Printable Small Estate Affidavit Form for Pennsylvania

In the wake of a loved one's passing, navigating the journey of administering their estate can often appear as an overwhelming and daunting task. Amidst the myriad of documents and legal formalities, the Pennsylvania Small Estate Affiditat emerges as a beacon of solace for those whose estates fall below a certain financial threshold, qualifying them for a more streamlined process. This expedited avenue permits the dispensation of the decedent's assets without the customary probate process, thereby offering a quicker, simpler pathway to resolution and closure. Emphasizing efficiency and accessibility, the small estate affidavit form encapsulates a set of carefully crafted stipulations designed to ensure that this process remains both equitable and attainable. It curtails the potential for protracted legal entanglements and reduces the administrative burden on those left behind, allowing them to fulfill the decedent’s final wishes with a greater degree of ease and peace of mind. Nevertheless, understanding the nuances and eligibility criteria encapsulated within this form is crucial for those wishing to employ its advantages fully, ensuring they navigate this process with the requisite knowledge and support.

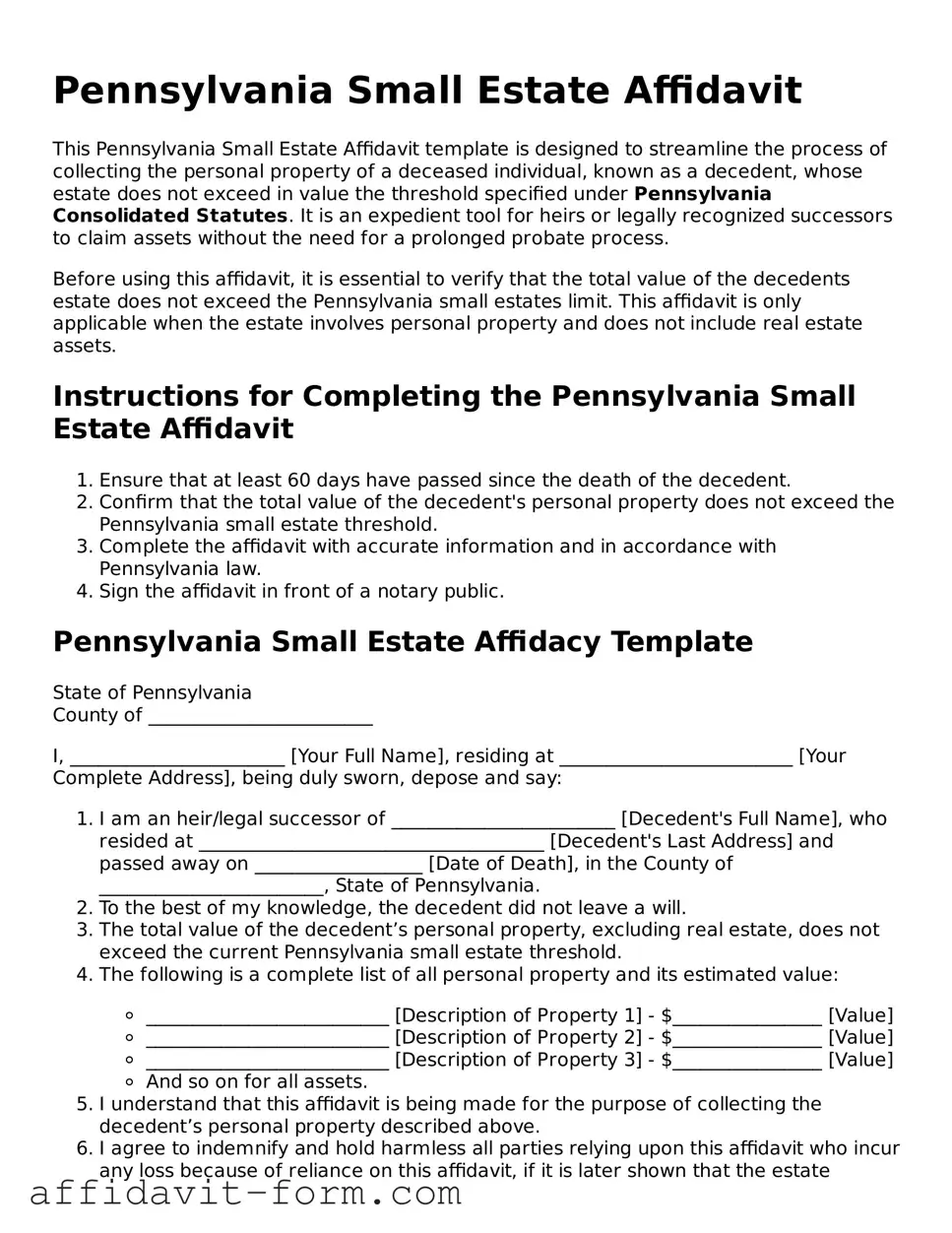

Form Example

Pennsylvania Small Estate Affidavit

This Pennsylvania Small Estate Affidavit template is designed to streamline the process of collecting the personal property of a deceased individual, known as a decedent, whose estate does not exceed in value the threshold specified under Pennsylvania Consolidated Statutes. It is an expedient tool for heirs or legally recognized successors to claim assets without the need for a prolonged probate process.

Before using this affidavit, it is essential to verify that the total value of the decedents estate does not exceed the Pennsylvania small estates limit. This affidavit is only applicable when the estate involves personal property and does not include real estate assets.

Instructions for Completing the Pennsylvania Small Estate Affidavit

- Ensure that at least 60 days have passed since the death of the decedent.

- Confirm that the total value of the decedent's personal property does not exceed the Pennsylvania small estate threshold.

- Complete the affidavit with accurate information and in accordance with Pennsylvania law.

- Sign the affidavit in front of a notary public.

Pennsylvania Small Estate Affidacy Template

State of Pennsylvania

County of ________________________

I, _______________________ [Your Full Name], residing at _________________________ [Your Complete Address], being duly sworn, depose and say:

- I am an heir/legal successor of ________________________ [Decedent's Full Name], who resided at _____________________________________ [Decedent's Last Address] and passed away on __________________ [Date of Death], in the County of ________________________, State of Pennsylvania.

