Printable Small Estate Affidavit Form for Rhode Island

Navigating the aftermath of a loved one's passing involves a myriad of tasks, among which the distribution of their estate looms large. For those managing estates in Rhode Island valued at a threshold deemed 'small' by statutory standards, the Small Estate Affidavit form emerges as a beacon of streamlined process. This legal instrument, designed to simplify the transfer of assets without the need for a prolonged probate process, ensures that beneficiaries can expedite their claims on the deceased's property. Its major components include verifying the estate's value falls below the stipulated maximum, listing the assets in detail, and affirming the rightful heirs or beneficiaries. Critical for individuals seeking a less cumbersome procedure, the form embodies an important tool in the legal toolkit for handling estate matters efficiently and with reduced complexity. Through its utilization, Rhode Island residents find a path to resolution and closure during a period marked by grief and transition.

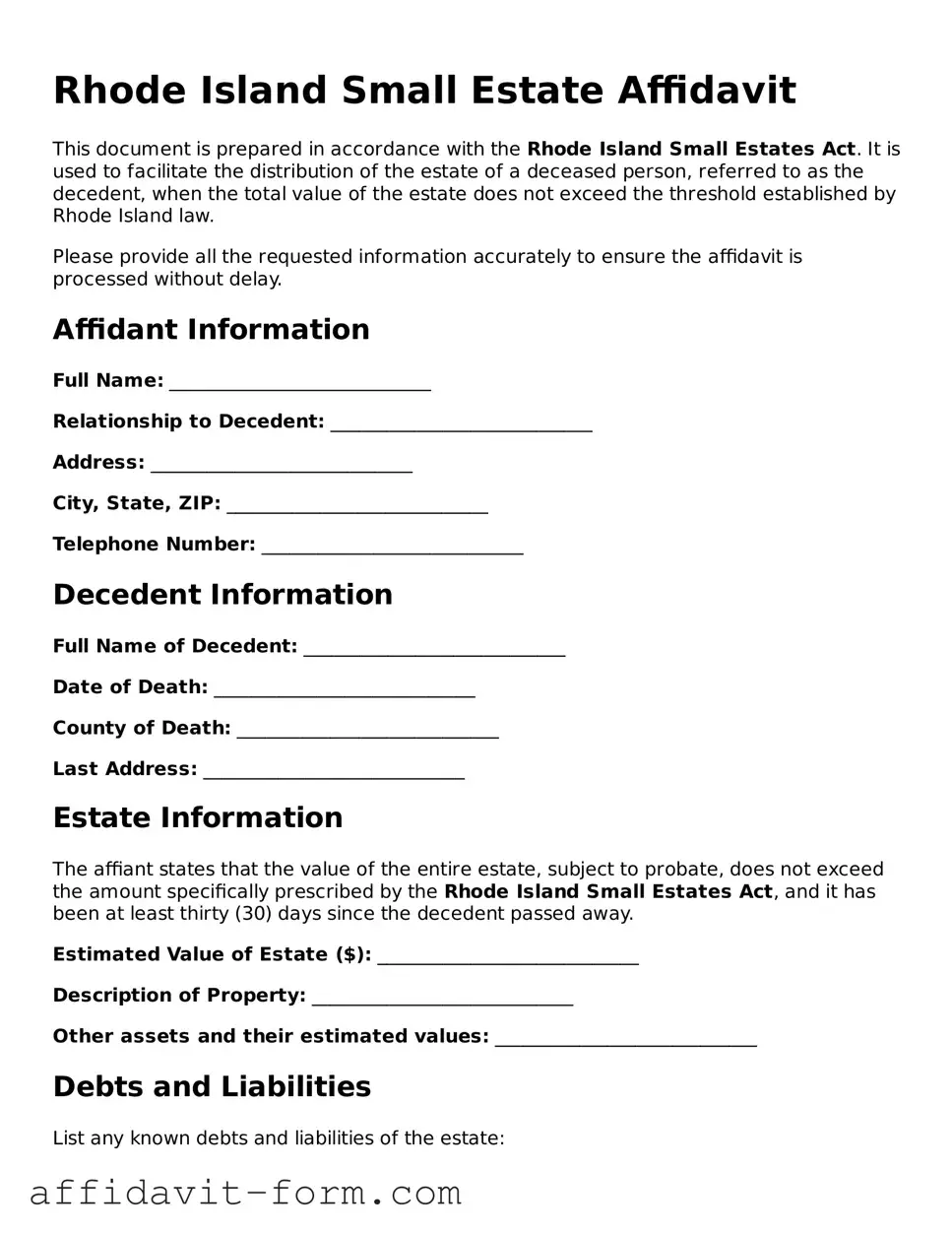

Form Example

Rhode Island Small Estate Affidavit

This document is prepared in accordance with the Rhode Island Small Estates Act. It is used to facilitate the distribution of the estate of a deceased person, referred to as the decedent, when the total value of the estate does not exceed the threshold established by Rhode Island law.

Please provide all the requested information accurately to ensure the affidavit is processed without delay.

Affidant Information

Full Name: ____________________________

Relationship to Decedent: ____________________________

Address: ____________________________

City, State, ZIP: ____________________________

Telephone Number: ____________________________

Decedent Information

Full Name of Decedent: ____________________________

Date of Death: ____________________________

County of Death: ____________________________

Last Address: ____________________________

Estate Information

The affiant states that the value of the entire estate, subject to probate, does not exceed the amount specifically prescribed by the Rhode Island Small Estates Act, and it has been at least thirty (30) days since the decedent passed away.

Estimated Value of Estate ($): ____________________________

Description of Property: ____________________________

Other assets and their estimated values: ____________________________

Debts and Liabilities

List any known debts and liabilities of the estate:

- ____________________________

- ____________________________

- ____________________________

Attestation

