affidavit exemplifies how the law accommodates varying estate sizes, ensuring that the process of claiming inheritance is as inclusive and accessible as possible.

Clay County Probate Forms - A Small Estate Affidavit form is a legal document utilized to manage the distribution of a decedent's estate when it falls below a certain value threshold, making the probate process shorter or unnecessary.

Small Estate Affidavit Montana - State laws vary regarding the maximum value of an estate that can be settled using a Small Estate Affidavit, emphasizing the need for compliance.