- To the best of my knowledge, the decedent did not leave a will.

- The total value of the decedent’s personal property, excluding real estate, does not exceed the current Pennsylvania small estate threshold.

- The following is a complete list of all personal property and its estimated value:

- __________________________ [Description of Property 1] - $________________ [Value]

- __________________________ [Description of Property 2] - $________________ [Value]

- __________________________ [Description of Property 3] - $________________ [Value]

- And so on for all assets.

- I understand that this affidavit is being made for the purpose of collecting the decedent’s personal property described above.

- I agree to indemnify and hold harmless all parties relying upon this affidavit who incur any loss because of reliance on this affidavit, if it is later shown that the estate exceeded the Pennsylvania small estates limit.

Subscribed and sworn to before me this ________ day of ______________, 20____.

__________________________________

[Your Signature]

__________________________________

[Printed Name of Notary Public]

My Commission Expires: _______________

Document Details

| Fact | Description |

|---|---|

| Governing Law | The Pennsylvania Small Estate Affidavit operates under the Pennsylvania Consolidated Statutes, Title 20, Sections 3101 et seq. relating to decedents, estates, and fiduciaries. |

| Eligibility Threshold | To use the form, the total value of the deceased's estate must not exceed $50,000, excluding real estate. |

| Purpose | The form is utilized to expedite the process of estate settlement for small estates, allowing for the distribution of assets without formal probate. |

| Required Information | Information needed includes the decedent's personal details, a list of assets, debts, and the names and addresses of heirs. |

| Asset Distribution | Assets can be distributed to rightful heirs upon completion and approval of the Small Estate Affidavit. |

| Filing Procedure | The completed affidavit must be filed with the Register of Wills in the county where the decedent resided. |

| Notarization | The Small Estate Affidavit needs to be notarized before submission to ensure its validity. |

How to Use Pennsylvania Small Estate Affidavit

When a loved one passes away, handling their estate can feel overwhelming. The Commonwealth of Pennsylvania offers a simplified process for small estates, allowing certain assets to be transferred without a formal probate process. The Small Estate Affidavit is a key document in this process, enabling the transfer of the deceased's assets to their rightful heirs or beneficiaries. It's important for those eligible to fill out this form accurately to ensure a smoother transition of assets. Here's a step-by-step guide to help you complete the Pennsylvania Small Estate Affidavit form confidently.

