Valid Small Estate Affidavit Form

When managing the estate of a loved one who has passed away, the process can often feel complex and overwhelming. Fortunately, for smaller estates, there's a simplified procedure available that can alleviate some of this burden: the Small Estate Affidavit form. This valuable document enables the rightful heirs or beneficiaries to collect assets and property without the need for a lengthy probate process. Each state has its own criteria for what constitutes a "small estate," generally based on the total value of the estate's assets. By using this form, the person claiming the estate—often a surviving spouse or child—can swiftly handle the transfer of assets, making it an efficient tool for finalizing a loved one's financial affairs. It's designed to help streamline what can otherwise be a daunting task, saving time and reducing legal fees in the process. Nonetheless, it's imperative to understand the specific requirements and limitations of the Small Estate Affidavit form in your jurisdiction to ensure a smooth procedure.

State-specific Tips for Small Estate Affidavit Forms

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

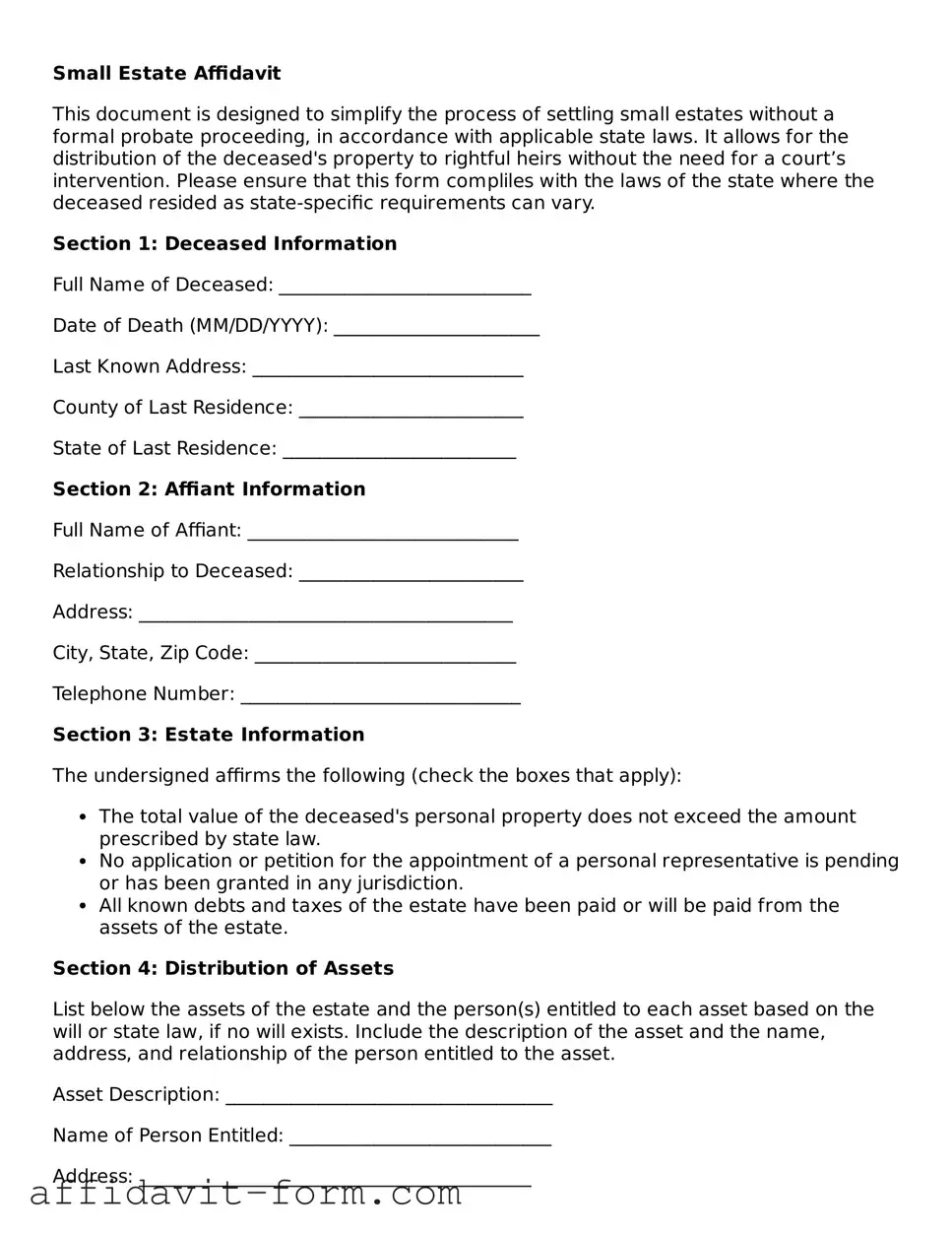

Form Example

Small Estate Affidavit

This document is designed to simplify the process of settling small estates without a formal probate proceeding, in accordance with applicable state laws. It allows for the distribution of the deceased's property to rightful heirs without the need for a court’s intervention. Please ensure that this form compliles with the laws of the state where the deceased resided as state-specific requirements can vary.

Section 1: Deceased Information

Full Name of Deceased: ___________________________

Date of Death (MM/DD/YYYY): ______________________

Last Known Address: _____________________________

County of Last Residence: ________________________

State of Last Residence: _________________________

Section 2: Affiant Information

Full Name of Affiant: _____________________________

Relationship to Deceased: ________________________

Address: ________________________________________

City, State, Zip Code: ____________________________

Telephone Number: ______________________________

Section 3: Estate Information

The undersigned affirms the following (check the boxes that apply):

- The total value of the deceased's personal property does not exceed the amount prescribed by state law.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- All known debts and taxes of the estate have been paid or will be paid from the assets of the estate.

Section 4: Distribution of Assets