I, the undersigned affiant, do hereby affirm that the information provided herein is true and accurate to the best of my knowledge and belief. I understand that knowingly making a false statement on this affidavit may subject me to criminal penalties.

Date: ____________________________

__________________________________

Signature of Affiant

State of Rhode Island

County of ____________________________

Subscribed and sworn to (or affirmed) before me on this __th day of ______________, 20__ by ___________________________________, who is personally known to me or who has produced _________________________ as identification.

__________________________________

Signature of Notary Public

My commission expires: ____________________________

Document Details

| Fact | Description |

|---|---|

| Purpose | The Rhode Island Small Estate Affidavit form is used to simplify the settlement of small estates that do not require a full probate process. |

| Eligibility Criteria | Estates eligible for this procedure typically do not exceed a certain value threshold and consist mainly of personal property. |

| Governing Law | This form and process are governed by the Rhode Island General Laws, specifically under Title 33 - Probate Practice and Procedure. |

| Value Threshold | The maximum value of the estate that can be administered via a Small Estate Affidavit is subject to change but is generally set by state statute. |

| Required Documentation | Submitting a Small Estate Affidavit may require accompanying documentation such as a certified death certificate and an inventory of the decedent's assets. |

How to Use Rhode Island Small Estate Affidavit

Filling out the Rhode Island Small Estate Affidavit form is a critical step for individuals who are dealing with the estate of a loved one who has passed away and whose estate qualifies as "small" under Rhode Island law. This form simplifies the process of estate administration, allowing for a more efficient transfer of the decedent’s assets to their rightful heirs without the need for a formal probate process. Accuracy and attentiveness to detail are key when completing this form, as any error can lead to delays. Following a step-by-step approach can help ensure the process goes smoothly.

- Begin by gathering necessary documents related to the decedent's estate, including the death certificate, a list of assets, and any debts owed. These documents will provide the information needed to complete the affidavit properly.

- Locate the Rhode Island Small Estate Affidavit form. This can often be found online on the Rhode Island Judiciary’s website or at a local probate court.