- Start by gathering the necessary information: the deceased's full legal name, date of death, and a list of the assets included in the small estate. This helps streamline the process.

- Fill in the county at the top of the form where the deceased resided. This indicates where the affidavit will be filed.

- Enter the full legal name of the deceased in the designated space, ensuring it matches the name listed on their death certificate.

- Provide the date of death exactly as it appears on the death certificate.

- List the assets being transferred via the affidavit. Be specific, including account numbers, descriptions of personal property, or vehicle identification numbers as applicable.

- Outline the names and relationships of the beneficiaries or heirs receiving the assets. This section is crucial for making sure the assets are distributed according to the deceased's wishes or state law, if there's no will.

- Calculate and enter the total value of the estate's assets. Remember, the estate must fall below a certain value threshold to qualify for the small estate process in Pennsylvania.

- The affidavit must be signed in front of a notary public. Once all parts of the form are completed, find a local notary to witness and notarize the affidavit.

- File the completed and notarized affidavit with the appropriate county office, often the Register of Wills or a similar entity within the county where the deceased resided.

- Lastly, present or submit the notarized affidavit to the institutions or entities holding the assets (e.g., banks, brokerage firms) to facilitate the transfer to the beneficiaries.

Filling out the Pennsylvania Small Estate Affidavit form is a key step in managing a small estate within the state. By following these steps closely, you ensure that the process is handled correctly and that the deceased's assets are distributed to their rightful heirs or beneficiaries efficiently. This process alleviates some burdens during a difficult time, making it a little easier to navigate the complexities of estate management.

Listed Questions and Answers

What is a Pennsylvania Small Estate Affidavit?

A Pennsylvania Small Estate Affidavit is a legal document used by the successors of a deceased person to collect the deceased's assets without going through formal probate proceedings. This document can be utilized when the deceased person's total assets are valued below a certain threshold, demonstrating to financial institutions and other entities that the signer has the right to collect the assets.

Who can use a Pennsylvania Small Estate Affidavit?

Use of a Pennsylvania Small Estate Affidavit is typically limited to the legal successors of the deceased. This often includes spouses, adult children, or other close relatives. The specific requirements for who can file this affidavit depend on Pennsylvania's state laws, which outline the order of succession and the maximum value of the estate for which this process can be used.

What is the maximum value of an estate that can be processed with a Small Estate Affidavit in Pennsylvania?

In Pennsylvania, the total value of the deceased's estate that qualifies for the Small Estate Affidavit procedure must not exceed $50,000, excluding real estate. This threshold is subject to legislative changes, so it's advisable to verify the current limit prior to filing.

What are the required documents to file a Small Estate Affidavit in Pennsylvania?

When filing a Small Estate Affidavit in Pennsylvania, various documents are needed to support the claim. These typically include:

- The completed Small Estate Affidavit form,

- A certified copy of the death certificate,

- Documentation evidencing the relationship to the deceased (e.g., marriage certificate, birth certificate),

- A list of the estate's assets,

- And possibly other documents depending on the specific circumstances.

How do you file a Small Estate Affidifavit in Pennsylvania?

Filing a Small Estate Affidavit in Pennsylvania involves completing the affidavit form with accurate information regarding the deceased's assets, debts, and heirs. Once the form is filled out, it, along with the other required documents, should be presented to the appropriate financial institutions or entities holding the assets. It is not filed with a court, but local rules and practices may vary, so checking with a county's Register of Wills or a legal professional is recommended.

What assets can be collected with a Small Estate Affidavit in Pennsylvania?

Assets that can typically be collected using a Small Estate Affidavit in Pennsylvania include:

- Bank accounts,

- Stocks and bonds,

- Small amounts of personal property,

- Certain types of vehicle titles,

- And other liquid assets.

Is there a waiting period to use a Small Estate Affidavit after someone dies in Pennsylvania?