List below the assets of the estate and the person(s) entitled to each asset based on the will or state law, if no will exists. Include the description of the asset and the name, address, and relationship of the person entitled to the asset.

Asset Description: ___________________________________

Name of Person Entitled: ____________________________

Address: __________________________________________

Relationship: _____________________________________

Additional Assets and Persons Entitled:

- ________________________________________________

- ________________________________________________

- ________________________________________________

Section 5: Affidavit

I, [Affiant's Name], under penalty of perjury, declare that the statements made in this affidavit are true and correct to the best of my knowledge and belief. I understand that false statements made herein are subject to penalties for perjury.

Date: _______________

Signature: ___________

State of ____________

County of ___________

Subscribed and affirmed before me this ___ day of ___________, 20__.

Notary Public: ________________________________

My commission expires: _________________________

Document Details

| Fact Name | Description |

|---|---|

| Function | The Small Estate Affidavit form allows for the transfer of a deceased person's assets without formal probate proceedings when those assets fall below a certain value threshold. |

| Value Threshold | The total value of the estate that qualifies for using a Small Estate Affidavit varies by state, often ranging from $5,000 to $150,000. |

| Eligible Assets | Eligible assets typically include personal property, bank accounts, and, in some states, real estate. |

| Excluded Assets | Assets titled in joint tenancy, designated beneficiary accounts, and life insurance proceeds are generally excluded from the small estate process. | >

| Governing Laws | Each state governs the use of the Small Estate Affidavit form under its laws, which dictate the form’s requirements, thresholds, and procedures. |

How to Use Small Estate Affidavit

Completing the Small Estate Affidavit requires attention to detail and accuracy to ensure the process of transferring the decedent’s property to their rightful heirs is conducted smoothly. This document is crucial for those managing the estate of a deceased person without going through the formal probate process, typically used when the total value of the estate doesn't surpass a certain threshold, as stipulated by state law. The following steps are designed to guide you through each section of the form to help you fill it out correctly.