- Read the form thoroughly before filling it out. Understanding every section in advance can help prevent mistakes and ensure you have all the required information.

- Enter the full legal name of the decedent, ensuring it matches the name on the death certificate.

- Fill in the date of death exactly as it appears on the death certificate.

- List all known assets of the decedent at the time of death. Be specific and include details such as account numbers, descriptions of property, and the estimated value of each asset.

- Identify and list any liabilities or debts owed by the decedent, including creditor information and the amount of each debt.

- Provide the legal names and addresses of all individuals entitled to receive assets from the estate, as well as their relationship to the decedent.

- If applicable, indicate whether there is a surviving spouse and/or minor children and allocate the appropriate share of assets as per Rhode Island law.

- Review the form carefully, ensuring all information provided is accurate and complete.

- Sign the affidavit in the presence of a notary public. The notary will verify your identity and witness your signature, officially notarizing the document.

- File the completed affidavit with the appropriate local court, typically the probate court in the county where the decedent lived. It may be necessary to pay a filing fee.

- Once the affidavit is filed and approved by the court, you may use the certified affidavit to collect the assets described in the document, distributing them according to the instructions laid out in the form.

Successfully completing and filing the Rhode Island Small Estate Affidavit form is a testament to your attention to detail and commitment to honoring the wishes of your loved one. It’s a process that requires patience and precision, but it's an important step in managing the affairs of the estate. By following these steps carefully, you can help ensure a clearer path through the legal aspects of estate resolution.

Listed Questions and Answers

What is a Rhode Island Small Estate Affidavit?

A Rhode Island Small Estate Affidavit is a legal document used to facilitate the transfer of assets from a deceased person's estate to their heirs without the need for a formal probate process. This document is typically utilized when the total value of the estate is below a certain threshold, making it a simpler and quicker option for small estates.

Who can file a Rhode Island Small Estate Affidavit?

To file a Rhode Island Small Estate Affidavit, the person must be a legally recognized inheritor of the deceased or an appointed representative. This includes direct heirs, such as spouses and children, or someone named in the will as an executor. It’s important to ensure that the individual filing the affidavit has the legal right to claim the assets.

What is the maximum value for a Rhode Island Small Estate to qualify?

The current threshold for an estate to qualify as a 'small estate' in Rhode Island is subject to change, so it's advisable to check the latest guidelines. Generally, estates with a total asset value below a specific limit, often around $15,000, may qualify for the small estate process. Always verify the current limit to ensure eligibility.

What documents are needed to file a Small Estate Affidavit in Rhode Island?

The following documents are commonly required to file a Small Estate Affidavit in Rhode Island:

- The completed Small Estate Affidavit form.

- A certified copy of the death certificate of the deceased.

- Documentation proving the right of succession or an executor’s appointment.

- Proof of the value of the estate's assets.

Additional documents may be needed depending on the specific circumstances of the estate.

How long does the process take?

The time frame for processing a Small Estate Affidit in Rhode Island varies depending on several factors, including the completeness of the submitted documents and the caseload of the probate court. Generally, the process can take anywhere from a few weeks to a couple of months. Making sure all the required documentation is submitted correctly can help expedite the process.

Are there any assets that cannot be transferred using a Small Estate Affidavit in Rhode Island?

Yes, there are certain assets that do not qualify for transfer via a Small Estate Affidavit in Rhode Island. These generally include:

- Real estate titled in the deceased’s sole name.

- Vehicles valued above a certain amount.

- Assets that are specifically directed to undergo formal probate as per the will.

It’s important to review the specific types of assets included in the estate and consult legal advice if unsure.

Where do I file a Rhode Island Small Estate Affidavit?

A Rhode Island Small Estate Affidavit is filed with the probate court in the county where the deceased person lived at the time of their death. If the deceased owned property in a different state, additional filings might be necessary in that state. It's advisable to contact the local probate court for specific filing instructions and requirements.