No specific waiting period is mandated by Pennsylvania law before a Small Estate Affidavit can be used after a person's death. However, financial institutions and entities may have their own policies regarding such a waiting period. It is advisable to verify directly with the institution in question or consult with a legal professional for guidance.

Can debts of the deceased be paid using a Small Estate Affidavit?

Yes, debts of the deceased can be paid using a Small Estate Affidavit in Pennsylvania. The person filing the affidavit is responsible for ensuring that the deceased's debts and any applicable taxes are satisfied from the estate's assets before distributing the remaining assets among the heirs. This process underscores the importance of a careful assessment of the estate's liabilities alongside assets.

What happens if the estate value exceeds the Small Estate Affidavit threshold?

If the total value of the deceased's estate exceeds the threshold for using a Small Estate Affidavit in Pennsylvania, the estate will likely need to be administered through formal probate proceedings. These proceedings involve a more detailed court process, including the appointment of an executor or administrator to manage the estate, pay debts, and distribute the remaining assets according to the will or state succession laws. Consulting with a legal professional is strongly recommended in such scenarios to navigate the more complex requirements and procedures.

Common mistakes

When dealing with the intricacies of small estate management in Pennsylvania, individuals often have to complete a Small Estate Affidavit form. This legal document, while seemingly straightforward, presents various pitfalls that can complicate the administration of the deceased's estate. Here are ten common errors made during this process:

Not verifying eligibility: Before embarking on filling out the form, it’s crucial to confirm if the estate qualifies as 'small' according to Pennsylvania law. An oversight here can lead to wasted effort and legal complications.

Incorrect information about the decedent: Filling in the decedent's name, date of death, or other personal details inaccurately can void the affidavit, delaying the distribution of assets.

Omitting required signatures: All necessary parties, often including the surviving spouse or next of kin, must sign the form. Missing signatures can render the document legally ineffective.

Failing to attach a death certificate: A certified copy of the death certificate is typically required to accompany the affidavit. Its absence can halt the process.

Misunderstanding asset valuation: Undervaluing or overvaluing the estate's assets can lead to financial discrepancies and potential legal scrutiny.

Leaving out certain assets: All assets that fall under the purview of the small estate should be listed. Excluding any can lead to incomplete asset distribution.

Inaccurate debt reporting: Debts and liabilities of the estate must be accurately reported. Incorrect information can affect the distribution of the remaining assets.

Improper representation: Misrepresenting one’s relationship to the deceased or entitlement to the estate can lead to fraud charges and the invalidation of the affidavit.

Not consulting legal guidance: The process, while designed to be user-friendly, often benefits from legal advice, especially in complex estates. Proceeding without consulting a professional might result in errors.

Use of incorrect form: Pennsylvania has specific requirements for the Small Estate Affidavit form. Utilizing an outdated or incorrect version can invalidate the whole process.

To avoid these common mistakes, thorough preparation, attention to detail, and, when necessary, professional legal assistance are recommended. Navigating the completion of the Pennsylvania Small Estate Affidavit form with care and diligence ensures the smooth transition of assets, honoring the decedent's wishes and providing for their loved ones with minimum delay.

Documents used along the form

When handling a small estate in Pennsylvania, the Small Estate Affidavit form is a useful document for simplifying the settlement of an estate that falls below a certain value threshold. However, to ensure a comprehensive approach to estate management, several other documents are often necessary to accompany this affidavit. These documents help to confirm the value of the estate, designate beneficiaries, and fulfill legal obligations regarding the deceased's assets and debts.

- Death Certificate: This official document serves as proof of death. It is essential for validating the Small Estate Affidavit and is required by financial institutions, government agencies, and courts to process the transfer of assets and benefits.

- Will: If the deceased left a will, it specifies the distribution of their assets according to their wishes. A will can significantly influence the execution of the Small Estate Affidavit by designating beneficiaries and potentially nominating an executor.

- Letters of Administration: In cases where there is no will, or an executor is not named, Letters of Administration may be issued by a probate court. These grant the legal authority to deal with the deceased's estate, including the distribution of assets as per state laws.

- Last Bank Statement: Providing the most recent bank statement is crucial for verifying the value of the decedent's accounts. It helps in determining whether the estate qualifies as a small estate under Pennsylvania law.