- Begin by identifying the decedent (the person who passed away), including their full legal name, the date of their death, and their last known address. This establishes whom the estate belongs to and initiates the transfer process.

- State your relationship to the deceased and assert your legal standing to file the affidavit. This could involve specifying whether you are a spouse, child, sibling, or other relative, or a creditor to the estate.

- List all known assets belonging to the deceased at the time of death. This should include checking and savings accounts, stocks, bonds, real property, and personal property items of value. Be as detailed and accurate as possible, including location, account numbers, and estimated values.

- Outline all debts and liabilities of the deceased, including funeral expenses, outstanding loans, credit card debts, and any other obligations. This identifies what claims may exist against the estate.

- Identify the heirs or beneficiaries entitled to receive the deceased’s assets. This involves naming each person, their relationship to the deceased, and specifying their share or interest in the estate.

- State whether there has been or will be a petition for appointment of a personal representative (executor) for the estate in probate court. If such a petition is not planned, explain why the small estate affidavit is being used instead.

- Sign the affidavit in front of a notary public. Your signature must be notarized to verify your identity and your sworn statement that all information provided is true to the best of your knowledge.

Upon completion, the Small Estate Affidiff will then need to be filed with the appropriate local court or used as prescribed by state law to distribute the assets. Usually, the document, along with a certified copy of the death certificate and any other required attachments, should be presented to the institution holding the assets (e.g., a bank) or to the person or entity owing a debt to the estate. It's important to adhere closely to the specific procedures and requirements of your jurisdiction to facilitate a smooth transfer of assets.

Listed Questions and Answers

What is a Small Estate Affidavit?

A Small Estate Affidaid is a legal document used to streamline the process of estate settlement for assets below a certain value, thereby avoiding lengthy probate proceedings. It allows for the distribution of the deceased's assets to heirs or beneficiaries quickly.

Who can use a Small Estate Affidavit?

Typically, close relatives or designated heirs of the deceased, such as spouses or children, can use a Small Estate Affidavit. The eligibility depends on the laws of the state where the deceased lived or where the property is located.

What are the requirements for a Small Estate to qualify?

- The total value of the estate must fall below a specific threshold, which varies by state.

- A certain amount of time must have passed since the death, with the period varying by state.

- The estate should not include real property, or if it does, certain states have specific provisions for handling such cases.

How do I fill out a Small Estate Affidavit?

Filling out a Small Estate Affidavit requires gathering necessary information about the deceased, their assets, debts, and beneficiaries. The form must then be completed with details such as the estate's value, the petitioner's relationship to the deceased, and a list of assets. Finally, it must be signed in front of a notary public.

Where do I file a Small Estate Affidavit?

The Small Estate Affidavit is usually filed in the probate court of the county where the deceased lived at the time of their death or where the property of the deceased is located.

What is the cost of filing a Small Estate Affidavit?

While filing fees for a Small Estate Affidavit are generally lower than those for a full probate process, the exact cost varies by state and sometimes by county. Contacting the local probate court for precise fees is best.

What is the threshold value for a Small Estate Affidavit?

The threshold value for considering an estate "small" and thus qualifying for a Small Estate Affidavit varies significantly by state, ranging from as little as $5,000 to upwards of $150,000.

What happens after filing a Small Estate Affidavit?

After a Small Estate Affidavit is filed, and if approved, the court allows the distribution of the deceased's assets to the rightful heirs or beneficiaries according to the affidavit's declarations. Each state has its timeline and process for this distribution.

Can debts be settled using a Small Estate Affidavit?

Yes, a Small Estate Affidavit can be used to settle the deceased's debts, but it must be done according to state laws. Typically, known creditors must be notified, and valid debts should be paid out of the estate's assets before distribution to heirs.

What are the risks involved in using a Small Estate Affidavit?

Using a Small Estate Affidavit carries some risks, such as potential challenges from creditors or disputes among heirs over asset distribution. It's crucial to ensure that all information provided in the affidavit is accurate and that all state requirements are met to minimize such risks.