Common mistakes

Filling out the Rhode Island Small Estate Affidavit form is a critical step in managing a deceased person's estate in a simplified manner. However, people often make several mistakes during this process that can lead to complications or delays. Understanding these common errors can help ensure the process is completed accurately and efficiently.

-

Not Verifying Eligibility: One prevalent mistake is not confirming whether the estate actually qualifies as a "small estate" under Rhode Island law. The state has specific criteria based on the estate's total value, excluding certain assets. Failure to verify this can result in the rejection of the affidavit.

-

Incorrectly Listing Assets: Often, individuals inaccurately list the assets of the estate, either by omitting assets that should be included or including assets that are not supposed to be part of the affidavit process. This error can significantly affect the administration of the estate.

-

Forgetting to Attach Necessary Documentation: The affidavit requires supporting documents, such as death certificates and proof of the right to inherit. Neglecting to attach these documents can stall the process, as the court or financial institutions need these to validate the claims made in the affidavit.

-

Misunderstanding the Signatory Requirements: Executors often misunderstand who needs to sign the affidavit. Rhode Island law dictates specific requirements about who is eligible to act as the affiant, which may include the closest next of kin or the individual designated in the will. An incorrect signatory can invalidate the document.

-

Failure to Properly Notify Potential Creditors: The affidavit process involves notifying potential creditors of the decedent’s death, giving them the opportunity to make claims against the estate. Overlooking or improperly managing this aspect can lead to financial and legal repercussions for the estate further down the line.

Addressing these mistakes upfront can mitigate the risk of complications in managing a small estate in Rhode Island. Carefully reviewing the estate's assets, ensuring all documentation is accurate and complete, and understanding the legal requirements can streamline the process, making it more efficient and less susceptible to errors.

Documents used along the form

When settling the estate of a loved one in Rhode Island, especially under the small estate procedure, several documents besides the Small Estate Affidavit form might be necessary. These documents work hand in hand to ensure a smooth transition of assets, clear legal standing, and compliance with state laws. Their purpose ranges from authenticating the death to officially transferring property. Understanding these forms will equip you with the knowledge to navigate the process effectively.

- Death Certificate: A standard document that officially confirms the death of an individual. Required to prove the demise of the decedent as part of the affidavit process.

- Will: The legal document in which the decedent has outlined how they wish their estate to be distributed. If available, it dictates the proceedings, even in small estates.

- Letters of Administration: These are issued when there's no will, authorizing someone (usually the next of kin) to settle the deceased’s affairs.

- Real Estate Deed: This document is crucial for transferring real estate owned by the deceased to the rightful heirs or buyers as determined by the small estate process or the will.

- Vehicle Title Transfer Forms: For the deceased’s vehicles to be lawfully transferred to the new owners, this form must be completed and submitted to the DMV.

- Bank Account Closure Forms: Required by banks to facilitate the process of transferring funds from the deceased’s account to the heirs or to close the account entirely.

- Stock Transfer Forms: If the decedent owned stocks or bonds, these forms allow for the official transfer of ownership to the heirs.

- Personal Property Affidavit: Sometimes, certain small items or collections (that do not have titles) can be transferred to the heirs using this simpler affidavit.

- Probate Court Petition: Even for small estates, a formal petition might be necessary to settle disputes or to validate the small estate process being used.

- Tax Forms: Depending on the specifics of the estate and the decedent’s last tax return, various tax documents might be necessary to ensure the estate is in compliance with federal and state tax laws.

Navigating the legal landscape after a loved one has passed can be daunting. Nonetheless, being armed with the right documents makes the process more manageable. From certifying the death with a Death Certificate to transferring assets through titles and deeds, each document plays a pivotal role in the small estate procedure. Understanding these documents, their purposes, and when they are necessary, will help ease the process during a difficult time.

Similar forms

The Rhode Island Small Estate Affidavit form is similar to other legal documents that streamline the process of asset distribution without the need for extensive court intervention. Documents of this nature are designed to simplify the legal proceedings for small estates, allowing for a more straightforward and less time-consuming process. Below, we'll explore how this form bears resemblance to others in its category, detailing those similarities further.