- Property Appraisal Reports: For estates that include real estate or valuable personal property, professional appraisals may be necessary. These reports establish the fair market value of such assets, essential for both the affidavit process and tax considerations.

- Vehicle Title and Registration Documents: If the deceased owned a vehicle, these documents are needed to transfer ownership. They may also be required to demonstrate the inclusion of such assets in the total estate value.

In conclusion, while the Small Estate Affidavit form is a key document for administering smaller estates in Pennsylvania, it is the combination of this form with other important documents that facilitates a thorough and lawful handling of the deceased's affairs. Gathering these documents in advance can streamline the process, ensuring that the estate is settled efficiently and in accordance with the law.

Similar forms

The Pennsylvania Small Estate Affidavit form is similar to other streamlined legal documents designed to simplify the transfer of assets. These documents, such as Transfer-on-Death (TOD) deeds and Payable-on-Death (POD) accounts, share the common purpose of allowing property to bypass the often lengthy and costly probate process. Each document, while serving a similar end, applies to different types of assets or circumstances.

Transfer-on-Death (TOD) Deeds: Like the Pennsylvania Small Estate Affidavit, TOD deeds enable an individual to designate beneficiaries for real estate, ensuring the property transfers directly to them upon the owner’s death without going through probate. Both documents simplify the process of transferring assets, but while the Small Estate Affidavit can apply to various kinds of personal property and vehicles below a certain value threshold, TOD deeds are specifically designed for real estate transactions. This distinction makes TOD deeds an invaluable tool for estate planning, complementing the purposes served by Small Estate Affidavits.

Payable-on-Death (POD) Accounts: Similarly, POD accounts avoid the probate process by allowing account holders to name someone who will receive the funds in the account upon their death. This tool is commonly used for bank accounts and securities. The principle of bypassing probate aligns with that of the Small Estate Affidavit, though POD accounts are specifically focused on financial assets. By naming a beneficiary directly on the account, the account holder ensures that these assets will transfer swiftly and without the need for a formal probate proceeding, offering a streamlined approach akin to what the Small Estate Affidavit provides for personal property and vehicles.

Dos and Don'ts

Filling out the Pennsylvania Small Estate Affidavit form is a legally binding process that requires attention to detail and an understanding of your responsibilities. It's critical to follow proper guidelines to ensure the process is completed accurately and in compliance with Pennsylvania law. Here is a concise guide outlining what you should and shouldn't do when preparing this affidavit.

Things You Should Do

Verify that the estate qualifies as a "small estate" under Pennsylvania law, typically meaning it has a value of $50,000 or less, excluding real estate.

Gather accurate information regarding all assets, debts, and beneficiaries of the deceased before filling out the form to ensure completeness and accuracy.

Ensure that all beneficiaries or heirs are in agreement with the distribution of assets as outlined in the affidavit, to avoid disputes and potential legal challenges.

Seek legal advice if you have any doubts or confusion about how to accurately complete the form or the legal implications of the affidavit.

Things You Shouldn't Do

Do not guess or estimate the value of assets. It's important to use exact figures to avoid legal complications or allegations of fraud.

Avoid skipping sections or leaving blanks on the form. If a section does not apply, it is better to indicate this with a “N/A” or “None” than to leave it empty.

Do not forget to check Pennsylvania's current laws and requirements for small estates, as statutes can change and may affect the validity of your affidavit.

Resist the temptation to distribute assets before the affidavit is properly filed and accepted by the appropriate entity, such as a bank or the probate court.

Misconceptions

When dealing with the transfer of assets from a deceased individual’s estate, the Pennsylvania Small Estate Affidavit form often comes into play. However, despite its usefulness, there are several misconceptions surrounding its application and requirements. Understanding these can help in navigating the process more effectively.

Only for Real Estate: Many believe the Small Estate Affidavit is exclusively for transferring real estate. In fact, it's utilized for transferring various assets, including bank accounts and personal property, provided the total value does not exceed a certain threshold.

Legal Representation Not Required: It's a common misconception that legal counsel is not necessary when filing a Small Estate Affidavit. While the process seems straightforward, consulting an attorney can ensure proper completion and submission, thus avoiding potential legal complications.