Common mistakes

The Small Estate Affidavit form is a critical document that facilitates the transfer of property from a deceased person to their heirs without a formal probate process. However, errors in completing this form can lead to delays and additional legal complications. Here are five common mistakes people make:

-

Not verifying eligibility criteria: Before using a Small Estate Affidavit, it's crucial to ensure that the estate meets the specific criteria set out by state law. These criteria can include the total value of the estate and the type of property. Failing to confirm eligibility can result in the affidavit being void.

-

Incorrect or incomplete information: Every detail on the form must be accurate, including the legal names of the deceased and the heirs, descriptions of property, and outstanding debts. Mistakes or incomplete information can lead to processing delays or the rejection of the affidavit.

-

Overlooking debts and liabilities: The form requires a listing of the deceased's debts and liabilities. It's a mistake to underestimate or omit this information, as creditors have rights to the estate that can impact the distribution of assets to heirs.

-

Not obtaining required signatures: The Small Estate Affidavit requires signatures from all legal heirs. Missing signatures can lead to disputes among heirs and challenge the validity of the form.

-

Forgetting to attach necessary documentation: In many cases, the affidavit must be accompanied by additional documents, such as the death certificate or proof of ownership. Failing to attach these documents can result in the affidavit not being processed.

Avoiding these mistakes can streamline the transfer of assets and help to ensure that the wishes of the deceased are honored without unnecessary legal complications.

Documents used along the form

When dealing with the estate of a person who has passed away, particularly in cases that qualify for the processing via a Small Estate Affidavit, there are often several other documents and forms that may be necessary to complete the process successfully. The Small Estate Affidavit itself is a tool used to settle estates that fall under a certain value threshold, making it simpler and faster to distribute assets to heirs without the need for probate court proceedings. However, settling an estate, even a small one, can require more documentation than just this affidavit. Below is a list of documents often used alongside the Small Estate Affidavit form, each playing a crucial role in ensuring the estate is settled correctly and in accordance with the law.

- Death Certificate: This is an official document issued by the government to certify the deceased's date, location, and cause of death. It is vital for legal and financial processes following a person's death.

- Last Will and Testament: If the deceased left a will, it outlines their wishes regarding the distribution of their assets and can specify an executor of the estate.

- Letters of Administration: Issued by a probate court, these letters give an individual the authority to act as the estate administrator if there is no will.

- Trust Documents: If the deceased had established any trusts, these documents would govern how those trusts are managed and distributed.

- Bank Statements: Recent statements from the deceased's bank accounts are necessary to understand the estate's assets.

- Life Insurance Policies: These documents are essential for claiming benefits that may be due to the beneficiaries of the policies.

- Property Deeds: Deeds for any real estate owned by the deceased are required to transfer ownership or to sell the property.

- Vehicle Titles: Titles for automobiles, boats, or other vehicles owned by the deceased are necessary for transfer of ownership.

- Stock Certificates: If the deceased owned stocks or other securities, certificates or broker statements are needed to manage or transfer the investments.

The process of settling an estate, even a small one, involves gathering many pieces of documentation to ensure everything is handled properly and according to the deceased's and the law's wishes. Each document, from death certificates to property deeds, serves its purpose in creating a comprehensive understanding of the estate's assets and liabilities. Together, these documents, along with the Small Estate Affidavit, facilitate the transfer of the deceased's property to their rightful heirs without the need for lengthy court procedures.

Similar forms

The Small Estate Affidavit form is similar to a handful of other legal documents that are designed to streamline certain processes upon an individual's death. These documents, while differing in their specific purposes and legal requirements, share common traits with the Small Estate Affidavit in that they aim to simplify the legal proceedings that typically follow a person's passing. Understanding how they compare can provide valuable insight into the legal landscape surrounding the distribution of an estate.