Affidavit for Collection of Personal Property

This document is quite akin to the Rhode Island Small Estate Affidavit in purpose and structure. Both are utilized to expedite the transfer of assets, bypassing the more cumbersome probate process for estates that meet certain criteria. Specifically, the Affidavit for Collection of Personal Property allows claimants to assert their right to collect personal property of the deceased, under the condition that the estate's value falls beneath a specific threshold. Similarly, the Rhode Island Small Estate Affidat also mandates a maximum estate value to qualify, reflecting a shared objective between the two documents: to facilitate a quicker resolution for eligible estates.

Transfer on Death Deed (TODD)

Although the Transfer on Death Deed (TODD) differs in that it is typically executed by a property owner prior to death, its core similarity to the Small Estate Affidavit lies in its goal to streamline asset distribution. A TODD allows for the direct transfer of real estate to a designated beneficiary upon the owner's death, circumventing the probate process. Like the Small Estate Affidat, this efficiency reduces legal and administrative overhead, ensuring properties can be passed on to heirs without the need for a prolonged legal process. Both tools offer valuable mechanisms for simplifying estate settlement, albeit at different stages of planning and execution.

Simplified Probate Procedures

Similarly, simplified probate procedures available in many jurisdictions share a fundamental goal with the Rhode Island Small Estate Affidavit: to make the legal process surrounding estate resolution as efficient and straightforward as possible for smaller estates. These procedures typically involve less paperwork, fewer court appearances, and reduced timelines. The common thread between them and the Small Estate Affidavit is their provision for a less challenging path through the legal system, made possible by limiting their applicability to situations that meet specific criteria, such as the overall value of the estate. This alignment in purpose demonstrates a broader legal recognition of the need to offer streamlined processes for estate resolution.

Dos and Don'ts

Navigating the process of filling out the Rhode Island Small Estate Affidavit form can be straightforward if you know what to do and what to avoid. This crucial document is designed to help settle small estates in a more streamlined manner, often without requiring a formal probate process. Here is a carefully curated list of dos and don's to guide you through this process.

Things you should do:

- Verify eligibility: Ensure the estate qualifies as a "small estate" under Rhode Island law. This involves confirming the total value of the estate does not exceed the threshold set by state law.

- Gather necessary documents: Compile all relevant financial statements, death certificates, and list of heirs beforehand. This preparation can significantly simplify the filling process.

- Provide accurate information: Fill out all sections of the form with correct and complete information to the best of your knowledge. Accuracy is crucial to prevent any potential delays or legal issues.

- Review the form carefully: Before submitting, review the affidavit thoroughly to check for any errors or omissions. This step is essential for ensuring the document’s validity.

- Seek legal advice if necessary: Consider consulting with a legal professional familiar with Rhode Island's probate laws if you encounter complex issues or have questions about the process.

Things you shouldn't do:

- Ignore time requirements: Avoid filling out the form too early or too late. Rhode Island laws may specify a certain period after the decedent's death within which the affidavit must be filed.

- Omit information: Do not leave any sections blank unless explicitly instructed to do so. Incomplete forms may result in rejection or returned paperwork.

- Guess on details: Avoid making guesses about financial values or heirship. If uncertain, seek out the correct information before submitting the form.

- Use unofficial forms: Do not use a generic or non-state-specific form. Always ensure you are filling out the latest version of the Rhode Island Small Estate Affliction that is officially recognized.

- Forget to sign and date: Failing to sign or date the form can render it invalid. Double-check that all required signatures are in place before submission.

Adhering to these guidelines will help ensure the process of filling out the Rhode Island Small Estate Affidavit form is as smooth and effective as possible. When in doubt, seeking assistance from a legal professional familiar with estate planning and the probate process in Rhode Island can be invaluable.