Immediate Family Members Only: Another mistaken belief is that only immediate family members can file the affidavit. Actually, it can be filed by any successor, a term that includes not only family members but also friends or organizations named in a will.

No Debts Considered: Some think that debts of the deceased are not considered when filing a Small Estate Affidavit. The estate must first settle all outstanding debts before assets can be distributed to successors.

Threshold Value is Fixed: The threshold value under which an estate qualifies as "small" is often misunderstood to be a fixed amount. This value can vary and should be verified as per Pennsylvania state guidelines at the time of filing.

Avoids Probate: Many assume that using a Small Estate Affidavit always avoids the probate process. While it can simplify and expedite transferring assets, some situations may still require probate, especially if the estate's composition is complex.

Instant Access to Assets: It's incorrectly believed that the Small Estate Affidavit grants instant access to the decedent's assets. Financial institutions and other entities may require additional documentation or time to release assets.

Applies to Jointly Held Property: There's a misconception that this affidavit can be used to transfer jointly held property. In most cases, jointly held property automatically passes to the surviving owner, outside of the affidavit process.

One Form Fits All: A common misunderstanding is that the Pennsylvania Small Estate Affidavit form is standardized. While there is a general format, additional documentation or specific information may be required, depending on the assets and the institution.

No Time Limit for Filing: Some believe there is no time constraint for filing a Small Estate Affidavit. However, Pennsylvania law may impose specific deadlines depending on the case, emphasizing the importance of timely action.

Dispelling these misconceptions is crucial for properly managing the estate of a loved one. For those unfamiliar with this process, seeking professional guidance can provide clarity and streamline the completion of the necessary legal steps.

Key takeaways

When a loved one passes away, handling their estate can seem daunting. In Pennsylvania, a Small Estate Affidavit form can simplify this process if the estate meets certain criteria. Here are key takeaways you should know about this important document:

- Eligibility involves estate value: To use a Small Estate Affidavit in Pennsylvania, the total value of the deceased's estate must not exceed $50,000. This threshold does not include certain assets, such as jointly-owned property and life insurance benefits paid directly to a beneficiary.

- Expedited process: This form enables a more expedited distribution of the deceased's assets, bypassing the more prolonged probate process typically required for larger estates.

- Applicability: It is important to know that this form is only applicable if the deceased did not leave a will. If there's a will, the estate must go through the normal probate process.

- Documentation is key: When filling out the Small Estate Affidavit, one must gather all necessary documentation of the deceased's assets, including bank statements, titles, and deeds, to accurately assess the value of the estate.

- Legal responsibilities: The person signing the affidavit, usually the surviving spouse or next of kin, is asserting that they will use the deceased's assets to pay outstanding debts and distribute the remainder according to state laws.

- Filing requirements vary: Requirements for filing a Small Estate Affidavit can vary from county to county. Make sure to check with local county court officials to ensure all necessary paperwork is completed correctly.

- Not for all asset types: Some assets may not be transferable through a Small Estate Affidavit. Complex assets, like certain investments and real estate in another state, could require additional legal processes.

- Seek legal advice: While a Small Estate Affidavit can simplify settling an estate, it's advisable to seek legal guidance to navigate the process accurately, especially if there are any disputes among potential heirs or unusual assets involved.

Understanding and using a Small Estate Affifold oversaved-loved ones' transition. However, each estate is unique, and navigating the legal requirements can be complex. A well-informed approach, often supported by legal advice, can make a significant difference in managing the estate efficiently and with peace of mind.

Fill out Popular Small Estate Affidavit Forms for Different States

Nevada Small Estate Affidavit - The affidavit helps to bypass the lengthy and costly probate court proceedings for small estates.

Affidavit of Heirship Alabama - An effective solution for swiftly managing small estates, it provides a legal pathway for asset distribution amongst heirs.

Illinois Affidavit Requirements - Makes it possible for heirs to claim and distribute assets of a small estate without a will.

Probate Process in Maine - If disputes arise among potential heirs or beneficiaries, the Small Estate Affidavit process could become more complicated and might not be the best option.