Transfer on Death Deed (TODD): Like the Small Estate Affidavit, a Transfer on Death Deed allows property to be passed to a beneficiary without the need for a lengthy probate process. The key similarity lies in their utility for avoiding probate; however, the TODD is specifically designed for real estate properties. In essence, both documents serve to expedite the transfer of assets upon death, directly to named beneficiaries, thereby circumventing the traditional, more time-consuming legal procedures.

Joint Tenancy with Right of Survivorship (JTWROS): This form of property ownership between two or more parties includes a significant feature that resembles the function of a Small Estate Affidavit — upon the death of one owner, their share of the property automatically transfers to the remaining owner(s), bypassing the probate process. Although JTWROS is a form of property title rather than a document per se, the concept parallels the Small Estate Affidavit's goal of streamlining asset transfer after death.

Payable on Death (POD) or Transfer on Death (TOD) Accounts: Similar to the Small Estate Affidavit, POD or TOD accounts allow account holders to designate beneficiaries who will receive the assets held in these accounts upon the holder’s death. Both tools avoid the probate process by directly transferring assets to named beneficiaries. While the Small Estate Affidavit applies broadly to various asset types within an estate, POD/TOD accounts are specific to financial accounts and securities.

Dos and Don'ts

Filling out a Small Estate Affidavit form can seem straightforward, but it's easy to make mistakes if you're not careful. Whether you're handling the estate of a loved one or preparing for your own estate's future, understanding what to do and what to avoid is crucial. Here are some guidelines to help ensure the process is smooth and correct.

Do's:

- Verify eligibility. Before proceeding, make sure the estate qualifies as a "small estate" under state law. Each state has its own definition, often based on the total value of the estate's assets.

- Gather accurate information. Collect all necessary details about the deceased’s assets, debts, and heirs. Accuracy is key to avoid delays or legal challenges.

- Check for debts. Ensure all debts and taxes of the estate are identified. These must often be settled before assets are distributed.

- Include all required documents. Attach any required documentation, such as death certificates or proof of account ownership, as specified by your state’s laws.

- Seek legal advice if necessary. When in doubt, consulting with an estate attorney can prevent mistakes and provide peace of mind.

- Review before submitting. Double-check the form for completeness and accuracy. Missing or incorrect information can cause delays.

- Follow state-specific guidelines. Each state has its own set of rules for small estates. Ensure the form meets your state’s specific requirements.

Don'ts:

- Rush the process. Take your time to fill out the form carefully. Rushing can lead to errors, causing delays or legal complications.

- Ignore state laws. Failing to comply with your state’s specific small estate laws can nullify the affidavit, requiring you to start over or face legal issues.

- Distribute assets too soon. Assets should not be distributed until the affidavit is processed and any stipulated waiting period has passed. Premature distribution can lead to personal liability for the executor.

- Overlook potential heirs. Make sure all potential heirs are considered and properly listed. Missing an heir can have serious legal implications.

- Fail to notify creditors. Most states require that creditors be notified and given a chance to make claims against the estate. Not doing so can result in legal problems.

- Assume it replaces a will. The Small Estate Affidavit is not a substitute for a will. It is a tool used when specific conditions are met, and may not cover all assets or wishes.

- Forget to file with the court. If your state requires it, failing to file the completed affidavit with the appropriate court can invalidate the process.

Misconceptions

When dealing with the Small Estate Affidavit form, many people hold misunderstandings about its function, requirements, and implications. Below are some of the most common misconceptions clarified to provide a better understanding.

- All states have the same requirements for a Small Estate Affidavit: This is not true. The criteria and thresholds for what constitutes a small estate vary significantly from state to state. Each state sets its own limits on the value of the property that can be transferred using this process.

- The Small Estate Affidavit process is lengthy and complicated: Actually, the purpose of the Small Estate Affidavit is to provide a simpler and faster process for the distribution of a deceased person's estate, as opposed to going through formal probate. The process is designed to be straightforward and can often be completed without a lawyer.