Misconceptions

When it comes to navigating the probate process in Rhode Island, the Small Estate Affidavit form is a crucial document for handling the estates of deceased persons under certain conditions. However, there are many misconceptions about this form and its use. Let’s clarify some of the most common misunderstandings:

- It can be used for any estate, regardless of size. In reality, the Small Estate Affidavit form in Rhode Island is only applicable for estates valued at $15,000 or less. This value does not include the value of certain assets, such as real estate.

- The form grants immediate access to the decedent's assets. While the form does streamline the process, the transfer of assets may still require time. Financial institutions and others may have their own procedures to follow before releasing assets.

- It eliminates the need for a probate court process. It's designed to simplify or bypass the standard probate process for small estates, but this doesn’t mean that court oversight is completely removed. In some cases, court approval may still be necessary.

- Only a family member can file the form. Although commonly filed by relatives, Rhode Island law allows any person in possession of the deceased’s property or who is owed a debt by the deceased to file this affidavit, as long as they meet other legal requirements.

- Filling out this form transfers the property titles immediately. Completing the affidavit is an important step, but the transfer of title for vehicles, real estate, or other titled property may require additional documentation and steps with the respective Rhode Island agencies or companies.

- There are no risks in using the Small Estate Affidavit form. Individuals who use the affidavit to collect assets are asserting that they have the legal right to do so. If this is done improperly, they may be held accountable for any issues or disputes that arise.

- A lawyer is not needed to fill out the form. While it's possible to complete the form without legal assistance, consulting with a lawyer can help navigate the process more smoothly and ensure that all legal requirements are met, particularly since estate laws can be complex.

- It can only be used for personal property. While mainly used for personal property like bank accounts and personal belongings, under certain circumstances, it may be associated with other types of property. However, real estate processes are generally more complicated and usually require different procedures.

- The form is the same in every state. Each state has its own laws regarding small estates and the affidavits used to manage them. The Rhode Island Small Estate Affidavit form and its requirements are specific to Rhode Island and may differ significantly from those in other states.

- Using the form avoids estate taxes. While it may simplify the process, the use of a Small Estate Affidavit does not inherently avoid estate taxes. The responsibility for settling the decedent's taxes remains, and how this is handled may require additional steps beyond the affidavit. Taxes are based on the estate's value and other factors, not the process used to settle the estate.

Key takeaways

When handling the Rhode Island Small Estate Affidavit form, it is crucial for individuals to approach the process with care and attention to detail. Below are key takeaways that can guide those looking to fill out and use the form effectively.

- Understand eligibility requirements. Before proceeding with the Rhode Island Small Estate Affidavit, ensure that the estate in question meets the state-specific criteria for being considered "small". This typically involves the total value of the estate not exceeding a certain threshold.

- Accurately complete all sections. It's imperative to fill out the form with accurate and complete information. Any errors or omissions can cause delays or legal issues. Information about the deceased, the assets, and the claimant must be clearly stated.

- Know the assets that can be claimed. Not all assets can be transferred using a Small Estate Affidavit. Familiarize yourself with the types of assets that are eligible for transfer under this process in Rhode Island to ensure compliance and smooth administration.

- Follow the proper filing procedure. Once the form is completed, it must be filed correctly, often with the local probate court or a similar entity. Knowing where and how to submit the affidavit is key to initiating the transfer of assets without undue hassle.

By keeping these takeaways in mind, individuals can navigate the process of using the Rhode Island Small Estate Affidavit with confidence and efficiency, ensuring the decedent's assets are distributed according to their wishes or the law.

Fill out Popular Small Estate Affidavit Forms for Different States

Create a Family Trust - Heirs can use this document to demonstrate their legal right to assets like bank accounts without needing a court order.

How Do I Get a Small Estate Affidavit in California? - This form is used to transfer property of a deceased person to their heirs without formal probate.

Small Estate Affidavit Georgia - It may be employed to settle estates where probate avoidance planning was not previously established.

Affidavit for Collection of Small Estate - It outlines the estate's assets, debts, and beneficiaries, ensuring a clear transfer of possessions.