- You can transfer real estate with any Small Estate Affidavit: While some states do allow for the transfer of real estate using a Small Estate Affidavit, many do not. It is important to check the specific provisions in your state regarding what types of property can be transferred.

- A Small Estate Affidavit gives you immediate access to the deceased’s assets: Even though the process is generally quicker than formal probate, there may still be waiting periods or specific requirements that must be met before assets can be distributed. This can depend on state law or the institution holding the assets.

- Using a Small Estate Affidavit avoids all taxes and fees: While using a Small Estate Affidavit can reduce some of the costs associated with settling an estate, it does not eliminate the obligation to pay any taxes or debts owed by the deceased. Those responsibilities still need to be met.

- Any family member can file a Small Estate Affidavit: States usually have specific rules about who can file a Small Estate Affidavit, often prioritizing spouses and next of kin. It’s essential to understand who is legally allowed to file under your state’s laws.

- There is no risk in using a Small Estate Affidavit: While the process is simplified, individuals completing the affidavit are asserting that the information they provide is accurate. If the estate turns out to be larger than the state’s threshold, or if there are contested claims, legal complications can arise.

- You can distribute assets however you want with a Small Estate Affidavit: The distribution of assets must comply with the deceased's will (if one exists) or follow state intestacy laws if there is no will. The Small Estate Affidificate does not allow for arbitrary distribution of the deceased's estate.

- There is no deadline for filing a Small Estate Affidavit: Many states do impose deadlines by which a Small Estate Affidavit must be filed after the death of the estate owner. These deadlines can vary, making it crucial to check the specific laws of your state.

Key takeaways

Filling out and using the Small Estate Affidavit form is an essential process for those handling the estate of a loved one who has passed away without a will, or with an estate that meets the criteria for "small" under state laws. Understanding the key aspects of this document can streamline this aspect of estate management, ensuring a smoother transition of assets to beneficiaries. Here are the key takeaways:

- Understand eligibility criteria: Not all estates qualify for the Small Estate Affidavit process. Eligibility is based on the total value of the estate, which varies by state. Before proceeding, confirm that the estate falls below this threshold.

- Gather necessary documents: Preparing to fill out the form requires gathering pertinent documents such as death certificates, asset documentation, and any existing wills. This preparation simplifies the completion process.

- Know your state’s specific requirements: The Small Estate Affidavit requirements and forms can differ significantly from one state to another. It's critical to use the form specific to your state and to understand the particular stipulations your state may have.

- Accurately list all assets: When filling out the form, precisely listing all assets within the estate is crucial. This includes bank accounts, vehicles, real estate (if applicable), and other personal property. Underreporting or omitting assets can result in legal repercussions.

- Understand the limitations: Some assets, such as those held in trust or with designated beneficiaries (e.g., life insurance policies, retirement accounts), are not typically processed through a Small Estate Affidavit. Recognize which assets are and aren't applicable.

- Notarization may be required: Many states require the Small Estate Affidavit to be notarized. This process validates the authenticity of the signature on the form, adding a layer of legal protection.

- File with the appropriate court: Once completed and, if necessary, notarized, the form must be filed with the appropriate local court. This step often involves a filing fee, and the requirements and location for filing can vary by jurisdiction.

Approaching the Small Estate Affidavit with a thorough understanding of these key points ensures that the process is handled correctly and efficiently. This approach not only respects the final wishes of the deceased but also provides a clear pathway for beneficiaries during a challenging time.

More Small Estate Affidavit Types:

Affidavit of Affixture Form - It is instrumental in modifying the property's legal status, thereby impacting its treatment under local and state law concerning rights, restrictions, and benefits.

How to Change a Name on a Birth Certificate - Its acceptance in legal affairs underscores the flexibility in meeting proof of birth requirements across various scenarios.

Self Proving Affidavit for Will - Utilizing a Self-Proving Affidavit can reduce the need for witnesses to provide live testimony, making the probate procedure more efficient.